|

1141

|

Economy / Economics / Re: Russia announced a default on foreign obligations!!!

|

on: April 11, 2022, 06:02:54 PM

|

The article I saw on CNN said russia paid its foreign debt in rubles rather than us dollars. Russia has defaulted on its foreign debt, says S&PLondon (CNN Business)Russia has defaulted on its foreign debt because it offered bondholders payments in rubles, not dollars, credit ratings agency S&P has said. Russia attempted to pay in rubles for two dollar-denominated bonds that matured on April 4, S&P said in a note on Friday. The agency said this amounted to a "selective default" because investors are unlikely to be able to convert the rubles into "dollars equivalent to the originally due amounts." https://www.cnn.com/2022/04/11/investing/russia-default-sp/index.html Which the S & P called a default. But it can still be worked out and a settlement made. |

|

|

|

|

1142

|

Economy / Economics / Re: Will sanctions force Russia to create a CBDC of its own?

|

on: April 09, 2022, 02:38:02 PM

|

How do you think Russia's economy will fare in the next 5-10 years? Russia seeks to become larger, wealthier and more powerful. While opposition forces seek to keep russia poor and contained. Over the next 5-10 years, both sides will maneuver and make adjustments to gain an advantage. Whichever side does a better job of it will emerge victorious. In a traditional war, russia would dominate the land war, while SWIFT bans and economic sanctions would dominate the economic war. But it appears we're living in a new era now. Russian tanks aren't the dominant force they were 50 years ago. Drones, IEDs, laser guided artillery and other new developments are changing war significantly. SWIFT and economic sanctions aren't the dominant power they were 50 years ago either. Digital currencies and crypto have also shifted the worlds of finance and economics. Whoever is willing to change and adapt quicker could gain the upper hand here IMO. Conventional wisdom is becoming outdated and obsolete at a faster rate in contrast to previous eras of history. |

|

|

|

|

1143

|

Economy / Economics / Tesla, Block and Blockstream team up to mine bitcoin off solar power in TX

|

on: April 09, 2022, 02:15:02 PM

|

MIAMI — Blockstream and Jack Dorsey’s Block, formerly Square, are breaking ground on a solar- and battery-powered bitcoin mine in Texas that uses solar and storage technology from Tesla. Tesla’s 3.8 megawatt solar PV array and 12 megawatt-hour Megapack will power the facility. Blockstream co-founder and CEO Adam Back, a British cryptographer and a member of the “cypherpunk” crew, told CNBC on the sidelines of the Bitcoin 2022 conference in Miami that the mining facility is designed to be a proof of concept for 100% renewable energy bitcoin mining at scale. “People like to debate about the different factors to do with bitcoin mining. We figured, let’s just prove it. Have an open dashboard so people can play along, maybe it can inform other players to participate,” Back said. The dashboard will be publicly accessible and show real-time metrics of the project’s performance, including power output and total bitcoin mined. The company said a later version of the dashboard will also include solar and storage performance data points. “This is a step to proving our thesis that bitcoin mining can fund zero-emission power infrastructure and build economic growth for the future,” Back said. Improving the economics of renewablesWest Texas is a mecca of renewable energy in the United States. “You get this perfect overlap with both sun quality and wind speed in West Texas,” said Shaun Connell, executive vice president of power at Houston-based tech company Lancium. But a lot of that wind and solar power is concentrated in remote parts of the state. With no financial incentive, there’s little reason to build out renewable infrastructure to harness this energy. Enter bitcoin miners. When these energy buyers co-locate with renewables, it creates a financial incentive for buildout and improves the core economics of renewable power production, which has been fraught with volatility. Miners provide demand to these semi-stranded assets and make renewables in Texas economically viable, according to Castle Island Venture’s Nic Carter. The constraint is that West Texas has roughly 34 gigawatts of power, five gigawatts of demand, and only 12 gigawatts of transmission. You can think of bitcoin miners as temporary buyers who keep the energy assets operational until the grid is able to fully absorb them. Back said the off-grid mine, expected to be completed later this year, highlights another key tenet of the bitcoin network: Miners are location agnostic and can “do it from anywhere without local infrastructure.” Should the project prove profitable in its pilot stage, Back said, the companies would add wind power to the mix and scale the entire project. “You’re making a sort of calculation of the optimal economic mix between solar and battery,” Back said. “There’s 3.8 megawatts of solar and one megawatt of mining, so you can see you have to overprovision, because the peak solar input varies during the day and, of course, it’s not there at night.” Adding wind to the mix, however, would reduce overall costs and help to balance out the downtime with solar. Ultimately, Blockstream said, a key goal is to strengthen the bitcoin network by diversifying the cryptocurrency’s energy sources. “By collaborating on this full-stack, 100% solar-powered bitcoin mining project with Blockstream, using solar and storage technology from Tesla, we aim to further accelerate bitcoin’s synergy with renewables,” said Neil Jorgensen, global ESG lead at Block and project lead for Block’s Bitcoin Clean Energy Initiative. https://www.cnbc.com/2022/04/08/tesla-block-blockstream-to-mine-bitcoin-off-solar-power-in-texas.html.... They plan to make all of their key datapoints publicly accessible so that it can be used as a benchmark for future crypto mining ops: The dashboard will be publicly accessible and show real-time metrics of the project’s performance, including power output and total bitcoin mined. The company said a later version of the dashboard will also include solar and storage performance data points The following is interesting and informative. Miners provide demand to these semi-stranded assets and make renewables in Texas economically viable, according to Castle Island Venture’s Nic Carter.

