Toxic2040

Legendary

Offline Offline

Activity: 1792

Merit: 4141

|

|

August 31, 2020, 07:19:28 PM |

|

Just because we are talking about walls and BTC price movement in the short term, does not really mean that we give too many shits about short term BTC price movements - or that we are not keeping long term likely UPpity in mind.

There is no need to get all UPpity JuanSnowGee. The UPpity will come at its proper time and place. You are participating in those same conversations and talking about what you believe about UP or DOWN in the short term, so shouldn't we lump you in the same category regarding what your concerns are because you are regularly posting about such?

No. There should be no lumping what so ever...especially if I am the lumpee. I will however concede that I much prefer to be the lumper rather than the lumpee if we are going to have lumpage of the unwashed masses. Of course, similar with traders, there are going to be all kinds of variation within any identified group, so yeah you are entitled to having your doom and gloom theory about miners potentially being over extended, even though I do not really buy that theory, personally.

I am unsure if my statements...or theory as would have you, qualifies as something that falls into a doom and gloom scenario. I believe that miners have overall been profitable, and sure they can hold back some coins in order to speculate on the BTC price going up, and likely they have always engaged in some conduct, but the longer and longer that bitcoin is in business the more and more the dumber miners have been getting screened out, and the more and more that miners have figured out ways to meaningfully balance their approach to cash out from time to time and also to hold back enough coins to speculate.

I believe this as well. If said miners tend to follow sound business practices and withhodl 3 to 6 months of operating capital for just in case, such capitulation theories become moot. I doubt that the bitcoin space is getting less and less stable with the passage of time, even though BIGGER and BIGGER players continue to come into the space and attempt to throw larger and larger capital at the situation to attempt to get their way, but in the end, we are seeing longer term (you like long term, right? chart patterns that are seeming to show 4 year fractal and even the stock to flow model to be almost too eerily close to being 100% spot on...

Yes. Yeah, I am not going to proclaim that the BTC price is guaranteed to continue to follow those 4-year fractal and stock to flow model patterns, but they continue to serve as some of the best predictors in spite a lot of the maneuvering and dickering around that either BIG money does or even crazy ass shit in the macro financial space.

This seems wise and I reluctantly agree. So for example, let's say we get a hundred thousand BTC dumped over a variety of exchanges and BTC prices drop down to $6,500 again, how long is that drop going to last? I will believe it when I see it. I am not suggesting that it is NOT impossible, but largely we are seeming way more inclined for UPpity than DOWNity, currently, even if we experience a few more dumpenings of coins to attempt to shake out some more weak hands, but if even the weakhands are not being shook, then I suppose that they are NOT fitting in the definition of weak hands.

Personally, I would not mind witnessing of shaking some of the ethereum and some of that defi bullshit smoke and mirror froth.. those areas seem way more vulnerable than speculative seemingly lame-ass theories of purported BTC miner capitulation. Roll Eyes Roll Eyes Roll Eyes

Stronghands are not shook...ever. I thought you knew this JuanSnowGee. ---- TypeError: must be toxic2040, not wordybot Please stand by as we run heuristics and reboot toxic2040.exe That is all. |

|

|

|

|

|

|

|

|

|

Remember that Bitcoin is still beta software. Don't put all of your money into BTC!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10161

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 31, 2020, 07:20:30 PM

Last edit: August 31, 2020, 07:42:48 PM by JayJuanGee |

|

Regarding creating wealth, patience, financial independence, compound interest, leverage, etc etc. If you have 3.5 hours to spare (which I have because painting the house) would definitely recommend listing to the podcast by @Naval: https://youtube.com/watch?v=1-TZqOsVCNM(quite sure this is something you enjoy listening to JJG)Thanks bitebits ... and of course, i am not the only one who posts on the financial management strategies topic.  Personally, I was not familiar with that particular guy or his podcast, and it seems as if currently, I have a bit of a podcast overload in my own life... there are more and more good podcasts, related to bitcoin.. and sure other topics, too.... Since I was able to find that same Naval podcast (and of course that particular episode) on Overcast, then I will be able to more easily add it to my cue and listen to it today or soon. tm.. I will report back to you (on the thread) what I think of the episode and gosh/shit I will report whether I am intending to add that podcast to my list of regular listens (like I mentioned, I am starting to tentatively speculate that I may have too many podcasts on my cue.. but sure, i will try to keep listening and prioritizing.. to the extent feasible). On average, I also tend to listen to podcasts at 1.75x (which also can be done on Youtube, but I still prefer overcast, for some reason), and sometimes I can speed some of the episodes up even more than 1.75x, but if they are dense with information, or I am feeling that I am having troubles following or comprehending some of the contents, then sometimes I have to even slow down the speed to a mere 1x.. or slightly above 1x -- like 1.25x or something like that. ...

