I never believed that Lightning could be really the one and only scaling solution for Bitcoin. A Lightning payment has a completely different character than an on-chain payment - at both sides of each payment. Someone who uses Lightning mainly to "pay things" has to regularly top up the channel. And for those receiving LN there is not only the infrastructure, but also the monitoring requirement. Old channel updates are more dangerous for those who receive Bitcoin frequently (and of course, the intermediate nodes). It may be controversial what I'll write now, but I think the way to go forward is in this case (and only this one!): follow Ethereum! Ethereum has experienced some progress with Layer-Two solutions, above all with the rollup technology, which made tumble transaction fees. See Bitcoinrollups for a way to implement that in BTC. But there are also some other interesting L2 concepts like Nomic*. I could also imagine a " BTC stablecoin" based on a collateral/lend-based technology similar to Dai, which could be used on all EVM-compatible altcoins. Chain-based L2s have a crucial advantage to LN: they can be used like Bitcoin or any other altcoin basically -- no 24/7 requirement, no major monitoring costs. The only disadvantage to on-chain is that the security is a bit lower. I still think Lightning is a part of a larger scaling solution. Several times I compared it with a prepaid card. That's how Bitcoiners should think about it - as a specialized micro- to small-payments solution. Not as a layer which has to be run by every single Bitcoin user, but by those who use Bitcoin frequently to make online (or offline) purchases like buying books, VPS, and other relatively low-cost items. For small payments, the attacks described last year are not profitable, so they will most likely never occur. *The main problem I see for most of these technologies is that they are often using centralized tokens for some PoS/PBFT consensus. But these solutions are mostly open source so they can be forked, and a PoW token could be created for consensus. |

|

|

|

Im Faden über virginoranges Strategie, um DCA zu verbessern, indem man sich nach dem Langzeittrend richtet, hatte ich die Idee eingebracht ein solches Modell etwas zu verfeinern, indem man versucht auch "externe Einflüsse" auf den Trend zu beachten. Damit sind Ereignisse oder Fakten gemeint, die den Trend beeinflusst haben könnten, ohne mit dem Trend selbst, oder noch besser: den fundamentalen Gründen für den Trend etwas zu tun zu haben. Auf Anregung von @Tubartuluk mache ich dafür einen eigenen Faden auf. Ein Beispiel, um was es geht:Bitcoin hat ja einen bisher positiven Langzeittrend beim Kursverlauf. Man könnte die Hypothese aufstellen, dass der Grund ist, dass immer mehr Menschen Bitcoin benutzen, bei gleichzeitig beschränkter Angebotsmenge. Die genaue Ursache ist aber erst mal egal. Wichtig ist, dass es einen solchen Trend gibt und man über diesen Trend eine Formel aufstellen kann, etwa mit Hilfe einer logarithmischen Regression (" Trolololo-Methode"). Nun kam es 2021 aber zum Corona-Crash, der den Preis aufgrund eines außergewöhnlichen Ereignisses wesentlich tiefer fallen ließ als in vergleichbaren Marktsituationen. Der Corona-Crash könnte den Kursverlauf der folgenden Jahre negativ beeinflusst haben. So hatten viele Bitcoiner erwartet, dass 2021 schon die 100.000 gerissen werden könnten, das Top lag aber "nur" knapp unter 70.000. Stimmt diese Hypothese, dann hätte der Corona-Crash den Langfristtrend nach unten verzerrt, und eine Formel, die diesen Trend darstellen soll, wäre womöglich "zu konservativ".

Könnte man solche "externen" Ereignisse quantifizieren? Man könnte dann eventuell besser verstehen, wie der grundlegende (also z.B. "adoptionsgeleitete") Kursverlauf-Trend aussieht, und kurzfristige Anomalien "herausfiltern". Die Idee sähe so aus: Man stellt sich eine Liste aus möglichen Kategorien von Ereignissen zusammen, die den Trend beeinflussen könnten, aber generell nicht viel mit allgemeinen Gründen für eine Bitcoin-Adoption zu tun haben. Beispiele: - Einschneidende positive/negative Ereignisse für die Weltwirtschaft allgemein (z.B. Corona)

- Entwicklung des Leitzinssatzes

- Bestimmte Nachrichten aus dem Bitcoin- und Krypto-Umfeld, die sich nur regional auswirken (also die allgemeine Adoption nicht beeinträchtigen) aber den Preis beeinflussen können (z.B. China-Mining-Bann, Anerkennung als gesetzliches Zahlungsmittel in El Salvador, Terra/Luna)