The constraint is that West Texas has roughly 34 gigawatts of power, five gigawatts of demand, and only 12 gigawatts of transmission. You can think of bitcoin miners as temporary buyers who keep the energy assets operational until the grid is able to fully absorb them. Last but not least, their approach highlights the multi megawatt hour sized battery needed to make solar power feasible. The massive grid tied battery stores energy during peak sunlight hours of solar generation, which can be used to power night time hours as well. Former twitter CEO Jack Dorsey and Elon Musk appear to be collaborating on this project. Could this set the stage for future joint projects? Or are their personalities more likely to clash? |

|

|

|

|

1144

|

Bitcoin / Bitcoin Discussion / Re: UFC fighters will get their bonus pay by Bitcoin

|

on: April 08, 2022, 12:47:26 PM

|

|

The UFC is doing a good job running their business. They have since the very beginning. Chuck Liddell, Forrest Griffin and Matt Hughes all had high paying jobs with the UFC after they retired where they literally didn't have to do anything. Unfortunately, after being acquired by WME-IMG Hughes and Liddell were removed from their positions and Forrest was the only one left as he was the only one who actually showed up to work and did the job.

Dana paid out of his pocket for many medical procedures fighters have needed over the years. He covered the cost of Stefan Struve's heart surgery and for Leslie Smith to have tumors removed. He has also covered the cost for the surgery of trainers at tiger muay thai and in other cases I don't remember.

All major MMA promotions that competed with the UFC are gone now. Pride is gone, strikeforce as well, WEC, affliction. They all sold their business or folded. Only the UFC remains.

I hope people appreciate the good job Dana and the UFC does, without them MMA could have been dead a long time ago.

|

|

|

|

|

1145

|

Economy / Economics / Re: Lets be honest sanctions and all others problems

|

on: April 08, 2022, 12:39:04 PM

|

|

What of issues on the supply side such as scarcity of commodities and necessities in global supply chains.

Issues of transportation and shipping associated with high fuel prices, which greatly trickle down to elevate the cost of pesticides, herbicides and fertilizers due to all 3 being strongly derived from fossil fuels.

Greater liquidity won't decrease fuel and transportation costs. Or spontaneously generate a greater supply of food products to reduce scarcity leading to elevated demand.

It may be that we must look elsewhere to solve our problems and be prepared for them to worsen rather than be resolved.

|

|

|

|

|

1146

|

Other / Politics & Society / Re: Is Putin at risk of being stopped by his own military Generals

|

on: April 08, 2022, 12:22:59 PM

|

|

Putin's generals are looting and pillaging ukraine as they invade. Increasing their personal wealth, power and prosperity.

Being in a position of power and influence, they may also be accepting bribes from the united states, NATO and other parties. Which could explain some of the more bizarre and irrational moves the russian army has made. Digging trenches in radioactive chernobyl for one. Of course, they say never attribute to malice that which can be explained by incompetence. There isn't necessarily a conspiracy in place. Its simply the idle workings of my mind trying to assemble the puzzle pieces of what Zelensky did with the billions funneled to him by the USA.

None of the russian general have the influence and fame to directly challenge Putin, in my opinion. There isn't anyone famous enough, who the russian people adore enough to make that move.

