Heee Glückwunsch xxJxx ! Pech im Spiel, Glück in der Liebe, sagt man das auch auf Deutsch? Das heißt, heute haben wir alle ein bisschen gewonnen   |

|

|

|

Guys, you are probably not paying attention to what I wrote earlier about the correspondence with the photos owner. - Please tell me, can I use them for republication on other resources? I will need to use the link to your resource as the original source and author?- yes, please link to the original source www.dietmareckell.com and claim copyright holder: © Dietmar EckellThis was not done! What else do I need to explain? Dude, there's only plagiarism if someone is pretending the works were made by himself. Don't act as if you're defending this photographer's rights, if you don't even know the difference between copyright breach and plagiarism.  You actually contacted the author for this? Wtf is your problem  Stop defending the undefendable. You made a mistake, so what. If you're wrong, admit, assume and continue your life. Oh and apologize to icopress. |

|

|

|

(...)

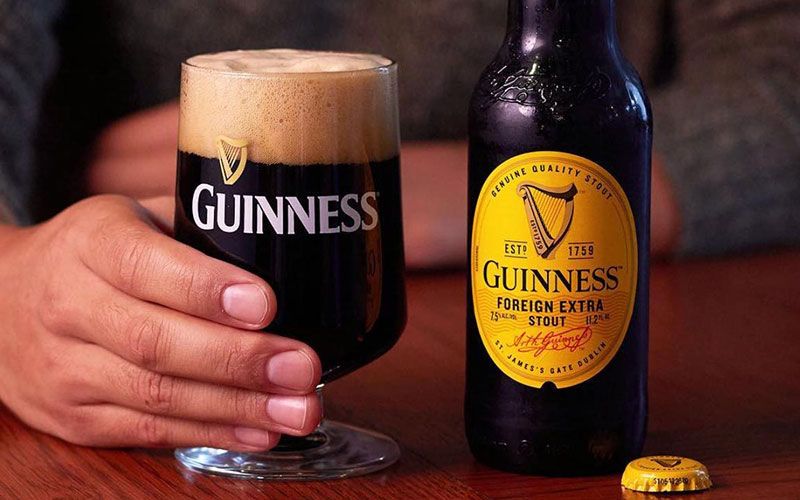

Should have bought a Jupiler, Stella, Duvel, Omer, Tripel Karmeliet, Affligem Blond, Chimay Blauw, Westmalle Tripel, La Chouffe, Orval, Pauwel Kwak, Lindemans kriek, Gueze, Chimay triple....

Whatever dude, always go for a Belgian beer..... Never regret it, this list could be a whole WO page full ...

Hear hear. Surely you didn't forget about this one - current price for 1 crate: BTC0.00385169   |

|

|

|

Here's that Guinness you bought me a while back.  I believe that one was brewed especially for the Belgian market. edit: Nope, it's this one:  Great beer, by the way. How's yours? |

|

|

|

(...) If I were passive, now I should've had twice the coins I have now. Well, mistakes of the growth, watcha gonna do. So I gave up my plan to sell to rebuy back with profit my bitcoins. I just was so frustrated, I couldn't think soberly, (...)

A very familiar feeling, that is. At such moments, I can't help but think about this famous quote by an ancient medieval Chinese philosopher: I'm done trading.

|

|

|

|

Sieht so aus als wird es bald mehr als 25 sein!! Fingers crossed hehe, aber +$14,120 schon! |

|

|

|

I think you'd better clarify what a spreadsheet updater is, and what defines him being "expert" or not. In my dictionary, a spreadsheet updater is just another part of a bounty manager's job, which means you. I'll gladly stand corrected if necessary.  |

|

|

|

|

It's good that this topic is treated once more on this forum, because this problem has existed from the very start of bounty campaigns.

At the same time, OP's making the very important and interesting suggestion of using escrows for bounty campaigns.

OP, next time if you know an escrow would be necessary to guarantee a trustworthy campaign, I'd suggest you to warn people from the very start instead of participating and complaining when it's too late.

