The rise of cryptocurrencies in recent years has presented a new group of instruments in which to store wealth, albeit far more volatile The Turkish lira has become so volatile that Turks have ditched the local currency for assets with an even riskier reputation: cryptocurrencies. While the lira unraveled against the dollar in the last quarter of 2021, cryptocurrency trading volumes using the lira leapt to an average $1.8 billion a day across three exchanges, according to blockchain analytics firm Chainalysis. Those volumes are still modest compared with the results of a 2019 survey by the Bank for International Settlements that found roughly $71 billion of lira transactions a day, but even so are more than any of the preceding five quarters. Turks are particularly enamored of the stablecoin tether, whose value is pegged to the dollar. The lira this fall became the most traded government-issued currency against tether, outpacing the dollar and the euro, according to data provider CryptoCompare. Turks have long weathered spells of economic turmoil by keeping their money in U.S. dollars, euros or gold. The rise of cryptocurrencies in recent years has presented a new group of instruments in which to store wealth, albeit far more volatile. Since September, the lira has lost 40% of its value against the dollar. Bitcoin initially jumped almost 40% against the dollar by early November, but is now down more than 10%. In Istanbul, Turkey’s largest city and its commercial capital, ads for cryptocurrency exchanges appear on trams, billboards and one of the city’s two airports. Shops selling bitcoin have cropped up in the Grand Bazaar, tucked into alleys near where traders also sell foreign currency and gold. President Recep Tayyip Erdogan plunged Turkey’s financial system into turmoil last fall with a push for repeated interest-rate cuts in the face of soaring inflation. The currency stabilized somewhat in recent weeks after a government bailout of savers, but local Turks remain wary. "The senseless policies regarding rates, diminishing trust for published statistics regarding inflation and political decisions…made cryptos a safe haven, even though cryptos are rather risky and volatile financial assets," said Kağan Şenay, a 27-year-old trader in Bursa in northwest Turkey. Mr. Şenay said he began trading bitcoin in 2017 to make extra money. Increasingly, he has also seen it as a way to protect his lira income from inflation. The buying power of the lira he earns from his job at a fabric producer has diminished alongside higher prices. Turks have embraced cryptocurrencies despite an official ban introduced last year on their use as a form of payment in the country. The ban, which was unveiled without warning, "created a traumatic experience in the Turkish cryptocurrency community," said Turan Sert, an adviser to Turkish cryptocurrency exchange Paribu. The government has promised a new cryptocurrency law will soon be sent to the country’s parliament, but there are few details of what its impact will be, according to Mr. Sert. Cryptocurrencies have grown in popularity in Turkey and parts of the developing world where distrust of government economic policies is high. Nigerians use bitcoin for payments after currency devaluations and tight control over access to foreign currencies. El Salvador last year became the first nation to recognize bitcoin as legal tender, after two decades of having its economy tied to the U.S. dollar. In Turkey, part of the distrust extends beyond the lira. Two-thirds of Turkey’s banking deposits are foreign currencies, mostly dollars and euros. Turkish banks lend out some of those dollars to the central bank and the government, which has used them to intervene in foreign-exchange markets in an unsuccessful battle to prop up the lira. If there was a rush to withdraw dollars, Turkish banks would need to get some of those dollars back to meet depositors’ needs, and there is some question whether the government could source the dollars. In a worst-case scenario, some fear the government could force banks to convert dollar deposits into lira. That is pushing some to exchange bank-held dollars and cash dollars for what are known as stablecoins, cryptocurrencies whose value is pegged to traditional currencies such as the dollar, according to several Turkish savers. More than half the trades against the lira in December involved tether, Chainalysis said. Stablecoins such as tether are also used as a gateway to trade in and out of positions in more volatile coins such as bitcoin and ether. Turkish crypto exchange Bitlo experienced a pickup in the number of new traders last quarter as the lira’s value cratered, said Esra Alpay, the firm’s chief marketing officer. "The Turkish lira’s volatility and rising inflation seen in recent months has led our investors to see cryptocurrency as a profitable investment in the long term and as a hedge against inflation in the short term," she said. Ege Tuluay, a 24-year-old student training to be a seafarer, walked into Caspicoin, a crypto shop in the Grand Bazaar, on Monday to check on the commission for buying tether with his U.S. dollar savings. He plans to use the tether to buy other cryptocurrencies. "Cryptocurrencies offer hope for Turkish people because they are broke, so they want to make money. It seems to be easy money for Turkish people," he said. https://www.foxbusiness.com/economy/turks-pile-bitcoin-tether-escape-plunging-lira.... Summary: While the lira unraveled against the dollar in the last quarter of 2021, cryptocurrency trading volumes using the lira leapt to an average $1.8 billion a day across three exchanges, according to blockchain analytics firm Chainalysis. One wonders if these circumstances could have a current stabilizing or bullish effect on bitcoin prices. This articles claims residents of turkey are using tether (USDT) as a hedge against native currency (lira) inflation. Someone correct me if I'm wrong. I don't think the world has seen much of tether or stablecoins being used as inflation protected assets to date. An unexpected circumstance given current concerns about US inflation. While inflation is a sad thing I hope no one has to experience. It does appear to have a bullish effect on bitcoin and cryptocurrencies in general. |