Man kann nun bei jedem dieser Ereignis-Typen versuchen, einen Wert zu finden, der den möglichen Einfluss auf den Gesamttrend ausdrückt (z.B. 5% weniger Wachstum im Jahr als durch den "Normaltrend", der durch eine Formel ausgedrückt wird - siehe oben - zu erwarten wäre). Man stellt sich dabei die Frage: Wie könnte der Trend verlaufen sein, wenn dieses Ereignis nicht eingetreten wäre? Wie groß ist demnach der mögliche Einfluss auf den Preis? Ideal wäre es, wenn man dafür ein Software-Tool benutzen könnte, das solche (erst mal rein hypothetische) Werte mit Preisdaten der Vergangenheit kontrastiert. Ein solches Vorgehen hat eine Einschränkung: Ich würde es nie als einziges Tool für die Preisprognose verwenden, denn es sollte unmöglich sein, alle Einflüsse auf den Preis zu ermitteln und quantifizieren. Es gibt auch viele Ambiguitäten, also Ereignisse die zwar einen "externen" Grund haben, aber die Bitcoin-Adoption in der Tat verzögern könnten (z.B. eine lange weltweite Wirtschaftskrise). Solche Ereignisse dann herauszurechnen zu versuchen wäre ein Fehler, da ja der fundamentale Grund für den gedämpften Trend sich real auf Bitcoin auswirkt. Es wäre daher eine reine Ergänzung zu einem Modell, das rein auf dem bisherigen Kursverlauf basiert, wie @virginoranges oben verlinktes Modell. Dennoch sollte es möglich sein, einige wenige einschneidende Ereignisarten vom Langzeittrend zu isolieren. Viel mehr als 1-2 Ereignisse pro Jahr würde ich nicht verwenden. Auch können unterschiedliche Anwender zu anderen Schlüssen kommen, welche Ereignisse wichtig genug sind. Dazu wäre ja dann das Software-Tool da, und jeder Trader basiert seine Entscheidungen ja auf Grund von unabhängigen Informationen. |

|

|

|

Ich verstehe nicht, wie ein im Ausweis eingetragener Künstlername nützlich sein soll. Wie bei Verheirateten, die einen anderen Namen als Geburtsnamen haben. Steht doch alles im Ausweis und Pass.

Meiner Interpretation nach könnte es dann was bringen, wenn man verschiedene Namen (echter Name, Künstlername, abgekürzter Name, zweiter Vorname etc.) für verschiedene Dienste verwendet. Die Idee dahinter wäre, dass wenn die Daten gehackt werden sollten, man nicht so viele Konten miteinander über den gleichen Namen "verbunden" hätte. Oder dass nur der "unwichtige" Künstlername betroffen wäre, man diesen also für unwichtigere/unsicherere Dienste wie Übersee-Krypto-Tauschbörsen verwendet. Natürlich müsste man dabei darauf achten, dass man so wenige Daten wie möglich für die "Identitäten" miteinander teilt, also die Identitäten klar auseinanderhält. Also z.B. eine unterschiedliche E-Mail-Adresse oder falls verlangt Telefonnummer für jede Identität verwenden. Der Allerweltsname als Künstlername ist natürlich da eine ziemlich gute Idee.  Um gegenüber Behördenanfragen zu verschleiern, wer man ist, taugt der Künstlername aber natürlich nichts, wie schon von anderen erwähnt. |

|

|

|

The big question is of course: Is there a fundamental reason for the long term Bitcoin trend?

To my mind that is not the question. Regarding that trendline, the likelihood that the relationship between Price and Date is caused by chance is close to zero. In other words: there must be some fundamental reasons. I think I should have written: Is there a fundamental reason outside the price history itself?The alternative would not be "chance", but that the growth's reason is related to the past price history. The price growth itself could have led to an increasing interest and thus cause a prolongation of the increasing trend (the "Bitcoin: I can get rich quick!" theory). But also the "I see there are bull-bear cycles of 4 years, thus I ride the waves" theory is such a "investment principle" without external influence which could have caused the long term trend. On the other ("a fundamental reason exists outside of price history") side, aside from the simple "adoption" theory there could be also something like "static demand surplus combined with increasingly lower supply growth" like in S2F. About more specific details of such a model I'll open a dedicated thread (as said per PM). The important thing for me is that you should be able to try several independent variables and test them empirically with a software tool. But such a model could not find the reason for every price movement, this would be too complex/next to imposssible. It's only meant to fine-tune a more general, price-history based model like virginorange's. |

|

|

|

|

This is nothing new or "innovative" at all. Please google the DAO/DAC concepts.

In fact, one of the biggest fails in crypto history was a high-profile "decentralized investment community" on Ethereum, called TheDAO, which collapsed in 2016 due to a problem in the smart contract which allowed an attacker to drain a lot of funds. It even led to a hard fork on Ethereum where they decided to roll back some of the "malicious" transactions.

I've seen various other communities of this kind but nothing really interesting, although the concept could work of course.

|

|

|

|

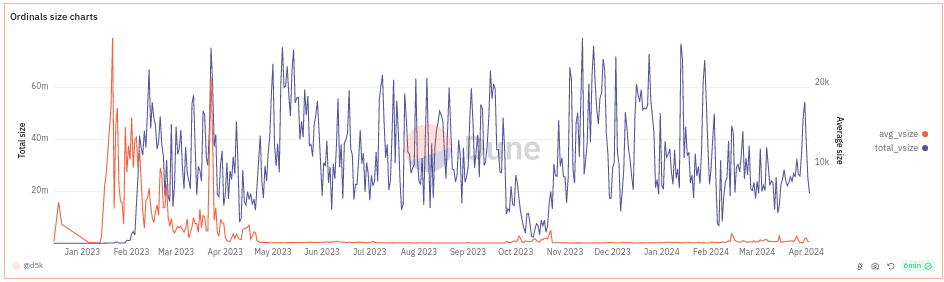

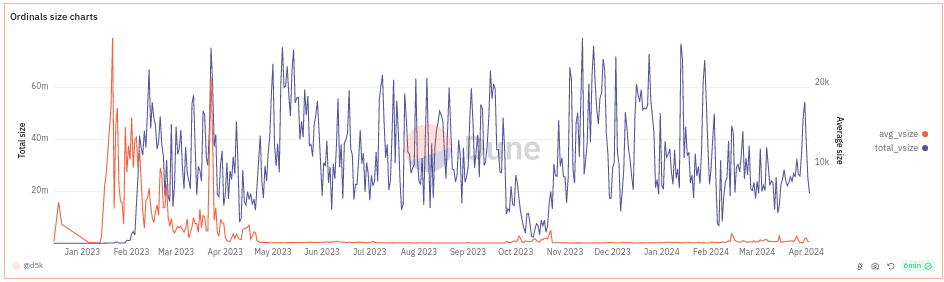

Pense que siendo ya una etapa bastante avanzada del BTC con varios Halvings en el lomo y con mayor adopción el porcentaje de Tx impulsado ademas por el reciente trafico producido por ordinals iba a andar medianamente por el 15%.