Futher on, if the team is known, contact a lawyer and sue them.

|

|

|

|

Actually the whole gambling community are shocked about this 5million dollars bet,This is something to be recorded in history and may not happen in the next elections.

The Counting now are very close but it looks like Trump is winning.

What and where are you looking at, based on this stat which looks credible Biden is winning by a very slim margin https://www.nytimes.com/interactive/2020/11/03/us/elections/results-president.htmlThe toss up states will play a crucial role on who is going to take this election, on states Biden expected to win narrowly Trump is getting a slice of it, 98 states remaining the next hours will be crucial if Biden maintain the leads he wins it 14 states is a huge gap. 98 votes, you mean, right? FYI, it will be hard to find a more biased source than the NY Times, who have openly pronounced their support for Biden. I have no idea why you're saying Biden is winning, based on this stat?? If you use the vote counting bar above the US map on your link, I hope you understand that that bar says nothing about the winner, until someone gets at least 270 votes. You have to check out the results in the grey-marked states as well. If the stat you're referring to turns out to be the end result, Trump is winning. |

|

|

|

|

There's a serious chance this guy might risk having a few sleepless nights. If I understood well, there's a realistic possibility that all definite results (not talking about 100% but simply irrefutable) will only be available around the weekend.

|

|

|

|

You're pointing out a lot of interesting things there, @20k20: 2. "(...) whether Coinbase could provide plaintiff with access to the forked currency is not dispositive; the pertinent question is whether Coinbase had a contractual obligation to do so, and the undisputed evidence submitted by Coinbase shows it did not"

A huge missed chance... The Court does not have to answer the important question if Coinbase should give the private keys to the client, if possible and when asked, because the Plaintiff is founding his defense on the principle of breach of contract (which it's not) and not on the principle of his (possible) property rights of the private keys. In other words, the important question if an exchange user has the right to have access to his private keys, is left unanswered because it's impertinent for this case.

In a fair world, the customers should have access to the privkeys. But we unfortunately do not live in a fair world, and if the contract doesn't specify the user has a right to the privkeys under custody, I guess the answer is "no".. ... or maybe the exact opposite? Since you're the owner of the keys, you have the right to have the privkeys, unless specified differently in the contract? Exactly why I called it a "missed chance": I was very curious as to hear if the judge would decide that the privkeys are an integral part of your crypto property. The decision does repeat the Plaintiff's statement that "nothing advises the customer he may not be able to access the private keys for his forked digital currency", so in a way it feels as if the judge would have accepted that he indeed has the right to have access to his privkeys (unless stated otherwise), but since the Plaintiff is asking for his forked coins and not for his keys, the judge doesn't (and doesn't have to) answer this big question  It does look as if we are close to answering the question if not owning your keys indeed means you're not owning your coins. Or put differently: (if not stated otherwise in the User Agreement and when asked) do exchanges have an obligation to provide you access to your private keys? To be continued soon...  If we take it as a comparison to banks, wouldn't privkeys be basically the backend of our bank accounts? I don't think handing out privkeys are an obligation to be honest, although I would highly prefer that to be the case. Handing out privkeys may also be bad from a security point of view.. I concur: while BTC gets integrated in society, I'm quite sure that a large majority of people will prefer to keep it on user-friendly wallets and leave the risks of security breaches in the hands of insurance companies and governments. In the end, this is largely a discussion of freedom vs. security, I guess. No need to say that I have my own ideas and preferences on this subject, but I think everybody should be free to decide and pick his own way of saving his coins, just like we should be able to be free to do as we please with ANY of our property assets, be it your furniture, your house, your clouds, your car, or your crypto coins. I could perfectly imagine exchanges giving people access to their privkeys if they want to. Of course, these users cannot expect insurance companies to cover all security risks, should they choose to have unlimited access to their keys. I see no legal or practical obstacle to this, as long as both parties agree, of course. In that way, the difference between fiat banks, who decide if and when you can get your money back vs. crypto exchanges, who hand out your privkeys if wanted, couldn't be accentuated more beautifully  The only true problem is, if the large majority is using exchange wallets without privkeys, most governments will be drooling to invent new rules and regulations, which will eventually count for ALL users, even those who do use their privkeys responsibly... A possible explanation could be that in the meantime the Plaintiff's Bitcoin Gold value was way lower than at the moment of the fork. For this reason, having access to his private keys would have become less interesting anyway, from a financial point of view. Therefore, the argument of "Breach of contract" might have been preferred as a strategy of trying to get an indemnity from Coinbase with the BTCGold value at the time of the fork, instead of trying to obtain the private keys and those Bitcoin Gold coins, which had a much lower value now.

