|

1101

|

Economy / Economics / Re: Economic Totalitarianism

|

on: March 12, 2017, 06:57:55 AM

|

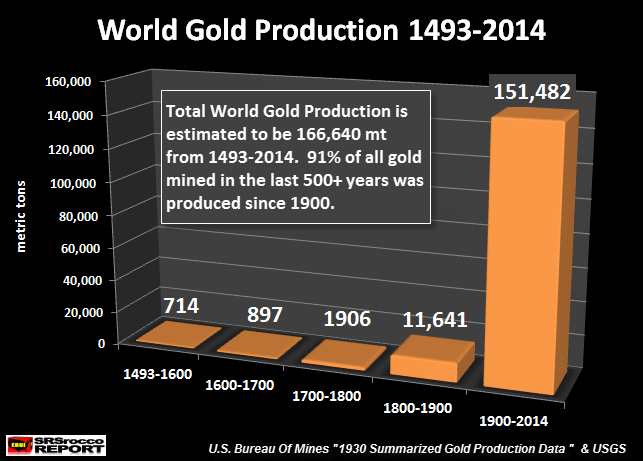

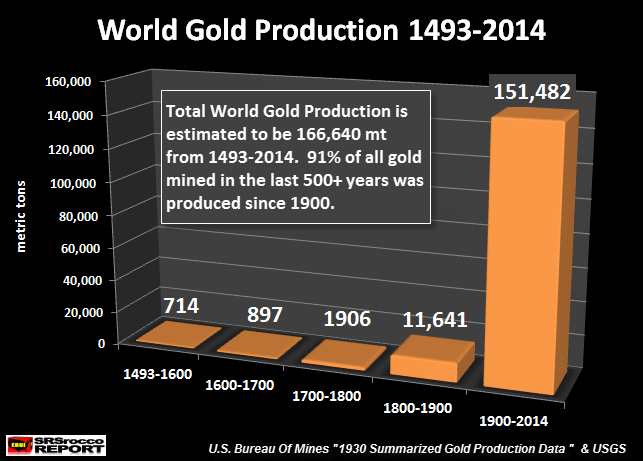

... tabnloz Sure, please do post whatever you find. And to be clear, I am not an expert on this matter, but I go with people whose work I trust, at least for now. Here is a link showing total world gold holdings of about 170,000 tonnes, and about how Bix Weir and Karen Hudes are wrong about the 2,000,000 tonnes they claim re Yamashita's Gold: https://srsroccoreport.com/setting-the-record-straight-on-the-massive-gold-supply-conspiracy/Ahh..., 170,000 tonnes (world total holdings) is the accepted figure of all apparently reputable gold analysts who are in a better position than I am to know. And from Steve's article, there is this graph, which is presumably true:  Where did the reputed "Yamashita's Gold" (2,000,000 tonnes) then come from? That would be over 10 times as much as the world has mined since 1493! Where did the reputed "Yamashita's Gold" (2,000,000 tonnes) then come from? That would be over 10 times as much as the world has mined since 1493!Let's do some more quick & dirty arithmetic. Let's say a pallet of gold bars (call it 1 cu mt) would weigh some 10 tonnes (metric tonnes, accounting for air and packaging). That would then make Yamashita's stash some 200,000 pallets. 200,000 pallets is a LOT of gold, and a LOT of weight & bulk. Do you actually believe that there would be 200,000 pallets of gold tucked away in cave complexes in the Philippines and/or in a "secret vault" at The Bank of Hawaii? Really? 200,000 pallets would be a little more than 300 * 300 * 2 pallets if all together (in one place, in a square, 2 pallets high). 300 pallets of 1 cu mt each is 300 METERS (if in a line). 300 meters * 300 meters square.Really? Please tell me where it all is, and how it all got there. |

|

|

|

|

1102

|

Economy / Economics / Re: Martin Armstrong Discussion

|

on: March 12, 2017, 06:43:27 AM

|

|

...

sidhujag

Sigh, I guess I was not clear. The BTC was taken from my account even though I "owned" the keys, and I never sent them to anyone. I did get my BTC back from blockchain.info (after some back & forth with them). So, they made me good again (gave me BTC to make up for what disappeared), but I never got the details on what happened, why the BTC disappeared.

