|

481

|

Local / Trading und Spekulation / Re: Der Aktuelle Kursverlauf

|

on: October 01, 2023, 12:44:42 AM

|

viel kurzfristige Spekulation, Arbitrage, Glattstellungen gegenläufiger Engagements, etc., also Geschäft, welches relativ unabhängig vom Preisniveau und Mining stattfindet. Ich stimme dir zu, dass man hier theoretisch etwas differenzieren müsste. Aber insgesamt sind auch die von dir genannten "Posten" von der Nachfrageentwicklung abhängig, besonders die kurzfristige Spekulation. Eine Hypothese wäre, dass die heute gemineten 900 BTC bei dieser Momentaufnahme enthalten sind, also alle 900 BTC auf einer der Börsen im

Moment angeboten werden. Und dann fällt das Halving eben schon ins Gewicht.

Und hier bin ich anderer Meinung, denn die paar Tausend BTC sind ja nur in einem Moment auf der Börse. Wenn wir also in Millisekunden rechnen, dann wären in der nächsten Millisekunde schon mehrere mBTC davon (börsenübergreifend) raus sein aus den Orderbooks, da sie gehandelt wurden, und dafür neue hinzukommen. Es gibt also ständig Fluktuation, und zwar insgesamt eben in der Größenordnung des Gesamtvolumens (also ca. Hunderttausende BTC). Das Tagesvolumen sollte also daher durchaus recht genau sein, wenn man reines Wash Trading rausrechnet (aber das macht ja CMC angeblich). Zudem müsste man eigentlich auch alle BTC dazurechnen, die gegen Güter und Dienstleistungen eingetauscht werden. Das dürften allerdings derzeit noch nicht viele sein. Dass Halvings eigentlich nur am Anfang der BTC-Historie Gewicht hatten (insbesondere 2012) kann man aber auch annehmen, wenn man den BTC-Preisverlauf dem Kursverlauf diverser Altcoins entgegenstellt. Dort gibt es Altcoins ohne Halving (Doge, Ethereum), Altcoins ohne Blockreward (NEM) sowie Altcoins mit Halving ähnlich wie Bitcoin (LTC). LTC z.B. hat die Halvings (abgesehen von kurzzeitiger Spekulation davor und danach) komplett ignoriert, daber dafür an anderen Punkten plötzlich Booms und Busts erlebt (siehe diese LTC/BTC Grafik, LTC/BTC statt LTC/USD deshalb, um den "Marktführereffekt" durch Bitcoin rauszunehmen). Die anderen Altcoins hatten ebenfalls ganz eigene Zyklen, die in diesem Fall 100% nachfragegetrieben sein müssen, da das "theoretische Angebot" ("Circulating Supply") entweder immer gleich blieb oder sich um immer die gleiche Menge erhöhte. Meine Hypothese in Bezug auf Bitcoin ist daher: - Halving 2012: war sehr bedeutsam, weil die "Goldgrube" Mining mit einem Schlag (gerade für CPU/GPU-Miner) wesentlich weniger oder überhaupt nicht mehr profitabel wurde und daher erst überhaupt signifikanter Kaufdruck entstand. - Halving 2016: dürfte noch einen signifikanten Effekt gehabt haben, aber einen wesentlich kleineren als die Charts hergeben - Halving 2020+: nur noch Mini- bis gar keinen Effekt, nur langfristig ein minimal geringerer Verkaufsdruck (siehe gleich). Was natürlich wahr ist, ist das "0,2 % weniger Angebot"* nicht unbedingt "0,2 % höherer Preis" bedeutet und umgekehrt, trotz der Quantitätstheorie des Geldes. Es kann z.B. vorkommen, dass in einer bestimmten Marktsituation, insbesondere in Seitwärtsmärkten, in denen es eigentlich gar keine wirkliche Tendenz gibt, diese 0,2 % entscheidend sind, um zwischen "Bär oder Bulle" zu entscheiden, und die reale Angebots/Nachfragegleichung beeinflusst. *das wäre etwa die Differenz zwischen der heutigen Situation (ca. 0.4% des Angebots sind Miner) und der nach dem nächsten Halving (0.2%) |

|

|

|

|

482

|

Bitcoin / Development & Technical Discussion / Re: NFTs in the Bitcoin blockchain - Ordinal Theory

|

on: September 30, 2023, 08:27:34 PM

|

Has something happened these days that led to this drop in BRC-20 tx?

