|

AnonyMint (OP)

|

|

April 04, 2014, 10:57:05 PM

Last edit: April 05, 2014, 12:32:57 PM by AnonyMint |

|

P.S. this thread is self-moderated, but I will only delete personal (meaning directed at a specific poster here) attacks, quoting the entire OP or other longish quote (noisy), or spam. I will not delete posts I disagree with, except for blablahblah who is so obnoxious that he is permanently banned from my life. https://bitcointalk.org/index.php?topic=400235.msg6075905#msg6075905I come across as overly self-important. It is because I tried to warn about the dangers of Bitcoin (while being fair to also praise its virtues) and in the process I had to shout over a lot of hurt feelings. And this hardened my resolve. Sorry this is not overconfidence, it is uber confidence because it is based in fact checking not in wishful careless arbitrary dreaming. Because when I spend a year digging into the details of something, I make many key insights and discoveries. And you all do not know what I discovered technologically because I haven't revealed it. Why should I give you my secret recipes when in fact you would piss on them any way. The only way forward is to prove you wrong. Sorry this is not a desire to be a jerk. It is a desire to do what is best for mankind, a desire to get wealthy doing it, and a desire to build a bigger ecosystem with more people like you profiting and smiling.

Now on to the analysis...

Well if this is the bottom it is U shaped, not V, which is what I predicted upthread.

The price action seems to be very quiet, so not much to talk about from a TA perspective.

First a math point about relating adoption rate to price. Peter R confirmed upthread with a chart that proxies for adoption, N, are tracking price = N x N. And if adoption is growing by rate R per year, then it grows R x R rate in two years. Thus we can say that the annual rate of price increases is proportional to the biannual rate of adoption. You see when our Y axis is logarithmic (e.g. log 10 on chart Risto shows) then exponentiation becomes additive and thus linearly proportional.

So I've been FA thinking about why Bitcoin adoption is likely declining, i.e. as I showed a log-logistic curve fit.

As I explained in that linked post, the slope of the price increase was 0.33 before July 2011, and has been 0.09 since January 2012 until now. So it had already declined. The question is was the early period an aberration or part of the trend?

SlipperySlope had been fitting a logistic curve to Bitcoin's price, because technology which spreads out to the masses typically has that S shape of exponential adoption. The key factor is that logistic adoption rate (slope) increases until the midway point, i.e. at 50% of the adoption before decreasing. Whereas, log-logistic adoption rate (slope) is maximum at the start and is always declining. This is a very important distinction because logistic means we can expect Bitcoin's price rate of increase to accelerate, whereas log-logistic we can expect the rate of price appreciation to slow further (as it already did slowing from 0.33 to 0.09 after July 2011).

I gave the explanation that money is power-law distributed and thus we should expect the greatest serious network effects on adoption at the beginning because the power investors come in the earliest. The log-logistic (cumulative distribution function) curve corresponds to the power-law distribution.

I had an epiphany in my dream last night that there is a simpler explanation which also corresponds to the power-law distribution of money as follows.

"Most people who learn about Bitcoin, don't adopt it".

Why? Because it doesn't fulfill a general need. The need it fulfills is very specific to a white male, hate central banking demographic. It doesn't have fast transactions, doesn't have consumer protection, the money is difficult to secure, it is technically challenging to use, etc..

A consumer adopted item such as a washing machine has logistic adoption curve because every person who hears about wants it. Thus maximum word-of-mouth is reached at 50% of adoption. Whereas, for Bitcoin maximum rate of effectiveness of word-of-mouth was when only the correct demographic was listening back before July 2011. Now as Bitcoin tries to speak to the masses, they mostly don't care.

Thus if you want to build a Bitcoin killer altcoin, you simply make sure it is something every person will want to do.

I have experience doing such things, as I created an application that had 1 million users and 1% of the internet back in late 1990s. Before that I was involved with what became Corel Painter and I helped bring it to 1 million global units and also the first $million milestone in Japan. The key thing is I sought out that company, not them finding me. I have always been attracted to paradigm shift technology and thinking about how to make it easier for people and thus increase adoption rates.

My reputation doesn't matter. I won't be using it any way. What matters here is determining what is really going on. Because an investor without the correct interpretation of reality is destined to lose money.

If there was a black budget team who designed Bitcoin, it appears they may have failed in their analysis. It appears they have no way to get the masses interested. But let's see if that changes as offchain services and fiat masks such as Bitpay and Coinbase proliferate.

Put Coinbase and Bitpay together and you have both the consumer and the merchant, you don't need the block chain any more. Also the mining is already centralized. How much more obvious could it be?

And during this time our core development team and Foundation have been doing what to ameliorate this outcome? Meeting with the CIA and CFR.

And then I wake up to see this at the top of the Google search for "Bitcoin price":

http://gigaom.com/2014/04/04/this-week-in-bitcoin-the-push-to-get-the-currency-in-the-hands-of-the-consumer/

And so again I will challenge Risto according to our original focuses when we first met each other back in 2007. What are you doing about this? I know what I am doing. And you know I warned you about this outcome from Day 1 when you shouted to me that Bitcoin was becoming very important. |

|

|

|

|

|

|

The forum strives to allow free discussion of any ideas. All policies are built around this principle. This doesn't mean you can post garbage, though: posts should actually contain ideas, and these ideas should be argued reasonably.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

Pente

|

|

April 04, 2014, 11:05:05 PM |

|

I don't get it.

How do I store value in a brainwallet with just Bitpay & Coinbase if there is no blockchain?

How do you prevent a inflation & a dilution of value without the blockchain?

How do you prevent a government shutdown of a centralized location without the blockchain?

|

|

|

|

|

|

AnonyMint (OP)

|

|

April 04, 2014, 11:05:24 PM |

|

"Most people who learn about Bitcoin, don't adopt it".

Why? Because it doesn't fulfill a general need.

New technology almost never fills a general need. It creates a need in a place where no need previously existed, until society begins to reshape itself because the new technology has forced a space for itself. Using a tired analogy, what need did the internet fill in society? We could shop in stores. We could send letters via fax and mail. We could call people over a telephone. There was no gaping "need" for access to generally useless information 24/7. We can only answer the question in retrospect. What about social networking? Were Facebook and Twitter created to fulfill a societal need? Can you imagine trying to pitch twitter to the world? "Hey guys, you know how you really NEED and WANT to post 140 character messages online? Well now you can!" Notwithstanding whether I am correct or not, the key distinction in my mind is that nearly everyone who learns about a washing machine or smart phone, wants one. There are those who said, "I don't need that, I will stick with the hand washing or the feature phone", but this is just denial. Eventually they realize they were wrong as their neighbors are more productive. Whereas, the resistance to Bitcoin is justified, i.e. "why would I want that, I already have Paypal and I don't want the negatives of Bitcoin". I am thinking about what advantage does Coinbase + Bitpay have over Paypal? The key is that the consumer pays the fees instead of the merchant. Thus more merchants will prefer it. Why will customers prefer that? Then I got to thinking. The problem with Paypal is there are too many competitors. The elite want to control this new digital money system. What if you combined Paypal + Bitpay! Then you can see the founder of Paypal is the main angel investor in Bitpay. This is all about getting more merchants and customers into the digital fiat system. |

|

|

|

|

|

|

|

hurricandave

Legendary

Offline Offline

Activity: 966

Merit: 1003

|

|

April 04, 2014, 11:50:07 PM |

|

Well, I may not be as eloquent but as for making a single starting point, of why or what need, can or does, Bitcoin propose to implement. In my view one may be as an international conductor of value. As you have stated the customer pays the transaction fee. So far this fee has historically been low when compared to the fee assessed by international monetary exchanges. As well as the equivalent exchange handling fee assessed by credit card companies with regards to international purchases made as point of transaction in a country other than the originating account billing address.