|

|

|

Bank of America said Tuesday it would eliminate insufficient funds fees and cut overdraft fees from $35 to $10—the latest move from a large bank away from the practice amid years of pressure from critics who say the fees unfairly target vulnerable communities. KEY FACTSBank of America plans to end non-sufficient funds fees in February, and reduce overdraft charges by $25 in May, the bank said in a press release. The changes will lead to a 97% reduction in overdraft revenues from where they were in 2009, according to Bank of America. The bank said it has slowly reduced its overdraft fee practices, including cutting overdraft fees tied to debit card purchases in 2010, and creating a checking account that did not allow customers to overdraft in 2014. CHIEF CRITICCritics have called for overdraft fees to be eradicated for years, saying they disproportionately affect people of color and people living paycheck to paycheck. Sen. Elizabeth Warren (D-Mass.) has been an advocate for eliminating the fees. She blasted JPMorgan Chase CEO Jamie Dimon for the bank collecting nearly $1.5 billion in overdraft fees in 2020 during a Senate hearing last year. “You and your colleagues came in today to talk about how you stepped up to help your customers during the pandemic,” Warren told Dimon during the hearing. “It's a bunch of baloney.” TANGENTCapital One became the first large financial institution to completely end overdraft fees in December, joining some smaller banks that have moved away from the practice. Ally Bank announced it would end the practice in June, citing the impact on low-income Americans and people of color. BIG NUMBER$15.47 billion. That’s how much U.S. banks made from overdraft and non-sufficient funds fees in 2019, according to a report from the Consumer Financial Protection Bureau. Bank of America, Wells Fargo and JPMorgan Chase accounted for 44% of the total, Reuters reports. https://www.forbes.com/sites/annakaplan/2022/01/11/bank-of-america-cuts-overdraft-fees-eliminates-insufficient-funds-fees/?sh=7d62ef6e53f2.... The official narrative says: banks are removing these fees due to them having a negative impact on minorities and vulnerable communities Could there be another explanation for this move, in terms of banks seeking ways to be more competitive with cryptocurrencies and 3rd party payment apps? While cryptocurrencies may never completely replace banks. They could benefit consumers by encouraging traditional finance to offer better terms and services. Perhaps market competition isn't such a bad thing after all? |

