|

901

|

Economy / Economics / Re: Good and Evil money — The Morality of earning Money/Rewards

|

on: July 11, 2022, 11:52:16 PM

|

Good money is money earned from doing good work... that is, from solving problems without creating more problems, while evil money is money earn from evil work, that is, works that create more problems rather solving them. Money earned from doing good work, no matter how little is always enough.

I have read and observed to see if this is true. There was a famous case of gamblers in the NBA having connections to referees who would held them to rig games in their favor. They made a lot of money. As far as I know, none of them lived a life which allowed them to enjoy the wealth they accumulated through corrupt means. To some extent this is documented. It is a well known story covered by mainstream media in years past when journalists were more honest and news was more reliable. Wealth accumulated through corrupt means could be blood money. It is ingrained with sin and malice which cannot easily be removed. It is cursed in a way. This is a topic I've always been curious of and wondered about. Whether karma exists and is a real thing. It is interesting to think about. |

|

|

|

|

902

|

Economy / Economics / China crushes mass protest by bank depositors demanding their life savings back

|

on: July 11, 2022, 11:30:44 PM

|

Chinese authorities on Sunday violently dispersed a peaceful protest by hundreds of depositors, who sought in vain to demand their life savings back from banks that have run into a deepening cash crisis. Since April, four rural banks in China’s central Henan province have frozen millions of dollars worth of deposits, threatening the livelihoods of hundreds of thousands of customers in an economy already battered by draconian Covid lockdowns. Anguished depositors have staged several demonstrations in the city of Zhengzhou, the provincial capital of Henan, over the past two months, but their demands have invariably fallen on deaf ears. On Sunday, more than 1,000 depositors from across China gathered outside the Zhengzhou branch of the country’s central bank, the People’s Bank of China, to launch their largest protest yet, more than half a dozen protesters told CNN. The demonstration is among the largest China has seen since the pandemic, with domestic travel limited by various Covid restrictions on movement. Last month, Zhengzhou authorities even resorted to tampering with the country’s digital Covid health-code system to restrict the movements of depositors and thwart their planned protest, sparking a nationwide outcry. This time, most protesters arrived outside the bank before dawn – some as early as 4 a.m. – to avoid being intercepted by authorities. The crowd, which includes the elderly and children, occupied a flight of imposing stairs outside the bank, chanting slogans and holding up banners. “Henan banks, return my savings!” they shouted in unison, many waving Chinese flags, in videos shared with CNN by two protesters. Using national flags to display patriotism is a common strategy for protesters in China, where dissent is strictly suppressed. The tactic is meant to show that their grievances are only against local governments, and that they support and rely on the central government to seek redress. “Against the corruption and violence of the Henan government,” a banner written in English read. A large portrait of late Chinese leader Mao Zedong was pasted on a pillar at the entrance of the bank. Across the street, hundreds of police and security personnel – some in uniforms and others in plain clothes – assembled and surrounded the site, as protesters shouted “gangsters” at them. Violent crackdownThe face-off lasted for several hours until after 11 a.m., when rows of security officers suddenly charged up the stairs and clashed with protesters, who threw bottles and other small objects at them. The scene quickly descended into chaos, as security officers dragged protesters down the stairs and beat those who resisted, including women and the elderly, according to witnesses and social media videos. One woman from eastern Shandong province told CNN she was pushed to the ground by two security guards, who twisted and injured her arm. A 27-year-old man from the southern city of Shenzhen, surnamed Sun, said he was kicked by seven or eight guards on the ground before being carried away. A 45-year-old man from the