|

1641

|

Bitcoin / Bitcoin Technical Support / Re: i found 150 BTC

|

on: June 03, 2023, 04:33:07 PM

|

What does it matter whose wallet it is?

You said it was your wallet! Those pictures you've posted show the reward from the first 3 blocks in Bitcoin history. This means you must be Satoshi, and as I'm quite unsure about your knowledge, let me explain further, this means you must have created Bitcoin! After all, I have the dat file. all we have to do is crack the password?

Yeah, that's all you have to do! So, drop the act, how much have you paid for it or how much are you going to ask a noob to pay for this garbage? |

|

|

|

|

1642

|

Economy / Economics / Re: China reopening was a flop, if we're heading to deflation, what about Bitcoin?

|

on: June 03, 2023, 02:47:28 PM

|

snip

Don't force yourself to write four mandatory lines if you don't have anything to say! Thinking backwards a bit, what if they continue to oppose bitcoin? And this story turns positive or negative for the crypto market

In what dimension could a continuous ban from China be a positive thing? I think its too early to say the market didn't change when the Hongkong start. Some are saying that it will need 6 months to see the effect in the market.

This is not about HK it's not about their laws regarding Bitcoin but about the whole Chinese economy that is starting to suffer right after the most anticipated economic event in the last years, it's roar back from the lockdowns, which turned into prolonged suffering. HK laws or HK acceptance are a speck in the global economy if China's output drops further, it's like comparing 10 guys going to Salvador beach with the FED rising rates, two things different by orders or magnitude. I don't think a lot of investors buy Bitcoin because they believe it will protect them from inflation, it's just a narrative for promoting Bitcoin. The actual reason is that people believe Bitcoin will be worth more in the future ...

Here you contradict yourself. Buying things that will be worth more in the future is the way to hedge against inflation, as long as the percentage increase exceeds it. In other words, if cumulative inflation over the next 4 years is 20%, the assets you have that equal or exceed that 20% in cumulative return have served to protect you from inflation. He can still be correct. A true hedge against inflation must work at every single moment, if inflation is 50% a year next year it must be worth 50% more, if inflation goes 30%,40%, or 50% it must follow this by at least the inflation rate to keep being a hedge against it because you need it at every single point in the future to preserve the value. A long time investment doesn't need to follow these steps, it can go down in value by 50% next month and can linger there for years, as long as in 4 years it goes 10x it has earned you profit even against inflation, but with a difference, it hasn't been able to do this for every single day. So if you're out of luck and you need money you're going to have to sell it at a loss before the spike, and that's not really protecting you from inflation one tiny bit. |

|

|

|

|

1643

|

Bitcoin / Bitcoin Discussion / Re: Fed didn't stop to paused

|

on: June 03, 2023, 02:32:10 PM

|

This past May 31, the Fed continued to raise interest rates. And the reason is "Bitcoin Recedes to $27K as Fed's Mester Favors Unabated Tightening" Because the Fed said, It's the other way around, it's not the reason, that's the consequence. New bank failures will positively affect the price of Btc.

And if those don't come? Bitcoin was doing great when the economy was doing great also, both the inflation and the war haven't helped the prices that much, so are we going to cheer for an economic disaster every time we want the price to go up? And after the halving, the price of Btc should be more expensive, otherwise the stock prices of companies that are engaged in mining will fall.

And? Miners have gone out of business, mining companies have gone bankrupt and others have begged investors for millions to keep them afloat, it's not a general rule that after the halving we need prices to get x2 to keep miners running at the same levels. This is not OPEC that can play with the output, if there will be no demand to rise the price to 60k it's bye-bye for most miners after the halving. |

|

|

|

|

1644

|

Bitcoin / Bitcoin Discussion / Re: 10% Cashback by paying with Bitcoin in more than 250 Shops in Lugano

|

on: June 03, 2023, 01:59:38 PM

|

How does the cashback work, though? Is using a centralized app to pay in BTC required?