|

|

|

The new company plans to let everyday Americans bet on civil lawsuits by buying and trading associated crypto tokens in "initial litigation offerings.”A new tech startup plans to become “the stock market of litigation financing” by allowing everyday Americans to bet on civil lawsuits through the purchase (and trade) of associated crypto tokens. In doing so, the company hopes to provide funding to individuals who would otherwise not be able to pursue claims. “Ryval’s goal is to make access to justice more affordable,” said Kyle Roche, a trial lawyer and one of the startup’s founders. “What I want to do is make the federal court system more accessible for all.” Roche believes the U.S. federal court system is one of the best in the world, but that navigating it is cost prohibitive for the average American. As a result, he believes, potential whistleblowers are too often hesitant to defy “well-resourced” corporations and other entities due to the potential cost of legal action. Through Ryval, Roche wants to “make lawsuits happen that maybe might not have happened.” However, on its website, Ryval focuses all of its attention on the potential return for investors. “Buy and sell tokens that represent shares in a litigation and access a multi-billion dollar investment class previously unavailable to the public,” the company states. Ryval also promises “50%+ Annual Returns,” though Roche admitted the figure “may be a little high” when Motherboard asked him about it. “What we do is: tell the story, vet the legal claim, and then allow the public to invest and give you the funds to go and litigate your case,” Roche explained. “And what does the public get in return? The public gets an interest in the outcome of your suit.” The way it works is a little like a crypto-infused and lawsuit-focused GoFundMe, if the crowd stood to profit from their investment. The company takes advantage of a rule created through former President Barack Obama’s JOBS Act, which allowed a private company to crowdfund up to $5 million from Americans, regardless of their wealth. Using the Avalanche blockchain, Ryval will allow “all investors regardless of accreditation status” to purchase tokens associated with a specific case and then hold or trade them on the open market. Whoever owns the token at the time of a settlement or verdict then cashes in. The team has dubbed the sale of tokens an “initial litigation offering,” and Roche has compared Ryval to Robinhood, but for the law. (A caveat: While wealthy and sophisticated “accredited investors” will be able to trade lawsuit tokens immediately, the non-rich will be legally required to agree to a year-long lockup period, according to Insider.) The concept of litigation funding isn’t unique. An industry built around the concept has been growing in popularity in recent years. Between June 2019 and June 2020, investors plowed $2.5 billion into the litigation funding sector, according to the finance advisory firm Westfleet Advisors. But up until now, only so-called “accredited” wealthy investors could put their money into the sector. Through the use of crypto tokens, Ryval claims, it can legally open up access to the industry to all. The tokenization of U.S. law will benefit users in a few other ways, including by providing the market with liquidity that previously wasn’t available in litigation funding, Roche claims. If someone with a token needs money or believes a case is heading south, they can sell their token to the highest bidder and cash out. Such tradeability will also allow the value of a token to rise or fall as the case develops. “Let's say, the plaintiff gets a big ruling from the court—not a win, but a big ruling. The price may go up,” he said. Roche’s law firm, Roche Freedman, has been working with the financial technology company Republic and smart contacts platform Ava Labs, which created the Avalanche blockchain and whose tagline is “Digitize All The World’s Assets,” to develop the Ryval. While still in the early going, Roche expects a full team will be announced in the first quarter of the year. The ILO already has a test case in Apothio, a hemp grower whom Roche began to represent after the Sheriff's Department in Kern County, California, unlawfully destroyed 500 acres of a crop field, according to the suit. “The destruction of that crop was catastrophic to their business,” Roche said. “I had presented the idea of the ILO to [Apothio’s CEO], and he liked it as a way to sort of get some visibility to what had happened to him and his case—and also to raise funds to help him rebuild his business.” The ILO, which was registered with the SEC and required a minimum $100 investment, subsequently raised nearly $350,000. (Roche clarified that his law firm will not be involved in most Ryval-vetted lawsuits and that he sees it more as a national platform for other law firms and clients.) But it wasn’t until after the initial Apothio ILO was launched that Roche realized the potential of the platform. That occurred in January of last year, when the online trading platform Robinhood temporarily suspended trading of GameStop shares after a massive surge of meme-related interest. The decision led some to accuse the trading platform of unlawful manipulation. “There was an explosion of ‘When can we ILO Robinhood? We want to hold Robinhood accountable,’” Roche said. Roche understands that messaging will be “very important” in the early going, which is why for the first few years, Ryval will be “focused on access to justice and taking on claims that we believe are good claims,” he said. “But at the end of the day, I don't think anybody should be the gatekeeper to who has access to the courts. I think access to the court system, access to the legal justice system should be something that is given to as many people as the justice system can handle.” Roche believes Ryval lawsuits will “run the full gamut” and include antitrust, securities claims, and wrongful termination. Asked if there were any types of cases Ryval would avoid, Roche replied, "I don't see anything that I wouldn't categorically not go near." To help novices navigate such a complex industry and decide where to place their bets, Ryval will provide users with the basic facts of the case and the procedural elements necessary in order to win, as well as other relevant information like how often a particular type of case is successful. “One of the real responsibilities we have in building this platform is to educate the market,” Roche said. But Roche said retail investors stand to gain more than they stand to lose by entering the legal market. “These investments have been very lucrative over the course of the last five to 10 years,” Roche said, adding that some top law firms average an “astronomical” annual percentage rate of 30-to-40 percent. He expects interest will be especially high in the event of a downturn, since litigation outcomes are largely “market agnostic,” providing people with an alternative form of investment. While Roche expects many people to invest in cases purely focusing on the potential return on investment, he hopes there will be a “pro bono element” of Ryval as well, in which people raise legal funds “for those who need it” without as much concern for their personal finances. He isn’t particularly concerned about the prospect of his company creating an explosion of frivolous lawsuits in a famously litigious country, not only because they plan to vet the claims, but due to the fact that Ryval will have a comments page where people can voice their concerns. “Exposing the idea and the lawsuit to the market serves as a good gating function,” Roche said, adding at another point, “I believe that access to capital creates a better justice system.” https://www.vice.com/en/article/v7d7x3/tech-startup-wants-to-gamify-the-us-court-system-using-crypto-tokens .... Novel concept here of crowdsourcing the cost of legal fees through the sale of crypto tokens. Verdict winnings are divided as a form of passive income to token holders. It appears they already have a test case: The ILO already has a test case in Apothio, a hemp grower whom Roche began to represent after the Sheriff's Department in Kern County, California, unlawfully destroyed 500 acres of a crop field, according to the suit. “The destruction of that crop was catastrophic to their business,” Roche said. “I had presented the idea of the ILO to [Apothio’s CEO], and he liked it as a way to sort of get some visibility to what had happened to him and his case—and also to raise funds to help him rebuild his business.” The ILO, which was registered with the SEC and required a minimum $100 investment, subsequently raised nearly $350,000. (Roche clarified that his law firm will not be involved in most Ryval-vetted lawsuits and that he sees it more as a national platform for other law firms and clients.) They claim that crowdsourcing can make legal fees in the united states more affordable. Which can allow lower income brackets who normally couldn't afford lawyer fees to have a chance of being represented in court. |

