|

|

|

|

|

|

|

In order to achieve higher forum ranks, you need both activity points and merit points.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

xtraelv

Legendary

Offline Offline

Activity: 1274

Merit: 1924

฿ear ride on the rainbow slide

|

|

September 04, 2019, 12:30:54 PM |

|

What did they make the basis of the case that he actually owned bitcoins at that point? Just his word?

So basically all he's done is claim he has x amount and provided the public address of such which anyone could do, but no actual proof of him ever actually owning or having access to them and them being in a trust is the excuse as to why he can't? Is there a list of addresses he's publicly claimed to have owned?

It is quite simple: The court is interested in is the bitcoins he claims to own and the bitcoins they can prove he owns. There are already other official records and court records where he claims to own specific bitcoins. That will determine the size of the award and penalties if the case is proven. Any bitcoins that he owns that he doesn't declare can be forfeited by future court action. |

|

|

|

|

Iamtutut

|

|

September 04, 2019, 12:34:40 PM |

|

I understand that my judgement is not relevant for the matter, however, you question the only US Federal Judge's findings on this matter - the creator of Bitcoin.

It appears as if you are under the mistaken impression that the judge's statement about their partnership supports CSW's claim to be Satoshi: "One, Dr. Wright and David Kleiman entered into a

50 percent 50/50 partnership to develop Bitcoin intellectual

property and to mine Bitcoin."^^^ This does not assert that said partnership created Bitcoin, only that they were supposedly developing Bitcoin-related IP at some point. Which bit of the judge's statement explicitly clarifying that they were not ruling on the matter of Satoshi Nakamoto's identity confuses you?  What did they make the basis of the case that he actually owned bitcoins at that point? Just his word? I see you still have trouble in reading the whole hearing from 08-26-2019, I will try to help. Ms McGovern, Dr.Wright's lawyer:In response to the Court's order, Dr. Wright has

provided the first 70 of those public addresses. There are

over 16,000. In addition, Dr. Wright has disclosed his full

holdings of Bitcoin as of December 31st, 2013, and has stated

under oath exactly how much Bitcoin he holds as of that date,

and has confirmed under oath that that Bitcoin has not moved.

So basically all he's done is claim he has x amount and provided the public address of such which anyone could do, but no actual proof of him ever actually owning or having access to them and them being in a trust is the excuse as to why he can't? Is there a list of addresses he's publicly claimed to have owned? That's it. The adresses stuff is anyways a big BULLSHIT. The Judge NEVER asked for the adresses and he repeated it several times in his decision to hold Wright in Civil contempt of Court. Justice Reinhart ordered Wright to display his holdings in bitcoins until the death of Dave Kleiman, Wright used as many excuses as possible not to do it and therefore the judge sanctionned him. |

|

|

|

|

hv_

Legendary

Offline Offline

Activity: 2506

Merit: 1055

Clean Code and Scale

|

|

September 04, 2019, 01:13:51 PM |

|

I understand that my judgement is not relevant for the matter, however, you question the only US Federal Judge's findings on this matter - the creator of Bitcoin.

It appears as if you are under the mistaken impression that the judge's statement about their partnership supports CSW's claim to be Satoshi: "One, Dr. Wright and David Kleiman entered into a

50 percent 50/50 partnership to develop Bitcoin intellectual

property and to mine Bitcoin."^^^ This does not assert that said partnership created Bitcoin, only that they were supposedly developing Bitcoin-related IP at some point. Which bit of the judge's statement explicitly clarifying that they were not ruling on the matter of Satoshi Nakamoto's identity confuses you?  What did they make the basis of the case that he actually owned bitcoins at that point? Just his word? I see you still have trouble in reading the whole hearing from 08-26-2019, I will try to help. Ms McGovern, Dr.Wright's lawyer:In response to the Court's order, Dr. Wright has

provided the first 70 of those public addresses. There are

over 16,000. In addition, Dr. Wright has disclosed his full

holdings of Bitcoin as of December 31st, 2013, and has stated

under oath exactly how much Bitcoin he holds as of that date,

and has confirmed under oath that that Bitcoin has not moved.

So basically all he's done is claim he has x amount and provided the public address of such which anyone could do, but no actual proof of him ever actually owning or having access to them and them being in a trust is the excuse as to why he can't? Is there a list of addresses he's publicly claimed to have owned? That's it. The adresses stuff is anyways a big BULLSHIT. The Judge NEVER asked for the adresses and he repeated it several times in his decision to hold Wright in Civil contempt of Court. Justice Reinhart ordered Wright to display his holdings in bitcoins until the death of Dave Kleiman, Wright used as many excuses as possible not to do it and therefore the judge sanctionned him. ... only under his assumption that he and Dave worked as legal 'partners' - how could he prove that ?  |

Carpe diem - understand the White Paper and mine honest.

Fix real world issues: Check out b-vote.com

The simple way is the genius way - Satoshi's Rules: humana veris _

|

|

|

|

Iamtutut

|

|

September 04, 2019, 01:20:38 PM |

|

There was no assumption from the Judge.

There is a sanction that establishes Kleiman & Wright as partners, only for the cause of the proceeding, because Wright is held in Contempt of Court.

|

|

|

|

|

|

HardFireMiner

|

|

September 04, 2019, 02:01:50 PM |

|

There was no assumption from the Judge.

There is a sanction that establishes Kleiman & Wright as partners, only for the cause of the proceeding, because Wright is held in Contempt of Court.

I will repost judge Reinhart's established facts: THE HONORABLE BRUCE E. REINHART

UNITED STATES MAGISTRATE JUDGE

Therefore, as a remedial measure pursuant to Federal

Rule of Civil Procedure 37(b)(2)(A)(i), the Court deems the

following facts to be established for purposes of this action:

And, by the way, I find that no lesser sanction is

sufficient than what I'm about to announce.

One, Dr. Wright and David Kleiman entered into a

50 percent 50/50 partnership to develop Bitcoin intellectual

property and to mine Bitcoin.

Second, it is deemed proven that all Bitcoin mined

by Dr. Wright prior to December 31st, 2013, was joint property

of Dr. Wright and David Kleiman at the time it was mined.

Because Dr. Wright's 10th affirmative defense relating to the

statute of frauds challenges the existence of a partnership,

it is inconsistent with these findings and these facts, so it

is stricken.

As a further punitive sanction, I deem the following

facts:

One, any Bitcoin-related intellectual property

developed by Dr. Wright prior to David Kleiman's death is

jointly and equally owned by Dr. Wright and by the plaintiffs.