To clear the confusion once and for all, the title of the topic is misleading!The discount only applies when you pay with LVGA! LVGA is a centralized token, it's pegged to the Swiss franc, it's impossible to convert on any exchange as it's impossible to transmit outside your app, it's basically PayPal money or Starbucks credit. The promotion has nothing to do with Bitcoin, : https://my.lugano.ch/en/MyLugano uses LVGA, a local payment token based on blockchain technology, to create a concrete incentive and thus support spending in the city. By downloading the app, users receive up to 10% cashback paid in LVGA to spend on subsequent purchases in the city.The partners , by releasing the cashback in LVGA, create a loyalty bond with the customer and help to keep the cashback money in the city, creating a virtuous effect with positive spillover effects on the entire city economic circuit. So this is shitcointalk material. It is not a scam, just like i have explained in my previous posts in this thread. The LVGA stable coin doesn't have any value, it cannot be used outside Lugano, and its only use-case is for making payments to merchants within Lugano. This stable coin is backed by the Swiss Francs, so it is more like you are just spending fiat, but in a digital way; the initiative is clear and open for people want to take advantage of it, you are correct that it is not really about BTC, but it isn't a scam.

You do realize you're cheering for a CBDC centralized, fully censorable, mandatory KYC, not your keys, not your coins shitcoins here, right? |

|

|

|

|

1645

|

Economy / Economics / Re: For average Joe advice about money finances and Investment

|

on: June 03, 2023, 01:36:27 PM

|

So it's been proven o et the time over and over again.

When Fed rates up .... it's BUY

When Fed rates down it's SELL

Proven? The first FED rate hype happened in March 2022, BTC price was $42 000k then by your advice you would have continued buying when it is clear the best course of action would have been to dump it all. So, back to the drawing board for you and drop the master from the username, n00b is far more fitting taking into account the number of stupid topics you're making around here. It's part of everyone's growth. We tend to make mistakes and we learn from it.

Learning from the mistakes is just a part of it and it only offers some comfort, when you lose all your money in some stupid pump-and-dump scheme you might have learned to not touch shitcoins again but with all your money gone there is no way for you to apply the gained knowledge in trading anymore. |

|

|

|

|

1646

|

Economy / Economics / Re: Child support - A state affair (Tokenization of child support)

|

on: June 03, 2023, 01:20:04 PM

|

Child support from the state is not payed out of taxes of other people!

Example - Germany:

That means an average expected future tax payment of ~600,000,000,000 Euro per year. For that credit-worthiness the german state is getting a lot of credit (money) from the banks! Through these credits the (german) state CAN generate a lot of profits. And from these profits child support from the state is payed for children, which parents cannot pay child support.

Completely flawed view. First, there is no "bank' that suddenly offers loans at zero interest to the German government, second, you're mistaken about the whole creditworthiness, and what's even worse you assume somebody will just lend a country money just because it will have children. So, why isn't this working in Nigeria or Bangladesh?  They could have trillions. The other problem is that the government can't make money out of thin air if it gets those loans without devaluation, it can only get those back from taxes paid by the citizen, even if it were to invest in highways or schools or industry, the revenue will still be in taxes, still paid by the average Joe well before the kid will get his first job. But most important you've forgotten about secondary benefits, Kinderfreibetrag and Kinderzuschlag and Unterhaltsvorschuss. These are not like credit granted by some unknown entity and in one case are actually tax deductions, completely invalidating your theory. Also, 600 billion per year? Lol, yeah! so 1/3 of the budget is made out of future loans. Common! Could we tokenize the synthetic asset of "average expected future tax payments" and bring it back in the hands of the people? Basically we could create "crypto token" for "average expected future tax payment" and give it the children to economize their own child support.

How about not?! Let's stop tokenizing and creating shitcoins for every single thing just because it sounds trendy or cool or promises flying unicorns farting honey? You're basically proposing money printing, at birth for each child to get 700-800k euros because yeah, printing money out of thin air solves everything! Why even stop there, let's give them 1000 trillion, let's create a school token worth 50 trillion or their education, let's create some other 4 billion food tokens and some 100000 quadrillion toy tokens cause it's to ease, just give people money and everything will be fine! Do you have another ideas?

How about not trying to fix what is not broken? |

|

|

|

|

1647

|

Economy / Economics / Re: China reopening was a flop, if we're heading to deflation, what about Bitcoin?

|

on: June 02, 2023, 07:52:19 PM

|

I think the inflationary pressure on most of the Fiat currencies will still outweigh whatever price reduction is recorded in commodities. And don't forget that the industries or attentions could move to least affected countries to fill up the demand gap.

You're mistaken things, industries will not move to other countries when there is no demand for their goods in the first place, neither local nor exports, industries move because of favorable locations and low wages and!! because of demand there. Not the other way around. IMO, China reopening is a big step in increasing the acceptance of cryptocurrencies like Bitcoin.