central city of Wuhan said his shirt was completely torn at the back during the scuffle. The protest outside the Zhengzhou branch of the country's central bank, the People's Bank of China, is the largest one depositors have staged in recent months. - Provided to CNN Many said they were shocked by the sudden burst of violence by the security forces. “I did not expect them to be so violent and shameless this time. There was no communication, no warning before they brutally dispersed us,” said one depositor from a metropolis outside Henan who had protested in Zhengzhou previously, and who requested CNN conceal his name due to security concerns. “Why would government employees beat us up? We’re only ordinary people asking for our deposits back, we did nothing wrong,” the Shandong woman said. The protesters were hurled onto dozens of buses and sent to makeshift detention sites across the city – from hotels and schools to factories, according to people taken there. Some injured were escorted to hospitals; many were released from detention by the late afternoon, the people said. CNN has reached out to the Henan provincial government for comment. The Zhengzhou Business District Police Station – which has jurisdiction over the protest site – hung up on CNN’s call requesting comment. Late on Sunday night, the Henan banking regulator issued a terse statement, saying “relevant departments” were speeding up efforts to verify information on customer funds at the four rural banks. “(Authorities) are coming up with a plan to deal with the issue, which will be announced in the near future,” the statement said. Shattered livesThe protest comes at a politically sensitive time for the ruling Communist Party, just months before its leader Xi Jinping is expected to seek an unprecedented third term at a key meeting this fall. Large-scale demonstrations over lost savings and ruined livelihoods could be perceived as a political embarrassment for Xi, who has promoted a nationalistic vision of leading the country to “great rejuvenation.” Henan authorities are under tremendous pressure to stop the protests. But depositors remain undeterred. As the issue drags on, many have become ever more desperate to recover their savings. Huang, the depositor from Wuhan, lost his job in the medical cosmetology industry this year, as businesses struggled in the pandemic. Yet he is unable to withdraw any of his life savings – of over 500,000 yuan ($75,000) – from a rural bank in Henan. “Being unemployed, all I can live on is my past savings. But I can’t even do that now – how am I supposed to (support my family)?” said Huang, whose son is in high school. Sun, from Shenzhen, is struggling to keep his machine factory from bankruptcy after losing his deposit of 4 million yuan ($597,000) to a Henan bank. He can’t even pay his more than 40 employees without the funds. Sun said he was covered in bruises and had a swollen lower back after being repeatedly stomped by security guards at the protest. “The incident completely overturned my perception of the government. I’ve lived all my life placing so much faith in the government. After today, I’ll never trust it again,” he said. CNN’s Beijing bureau and Yong Xiong contributed to this report. https://www.msn.com/en-us/news/world/china-crushes-mass-protest-by-bank-depositors-demanding-their-life-savings-back/ar-AAZqmng.... Its becoming harder to find safe spaces to store wealth everyday. Even the reputation of banks isn't what it used to be. Interestingly, these bank runs in china appear to affect mainly rural areas. Banks located in cities do not appear to be affected. I wonder if it could be tied to rising cost of natural gas based fertilizer in farming communities or other financial difficulties brought on by rising fossil fuel prices. In which case, we could see similar trends in other nations emerge as well. Evergrande is a hot topic for chinese debt. There is also their outstanding vehicle loan bubble which is denominated in trillions. Banks in the country have needed debt renegotiating in years past to avoid these types of bank runs. These types of stories have been published for years without much apparent effect on china's economy. Many predicted the imminent demise of china's economy over the past 20 years. None have so far been accurate. Perhaps modern day economies are more durable and resilient than we realize and doom and gloom will never materialize. |