And, two, any Bitcoin mined by Dr. Wright prior to

David Kleiman's death and any assets traceable to those

Bitcoin is presently jointly and equally owned by the

plaintiffs and Dr. Wright.

Dr. Wright's third, fourth, fifth, sixth, seventh,

eighth, second seventh affirmative defenses assert that David

Kleiman surrendered has legal rights in return for shares in a

corporation. These affirmative defenses are inconsistent with

the facts as I have deemed them, so they are stricken.

I do not strike Dr. Wright's first, second, I think

ninth, or 11th and 12th affirmative defenses. So I do not --

I do not strike all of his pleadings. I do not enter a

default judgment. I leave in place the affirmative defenses

relating to statute of limitations, latches, res judicata and

the one I can't remember.

In addition, Dr. Wright's April 18th motion which

was in substance a motion for protective order was denied, the

plaintiffs' June 3rd motion to compel was granted, and the

current motion is also granted. Therefore, I will order that

the plaintiffs are entitled to receive reasonable attorney's

fees and expenses related to each of those motions.

As you can see from above, there ARE not only assumptions by the Judge, there are established facts. There are also points in Dr. Wright's affirmative defense ACCEPTED by the court. Hope this clears it up for you. |

|

|

|

cryptodevil

Legendary

Offline Offline

Activity: 2170

Merit: 1240

Thread-puller extraordinaire

|

|

September 04, 2019, 02:11:22 PM

Last edit: September 04, 2019, 02:42:44 PM by cryptodevil |

|

What did they make the basis of the case that he actually owned bitcoins at that point? Just his word? Yes. Don't forget that it is absolutely in the Kleiman family's interest to let his claim of bitcoin address ownership remain uncontested. Because if he can't actually hand over 500k+ btc then they are still owed the equivalent in cash/asset value which he is liable for. So basically all he's done is claim he has x amount and provided the public address of such which anyone could do, but no actual proof of him ever actually owning or having access to them and them being in a trust is the excuse as to why he can't? Is there a list of addresses he's publicly claimed to have owned?

CSW simply had his guy extract a list based on the following criteria: 1. Blocks mined between January 3, 2009 and August 21, 2010 2. Unspent coinbases 3. Pay to public key coinbases 4. Non-reused addresses 5. Single coinbase output 6. Nonce least significant byte of 0-58 This excellent redditor explains moreAs you can see from above, there ARE not only assumptions by the Judge, there are established facts.

Why are you being so dishonest? I already explained to you that ' the Court deems the following facts to be established for purposes of this action:' is solely about this case alone as they are facts neither side contested |

WARNING!!! Check your forum URLs carefully and avoid links to phishing sites like 'thebitcointalk' 'bitcointalk.to' and 'BitcointaLLk' |

|

|

BitcoinFX

Legendary

Offline Offline

Activity: 2646

Merit: 1720

https://youtu.be/DsAVx0u9Cw4 ... Dr. WHO < KLF

|

|

September 04, 2019, 02:32:25 PM

Last edit: September 04, 2019, 03:08:44 PM by BitcoinFX Merited by DaCryptoRaccoon (1) |

|

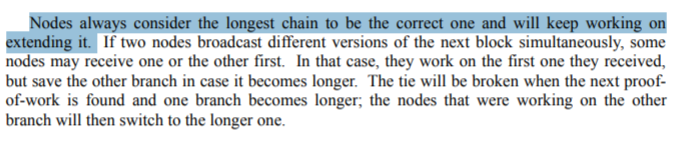

...snip... Remember when Craig announced that he was working on true fungibility and mixing for BCH? I do!  Jep - but that's not against tracability IF YOU NEED IT to prove against regulatory instances where your ownings came from. Otherwise you ll get rekt or blacklisted anyway Mixing (on or off chain) is probably the worst way to do privacy, anonymity, or to prevent traceability etc., This only provides plausible deniability, at best. What people don't currently realize is "Oblivious Transfers", won't even add 'true' fungibility. - SWIM  - https://en.wikipedia.org/wiki/FungibilityDefinition of oblivious;

1 : lacking remembrance, memory, or mindful attention

2 : lacking active conscious knowledge or awareness —usually used with of or to

Synonyms;

clueless, ignorant, incognizant, innocent, insensible, nescient, unacquainted, unaware, unconscious, uninformed, unknowing, unmindful, unwitting  This is a very interesting topic. If a solution was found, a much better, easier, more convenient implementation of Bitcoin would be possible.

Originally, a coin can be just a chain of signatures. With a timestamp service, the old ones could be dropped eventually before there's too much backtrace fan-out, or coins could be kept individually or in denominations. It's the need to check for the absence of double-spends that requires global knowledge of all transactions.

The challenge is, how do you prove that no other spends exist? It seems a node must know about all transactions to be able to verify that. If it only knows the hash of the in/outpoints, it can't check the signatures to see if an outpoint has been spent before. Do you have any ideas on this?

It's hard to think of how to apply zero-knowledge-proofs in this case.

We're trying to prove the absence of something, which seems to require knowing about all and checking that the something isn't included.

- https://en.wikipedia.org/wiki/Zero-knowledge_proof- https://en.wikipedia.org/wiki/Non-interactive_zero-knowledge_proof  I see you cited satoshi and wiki, however, you failed to understand what satoshi meant, i will try to help, I cited the (5) reference, about the 2 colored balls ( https://www.linkedin.com/pulse/demonstrate-how-zero-knowledge-proofs-work-without-using-chalkias) This example requires two identical objects with different colours such as two coloured balls.

Imagine your friend is red-green colour-blind (while you are not) and you have two balls: one red and one green, but otherwise identical. To your friend they seem completely identical and he is skeptical that they are actually distinguishable. You want to prove to him they are in fact differently-coloured, but nothing else; in particular, you do not want to reveal which one is the red and which is the green ball.

Here is the proof system. You give the two balls to your friend and he puts them behind his back. Next, he takes one of the balls and brings it out from behind his back and displays it. He then places it behind his back again and then chooses to reveal just one of the two balls, picking one of the two at random with equal probability. He will ask you, "Did I switch the ball?" This whole procedure is then repeated as often as necessary.

By looking at their colours, you can of course say with certainty whether or not he switched them. On the other hand, if they were the same colour and hence indistinguishable, there is no way you could guess correctly with probability higher than 50%.

Since the probability that you would have randomly succeeded at identifying each switch/non-switch is 50%, the probability of having randomly succeeded at all switch/non-switches approaches zero ("soundness"). If you and your friend repeat this "proof" multiple times (e.g. 100 times), your friend should become convinced ("completeness") that the balls are indeed differently coloured.