Bad strategy (imo) if so. Under the last instance, I would've at least tried to ask for the privkeys as a last resort. Maybe the Plaintiff only discovered about this fork when it was too late, price too low already etc. As he had over 300 BTC on Coinbase, trying to get the coins at a price of $5-10 would probably not have been worth the shot. Trying to get an indemnity at the ATH value of almost $500 is a bit more interesting, heh  Again, I'm absolutely guessing, as I do not know if this is the real reason and I haven't read the trial judgment either, as stated above. Let's call it a rather educated guess  1. Read the frigging Terms of Use, before transferring your coins and make sure they're watertight. Would you buy a car or a smartphone or a TV without reading any reviews? Same goes for an exchange. KNOW WHAT YOU USE BEFORE USING IT.

Hehe, the old ToS problem.. To be honest, out of a million people, I'd be surprised to find out that 100 read the ToS of a software/website before registering. 100 may be a generous number. People sign bank contracts without reading a single word out of it. This is how bad the ToS reading situation is. Fortunately, there are a few websites that have been reviewed on ToS;DR. At least do that if you're lazy enough to read terms before signing them. There's so many people who repeat over and over again, that this market is unregulated, and there's thousands of shit threads on this forum that "Bitcoin will need some regulation sooner or later", and many many more. Again, in the BDI CAPITAL, LLC v. BULBUL INVESTMENTS LLC case, the judge literally stated: "Bitcoin investors are aware they are operating in an unregulated market, and therefore it seems more reasonable to place the burden to ensure access to forked currency on the investors themselves. There is no requirement that investors keep their coins in exchanges; they can always withdraw the coins to their own private wallets. In the unregulated cryptocurrency market, potential investors are well advised to ensure that the terms of service of the exchange they are using clearly spell out what the exchange's obligations are with respect to forked cryptocurrency, if any." Oh sure, if you mean their hundreds of specially invented codes and rules f.i. for banks, or companies that work with food, or hotels, etc., then, indeed, this market is unregulated. Or if you mean by "unregulated" that governments and corporations have not (yet) (completely) stuck their fingers in our crypto affairs to regulate us (and get taxes), then, indeed, this market is not regulated. The truth is of course: this market is NOT unregulated. It's proven every day again on this forum: we have paid campaigns, loan sections, escrows, gaming and gambling sections, people who are buying and selling and trading in hundreds of ways constantly, etc. How could this be possible, if this market was unregulated? It's based on the right of private property (imo as a libertarian, it's the only rule that should exist and of which all agreements and decisions can be deduced). Of course, this also means users will have to take their responsibility and read the ToS, because there will be no government to "help" them out, if they missed out on the content in the contract they signed without reading. These people are indeed lazy and blind and will probably get poor fast, whilst hoping for the opposite. Every day again, activity on this forum as well as elsewhere, and the huge amounts of successful crypto trades all over the world, are proof over and over again that WE DON'T NEED EXTRA REGULATION. (but this discussion would lead us too far off-topic, I guess...) |

|

|

|

|

I'd go for 66 friends1980, thx for just another great raffle, OP.

|

|

|

|

|

66 Biden - friends1980. Things could still change as soon as all mail-in ballots have been counted. Thx once again OP.

|

|

|

|

|

FYI, wrongfully accusing someone from an offense defines as slander or defamation, which is by the way an offense in itself.

Just sayin, WMW.

You probably meant well (or not, dunno), but you're wrong.

|

|

|

|

Also dann nehme ich mal BTC, anscheinend wagt niemand es dieses Los bis zum Ende zu wählen  klopfe auf Holz und vielen Dank OP für diese Initiative...   (yup... Lauda is gone) |

|

|

|

Soon we will all be chipped, so you won't have such problems. See, the state is taking good care of us.