I still have all my communications with them in resolving the problem. If I had given away my keys (or the 12 words), then it would have clearly been my fault, and they would not have paid me back.

|

|

|

|

|

1103

|

Economy / Economics / Re: Economic Totalitarianism

|

on: March 12, 2017, 04:05:17 AM

|

|

...

lilit, m-t, tabnloz

Most of the analysts of gold in whom I have confidence say that Yamashita's [possible sic] Gold is just a fairy tale. I have no way of knowing, but SRSrocco wrote up a piece not long ago showing ENTIRE global production was not enough to account for the massive amounts of gold supposedly there (or now elsewhere). Sensible, logical FOFOA says that Bix Weir (etc.) are FOS on huge, hidden piles of gold.

One thing I learned long ago: if there is a big sexy secret, it doesn't stay secret long. The only exception to this was The Manhattan Project (atomic bomb) in the 1940s.

"Three can keep a secret if two of them are dead."

-- Mark Twain (?)

|

|

|

|

|

1104

|

Economy / Economics / Re: Martin Armstrong Discussion

|

on: March 12, 2017, 03:56:10 AM

|

... Bitcoin IS full of counter-party risk. blockchain.info had some kind of a weird problem some three (?) years ago, and I had all of my BTC stolen from the account (despite their propaganda saying that I held the Keys, etc., etc.). And should you want to SPEND your Bitcoin, ah, there's another risk, you have to find someone who will take it for what you want, in my case I bought gold a few times with BTC. In retrospect, perhaps not a wise decision, but I learned how to make purchases with BTC. Extreme price variation and complexity of its use make it too challenging for most newbs. And the merchant base (people who will take BTC in payment) is still way too small. * * * I am very wary of Peak Oil claims. The USA is now on the verge of exporting more oil than we ever have before. Yes, I read all that about EROEI (esp. SRSrocco, ol' Steve there). But, solar seems to be becoming much more efficient than before. Should solar's cost continue to decline (and I have no idea), then our electricity problems will be mostly solved. The USA has lots of NatGas as well. As does Peru. As do lots of other countries. And if oil climbs back to $100 / bbl, then moar becomes worth recovering. I am not saying that Peak Oil is not a problem, I am just saying that there are a LOT of annoying facts out there that invite careful examination and longer-term study. |

|

|

|

|

1105

|

Economy / Economics / Re: Martin Armstrong Discussion

|

on: March 09, 2017, 08:48:55 PM

|

which is also wrong because it being an ideal form of currency has already passed, thats how the market works

I dunno what you're smoking but that's not how the market works at all. The market works by coercion and has nothing to do with what's better or not. What's theoretically the best on a drawing board doesn't factor into anything. And I also think you are making an extreme error calling bitcoin an ideal form of money, when I don't think it's really even decentralized in the first place, nor will it sufficiently scale, so the entire thing is probably just a Rube Goldberg machine that's pointless. How can you call such a thing "ideal money"? It's ridiculous. Current cryptocurrency does not compete against metals whatsoever, and there's a very large chance that it might be impossible for them to do so. They will always be Rube Goldberg machines - the equivalent of show and tell science class projects scaled up from middle school to grown man level, but still just as equally not groundbreaking and pointless. Market does not work by coercion i agree sometimes simple is better ala web stack sucks today but over time an ideal form of web technology will take over perhaps something like ipfs etc.. in the same way money will take a new shape as markets are always forward looking and not backwards.. any manipulation or coercion usually leads to bigger corrections and recessions.. see boj and snb. Cryptocurrency offers more utility than gold can ever imagine and thus it is backwards to assume market will readjust to base itself on a metal that is just thought of as a safe haven. Since it is not clear at all that Bitcoin will survive long-term (maybe not even for 2017-2018 if the developers & miners let the problems destroy it), it is not wise to hold just BTC. And since we do not know, exactly know, what the fate of gold is, it is not wise to hold just gold either. Bitcoin offers a realistic possibility of a huge price movement up, but it is risky... Gold offers about as good a financial insurance (safe haven) as exists, but the possible/probable upward price trajectory is not as dramatic (unless FOFOA is right). For that matter, smart diversification suggests that holding some of stocks, bonds, real estate and other conventional assets is recommended. Maybe less so now than earlier, but still smart if you have the money. * * * I am liking more and more iamnotback's suggestion to LEARN in the likely upcoming Knowledge Age. |

|

|

|

|

1106

|

Bitcoin / Bitcoin Discussion / Re: Fiverr.com forced to remove BTC as a payment option due to high fees

|

on: March 08, 2017, 04:42:42 AM

|

Will be interesting if they and other crypto-friendly merchants start announcing support for litecoin or dash or zcash or something else with higher TX capacity. That could ignite some serious competition against bitcoin at last, and force the warring bitcoin factions to wizen up, lock themselves in a room with a good facilitator and a copy of Kevin Sande's The Peacemaker, and not come out until they unified around a plan to move bitcoin forward. As long as they keep shouting that the other side is the Great Satan, bitcoin is stuck in the mud. Not good in a rapidly developing, cutting edge environment like cryptocurrency.