I've noticed that too, as I've also created a related query dashboard  Apart of the community "turmoil" mentioned by nutildah above, maybe the "Runes" proposal by Casey Rodarmor has to do something with that. See the proposal here. I've not looked really at it still, at a very first glance it looks like ... coloured coins with another name? On the other hand, Ordi token is doing relatively well, it has lost 85% of its value from ATH but has stabilized already some weeks ago and even had a bounce. AFAIK this is one of the most popular Ordinals/BRC-20 tokens. So I'm currently quite clueless, but your suspicion about most of the Ordinals activity being maintained by a few centralized actors (regardless of their intentions) could be true actually. |

|

|

|

|

483

|

Local / Trading und Spekulation / Re: Der Aktuelle Kursverlauf

|

on: September 30, 2023, 06:01:49 PM

|

Er erklärts in seinen Videos näher und bezieht sich hier auf den instabilen Gesamtmarkt rund um Inflation, Krieg(e) und Teuerung. Nuja, ich hätte so eine Prognose 2022 oder noch Anfang 2023 verstanden, aber inzwischen scheint sich eigentlich alles in Richtung einer neuen Niedriginflationsphase einzupendeln, was auch wieder bald in Richtung einer Niedrigzinspolitik deuten würde. China geht da ja schon mal mit großen Schritten voraus, Europa ist etwas hinterher aber schon bei ~4% (und einige europ. Länder schon bei unter 2%). Ein Dip deutlich unter 20000 (es sieht ja fast aus auf dem Bild als dass sogar die 15000 perforiert würden und es somit ein neues Low gäbe) wie in seinem Chart anklingt würde dagegen schon auf ein ziemlich fundamentales Problem hinweisen. Ich könnte mir da momentan höchstens vorstellen, dass im Ukrainekrieg bei einer drohenden russischen Niederlage noch einige Eskalationsschritte kommen (Atomwaffen schließe ich inzwischen aus, so blöd ist Putin auch nicht, aber z.B. der Abbruch aller Gaslieferungen nach Europa). Oder ein Black Swan, aber der kann ja immer auftreten. eher als Denkanstoß möglicher Szenarien - also eigentlich wozu eine TA meiner Meinung nach eingesetzt werden sollte.

Hier hingegen vollkommene Zustimmung  Zum Halving und dem "Preisdruck" wiederhole ich mich gerne noch mal  Wir haben heute laut CMC (an einem niedrigen Tag, Wochenende ...) ein BTC-Handelsvolumen von 5,7 Mrd. USD oder rund 212800 BTC. Meistens sind das eher 10 Mrd. USD. Die 900 BTC, die Miner täglich generieren, machen da nicht viel aus, weniger als 0,5%. Nachfrageschwankungen sind damit imo viel wichtiger als Halvings. |

|

|

|

|

484

|

Local / Deutsch (German) / Re: Bitcoin-Adoption EU (➔keine Krise): von Schwellenländern (➔Krise) lernen

|

on: September 29, 2023, 09:46:06 PM

|

Kurz zur Spezialistendiskussion: Ich denke, da gibt es je nach "Spezialistentum" Unterschiede. Zum Lokführer/Busfahrer (wird ja in Europa gebraucht z.Zt) kann man sich schnell in ab einem halben Jahr (siehe DB) umschulen lassen. Handwerker dauert zwar länger ist aber auch noch machbar, das mehrmals im Leben durchzuziehen, wenn man nicht unbedingt einen Meister anstrebt. Zum Chemiespezialisten mit Doktortitel und 30 Jahren Berufserfahrung natürlich nicht. Diese "Superspezialisten" sind zwar sehr gefragt, aber wirklich benötigt werden nur wenige, aber da es eben auch wenige gibt ist der Nachfrageüberschuss hoch und sie können sich ihre Jobs wahrscheinlich auch in einer Krise weiterhin aussuchen. Mich würde es aber wundern wenn das mehr als 2-3% der Bevölkerung beträfe. Handwerker und Landwirte für einen lokalen Kleinbetrieb sowie Pflegeassistenten u.ä. dagegen wären Berufe, die dann für die Masse in Frage kämen, und bei denen es auch eine hohe Fluktuation von Neulingen geben könnte, falls andere Branchen (wie die angesprochene Werbung) einbrechen. Da wäre ich dann eher bei @Etranger, das sowas sowohl in einer chronischen als auch in einer akuten Krise (Krieg o.ä.) passieren könnte und sich hier Flexibilität auszahlt. Zum Thema persönliche Resourcenallokation: Ich denke generell würde ich allen deinen Beispielen zustimmen, aber das so systematisch zu sehen, sieht schon etwas cringe aus  Aber das ist ja das, was generell oft als "Vitamin B" bezeichnet wird. |

|

|

|

|

485

|

Alternate cryptocurrencies / Speculation (Altcoins) / Re: The Big Decentralized Alts (DOGE, LTC and XMR) - Speculation

|

on: September 29, 2023, 09:14:24 PM

|

How is the endless block rewards of 10,000 doge every minute a good thing? It's literally one of the pillars of crypto and why this experiment was created to combat endless "printing" demand will forever have to increase otherwise your buying power will always decrease. Why would ypu hold doge long term?