And why would they want to challenge Putin when they can loot and pillage ukraine to increase their own personal wealth simply by following orders.

|

|

|

|

|

1147

|

Economy / Economics / Re: Nigeria Economy before and Now after cryptocurrency Ban.

|

on: April 07, 2022, 12:19:49 PM

|

SOLUTION

therefore what the Federal Government and central Bank of Nigeria should have done is find a way to regulate cryptocurrency and it activities

A ban on crypto trading is a form of regulation. I think what you mean is, regulators might have tried for a more even and fair type of regulation. As opposed to adversarial and heavy handed banning. If I remember right, nigerian regulators were surprised at the response and aftermath of the bans they themselves implemented. Perhaps what is needed are better regulators who better understand crypto markets, who can better predict outcomes. African nations like zimbabwe are known for hyperinflation and negative economic conditions. Good leadership at the highest levels is not common there. Good leadership is becoming less common around the world as we speak. This negative trend reduces the reliability of regulation, across the board, unfortunately. |

|

|

|

|

1148

|

Economy / Economics / Re: Bad economy is not good for either super rich or very rich

|

on: April 07, 2022, 12:10:51 PM

|

|

Many rich and powerful today have fortified underground bunkers to retreat to in the event of an emergency. They can collect their families and travel to these bunkers quickly via their own private helicopters or jets. They have stockpiles of food and creature comforts to wait out some types of crisis.

The biggest fear for the rich and powerful has to be looting by armies like russia's or organized crime. Having amassed considerable wealth could make them a target and placed unwanted attention on their heads. Many wealthy mansions were looted during World War II and other crisis. They are prime targets of rampaging armies and organized criminal factions when order and civilization break down.

I guess the real question is, whether order and civilization would return in the event it was ever lost. How long would it take. What format would post crisis civilization resemble.

The issue with crisis and war is it could easily spiral out of control, to a point where the outcome became entirely unpredictable and uncontrollable. If communists ever take over the world, I would hope for it to be a relatively clean and orderly transition that was humane and clean. Rather than an ugly business where considerable life and destruction of properly occurred. Maybe there is no former option, but I can dream.

|

|

|

|

|

1149

|

Economy / Economics / Re: Economic consequences of Russian-Ukraine War

|

on: April 07, 2022, 11:43:00 AM

|

|

During times of crisis: suicide rates, drug overdoses, theft, homicides and crime dramatically rise. Homeless encampments swell in size. Migration rates increase, driven by refugees seeking to escape bad living conditions.

It happened during the 2008 economic crisis and COVID as well.

Having witnesed the effects of dependence on russian oil and uranium fuel, nations could seek to become more independent on local suppliers in an effort to depend less on global markets. The way that americans once sought to reduce dependence on oil from the middle east. Perhaps this is an outdated and obsolete mentality. People today don't seem to care much if they depend on foreigners for essentials.

The united states served for many years as a global police force. As the US dollar declines in its role as an international reserve currency, america's role as global police could also decline.

|

|

|

|

|

1151

|

Economy / Economics / Re: Russian oligarchs and economy 2022 and 1929 similar years

|

on: April 06, 2022, 11:24:07 PM

|

|

It seems that reliance and dependency, turn into leverage in times of crisis. Being reliant upon russian oil or global supply chains can be weaknesses.

There is a classic and cynical story about a man who treats women well, until they're married and she depends on him. Then there's no reason for him to pretend to be nice anymore. He has all the leverage in the relationship allowing him to become a tyrant and oppressor if he so chooses. The woman must tolerate the abuse as she has no one else she can turn to.

We could be witnessing something similar on a global scale. Where dependence on corporations & governments is being exploited. The way that russians exploit dependency on oil, and other dependencies are becoming avenues of attack.

Relying as little as possible on corporations or governments could be a good ideology to pursue.

If everyone lived on a self sufficient farm, it would certainly give corporations and governments reduced leverage and control over us.

|

|

|

|

|

1152

|

Economy / Economics / Re: New Financial Year Begins | Are you ready?

|

on: April 05, 2022, 11:58:33 PM

|

|

I do some oddball things as far as financial planning go.

At the moment I'm saving all of my beverage cans and bottles. 2 liter bottles can have holes drilled in the bottom to use as holders for plants. Soda cans are aluminum which can be used for a few different things. Aluminum cans be flattened into sheets and used to make embossed artwork. They can also be used to make cooling fins for heatsinks, windmill blades, etc. Aluminum as a material has good thermal conductivity and dissipation which can make it well suited as a water condenser. In an emergency, a condenser might be used to condense evaporated air from water to produce water -- which would then need to be filtered and perhaps distilled. But water nonetheless.