Just as much as the gate to hell opening will mean a lot of devils will buy into Bitcoin! Seriously? China and Bitcoin? I will personally preferred the deflationary consequences on the economy than having inflation which has been a consistent reoccurrence in most economic settings, but the issues with deflation is that the government got affected than in inflation where the people are the ones affected most, we cannot do without having the encounter of either of the two in a standard economy, but in place of China, if it has developed a racial economy ties with other countries in collaboration, the rate of this consequences would have been reduced oner going deflated.

Deflation sounds good on paper, in reality, is a nightmare! You think only of your current wage and how much you can buy from it monthly but deflation will sap n t the value of all your assets, your house will be less, your assets will be less, your stocks will be less, and everything you own will be worth less than before. It might sound good if you live paycheck to paycheck but in reality, not even there it's all rosy! |

|

|

|

|

1648

|

Other / Beginners & Help / Re: Danger of posting your bitcoin address online

|

on: June 02, 2023, 10:26:42 AM

|

But for bitcoin, nothing will be revealed relating to you by merely seeing your address.

This is a mistake! Nothing can be revealed when you just post an address that has either zero balance or that you have just deposited some coins from a really private source, like a mixer and that's it. The moment you start using the address that has been linked to your profile and the more you post about your profile, with every single action your privacy gets eroded till you will not be safe anymore, and in extreme cases it might be even worse than a bank. Let me give you an example, of how badly this can turn - you purchase from that address a hard wallet since a ton of chain analysts can label almost all business and value at the moment of the tx, they will see you have made a transfer of the exact value of a Ledger Nano X. - Ledger does what it knows best and leaks the data again So now everyone can link all the addresses that have paid the price of a ledger wallet to the addresses posted online on social media, and here you go, addresses bc1xxxx, with a balance of 100 BTC which is tempting to any thief has a user that is from Shangri La and here you go, the address, your phone number, and everything are now tied together and your privacy is gone, forever! And it's not just that complicated, you order a simple pizza from that address, the pizza store owner knows your apartment address for the delivery and knows from where you have paid him, from now he can have a new hobby, let's see what this customer of mine has been doing, oh, he just withdraw 20 BTC, half a million from ana exchange...Hmm, I know a few guys!!! |

|

|

|

|

1649

|

Bitcoin / Bitcoin Discussion / Re: Is it a mistake to make a separate Bitcoin channel on YouTube?

|

on: June 02, 2023, 10:11:27 AM

|

So, should I accept that Bitcoin has now become an established medium of exchange and savings, and just include videos about it in a general offgrid camper channel? The alternative would be to create a dedicated Bitcoin channel, and thus have to compete with all the established Bitcoin channels.

Just talking about the fundamentals of Bitcoin won't help your channel gain traction as you've already guessed. You will either have to come up with sensationalistic clickbait titles and stories, out of which you have to invent 99% of them, or simply deal with the fact that you can't get hundreds of sounds of subscribers and cater to a smaller community. So I would definitely pick the second choice, of combining Bitcoin with something different, now you get a second niche, you get more material and you get to show different things, people get tired of a guy simply talking in front of the camera like the old tv days, they need diversity. I've also got a problem with the new GA4 Google analytics. Should I include my Bitcoin websites in my Offgrid Camper property, or, again, would it be better to have a financial property for Bitcoin?

What do you mean by a financial property for Bitcoin in this case? |

|

|

|

|

1650

|

Economy / Economics / China reopening was a flop, if we're heading to deflation, what about Bitcoin?