In addition to what I wrote in the post before, I invite you to read about the theories and arguments about a "tail supply" (and why for example XMR has adopted such a scheme). Even if there is "endless" "printing" of 10.000 DOGE per block, this means that, in comparison to the supply, the inflation (i.e. the equation "newly printed coins" / "available coin supply") is lower in each block*, even if there is no halving. This is because the newly printed amount is constant, while the supply increases, so the equation result in a lower value for each block. "Demand will forever have to increase" would only be true if there were no lost coins at all. Lost coins however are happening constantly. And even if there were no lost coins, as I wrote the demand surplus needed would decrease with each block. Doge inflation is currently 3.727% per year, next year it will be 3.59%, and so reducing over time (in comparison, BTC has 1,5 and decreasing currently, but will sharply reduce to 0,7 next year; that looks better for hodlers of course, but also is a bit an obstacle for "as a currency" adoption). Doge's tail supply also ensures its long-term security as there's always a reward for miners, and it may even have positive benefits for LTC's security (and thus its price evolution), because LTC's reward lowers like Bitcoin's, but as both coins are merged mined, a LTC miner will always be able to receive DOGE, and vice versa, so it's rational always for miners to mine both.

That's actually what the famous "Stock to flow" theory is all about, and it's the part I agree with - but they build a complete price theory around that concept with a predicted price evolution without taking into account demand, which I think is pseudocientific (in short: because scarcity != supply, scarcity == supply / demand). |

|

|

|

|

486

|

Alternate cryptocurrencies / Speculation (Altcoins) / Re: The Big Decentralized Alts (DOGE, LTC and XMR) - Speculation

|

on: September 29, 2023, 08:09:14 PM

|

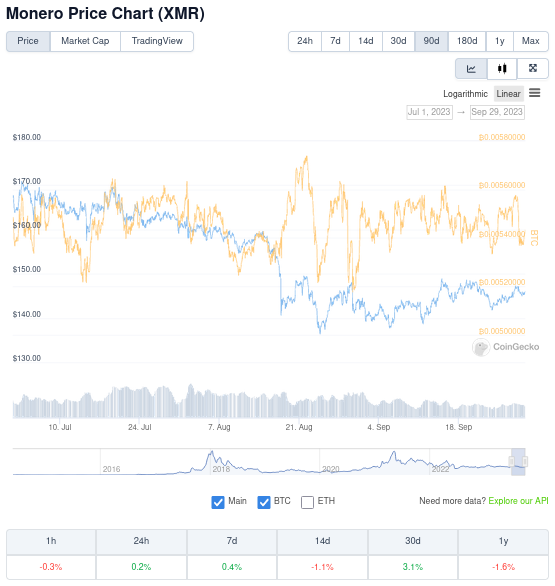

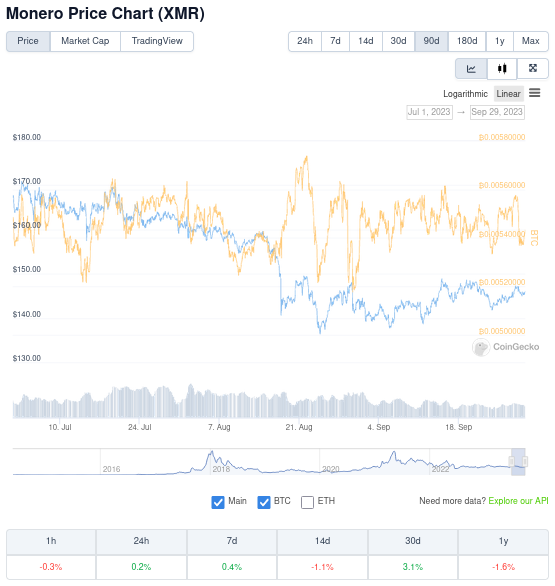

I think it's time for a little update on the state of things regarding the three major decentralized altcoins. First, let's talk about Monero (XMR). Coingecko shows us an interesting pattern: it was, in the last 90 days, almost 100% pegged to Bitcoin, following all of BTC's ups and (mostly) downs. There are only short term significative variations: so when bitcoin dipped from the 29k to the 26k level, Monero went up for some days, but then returning to the mean fastly, which is between 0.0054 and 0.0056 BTC. Monero was in the past indeed one of the most stable altcoins, but this level of "peg" is surprising. I think there are good reasons to think this could be continue. However, that could change if Bitcoin turns bullish again. I would expect a price increase with respect to BTC in this case.  SourceLitecoin (LTC) SourceLitecoin (LTC) instead suffered a major crash around and after its block reward halving date in August. In late August, after a bearish "glide", a single selloff event crashed it down into the 60-70$ area, or 0.0024-0.0025 in BTC. Since then however, it hovers around these values in a quite stable manner, and there were no major variations neither compared to the USD nor to BTC. My guess for the following months is here that the further price development could be very dependant on the general market sentiment. If the market turns bullish, I guess LTC could recover even more than BTC. In the case of a continuation of the sideways market however it's not unlikely that we see another dip even compared to BTC. Anyway, I think surpassing the 0.0025 mark would imo trigger probably an uptrend, and the 0.00238 low should be held to prevent another dip. In general terms I continue to think that LTC is long term undervalued, as it's a currency with a significant regular usage.  SourceDogecoin (DOGE) SourceDogecoin (DOGE) had a similar selloff as LTC in late August, however it "only" crashed until the mid-year levels after a short uptrend in late July and early August. It then stabilized, but still is in a very slight bearish trend. I think DOGE is the most speculative of all three decentralized alts. I have several times thought its time as a memecoin was over, but it surprised me a lot of times with new heights, in particular in the era when everybody and their grandpa traded Elon Musk's tweets. So while in my opinion it's maybe the coin with the least positive long term outlook (as it's used a lot less for transactions than LTC, for example, despite its reputation as a "tipping" cryptocurrency) I don't rule out that it can surprise me again and, for example, passes the 10 cent mark again eventually. For example, there's a real possibility for it to form a double bottom pattern. It continues to be a coin for gamblers   Source Source |