A mí también me sorprendió esto. El tema es que la actividad de Ordinals bajó muchísimo en febrero y marzo, a aproximadamente la mitad del volumen al que estábamos acostumbrados (hubo un pequeño "rebrote" en un momento, seguramente aprovechando las bajas comisiones de hace 2 semanas aproximadamente, pero se ve que no influyó mucho en las fees). Como dije en el hilo sobre el "bloque más valioso", es posible que esta actividad se incremente cerca del halving por la carrera de lanzar inscripciones en el primer bloque del nuevo período, pero no creo que se rompa la tendencia "bajista".  Para comparar: Los 15% los tuvimos el año pasado en el momento del auge de Ordinals (ver el cuadro que subí unos posts más arriba). Respecto al Halving venidero, como bien marcas va a ser un golpe duro, haciendo una matemática muy básica y pobre digamos que necesitaría un x2 en el precio para contrarrestar el efecto /2 del halving, el tema es que en esta cuenta no se contempla para nada el esfuerzo extra de la subida de dificultad de los bloques por ende mas gasto de energia y tampoco que tanto pooles medianos no podrán competir contra grandes/gigantes.

Bueno en realidad ya tuvimos un x2 o un x3 comparado con distintos meses en 2023. Pero claro, desde este momento volvió a subir la dificultad. Hay que ver cuanto de esto se puede atribuir a mejoras del hardware - esta parte del incremento del hashrate "no cuenta". Este artículo que ya data del año pasado, menciona algunas estrategias que los mineros están empleando para sobrevivir el halving: - optimizar el hardware - diversificar la actividad, algunos se están metiendo en el mercado de computación en la nube y Colocation - bajar los costos de la electricidad sumando fuentes de generación renovable - generar reservas de cash El segundo punto es muy interesante, a menudo quizás uno olvida que los mineros no están obligados a vivir solamente de la minería y pueden aprovechar su conocimiento sobre hardware etc. en rubros relacionados. |

|

|

|

Hoy lo probé y funcionó bien (obviamente no con una dirección mía). En cuanto al tema de la protección de datos, no me parece que cambie mucho. Mucha gente usa Google para todo porque es "la Internet"  , y esa gente para ver su saldo quizá ya en el pasado usó Google poniendo la dirección BTC. Google sin problemas podría haber usado un filtro para direcciones BTC y silenciosamente haber añadido la dirección a la información oculta que almacena junto con cuentas Google y/o direcciones IP como "búsquedas de direcciones". Lo que sí veo es un cambio gradual. Ahora es más atractivo hacer eso, y entonces mucha gente a la que no le importa la protección de sus datos, lo hará más frecuentemente. Creo que es "seguro" ver el balance propio si uno se conecta a través de Tor o de una VPN, además de salir de la cuenta de Google o usar un perfil distinto en el navegador. Y no usar Chrome ni un navegador que no sea de código abierto. Yo acompañaría eso con la estrategia de lanzar, cada rato, búsquedas para direcciones que no son mías (simplemente copiarlas de algún explorador de bloque, quizá tener en cuenta que no sean direcciones de mineros porque estos quizá en la base de datos "real" de Google están en una tabla aparte). Todo eso igual lo haría con todos los exploradores de bloque en los que no puedo confiar - o sea, todos  Lo de que Google "publique tu saldo" me parece un tema menor porque esta información estuvo disponible en Internet libremente desde que funciona el primer explorador de bloques de BTC, y también siempre salía en los buscadores (no directamente, pero la página de un explorador de bloques). Es imposible tratar de impedir eso con acciones legales porque hay miles de exploradores de bloques. El tema me hace acordar de un caso en 2013 cuando existió un servicio llamado Instawallet al cual se accedía ... con la información para acceder a la cuenta (es decir, una especie de "clave") como parte del URL (!). En algún momento la gente empezó a usar Google para acceder a sus cuentas (!!) y esto provocó que Google terminó indexando claves de usuarios del servicio (!!!) y las mostraba en las búsquedas (!!!!). Demás esta decir que el balance de estas cuentas rápidamente fue 0. |

|

|

|

But what is the message out of it for future peaks? The "peak line" now pretends to predict the next peak more precisly, but that is just not true, as the "model" is still based on very few (=4) target points and other black swan events in both directions could occure at any time. Therefore it would be kind of missleading to my mind.