Scanning youtube, there appear to be other uses for 2 liter bottles aside from imporivised pots for plants. There are some who use them as tanks for pressurized air and improvised piping.

So it would seem that I save things most would consider trash and try to scavenge some degree of functionality from them, which could be used in an apocalyptic event. Which is kind of meh.

I've also bought things like sewing machines and other junk I don't know how to use, and have no experience with, which could be useful if supply chains had issues and other crisis arose.

|

|

|

|

|

1153

|

Economy / Economics / Gold-backed ruble could be a game-changer

|

on: April 05, 2022, 11:44:41 PM

|

Linking the currency to gold and energy is a paradigm shift for the global economy, a precious metals analyst tells RTThe Bank of Russia has resumed gold purchases this week, but more importantly, the regulator is doing so at a fixed price of 5,000 rubles ($59) per 1 gram between March 28 and June 30, raising the possibility of Russia returning to the gold standard for the first time in over a century. If the country takes the next step, as has been proposed this week, to sell its commodities priced in rubles, these combined moves could have huge implications for the ruble, the US dollar, and the global economy. To get some answers, RT spoke to precious metals analyst Ronan Manly at BullionStar Singapore. — Why is setting a fixed price for gold in rubles significant?By offering to buy gold from Russian banks at a fixed price of 5,000 rubles per gram, the Bank of Russia has both linked the ruble to gold and, since gold trades in US dollars, set a floor price for the ruble in terms of the US dollar. We can see this linkage in action since Friday 25 March when the Bank of Russia made the fixed price announcement. The ruble was trading at around 100 to the US dollar at that time, but has since strengthened and is nearing 80 to the US dollar. Why? Because gold has been trading on international markets at about US$62 per gram which is equivalent to (5,000 / 62) = about 80.5, and markets and arbitrage traders have now taken note, driving the RUB/USD exchange rate higher. So the ruble now has a floor to the US dollars, in terms of gold. But gold also has a floor, so to speak, because 5,000 rubles per gram is 155,500 rubles per troy ounce of gold, and with a RUB/USD floor of about 80, that’s a gold price of around $1,940. And if the Western paper gold markets of LBMA/COMEX try to drive the US dollar gold price lower, they will have to try to weaken the ruble as well or else the paper manipulations will be out in the open. Additionally, with the new gold to ruble linkage, if the ruble continues to strengthen (for example due to demand created by obligatory energy payments in rubles), this will also be reflected in a stronger gold price. — What does it mean for oil?Russia is the world’s largest natural gas exporter and the world’s third largest oil exporter. We are seeing right now that Putin is demanding that foreign buyers (importers of Russian gas) must pay for this natural gas using rubles. This immediately links the price of natural gas to rubles and (because of the fixed link to gold) to the gold price. So Russian natural gas is now linked via the ruble to gold. The same can now be done with Russian oil. If Russia begins to demand payment for oil exports with rubles, there will be an immediate indirect peg to gold (via the fixed price ruble – gold connection). Then Russia could begin accepting gold directly in payment for its oil exports. In fact, this can be applied to any commodities, not just oil and natural gas. — What does that mean for the price of gold?By playing both sides of the equation, i.e. linking the ruble to gold and then linking energy payments to the ruble, the Bank of Russia and the Kremlin are fundamentally altering the entire working assumptions of the global trade system while accelerating change in the global monetary system. This wall of buyers in search of physical gold to pay for real commodities could certainly torpedo and blow up the paper gold markets of the LBMA and COMEX. The fixed peg between the ruble and gold puts a floor on the RUB/USD rate but also a quasi-floor on the US dollar gold price. But beyond this, the linking of gold to energy payments is the main event. While increased demand for rubles should continue to strengthen the RUB/USD rate and show up as a higher gold price, due to the fixed ruble - gold linkage, if Russia begins to accept gold directly as a payment for oil, then this would be a new paradigm shift for the gold price as it would link the oil price directly to the gold price. For example, Russia could start by specifying that it will now accept 1 gram of gold per barrel of oil. It doesn’t have to be 1 gram but would have to be a discounted offer to the current crude benchmark price so as to promote take up, e.g. 1.2 grams per barrel. Buyers would then scramble to buy physical gold to pay for Russian oil exports, which in turn would create huge strains in the paper gold markets of London and New York where the entire ‘gold price’ discovery is based on synthetic