|

|

|

|

903

|

Economy / Economics / Re: {Economy} What is happening in Japan?

|

on: July 08, 2022, 08:29:30 PM

|

crime rate related to guns is very low in Japan at present.

Japan's crime rate has always been misleading. If police in japan find a body with cigarette burns and obvious indications of torture. They'll label the case "suicide" if they have no leads. To ensure their statistics for solving cases continue to look good. This trend has been documented for many years. But has not received much publicity. I think edged weapons like knives and swords are preferred tools of violence in japan. Due to them being harder to trace and identify than guns. The yakuza were the main faction of organized crime in japan. Recently, japan passed laws cracking down on yakuza which prevents them from owning phones, having bank accounts and barring them from other essential daily necessities. It would seem the yakuza are being replaced by other forms of organized crime. And perhaps we're seeing indications of this with Shinzo Abe's unfortunate assassination attempt. |

|

|

|

|

904

|

Bitcoin / Bitcoin Discussion / Re: With the hacks and Bitcoin for ransome, who's to be blamed?

|

on: July 08, 2022, 08:15:22 PM

|

Who is to be blamed for funds hacks, data leak/hack?

Statistics claim the majority of electronic data breaches are inside jobs. Disgruntled ex employees or current employees. A good percentage of ransomware attacks involving crypto are state sanctioned attacks credited to north korea. Electronic attacks planned and executed by nations are difficult to defend against. In the past we have also seen the united states and israel credited with carrying out stuxnet attacks on irans uranium fuel centrifuges. There is an arms race of electronic vulnerabilities being collected and stockpiled by countries who have zero day attacks stored in vaults. There are many undocumented and unknown exploits to software applications and operating systems used by millions worldwide. There is simply no defense for it. Being patched up to date, won't defend an undocumented vuln that was never released to the public. Of course governments, intelligence agencies, the corporate sector and approved security practices also factor in. Government and intelligence want backdoors built into everything. The private sector wants monitoring so they can earn extra profits selling end user meta data to the highest bidder. The electronic world is opaque with the inner workings of software and devices being a mystery. If people want things to change, they could push for greater transparency and broadscale adoption of open source code to avoid exploitation and abuse. But I don't think people would recognize the importance. |

|

|

|

|

905

|

Economy / Economics / Re: U.S dollar almost equal to Euro

|

on: July 08, 2022, 08:12:16 PM

|

|

Prices of goods and services matter far more than exchange rates.

To say "the dollar is strong" is a misleading statement. Its only "strong" if its being exchanged for a foreign currency or perhaps precious metals. The average consumer will notice no difference.

I would contend a truly strong dollar would be reflected by prices in stores and gas pumps decreasing. Which is not something we're likely to see anytime soon.

A strong FOREX dollar reflects greater buying demand in contrast to other international currencies.

There is also another aspect to a strong dollar which implies reduced printing of the asset. That's the type of strength we need in the current day economy.

|

|

|

|

|

906

|

Economy / Gambling discussion / Re: Payouts in casinos

|

on: July 08, 2022, 07:52:35 PM

|

|

Bigger and more established casinos can afford to reduce payouts.

While smaller and less established venues may raise payouts in an effort to entice new customers and grow their brand.

Not all slots and roulette machines are built identical. They have their own quirks. Some machines may payout more often. Which will necessitate a lower reward.

Casinos are run differently. Those with a physical location might have a higher upkeep and overhead. Which could reduce payouts. While casinos with an internet only presence may offer higher payouts due to not needing to cover the real estate lease.

There are many different variables in play. All of which gamblers can make work for them.