|

on: June 02, 2023, 09:48:02 AM

|

Had to chop the title so it really sucks but I can't do better right now!  With everyone focused on the debt of the US, the freezing Europeans, yeah lol, there is some really bad news on the horizon and for all sides in this game. If a slowdown in the Western world could be explained by jumping energy prices last year, prices that have since gone down to 2013 levels when it comes to pipe gas, in China manufacturing is dropping right after the reopening, at a continuous pace and despite the downturn in both raw materials and energy prices, copper, coal, iron, steel, wheat, everything is sliding with the PMI alongside. So, to not be biased and using only the English version of the mouthpiece of the Chinese government: China’s factory activity growth falters in March due to weaker demand, slowing productionChina’s factory activity dipped in April on weak demand as bumpy post-Covid economic recovery continueChina’s official manufacturing purchasing managers’ index (PMI) fell to 48.8 in May from 49.2 in AprilAnd things get worse, remember this is Chinese information, so take it with a grain of salt since it might be far worse: Youth unemployment has become one of Beijing’s biggest economic headaches amid its recovery efforts, and in April, 20.4 per cent of China’s 16-24 age group were unemployed, up from 19.6 per cent in March. So no manufacturing so now jobs for the not qualified, no jobs for the young ones that have finished college, which is a different area, and this can lead only to one direction. If the economic slowdown is present everywhere, China and the Western World, manufacturing is affected on all continents there is only one culprit in sight, and that is demand destruction, and with this, there is a chance we might end in a deflation period if things don't change. There is simply no demand, and with no demand, there are two choices, prices going down, which means obvious deflation, or bankruptcies which I doubt anyone is that stupid to do before trying the first solution, but the first choice is pretty hard to do when you just had an influx of free money and the rate rises have not yet started to be serious enough. There is an interesting piece on this from Forbes: https://www.forbes.com/sites/greatspeculations/2023/05/13/more-proof-deflation-is-the-future/of course, it's just an opinion and I will from the start warn you it's a bit speculative even with the data presented but it ends with the same warning as many others on the incoming deflation, although their take on what to do and what next is really not my cup of tea. Now, slowly turning from this to Bitcoin. Bitcoin was mainly designed as a p2p way of exchanging and transmitting value, due to its limited supply it turned into a way of safekeeping your wealth and further down the line evolved into an investment! Now, assuming all the required stars align and we really head into a deflationary period for fiat currencies, how will the price of Bitcoin react, since this is the only thing that can be affected by the economy, the rest, the p2p payments, the cold storage, the be your own bank will for sure not be affected, but lately those are of less interest and the focus is on the price most of the time. For sure, Bitcoin has the required advantage to erase all fears, that is adoption, unlike other commodities it can still attract users, and since I don't really believe those hundreds of millions of users quoted by most sources right now I can safely bet in my mind an x10 adoption rate would be doable at any time from the current moment. But, the question is, will it happen in this short span with enough traction? So, to make this long story short, two simple opinions: - do you believe we're heading to deflation? - how do you think the price of BTC will be influenced if we do so? |

|

|

|

|

1651

|

Economy / Economics / Re: Sanctions at work:Russia posts its second highest deficit in the post-Soviet era

|

on: June 02, 2023, 09:15:30 AM

|

And here I was, almost convinced that sanctions don't work since - Russia's GDP drops only 2.5% insignificantly while Germany's economy crashes 0.3% which is a disaster /s - Russia is experiencing deficit after deficit every month, but I was told this is normal - Gazprom is cutting dividends pay for the first time in decades, but this is also good for god knows what reason and now this shit, almost unexpectedly: https://markets.businessinsider.com/news/commodities/russia-economy-drop-industrial-output-labor-shortage-ukraine-war-mobilization-2023-5Russian industrial production fell 5% in April from the prior month, according to the economy ministry. and what a surprise, they managed to fix unemployment at 3.3%. Of course, with hundreds of thousands fleeing the country, hundreds of thousands killed and maimed for life and every single foreign worker fleeing the country not willing to die for Russian Mir, it was pretty obvious! I wonder what the long-term plan is right now, https://worldpopulationreview.com/countries/russia-populationBirths per Day 3,766

Deaths per Day 4,760

Migrations per Day -373

Net Change per Day -1,368

Population Change Since Jan. 1 -207,936 maybe kidnap some children from other countries? Oh, wait!!!!!! |

|

|

|

|

1652

|

Bitcoin / Bitcoin Discussion / Re: Could invested assets be nullified by progressive gas fee after halving?

|

on: May 31, 2023, 03:25:32 PM

|

To put it simple: with increase in bitcoin price the value of gas fee rises.