Coinbase is the interface to which I have some degree of experience with. I would point out that their fees for purchasing Bitcoin are similar to what a merchant pays for credit and debit card use. Where as, if I wanted to purchase an item in Austria and I am American, I would need to exchange my USD currency at a fee per transaction that has historically been well above 5% of the value of the exchange. With the adoption of Bitcoin that conversion fee is no longer collected by an exchange desk. I believe that was part of the same argument made for the adoption of the Euro, except the Euro is not accepted at the check out counter of retailers world wide anymore than Bitcoin is at this point in time. Bitcoin is a potential monetary equalizer in the electronic retail environment with the ability to also be adopted world wide by walk in merchants as well.

|

|

|

|

|

|

mgburks77

|

|

April 04, 2014, 11:51:13 PM |

|

Regarding change:

Ultimately the question is more along the lines of "Is technology liberating or a means to oppress?".

Any type of organization necessarily requires a limitation of degrees of freedom so why does organization ever occur in the first place? Is technology the result of organization or is it cause of greater organization?

From questions like this we can establish some baseline principles upon which to guide ourselves.

It may be that technology is not a means of human liberation.

|

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 12:09:15 AM |

|

Regarding change:

Ultimately the question is more along the lines of "Is technology liberating or a means to oppress?".

Cross posting an excerpt from an ongoing discussion in another thread... 1. I generally disagree with this one. Never in the history of mankind has the average Joe won in mass, IMHO. Somehow I don't believe it will magically happen now that Bitcoin is around.

Bitcoin is a technology. Most every time the benefits of a new technology, properly applied, have benefited the average Joe sooner or later. Risto it appears you excel on "counting" games, but when it comes to logic it appears you over generalize (or choose the simplest understanding for efficiency) and this causes you to make mistakes. I suck at board games but I appear to excel at seeing all the conceptual issues in full range of depth and extracting the generative essence. Our brains appear to be wired differently. That appears to make you better at finding arbitrage opportunities than me (but gives you no advantage in timing market moves), but my skill appears to make me a superior visionary than you. I don't excel mentally with anything that requires me to interact with my external sensors. I excel with short I/O tape and then let my mind run on it, although normally my reading comprehension is very high but don't expect me to interact in parallelized real-time with my I/O i.e. that game you mentioned upthread (I tried while getting sleepy and only managed 16000 after several tries perhaps I would do better if I put some thought into how I should be calculating the move probabilities on that grid, but it appears to come naturally to you?). I had the following insight before, but no one prompted me to share it. It is difficult for me to keep track of all my ideas. Contemplate that the technologies which benefit the masses are those which have individual scope; whereas, those which subject the masses to greater extortion via the collective have collective scope. For example, washing machines have only individual scope and were rapidly (logistically) adopted across the breadth of the developed world. Whereas, nuclear power and nuclear weapons can't be individualized and have further enslaved us in the collective. The internet (networking in general) is a mix of individual empowerment and collective enslavement. What does anonymity do in theory? In theory it makes it possible to have all the individual empower without any (most) of the collective enslavement. This is why I am so obsessed with making sure we have anonymity, not just in our money but in every aspect of the internet. The technology I am working on is not only applicable to crypto-currency. I want to change the entire internet to make it asymmetrically more of an individual empowerment. Throughout history we had anonymity in our money because it was physical. Now Bitcoin comes along with a fully traceable public ledger and we give up asymmetric power to the collective. This alarmed the shit out of me!!!!!!!!!!!!!!!!!!!!!!!!!!!! I said to myself a year ago, "hell no! not if I can do anything about it". In geek speak, "you just don't get it". The other asymmetric problem specific to Bitcoin is it uses ASICs thus mining is in the hands of the few, and also there is nothing in the design which economically discourages large pools thus one pooltwo or three pools now controls more than 50% of the hash rate. Bitcoin has already fallen and can NEVER be a benefit to the individual. Sorry! Just wishing it to be not so is foolish. I don't have a vendetta against crypto-currency, rather I am logically analyzing the situation. And attempting to fix it. I was frankly initially shocked that you were so dismissive and uninterested (and others even attacked me for wanting to improve the situation), but then I realized it is because you guys don't think on a deep level as I do or you are blinded by your speculative fever and vested interests as owners of Bitcoins. And thus you walk right into the honey pot so designed to trap you. (And there are both technical and political reasons improvements to these issues can NEVER be back ported into Bitcoin. Sorry!) P.S. the other fundamental driver of asymmetric power of the collective on the internet is the client-server model instead of P2P. It is a fact that a physical multifurcating network is more efficient than a fully connected mesh topology, i.e. running a smaller pipe from the water district to each house increases the cost and back pressure than running a main line and then multifurcating branches off it (cross-sectional area reduces by the square of the proportional diameter decreases). However, the transfer of data on the internet does not obey that physical law because we don't charge for data according to the path it takes. However the challenge is the efficient, redundant DHT storage and serve of data for a purely P2P internet. That is a more difficult technical hurdle. P.S.S. I predicted a couple of weeks ago the IRS ruling would be what it is and that it would cause the price to dive. The post is some where in my public archives on bitcointalk. |

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 12:14:42 AM |

|

Coinbase is the interface to which I have some degree of experience with. I would point out that their fees for purchasing Bitcoin are similar to what a merchant pays for credit and debit card use. Where as, if I wanted to purchase an item in Austria and I am American, I would need to exchange my USD currency at a fee per transaction that has historically been well above 5% of the value of the exchange. With the adoption of Bitcoin that conversion fee is no longer collected by an exchange desk.

Bitpay is taking over (3X adoption increase month-on-month compounded!). And you pay the exchange rate (plus some fudge factor to hide Bitpay's fees in the exchange rate). Thus now you are paying through the nose twice. And Peter Thiel's wallet is getting fatter. |

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 12:18:01 AM

Last edit: April 05, 2014, 12:29:07 AM by AnonyMint |

|

Btw, I don't expect the "yes" vote to be higher than the "BTC" vote.

One goal I have is to put it on record how dumb (myopic/mass mania/groupthink/vested interest/incapable) the "BTC" majority is. So later when my warnings come true, I can say "I told ya so".

My other goal is to tell the "yes" voters, they will soon have better alternative(s). Keep the faith.

You will also find that many "BTC" votes will be just irrational hate towards me personally. It is good to feed their hate and let them vent it. You will note they can't make one rational argument in this thread. Even I have promised not to delete any arguments I disagree with. You see they are really feeble and helpless (and shameless).

My message to Peter Thiel is, "you think you can win with the feeble on your side?".

P.S. I feel justified calling out Thiel and (my friend) Risto, because they both put themselves in the position of being leaders of the "BTC". W.r.t. to Risto, I am merely trying to encourage him to use his resources wisely.

|

|

|

|

|

twiifm

|

|

April 05, 2014, 12:36:37 AM |

|

Interesting article.

On one hand you have merchants using Bitpay. These merchants don't want to hold BTC. They convert it to fiat before it touches their account. They are BTC sellers

On the other side you have hoarders who don't wanna to spend BTC because they are buying it for speculation.

As more merchants accept BTC thru Bitpay; this creates an asymmetry of sellers over buyers. This puts a lot of selling pressure on BTC driving the price down.