If you have 3.5 hours to spare (which I have because painting the house) ...

Do you have 3.5 hours to spare becaise you are putting off painting the house, or because you are waiting for a coat of paint to dry? I speculate that bitebits is technically watching such paint dry rather than mere waiting for it to dry.      Go figure what wall observers will do to show their dedication to the cause.  |

|

|

|

|

fillippone

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

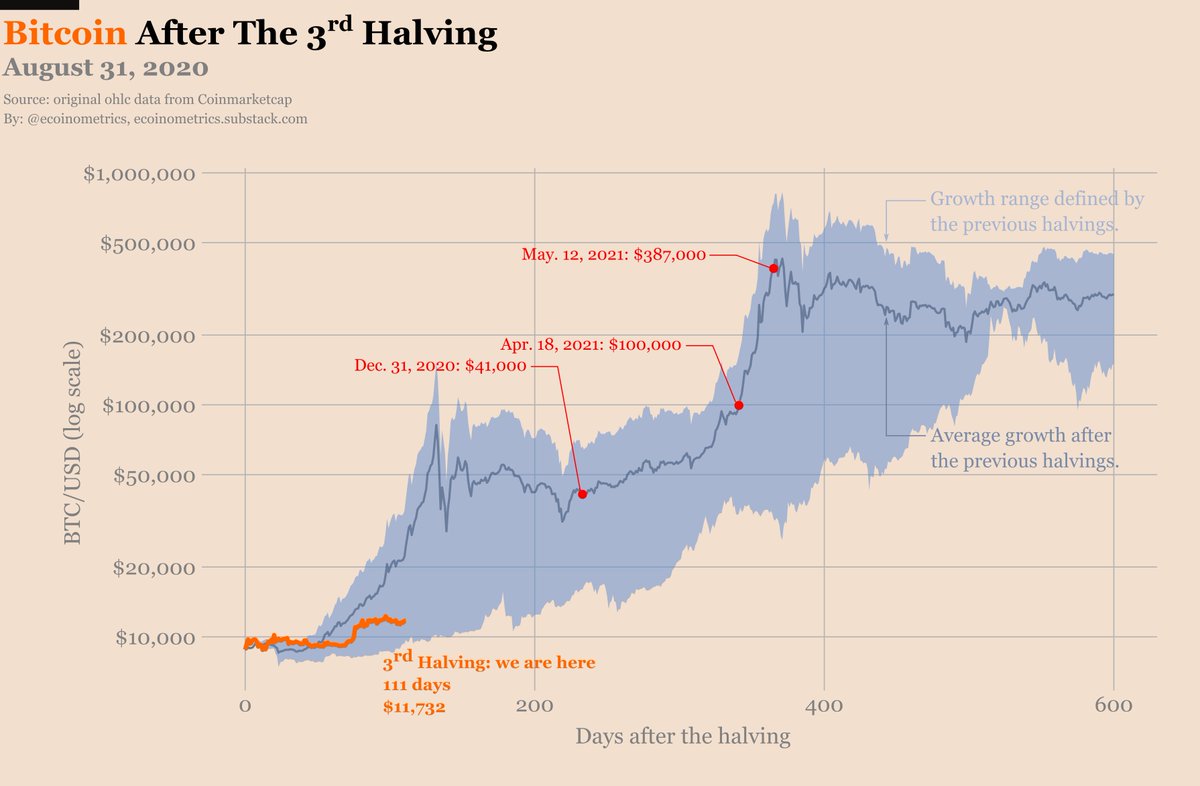

Hopium. My body is ready: #Bitcoin after the Halving Aug. 31, 2020 111 days after the 3rd halving. #BTC at $11,732. Looking solid 👇  Confidence bands based on past halvings. I am happy with this slight underperformance, diminishing returns, I am ok with that. |

|

|

|

|

Toxic2040

Legendary

Offline Offline

Activity: 1792

Merit: 4141

|

|

August 31, 2020, 07:28:51 PM |

|

a now late wall report..minus the report Just some charting against a backdrop that essentially looks fine imo. Not sure what is causing folks to feel bearish other than perhaps wanting cheap coins. Bitcoin is trading over $11.7k..this seems fine. #dyor 1h  4h  #stronghands |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10161