|

|

|

|

I like the recent trend of blockchain and cryptocurrency powered fractional real estate. Real estate being priced outside the budget of many. Makes it well suited for a fractional ownership format where real estate is divided into many small portions which lower income earners can afford. In some cases fractional chunks of real estate can earn a small amount of passive income. That seems like a natural market trend people might embrace due to its intuitiveness.

The ratio of population to living space is one good barometer of where housing prices are currently via supply and demand. Metrics and statistics relating to housing markets could be tapped to create crypto tokens which reflect or attempt to correct market conditions.

|

|

|

|

|

Nothing is better than gambling with a cryptocurrency in a bull market. It guarantees gains even on inactivity. And can add considerable compounding interest on top of winning wagers.

Gamblers generally being a bit skittish. They usually prefer crypto with fast payouts, due to crypto being relatively new. And fearing scams.

Fiat being the tried and true traditional option. Gamblers feel safer and more stable using it.

|

|

|

|

|

Gambling is for those who enjoy analyzing and breaking down sporting events to find patterns that are relatively consistent.

Big data and statistical analysis can play a big role here. As illustrated by players on fantasy sports platforms who have won big using the approach.

There are some who enjoy being know it alls and being right about everything. That could be the personality type best suited to being successful in the gambling world. As they might be the most obsessed with being accurate and correct about their calls. They may also have a good drive to learn from mistakes. And to overthink things to a point further than most would be willing to go.