The above proof is zero-knowledge because your friend never learns which ball is green and which is red; indeed, he gains no knowledge about how to distinguish the balls.

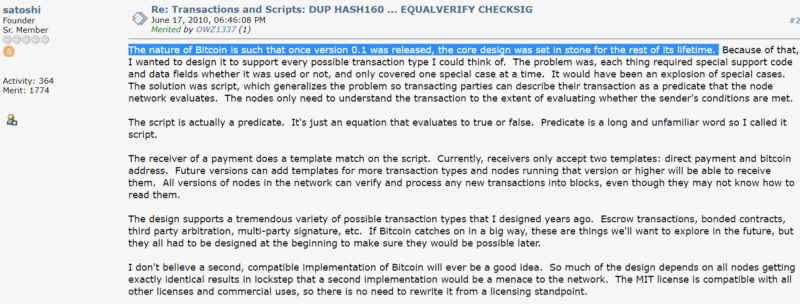

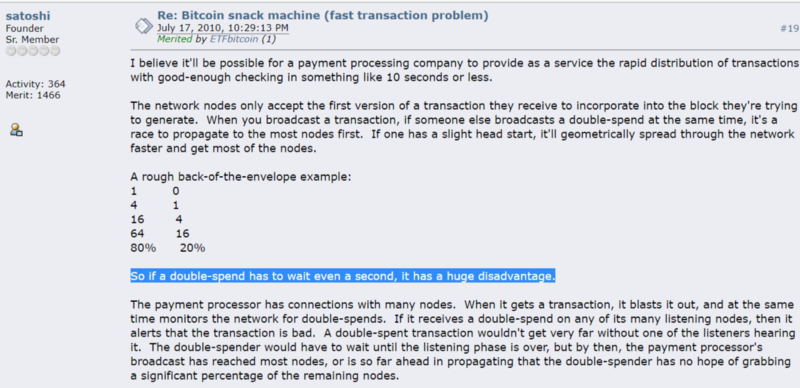

This example cannot be applied to bitcoin since it is interactive. You convince just the colorblind friend and nobody else. And, by the way, even in this case, there is no way you show him are there any unspent coins inside those colored balls. This is what you failed to understand. You will say that you provided the link for Non-interactive zero-knowledge proof and Pairing-based cryptography and it's further implementation to ZCash protocol. I will say that this is not needed. 0-conf is not needed in Bitcoin. From Bitcoin whitepaper:   And another quote from satoshi on this forum:  Bitcoin TX's may be fast, bitcoin can even scale(BSV), however, they are not instant and were not designed to be so. Failed delivery, rerouting, damage in delivery (malicious maltreating included) or simply delayed all arise with Bitcoin transactions.  Cool tournament, by the way. I have not failed to understand what the real Satoshi meant (who is most certainly not CSW). I also do not require your help in any matter whatsoever either ... Bitcoin TX's are not fast, they are in fact more or less instant, when broadcast. Transaction throughput (network confirmation time etc.,) is largely what governs scalability. Not block size. It is mostly the 10 min. blocktime which directly hinders throughput / volume of congested bitcoin transactions. Changing this "Set in Stone" value obviously would alter the economic distribution model, something which is far from acceptable. This is why Hal said off chain transactions were important to scaling bitcoin and for mass adoption. Good luck with the BSV big blocks 'sand pit'. All BSV will do is increase centralization of it's own network / protocol. I made a quote on this forum in this regard very early on in BTC days, something to the effect of "It does not matter what you do, eventually you will run out of space."Better, faster, more private blockchain's are coming. ... Oh wait, actually you could request that your BSV 'fraudtoshi' leader (CSW) create a new account on this forum and drop me a PM ... Ask him to tell me what Satoshi told me that he/she/they wanted to build for bitcoin before I left this forum ? It would also be preferable if the message was signed with Satoshi Nakamoto's PGP Key ... - https://nakamotoinstitute.org/static/satoshinakamoto.ascI will wait until May 2020, although I will most certainly continue to wait longer.  - https://youtu.be/vA2vCG6WwQA- https://bitcointalk.org/index.php?topic=5.msg188#msg188BitcoinFX, can you pm or email me, I have a couple questions about back in 2010.

Is/was that you CSW ? Fishing for Luckies ? lol and ... How to be a "Faketoshi", better than any other "Faketoshi" !?!- https://bitcointalk.org/index.php?topic=5148607.0 |

|

|

|

|

Iamtutut

|

|

September 04, 2019, 04:19:16 PM

Last edit: September 04, 2019, 08:50:51 PM by Iamtutut |

|

There was no assumption from the Judge.

There is a sanction that establishes Kleiman & Wright as partners, only for the cause of the proceeding, because Wright is held in Contempt of Court.

I will repost judge Reinhart's established facts: THE HONORABLE BRUCE E. REINHART

UNITED STATES MAGISTRATE JUDGE

Therefore, as a remedial measure pursuant to Federal

Rule of Civil Procedure 37(b)(2)(A)(i), the Court deems the

following facts to be established for purposes of this action:

And, by the way, I find that no lesser sanction is

sufficient than what I'm about to announce.

One, Dr. Wright and David Kleiman entered into a

50 percent 50/50 partnership to develop Bitcoin intellectual

property and to mine Bitcoin.

Second, it is deemed proven that all Bitcoin mined

by Dr. Wright prior to December 31st, 2013, was joint property

of Dr. Wright and David Kleiman at the time it was mined.

Because Dr. Wright's 10th affirmative defense relating to the

statute of frauds challenges the existence of a partnership,

it is inconsistent with these findings and these facts, so it

is stricken.

As a further punitive sanction, I deem the following

facts:

One, any Bitcoin-related intellectual property

developed by Dr. Wright prior to David Kleiman's death is

jointly and equally owned by Dr. Wright and by the plaintiffs.

And, two, any Bitcoin mined by Dr. Wright prior to

David Kleiman's death and any assets traceable to those

Bitcoin is presently jointly and equally owned by the

plaintiffs and Dr. Wright.

Dr. Wright's third, fourth, fifth, sixth, seventh,

eighth, second seventh affirmative defenses assert that David

Kleiman surrendered has legal rights in return for shares in a

corporation. These affirmative defenses are inconsistent with

the facts as I have deemed them, so they are stricken.

I do not strike Dr. Wright's first, second, I think

ninth, or 11th and 12th affirmative defenses. So I do not --

I do not strike all of his pleadings. I do not enter a

default judgment. I leave in place the affirmative defenses

relating to statute of limitations, latches, res judicata and

the one I can't remember.