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 31, 2020, 07:34:32 PM |

|

There has been systematic fucking around with regular people (who have turned into rioters) and even giving so many of the spoils to the rich, and lack of attention to the infrastructure of normies, so normies start to feel that they have nothing to lose - they turn into rioters.

normies are just like us

I don't care how frustrated they are, I have something they apparently lack... morality, ethics, compassion, and law-abiding. Seems like you are merely engaging in generalizations, to me. Individuals have all kinds of motivations, and lumping them all into some kind of amorphous group, as if they are the enemy, seems a bit lacking in understanding of what is actually going on... but hey, we are each entitled to our own opinions. Anarchistic rioters and looters are not "peaceful protesters with a cause", they are criminals. So stop justifying their actions.

Aren't you hootie and falootie knowing about all things, including what is permissible and legal.... a self-assigned protest expert... yeah right.   By the way, there is no such thing as antifa, too.. it is a made up acronym that tries to suggest that rioters are some kind of organized entity, when they are just a bunch of frustrated and unorganized normies.. who don't have property or seem to have opportunities

Ok whatever you say Jay...    My statements likely make more sense than your overgeneralizations, even though I will admit that I was merely responding to you and not really attempting to descriptively capture the whole space, as you seemed to have been attempting to do. |

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

August 31, 2020, 07:47:30 PM |

|

Voted $12.0k - $12.5k.

Quite some resistance to take out until even touching $12k, though.

|

|

|

|

|

|

TheJuice

|

|

August 31, 2020, 07:49:19 PM |

|

It's unlikely we will see growth the same as the past halvings. I think ~3-5x the prior ATH (so 60-100k) is a reasonable peak this time around. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10161

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 31, 2020, 08:04:07 PM |

|

Just because we are talking about walls and BTC price movement in the short term, does not really mean that we give too many shits about short term BTC price movements - or that we are not keeping long term likely UPpity in mind.

There is no need to get all UPpity JuanSnowGee. The UPpity will come at its proper time and place. Surely, I am not rushing it. I am willing to go with the flow. You are the one who seems to be anticipating possible calamaties based on various unknowns that you seem to want to assign unduly high (relatively speaking) levels of probabilities You are participating in those same conversations and talking about what you believe about UP or DOWN in the short term, so shouldn't we lump you in the same category regarding what your concerns are because you are regularly posting about such?

No. There should be no lumping what so ever...especially if I am the lumpee. Good job. One of the most potent techniques of effective argumentation is to deny first and ask questions later. I will however concede that I much prefer to be the lumper rather than the lumpee if we are going to have lumpage of the unwashed masses.

Well that's what you seemed to have been doing. You lumped everyone else, and proclaimed that you were not part of such group.    Another "great" technique.    Of course, similar with traders, there are going to be all kinds of variation within any identified group, so yeah you are entitled to having your doom and gloom theory about miners potentially being over extended, even though I do not really buy that theory, personally.

I am unsure if my statements...or theory as would have you, qualifies as something that falls into a doom and gloom scenario. O.k. we won't call it doom and gloom anymore, we will call it self-destructive urge. Is that better? I believe that miners have overall been profitable, and sure they can hold back some coins in order to speculate on the BTC price going up, and likely they have always engaged in some conduct, but the longer and longer that bitcoin is in business the more and more the dumber miners have been getting screened out, and the more and more that miners have figured out ways to meaningfully balance their approach to cash out from time to time and also to hold back enough coins to speculate.

I believe this as well. If said miners tend to follow sound business practices and withhodl 3 to 6 months of operating capital for just in case, such capitulation theories become moot. I am sure that there is variation, but the longer that we are in such business, the more likely that some of the BIGGER players are going to engage in more efficient practices in order to attempt to out compete the more reckless players, to the extent that they are able to profit from maximizing efficiencies through sounder business practices. I doubt that the bitcoin space is getting less and less stable with the passage of time, even though BIGGER and BIGGER players continue to come into the space and attempt to throw larger and larger capital at the situation to attempt to get their way, but in the end, we are seeing longer term (you like long term, right? chart patterns that are seeming to show 4 year fractal and even the stock to flow model to be almost too eerily close to being 100% spot on...