and fractionally-backed cash-settled unallocated ‘gold’ and gold price ‘derivatives. — What does it mean for the ruble?Linking the ruble to gold via the Bank of Russia’s fixed price has now put a floor under the RUB/USD rate, and thereby stabilized and strengthened the ruble. Demanding that natural gas exports are paid for in rubles (and possibly oil and other commodities down the line) will again act as stabilization and support. If a majority of the international trading system begins accepting these rubles for commodity payments arrangements, this could propel the Russian ruble to becoming a major global currency. At the same time, any move by Russia to accept direct gold for oil payments will cause more international gold to flow into Russian reserves, which would also strengthen the balance sheet of the Bank of Russia and in turn strengthen the ruble. Talk of a formal gold standard for the ruble might be premature, but a gold-backed ruble must be something the Bank of Russia has considered. — What does it mean for other currencies?The global monetary landscape is changing rapidly and central banks around the world are obviously taking note. Western sanctions such as the freezing of the majority of Russia’s foreign exchange reserves while trying to sanction Russian gold have now made it obvious that property rights on FX reserves held abroad may not be respected, and likewise, that foreign central bank gold held in vault locations such as at the Bank of England and the New York Fed, is not beyond confiscation. Other non-Western governments and central banks will therefore be taking a keen interest in Russia linking the ruble to gold and linking commodity export payments to the ruble. In other words, if Russia begins to accept payment for oil in gold, then other countries may feel the need to follow suit. Look at who, apart from the US, are the world’s largest oil and natural gas producers - Iran, China, Saudi Arabia, UAE, Qatar. Obviously, all of the BRICS countries and Eurasian countries are also following all of this very closely. If the demise of the US dollar is nearing, all of these countries will want their currencies to be beneficiaries of a new multi-lateral monetary order. — What does this mean for the US dollar?Since 1971, the global reserve status of the US dollar has been underpinned by oil, and the petrodollar era has only been possible due to both the world’s continued use of US dollars to trade oil and the USA’s ability to prevent any competitor to the US dollar. But what we are seeing right now looks like the beginning of the end of that 50-year system and the birth of a new gold and commodity backed multi-lateral monetary system. The freezing of Russia’s foreign exchange reserves has been the trigger. The giant commodity strong countries of the world such as China and the oil exporting nations may now feel that now is the time to move to a new more equitable monetary system. It’s not a surprise, they have been discussing it for years. While it’s still too early to say how the US dollar will be affected, it will come out of this period weaker and less influential than before. — What are the ramifications?The Bank of Russia’s move to link the ruble to gold and link commodity payments to the ruble is a paradigm shift that the Western media has not really yet grasped. As the dominos fall, these events could reverberate in different ways. Increased demand for physical gold. Blowups in the paper gold markets. A revalued gold price. A shift away from the US dollar. Increased bilateral trade in commodities among non-Western counties in currencies other than the US dollar. https://www.rt.com/business/553099-gold-backed-ruble-gamechanger-west/ .... I am skeptical of claims russia will back the ruble with gold. Other nations have made similar announcements in the past only a few years ago. Gold-backed yuan may challenge flagging dollar AUGUST 12, 2020 One of President Xi Jinping’s top priorities is increasing the yuan’s role in global trade. That, of course, would mean making the currency fully convertible and foregoing all capital controls – things that aren’t going to happen in 2020. All this has observers getting creative. Among them is economist Liu Shanen, secretary-general at the Beijing Gold Economic Development Research Center. In a recent interview with news portal Guancha, Liu detailed a plan to “revive the gold standard” as the US dollar loses luster. https://asiatimes.com/2020/08/gold-backed-yuan-may-challenge-flagging-dollar/ So it seems we have proposals made by china and russia to back their currencies with gold over the last 2 years. As part of a strategy to quicken their replacement of the US dollar as a diminishing global reserve currency. Economic sanctions and financial war waged against russia could serve as incentive for them to fast track their adoption of a gold standard before china does. This appears to be one aspect of russia's economic situation which is being neglected atm which could use some attention from crypto and precious metals sectors. |

|

|

|

|

1154

|

Economy / Gambling discussion / Re: Free Gambling Course provided by OnlineGambling