|

|

|

|

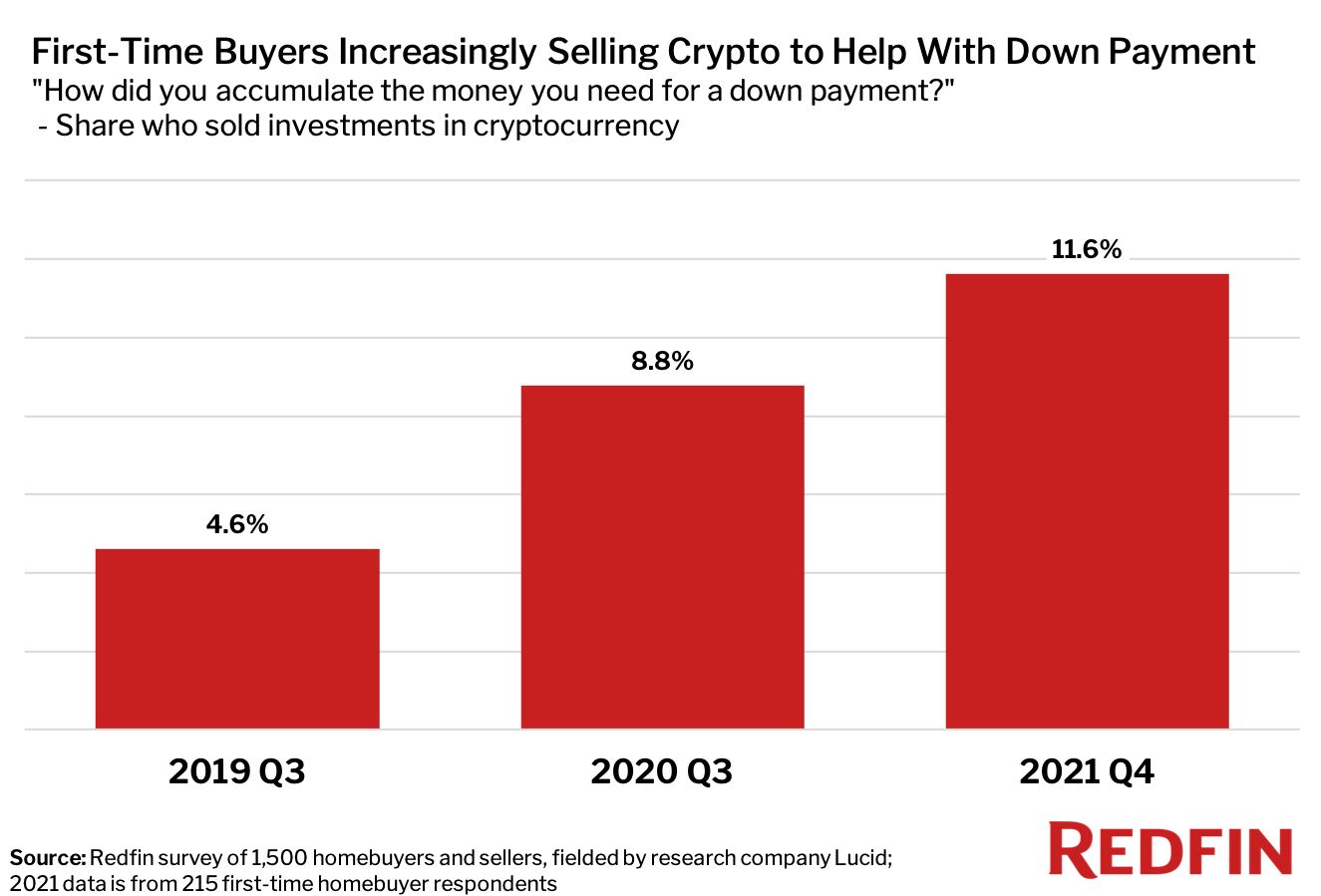

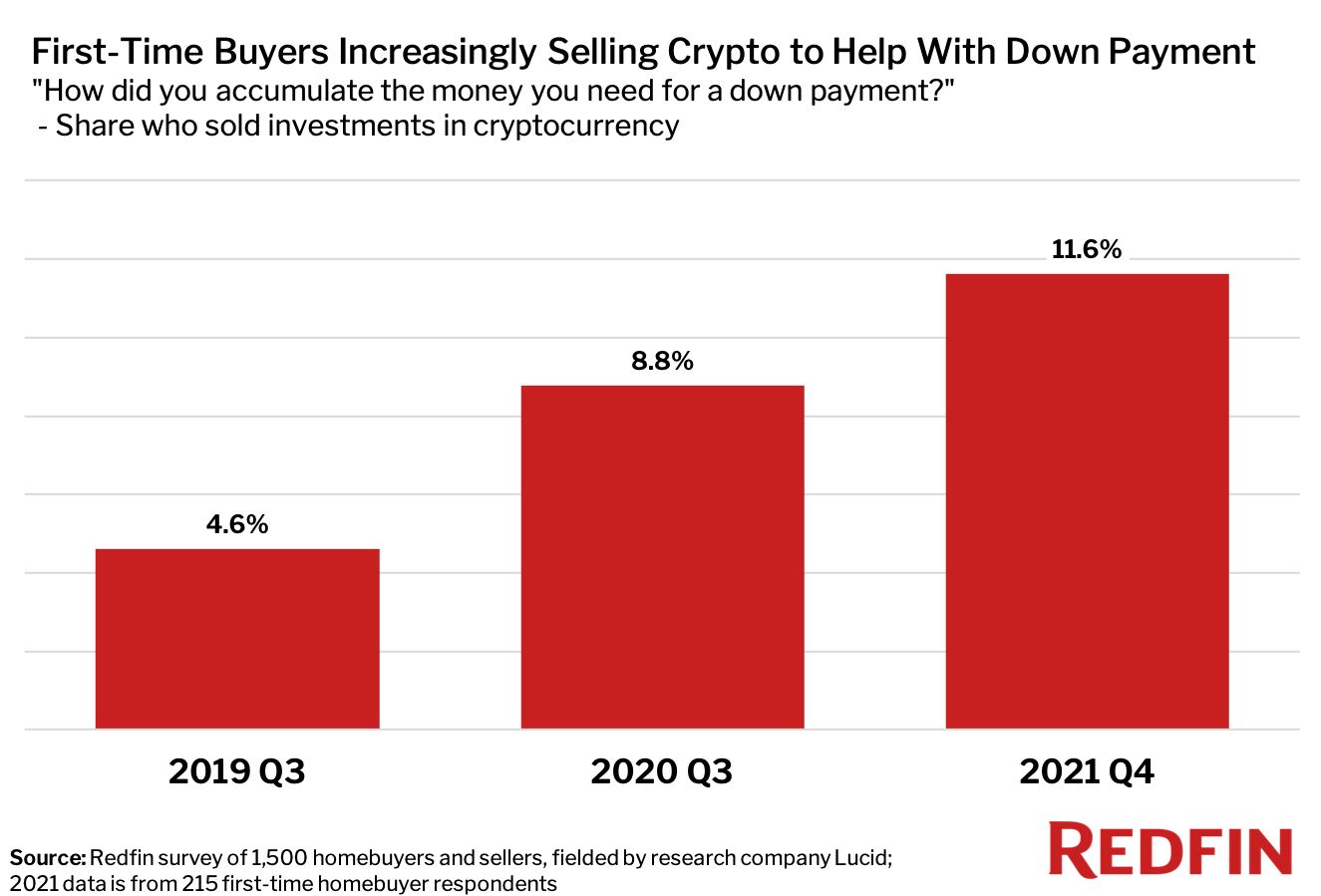

12% of First-Time Homebuyers Say Selling Crypto Helped Save for Down Payment, Up From 5% in 2019Digital currencies are becoming an increasingly common payment method as millennials rush the housing market. One in nine first-time homebuyers (11.6%) surveyed in the fourth quarter said selling cryptocurrency helped them save for a down payment. That’s up from 8.8% in the third quarter of 2020 and 4.6% in the third quarter of 2019.  This is according to a Redfin-commissioned survey of 1,500 U.S. residents planning to buy or sell a home in the next 12 months. The survey, which was fielded to a representative sample of the American population, was conducted by research technology company Lucid from Dec. 10 to Dec. 13, 2021. Respondents were not made aware that Redfin was the sponsor of the research. This report focuses on the 215 of those 1,500 respondents who answered the question “How did you accumulate the money you need for a down payment?”—a question we only posed to participants who indicated they were planning to buy their first home in the next year. The most common response was “saved directly from paychecks” (52%), while less common answers included “cash gift from family” (12%) and “pulled money out of a retirement fund early” (10%). “With extra time and a lack of exciting ways to spend money, many people began trading cryptocurrencies during the pandemic,” said Redfin Chief Economist Daryl Fairweather. “Some of those investments went up in smoke, but others went ‘to the moon,’ or at least rose enough to help fund a down payment on a home.” Bitcoin, the world’s largest digital currency, hit a record high of nearly $69,000 in November. Ether, the second most valuable cryptocurrency, also reached an all-time high, though both coins have since lost some of those gains. With surging home prices leading to larger down payments, some buyers are finding non-traditional ways to cover the cost and compete with other bidders. “Crypto is one way for people without generational wealth to win a lottery ticket to the middle class,” Fairweather said. Digital currencies are also likely on the rise as a payment method among homebuyers because millennials and Generation Z are taking