Yes. If you merely agree with me, then you are giving me nothing to argue with you about. Yeah, I am not going to proclaim that the BTC price is guaranteed to continue to follow those 4-year fractal and stock to flow model patterns, but they continue to serve as some of the best predictors in spite a lot of the maneuvering and dickering around that either BIG money does or even crazy ass shit in the macro financial space.

This seems wise and I reluctantly agree. ditto, my above response here. So for example, let's say we get a hundred thousand BTC dumped over a variety of exchanges and BTC prices drop down to $6,500 again, how long is that drop going to last? I will believe it when I see it. I am not suggesting that it is NOT impossible, but largely we are seeming way more inclined for UPpity than DOWNity, currently, even if we experience a few more dumpenings of coins to attempt to shake out some more weak hands, but if even the weakhands are not being shook, then I suppose that they are NOT fitting in the definition of weak hands.

Personally, I would not mind witnessing of shaking some of the ethereum and some of that defi bullshit smoke and mirror froth.. those areas seem way more vulnerable than speculative seemingly lame-ass theories of purported BTC miner capitulation. Roll Eyes Roll Eyes Roll Eyes

Stronghands are not shook...ever. I thought you knew this JuanSnowGee. I can see that you are getting angry toxicmoxic, and I am sorry about that.

----

TypeError: must be toxic2040, not wordybot

Please stand by as we run heuristics and reboot toxic2040.exe

That is all.

You better reboot and come back with some better proclamations.. .Maybe hook up with torque? He's been coming out with some doosey conspiracy wannabe theories, lately.    It's unlikely we will see growth the same as the past halvings. I think ~3-5x the prior ATH (so 60-100k) is a reasonable peak this time around. TheJuice = pessimist (aka party poop)   #thatisall |

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

August 31, 2020, 08:23:44 PM |

|

It's unlikely we will see growth the same as the past halvings. I think ~3-5x the prior ATH (so 60-100k) is a reasonable peak this time around. In terms of market cap, i'd disagree. And then there's that thing about scarcity. Acceptance is the key here. Derivatives might actually help, while slowing down market cap growth in the beginning. |

|

|

|

|

Toxic2040

Legendary

Offline Offline

Activity: 1792

Merit: 4141

|

|

August 31, 2020, 08:26:43 PM |

|

Voted $12.0k - $12.5k.

Quite some resistance to take out until even touching $12k, though.

|

|

|

|

|

fillippone

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

It's unlikely we will see growth the same as the past halvings. I think ~3-5x the prior ATH (so 60-100k) is a reasonable peak this time around. In terms of market cap, i'd disagree. And then there's that thing about scarcity. Acceptance is the key here. Derivatives might actually help, while slowing down market cap growth in the beginning. Two opposing forces: - Downward pressure: bigger market caps drags price action, as more money inflow is required to move the price

- Upward pressure: every day the S2F holds, it gets stronger and stronger, so future appreciation gets discounted into price, providing a lift to prices.

It’s a battle.

👇 👇 👇 someone send merits to this men. I am dry. |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9495

#1 VIP Crypto Casino

|

I think we’ll top out at around $150,000 in late 2021. It all depends on how much the money printing effects fiat currencies & how badly traditional assets depreciate due to covid over the next 18 months. If bitcoin is seen as some kind of safe haven & people flock to it then the top end of what fillippone posted could materialise.

I’m saying $150,000 top though (current estimate).

|

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

August 31, 2020, 08:44:00 PM

Last edit: August 31, 2020, 09:00:52 PM by OutOfMemory |

|

Two opposing forces: - Downward pressure: bigger market caps drags price action, as more money inflow is required to move the price

- Upward pressure: every day the S2F holds, it gets stronger and stronger, so future appreciation gets discounted into price, providing a lift to prices.