|

|

|

|

487

|

Local / Trading und Spekulation / Re: Der Aktuelle Kursverlauf

|

on: September 29, 2023, 05:31:01 PM

|

Habe dbgzl. vor kurzem die Prognose von BrianBeamish (@therationalinvestor) gelesen, der sieht das so:

Hm, also dass er ausgerechnet das Corona-Jahr 2020 und den dazugehörigen Dip da reinprojiziert ... ein Schelm wer da Böses bei denkt.  Eher würde ich da die Kurve von 2016 oder 2012 nehmen. Es sei denn natürlich man geht von weiteren Katastrophen aus. 50k bis Ende Jahr tönt für mich aktuell sehr optimistisch, wobei ich deutlich sagen muss, das ist reines Bauchgefühl.

Für mich hängt es wie mehrmals gesagt davon ab, ob sich ein bullisches Momentum bildet, das wieder neue Kaufaktivität auslöst. Also Aufmerksamkeit wie damals bei 20k, dass man ja wieder vielleicht etwas Geld machen könnte, wenn man die "Welle reitet". Das wäre meiner Meinung nach wahrscheinlich der Fall, wenn der 32-33K-Bereich überschritten würde. Die Geschichte hat gezeigt, dass sich in solchen Situationen sehr große und schnelle FOMO-Sprünge ergeben könnten. Also, falls du wieder eine Analyse von mir speichern willst:  - Schafft BTC es noch im Oktober die 32k zu überschreiten, halte ich 50k bis Jahresende für möglich. (Nicht für zwingend, aber ein Jahreshoch unter 40k würde mich dann eher enttäuschen.) - Braucht es hingegen länger bzw. der Widerstand wird nicht überschritten, kann ich mir sogar noch mal einen tieferen Dip vorstellen, jedenfalls im allerbesten Fall 40-42k als Jahreshoch. Denn das Jahresende die Monate Oktober/November sind bei Bitcoin in Bullruns oft mit einer Preissteigerung assoziiert, wenn diese ausbleibt, verkaufen einige (besonders die, die schon Gewinn gemacht haben, weil sie um oder unter 20k eingestiegen sind) ihre Coins vielleicht lieber für die Weihnachtsgeschenke usw. Wobei unter 20k schon wieder eine Übertreibung wären. |

|

|

|

|

488

|

Local / Español (Spanish) / Re: Red de Bitcoin, utilizada para almacenar NFTs ...

|

on: September 28, 2023, 03:09:50 PM

|

Casey Rodarmor (quien ahora parece que se ha pasado al bando de los críticos de BRC-20) ahora inventó un nuevo protocolo para tokens en la cadena Bitcoin llamado Runes. A simple vista no logro entender cual es la ventaja con respecto a los "coloured coins" tradicionales (sí entiendo las ventajas que enumera comparado con RGB, Taproot Assets, Counterparty y Omni). Es interesante que en los últimos días las fees bajaron de manera abrupta. Quizá tenga que ver con que se reanudó el mercado bajista en los tokens BRC-20 como ORDI, aunque todavía no se ve el colapso total que uno podría esperar. En mi cuadro de mandos de Dune también se ve una baja muy pronunciada de transacciones basadas en Ordinals en los últimos días. He estado buscando información al respecto que sea concisa del rol de bitcoin en toda la plataforma, pero no he logrado ver nada conciso todavía.

He notado lo mismo y tampoco pude encontrar información técnica precisa. Huele bastante mal, aunque voy a seguir investigando. El tema es que hasta hace poco pensé que los "rollups" en Bitcoin eran todavía imposibles (al menos sin elementos centralizados) debido a que faltaría un comando (opcode) en el lenguaje Bitcoin Script. |

|

|

|

|

489

|

Economy / Exchanges / Re: [List] Atomic swap tools and exchanges for Bitcoin (work-in-progress)

|

on: September 28, 2023, 07:01:09 AM

|

Thorchain is non-custodial and without kyc.

Thank you. I think it qualifies, and according to descriptions like this one it works a bit similar to Blocknet, with a cross-chain swap on a dedicated blockchain which uses the Cosmos/Tendermint PoS consensus. I've linked your short guide, but what I don't like that much is that you connect to centralized services like Shapeshift and Metamask. If you know a guide where it's explained how to use it without these platforms, it's welcome here  Technically, I am not sure why atomic swap tools vs atomic swap dex. The dex is tool already.