up an increasing share of the U.S. housing market. Millennials, who own more cryptocurrency than other generations, now account for more than half of new mortgages. https://www.redfin.com/news/real-estate-cryptocurrency-down-payments/ .... Title was too long to fit, it should read: 12% of First-Time Homebuyers Say Selling Crypto Helped Save for Down Payment, Up From 5% in 2019One great thing about this is, it shows how cryptocurrencies carry a potential for economic benefit. In terms of it making it easier for people to afford houses and real estate. Its difficult to measure the impact that cryptocurrencies have about society as a whole. Its been generalized as being a creator of jobs and wealth. I have gone so far as to claim that it elevates our standard of living. If nothing else, I hope we can all agree that crypto provides us with more opportunities and options than we would have without it. And that's always a good thing, am I right. |

|

|

|

I think everyone explores stablecoins ever since tether destroyed $500 million dollars worth of their own supply back in 2018. The $500 million number definitely put stablecoins on many peoples radar and those positioned to leverage those types of gains in the financial world would naturally explore and pursue such an option if it became available. Tether Just Burned 500 Million USDT Stablecoin TokensShortly before 1:00 p.m. ET Wednesday, Tether, the company behind the dollar-linked stablecoin of the same name, announced via Twitter that it had destroyed 500 million tether (USDT) tokens. From Oct. 14, when USDT started to slip below $1.00, to Oct. 23, 680 million USDT were transferred to the company-controlled Treasury wallet. As a result of these transfers, the supply of tethers in circulation has dropped by around a quarter in a week and a half, to approximately $2 billion. Now many of these tokens, in addition to having been taken out of circulation, have been "burned" or destroyed by the company. https://www.coindesk.com/markets/2018/10/24/tether-just-burned-500-million-usdt-stablecoin-tokens/ Without knowing more details, its difficult to say exactly what paypal's motive is. Perhaps they feel pressure from 3rd party payment apps like venmo, apple pay and whatsapp and are looking for competitive advantages. |