It is only true if fee size is the same. No, it's not true in any case! The fees depend only on network congestion. We have been at the same price levels 6 months ago and the fees were in the 1-2 satoshi per byte range, now it's 20x times more. Even if OP is talking about CEX fees, there is no longer a thing of size since no exchange is charging by the size a withdrawal. Also, there is no "gas" in Bitcoin! |

|

|

|

|

1653

|

Economy / Economics / Re: Russian Gas ban - A problem for Europe or suicide for Russia?

|

on: May 31, 2023, 01:07:09 PM

|

Although it is true that countries such as Germany have reduced the consumption of natural gas, it came at an enormous cost to the economy. For those idiots who still live in the dreamland, I dedicate this news article:

Math is really not your thing, isn't it? Germany's statistics office showed that Germany’s GDP declined by 0.3% for the quarter when adjusted for price and calendar effects 0.3% is the enormous cost? What about the 2.5%, 8 times bigger for Russia? That doesn't count right? Also, not a word that gas is no cheaper than before!!! the invasion of Crimea? So cheaper than all this shit began in 2014? Nothing? Not a word? No statistics? No price per 1000 cubic meters? What happened?  You have kept us updated with the price in this topic 41 times!!!!!, not one update since US LNG is now cheaper than Russian gas before the annexation! Not a word on the x1000 profits Gazprom was making? Nothing?  |

|

|

|

|

1654

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin Transaction Accelerator. Does it Work or Just Another Hype?

|

on: May 31, 2023, 12:40:13 PM

|

My ViaBTC accelerator experience is the same as mentioned above.

~

Even the paid one is not expensive and definitely worth using.