I'm not sure if I understand right but I think you mean there should be no difference in the OP between "DEXes" and "tools"? In this case I disagree. For me, an atomic swap "tool" can be simply a software where you can create the HTLCs necessary for an atomic exchange, and maybe you can exchange the data with your trade partner on another platform (Bitcointalk or another forum, IRC, XMPP, Nostr, etc.). A "DEX" in general also cares about the communication part and typically has more functionality like order matching for which a separate P2P network may be necessary (or it's done on a centralized web server). It's thus a more complete tool. I think it makes sense to categorize them in different groups, but anyway my list has no strict categorization. I've however added Blocknet to the main list, I think there's nothing really against it, even if I'm not 100% convinced of the "special blockchain" model. (Edit: Ah, I think I know what you mean - my remark in the original OP that Blocknet isn't really a "Bitcoin tool". I think when I started the thread in 2019 I was a bit reacious first to add "specialized blockchains" due to this thread focusing on Bitcoin, and the danger that it could be moved into the altcoin forum where it would be much less visible. As I have now a good number of native Bitcoin tools listed I think this danger isn't present anymore.) |

|

|

|

|

490

|

Bitcoin / Development & Technical Discussion / Re: [Discussion] Spiderchains

|

on: September 27, 2023, 05:50:20 PM

|

I don't like the idea of having a peg, because that tends to imply "here are two different coins you can trade separately" which is usually the case for other pegs.[...]The supply of LNBTC eventually goes back into the BTC mainnet.

I don't see that much of a conceptual difference between a 2-way pegged spiderchain token (can be applied to all similar sidechain designs) and LNBTC. In both cases, you have contracts on the mainchain which ensure that the supply is always 1 peggedBTC = 1BTC, and you can describe them as methods to bundle BTC transactions. On a sidechain/spiderchain, when the "Orchestrators" try to steal coins, this is very similar to a LN member trying to close a channel in an old state. Nothing is changed regarding the token supply, but there is an unintended ownership change which would not be possible only using on-chain methods. The only difference I see is that a sidechain in theory could be buggy in the sense that some unintended function leads to a supply inflation of the pegged token (let's say something like the Bitcoin overflow bug in 2010). From my limited understanding that would not be possible in LN, not even taking into account milisats, but all sidechains have this theoretical problem. As long as they work as expected though that's not a problem. Where a difference could be possible is if the sidechain stakers cooperate to create such a bug intentionally. This would however damage all Orchestrators, because they couldn't exit 1:1 anymore. So the attacking subset would have to profit purely by operations on the sidechain (e.g. fast sells of the sidechain tokens on exchanges, or buying goods/services) and I cannot imagine that kind of attack to be easy to be profitable as long as the sidechain isn't extremely popular (and of course, it would be detected in one block as a maximum). This little drawback however is compensated by the big advantage that you can "onboard" people completely independently of mainchain transactions. |

|

|

|

|

491

|

Bitcoin / Development & Technical Discussion / Re: [Discussion] Spiderchains

|

on: September 26, 2023, 08:27:42 PM

|

[PoS] require Spiderchain to be popular in first place.

I think security is really a challenge in this sidechain model. The native token of the sidechain has to be quite valuable if they want to ensure the incentive mechanism prevents them to steal money via fake peg-ins/peg-outs. There could even be a formula for that: the slashing penalty for the qualified majority of the selected subset of stakers which manages the peg in a block has to be higher than the maximum expected total Bitcoin peg-in/peg-out transfer. If this wasn't the case, a big whale could simply buy a lot of staking nodes and then wait for his nodes being selected as the majority of the staking nodes, then stealing all the Bitcoins or alternatively stalling the process and short the sidechain token. Both attacks would be catastrophic for the Spiderchain probably. So the value the sidechain is able to manage safely depends directly on the market cap of the native Spiderchain token, and of the slashing value. Of course, for PoW sidechains a similar rule applies, but Drivechains seem to be a bit more secure as they require cooperation from mainchain miners. Perhaps with this in mind, it would be recommendable to start not pegging a token to Bitcoin but to some altcoin instead, so the spiderchain can demostrate it works with low peg-in/peg-out volumes, and then slowly increase its value and then finally offer a Bitcoin peg once a certain level has been reached. |