The fact that governments and corporations are finding easier and more practical ways to apply their etatist rules is not my problem as such. My problem is the simple fact that these rules exist. (though I'm quite sure I'm preaching for the choir anyway)  |

|

|

|

Let me share a curios and a little unpleasant story. In my country, a large part of the population ID's expires this year. The government has decided to extend this period by another year due to the covid crisis and to avoid crowds. So far so good. But I started receiving letters from all crypto exchanges that my ID has expired. And now I have to write letters to the support, to explain myself to them to give me access to my accounts. I do not currently have access to any exchange and I have to wait days, probably weeks for this issue to be resovled. This sucks.

I was denied a credit card because my DL was expired, even though my passport was valid. What does driving have to do with credit??? My bitcoin wallet never expires. I was denied entry to a bar once because my DL had expired. I was 29 at the time. How dare you?    I was denied (re-)entry to a bar once after I got out 2 minutes to make a phone call because I had no network connection inside. The security guy called his colleague on his intercom to actually go and check out if my jacket (having my ID in it) was indeed hanging inside. I think I was about 25 years old, and by the way, this was in a beer cellar somewhere in Munich, not in the US. |

|

|

|

Wäre aber interessant mal zu überlegen warum es bis zum Ende gedauert hat, bevor jemand es gewagt hat den " BTC" zu wählen  können doch kaum behaupten, dass BTC uns bisher Unglück gebracht hat   |

|

|

|

A few months ago, the Court of Appeal of the State of California published its decision in the case of Darrell Archer vs. Coinbase. Archer, a Coinbase user, filed suit against Coinbase for refusing access to his part of the forked Bitcoin Gold coins, which were forked from the BTC he owned on the Coinbase exchange. Archer lost both trial and appeal. Following the publication of the Court's decision, self-declared "crypto lawyer" Justin Wales stated on Twitter that this case confirms the principle of "Not your keys, not your coins". While I can imagine his tweet no doubt got him the media attention he was hoping for  this case does not confirm "Not your keys, not your coins" at all this case does not confirm "Not your keys, not your coins" at all. What could be - maybe, carefully, cautiously - concluded at best from this decision, is: "not your keys, not your forked coins" (even though in reality, the Court simply does not deal with "the key issue" directly). Here are the (imo) most important parts of the decision, with my (humble) personal analysis - let me clarify that I have not read the trial judgment, only the Appeal decision: 1. "It is undisputed that the User Agreement does not contain a provision requiring it to support or provide services for any particular digital currency created by a third party."Forked coins are "third-party" coins even if they're forked from supported coins, and the exchange has no obligation to install its software or to provide services related to these third-party coins, if this is not marked in the User Agreement. The exchange has therefore no obligation to make forked coins available to its users. (Judicially irrelevant, yet still mentioned in the decision - and interesting for us to know - is the fact that Coinbase did in fact consider a Bitcoin Gold integration and did evaluate its security risks) Furthermore a judge confirmed in an earlier decision - also quoted in the present one - that, were the Court to acknowledge this obligation, then "The Court would be imposing a major new duty on all cryptocurrency exchanges (...) to affirmatively honor every single bitcoin fork." This point of view was shared by aesma in this post. 2. "(...) whether Coinbase could provide plaintiff with access to the forked currency is not dispositive; the pertinent question is whether Coinbase had a contractual obligation to do so, and the undisputed evidence submitted by Coinbase shows it did not"A huge missed chance... The Court does not have to answer the important question if Coinbase should give the private keys to the client, if possible and when asked, because the Plaintiff is founding his defense on the principle of breach of contract (which it's not) and not on the principle of his (possible) property rights of the private keys. In other words, the important question if an exchange user has the right to have access to his private keys, is left unanswered because it's impertinent for this case. 3. "Though plaintiff argues nothing advises the customer he may not be able to access the private keys for his forked digital currency, plaintiff does not dispute he knew at the time of the Bitcoin Gold fork that Coinbase does not support every digital currency."Again, oh-so extremely close... But no cigar.  The Court does neither confirm nor deny the right to have access to your private keys. However, the Court does confirm that access to your private keys is not expressly excluded in Coinbase's User Agreement. Sadly, the Plaintiff apparently did not use the argument that he should receive his private keys, but that Coinbase should give him his Bitcoin Gold. Based on what I read in this decision, the Plaintiff actually never asked Coinbase to make the keys available prior to the fork either. We can of course not expect the Court to make a decision based on assumptions and hypotheses... Now why did the Plaintiff choose this strategy and why he did not simply demand that Coinbase give him access to his private keys??? A possible explanation could be that in the meantime the Plaintiff's Bitcoin Gold value was way lower than at the moment of the fork. For this reason, having access to his private keys would have become less interesting anyway, from a financial point of view. Therefore, the argument of "Breach of contract" might have been preferred as a strategy of trying to get an indemnity from Coinbase with the BTCGold value at the time of the fork, instead of trying to obtain the private keys and those Bitcoin Gold coins, which had a much lower value now. Of course, I'm only guessing, but my line of thought is probably not too absurd. 4. "(Plaintiff) contends Coinbase was required to provide “the usual and customary” services, including services for “ ‘fork’ occurrences,” but he identifies no basis for that alleged duty, nor evidence of any written or oral representation by Coinbase that it would provide such services (...)"Another confirmation of the obligation to respect the mutual agreements between parties - nothing less, but also nothing more; so there's no obligation to provide services for "third-party" coins, even if these are forks from supported coins.