|

|

|

Cryptoland and Satoshi Island believe they'll become paradises where the cryptoeconomy can flourish.For as long as cryptocurrencies have existed, libertarians have dreamed of using them to create communities, seasteads, and cities free from the prying eyes of the state and its tax collectors. We’ve seen crypto-inspired attempts to claim disputed lands as tax havens, use UFOs and fireworks to christen a new tax-free Bitcoin town, build cities with DAOs, and establish communities inside of U.S. colonies to avoid taxes. But there’s now a wave of attempts to buy entire islands and build the next crypto “paradise.” The first one to look at is “Cryptoland,” founded by Max Oliver and Helena Lopez, who reportedly have a checkered history with the Spanish YouTuber community mired in allegations of doxxing and the resulting boycott of an awards show linked to the pair. Cryptoland burrowed into the public’s mind when its unlisted 18-minute animated sales pitch was found on YouTube in December. It features three sections littered with bombastic rhetoric about what is to come, a manifesto of sorts, a memorial to Bitconnect—arguably the most infamous scam in Bitcoin history—and promises to “make crypto enrich a harmonious co-existence with the world energy of its surroundings.” Since going viral, Cryptoland has taken down its unlisted sales pitch but a shorter public version is still available to behold. https://www.youtube.com/watch?v=jf3ajS5me78CRYPTOLANDThe first section is a minute-long introduction to Cryptoland as a "paradise made by crypto enthusiasts for crypto enthusiasts” and its three proposed main areas: Cryptoland Bay, House of DAO, and the Blockchain Hills. The Bay can be best thought of as a massive theme park for any and every meme that has ever existed that is related to crypto—the video promises it’ll include a beach, resort, “working hub,” and more. The DAO promises to be a startup village that will incubate the future of blockchain technology. The Hills will be the "crown jewel" as an exclusive residential area that you can only access if you purchase a one-acre parcel of land available as an NFT. The video continues with a 10-minute long animation that is best described as an unhinged fever dream driven by a talking Bitcoin tour guide, a miserable amount of crypto jokes every step of the way, a strange dance number, and more. It’s a full-on suffocation by blockchain meme; the toilets on the island are called “SHITCOIN” and the toilet paper is made of dollar bills and labelled “WIPE PAPERRR” (which, for the blissfully uninitiated, is a tortured play on the term “white paper” and the stimulus meme “money printer go brrrr”). It’s hard to also overstate how important the creators of Cryptoland see this widely-mocked video as being to their mission. "We quickly realized that it was practically impossible to convey this all with a PDF or something because it's so abstract,” Oliver says in the video. “You have to see it rather than read it like the lambos, the Bitconnect scam memorial, the Crypto Kitties, things that we know people will get it if they see it. So after a lot of brainstorming we came up with the idea of creating a 3D animation video. The film had to be awesome but also very accurate at the same time because we must be sure we can deliver." As The Next Web pointed out in its dive into the island and Wikipedia editor Molly White in a Twitter thread sharing her research into the project, there are a few problems that stick out even beyond Cryptoland's wild marketing video. Take the fact that the island mentioned in its "Why Paper"—an island in Fiji named Nananu-i-cake— is still for sale on at least two websites, despite the project’s website claiming that it has secured an “island purchase agreement.” And then there’s the island’s small size compared to the grandiose plans: it’s just 600 acres, or less than one square mile. Or eyebrow-raising tweets: when one Twitter user asked Cryptoland what the age of consent would be, Cryptoland’s Twitter account replied “Mental maturity should be more than enough!  ” One thing that is certain, though, is that Cryptoland is selling NFTs. They feature the video’s talking Bitcoin mascot and fall into two types of NFTS. King Cryptolander NFTs that cost 319 ETH (just over $1 million), of which there will only be 60. The remaining 9,940 will be standard Cryptolander NFTs that cost on average about 0.11 ETH (about $350). If you are planning on splurging on a King Cryptolander NFT, you may want to slow down as you have to confirm you are not a US citizen when purchasing them. "We have been victims of what seems to be a planned attack to harass, vilify and twist our work," Cryptoland said in a statement responding to the waves of criticism after the presentation went viral. "We condemn all the false information and false accusations being spread about Cryptoland and invite those who are truly interested, to make their own research and politely ask us if they want to know anything about this amazing project." Cryptoland did not respond to Motherboard’s request for comment. Cryptoland isn’t alone. Satoshi Island is another crypto utopia supposedly in the works, featuring a 32 million square foot island (approx 1.1 square miles) in Vanuatu—an archipelago of islands between Australia and Fiji. It’s slightly larger than Cryptoland, but has substantially less information available on it. Its website states that the island is owned by Satoshi Island Limited, but there’s no information on who runs the company or how beyond a Team section listing some individuals involved. It also claims to have "a green light from the Vanuatu Ministry Of Finance and all approvals in place.” Motherboard reached out to various Vanuatu offices to confirm this, but has not heard back. Satoshi Island told Motherboard they have owned the island for some years, but when asked about the company’s ownership said “Some of the public team and advisors have legal control of the company” and pointed at the Team section. Running the "master planning and development process" is James Law Cybertecture, a Hong Kong architecture firm animated by the belief that "our work can alleviate suffering for all segments of society." While the founders and main backers are obscured, Law is held up as one of the public faces in press releases and on the site which promises to design the island according to his vision. "Modular development is the future of city building, instead of decades they will be completed within a few short years,” reads one quote from Law prominently emblazoned across a website. What does that mean? Well Law's designs feature modular units that can be "combined and placed into hundreds of positions to create unique homes, apartments, amenities and offices." Imagine see-through shipping containers with softer edges. To help pay for this, there will be two types of NFTs that, similar to Cryptoland, are not yet available: Citizenship and Land NFTs. The Citizenship section’s first words are a disclaimer warning “Satoshi Island Citizenship NFTs have no relation to citizenship of Vanuatu.” 21,000 Citizenship NFTs will be minted with the first edition granted via airdrop to early investors, the project says, and Citizenship NFTs automatically whitelist the owner for early access to future NFT mints and airdrops, such as Land NFTs. They'll also be the first allowed on the island and gain access to "advanced NFT security features” that establish beneficiaries if wallet access is lost and trustees meant to halt unauthorized transactions by enlisting wallet addresses as co-signers. Citizenship NFTs will also grant voting rights: In a weird blend of Athenian democracy and universal suffrage, each wallet can only have one Citizenship NFT which grants one vote. "One NFT. One vote," the site proudly declares. This brings us to Land NFTs, which are distinct from Citizenship NFTs. Satoshi Island told Motherboard that it will split each of its 2,100 lots of land into10 individual NFTs, for a grand total of 21,000 NFTs split across 7 collections. The first collection—the South Wing Land collection—will comprise 5,620 individual NFTs and is supposed to launch sometime in January or February. A recent press release hints at a process by which they can convert into a Non Fungible Property Token (NFPT) at which point the holder will need the island’s help to convert this NFPT into a traditional deed logged on Vanuatu’s land registry. It’s important to note that, for both islands, almost none of this exists yet. It’s not clear if any of it will ever exist, as the details offered are not only relatively scant and nebulous, but it’s not clear if it's possible even if tens of millions are not raised through NFTs and other means. And, given that Cryptoland and Satoshi Island are just two examples of a growing trend, it’s starting to look like bespoke crypto-utopias are another bubble within a bubble. https://www.vice.com/en/article/z3n38x/cryptocurrency-investors-try-to-turn-private-islands-into-blockchain-utopias .... If I remember right, this island trend began in 2017 when vanuatu offered citizenships for sale in bitcoin. Since then we've had el salvador embrace bitcoin. Akon city in africa. And many migrating to puerto rico to benefit from its 4% income tax. Now the latest trend -- island resorts which propose to generate development funding through the sale of NFTs. I'm not certain if the the business strategy is a sound one. Its very similar to metaverse offerings which sell digital real estate. Maybe too similar. The market could become too heavily saturated with supply greatly exceeding demand. Private islands are not always high dollar properties. There are many private islands which sell for $50,000 to $400,000. The real cost with islands is transportation and cost of supplies and amenities. I'm not certain if barebones lot NFTs could accumulate value without the support necessary to comprise a total package. |