|

on: April 05, 2022, 09:10:50 PM

|

According to the Wikipedia blackjack is described as : Blackjack is a casino banking game. The most widely played casino banking game in the world, it uses decks of 52 cards and descends from a global family of casino banking games known as Twenty-One. This family of card games also includes the British game of Pontoon and the European game, Vingt-et-Un The card game sabacc in star wars also derives from blackjack. https://www.starwars.com/databank/sabaccThe math, probability and strategy behind card games can be interesting and deep. If online gambling amassed a good course on the topic, it definitely would be compelling material. The foundational fundamentals of it could also be applied to investment and trading of assets. The book "Beat The Dealer" by Ed Thorp focuses primarily on blackjack math and strategy and is known as a very recommended piece of content for aspiring wallstreet investors and traders. |

|

|

|

|

1155

|

Economy / Economics / Re: How did we all get here?

|

on: April 04, 2022, 07:52:18 PM

|

Some might find the following interesting. David M. Walker (born October 2, 1951) served as United States Comptroller General from 1998 to 2008, and is founder and CEO of the Comeback America Initiative (CAI) from 2010–2013. In the national press, Walker has been a vocal critic of profligate spending at the federal level. In Fortune magazine, in 2008 he warned that "from Washington, we'll need leadership rather than laggardship".[11] In another op-ed in the Financial Times, he argued that the credit crunch could portend a far greater fiscal crisis;[12] and on CNN, he said that the United States is "underwater to the tune of $50 trillion" in long-term obligations.[13] He compared the thrift of Revolutionary-era Americans, who, if excessively in debt, would "merit time in debtors' prison", with modern times, where "we now have something closer to debtors' pardons, and that's not good".[14][15] In the fall of 2012, the Comeback America Initiative led a campaign called the "$10 Million a Minute" Bus Tour. The tour covered about 10,000 miles and stopped at universities, technical colleges, businesses, and more in over a dozen states. The tour's goal was to bring national attention to the economic and fiscal challenges that face our nation and various nonpartisan solutions that should be able to gain bipartisan support. Along with former Fed Vice Chairman Alice Rivlin, Walker danced the Harlem Shake in a video produced by The Can Kicks Back, a nonpartisan group that attempted to organize millennials to pressure lawmakers to address the United States' then $16.4 trillion debt.[16] https://en.wikipedia.org/wiki/David_M._Walker_(U.S._Comptroller_General)#Campaign_for_fiscal_responsibility I thought the national debt was important back around 2012 when David Walker was making his nationwide tour on potential negative long term consequences of the US deficit. Most were thoroughly convinced the deficit would have zero impact on their quality of life. Despite coverage from many big name publications and media sources, people choose to ignore the warning signs. |

|

|

|

|

1156

|

Economy / Economics / Re: WTF? Food prices expected to raise up to 50% in German supermarket.

|

on: April 04, 2022, 07:36:55 PM

|

Farmers in europe have protested negative conditions there for many years. Greek Farmers on Tractors Protest 'Unbearable' Fuel, Fertilizer CostsMarch 18, 2022 ATHENS (Reuters) - Hundreds of Greek farmers, some on tractors, protested in Athens on Friday, demanding more tax cuts and subsidies to combat high fuel and fertilizer prices which have soared since Russia's invasion of Ukraine. The farmers, who staged weeks of protests over high energy prices earlier this year, say their costs are so high they will be forced to produce less and also raise prices for consumers. The government has so far spent about 3.7 billion euros ($4.08 billion) since September to alleviate pain from soaring energy and fuel costs for farmers, households and businesses. It cut a sales tax on fertilisers by 46% to 13% and on Thursday announced it would be lowered further, to 6%, and also announced a tax rebate on fuel for agricultural vehicles. Farmers say the measures do not go far enough and everything has become too expensive, from fuel to animal feed. https://www.usnews.com/news/world/articles/2022-03-18/greek-farmers-on-tractors-protest-unbearable-fuel-fertilizer-costs Now it seems, negative financial issues farmers have can no longer be contained and are beginning to spillover into consumer markets. Farmers in europe have been strained with difficulty remaining liquid for more than a decade. Italian farmers protest against 'sub-quality' imported foodsTue 6 Jul 2010 Demonstration sparked after imported batches of white mozzarella turned blue because of bacterial contamination Thousands of Italian farmers and farm activists today gathered at the Italian border with Austria to protest against the importing of what they said were sub-quality foods purporting to be from Italy. The protest, at the Brenner pass through the Alps, was sparked by the blue mozzarella scandal, in which imported batches of the creamy white cheese – a food Italians consider to be one of their country's hallmarks – turned blue because of bacterial contamination. https://www.theguardian.com/world/2010/jul/06/italian-farmers-protest-imported-food As an american, I remember seeing many clips on youtube of european farmers protesting in their tractors. Over a long span of years. Unfortunately, I do not remember exactly what the fundamental motives were for the protests. |

|

|

|

|

1157

|

Economy / Economics / Re: Read If you are between 18 and 68 years old!