So at some point the future the price will be driven low enough where there is an equilibrium of sellers vs buyers in order for BTC stabilize. But if a better tech comes along like Ripple, BTC might just go extinct.

|

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 12:53:55 AM |

|

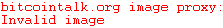

Humor timeout... Notice the deer are allowed passage (see sign in distance)  With anonymity, let's be the freerange, agile deer. TPTB can spend forever regulating (pointing at) shadows. > Yep = TECHNOCRACY > Good one, AnonyMint! LOL > > >> Date: Fri, 4 Apr 2014 01:01:33 -0400 >> Subject: humorous photo showing government banning everything/freedom >> From: AnonyMint >> To: xxxxxxx >> >> Do not proceed: >> >> Attachment: noway.jpg >>  |

|

|

|

|

thaaanos

|

|

April 05, 2014, 12:59:05 AM |

|

People don't adopt when they learn about bitcoin because people are not confident on securing digital assets. people have experience with - crashed hdds

- broken/burned/lost flash disks

- scratched CD/DVDs

- files erased by viruses

- passwords/keys forgotten or lost

Why do you think people keep buying printers? |

|

|

|

|

7thKingdom

Member

Offline Offline

Activity: 107

Merit: 10

|

|

April 05, 2014, 01:02:39 AM |

|

AnonyMint, what is your opinion of the value of Bitcoin as a hedge against the dollar?

You say that one of the major problems with bitcoin is that, to the average consumer, it doesn't fill a real need. With the way Bitpay and Coinbase operate, bitcoin has essentially become a "digital fiat system". And I certainly see your point. Bitcoin is 100% pegged to the dollar, and to most people, it doesn't really offer any practical advantage over the current system. As is, it is unnecessary, and as such, it can not grow at a similar adoption rate as new technology that fills an immediate need, like the washing machine.

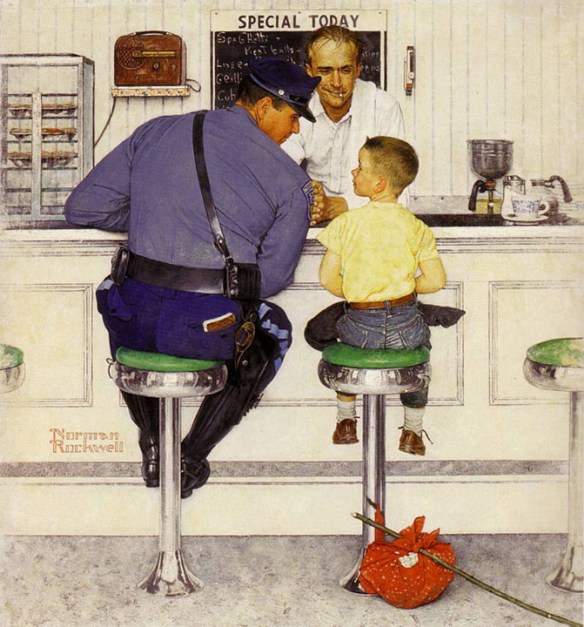

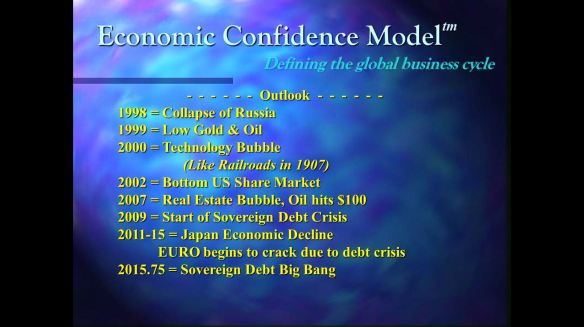

So if we buy into your log-logistic adoption rate and admit that growth is slowing, how would any impending economic instability play into the equation? Because if I remember correctly, you have written in the past about economic cycles and how we are due for a serious downturn towards the second half of 2015 (forgive me if I am wrong, it was a while back than I recall reading it). If this is true, how would this effect the bitcoin economy (and the crypto scene as a whole)? Wouldn't such a downturn create a void, a need, that bitcoin would then fill, thereby increasing the rate of adoption vs before the economy went south and that need was there? The entire ecosystem as it exists now, this "digital fiat system" as you put it, with merchants only "accepting" bitcoin through companies like bitpay and then immediately turning it into fiat, would change, would it not?

I'm interested to hear your thoughts on bitcoins role in such a scenario.

|

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 01:03:03 AM |

|

I forgot to put in the OP that if the log-logistic adoption curve fit I did is correct, it predicts BTC price to rise 10X every 16 to 20 months, just not the 12X per year appreciation "to the moon". And predicts that rate to slow again after another 2 years. Thus I don't expect BTC > $10,000 before 2016. And I never see BTC ≥ $100,000 (low probability of occurrence) because growth rate will be roughly 1/16 of current after $10,000, certainly $1 million is fantastical delusion.

|

|

|

|

|

mgburks77

|

|

April 05, 2014, 01:04:52 AM |

|

I think it's pretty clear that the answer to the question asked by the OP is yes. BTC is a fiat system in all respects except overt endorsement by a state but as soon as the protocol meets specific criteria, and that is being worked on as we speak, it will be incorporated by the fiat system and receive that endorsement. It seems like that is the end game as viewed from the perspective of entities such as the Bitcoin Foundation, and other big players.

I also agree that true anonymity and ubiquitous individualized mining are essential elements of any cryptocurrency that will escape government regulation, something which is synonymous with being coopted by the fiat system, and become a tool of individualized use. If any technical advance can be liberating, this is the path it will necessarily take. Anything less is submission.

I cannot be convinced that this wasn't the goal of the creators of btc all along. The tale of Satoshi Nakamoto is rubbish. There's real money behind the development of bitcoin, it never would have gotten this far without it. The reason for the covert nature of it's development is that despite it's shortcomings the protocol and the idea that spawned it is truly revolutionary, so it has to be managed carefully or it could blow up in the face of whoever presents it to the world. Once the technology is proven the truth about who created will emerge.

I'm still not sure that collectivized production ie civilization is the best outcome for humanity or that any technology can be individualized. Even something as seemingly innocuous as a washing machine does lock the individual into collective production.

Also I am pretty sure that human genius is the product of forces utterly beyond our control. Life is a biochemical system, the individualized components have no degree of freedom beyond what is allowed by the movement of the other components of the system.

The idea of human "liberation" may not be possible. Not sure where that leaves us yet.

|

|

|

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 01:35:34 AM

Last edit: April 05, 2014, 02:05:17 AM by AnonyMint |

|

So if we buy into your log-logistic adoption rate and admit that growth is slowing, how would any impending economic instability play into the equation?

Without anonymity we are toast. Is Bitcoin anonymous? Will the Bitcoin block chain even have a liquid anonymous market any more by 2016 when it matters to us? Or will everything be registered in Coinbase, Bitpay, Paypal, etc... Because the governments have no choice but to increase revenues as we collapse into a global debt default. And the more they tax + confiscate wealth, the more the GDP will collapse. Thus the more they will need to take from wealth. It is a downward spiral. Very scary. According to Martin Armstrong's very high placed sources, the Fed has already told the banks not to expect a bailout next big crash (which should be 2016). They are going to let this sucker downward spiral but with capital controls so that government can pay the debt and obligations while private pensions and banks implode taking all the wealth down with them. The USA is temporarily bouncing up and stock market might even double before Sept 2015. But this is just capital fleeing the emerging markets and rushing back to the reserve currency for one last hooray before the whole mess collapses. Gold hoarding causes a collapse in the velocity of money V in the equation M x V = GDP, thus GDP collapses. It is Mad Max directed outcome because the world is $223 trillion in debt + $1000 trillion in derivative swaps to hold up pension plans & finance + $1000 trillion in unfunded promises to society (welfare, pensions, etc). P.S. $4 trillion of it has been unaccounted for in the USA Federal budget and is called the "black budget". Imagine what the " Fourth Branch" of government can do with $4 trillion. Catherine Austin Fitts' point that government intentionally designs in failure when it is in its best interest but can act very swiftly when that is in its best interest (i.e. the best interests of the elite "Fourth Branch of Government" who capture the government). She talks about the $4 trillion black budget. I highly recommend listening to the audio interview. She is very articulate and gets directly to the point. She was former Assistant Security of HUD in the USA government. She was also a major player on Wallstreet. So she has insider connections. Janet Napolitano once told her to prepare for mass voilence and upheavel in the USA after 2016. http://www.dailypaul.com/314402/complete-breakdown-of-financial-controls-in-us-government-says-austin-fittsJanet Napolitano was the former head of the Homelust (hands down your child's pants) ScrewUrity department. The well known mainstream Bill Moyers did a documentary on the Fourth Branch of the USA government: http://billmoyers.com/episode/the-deep-state-hiding-in-plain-sight/If you listen to both Bill Moyer's video and Fitt's audio interview, you will drastically increase your understanding. More here: https://bitcointalk.org/index.php?topic=455141.msg5704180#msg5704180 |