It’s a battle. I didn't look at this as simple as that, but you quite nailed it, imho. You can see the increasing linear spread of market cap and price figures, for example on coinmarketcap graphs. The more BTC get's recognized as what it is, the more inflow acceleration will occur as a logical result. But i'm uncertain how increasing inflation will influence the latter. In critical times, people tend to fall back to traditional solutions, namely gold. EDIT: @JJG: Don't call me bearish just because of that statement about gold  Bitcoin should take over, imo. Only a matter when people will grasp this. |

|

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

August 31, 2020, 08:45:44 PM

Last edit: August 31, 2020, 09:05:11 PM by jbreher |

|

By the way, I managed to withdraw everything from Bitmex before going through the latest KYC/AML doorway. Anybody still keeping funds with them must complete identification before they can trade, deposit or withdraw.

same story with Bitstamp some time ago (don't remember which year it was). Bitstamp switched to KYC/AML. Still looking for a DEX that allows trading pairs of BTC:USD, BCH:USD, and/or BSV:USD, and is actually... you know... decentralized. Suggestions? I think thats not possible, you need to use a stablecoin pair if you want to trade for fiat. Yes, it seems fundamentally an unsquarable circle. I keep lookin' tho. So, given stated constraints and preferences, how about a suggestion for a DEX for core:honest-stablecoin? Maybe for BTC:USDC? And actually... you know ... decentralized? |

|

|

|

|

jojo69

Legendary

Offline Offline

Activity: 3150

Merit: 4309

diamond-handed zealot

|

|

August 31, 2020, 09:10:10 PM |

|

|

|

|

|

|

sirazimuth

Legendary

Offline Offline

Activity: 3346

Merit: 3484

born once atheist

|

|

August 31, 2020, 09:52:40 PM |

|

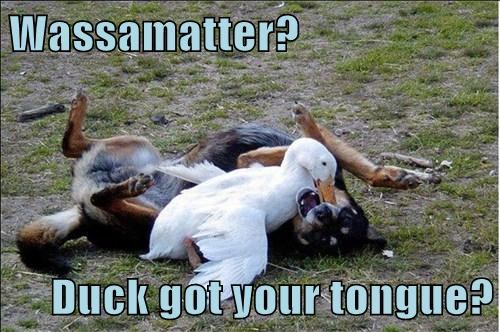

Oh don't be mean bud.

Lately it would seem the cat's got his tongue...

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10161

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 31, 2020, 10:00:45 PM

Last edit: September 01, 2020, 12:09:53 AM by JayJuanGee |

|

Two opposing forces: - Downward pressure: bigger market caps drags price action, as more money inflow is required to move the price

- Upward pressure: every day the S2F holds, it gets stronger and stronger, so future appreciation gets discounted into price, providing a lift to prices.

It’s a battle. I didn't look at this as simple as that, but you quite nailed it, imho. You can see the increasing linear spread of market cap and price figures, for example on coinmarketcap graphs. The more BTC get's recognized as what it is, the more inflow acceleration will occur as a logical result. But i'm uncertain how increasing inflation will influence the latter. In critical times, people tend to fall back to traditional solutions, namely gold. EDIT: @JJG: Don't call me bearish just because of that statement about gold  Bitcoin should take over, imo. Only a matter when people will grasp this. I might call you delusional, rather than bearish. Sure there is a lot of sentiment out there regarding gold serving as a sufficient and adequate hedge against ongoing fiscal irresponsibility.. but you really believe that gold is providing anything that bitcoin is NOT going to be providing in the coming years? Not only is bitcoin better than gold in terms of portability, divisibility, verifiability and a few other important characteristics, bitcoin also has the exponential s-curve adoption aspect, which surely is an unfair advantage for bitcoin to be going through early stages of adoption while gold hardly has anywhere to go in terms of actual adoption, but why would the market give any shits about the fairness of this particular situation... eg the lopsided circumstances favoring bitcoin? So sure, maybe you won't lose your wealth as fast in gold as you might lose it in various kinds of fiat-based investments, but I still am NOT sure where you are speculating that you might be able to get something from gold that you cannot get from bitcoin... Seems to me that you are likely speculating about gold's value proposition based on longer history and the already existence of financial instruments that are going to easily allow traditional financial institutions to quickly get into gold, but really? you believe gold is going to perform as well as bitcoin in the coming years? What's coming first? A $10k gold or a $60k bitcoin? Both are around 5x price appreciation points from today's price. Which one is getting there first? You betting evenly on this? You have 50% in each? How about after gold reaches $10k (hypothetically)? You gonna get another 4x out of gold, to $40k? you going to bet on that happening? How about bitcoin? Do you consider that bitcoin could arrive at $240k (that is 4x after reaching $60k) a bit more easily after it had already 5x'd as compared with gold arriving at $60k after it had already gotten to $10k? I could keep going on with higher and higher numbers, and the upside still seems way more favorable for bitcoin as compared to grandpa coin (aka gold) reaching those higher numbers. Make your bets however you choose, OOM, but I am having troubles appreciating how you might be so willing to suggest that gold is reasonable, feasible and necessary in light of where king daddy happens to be and where king daddy seems likely to be going in the coming years. Edit: Clarified a few points and fixed a few typos. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10161