In addition, Dr. Wright's April 18th motion which

was in substance a motion for protective order was denied, the

plaintiffs' June 3rd motion to compel was granted, and the

current motion is also granted. Therefore, I will order that

the plaintiffs are entitled to receive reasonable attorney's

fees and expenses related to each of those motions.

As you can see from above, there ARE not only assumptions by the Judge, there are established facts. There are also points in Dr. Wright's affirmative defense ACCEPTED by the court. Hope this clears it up for you. An established fact IS NOT an assumption, I don't need any clearing. An assumption (supposition / opinion / belief) is what one (edit here, forget an "e") side claims. The judge Stroke Wright by deciding the claims of the plaintiff NOT to be assumptions but facts for the cause and the cause only. |

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4879

Doomed to see the future and unable to prevent it

|

|

September 04, 2019, 04:32:23 PM |

|

...snip... Remember when Craig announced that he was working on true fungibility and mixing for BCH? I do!  Jep - but that's not against tracability IF YOU NEED IT to prove against regulatory instances where your ownings came from. Otherwise you ll get rekt or blacklisted anyway Mixing (on or off chain) is probably the worst way to do privacy, anonymity, or to prevent traceability etc., This only provides plausible deniability, at best. What people don't currently realize is "Oblivious Transfers", won't even add 'true' fungibility. - SWIM  - https://en.wikipedia.org/wiki/FungibilityDefinition of oblivious;

1 : lacking remembrance, memory, or mindful attention

2 : lacking active conscious knowledge or awareness —usually used with of or to

Synonyms;

clueless, ignorant, incognizant, innocent, insensible, nescient, unacquainted, unaware, unconscious, uninformed, unknowing, unmindful, unwitting  This is a very interesting topic. If a solution was found, a much better, easier, more convenient implementation of Bitcoin would be possible.

Originally, a coin can be just a chain of signatures. With a timestamp service, the old ones could be dropped eventually before there's too much backtrace fan-out, or coins could be kept individually or in denominations. It's the need to check for the absence of double-spends that requires global knowledge of all transactions.

The challenge is, how do you prove that no other spends exist? It seems a node must know about all transactions to be able to verify that. If it only knows the hash of the in/outpoints, it can't check the signatures to see if an outpoint has been spent before. Do you have any ideas on this?

It's hard to think of how to apply zero-knowledge-proofs in this case.

We're trying to prove the absence of something, which seems to require knowing about all and checking that the something isn't included.

- https://en.wikipedia.org/wiki/Zero-knowledge_proof- https://en.wikipedia.org/wiki/Non-interactive_zero-knowledge_proof  I see you cited satoshi and wiki, however, you failed to understand what satoshi meant, i will try to help, I cited the (5) reference, about the 2 colored balls ( https://www.linkedin.com/pulse/demonstrate-how-zero-knowledge-proofs-work-without-using-chalkias) This example requires two identical objects with different colours such as two coloured balls.

Imagine your friend is red-green colour-blind (while you are not) and you have two balls: one red and one green, but otherwise identical. To your friend they seem completely identical and he is skeptical that they are actually distinguishable. You want to prove to him they are in fact differently-coloured, but nothing else; in particular, you do not want to reveal which one is the red and which is the green ball.

Here is the proof system. You give the two balls to your friend and he puts them behind his back. Next, he takes one of the balls and brings it out from behind his back and displays it. He then places it behind his back again and then chooses to reveal just one of the two balls, picking one of the two at random with equal probability. He will ask you, "Did I switch the ball?" This whole procedure is then repeated as often as necessary.

By looking at their colours, you can of course say with certainty whether or not he switched them. On the other hand, if they were the same colour and hence indistinguishable, there is no way you could guess correctly with probability higher than 50%.

Since the probability that you would have randomly succeeded at identifying each switch/non-switch is 50%, the probability of having randomly succeeded at all switch/non-switches approaches zero ("soundness"). If you and your friend repeat this "proof" multiple times (e.g. 100 times), your friend should become convinced ("completeness") that the balls are indeed differently coloured.

The above proof is zero-knowledge because your friend never learns which ball is green and which is red; indeed, he gains no knowledge about how to distinguish the balls.