|

|

|

|

mgburks77

|

|

April 05, 2014, 01:39:16 AM |

|

It is not personal identity that is important, but rather reputation.... Interesting idea, must digest thanks for links! It's difficult to locate this type of content |

|

|

|

|

farnsworth7

Newbie

Offline Offline

Activity: 31

Merit: 0

|

|

April 05, 2014, 02:30:27 AM

Last edit: April 05, 2014, 02:49:36 AM by farnsworth7 |

|

AnonyMint, thanks for this very interesting thread. I'm not sure I agree with everything you write, but you do make very valid points. Without anonymity we are toast.

Why do you think anonymity is so important for mankind ? Is it based on the assumption that anonymity gives more freedom to individuals ? I tend to think giving individuals more freedom is not sufficient to make a better world. I believe an essential key for a better life on earth is related to the quality of the interactions between individuals, ie the quality of the collective mechanisms. Because human is a social animal, you know  Don't you think global transparency in financial systems (thanks to a traceable public ledger) might be a good thing ? (To help fight corruption, for instance) (by the way sorry for any grammar mistake, english is not my native language) |

|

|

|

|

|

MahaRamana

|

|

April 05, 2014, 02:45:53 AM |

|

Without anonymity we are toast.

I don't think the elites will allow the propagation and popularisation of a crypto that ruins their plans. There are many things they can do, the first of which is to allow bitcoin to take the lead. You once used the analogy of the shift from MySpace to Facebook to justify the fact that we could shift to another crypto, but Facebook has accepted allegiance to the elites and the elites have accepted Facebook in their planning. This is very clear by the way it is shutting off all pages that the mainstream don't like or that are too critical to the elites. The difference in our case is that the elites will not accept a currency that frees the people and thus the shift will never happen. If they allow bitcoin, it means that either 1. bitcoin is a creation of their master(s) and its purpose is further enslavement or 2. they found ways to use it to their own advantage. In any case the people are enslaved by the power grabbers and I think it is only wishful thinking to believe we can change this by launching some specific new crypto. Because the governments have no choice but to increase revenues as we collapse into a global debt default. And the more they tax + confiscate wealth, the more the GDP will collapse. Thus the more they will need to take from wealth. It is a downward spiral. Very scary.

We have been hitting the peak of numerous natural resources while demographics are strongly up worldwide and consumption of land, water, rare minerals, energy resources etc... is completely unsustainable. The fact is that GDP must collapse. The elites only want to make sure that they have or create as much power as possible through and after the GDP collapse and are planning accordingly. It is unavoidable. Bitcoin either was part of or is being integrated in the planning of the elites. Actually, the elites do have the choice in front of defaults : inflation. But they probably prefer to do some rounds of confiscation first to lower the power of the wealthy outside of their ranks. |

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 02:48:32 AM

Last edit: April 05, 2014, 03:48:28 AM by AnonyMint |

|

AnonyMint, thanks for this very interesting thread. I'm not sure I agree with everything you write, but you do make very valid points.

I don't expect readers to agree with my perspective, because by definition the bulk of society is not freaking out (yet). Because the powers-that-be have been very successful in hiding the truth. If I can merely touch your consciousness, you will be more prepared than if I had not gotten your attention. I can't expect you to completely shift your perspective. It took me years. As you dig more (if you do), you will very likely find your eyes peel back. Again I urge readers to listen to the Catherine Austin Fitts and Bill Moyer's interviews. Perhaps start with the Bill Moyer one since it is easier to listen to and more immediately convincing. The Fitts interview is more damning (especially the latter 2/3). Feel free to express disagreement. Please try to expend some effort to dig and actually evaluate (for your own benefit of course). Without anonymity we are toast.

Why is anonymity so important for mankind ? Don't you think global transparency in financial systems might be a good thing ? (To help fight corruption, for instance) This is the most difficult thing for people to understand because we are so accustomed to the normalcy of society. We just can't conceive of the notion that the regulators are captured by those being regulated. And that voting can't change it. The Bill Moyers video explains this very professionally. I highly recommend it. Global transparency is the way you promote the Deep State corruption to globalized power. That will be an even worse outcome. Because again, the regulators and the regulated are two heads of the same monster. Anonymity is the only way the individual can opt-out of that unfixable (evil) symbioses that is going to torch the earth after 2016. Note gold is anonymous except it reduces trade because it can't be moved or divided into smaller pieces and them recombined easily. Requires smelter, assay, etc. thus it isn't really autonomous (that isn't a misspelling, autonomy isn't not same concept as anonymity). And transport is risky. By opting-out of the taxation, confiscation, and corrupt regulation, we can prevent the evil symbioses from destroying all capital and locking down humanity in evil symbiosis. It is a release valve that will abate the symbioses and end it. Because prosperity will gravitate to what can't be destroyed, where everything else is being destroyed symbiotically. You really have to understand the keyword: symbiotic. The Bill Moyer's video explains it well. To understand the symbioses more algorithmically, please read this summary I wrote yesterday: https://bitcointalk.org/index.php?topic=400235.msg6060440#msg6060440I think that was fairly well written. One of my better posts. Please click to read it. I do believe that after a great crisis and suffering, the youth of the world will restore normalcy and then we can regulate again. But this will eventually fail again. Any way, the interim transition is going to get very nasty and we need anonymity to abate an overshoot into the abyss of totalitarianism. Because even if the people tried to organize now, they don't understand and can be easily fooled. The only interim solution is to opt-out. This is more than " a little bit dangerous". (sorry needed some music, the topic is getting too intense) |

|

|

|

|

mgburks77

|

|

April 05, 2014, 02:55:52 AM |

|

Wrong! The commons means knowledge takes control. For example, physics assures us that energy is neither created nor destroyed, so it is only the lack of knowledge production that makes energy finite or scarce. And I am not referring to perpetual motion machines, rather to more efficiency and automation of extraction of energy through greater innovation due to faster propagation of knowledge. This interests me on several levels. The technical term "the commons" denotes a social organization that consisted of individualized production and no political system to coerce cooperative behavior. The concept of social control via political economy didn't exist yet. When it emerged the commons were enclosed and converted into private property and the population was reduced to bondage. We typically think of this as "the human condition" and have resigned ourselves to it's inevitability. This sort of belief is due to social conditioning and I do not share it. If a similar organization can be restored for mass society via adroit use of technical means to defeat those who would protect rent seeking and usury with coercive force I'm all for it. It also interests me on a cosmological and philosophical level in regard to the function of life, information, and consciousness as a physical means to degrade energy differentials in the wave function. It is in this regard that my doubts about the possibility of absolute freedom to express one's will lie. However there is probably a way to balance the conflict between the individual and the collective and maximize what we experience as "free will" and this way is through greater understanding of the world around us and how it functions according to materialistic definitions. I think perhaps that this is what we are both after? |

|

|

|

|

|

mgburks77

|

|

April 05, 2014, 03:07:46 AM |

|

put simply we need anonymity because the state is abusive

|

|

|

|

|

|

thaaanos

|

|

April 05, 2014, 03:19:10 AM |

|

I agree with mgburks77 here, the more individuals become cells in a larger system, whether hierarchical or networked it doesn't matter. They sacrifice degrees of freedom (free will) to the superstructure. I think only the top layer can enjoy free will or "liberty", it's inevitable, but not unacceptable.

|

|

|

|

|

farnsworth7

Newbie

Offline Offline

Activity: 31

Merit: 0

|

|

April 05, 2014, 03:21:02 AM |

|

I understand that part of the elite is abusive, and we could opt-out of the system that sustain these evil elites, to stop giving them power. And anonymity in cryptocurrencies might give us this freedom. That makes sense.