Yes. This is the first tangible reaction against the BTC Congestion we are suffering through. We may be nearing Critical Mass in just how much of this we can take while the Core Developers and the Miners sit around and twiddle their thumbs. Locking them up in a room (like they do with the Cardinals in Rome when picking a new Pope) may be the only way. Else BTC may lose out to competitors... |

|

|

|

|

1108

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: March 08, 2017, 04:25:16 AM

|

It's a bloodbath.

What did you expect with huge fees and congestion of the network?

Fiverr.com just dropped Bitcoin as a payment method since fees are amounting to 20-40% of all bitcoin transactions.

Good Game, it was fun while it lasted.

The idiots over at Kore ruined this rally.

It's ugly, $1188. IMO, much of this can indeed be blamed squarely on those (core developers and miners) who just cannot seem to get their acts together and actually solve problems. And they keep saying Bitcoin is strong. Mmm-hmm... |

|

|

|

|

1109

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin/Blockhain is dead.

|

on: March 07, 2017, 08:31:56 PM

|

Bitcoin is not suitable for low value transactions, at least not anymore, try litecoin, cheap transactions, fast confirmations.

I predict in 2017 bitcoin will achieve new all time highs and neither Segregated Witness nor Bitcoin Unlimited will be adopted, so if you want to do low value transactions you'll need to find an alternative.

Better to use a coin that will likely replace bitcoin. Just use Dash. Has integrated tumbler and you can choose instant transaction. Dash is too shady, premined as fuck and way too pumped, the risk is very high, if people want to make business, a stable and transparent coin is better. Knowing very little about alts (other than that none have caught on in a big way), I would agree. In a competition, usually there is only one winner, and to date Bitcoin is it. It does look like making micro-payments is dead for now. I will be sending virtually all of my transactions for a higher fee. It disappoints me that the miners & developers cannot fix this. And while BTC is certainly not dead, this kind of infighting and sloth in coming to an agreement opens the door for an eventual Bitcoin Death Experience. |

|

|

|

|

1110

|

Bitcoin / Bitcoin Discussion / Re: "Vault 7" (Wikileaks) Discussion. Best Practices for Us?

|

on: March 07, 2017, 08:22:44 PM

|

|

...

I see at least two tangible dangers that would worry me:

1) That any BTC that we "own" in web wallets could be stolen reasonably easy (with info from our own computers)

2) Keystroke loggers..., which to me seem to be perhaps the greatest danger. They could get our passwords...

Yep, as ebliever just wrote above, these tools are now out there "in the wild". No telling who and what malicious users will try to inflict on us.

|

|

|

|

|

1112

|

Economy / Service Discussion / Re: Did ViaBTC accelerator stop working?

|

on: March 07, 2017, 05:27:50 PM

|

That 100 tx cap is not between two blocks they mine, it is for every hour. A maximum of 100 TXs submitted can be accelerated every hour. Don't know at what time they reset this count but i think its UTC time. EDIT: Timezone confirmed, their counter reset on every hour. I have just included one transaction (some random one)  That would match my experience of just last night. I tried to accelerate a small transaction that had been unconfirmed for 11 hours, but ViaBTC gave me the error message. I then waited until 30 seconds after 11:00 PM (US ET) and tried again. "Acceleration succeeded" And it was confirmed on the second block afterwards. So, it looks like to get an acceleration using ViaBTC's service, the way to do it is to try just after the top of the hour. |

|

|

|

|

1113

|

Bitcoin / Bitcoin Discussion / "Vault 7" (Wikileaks) Discussion. Best Practices for Us?

|

on: March 07, 2017, 05:16:43 PM

|

|

...

Today Wikileaks leaked a huge trove of information on malware being used by our government. Details can be found at Drudge and ZeroHedge (but not at cnn.com, LOL). The viruses, trojans, "Year Zero" bugs, worms, etc., etc. are targeted at a huge number of digital devices, including smartphones, Samsung TVs, cars (think about that), and a large number of operating systems (including several LINUX systems).

One comment I read suggested that much of this malware will be easily stolen and used by our enemies (as STUXNET is).