So my conclusion about the content of this decision: not your keys = not your forked coins, unless stated otherwise in the User Agreement. In other words, in the end this decision is imo nothing more than a confirmation of the fact that agreements and contracts have to be respected by both parties. Nothing less, but also nothing more. So this decision's not very shocking as such, and it is simply confirming the "basic" Private Law "pacta sunt servanda" principle, meaning that "agreements have to be respected". Nonetheless, I can't help but feel that decision probably has missed out on becoming a landmark crypto decision only by a breath...  It does look as if we are close to answering the question if not owning your keys indeed means you're not owning your coins. Or put differently: (if not stated otherwise in the User Agreement and when asked) do exchanges have an obligation to provide you access to your private keys? To be continued soon...  Some of you probably already know, I've been an advocate for reading these Terms, and have been warning people quite often about the risks they are taking when trusting their coins to several low-quality exchanges. Sadly, many of the exchanges I was warning people for in the last months and years, have in the meantime closed shop or gone bankrupt, with little or no action possible, because users suddenly discover everything was mentioned in the Terms of Use (or they discovered the Terms were fishy as hell). It's the main reason why I find it rather disturbing that this principle of "not your keys, not your coins" is used over and over, whether appropriate or inappropriate (even by this self-declared "crypto lawyer"). People will never blindly or unthinkingly accept or understand such advice - no matter how well meant it is - if they do not understand WHY. I'd like to urge members who have the knowledge and experience to not use this expression recklessly, because it's eroding its credibility and undermining the important message it really does contain.My advice and the warning I am once more giving users of exchanges (and in this case specifically for people who want their forked coins), would therefore be: 1. Read the frigging Terms of Use, before transferring your coins and make sure they're watertight. Would you buy a car or a smartphone or a TV without reading any reviews? Same goes for an exchange. KNOW WHAT YOU USE BEFORE USING IT. 2. Ask yourself which issues could rise in the future (needless to say this forum is a treasured source of knowledge for all possible obstacles on your trading adventure). Since one of those "issues" could be the launch of forked coins: keep your coins on your own private wallet during the fork and avoid any discussion or problem. 3. Finally, taking into account the points above, ask yourself: would you trust this exchange with the keys of your car or your house, and what could be the possible consequences? The principle for your coins is exactly the same. Hat tip: Last of the V8s. |

|

|

|

|

Apart from the fact that this is a great design with a very original package and especially an extremely important message, this also is a wonderful gesture towards this community.

I'd like the number 25 friends1980 plz.

Thx mate and good luck to all participants!

|

|

|

|

|