But this freedom is not sufficient at all to build a better system, is it ? What happens next ? Anarchy ? Freedom alone is not a solution.

|

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 03:23:19 AM

Last edit: April 05, 2014, 03:43:29 AM by AnonyMint |

|

Without anonymity we are toast.

I don't think the elites will allow the propagation and popularisation of a crypto that ruins their plans. There are many things they can do, the first of which is to allow bitcoin to take the lead. If they are going to tax + confiscate, they will drive wealth away from non-anonymous Bitcoin directly to the anonymous coin. Eventually they checkmate themselves. I think this is it. They are going to lose. They can try to stop the protocol, but we can cloak it. Don't underestimate us hackers. We have math on our side, and we are very good at math. Some details will be forthcoming. You once used the analogy of the shift from MySpace to Facebook to justify the fact that we could shift to another crypto, but Facebook has accepted allegiance to the elites and the elites have accepted Facebook in their planning. This is very clear by the way it is shutting off all pages that the mainstream don't like or that are too critical to the elites.

They will drive people away from Facebook to our anonymous Amigobase.com (I own that domain, nothing there just a future project maybe) once they start abusing Facebook identities. I also own coolpage.com Their model is peaking and being exposed. Our time is coming into view now. I can see it clearly. The difference in our case is that the elites will not accept a currency that frees the people and thus the shift will never happen.

If they allow bitcoin, it means that either 1. bitcoin is a creation of their master(s) and its purpose is further enslavement or 2. they found ways to use it to their own advantage.

In any case the people are enslaved by the power grabbers and I think it is only wishful thinking to believe we can change this by launching some specific new crypto.

Maybe so, but defeatism is not my cup of tea. Like I said, let all the feeble people stay in Bitcoin and Bitpay. Let's see if Peter Thiel can win with that base of non-doers. I like the odds of the coin that has all the super smart and motivated doers working on it constantly night and day. Not this gridlock Bitcoin. Because the governments have no choice but to increase revenues as we collapse into a global debt default. And the more they tax + confiscate wealth, the more the GDP will collapse. Thus the more they will need to take from wealth. It is a downward spiral. Very scary.

We have been hitting the peak of numerous natural resources while demographics are strongly up worldwide and consumption of land, water, rare minerals, energy resources etc... is completely unsustainable. The fact is that GDP must collapse. The elites only want to make sure that they have or create as much power as possible through and after the GDP collapse and are planning accordingly. It is unavoidable. Bitcoin either was part of or is being integrated in the planning of the elites. Actually, the elites do have the choice in front of defaults : inflation. But they probably prefer to do some rounds of confiscation first to lower the power of the wealthy outside of their ranks. Agreed all you wrote except I don't agree there is a peak in sustainability. The problem is knowledge was impeded by the corrupt system, thus we stopped increasing production of what we needed and produced Wallmart consumerism instead. It is actually the debt that causes the misallocation of resources. The same happened to the fall of Rome. The debt caused overintensive farming, then they polluted their irrigation. Same in Greece, overproduction of goats due to debt, then they had desertification. mgburks77 quoted me on this: Wrong! The commons means knowledge takes control. For example, physics assures us that energy is neither created nor destroyed, so it is only the lack of knowledge production that makes energy finite or scarce. And I am not referring to perpetual motion machines, rather to more efficiency and automation of extraction of energy through greater innovation due to faster propagation of knowledge.

Malthusians have always ended up fools. They have never been correct. Don't fall into that propaganda malaise. It is unhealthy for your brain. I care about you. Please try to snap out it. I don't say this as a personal attack at all. I know that people who care about the environment really think there is sustainability problem. And I know they think that those who don't are evil. But I guarantee you, there is no sustainability problem. It is all lies. I can surely convince you if I have enough time, but I don't. So let's not fight about this please. No bad feelings. I care about the environment, but I am not worried. |

|

|

|

farnsworth7

Newbie

Offline Offline

Activity: 31

Merit: 0

|

|

April 05, 2014, 03:35:05 AM |

|

I agree with mgburks77 here, the more individuals become cells in a larger system, whether hierarchical or networked it doesn't matter. They sacrifice degrees of freedom (free will) to the superstructure. I think only the top layer can enjoy free will or "liberty", it's inevitable, but not unacceptable.

A superstructure will always exist. Complete freedom is an illusion. We can not break free from the laws of physics, from our emotions, or from the need for a coherent human society (we are social animals). The best thing we can do is make our "prison" more enjoyable, ie make a society that is fairer for everyone. But we will always be individual cells in a body called mankind. I think we need to accept that, and stop believing freedom is the holy grail, because 1. it doesn't exist 2. it would not even solve anything. |

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 03:44:31 AM |

|

MahaRamana please re-read the end of my reply. I added examples about Rome and Greece. History is your guide that debt is the cause.

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 03:50:39 AM |

|

Don't you think global transparency in financial systems (thanks to a traceable public ledger) might be a good thing ? (To help fight corruption, for instance)

The corrupt own the regulators. So they escape and yet the public ledger can be used to take everything from us. This is an asymmetric advantage for corruption. They trick us into believing it is for our own good. They are so clever at fooling us. |

|

|

|

|

twiifm

|

|

April 05, 2014, 03:51:59 AM |

|

I agree with mgburks77 here, the more individuals become cells in a larger system, whether hierarchical or networked it doesn't matter. They sacrifice degrees of freedom (free will) to the superstructure. I think only the top layer can enjoy free will or "liberty", it's inevitable, but not unacceptable.

A superstructure will always exist. Complete freedom is an illusion. We can not break free from the laws of physics, from our emotions, or from the need for a coherent human society (we are social animals). The best thing we can do is make our "prison" more enjoyable, ie make a society that is fairer for everyone. But we will always be individual cells in a body called mankind. I think we need to accept that, and stop believing freedom is the holy grail, because 1. it doesn't exist 2. it would not even solve anything. I agree. I think its all about the rules. In a game like Monopoly eventually there will one winner and everyone loses. In a game like Rock-Paper-Scissors each player takes turn winning (not good example but I can't think of another game that doesn't allow concentration of power) The inevitable end of free market Capitalism is monopoly & the opposite Communism/ Socialism doesn't work either. What is the optimum system? Nobody knows yet. But we all know what we have doesn't work. |

|

|

|

|

|

thaaanos

|

|

April 05, 2014, 03:54:38 AM |

|

I don't say this as a personal attack at all. I know that people who care about the environment really think there is sustainability problem. And I know they think that those who don't are evil. But I guarantee you, there is no sustainability problem. It is all lies. I can surely convince you if I have enough time, but I don't. So let's not fight about this please. No bad feelings. I care about the environment, but I am not worried.

Are you sure this is not wishful thinking? Because you know/fear/block that if in our future we hit scarcity in resources we are going be regulated like never before. I fear that we will even lose liberties that never knew we had, like liberty to breath, mate, move, sleep, not die a random death. Think about the way of life of astronaut, it is the future, and it wont matter if you are on the planet or not. |

|

|

|

|

|

mgburks77

|

|

April 05, 2014, 04:00:20 AM |

|

What is the optimum system? *Decentralized political economy and mix of individualized artisan quality production and automation to replace consumerism and authoritarian top down control of collectivized production. |

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 04:01:29 AM

Last edit: April 05, 2014, 04:17:06 AM by AnonyMint |

|

Wrong! The commons means knowledge takes control. For example, physics assures us that energy is neither created nor destroyed, so it is only the lack of knowledge production that makes energy finite or scarce. And I am not referring to perpetual motion machines, rather to more efficiency and automation of extraction of energy through greater innovation due to faster propagation of knowledge.