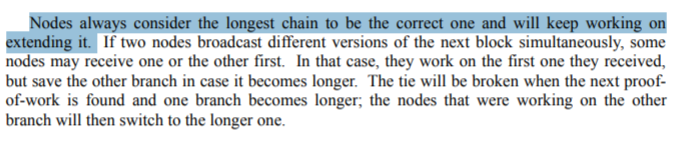

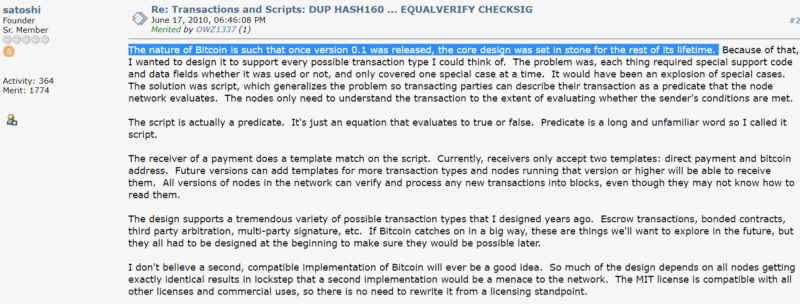

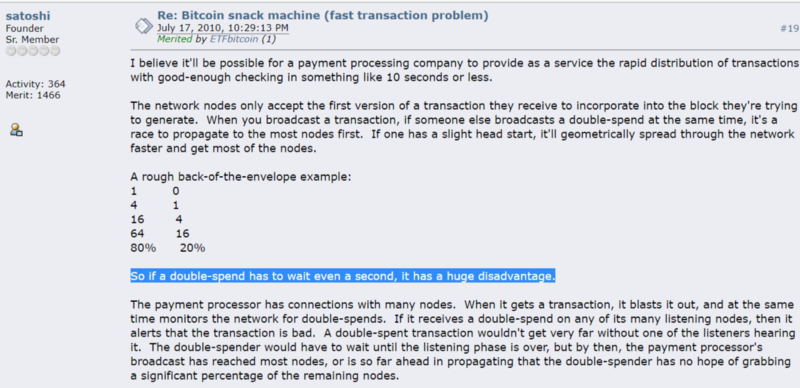

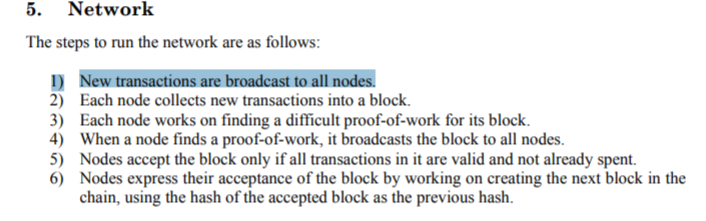

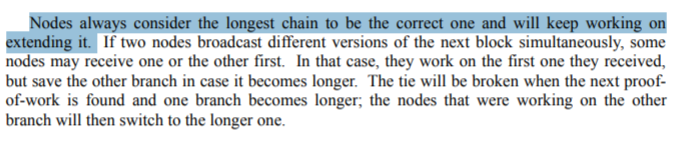

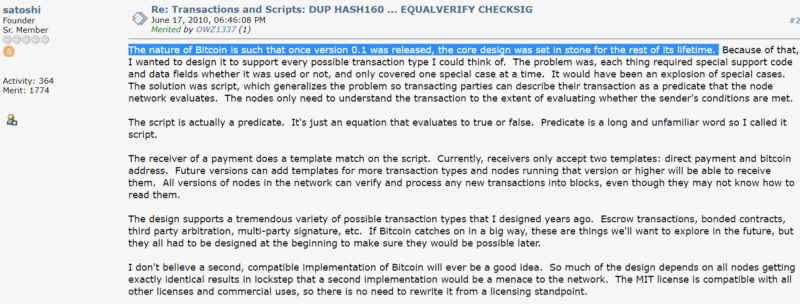

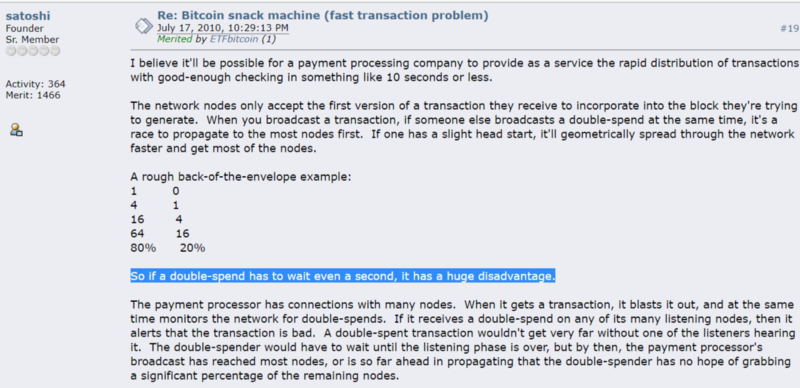

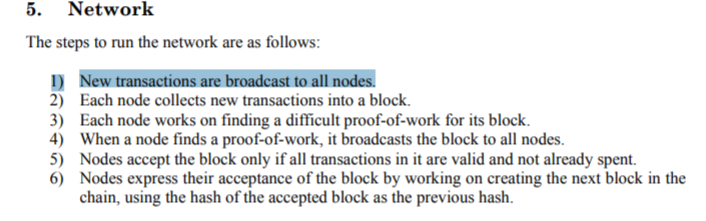

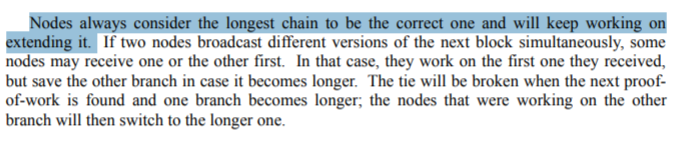

This example cannot be applied to bitcoin since it is interactive. You convince just the colorblind friend and nobody else. And, by the way, even in this case, there is no way you show him are there any unspent coins inside those colored balls. This is what you failed to understand. You will say that you provided the link for Non-interactive zero-knowledge proof and Pairing-based cryptography and it's further implementation to ZCash protocol. I will say that this is not needed. 0-conf is not needed in Bitcoin. From Bitcoin whitepaper:   And another quote from satoshi on this forum:  Bitcoin TX's may be fast, bitcoin can even scale(BSV), however, they are not instant and were not designed to be so. Failed delivery, rerouting, damage in delivery (malicious maltreating included) or simply delayed all arise with Bitcoin transactions.  Cool tournament, by the way. I have not failed to understand what the real Satoshi meant (who is most certainly not CSW). I also do not require your help in any matter whatsoever either ... Bitcoin TX's are not fast, they are in fact more or less instant, when broadcast. Transaction throughput (network confirmation time etc.,) is largely what governs scalability. Not block size. It is mostly the 10 min. blocktime which directly hinders throughput / volume of congested bitcoin transactions. Changing this "Set in Stone" value obviously would alter the economic distribution model, something which is far from acceptable. This is why Hal said off chain transactions were important to scaling bitcoin and for mass adoption. Good luck with the BSV big blocks 'sand pit'. All BSV will do is increase centralization of it's own network / protocol. I made a quote on this forum in this regard very early on in BTC days, something to the effect of "It does not matter what you do, eventually you will run out of space."Better, faster, more private blockchain's are coming. ... Oh wait, actually you could request that your BSV 'fraudtoshi' leader (CSW) create a new account on this forum and drop me a PM ... Ask him to tell me what Satoshi told me that he/she/they wanted to build for bitcoin before I left this forum ? It would also be preferable if the message was signed with Satoshi Nakamoto's PGP Key ... - https://nakamotoinstitute.org/static/satoshinakamoto.ascI will wait until May 2020, although I will most certainly continue to wait longer.  - https://youtu.be/vA2vCG6WwQA- https://bitcointalk.org/index.php?topic=5.msg188#msg188BitcoinFX, can you pm or email me, I have a couple questions about back in 2010.

Is/was that you CSW ? Fishing for Luckies ? lol and ... How to be a "Faketoshi", better than any other "Faketoshi" !?!- https://bitcointalk.org/index.php?topic=5148607.0Jesus this post somehow sent me down the rabbit hole and i ended up here https://forums.somethingawful.com/showthread.php?threadid=3413928&userid=0&perpage=40&pagenumber=444and just got worse from there.  |

“Bad men need nothing more to compass their ends, than that good men should look on and do nothing.”

|

|

|

|

HardFireMiner

|

|

September 05, 2019, 08:47:20 AM |

|

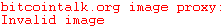

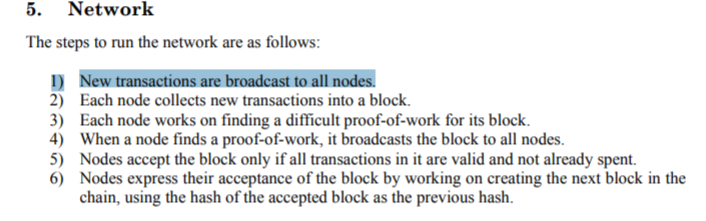

This is a very interesting topic. If a solution was found, a much better, easier, more convenient implementation of Bitcoin would be possible.