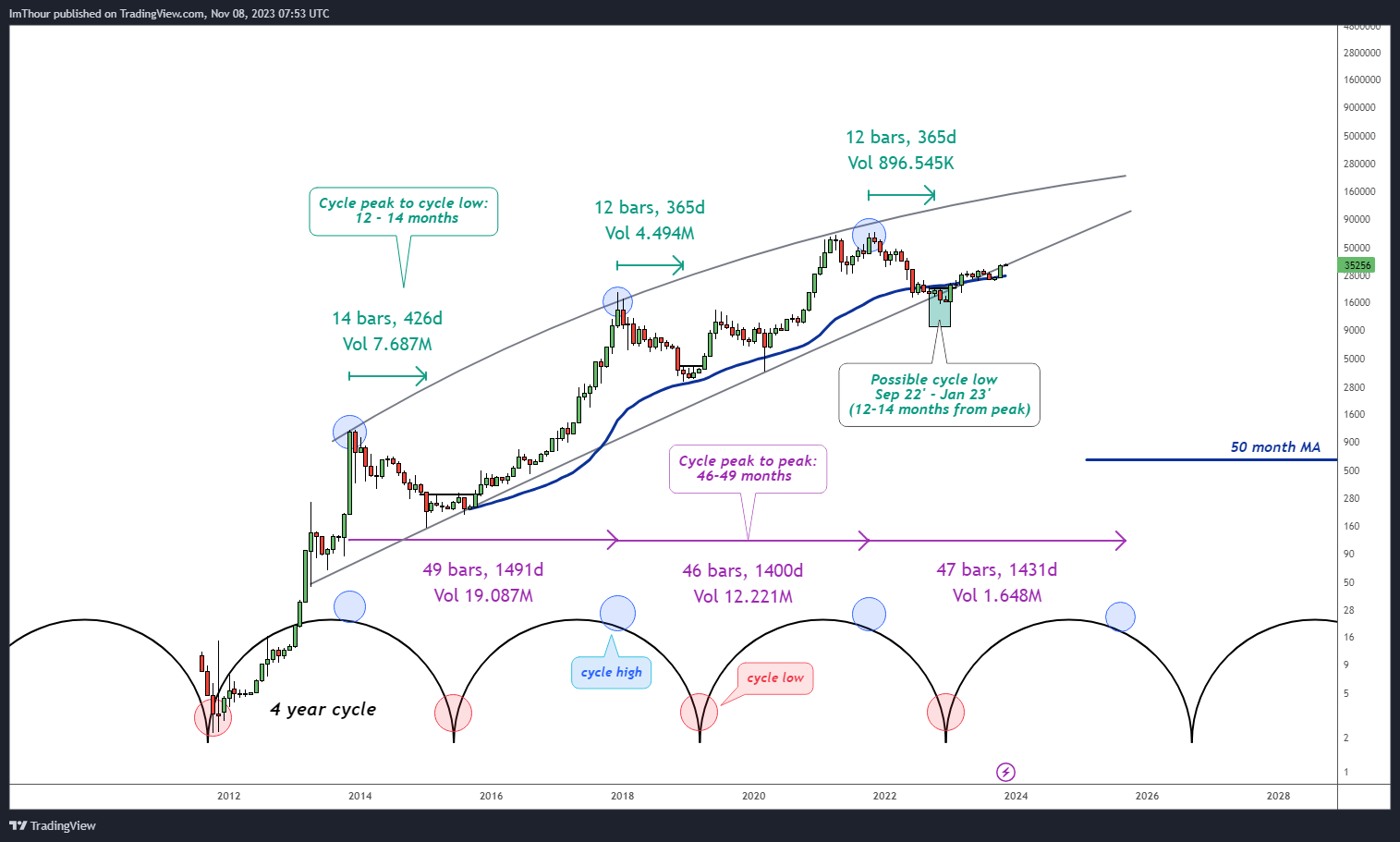

Thank you for your calculations, I think you have a valid point here. And in general I think to simply outperform DCA for the next few years @virginorange's model in its pure form would work even if it was slightly distorted. Taking external factors into account would mainly be useful for longer timeframes, but also could yield a slightly better performance in the mid term. But the longer a model seems to work although it is distorted, the bigger the risks that its predictions will be totally off for the next cycle. We have already an example where a model which was based on the past price history and "seemed to work fine" for years but then failed because it was distorted: Stock to Flow. People who adopted risky strategies based on the original model which predicted a 2021 peak of well over 100.000$ will very likely have suffered big losses in the 2021-2022 bear. Virginorange's model is much, much better than S2F, but the "problem" that it is only based on price history remains. The big question is of course: Is there a fundamental reason for the long term Bitcoin trend? If we assume the answer is "yes", like I wrote before assuming that the "grade of adoption" is the main factor here, then it would be useful to "isolate" this trend curve in some way. And then there is room to improve the model with such an "external effect factor". If however your answer is "no", which is also a valid assumption, then I'd go for the "pure" price history based model. Many traders/investors would disagree about this question, and that's totally fine. |

|

|

|

|

I recently wrote something about this case in another thread.

First, yes, such an attack is of course possible. Besides of the high cost even for states, there is however also another problem. If the state-level agent wants really to harm Bitcoin, he would need additional measures which would make the attack even more expensive:

First, he should be able to maintain the attack for some time (was already mentioned). But second, to really initiate a big dump, he should create real damage, e.g. double spending several big amounts on big exchanges or payment processors.

For this to happen, he'd need to create a network of fake accounts on several exchanges, bypassing KYC measures. Of course he has to take into account that these exchanges have some safety measures in place, such as requiring confirmations for BTC deposits. It is likely that the attack would be noticed already in the timeframe between the 51% incited re-org and the moment the deposit gets "credited", or at most the intent to cash out by the attacker, and the exchange would simply refuse to credit BTC deposits which were the result of a double spend.

Atomic swap and no-KYC exchange liquidity should be too low to create such an "real damage" attack.