[snip] The technical term "the commons" denotes a social organization that consisted of individualized production and no political system to coerce cooperative behavior. The concept of social control via political economy didn't exist yet. When it emerged the commons were enclosed and converted into private property and the population was reduced to bondage. [snip] If a similar organization can be restored for mass society via adroit use of technical means to defeat those who would protect rent seeking and usury with coercive force I'm all for it. [snip] However there is probably a way to balance the conflict between the individual and the collective and maximize what we experience as "free will" and this way is through greater understanding of the world around us and how it functions according to materialistic definitions. I think perhaps that this is what we are both after? You need to quote the rest of the key point: I am quite flabbergast that Eric S. Raymond (self-professed to have 150 - 170IQ, the creator of the "open source" movement) could get the logic so wrong on the coming Knowledge Age. In his critique of Jeremy Rifkin's book, The Zero Marginal Cost Society, he misses the key generative model of open source, which is that the source is always changing. The enslavement of knowledge by capital is due to the transactional cost of the propagation of creations. As we lower that friction, knowledge takes over. And he apparently fails to comprehend capital can't buy knowledge because thought isn't fungible, and this becomes more evident as the diversity of innovation becomes more fine-grained. The claim that the material input costs will be significant relative to the marginal cost of distributing more copies of intellectual property is wrong because the only costs in material production that can't be reduced asymptotically to 0 at economy-of-scale and automation are the knowledge inputs. Thus knowledge is infinitely more valuable than material production at the asymptote. The only reason that capital has been able to enslave the knowledge portion of the cost in the material cost is due to inability of fine-grain, autonomous knowledge to control the creative outputs of material production. The 3D printer changes this because the printer will be in every person's home. The commodity value relative to knowledge value of raw material inputs will fall asymptotically to 0 [snip] The point is that due to networks effects on knowledge propagation, material costs will decline towards 0 relative to the value society will assign to the knowledge. Knowledge was only enslaved because knowledge did not have the control over creation. Industrialization had control over the knowledge. Computer changed that for software. The home 3D printer changes it for everything else. This polarity is reversing (inverting) as we speak. You will a massive change to the world. This is why most of you don't understand that structure you think is relevant is no longer relevant. What is the optimum system? *Decentralized political economy and mix of individualized artisan quality production and automation to replace consumerism and authoritarian top down control of collectivized production. Careful. I agree but not sure if you were leaning Marxist. It won't be done for free. The Marxist slant is very wrong. Eric Raymond explained that very well and I didn't disagree. |

|

|

|

|

thaaanos

|

|

April 05, 2014, 04:05:09 AM |

|

What is the optimum system? *Decentralized political economy and mix of individualized artisan quality production and automation to replace consumerism and authoritarian top down control of collectivized production. Nah... the optimum system is *disconnection* isolation, not integration MahaRamana please re-read the end of my reply. I added examples about Rome and Greece. History is your guide that debt is the cause.

Those examples are totally unbased |

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 04:15:18 AM |

|

What is the optimum system? *Decentralized political economy and mix of individualized artisan quality production and automation to replace consumerism and authoritarian top down control of collectivized production. Nah... the optimum system is *disconnection* isolation, not integration Go ahead. You will be very impoverished compared to those who leverage the specialization and cooperation. You will produce everything yourself from raw resources, dig up your own ore, build your own smelters, etc. And forget 3D printing, because you want to be disconnected from knowledge. You want to go back to a caveman? That is what you are saying. I hope you realize. MahaRamana please re-read the end of my reply. I added examples about Rome and Greece. History is your guide that debt is the cause.

Those examples are totally unbased I have canonical citations on those but hard to dig them up. I don't feel like being bothered at the moment. It is a fact that Rome collapsed due to environmental degradation due to debt caused overintensive farming which lead to the inability to produce enough to sustain. But Rome's collapse had many facets, yet this was one of the fundamental factors. I had also a citation about pottery records showing farming was still increasing right up until the collapse. Also have much documentation about the environmental degradation and as always this caused the marginal utility of debt to go negative because the marginal increase in production from farms went negative. Don't forget that Rome was entirely agriculture based. That was the reason the empire existed to build roads and military security to increase commerce from agriculture. Do you have any reason to believe this is wrong? |

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 04:17:43 AM |

|

Computer changed that for software. The home 3D printer changes it for everything else. Added that to prior post. Key point. |

|

|

|

|

twiifm

|

|

April 05, 2014, 04:22:41 AM |

|

What is the optimum system? *Decentralized political economy and mix of individualized artisan quality production and automation to replace consumerism and authoritarian top down control of collectivized production. Decentralized political economy --- Is this like feudalism? Individualized artisan production -- Pre Industrial production? I was thinking more in line of stimulus. Like QE, but direct to private enterprise for the purpose of entrepreneurship or job creation. Entrepreneurs capitalized from the Feds money without banks in the middle. Fed owns equity in the business. Then ring fence speculative trading or only allow cash based speculation without derivatives. Let the hedge funds gamble but not on leveraged instruments. If they go bust it doesn't drag down the rest of the system Maybe Job Guarantee? Govt as employer of last resort. I don't know. Its a tough thing to ponder |

|

|

|

|

|

mgburks77

|

|

April 05, 2014, 04:24:09 AM |

|

Decentralized political economy --- Is this like feudalism? more like prior to feudalism Individualized artisan production -- Pre Industrial production? post industrial |

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 04:25:36 AM |

|

Careful. I agree but not sure if you were leaning Marxist. It won't be done for free. The Marxist slant is very wrong. Eric Raymond explained that very well and I didn't disagree.

I recognize the validity of some marxian analysis but I'm more of a radical individualist and opportunist than anything ideological, though. Quite disillusioned, don't believe in much but myself anymore. I think I will be able to do more by coding than talking. I think it is difficult for you all to visualize what I am talking about, until you actually interact with it in reality. |

|

|

|

|

mgburks77

|

|

April 05, 2014, 04:29:01 AM |

|

Careful. I agree but not sure if you were leaning Marxist. It won't be done for free. The Marxist slant is very wrong. Eric Raymond explained that very well and I didn't disagree.

I recognize the validity of some marxian analysis but I'm more of a radical individualist and opportunist than anything ideological, though. Quite disillusioned, don't believe in much but myself anymore. I think I will be able to do more by coding than talking. I think it is difficult for you all to visualize what I am talking about, until you actually interact with it in reality. Sounds amazing. I can't wait. |

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 04:32:59 AM |

|

Concrete example of the Knowledge Economy. You produce a 3D printing design for a car. I buy it using anonymous coin, print it and drive it around. I improve it and publish my improvement. Did you see the fixed a guy's face with 3D printing? You see the knowledge will take over. The knowledge will improve everything so fast at 1000s of iterations of new designs per day or week. We will be living Jetsons life within 10 to 20 years. There is absolutely no problem once we kick the bastards off our virtual lawn using anonymity so they can't extort from us any more using the government force. They can't afford to put a thug policeman inside of every home on earth. |

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 04:37:33 AM |

|

Guys love to create stuff. Guys are going to love the new economy. And women are going to love you.

|

|

|

|

|

mgburks77

|

|

April 05, 2014, 04:39:52 AM |

|

I was thinking more in line of stimulus. Like QE, but direct to private enterprise for the purpose of entrepreneurship or job creation. Entrepreneurs capitalized from the Feds money without banks in the middle. Fed owns equity in the business. Then ring fence speculative trading or only allow cash based speculation without derivatives. Let the hedge funds gamble but not on leveraged instruments. If they go bust it doesn't drag down the rest of the system

Maybe Job Guarantee? Govt as employer of last resort.