Originally, a coin can be just a chain of signatures. With a timestamp service, the old ones could be dropped eventually before there's too much backtrace fan-out, or coins could be kept individually or in denominations. It's the need to check for the absence of double-spends that requires global knowledge of all transactions.

The challenge is, how do you prove that no other spends exist? It seems a node must know about all transactions to be able to verify that. If it only knows the hash of the in/outpoints, it can't check the signatures to see if an outpoint has been spent before. Do you have any ideas on this?

It's hard to think of how to apply zero-knowledge-proofs in this case.

We're trying to prove the absence of something, which seems to require knowing about all and checking that the something isn't included.

- https://en.wikipedia.org/wiki/Zero-knowledge_proof- https://en.wikipedia.org/wiki/Non-interactive_zero-knowledge_proof  From Bitcoin whitepaper:   And another quote from satoshi on this forum:  Bitcoin TX's may be fast, bitcoin can even scale(BSV), however, they are not instant and were not designed to be so. Failed delivery, rerouting, damage in delivery (malicious maltreating included) or simply delayed all arise with Bitcoin transactions.  Cool tournament, by the way. I have not failed to understand what the real Satoshi meant (who is most certainly not CSW). I also do not require your help in any matter whatsoever either ... Bitcoin TX's are not fast, they are in fact more or less instant, when broadcast. Because a transaction is considered settled and confirmed when broadcast to the network? Once broadcast, transaction confirmed, instantly? Riiiiight. Transaction throughput (network confirmation time etc.,) is largely what governs scalability. Not block size.

Where did I say something about block size? We were talking about transactions, as far as I can tell. |

|

|

|

BitcoinFX

Legendary

Offline Offline

Activity: 2646

Merit: 1720

https://youtu.be/DsAVx0u9Cw4 ... Dr. WHO < KLF

|

|

September 05, 2019, 10:30:43 AM

Last edit: September 05, 2019, 11:56:05 AM by BitcoinFX |

|

Where did I say something about block size? We were talking about transactions, as far as I can tell.

@HardFireMiner Yes we are talking about transactions - speed and throughput capabilities on the network (TX's per. sec. and fees etc.,), all being relative to what is/was the ongoing blocksize debate, which fractured the community and is/was the major reason for the BCH and BSV forks. It may surprise you that I'm far from being a Bitcoin maximalist. This is very simple really (and from a mostly non-technical perspective) ... If 100 people (transactions) are waiting for a bus (a block) at a bus stop (the point of sale) and said bus can only carry 50 people, the other 50 people must wait for the next bus (assuming that the bus is not already full of course!). The people waiting for the next bus are stuck in the mempool. The frequency of buses on the timetable (blocktime) is fixed at 10 mins. ("Set in Stone"), said 50 people must therefore wait approx. 10 mins. for the next bus etc., etc., This is the nature of Bitcoins TX model (herewith, real-time example) ... - https://bitcoinfees.earn.com/The BCH / BSV 'solution' is/was to assume that we simply require bigger buses (blocks) to solve the issue. Whilst this might seem to be the perfect solution, more congestion actually occurs and the reason relative to buses is that it takes longer for people to board and to alight from the bus. In terms of Bitcoin, bigger buses (blocks) cause more pollution and will fill up your hard drive faster. If your hard drive is full you can no longer run a node or you need to buy a bigger more expensive hard drive i.e. increased centralization and barrier to entry etc., HINT: Empty buses don't need to be bigger!  The Lightning Network is one off-chain solution to this problem by effectively providing separate shuttle bus services for say peak times - by offloading micro payments etc., Hence ... ...snip... Hal Finney seemed to understand it back in 2010. Actually there is a very good reason for Bitcoin-backed banks to exist, issuing their own digital cash currency, redeemable for bitcoins. Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient. Likewise, the time needed for Bitcoin transactions to finalize will be impractical for medium to large value purchases.

People who think 'Electronic Cash' simply means an asset designed for small daily payments (and need to have no fees and instant confirmations) need to read the Cypherpunk Manifesto: https://www.activism.net/cypherpunk/manifesto.html...snip... Please think around these concepts further (super market checkouts are also a good example) and the stark reality may dawn on you that BSV is essentially an out-of-service GIGAMEG's (lolz) bus - headed back to the depot of centralization. Supposedly, thousands of passengers are waiting for this mega bus to arrive and each of them is carrying large suit cases of additional data (such as weather maps). Sounds like a nightmare to me. I do hope the bus doesn't crash or breakdown or something ... "...CRASHing..." ... Erm ... - https://cypherpunks.venona.com/date/1993/12/msg00218.html" I thought of a new name today for digital cash: CRASH, taken from

CRypto cASH. "How much crash have you got in your account? Can we FTP

this GIF?" "Not enough... Hey, can I borrow some crash?" It has a nice

cyberpunk sound to it. I don't know if we need a name for the units,

or if we could just get by without.

One of the lessons of the CP publicity is that having a sexy name is

a big plus.

(Apologies if I'm unknowingly regurgitating someone else's idea!)

Hal "Always, way ahead ...  Now imagine trying to store every .torrent on the entire internet on your hard drive. No, not only the .torrent files, but the actual files. ... Riiiiight.- https://youtu.be/yuTMWgOduFM- https://youtu.be/jO5VV5PISHU |

|

|

|

|

HardFireMiner

|

|

September 05, 2019, 12:19:43 PM |

|

Where did I say something about block size? We were talking about transactions, as far as I can tell.