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 31, 2020, 10:09:17 PM Merited by sirazimuth (1) |

|

Oh don't be mean bud.

Lately it would seem the cat's got his tongue...

Jojo sent me a private message, and based on that, I am pretty sure that it was a duck that had his tongue.  He seems to be attempting a recovery. |

|

|

|

|

explorer

Legendary

Offline Offline

Activity: 2016

Merit: 1259

|

|

August 31, 2020, 11:04:35 PM |

|

It's unlikely we will see growth the same as the past halvings. I think ~3-5x the prior ATH (so 60-100k) is a reasonable peak this time around. Resistance futile Supply is diminishing FOMO then we moon When the supply of resistance coins gets gobbled, the price just goes bananas. There is no reasonable number. FOMO is not reasonable. My expectations: 50k will be akin to 2017's ~4k. Woohoo, sideways/down, then off again to moon. :rollercoaster.gif |

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

August 31, 2020, 11:48:19 PM |

|

Two opposing forces: - Downward pressure: bigger market caps drags price action, as more money inflow is required to move the price

- Upward pressure: every day the S2F holds, it gets stronger and stronger, so future appreciation gets discounted into price, providing a lift to prices.

It’s a battle. I didn't look at this as simple as that, but you quite nailed it, imho. You can see the increasing linear spread of market cap and price figures, for example on coinmarketcap graphs. The more BTC get's recognized as what it is, the more inflow acceleration will occur as a logical result. But i'm uncertain how increasing inflation will influence the latter. In critical times, people tend to fall back to traditional solutions, namely gold. EDIT: @JJG: Don't call me bearish just because of that statement about gold  Bitcoin should take over, imo. Only a matter when people will grasp this. I might call you delusional, rather than bearish. Sure there is a lot of sentiment out there regarding gold serving as a sufficient and adequate hedge against ongoing fiscal irresponsibility.. but you really believe that gold is providing anything that bitcoin is NOT going to be providing in the coming years. Not only is bitcoin better than gold in terms of portability, divisibility, verifiability and a few other important characteristics, bitcoin also has the exponential s-curve adoption aspect, which surely is an unfair advantage for bitcoin, buy why would the market give any shits about fairness. So, sure, maybe you won't loose your wealth as fast in gold as you might lose it in various kinds of fiat-based investments, but I still am NOT sure where you are speculating that you might be able to get something from gold that you cannot get from bitcoin... and sure you are likely going based on longer history and the already existence of financial instruments that are going to easily allow traditional financial institutions to quickly get into gold, but really? you believe gold is going to perform as well as bitcoin in the coming years? What's coming first? A $10k gold or a $60k bitcoin? Both are around 5x price appreciation. Which one is getting there first? You betting evenly on this? How about after gold reaches $10k (hypothetically)? You gonna get another 4x out of gold, to $40k? you going to bet on that? How about bitcoin? Do you consider that bitcoin could arrive at $240k (that is 4x after reaching $60k) a bit more easily than gold? I could keep going on with higher and higher numbers, and the upside still seems way more favorable for bitcoin as compared to grandpa coin (aka gold). Make your bets however you choose, but I am having troubles appreciating how you might be so willing to suggest that gold is reasonable, feasible and necessary in light of where king daddy happens to be and where king daddy seems likely to go in the coming years. I mean: Bitcoin would deserve a good amount of inflow of gold instead, but most of the grannies still love their "granny-coin". It's them* who are delusional, not me. I don't trade with, nor do i hold any PMs. *not the grannies, but the gold holders. EDIT: #hodlsleep in 3... 2... 1... |

|

|

|

|

|

Poll

Poll