|

|

|

|

492

|

Bitcoin / Development & Technical Discussion / Re: [Discussion] Spiderchains

|

on: September 24, 2023, 11:56:00 PM

|

Interesting. It seems that this year really something is moving when talking about sidechains. These spiderchains at the very first glance (have to investigate more) look a bit similar to a model @vjudeu proposed a couple of months ago in the Drivechain thread (from this post on, it's detailed later). There is also Nomic, which looks a bit similar too and seems to be already working, and Stacks (sBTC), which is in alpha state (I erroneously thought it was already working, but no). And Trustless Computer (which comes out of the ... Ordinals community  ) could also be mentioned, although I'm quite sceptical in this case, it seems difficult to find information how it really works (in theory it's an Optimistic Rollup). Perhaps it's ... not really a solution (to not write the S-word). PS: The Bitcoin Magazine article explains a bit more about the technical side. It looks like there are some similarities to the Stacks/Nomic system of "dynamic federations": The spiderchain (PoS) stakers select randomly a subset of their addresses as a multisig federation on the Bitcoin main chain, which is renewed each block (so we have 1 Bitcoin tx per sidechain per block, if I understand correctly). These multisig federations decide, by majority, about peg-ins and peg-outs, and if some of the stakers misbehave they're slashed at the spiderchain. I've not completely understood why there is a "third" layer mentioned (mainchain -> spiderchain -> sidechain) but maybe the "third layer" isn't really a layer but only the "Bitcoin-pegged token" which lives at the spiderchain. |

|

|

|

|

493

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin miners energy usage has exceeded 50%, where is Elon?

|

on: September 24, 2023, 05:25:42 PM

|

But that would be inefficient. Why re-buy the "wasted Bitcoins"? Why not merely use the fiat to directly buy the car instead of using your Bitcoin, then replacing the Bitcoin? That's why it doesn't make sense that users do "Fiat -> Bitcoin -> Purchase" unless you absolutely have no choice but to use Bitcoin, or if you truly earned the Bitcoin you spend, like Laszlo.

Of course the ideal situation is when you also earn Bitcoins, e.g. if your salary is partly paid in BTC, and/or if you are a service provider accepting BTC. Then the "Bitcoin circulation" aspect would come naturally: You could spend a part of the Bitcoins in things like a Tesla car, and you'll get them back (albeit getting back what you paid for a car it may be quite slow, but Tesla cars aren't directed at the lower middle class). I'm aware that this isn't the norm today. Another case: Particularly in market situations when you have already made some profit with your BTC, it makes sense to spend part of them if you can satisfy a necessity, like a car. I think particularly producers of high-priced goods like cars can direct their efforts to that public: early adopters or those who are "in" at least since the bottom of the last bear market. You'll not always have (in addition to the BTC) the fiat to spend it on such a good, and in this case it may make sense to simply spend the BTC, and if you like to buy back some BTC, then you can do it. I don't think "changing between payment methods" is that much of a hassle. People do it all the time, transferring between different bank accounts, using ATMs, etc, so re-buying BTC if you have a good exchange partner isn't much of a problem. And again: if you're a Bitcoin bull, strengthening the currency ecosystem is adding value to BTC, so why not simply do it? You can even get social prestige (e.g. posting your Tesla you bought directly with BTC on Twitter, pardon X). And there is another aspect: Buying BTC has become increasily easier than selling them, due to AML/KYC regulations (proof of source for BTC you received, etc.). So if you have some BTC from old investments in ICOs or altcoin trading for example, which are difficult to track because the exchanges where you traded don't exist anymore, then a purchase of a good may be a good way to spend them. That may be not the case with cars as car sales are regulated in many countries, but with other goods it isn't a bad idea. The re-bought BTC instead can be tracked well and it will be much easier to provide a proof of source for them. |

|

|

|

|

494

|

Local / Español (Spanish) / Re: Red de Bitcoin, utilizada para almacenar NFTs ...

|

on: September 23, 2023, 05:45:43 PM

|

Aparentemente esta red social no está relacionada con Ordinals. Si entiendo bien usa un "rollup optimista" llamado Trustless Computer. Los rollups son un tipo de cadena lateral (es decir, una blockchain en la que se puede transmitir un token pegado o "anclado" al BTC con un mecanismo de "convertibilidad"), en la cual se graban datos clave en la blockchain principal, pero con un impacto mucho menor que las transacciones tradicionales. Esto les permite, en el caso de un conflicto, tener todos los datos disponibles para resolverlo usando la blockchain de BTC. También mencionan que usan la cadena de Polygon para almacenar datos. Con esto quizá se refieren a los NFT que ofrece la plataforma, y en este caso no veo ningún problema ya que se trata de una altcoin bastante pequeña que seguramente tendrá algo de espacio disponible en su cadena. Es interesante porque es la primera vez que veo un rollup (no se si hay un término en castellano) basado en la blockchain de Bitcoin. La tecnología es usada principalmente en Ethereum y parece que se ha popularizado bastante porque permite usar más eficientemente el espacio de la cadena. Quizá me pondré a investigar como funciona su mecanismo de "convertibilidad" para pegar el valor de su token de BTC con el BTC "real". |

|

|

|

|

495

|

Local / Español (Spanish) / Re: Red de Bitcoin, utilizada para almacenar NFTs ...