|

|

|

|

|

907

|

Economy / Economics / Re: Ws and traders language food shortages aka food shorts

|

on: July 06, 2022, 11:59:02 PM

|

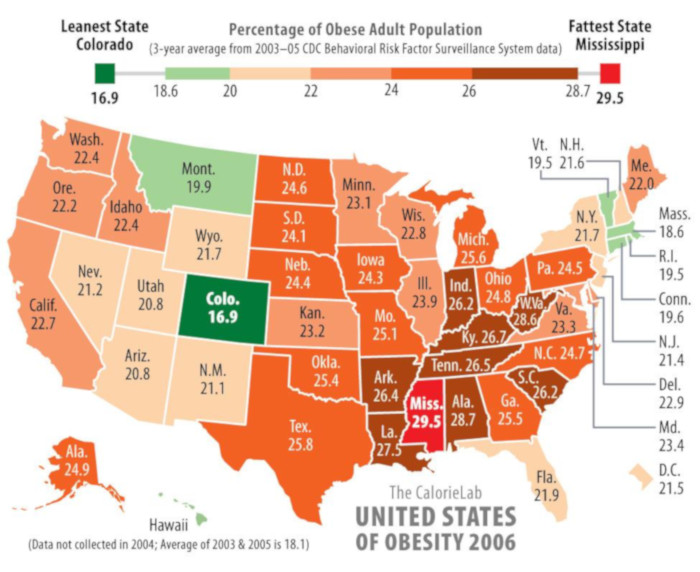

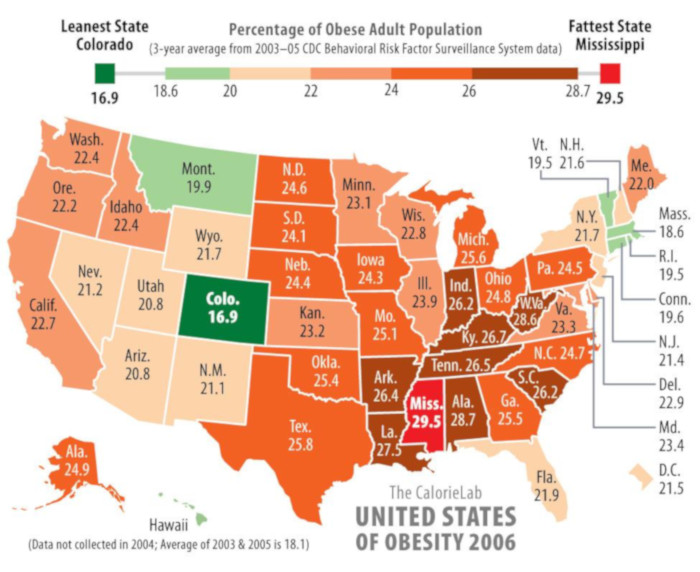

It is a good time for rural residents to grow more and boost production of food. To bring prices down. With food market prices on the rise. Growing (food mining) becomes more profitable. As we have seen more crypto miners focus on bitcoin during peaks. Rising prices should naturally compel farmers to expand operations and grow in higher volumes. When I had COVID. I lost senses of taste and smell. Sense of hunger was also lost. I went 4 or 5 days without feeling the hungry and felt no need to eat anything. It ended up being a 4 to 5 day water fast where I only drank and barely ate anything. This was good for my health. And I looked and felt better afterward.  Image link: https://i.ibb.co/cwYWX8j/unitedstatesofobesity.jpgWhile rising food prices may not be ideal. Hopefully others can find some health benefit to it. |

|

|

|

|

908

|

Economy / Economics / Re: Sensational Push For Cryptocurrencies As US Fed

|

on: July 06, 2022, 11:52:38 PM

|

They recommended that crypto assets be allowed to flourish in the U.S. economy as it would further strengthen the dollar’s status.

I would be interested to know if it is possible for the dollar to significantly strengthen. Without stabilizing fossil fuel prices and inflation. They're proposing to move all passengers and cargo on the titanic to the stern of the ship to stabilize its nose dive, without plugging the hole. The ship is still sinking but the aesthetics will be better, I guess? Whatever moves they make, I doubt they'll cross a line to being more bitcoin friendly than florida, texas and US states which extend positive regulation towards crypto. Ethos of the central bank have always paralleled new york's approach towards crypto. Which has been to make friendly sounding announcements while cracking down hard behind the scenes, banning stablecoins like tether as new york has done. |

|

|

|

|

909

|

Economy / Economics / Re: Why You should not worry about BTC price action

|

on: July 06, 2022, 11:41:39 PM

|

|

What if I said that a certain single entity was responsible for more than 80% of US stock market price trends from the economic crisis in 2008, to the present. And that this same entity could be responsible for as much as 90% of negative bitcoin price movement in 2022.

I don't think people would know or care if it was true. Most don't take the time to recognize or quantify price trends.

There is reason to be concerned over price movement in 2022. I think most of the credible sources recognize the 2022 downtrend in BTC is different from the bust cycles of previous years.

I have seen many acknowledge the interesting trend of many media sources suddenly spamming anti crypto content to coincide with price declines. Sam Bankman-Fried even went so far as to name the biggest trading partner who is behind our recent decline.

|

|

|

|

|

910

|

Economy / Gambling discussion / Re: [CHESS] FIDE Candidates Chess Tournament 2022

|

on: July 06, 2022, 11:35:03 PM

|

The concept still remains extremely curious. The current world champion in classic chess, Magnus Carlsen, does not have to complete any qualifying series and basically only has to play a final against the challenger who wins this tournament. Firouzja started the tournament very badly and basically eliminated himself with that. The notable name I'm missing from this tournament is Anish Giri. Actually, it should be a normal formula, just like playing football. Protective status is ridiculous.

The champion is the biggest draw. His name is the one, people come to see. He draws the largest crowds. Giving the competition the most authenticity and legitimacy. And so they make efforts to give him an advantage in the game. The same thing happens in boxing where names like Canelo are protected and given advantages in judging. It also happens in MMA to an extent. Where the champion in past japanese Pride tournaments would know who they would be fighting. While their opponent would not know until the last second who their opponent would be. It could be considered logistics or statistics, moreso than unfairness to some extent. |

|

|

|

|

911

|

Economy / Gambling discussion / Re: Casino can play a role in changing fortune?

|

on: July 05, 2022, 11:52:13 PM

|

|

I think there definitely is a small sliver of the population who consistently profit from gambling.