@HardFireMiner Yes we are talking about transactions - speed and throughput capabilities on the network (TX's per. sec. and fees etc.,), all being relative to what is/was the ongoing blocksize debate, which fractured the community and is/was the major reason for the BCH and BSV forks. It may surprise you that I'm far from being a Bitcoin maximalist. This is very simple really (and from a mostly non-technical perspective) ... If 100 people (transactions) are waiting for a bus (a block) at a bus stop (the point of sale) and said bus can only carry 50 people, the other 50 people must wait for the next bus (assuming that the bus is not already full of course!). The people waiting for the next bus are stuck in the mempool. The frequency of buses on the timetable (blocktime) is fixed at 10 mins. ("Set in Stone"), said 50 people must therefore wait approx. 10 mins. for the next bus etc., etc., This is the nature of Bitcoins TX model (herewith, real-time example) ... - https://bitcoinfees.earn.com/The BCH / BSV 'solution' is/was to assume that we simply require bigger buses (blocks) to solve the issue. Whilst this might seem to be the perfect solution, more congestion actually occurs and the reason relative to buses is that it takes longer for people to board and to alight from the bus. In terms of Bitcoin, bigger buses (blocks) cause more pollution and will fill up your hard drive faster. If your hard drive is full you can no longer run a node or you need to buy a bigger more expensive hard drive i.e. increased centralization and barrier to entry etc., HINT: Empty buses don't need to be bigger! Cheesy The Lightning Network is one off-chain solution to this problem by effectively providing separate shuttle bus services for say peak times - by offloading micro payments etc., Hence ... You say "In terms of Bitcoin, bigger buses (blocks) cause more pollution and will fill up your hard drive faster." This sounds reasonable but i will try to explain my view on it :On BTC, when 50 people arrive and enter the bus, every individual that comes after the 50th and before 10 minutes, will wait for the next bus, that will carry 50 people as well. Now lets assume that there is heavy network activity, i.o.e. all the people in the town want to take the bus in relatively same time. They will be blocked, a panic will occur, everybody will try to pay more to get accepted (remember those huge fees during the 2018 BTC network congestion? not to mention, up to 2 weeks wait time for transactions to be delivered) and no matter what those people do, the bus takes 50, no more people. Lets say there were 25000 people waiting for the next bus. They waited 2 weeks(2018 btc network congestion). ( The space on hard drive will be same as on BSV, the only difference is in time confirmation and fee) On BSV, there are no, or mostly no limits on how many people a bus can carry, it is up to the bus operators(miners). Now lets assume same situation described above - heavy network activity. 50 people come enters bus, yes it will still stay 10 minutes waiting for others, but others will be able to take the bus and leave in maximum 10 minutes, not 2 weeks, with reasonable fees. It is up to miners want they to mine big blocks or not. Same 25000(actually, close to as many as necessary) people waited 10 minutes( The space on hard drive will be same as on BTC, the only difference is in time confirmation and fee). Big blocks can and will see their rise and necessity when the next huge network congestion will occur, the network will freeze and many more can happen and most likely will happen. So while your statement sounds reasonable, it is not because bigger blocks will only occur if necessary, to deliver what bitcoin was designed to do from the beginning - Same transactions per second(TPS) ability as VISA or paypal, or anyone, for that matter. It's like saying, lets eat less, to poop less(hello Bolsonaro). BTC will get those 50 gb of storage during a heavy network activity in a ridiculous amount of time, we will see sooner rather than later. Bitcoin will get those 50 gb of storage like a boss in 10 minutes and will put the headstone on BTC ability to scale. Yes, in time, not everyone will be able to store the blockchain and mine bitcoin, it will be economically unreasonable. In this, like in every field in capitalism, the strongest and most effective business model will dominate. Bitcoin mining doesn't need to be different in today's global economy. As businesses develop, the business models also develops, in time, competition creates a fairer price for the consumer and a more stable revenue for the producer, every mature business tends to be more efficient. Everybody can start an oil business, but can everybody afford it? Who can compete with Standard Oil starting from scratch? Not many people. While the myth of monopoly and oligarchy is present in the bitcoin world, i totally disassociate with such statements as they are not based on common sense, I see them as mediocre socialists/anarchist that live in a parallel world. If there will be demand, and it will, bitcoin will scale and will deliver any size necessary of blocks, and thus delivering any TPS(in 10 minutes  ). |

|

|

|

Phinnaeus Gage

Legendary

Offline Offline

Activity: 1918

Merit: 1570

Bitcoin: An Idea Worth Spending

|

|

September 05, 2019, 02:17:57 PM |

|

...snip... Remember when Craig announced that he was working on true fungibility and mixing for BCH? I do!  Jep - but that's not against tracability IF YOU NEED IT to prove against regulatory instances where your ownings came from. Otherwise you ll get rekt or blacklisted anyway Mixing (on or off chain) is probably the worst way to do privacy, anonymity, or to prevent traceability etc., This only provides plausible deniability, at best. What people don't currently realize is "Oblivious Transfers", won't even add 'true' fungibility. - SWIM  - https://en.wikipedia.org/wiki/FungibilityDefinition of oblivious;

1 : lacking remembrance, memory, or mindful attention

2 : lacking active conscious knowledge or awareness —usually used with of or to

Synonyms;

clueless, ignorant, incognizant, innocent, insensible, nescient, unacquainted, unaware, unconscious, uninformed, unknowing, unmindful, unwitting  This is a very interesting topic. If a solution was found, a much better, easier, more convenient implementation of Bitcoin would be possible.

Originally, a coin can be just a chain of signatures. With a timestamp service, the old ones could be dropped eventually before there's too much backtrace fan-out, or coins could be kept individually or in denominations. It's the need to check for the absence of double-spends that requires global knowledge of all transactions.

The challenge is, how do you prove that no other spends exist? It seems a node must know about all transactions to be able to verify that. If it only knows the hash of the in/outpoints, it can't check the signatures to see if an outpoint has been spent before. Do you have any ideas on this?

It's hard to think of how to apply zero-knowledge-proofs in this case.

We're trying to prove the absence of something, which seems to require knowing about all and checking that the something isn't included.

- https://en.wikipedia.org/wiki/Zero-knowledge_proof- https://en.wikipedia.org/wiki/Non-interactive_zero-knowledge_proof  I see you cited satoshi and wiki, however, you failed to understand what satoshi meant, i will try to help, I cited the (5) reference, about the 2 colored balls ( https://www.linkedin.com/pulse/demonstrate-how-zero-knowledge-proofs-work-without-using-chalkias) This example requires two identical objects with different colours such as two coloured balls.

Imagine your friend is red-green colour-blind (while you are not) and you have two balls: one red and one green, but otherwise identical. To your friend they seem completely identical and he is skeptical that they are actually distinguishable. You want to prove to him they are in fact differently-coloured, but nothing else; in particular, you do not want to reveal which one is the red and which is the green ball.

Here is the proof system. You give the two balls to your friend and he puts them behind his back. Next, he takes one of the balls and brings it out from behind his back and displays it. He then places it behind his back again and then chooses to reveal just one of the two balls, picking one of the two at random with equal probability. He will ask you, "Did I switch the ball?" This whole procedure is then repeated as often as necessary.