|

on: September 23, 2023, 05:03:34 PM

|

El mío está refrescado algo más reciente que el tuyo, pero contrastando los valores de los últimos días completos que tienen en tu Cuadro de Mandos (Chart 1), me salen los mismos valores de TotalSize para los días 1, 2, y 3 de Septiembre 2023 (contrastando con la tabla "Weight of Ordinals per day (blocksize)% Block with ordinals per day" del mío). Creo que estamos en la misma onda numérica. Tenés razón, actualicé las consultas de mi cuadro de mandos y la diferencia se debe solamente a los datos de las últimas dos semanas que no estaban todavía en mi dashboard. De esta manera se confirma que hay un pequeño resurgimiento de BRC-20 y de los Ordinals, probablemente relacionado al "respiro" del precio de algunos tokens como ORDI que mencioné en el otro post. Contando con un montón de créditos en Dune que se me vencen mañana me permití de actualizar el cuadro tuyo también  |

|

|

|

|

496

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin miners energy usage has exceeded 50%, where is Elon?

|

on: September 23, 2023, 04:54:32 PM

|

I'd liked the article linked in the OP to be referenced with more data. However it mentions Daniel Batten, who conducted the Beest study from February which comes to similar conclusions (52%, considering renewable + nuclear) and is not based on Bitcoin Mining Council data but simply enriches the CCAF study with some independent research. Generally however I don't think there's much to doubt about the general order of magnitude of the numbers. In the worst case we'd be talking about a few percentage points, but the 37% CCAF reported is very likely outdated. Why would any HODLer waste their Bitcoin on a car that would merely start to depreciate in value right after it goes out of the factory?

HODLers can instantly re-buy the "wasted" Bitcoins. Or maybe they want to take some profits with less KYC hassle involved. They can re-buy partially then. In any case, they're strengthening Bitcoin's "use as a currency" ecosystem and make Bitcoin's value proposition stronger, which could benefit them in the long term. Think about Laszlo in 2010. He "wasted" lots of BTC but strengthened the ecosystem, and I'm sure he got the 10.000 BTC back very fast (via mining, etc.). |

|

|

|

|

497

|

Local / Español (Spanish) / Re: Red de Bitcoin, utilizada para almacenar NFTs ...

|

on: September 23, 2023, 02:38:05 PM

|

Lo que observo es que hubo una tendencia a la baja, pero que esta se revirtió en agosto y hubo un pequeño "bounce". Esto también se refleja en el precio del token ORDI (uno de los más populares del "estándar" BRC-20). Este viene de un precio de $20 por token, cayó a $3, y ahora volvió a subir un poco.  He actualizado mi cuadro de mandos en Dune. Curiosamente, considerando el tamaño total que ocupan todos los ordinals, la tendencia a la baja continúa, aunque muy, muy lentamente, lo cual se contradice un poco con el cuadro de DdmrDdmr (esto es el primer gráfico, el segundo muestra la cantidad absoluta de Inscriptions, categorizados por su tamaño). (ver abajo, datos estaban desactualizados) Se ve también que las inscripciones grandes ya casi no existen, aparentemente es casi todo BRC-20, o podrían ser también transferencias de NFTs. Lo que aparentemente ya casi es irrelevante es la creación de nuevas colecciones de NFTs de más de 1 kB.  Habrá que ver si después del servicio de nombres/dominios y los "Audionals" inventarán algún otro "estándar" para mantenerse a flote. Es bastante llamativo que los sitios de BRC-20 no ofrezcan gráficos de la evolución de precios a mediano/largo plazo. Sabrán por qué.  PD: Ah, algo que me olvidé de mencionar en este hilo: a largo plazo, si lo que Gregory Maxwell escribió en este post es verdad, los Ordinals en algún momento desaparecerán de la cadena.  Aparentemente se están investigando maneras de almacenar la cadena sin tener que almacenar las transacciones "en bruto" completamente, sino utilizando técnicas ZKP (pruebas de conocimiento cero). No se refiere al "pruning" que ya conocemos, sino a métodos nuevos que permiten reconstruir todas las transacciones, pero se podrían ignorar datos arbitrarios "no financieros". Esto quiere decir que a largo plazo solamente un grupo selecto de "nodos archivo" almacenarán todos los datos, y probablemente cobrarán una comisión para accederlos por los riesgos legales. Abrí un hilo en el subforo de desarrollo hace unas semanas al respecto. Y vi unos trabajos de investigación que se acercan ya bastante, que permiten comprimir la cadena a una fracción de su tamaño, almacenando solo los datos que son realmente necesarios para verificar transacciones (pero aún sin ZKP). |