Rather than being a suave character smoking a cigar from a movie. They're more likely to be math geeks with spreadsheets and big number crunching algorithms who endlessly pore over game statistics. In a setting and routine most would find tedious and boring.

Over the last 50 years, the quant movement of geeks using math and statistic based logic, have come to dominate asset trading and gambling sectors. Mathematically quantifiable logic has come to surpass gut feelings and intuitive emotional reasoning in ways that can be applied to real world settings to generate consistent results.

Such could represent the most neglected aspect of gambling and investment trading. That there is a side to it which can be learned and taught through practice and training.

|

|

|

|

|

912

|

Economy / Economics / Re: Things are easy to understood now

|

on: July 05, 2022, 11:35:08 PM

|

prices going lower. One solution to diminishing prices that I like. Is an increase of production. Whatever scarcity and inflation can produce, an overabundance might overturn. Scaling up production can also decrease production costs. Corporate profit margins in sectors like oil have done well for themselves. Now we can encourage an expansion of production. Or find alternate means. Perhaps biodiesel can make a comeback. Or ethanol production can be expanded. There are youtube clips of people making their own biodiesel and ethanol. The technology may be viable and openly accessible on an entry level scale. Rampant consumerism we have all seen and lived through. Credit and installment buying. Amazon free shipping. Social media ads targeting text message and microphone keywords. Now is a time for rampant productionism. |

|

|

|

|

913

|

Economy / Economics / Re: Zimbabwe resorts to gold coins as local currency tumbles

|

on: July 05, 2022, 10:58:58 PM

|

|

"Gold is money, everything else is credit." --JP Morgan

Gold being likely to appreciate in value during eras of high inflation and economic recession, solves the basic problem with inflation.

Which is poor to middle class earners lacking access to inflation protected assets which could protect their wealth from inflation devaluation.

Gold isn't a perfect solution. It can be prone towards scams. Metals like tungsten which have a similar density and volume to weight ratio as gold can be used to make counterfeit gold bars and coins. Gold has many known issues.

For the majority of applications gold is still a great candidate for inflation protection.

The big question now is whether other nations will demand support for gold based financial infrastructure and laws.

|

|

|

|

|

914

|

Other / Off-topic / NIST Announces First Four Quantum-Resistant Cryptographic Algorithms