The state-level attacker could of course get, in theory, some of his costs back if he manages to short Bitcoins just before the attack. But shorting currently is only possible on centralized platforms. If these detected anomalies like a considerable number of shorts just before the attack, they would for sure initiate investigations. And the state-level agent would then be responsible for any damage created to nationals of other countries by the "short selling" part of the attack, because "insider trading" is a crime in all countries I'm aware of. So no, the most likely outcome is that he would get next to no "returns" from the attack.

What they could try is to inflict damage with the "cheapest possible" 51% attack, i.e. with only a small amount of double spends and only for a couple of blocks. But the harm created would then also be quite low. Several coins which were attacked in the past, like ETC, have since then recovered.

I think thus for state-level agents the "FUD attack" is much more promising: tighten regulations, trying to create narratives like "Bitcoin is harmful for the environment", or outright ban Bitcoin, the latter being probably possible only in authoritarian countries.

|

|

|

|

|

Glücklicherweise ist die Datensammlerei ja recht einfach zu umgehen:

- Tor

- VPN

- vielleicht Nutzung von Google-Interfaces, die sich zwischen die Nutzer und Google stellen, z.B. Startpage.com (habe mal dort geschaut, dieser Anbieter zumindest zeigt nur reguläre Suchergebnisse an wenn man eine Addresse eingibt)

- ganz Vorsichtige können sich zusätzlich einen Pool von nicht ihnen gehörenden Adressen anlegen und grundsätzlich einige dieser Adressen zusätzlich eingeben

- natürlich aus allen Google-Accounts grundsätzlich ausloggen, wenn dieses Feature genutzt wird

Das Problem ist aber natürlich, dass dieser (stark vereinfachte) Block-Explorer-Dienst auf Nutzer zielt, die sich über Datenschutz keine Gedanken machen, wie so vieles bei Google.

Ob da aber jetzt eine zusätzliche Gefahr besteht? Es könnte ja sein, dass Google schon lange die Eingaben in ihrem Feld auf Crypto-Adressen prüft und den Google-Accounts zuordnet. Man müsste mal die Datenschutzrichtlinien studieren, ob man dafür seine Einwilligung gibt ...

Im Grund genommen sollte man aber bei allen Block Explorern genauso misstrauisch sein. Wer weiß, welche Verbindungen schon heute zwischen den Tech-Giganten und den Block-Explorer-Anbietern bestehen ...

|

|

|

|

Long term -- Established coins

Short term -- You can do new coins/tokens too, but be very careful and get out as soon as you get good profit. Do not be so greedy.

I would even go further and say: Long term (more than 3-4 years): Bitcoin or at most Ethereum. Even coins of the "second row" like Solana and BNB were beaten by Bitcoin when it comes to 4-year performance. Ethereum didn't still reach its 2021 ATH. And there are even relatively few coins which manage to be in the top 30 for more than 2 cycles (stablecoins aside). Alternatively, security tokens which are run by companies not focussed in the crypto sector (e.g. gaming) could become an alternative in the future. I would also add another category: Mid-term: established coins of the second tier (e.g. Solana) These are coins you may want to buy in the crypto winter when they usually lose more than 90%, and hold until the point of maximum FOMO. - Bull run? Increase risk tolerance and chose new tokens from a good enough project with reputable team.

- Bear trend? Reduce risks by diversifying into established coins than their newer counterparts.

I do not fully agree here. Yes, in a bear market I would definitely go out of altcoins which had phenomenal growth in the last bull market, for example meme coins, risky ICOs and so on. But just in bear markets there can be very new projects emerging which may beat the market better than the established coins. These projects have to be either 1) totally new, i.e. created after the last bull market ended, or 2) created before, but still weren't discovered by altcoin speculation. An example is Kaspa which afaik was created in the very last stage of 2021s bull run but was able to grow quite well in 2022, and then exploded in the 2023/24 bull market. |

|

|

|

Busqué un poco de información en Internet sobre el tema "granizo y fotovoltaica" y aparentemente no es un asunto tan grave. Existen distintas clases de paneles fotovoltaicos con respecto a su resistencia al granizo, y los que tienen certificación IEC 61215 son resistentes a granizos "normales". Hay otros de calidad superior que también deberían resistir tormentas excepcionales como quizá en este caso de Texas. Por eso calculo que en esta granja solar se usaron paneles de baja calidad, o la tormenta fue muy superior a lo normal. Habrá que ver si la empresa que la operó tenía seguro contra granizo (supongo que sí). |