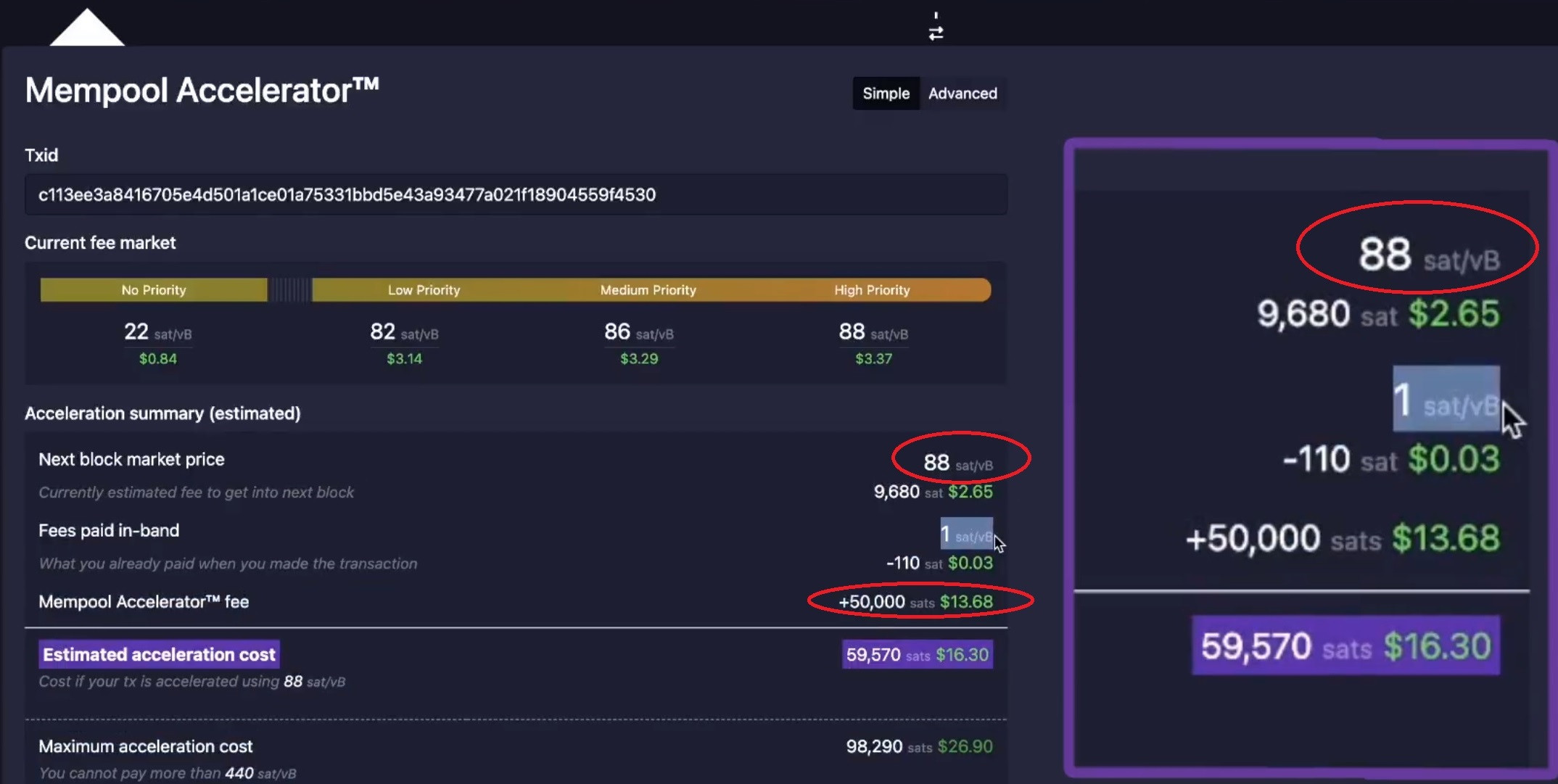

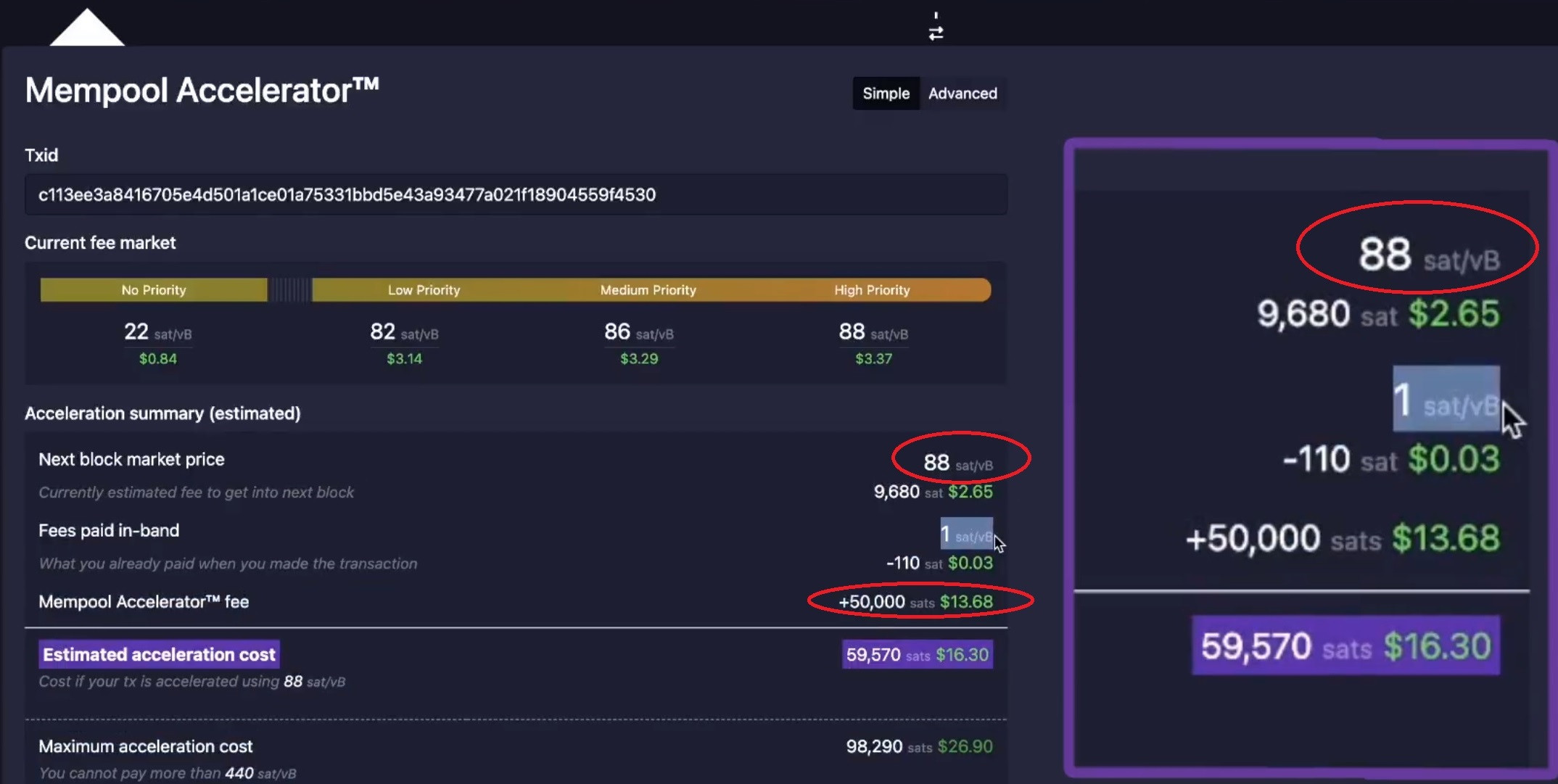

Not expensive? I've picked a random 1 input 1 output tx from the mempool and this is what the paid service will ask for: 45f8ce98c5c4b9839eec8f6045bfec80d2ea2b863e06622f4cd0d33accdc67f5