|

on: July 05, 2022, 10:49:41 PM

|

GAITHERSBURG, Md. — The U.S. Department of Commerce’s National Institute of Standards and Technology (NIST) has chosen the first group of encryption tools that are designed to withstand the assault of a future quantum computer, which could potentially crack the security used to protect privacy in the digital systems we rely on every day — such as online banking and email software. The four selected encryption algorithms will become part of NIST’s post-quantum cryptographic standard, expected to be finalized in about two years. “Today’s announcement is an important milestone in securing our sensitive data against the possibility of future cyberattacks from quantum computers,” said Secretary of Commerce Gina M. Raimondo. “Thanks to NIST’s expertise and commitment to cutting-edge technology, we are able to take the necessary steps to secure electronic information so U.S. businesses can continue innovating while maintaining the trust and confidence of their customers.” The announcement follows a six-year effort managed by NIST, which in 2016 called upon the world’s cryptographers to devise and then vet encryption methods that could resist an attack from a future quantum computer that is more powerful than the comparatively limited machines available today. The selection constitutes the beginning of the finale of the agency’s post-quantum cryptography standardization project. “NIST constantly looks to the future to anticipate the needs of U.S. industry and society as a whole, and when they are built, quantum computers powerful enough to break present-day encryption will pose a serious threat to our information systems,” said Under Secretary of Commerce for Standards and Technology and NIST Director Laurie E. Locascio. “Our post-quantum cryptography program has leveraged the top minds in cryptography — worldwide — to produce this first group of quantum-resistant algorithms that will lead to a standard and significantly increase the security of our digital information.” Four additional algorithms are under consideration for inclusion in the standard, and NIST plans to announce the finalists from that round at a future date. NIST is announcing its choices in two stages because of the need for a robust variety of defense tools. As cryptographers have recognized from the beginning of NIST’s effort, there are different systems and tasks that use encryption, and a useful standard would offer solutions designed for different situations, use varied approaches for encryption, and offer more than one algorithm for each use case in the event one proves vulnerable. “Our post-quantum cryptography program has leveraged the top minds in cryptography — worldwide — to produce this first group of quantum-resistant algorithms that will lead to a standard and significantly increase the security of our digital information.” —NIST Director Laurie E. Locascio Encryption uses math to protect sensitive electronic information, including the secure websites we surf and the emails we send. Widely used public-key encryption systems, which rely on math problems that even the fastest conventional computers find intractable, ensure these websites and messages are inaccessible to unwelcome third parties. However, a sufficiently capable quantum computer, which would be based on different technology than the conventional computers we have today, could solve these math problems quickly, defeating encryption systems. To counter this threat, the four quantum-resistant algorithms rely on math problems that both conventional and quantum computers should have difficulty solving, thereby defending privacy both now and down the road. The algorithms are designed for two main tasks for which encryption is typically used: general encryption, used to protect information exchanged across a public network; and digital signatures, used for identity authentication. All four of the algorithms were created by experts collaborating from multiple countries and institutions. For general encryption, used when we access secure websites, NIST has selected the CRYSTALS-Kyber algorithm. Among its advantages are comparatively small encryption keys that two parties can exchange easily, as well as its speed of operation. For digital signatures, often used when we need to verify identities during a digital transaction or to sign a document remotely, NIST has selected the three algorithms CRYSTALS-Dilithium, FALCON and SPHINCS+ (read as “Sphincs plus”). Reviewers noted the high efficiency of the first two, and NIST recommends CRYSTALS-Dilithium as the primary algorithm, with FALCON for applications that need smaller signatures than Dilithium can provide. The third, SPHINCS+, is somewhat larger and slower than the other two, but it is valuable as a backup for one chief reason: It is based on a different math approach than all three of NIST’s other selections. Three of the selected algorithms are based on a family of math problems called structured lattices, while SPHINCS+ uses hash functions. The additional four algorithms still under consideration are designed for general encryption and do not use structured lattices or hash functions in their approaches. While the standard is in development, NIST encourages security experts to explore the new algorithms and consider how their applications will use them, but not to bake them into their systems yet, as the algorithms could change slightly before the standard is finalized. To prepare, users can inventory their systems for applications that use public-key cryptography, which will need to be replaced before cryptographically relevant quantum computers appear. They can also alert their IT departments and vendors about the upcoming change. To get involved in developing guidance for migrating to post-quantum cryptography, see NIST’s National Cybersecurity Center of Excellence project page. All of the algorithms are available on the NIST website. https://www.nist.gov/news-events/news/2022/07/nist-announces-first-four-quantum-resistant-cryptographic-algorithms.... How would people feel if a campaign was made to mandate these cryptographic algorithms as standardized industry practices in everything regarding cryptography. Would people prefer technologies like bitcoin using elliptic curve signatures or these vaunted new quantum resistant algorithms were are regulated and controlled by government agencies. I would be interested to know what public opinion is on everything associated with quantum computers. There is so much marketing behind the multiverse, web3, quantum computers, artificial intelligence and similar movements. We know there is a lot of hype. But how much faith and hope are people investing in these newfangled things. |

|

|

|

|

915

|

Economy / Economics / Re: Can Bitcoin Reduce the Global Wealth and Income Inequalities in 2022?

|

on: July 04, 2022, 08:04:12 PM

|

In the country where I reside the prices of everything are skyrocketing but the income remains the same year to year. Is it still possible that in 2022 Bitcoin can help reduce this wealth and income inequality? Bearing in mind that most people were not early adopters.

Thanks to bitcoin's trustless format, it doesn't rely on wage based employees or bank managers who are trusted to monitor and run day to day operations. This shift in design translates to greater efficiency. Which in turn equates to large sums of money being transferrable across the world at lower cost. The single area of grievance has been transaction time. But that has always been a bit of a misnoner with classifications. Bitcoin was being compared to credit card companies, when it functions closer to a credit union or bank that takes multiple working days to complete transactions. While bitcoin's performance hasn't been ideal with large institutional traders buying and selling it like a stock. And tying its value to indicators and variables that are wholly unrelated to its function. There is still a chance bitcoin could deliver on its potential. It is a very strange scenario. In that many don't seem to care much about the underlying mechanics behind innovations like bitcoin. They only know if the price is going up or down. And don't seem to care much about the motives or conditions behind it. For bitcoin to truly thrive people must know more about it from a design and engineering perspective. |

|

|

|

|

916

|

Economy / Economics / Re: When I started driving.

|

on: July 04, 2022, 07:51:41 PM

|

|

Voltaire is legendary for saying:

"Paper money eventually returns to its intrinsic value: zero."