|

on: April 04, 2022, 07:27:46 PM

|

|

Everyone should read a few books on financial planning. The statistics and basic information they offer are mind blowing and vital for life. Schools should adopt courses on these topics as basic curriculum. Youth can definitely get a headstart by educating themselves on financial plans. Not venturing into those areas, is like running a race with a late start behind everyone else.

There are so many people I see who are older than 30 who don't understand what a credit score does, or how it can affect monthly payments on their real estate, car or education loans. Many never learn the basics about finance or money, its like playing a game without knowing the rules. Many set themselves back by not knowing the fundamentals.

Its great how bitcoin and crypto have opened peoples eyes to the opportunities that are available. It encouraged many to leave their comfort zone and venture out into areas of investment and finance they might never have bothered with, otherwise. There are many who believe stock markets and any investment aside from having a job is a scam designed to rob them. And its sad to see, as many opportunities are missed by having this type of mentality.

|

|

|

|

|

1158

|

Economy / Economics / Re: The first country in Europe to pay for gas to Russia in rubles

|

on: April 04, 2022, 06:49:54 PM

|

It can be said that European sanctions against Russia have failed. It should be mentioned russia is also the #1 exporter of uranium fuel for nuclear power plants. Russia leads the world at nuclear-reactor exportsChina is its only real competitor THE nuclear power industry, which had been in the doldrums since the 1980s, suffered a devastating blow in 2011 when a tsunami engulfed the Fukushima power plant in Japan, ultimately causing a meltdown. The amount of electricity generated by nuclear power worldwide plunged 11% in two years, and has not recovered since. Within this declining industry, one country now dominates the market for design and export of nuclear plants: Russia. Flat domestic demand for electricity has curtailed construction of new plants at home, so Rosatom, Russia’s state-owned nuclear-power company, has been flogging its wares abroad. It is focused on what some call the “great grand middle”: countries that are close allies of neither the United States nor Russia. In April Russia started building Turkey’s first nuclear plant, worth $20bn. Its first reactor is due for completion in 2023. Rosatom says it has 33 new plants on its order book, worth some $130bn. A dozen are under construction, including in Bangladesh, India and Hungary. https://www.economist.com/graphic-detail/2018/08/07/russia-leads-the-world-at-nuclear-reactor-exports If sanctions are to have a chance of success, perhaps russia's global monopoly of the nuclear fuel market can be addressed. It is premature to say if sanctions can succeed. Many different things can still happen, that will alter the course of events.  The russian ruble appears on a path to recovery. While the vatican may not be buying rubles, to stabilize its value, it would appear someone out there is. |

|

|

|

|

1159

|

Economy / Economics / Re: Ukraine VS Russia. Ideological or Economical conflict?