I don't know. Its a tough thing to ponder There are a lot of moving parts to take into consideration. Something like that I would see as a stopgap measure at best because it doesn't really get to the basis of the problem, because leveraged trading is far from the only way that capital is misallocated by our society. |

|

|

|

|

|

mgburks77

|

|

April 05, 2014, 04:40:51 AM |

|

Guys love to create stuff. Guys are going to love the new economy. And women are going to love you.

Huzzah!  I like it |

|

|

|

|

|

twiifm

|

|

April 05, 2014, 04:41:11 AM |

|

Decentralized political economy --- Is this like feudalism? more like prior to feudalism Individualized artisan production -- Pre Industrial production? post industrial Whats prior to feudalism? Empires or tribalism? How would you unravel our modern systems to obtain this state? |

|

|

|

|

|

thaaanos

|

|

April 05, 2014, 04:44:15 AM |

|

Go ahead. You will be very impoverished compared to those who leverage the specialization and cooperation.

You will produce everything yourself from raw resources, dig up your own ore, build your own smelters, etc. And forget 3D printing, because you want to be disconnected from knowledge.

You want to go back to a caveman? That is what you are saying. I hope you realize.

More like smaller societies physically disconnected, not each on his own. Culture/Art you know is an oppressive beast and a topic untouched yet. Knowledge isn't everything. I have canonical citations on those but hard to dig them up. I don't feel like being bothered at the moment.

It is a fact that Rome collapsed due to environmental degradation due to debt caused overintensive farming which lead to the inability to produce enough to sustain. But Rome's collapse had many facets, yet this was one of the fundamental factors. I had also a citation about pottery records showing farming was still increasing right up until the collapse. Also have much documentation about the environmental degradation and as always this caused the marginal utility of debt to go negative because the marginal increase in production from farms went negative.

Don't forget that Rome was entirely agriculture based. That was the reason the empire existed to build roads and military security to increase commerce from agriculture.

Do you have any reason to believe this is wrong?

Rome's collapse was political, cultural and scientific stagnation after the initial breakthroughs that made them an empire. Greece collapse was as ever the internal strife, we worship Eris. |

|

|

|

|

|

mgburks77

|

|

April 05, 2014, 04:44:26 AM |

|

Concrete example of the Knowledge Economy. You produce a 3D printing design for a car. I buy it using anonymous coin, print it and drive it around. I improve it and publish my improvement. Did you see the fixed a guy's face with 3D printing? You see the knowledge will take over. The knowledge will improve everything so fast at 1000s of iterations of new designs per day or week. We will be living Jetsons life within 10 to 20 years. There is absolutely no problem once we kick the bastards off our virtual lawn using anonymity so they can't extort from us any more using the government force. They can't afford to put a thug policeman inside of every home on earth. Sounds like you are talking about post scarcity, I'm in |

|

|

|

|

|

mgburks77

|

|

April 05, 2014, 04:44:59 AM |

|

Decentralized political economy --- Is this like feudalism? more like prior to feudalism Individualized artisan production -- Pre Industrial production? post industrial Whats prior to feudalism? Empires or tribalism? How would you unravel our modern systems to obtain this state? I'm referring to stateless society edit: Here's a nice example: http://en.wikipedia.org/wiki/Icelandic_Commonwealth |

|

|

|

|

|

twiifm

|

|

April 05, 2014, 04:46:45 AM |

|

I was thinking more in line of stimulus. Like QE, but direct to private enterprise for the purpose of entrepreneurship or job creation. Entrepreneurs capitalized from the Feds money without banks in the middle. Fed owns equity in the business. Then ring fence speculative trading or only allow cash based speculation without derivatives. Let the hedge funds gamble but not on leveraged instruments. If they go bust it doesn't drag down the rest of the system

Maybe Job Guarantee? Govt as employer of last resort.

I don't know. Its a tough thing to ponder There are a lot of moving parts to take into consideration. Something like that I would see as a stopgap measure at best because it doesn't really get to the basis of the problem, because leveraged trading is far from the only way that capital is misallocated by our society. Yeah I know there's a lot of moving parts. That's why it's hard to design a system that incorporate everything. I don't see leveraged instruments as capital misallocation. I see de-leveraging as contributor to liquidity crisis. I wouldn't outlaw derivatives just ring fence them |

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 04:49:38 AM |

|

Go ahead. You will be very impoverished compared to those who leverage the specialization and cooperation.

You will produce everything yourself from raw resources, dig up your own ore, build your own smelters, etc. And forget 3D printing, because you want to be disconnected from knowledge.

You want to go back to a caveman? That is what you are saying. I hope you realize.

More like smaller societies physically disconnected, not each on his own. Culture/Art you know is an oppressive beast and a topic untouched yet. Knowledge isn't everything. I am talking everyone can connect to everyone without a bastard freeloading middle man (who captures the State to help him maintain in his monopoly). We have to get rid of centralized exchange. We move to P2P, etc.. Each person's work is their own. No one takes a transaction fee or cut of the action! Rome's collapse was political, cultural and scientific stagnation after the initial breakthroughs that made them an empire.

Greece collapse was as ever the internal strife, we worship Eris.

Your talking effects. I was talking cause. The cause was as always centralization of power, and too much debt. The ill effects of debt is knowledge stagnates and everyone does dumb xerox copy shit. And this monotonicity causes the appearance of resource scarcity. If everyone is figuring out how to consume and no one is figuring out how to innovate, then it isn't surprising that consumption outstrips efficiencies of resource extraction. Fact is that the 2000 year price of commodities has always trended downwards. This will not stop. Iron used to be a precious metal. |

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 04:58:47 AM |

|

Decentralized political economy --- Is this like feudalism? more like prior to feudalism Individualized artisan production -- Pre Industrial production? post industrial Whats prior to feudalism? Empires or tribalism? How would you unravel our modern systems to obtain this state? No we are not going backwards. Material costs will trend towards zero relative to knowledge value, because knowledge will propagate in diverse fine-grained interactions of creations. Thus we don't need to go backwards. This is a totally new way to organize ourselves distributed without top-down control, because the economics of production have suddenly been ameliorated by the computer and 3D printing. |

|

|

|

|

thaaanos

|

|

April 05, 2014, 04:58:53 AM |

|

Go ahead. You will be very impoverished compared to those who leverage the specialization and cooperation.

You will produce everything yourself from raw resources, dig up your own ore, build your own smelters, etc. And forget 3D printing, because you want to be disconnected from knowledge.

You want to go back to a caveman? That is what you are saying. I hope you realize.

More like smaller societies physically disconnected, not each on his own. Culture/Art you know is an oppressive beast and a topic untouched yet. Knowledge isn't everything. I am talking everyone can connect to everyone without a bastard middle man. We have to get rid of centralized exchange. We move to P2P, etc.. Each person's work is their own. No one takes a transaction fee or cut of the action! Maybe everyone talking to everyone is not optimal. Maybe some Ideas should never meet. Why work anyway, lets all get a hobby or something. Not everything is about economy, production, transaction Rome's collapse was political, cultural and scientific stagnation after the initial breakthroughs that made them an empire.

Greece collapse was as ever the internal strife, we worship Eris.