Obviously this is troubling, perhaps especially to non-programmers like me.

I invite comments..., especially on Best Practices we might follow to protect our IDs, our BTC and whatever other of our digital information we care about.

|

|

|

|

|

1114

|

Bitcoin / Bitcoin Discussion / Re: How would you store >100 Bitcoins?

|

on: March 07, 2017, 05:07:10 PM

|

|

...

I travel, so I would like to have access to BTC when on the road (never know), but I want security as well.

So I compromise. I have two web wallets, two wallets on my PCs and three hardware wallet devices (Trezor, Ledger Nano and Digital Bitbox -- that last one I am just starting to learn). I have one on my mobile, but I don't use it much because it is unpredictable (for me).

One or more hardware wallets is probably best if you plan on cold storage of a significant amount (say, 5 or more) of BTC.

|

|

|

|

|

1116

|

Economy / Service Discussion / Re: Is viabtc transaction accelerator really working?

|

on: March 07, 2017, 04:08:14 AM

|

|

...

I have a small incoming transaction that has not confirmed in 11 hours. So I gave ViaBTC's service a shot to speed up my confirmation. I put in the trx no. and they informed me that the limit was exceeded (greater than 100 / hour). I read something elsewhere that suggested that the hour might start "on the hour", so I tried again at some 30 seconds after 11:00 PM US ET.

"Acceleration succeeded"

Now I am waiting on the next block to see if it really did...

|

|

|

|

|

1117

|

Economy / Service Discussion / Re: ViaBTC offers a nice service for very small transactions

|

on: March 07, 2017, 03:59:03 AM

|

... I just tried it out for the first time in a week or two, and yeah, the service is currently all full (100 trx). Ah well. I think I remember reading that one can "manually push" a transaction along. I forget where I read that and know nothing else about that. Anyone know anything about manually pushing transaction? * * * Interesting that ViaBTC would have the best cloud mining contracts too. EDIT: I just put my trx no. in again at some 30 seconds after 11:00 PM US ET. "Acceleration succeeded"  EDIT 2: Actually confirmed on the second block after. ViaBTC won that block. |

|

|

|

|

1118

|

Bitcoin / Bitcoin Discussion / Re: ETF POLL APPROVAL / REJECTION

|

on: March 06, 2017, 07:21:10 PM

|

|

...

I hope that the BTC ETF is approved. My *guess*, FWIW, is that it will be.

But what is more important is the acceptance of Bitcoin itself! This is what is really more important, acceptance by more users and more merchants. Approval of the ETF might speed up acceptance by mroe people as it enhances BTC visibility. And makes Bitcoin less shady-looking.

|

|

|

|

|

1119

|

Economy / Economics / Bitcoin price is higher than 1 oz of Gold. But,

|

on: March 06, 2017, 07:15:01 PM

|

|

...

I cheer that the price of Bitcoin is now over that of 1 oz of gold. Great.

But, I recently read that Bitcoin does not have history (this of course is not a new idea), it has no long-term record of going through the cycles of economic and even political history. Bitcoin is unproven going into the future.

Bitcoin has shown itself to be reasonably sturdy in recent years and is catching on, more slowly than I would like, as a payment mechanism (a currency).

There are many facets of looking at the price relationship of Bitcoin and gold. In this thread, I invite comments re history and its relevance on gold and Bitcoin as Store of Value, now and into the future.

|

|

|

|

|

1120

|

Economy / Economics / Re: Bitcoin has defeated gold

|

on: March 05, 2017, 04:39:20 PM

|

Yes, though I really don't see the relevance of this. Apparently a lot of others do.

I think when I get paid from my signature campaign this coming Wednesday, I may just end up buying a gold coin or some silver from Provident Metals. I said in another thread that I was done spending bitcoin, but actually having a physical coin as the result of my earnings here is meaningful to me. I'm not pumping Provident here, they just happen to be pretty much the only place that takes bitcoin. Amagi metals has shit for selection. But I'll have to see what the price is on Wednesday. I must say, I'm reluctant to get rid of any bitcoin right about now. We could very well be on the rocket ship to Pluto. F- the moon.

Yeah, that's my favorite way to spend Bitcoin, buying gold. Buying gold is like spending and saving at the same time.  But, I agree that it is hard to think about spending BTC now, as the price now could really move up big. Another thing to keep in mind is that buying gold now means you would be "selling high (BTC) and buying low (gold)" at the same time, generally buying low and selling high is a winner in investing. |

|

|

|

|