Transaction Size (Current TX Size + Previous Unconfirmed TX Size)

141 Bytes = (141 + 0) Bytes

Total fee

0.0021432 BTC ≈ $ 58.10 $58.10 is not expensive?  For a larger tx of 2000 bytes, it's...0.0220192 BTC ≈ $ 596.78 !!! Never understood what's the point of a transaction accelerator, from the pool's part. They have nothing to gain. It's basically like giving free bitcoin, and as far as the mempool is concerned, 100 transactions for free is rather lots of money.

Promotion, mainly for other services as miners are not really happy about it, see this: https://bitcointalk.org/index.php?topic=5345553.msg57304026#msg57304026By the way, I don't see them having a size limit. You could create a large transaction, broadcast it and have them accelerated for you? Has anyone tried this?

≤0.5 KB, they are not accepting anything bigger, also over 10sat/b not vbyte, and not CPFP tx! |

|

|

|

|

1655

|

Bitcoin / Mining / Re: Marathon CEO Responds to Why the Miner Tax Plan Won’t Work

|

on: May 31, 2023, 11:13:04 AM

|

Maybe I should explain it in details: I don't actually mean that miners should pay zero tax, no, but tax shouldn't be very high to scare miners. If the USA governments tax miners with as between 2-9%, that will be fine and acceptable for everyone.

Now we're talking numbers, you see, that's why I am asking you to read the financial statements again. You said 2-9% is acceptable, not please check how much have those companies paid till now, cause you're going to be in one hell of a surprise! Yes, when you are the United States Of America, you have to remain top in everything, including mining.

Why? Seems like none of the G7 is interested in that and we can only find two G20 countries that could replace the US if this stops being an option. What major breakthrough is Bitcoin mining? I would have understood if it would be making the chips, but just hosting gear it's nothing out of the ordinary! And if we talk about revenue, the US could buy more coins that are mined in a day just by mooring one carrier rather than having it sail around the globe! |

|

|

|

|

1656

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin Transaction Accelerator. Does it Work or Just Another Hype?

|

on: May 31, 2023, 11:03:02 AM

|

I would say they actually do work but just like the post above only ViaBTC is the most trusted by the forum community, but there is also the BitTools but I am not certain of its transparency. It's not a tx accelerator, it's just rebroadcasting txs. It even says there on it's page: Just enter the transaction ID (TXID), confirm you are a human by check the CAPTCHA and click the "Accelerate" button. Our service will rebroadcast the transaction via 17 Bitcoin nodes.

Rebroadcasting does nothing! 1. Most of them just rebroadcast the transaction to the network. AFAIK, ViaBTC accelerator is the only one that does its job[1]

And in the future, mempool.space also will offer accelerator service[1]. Unfortunately, a tiny difference, it will not be as cheap as ViaBTC is right now. From what I understood in that video, it will make you pay the minimum next block fee, so you basically won't save a thing and you will also pay an extra 50k sat. It's going to be good for those that can't RBF or don't have control over the tx but it won't save you money at all.  |

|

|

|

|

1657

|

Bitcoin / Development & Technical Discussion / Re: BRC-20 needs to be removed

|

on: May 31, 2023, 10:50:34 AM

|

Let's combine a bit the replies! I was saying that, as many others, I don't agree with this garbage in the blockchain!

I said it before, and I used the same term, delusional majority, when some 2-3-100 guys in a tiny crowd think that just because there are others who agree with them and in this tiny space they are more numerous than the ones that disagree they somehow are the overall majority. The same shock as a 24/7 wow player has when he enters a cafe and nobody gets his gaming jokes! Going further: Seems to me that BSV devs are just defecting to BTC because there's way more money flowing in Ordinals / BRC20. I could of course be mistaken. But LTC and DOGE are now facing similar issues with spam, blockchain bloat & network congestion so I'm inclined to believe its not an anti-BTC conspiracy.