|

|

|

|

498

|

Alternate cryptocurrencies / Speculation (Altcoins) / Re: Litecoin's comeback

|

on: September 23, 2023, 03:31:04 AM

|

By "mainstream popularity", I mean LTC becoming a big hit worldwide. Sort of like it's the case with Bitcoin and Ethereum these days. I'm surprised that hasn't been the case with LTC, especially when it has a deflationary modellike Bitcoin. If worthless "meme" coins like Dogecoin and Shiba Inu got the attention of the masses, why can't Litecoin do the same? I think there is currently a big gap between Bitcoin & Ethereum and "the whole rest of altcoins" (maybe BNB, XRP and maybe Toncoin and of course stablecoins have a special position still, due to their "enterprise" character and their link to popular services). But I see LTC firmly in the second tier, together with the toothless "Ethereum killers" and of course Monero. Doge still profits from its association with Elon Musk but the market cap difference between Doge and LTC is already fading away. Doge is a coin I have sympathy for but I quite have a sensation that their heyday could be over, and then LTC as the more solid alterntive could again lead in the space of the "decentralized" coins. The halving didn't have any positive effect over the price. Which was totally expectable, because LTC never has reacted in any way to a halving (save some speculative action before the halving). I've already written about that in the thread. About longer-term effects, the halving could have a minimal effect on scarcity (i.e. the supply/demand equation), but LTC's outstanding supply is already quite small, a lot has been mined already, very similar to Bitcoin four years ago. The good thing about that is that massive miner dumps are becoming less likely. I would've hoped that AgoraDesk added LTC to its platform. Maybe it will happen someday?  That would of course be really cool. I don't know if this ever has been proposed to them. They're closer to the Monero community though, so I don't know how realistic it is. I've asked in the Litecointalk forum if anybody knows about the state of LitecoinLocal.net. A mod from the forum answered but they didn't even know about its existence. The interesting thing is that even if the site looks completely dead with its outdated offers, there seems to be some money in their hot wallets still (~40 LTC). Not much but maybe they're still operating. |

|

|

|

|

499

|

Local / Trading und Spekulation / Re: Der Aktuelle Kursverlauf

|

on: September 23, 2023, 12:00:48 AM

|

Nichts von seinen Voraussagen ist wirklich eingetreten (außer in Russland & Big Brother?) - aber genau das spricht für seine Einzigartigkeit. Meines Wissens hat Orwell damals existierende Tendenzen in der Politik und Gesellschaft mit seiner Literatur kritisiert. "1984" erschien ja 1948, kurz nach bzw. noch während der bisher wohl schlimmsten Auswüchse autokratischen, gewalttätigen Herrschens. Also er hat nicht wirklich was "prognostiziert", sondern vor bestimmten Tendenzen sowohl im Faschismus als auch im Realsozialismus/Stalinismus gewarnt (die DDR ging ja ab den 1970ern durchaus verstärkt in die Richtung, und 1984 erging es ja denen, die von der Stasi überwacht wurden, vielleicht gar nicht so unähnlich wie dem Herrn Smith in seinem Roman). Ich denke sein Ziel bzw. seine Aufforderung war es, dass sie sich die Menschen seinen eigenartigen Prognosen widersetzen.

So etwa, nur dass ich nicht glaube, dass es wirklich "Prognosen" waren, sondern wie gesagt sich auf die damalige Gegenwart bezog. Eher eine Prognose waren Romane wie "Wir" von Jewgeni Samjatin (in den 1920ern geschrieben, also noch vor der Hochzeit des Faschismus). Um aber mal kurz auf die geplante EU-Verordnung zurückzukommen: Meines Wissens geht es da darum, dass Kryptodienstleister Steuerbehörden über die Transaktionen von Kunden informieren müssen und diese Informationen EU-weit ausgetauscht werden. Ich finde das nicht sonderlich gut, weil wieder mal ein Datenwulst entsteht, aber es ist in anderen Ländern längst Realität, und bei anderen Kapitalanlagen ist es sowieso schon der Fall. |

|

|

|

|

500

|

Economy / Speculation / Re: A Simple Reason Why Bitcoin and Crypto Prices Must Fall to Zero

|

on: September 22, 2023, 11:28:53 PM

|

I'm having a deja vu: someone some months ago started a thread with very similar arguments, and he also shared a treat with JamesNZ: he got angry and was insulting people INSTANTLY. And of course, always talking about "reality" vs "crypto propaganda" etc. I've even discussed with that person, so Mr. "James" maybe you remind me  No, I'll not waste time searching that thread. However, an answer to LoyceV: Here's a thought: you opened an account on Bitcointalk because you saw value in doing so.

Maybe he's shorting BTC and the price isn't moving into the direction he wanted? This may also explain his anger  "James", so if you really are interested in a discussion about the topic of Bitcoin's value proposition and/or unique characteristics which give it value, (until now, it looks not, due to your aggressive behaviour) please use the forum's search function or Google about Bitcoin's "value proposition" or "USP". I'm ready to discuss that but will wait until you show some sign of goodwill. Other than that, I'll consider you a (possibly paid) troll. @Don Pedro Dinero: Haha, hilarious post you linked to! Made my day! |

|

|

|

|

Eher würde ich da die Kurve von 2016 oder 2012 nehmen. Es sei denn natürlich man geht von weiteren Katastrophen aus.

Eher würde ich da die Kurve von 2016 oder 2012 nehmen. Es sei denn natürlich man geht von weiteren Katastrophen aus.

) could also be mentioned, although I'm quite sceptical in this case, it seems difficult to find information how it really works (in theory it's an Optimistic Rollup). Perhaps it's ... not really a solution (to not write the S-word).

) could also be mentioned, although I'm quite sceptical in this case, it seems difficult to find information how it really works (in theory it's an Optimistic Rollup). Perhaps it's ... not really a solution (to not write the S-word).