|

|

|

Argentina expert here  (sort of ...) He then set out to carry out some economic reforms. Some of his economic achievements like a budget surplus and decreased inflation have been impressive. First, "decreased inflation" is not true. The new government itself is responsible for the December/January inflation rate, which was much higher than what was experienced in most of 2023 and was caused by the first measures of the government after December 10 (above all a >50% devaluation of the ARS, which made many imported goods much more expensive). December and January had over 20% inflation monthly, while in 2023 most of the time it was around 10% monthly. I chose the monthly rate because the yearly rate doesn't really explain what's happening. Now in February the inflation went down to 13,2%, which is an improvement over January, but still worse than in most of 2023. March is expected to have similar figures (10-15%). The budget surplus was achieved with pretty simple measures, like reducing pensions (relatively to inflation) and subsidies, and closing several nationwide institutions, reducing thus personal costs. I agree with some of these measures, because some state institutions were inflated by clientelist structures, but with others I don't agree (see below). But what I do not understand is that some of his policies aimed at slashing government programs and instituting extreme libertarian reforms, is triggering a deep recession and reduction in the purchasing power of the Argentines. The problem here is, as Don Pedro Dinero already wrote, a conflict between short term and long term effects. A reduction of public spending is recessive in the short term, because the state makes up a quite big part of the demand in the local economy. Public spending in Argentina makes up about 37% of GDP, which is similar to the US (38%) but significantly lower than in Europe (often 40%+, for example Germany has 49% and Italy, Austria and France even more than 50%, according to latest available figures). If you take this into account, even if the provincial/municipal level also is important and it decreased less, then it becomes "logic" that many local companies are now suffering decreasing sales in the internal market because of the federal states budget reduction. Above all the construction sector is affected directly by this. Another problem is that due to the extreme inflation between December and January (together about 60%), the real salaries decreased, harming the local companies' sales even more, although they are partly responsible for this because many exaggerated their price increases. What the government wants to achieve with this is a long-term effect: reduce inflation really significantly (at least to the level of pre-2022, to two figures anually) and achieve that the financial sector "normalizes", creating more stable conditions, which could be a pillar for future growth. Recession normally reduces inflation, as companies increasing prices too much will be punished by lesser sales. Currently this is already begining to work: it is likely that if current trends continue, in April and May the prices will rise below the 2023 average level. This is combined by a conservative Central Bank policy, reducing "money printing", which also reduces inflation according to the most established economic theories. But the question is: if the recession is too deep, Argentina's economy could be harmed structurally, for example due to an exodus of talented workers to other countries. This would harm above all the industrial sector and reduce economic diversification. Some say the industrial sector is currently bloated and lacks competitivity. But on the other hand, Argentina is South America's only country designing and building complete own satellite missions and fabricating integrated circuits. If such strategic sectors are lost, the economy will suffer even more in the long term. There could be also a further structural poverty increase, and poverty rate is already high (35-42% in the last 6 years), which could cause a rise in welfare expenditure, or a loss of the general population's welfare level. It's a gamble: it could work or not, or work for some time (like in the 90s when similar policies were tried), but then lead to a big bust (2001). |

|

|

|

I think there is an overarching aspect to be found in Bitcoin's potential future proliferation that encompasses your 3) and 4) as well as countless of other aspects. I am referring to the institutionalization of Bitcoin within local, regional and eventually the global society. The needs of specific sub-societies that Bitcoin can serve are fundamentally different across the globe. Very good points. "Legitimacy" is indeed important. We can argue that even if the ETFs approved this year "only" are providing access to Bitcoin for a selected class of investors, the psychologic effect ("Bitcoin is now part of the established financial system"), even increased by the fact that it was accepted by an entity (the SEC) often regarded as to be hostile to cryptocurrencies, is probably crucial here. For the case of societies in lesser developed countries, I could bring up the case of Argentina, where BTC often even in bear markets performed better (sharp crash episodes like near the Terra/Luna desaster aside) than the local currency which constantly lost 10-25% per year (and 20-65% per year in 2021-24). These use cases however still are limited: your currency must be extremely weak for that to happen. And even in Argentina the USDT and other stablecoins are way more popular as an investment than Bitcoin, even if they can be censored easily (due to Ethereum providing blacklist mechanisms). Thus, I'm still interested in the development of decentralized (i.e. equally or nearly equally censorship-resistant as BTC) financial products providing additional possibilities to hedge against Bitcoin volatility, mainly against the harsh bear markets. I've often mentioned the potential of decentralized option contracts based on atomic swaps but I still see no significant progress in this field, while DeFi on altcoin chains already provides such possibilities, but with a much weaker censorship protection. So there are definitely still some obstacles to be sorted out. Smart property-like systems could help here too, but they also are difficult to realize if they should be both censorship-resistant and low-risk. By reducing overall uncertainty as to where legislation and politics will allow Bitcoin to go, more people will decide to include Bitcoin as a saving plan, i.e. more DCA, and they will more courageously catch the falling knife, thereby reducing the drop height of the falling knife further and further from cycle to cycle. That is how your super cycle will play out over time. The downside "correction" will turn into potential, which will more quickly be exploited, which will reduce the drop height of the falling knife in the next cycle, which will foster confidence, etc. etc.

Exactly that is the idea. Once it happens, it will likely become a virtuous cycle. Such a development could however bring also a particular new risk: the probability for the extreme growth that characterized past bull runs would decrease in this scenario, and certain traders (mainly) will leave Bitcoin and dedicate e.g. to small-cap and micro-cap stocks again because they need more volatility. The challenge is thus that ideally this "speculator exodus" should happen only when legitimacy and confidence for BTC are already so high that the Bitcoin market doesn't get hit and can sustain itself without this class of traders and speculators (including the "lets get rich quick" people). Thus I think while we are on the path, on the way forward there could still go something wrong, which could lead into the other extreme: the bear supercycle (>4 years without new ATHs and significantly lower prices). I'm optimistic but still think there's a significant probability for such a scenario. |