Almost 2,000 years ago the roman denarius suffered from high inflation.

It is possible that human civilization has experienced more than 2,000 years of currency devaluation and inflation.

It may be the inevitable end result of nearly every monetary system that has ever been devised by humanity.

The power to print money may be too much for mortal minds to bear.

We're lucky to have bitcoin which is probably one of few monetary systems devised to resist devaluation and inflation.

|

|

|

|

|

917

|

Economy / Economics / Re: Unemplyment at least 50% how world will look like then ?

|

on: July 04, 2022, 07:22:47 PM

|

|

I think portugal and spain have both endured youth unemployment statistics near to 50% for their age bracket of 19 to 24. It would seem parts of europe have already achieved 50% unemployment for some segments of the population. Wages rather than unemployment determine prices. It all depends on what consumers can afford to pay.

In africa where the average wage can be as low as $30 per month, prices are low. In other nations with higher average wages, prices will be higher.

Unemployment doesn't have much affect on prices. And cities are generally becoming less friendly and hospitable towards unemployed and homeless populations as time passes.

|

|

|

|

|

918

|

Economy / Economics / Re: Fashion Brands uses Blockchain Technology

|

on: July 04, 2022, 07:17:07 PM

|

The platform leverages blockchain technology, which has the features of transparency and immutability to ensure that consumers of the brands are buying original copies. So its being used to protect the data integrity of luxury item production and distribution. To cut down on counterfeit copycats and imitation wares. The medial marijuana industry did something similar in years past. Where the production and distribution of THC products were recorded in a blockchain ledger to verify their legitimacy and integrity. These apps are on private blockchains to deter unwanted 51% attacks. It would appear blockchain technology is well suited for these types of applications. As matson, walmart and others have used them for years without apparent issue. |

|

|

|

|

919

|

Economy / Gambling discussion / Re: Finding value bets

|

on: July 04, 2022, 07:10:25 PM

|

Last night, Djokovic, one of the best tennis players on grass out there (potentially he is the favorite to win in Wimbledon) - had odds of 1.25 at peak against Timmy, after Timmy won one set.

Would you see that 1.25 as a value bet or not? I would look at their game history. And see how consistently they win sets 1, 2, 3, 4, etc. And by how many points. Then I would look at their opponent's game history and check for the same stats. How strong both players were in the 2nd set. Would determine whether it was value enough to pursue. 1.25 bets need to be hit with around 80% accuracy to break even. You can lose 1 in 5 bets at 1.25 odds and break even. |

|

|

|

|

920

|

Economy / Economics / Re: Uganda’s gold discovery: What it could mean for crypto !!!

|

on: July 02, 2022, 11:42:32 PM

|

|

Apple co founder Steve Wozniak remarked upon science devising better methods to detect and extract gold from the earth's crust. As science progresses the state of gold mining will progress. While the rate of bitcoin mining will essentially remain the same, no matter what progress is made with moore's law. That is a great overview of supply side contrasts separating BTC and precious metals.

It is also possible that asteroid mining could someday become a reality. With asteroids containing many metric tons of precious metals being harvested to increase the supply of gold, silver, platinum and precious metals on earth.

Gold and precious metals today are not great tokens of exchange as they cannot be stored and shipped easily in larger quantities. They also cannot easily have fractional amounts shaved off ingots of gold or silver to pay for a cup of coffee and other retail expenses. The increasing price of oil, shipping and transportation only contribute to these disadvantages.

Uganda is not the only nation to have recently discovered precious raw material reserves. It is also claimed that afghanistan contains trillions of dollars worth of raw materials. The discovery of these deposits does not guarantee an industry will arise which will harvest resources. It seems that the current trend is shifting towards non exploitation of reserves, rather than the opposite.

|

|

|

|

|