As I was saying, everyone has their own opinion, even on this thing, the first tweet is about people defecting from BSV and going back to BTC, although I really think it's a ton of sarcasm in that reply I don't doubt more think the same, it's not an attack, it's a way they make money cause there is demand on BTC rather than on BSV. Some might see it as proof of BTC being better some might see it as a terrorist attack, unless we go and have a mandatory vote and count everyone on this planet it's a bit premature to say the majority hates or loves Ordinals. what consequences is that? if it dies down then we're back to normal right?

The consequences of doing nothing to prevent the next one?  With users seeing this and ending forever their plans on dealing only in BTC for on-chain tx and switching to alternatives? |

|

|

|

|

1658

|

Economy / Economics / Re: Dedollarization is here, like it or not

|

on: May 31, 2023, 10:35:40 AM

|

Lol. You guys used to get on well with each other, right?  Not really, but it went all south when those stupid Americans with their stupid garbage American weapons that can't hit a thing turned the former leader of ISIS, my bad IRCG, (same shit) into kotlet. Then it went around the globe and further south when instead of downing a F35 as they claimed it turned the next day they hit a civilian plane with their mighty weapons. Since I made fun of him over and over he ended up ignoring me! But I like to think of it as Yin and Yang. He comes with the propaganda, I come with facts and debunk it. He spills venom right and left about Europeans dying of hunger, cold, thirst and raccoon bites, I came with positivity.  Isn't life fun? Of course, not if you're executed if you wear jeans in a public place!  Regarding the subject in question, it is true that we hear a lot more nowadays of various countries proposing an alternative to the dollar and even starting to make some trades with alternative currencies. To what extent they may succeed remains to be seen.

The weird part is that I don't see the change right here, exactly by the same people claiming the dollar is dead, I mean everyone is in: Signature Campaign > Up to $x/week Isn't weird to hate the dollar, despise it but still agree to get paid by its value?  There is propaganda, and there is reality! |

|

|

|

|

1659

|

Bitcoin / Mining / Re: Marathon CEO Responds to Why the Miner Tax Plan Won’t Work

|

on: May 30, 2023, 01:23:35 PM

|

They have to release financial statements but what has that to do with what was said above?

Everything! There is a small, post-soviet union country called Georgia. In 2015, this country made a deal with BitFury and exclusively for them, they created a free zone that lets Bitfury to avoid corporate taxes, VAT, import taxes and other fees. Georgian guys were working near to my house in Germany, doing some road-related stuff and we had some small talk in Russian (yes, I speak it too). They told me that this is a poor country where salaries are super low, food is expensive, etc and they have to work in western countries to feed their families in their homeland. They told me that this country is unofficially run by a billionaire and so on. Now, my question is, think about it, why did they create a tax-heaven for BitFury? And keep in mind that BitFury uses around 9% of the country's electricity. And even keep in mind that this country imports electricity because their own isn't enough for people. C'mon man, don't you really think that BitFury doesn't share profit with people in government? Nice story, so in conclusion: - Georgia gives cheap energy 9% of the total to Bitfury - you have neighbors who have fled the country because of super low salaries How the f-word did having miners in the country helped the economy, that's what I am asking you!!!! For three messages in a row, you told me how beneficial for the economy having miners is and you still are unable to give me an example of it, furthermore going full contrarian and showing me an example of how setting mining farms in a country doesn't change shit in the national economy! So, which one is it? |

|

|

|

|

1660

|

Economy / Scam Accusations / Re: Is Happyminer real?

|

on: May 30, 2023, 12:59:05 PM

|

but this site am given looks good.

Looks good? Seriously, that's your criteria?  I don't know who that guy is but if after spending 5 minutes on that website he can't smell a scam he must quit whatever he's doing! When you sign up, you get $10 immediately. You can use it to buy the Primary Mining package daily, and you will get $0.80 daily. When you reach $100, you can withdraw it all. 0.80 daily is 10TH/s before power, to offer that for 10$ when the cheapest gear would cost you 11$ per TH, that's $110 upfront before electricity, hosting cost, labour cost means it's a scam! 1.5% daily means 45% a month, in order to pay that you would a miracle! If I would invest $1000 I would get $450, how could it be possible for them to make a penny after giving you that much? One of the reviewers is quite funny! https://www.trustpilot.com/users/62a0a058871da7001461fa2eThe guy got scammed by 4 ponzi schemes before and now he's trusting this scam. Triple facepalm. |

|

|

|

|

They could have trillions.

They could have trillions.