|

|

|

Hmm. While I agree, that those items mentioned have major impact, i am not a friend of that "bucket list" idea. As it is easy to add items it is likely that you get an overfitted model in the end. And when that model does not fit the future prices anymore it is likewise easy to say, that is because another item that is not on the list and has to be added. Even if you had something different in mind, i dont have a clue how you want to prevent that risk?! Obviously an exact price prediction is impossible. What virginorange instead pretends (if I interpret correctly) is to find general guidelines for retail investors to know when it's a good time to increase the position in Bitcoin, and when it's better to decrease it, not an exact moment when to buy or sell (which would be impossible). The idea is basically to not ignore these "external" factors. Everybody interested in this model can vary his own bucket list and add or remove items - different traders will always process information differently (at least if they're not using the same trading bot or so  ) and thus concede some factors more and others less weight. It would be interesting to create a software tool to be able to contrast such variables with the past price data, being able to adjust the weights of each factor. This tool could then be used in combination with virginorange's general model. On the other hand you could also argue, that all those items mentioned (an much more major and minor impacts) were already priced in and therefore part of chart history. Additionally you don't have to discuss weighting of the list items, as market has already decided for you. In the end you come back to a (mathematical) model based on chart history as it keeps things more simple. The problem is that if you base a model on a chart history which was partly influenced by external factors, you may get a distorted model. The most significant example would be the "underperforming" 2021 bull run. In my opinion without Covid and the begin of inflation growth later that year, the bull run could have been stronger and already reached or approached $100.000 in that year. That was expected by many Bitcoiners that time. The theory about an "underperformance" of course is only an assumption, like everything we discuss in these sections. But this "underperforming" bull run could lead that in the current bull run (and the next ones, if there are any left  ) you may sell too early because the model considered 2021's "underperforming" run part of a general trend where highs tend to be lower. I don't dispute here that the volatility to the upside is probably decreasing, but from my impression particularly the last stretch of 2021 bull (November high was less than 10% above the May high) was quite weak compared with earlier bulls. To my mind it is fine if you keep flexibility and don't get a 100% fit with past price history. Such a high fit is often only possible with a very small number of target points (e.g. only highs or lows instead of 1D closing prices) and would suggest an accuracy which is unrealistic for future "prediction".

Fully agree here. |

|

|

|

Interesting approach. What kind of sentiment analysis you have in mind? Do you know some good "pure sentiment" indicators?

First, I don't know if "sentiment" is the correct word, because "sentiment"-based indices like Greed & Fear are partly based on the price evolution itself. Perhaps one could call this indicator "general market situation". Or simply "External effects influence". I'd thought about a simple "bucket list" of items you can assign a value and apply it to the general "trend index". For example: - Interest rates in a significant part of the most markets (North America, Europe, India, China) more than 1.5 percentual points above the 20-year average --> -10% - " " more than 1.5 percentual points below the 20-year average --> +10% - same for world economic growth rate (this would explain the Covid anomaly) - Regulatory/political event affecting demand negatively in a significant part of the Bitcoin market (e.g. trading/mining ban in China) -> -5% to -20% depending on the size of the market affected and so on. - Regulatory/polical event of high impact in a smaller market, but first of its kind (example: El Salvador's acceptance as legal tender) +/- 10% The good thing is that such indicators are hard enough be tested with past market data. I would limit them to important events. For example, El Salvador's Bitcoin law would be an item I'd include, but the Central African Republic's short-lived Bitcoin law not as it wasn't the first of its kind and its impact was also low. It would be of course object of debate which "hard" indicators determine what to include, but that's a challenge for any of such indices. |

|

|

|

With what do we compare it, gold lingots? Visa cards? Stock market shares distribution? Robinhood accounts?

This is the reason why every time I hear adoption I want to ask what kind of adoption and more importantly, for what adoption do we (whatever we means here) even aim?

I've already listed some points in the OP. But to elaborate a bit further on my "line of thought": Bitcoin's most important unique selling proposition is censorship resistance. Censorship resistance makes sense mainly for payments (value transfers) and "storage of value". Thus all adoption based on these two main functions should imo be encouraged. But these functions are the ones most affected by Bitcoin's volatility. You currently don't really have a reliable storage of value with BTC, only if you hold it for more than 2-4 years (depending where you invested). And the payments function is stagnating partly also due to volatility ("why waste my precious btc on buying things") and also because of the fee problem, which is why scalability-enhancing technology is so important. Currently, there are more ecommerce transactions in LTC than in BTC! The points I outlined in the OP are several kinds of investment and/or usage scenarios which would be useful to really enter the path to a storage of value and payment medium. It doesn't have to be a perfect unit of account, but it should also not put your capital in serious danger if you invest in a bad moment (and can face a 70-90% price decrease). Numbers aren't that important ("1 billion people using BTC"), the important thing is that the share of these usage scenarios grows and eventually becomes dominant. I think we are on the path already, but need to advance further, and the faster the better. In contrast, speculation on CEXes is exactly the opposite. You don't need censorship resistance for that, because the CEX can always censor you. It can be argued that many of the strategies employed by speculators are even harmful to the storage of value concept because they tend to rise volatility (short selling, massive squeezes and liquidations, extreme FOMO etc.). So this is an use case where while I would not say we should discourage directly (only regarding security) no further encouragement is necessary. |

|

|

|

SegWit and Taproot didn't change much for an average user, and LN is still so far from being "officially" launched that it might as well be ignored. I disagree. Imagine where the fees would be now if Segwit hadn't happened. BTC throughput has more than doubled since pre-Segwit times. Taproot is still new, but stuff like RGB and Taproot Assets, once more mature, could be game changers too, leading to a new paradigm for crypto tokens where off- and onchain methods are combined for a more scalable approach. And while sidechains/rollups are still not really a thing on Bitcoin, they have improved Ethereum throughput already greatly. Already in 2023 gas fees plummeted 80%. I'm observing some projects which could lead to similar developments on Bitcoin, mainly Nomic (already operational but still in an experimental stage) and SBTC on the Stacks blockchain (mainnet not launched still). These projects have still their problems, and I would even predict that a completely different sidechain will be the one that finally reaches the breakthrough. But compared to 3-4 years ago when the development of L2s had been almost stalled, they have made a big jump forward. Regarding LN, you may have missed that it is now accepted at most major exchanges which is a big milestone. LN was launched in 2018 on mainnet, it is now at the same stage than social networks were in 2003 (if we take into account that the first social networking service, SixDegrees, was launched in 1997). The early 2000s in social media tech were a period which "to the average user" looked like a stagnation but under the hood there was MySpace and one year later Facebook emerging which were the foundation for the boom of this tech in 2007-10. So if LN evolved in the same speed than social networks, we could expect a final breakthrough in mass adoption in ~2026-28. Maybe it's even faster  The perspective has changed and it's no longer perceived as something that can just go out the back door in a matter of seconds, it has earned a solid foothold in the markets, there are people with long term investments that are chasing not just huge revenues but even continuous over the stock market average small gains long-term.