You talking effects. I was talking cause. The cause was as always centralization of power, and too much debt. I was thinking the same about your post, anyway Greece never had centralization until 19 century. You could say that the city states were a token of decentralized world |

|

|

|

|

|

thaaanos

|

|

April 05, 2014, 05:00:40 AM |

|

Decentralized political economy --- Is this like feudalism? more like prior to feudalism Individualized artisan production -- Pre Industrial production? post industrial Whats prior to feudalism? Empires or tribalism? How would you unravel our modern systems to obtain this state? No we are not going backwards. Material costs will trend towards zero relative to knowledge value. Thus we don't need to go backwards. This is a totally new way to organize ourselves distributed without top-down control, because the economics of production have suddenly been ameliorated by the computer and 3D printing. Unless we make everything out of graphene I don't see that happening. You will still need to get the "ink" |

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 05:01:44 AM |

|

thaaanos I don't think you want to join us. Take care my friend. I bet you will change your mind later.

I don't have time to argue about the intricacies of how debt causes failure. I am sure you will find it was debt that caused Greece's failure. From your name, I assume you are from that area of the world?

Good luck and no bad feelings okay. We can agree to disagree.

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 05:04:30 AM

Last edit: April 05, 2014, 05:16:58 AM by AnonyMint |

|

Unless we make everything out of graphene I don't see that happening. You will still need to get the "ink"

Relative value of knowledge compared to the cost of ink will trend asymptotically towards infinity. Or stated the other way, the cost of ink relative to what you earn from knowledge, will trend asymptotically towards ZERO. Click the link in the post below and look at the chart. >So @esr, how do you align the long tail of maintenance into the sunk v marginal cost framework? Er, simply by observing that it is neither of those things and can’t be jammed into that framework. He makes it clear that he didn't even consider that the lower transactional propagation cost of digital distribution of editable creations increases the frequency, granularity, and autonomy of those maintenance edits. He apparently doesn't remember that Metcalfe's or Reed's Law says that as the number of those editing nodes increases, then the value of the knowledge network increases squared.See the interconnections are what causes the knowledge value to scale non-linearly at n^2. You will miss out on that because you want to be isolated. You don't have math on your side. |

|

|

|

|

mgburks77

|

|

April 05, 2014, 05:09:37 AM |

|

Decentralized political economy --- Is this like feudalism? more like prior to feudalism Individualized artisan production -- Pre Industrial production? post industrial Whats prior to feudalism? Empires or tribalism? How would you unravel our modern systems to obtain this state? No we are not going backwards. Material costs will trend towards zero relative to knowledge value. Thus we don't need to go backwards. This is a totally new way to organize ourselves distributed without top-down control, because the economics of production have suddenly been ameliorated by the computer and 3D printing. Unless we make everything out of graphene I don't see that happening. You will still need to get the "ink" All sorts of materials can be used in additive manufacture. Plastics, metals, glass, even chocolate. Even better there are bio-materials being developed which will be used to print organs for transplant etc. Maybe some day we will understand how to utilize base particles to manufacture objects made from any solid material on the periodic table. |

|

|

|

|

|

thaaanos

|

|

April 05, 2014, 05:20:20 AM |

|

[Relative value of knowledge compared to the cost of ink will trend asymptotically towards infinity. Or stated the other way, the cost of ink relative to what you earn from knowledge, will trend asymptotically towards ZERO.

I would disagree here, because "ink" producers will be a monopoly while "design" producers will move in a highly competitive field. Current analogy, How much does it cost me to print a book instead of buying it? (disregarding the fact that it doesn't need printing) thaaanos I don't think you want to join us. Take care my friend. I bet you will change your mind later.

I don't have time to argue about the intricacies of how debt causes failure. I am sure you will find it was debt that caused Greece's failure. From your name, I assume you are from that area of the world?

Good luck and no bad feelings okay. We can agree to disagree.

Join what? Yes I am Greek and can say have intuitive knowledge in our history. I just don't like it when people weaken good ideas by reinforcing them with biased facts @mgburks77 I would place my bets on graphene and the rest of nano-carbons for the forseeable future |

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 05:21:36 AM |

|

I was thinking more in line of stimulus. Like QE, but direct to private enterprise for the purpose of entrepreneurship or job creation. Entrepreneurs capitalized from the Feds money without banks in the middle. Fed owns equity in the business. Then ring fence speculative trading or only allow cash based speculation without derivatives. Let the hedge funds gamble but not on leveraged instruments. If they go bust it doesn't drag down the rest of the system

Maybe Job Guarantee? Govt as employer of last resort.

I don't know. Its a tough thing to ponder There are a lot of moving parts to take into consideration. Something like that I would see as a stopgap measure at best because it doesn't really get to the basis of the problem, because leveraged trading is far from the only way that capital is misallocated by our society. You don't fix the power vacuum of democracy with financialization trickery. The only way is to fundamentally change the economics of production and creativity and by removing the ability of the collective to tax private property. In this new world, everything you create is yours. Nobody takes a cut of your action. You trade your knowledge goods in the open market. This is already happening in software. Now we move to the next stage of this transition. Those who get on this bandwagon are the new wealthy of the world. |

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 05:26:12 AM |

|

Join what?

Ahem. I guess you will know soon eh.  Any way I am describing an imminent paradigm shift underway. It will come from many people and directions (I don't know who they are, this is a natural movement of society). I just happen to be involved in one aspect of that. Yes I am Greek and can say have intuitive knowledge in our history.

I just don't like it when people weaken good ideas by reinforcing them with biased facts

Let's get into this later. I would like to learn more from you and I think we can hash it out to realize that the power vacuum of democracy and debt were the essential cause. Those terms need definitions and I don't want to go endlessly into that discussion now. Some Iron Laws of Political Economics |

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 05:37:10 AM |

|

[Relative value of knowledge compared to the cost of ink will trend asymptotically towards infinity. Or stated the other way, the cost of ink relative to what you earn from knowledge, will trend asymptotically towards ZERO.

I would disagree here, because "ink" producers will be a monopoly while "design" producers will move in a highly competitive field. Current analogy, How much does it cost me to print a book instead of buying it? (disregarding the fact that it doesn't need printing) You didn't understand the scaling math. You expect someone to corner the market of ink? Okay the knowledge producers will simply substitute other materials. The raw tangible materials are not scarce. The virtual (even anonymous) knowledge is. The raw material producers can't do their business competitively without the knowledge. We can design bots which bore into ground and mine ore following the highest grade veins with no stripping ratio 100X more efficiently. Those idiot monopolists will be holding worthless open pit mines. Our zillions of tiny autonomous bots will be mining it out from under them. The bastards have no chance. Checkmate. Knowledge is power. What do they have? All they ever had was our inability to organize ourselves decentralized so that we don't need them. Now we have it. We don't need them any more. |

|

|

|

|

thaaanos

|

|

April 05, 2014, 05:41:26 AM |

|

I understand what you mean on the new paradigm and believe that it will happen,

but I cannot pinpoint what market force will drive the cost price of "ink" down, and not scale arbitrary in tandem with the "design"

The ink producers can and will create a cartel, based on the physical scarcity of prime materials, much like ie oil right now.

Oil is probably a perfect analogy of "ink" as it feeds every other industry, and yet it dominates the price of the products.

The cartel will not be based on the efficiency of their operation, rather on the "Rights" to mine, and we fall back to the scarcity of Land

|

|

|

|

|

|

AnonyMint (OP)

|

|

April 05, 2014, 05:44:03 AM |

|

They can stop the innovation. For example, they do something society hates, then hackers spread a 3D printer design for a bot that subverts what ever they are doing.

They will be defeated because in 1 hour 1 million people can make bots at any spot in the world and put them to shame.

They maintain their monopolies only because individuals can't take action.

Once individuals can take direct action, it is game over for them.

If there was a bot design now to stop the shit going on in Syria, do you think the people wouldn't 3D print it now?

Of course the people will rise up with rage once they have the tools to do so.

|

|

|

|

|

mgburks77

|

|

April 05, 2014, 05:49:39 AM

Last edit: April 05, 2014, 06:04:31 AM by mgburks77 |

|