|

on: April 04, 2022, 06:25:53 PM

|

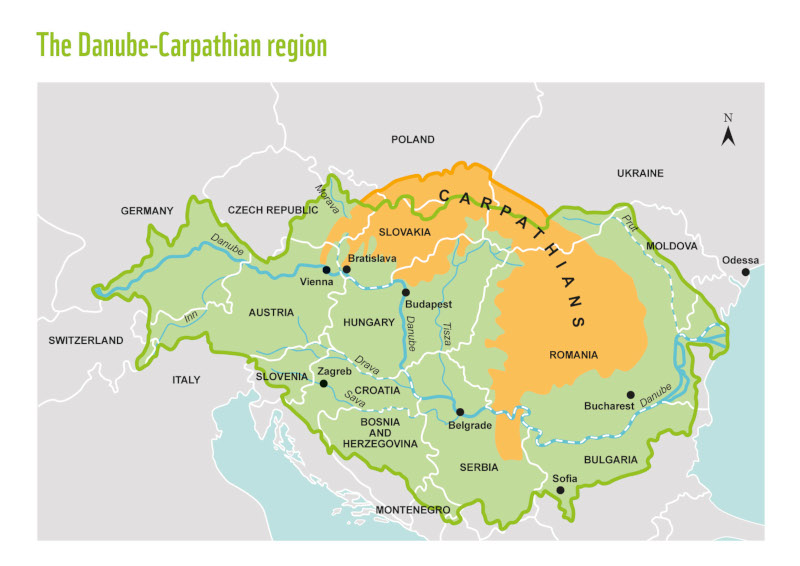

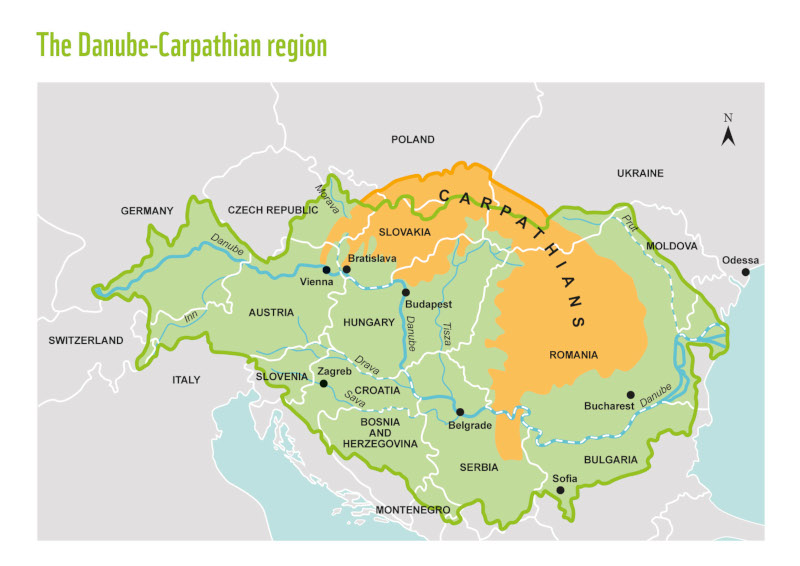

Some might find the following interesting. Ukraine: The breadbasket of EuropeJanuary 13, 2020 Ukraine increased its grain exports by 34 per cent to 31.1 million tonnes in the 2019-20 July-June season, helped by higher wheat and corn exports, the country’s Ministry for Development of Economy, Trade, and Agriculture has revealed. Wheat exports rose by 4.5 million tonnes to 14.99 million tonnes, while the country also exported 3.7 million tonnes of barley and 12 million tonnes of corn. Ukraine harvested a record 74 million tonnes of grain this year compared with 70 million tonnes in 2018. Figures from the European Commission also suggest that agriculture in Ukraine is booming: the country was the third largest supplier of agricultural produce to the European Union in the period November 2018 – October 2019, exporting 7.26 billion euros worth of produce to the EU during the 12-month period, behind only the US and Brazil. https://emerging-europe.com/business/ukraine-the-breadbasket-of-europe/ It appears ukraine is the 3rd largest supplier of agricultural produce to the european union. If Putin was able to invade ukraine, he would own a good percentage of EU oil consumption and agricultural produce.  The Carpathian Mountains are a good natural defense. Putin asked for land behind this mountain range, if I remember correctly. There is a famous story about Putin's childhood circulating in the media. As a child Putin cornered a rat. The rat was boxed in and had no path to escape. It decided to attack Putin. Pundits claimed that Putin had come full circle in his life by eventually becoming the cornered rat, himself. I'm not certain I believe that but it is an interesting observation. |

|

|

|

|

1160

|

Economy / Economics / Re: Russia wants to build a new world order with China

|

on: April 01, 2022, 10:49:24 PM

|

High inflation rates weaken USD dominance for sure but are it really possible to replace USD as a reserve currency or the USA will allow that so easily? It is key here to note how bitcoin is considered a trustless financial network. While traditional finance and economics revolve around trust based systems. In a trust based design paradigm, the world's reserve currency, is simply the one people of the world trust the most. In the current era the US dollar was considered the most stable, reliable and trustworthy currency in the world. These specific circumstances led to it being adopted as the international reserve currency. Over time, if the united states economy and its fundamentals shift to becoming less reliable, trust in the US dollar will erode as well. This can be reflected in numerous de-dollarization programs implemented by japan and china who have dumped holdings of US bonds. While the US dollar is less trusted than it was at its peak, this does not mean that russia and china will take over. The international reserve currency is a precedent built on trust, stability and brand name recognition. I'm not certain that people of the world have much trust in either russia or china at the moment. |

|

|

|

|