But still not quite a supercycle, more like a chimera of things, cause I don't see with this change huge jumps happening also, when gains will in short periods outpace other investment some will just take those gains and switch to something else, believing and creating themselves tiny cycles of growth and retracements but with an overall direction following stock markets and economic trends.

I sorta agree here, although I think it's still a quite optimist point of view. It's possible that we've not reached this point entirely. But we may be on a good path, partly due to ETFs, ETNs and other financial products based on BTC. I'm on the same page as hatshepsut93 on the stagnation, let's be honest other than the price, it for sure hasn't made any progress in things like commerce or even remittance, adoption has turned more to some numbers in a CEX account, and ..that's about all.

I agree here and that's the whole point of the thread  "Adoption" in these times is basically "more people speculating". And if we're unlucky, it's people speculating in exactly the same way than in the 2013 and 2017 bull runs: trying to buy when the bull market is already in full force and then refuse to sell when the greed level is highest -- and then panic selling in the bear market. I see more people talking about DCA and similar stuff (I take the opportunity to this excellent thread by @virginorange for an improved DCA strategy) but I believe it's still a minority phenomenon. If we want the Supercycle, this has to change. Maybe gradually. |

|

|

|

Diese Grafik/Vorhersage hat für mich eine Schwäche: Der 4-Jahres-Zyklus ist zu statisch. Bisher hatten wir nur zwei (!) vollständige Vier-Jahres-Zyklen (2013-17 und 2017-21) und beim zweiten (wie ich schon mal geschrieben habe) bin ich skeptisch ob dieser wirklich so lange gedauert hätte wenn Corona nicht den Bullenmarkt verzögert hätte, sonst wäre es womöglich ein 3-Jahres-Zyklus geworden. Ich wäre bei der Bestimmung des Zeitpunkts des Tops wesentlich flexibler. Es könnte sich z.B. auch mal wieder ein 2-Jahres-Zyklus einschleichen wie 2011, oder eine längere Seitwärtsmarktphase. Und dazu kommt der Effekt, dass sich der schnelle Anstieg im Bullenmarkt tendenziell nach vorne verlagert, je mehr diese Information (etwa: "dass ein Bitcoin-Bullrun wie vor einigen Jahren ansteht und dieser sehr profitabel sein kann") zur Masse der Anleger durchdringt. Auch die Erkenntnis, dass sich die Volatilität nach oben hin abflacht, finde ich im Prinzip gut, aber auch hier wird imo versucht, eine "genaue" Kurve zu finden wo es nur ungefähre Werte geben könnte, weil dieses Top von zu vielen Variablen abhängt (z.B. kann der Leitzinssatz mit reinspielen). danke @Tubartuluk für den Hinweis auf virginorange's Thread, sehr schöner Faden, hab mal dort auch was gepostet  Ich bezweifle inzwischen ob das Halving ein Sell-the-news-Event wird wie in der Vergangenheit. Diesmal könnte es vielleicht zyklisch so passen, dass es noch mal als Beschleuniger auftritt, denn der Kursverlauf sieht mir diesmal eher ähnlich wie 2016-17 als wie 2020-21 aus. Kommt das so, würde ich 1-2 Monate danach erst die Korrektur erwarten, und dann Ende 2024 den finalen Bullrun (Elliott-Welle 5) auf (möglicherweise deutlich) über 100.000. |

|

|

|

$115 is the real milestone, until there I expect more volatility, with rises and pullbacks. But then it could rise quite fast if we take into account what happened in past cycles. Let's see how the 2021 bullrun happened:  The interesting thing here to observe is the behavior of the LTC/BTC price compared to LTC/USD. LTC/BTC was still decreasing when LTC/USD already rose sharply. This was the "trickle down" effect from Bitcoin down to most altcoins in most of the bull market. But then suddenly LTC/BTC takes off, leading to a much steeper increase in LTC/USD too. This spike happened in April/May 2021, which was a major "alt season". LTC could be now in a situation like in January 2021: price is slowly rising, but still not in comparison with BTC. But in 2-3 months a similar spike could happen. |

|

|

|

|

, y esa gente para ver su saldo quizá ya en el pasado usó Google poniendo la dirección BTC. Google sin problemas podría haber usado un filtro para direcciones BTC y silenciosamente haber añadido la dirección a la información oculta que almacena junto con cuentas Google y/o direcciones IP como "búsquedas de direcciones".

, y esa gente para ver su saldo quizá ya en el pasado usó Google poniendo la dirección BTC. Google sin problemas podría haber usado un filtro para direcciones BTC y silenciosamente haber añadido la dirección a la información oculta que almacena junto con cuentas Google y/o direcciones IP como "búsquedas de direcciones".