By looking at their colours, you can of course say with certainty whether or not he switched them. On the other hand, if they were the same colour and hence indistinguishable, there is no way you could guess correctly with probability higher than 50%.

Since the probability that you would have randomly succeeded at identifying each switch/non-switch is 50%, the probability of having randomly succeeded at all switch/non-switches approaches zero ("soundness"). If you and your friend repeat this "proof" multiple times (e.g. 100 times), your friend should become convinced ("completeness") that the balls are indeed differently coloured.

The above proof is zero-knowledge because your friend never learns which ball is green and which is red; indeed, he gains no knowledge about how to distinguish the balls.

This example cannot be applied to bitcoin since it is interactive. You convince just the colorblind friend and nobody else. And, by the way, even in this case, there is no way you show him are there any unspent coins inside those colored balls. This is what you failed to understand. You will say that you provided the link for Non-interactive zero-knowledge proof and Pairing-based cryptography and it's further implementation to ZCash protocol. I will say that this is not needed. 0-conf is not needed in Bitcoin. From Bitcoin whitepaper:   And another quote from satoshi on this forum:  Bitcoin TX's may be fast, bitcoin can even scale(BSV), however, they are not instant and were not designed to be so. Failed delivery, rerouting, damage in delivery (malicious maltreating included) or simply delayed all arise with Bitcoin transactions.  Cool tournament, by the way. I have not failed to understand what the real Satoshi meant (who is most certainly not CSW). I also do not require your help in any matter whatsoever either ... Bitcoin TX's are not fast, they are in fact more or less instant, when broadcast. Transaction throughput (network confirmation time etc.,) is largely what governs scalability. Not block size. It is mostly the 10 min. blocktime which directly hinders throughput / volume of congested bitcoin transactions. Changing this "Set in Stone" value obviously would alter the economic distribution model, something which is far from acceptable. This is why Hal said off chain transactions were important to scaling bitcoin and for mass adoption. Good luck with the BSV big blocks 'sand pit'. All BSV will do is increase centralization of it's own network / protocol. I made a quote on this forum in this regard very early on in BTC days, something to the effect of "It does not matter what you do, eventually you will run out of space."Better, faster, more private blockchain's are coming. ... Oh wait, actually you could request that your BSV 'fraudtoshi' leader (CSW) create a new account on this forum and drop me a PM ... Ask him to tell me what Satoshi told me that he/she/they wanted to build for bitcoin before I left this forum ? It would also be preferable if the message was signed with Satoshi Nakamoto's PGP Key ... - https://nakamotoinstitute.org/static/satoshinakamoto.ascI will wait until May 2020, although I will most certainly continue to wait longer.  - https://youtu.be/vA2vCG6WwQA- https://bitcointalk.org/index.php?topic=5.msg188#msg188BitcoinFX, can you pm or email me, I have a couple questions about back in 2010.

Is/was that you CSW ? Fishing for Luckies ? lol and ... How to be a "Faketoshi", better than any other "Faketoshi" !?!- https://bitcointalk.org/index.php?topic=5148607.0Jesus this post somehow sent me down the rabbit hole and i ended up here https://forums.somethingawful.com/showthread.php?threadid=3413928&userid=0&perpage=40&pagenumber=444and just got worse from there.  SA, now that's a blast from the past. Here's a quote from just below the fold ... I like how quickly Bruce went from crazy Bitcoin guy with way too much ambition. To full blown rapist-pedophile. I'll give you one guess as to who was instrumental in getting Pedo Bruce ousted from the crypto community. Hint: https://bitcointalk.org/index.php?topic=39476.0. |

|

|

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4879

Doomed to see the future and unable to prevent it

|

|

September 05, 2019, 07:41:13 PM |

|

SA, now that's a blast from the past. Here's a quote from just below the fold ... I like how quickly Bruce went from crazy Bitcoin guy with way too much ambition. To full blown rapist-pedophile. I'll give you one guess as to who was instrumental in getting Pedo Bruce ousted from the crypto community. Hint: https://bitcointalk.org/index.php?topic=39476.0. Yeah, i did notice that, nice job.  I thought it amusing that i started on one thing and I was on a completely unrelated thing an hour later! Happens to me too often these days.  |

“Bad men need nothing more to compass their ends, than that good men should look on and do nothing.”

|

|

|

TheNewAnon135246

Legendary

Offline Offline

Activity: 2198

Merit: 1989

฿uy ฿itcoin

|

|

September 05, 2019, 07:43:59 PM |

|

I talk to both of them quite frequent on Twitter. They have been doing a great job documenting all of Craig's bullshit. |

|

|

|

|

Baofeng

Legendary

Offline Offline

Activity: 2576

Merit: 1655

|

|

September 05, 2019, 11:31:10 PM |

|

https://www.reddit.com/r/Bitcoin/comments/cz9pxk/craig_wright_was_at_least_accurate_on_one_thing/Craig Wright was at least accurate on one thing according to the above reddit entry. "Very soon people are going to discover that when you start lying and when you troll that there are consequences"I literally fell on the chair when I hear CSW talking about trolling and lying.

|

| │ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███▀▀▀█████████████████

███▄▄▄█████████████████

███████████████████████

███████████████████████

███████████████████████

█████████████████████

███████████████████

███████████████

████████████████████████ | ███████████████████████████

███████████████████████████

███████████████████████████

█████████▀▀██▀██▀▀█████████

█████████████▄█████████████

████████▄█████████▄████████

█████████████▄█████████████

█████████████▄█▄███████████

██████████▀▀█████████████

██████████▀█▀██████████

▀███████████████████▀

▀███████████████▀

█████████████████████████ | | | O F F I C I A L P A R T N E R S

▬▬▬▬▬▬▬▬▬▬

ASTON VILLA FC

BURNLEY FC | | | BK8? | | | .

..PLAY NOW.. |

|

|

|

|

|

|

Iamtutut

|

|

September 06, 2019, 08:08:43 AM Merited by JayJuanGee (1) |

|

Fraudtoshi aka Craig Wright is caught plagarizing. Yeah I know it might be the 1321864348943646th time https://twitter.com/Zectro1/status/1169703880705200128-> One of the papers Craig Wright is presenting at his conference tomorrow, "A Proof of Turing Completeness in Bitcoin Script," was almost completely plagiarized from C. Böhm, "On a family of Turing machines and the related programming language" |

|

|

|

|

|