|

|

|

The chess grandmaster expects a basket of coins to replace the dollar within a decade.Garry Kasparov knows math. He knows logic, strategy and decision-making. Widely regarded as the greatest chess player in the history of mankind, the Russian grandmaster – ranked No. 1 from 1984 to 2005 – sees the world with a certain clarity. So it will delight many in the blockchain industry to learn that Kasparov, easily one of the smartest people alive, is now a champion of cryptocurrency. And it’s partly because of math. Kasparov has spent his “retirement” opposing Russian President Vladimir Putin (a defiance that once got him tossed in jail), fighting for humanitarian causes and serving as chairman of the Human Rights Foundation (a nonprofit that strongly supports bitcoin as a freedom-giving tool). Now he views crypto as a way to check government power. Bitcoin offers protection against rampant government spending, says Kasparov, “because you’re protected by math” – by the logic of the code itself. Kasparov also sees merit in non-fungible tokens. In December, in partnership with 1Kind, he dropped a series of 32 NFTs that showcase iconic moments from his life: the 1985 match that crowned him as the youngest world chess champion, the epic battle against International Business Machines’ artificial intelligence-powered “Deep Blue” and speeches against totalitarian governments. It’s this battle against totalitarianism that has defined the current chapter of his life, and Kasparov sees crypto as part of that struggle. Or as the grandmaster puts it, “I believe that supporting crypto is an important part of my contribution to the future of humanity.” This interview has been condensed and lightly edited for clarity. CoinDesk: How’d you get into the crypto space?Kasparov: If you followed my career and read about my early interest in computers and technology, you should not be surprised that I was very excited when I recognized the value of cryptocurrencies and NFTs. This goes all the way back to the ‘80s; I always tried to be at the cutting edge. It started with chess. But I also saw an opportunity to use computers and new tools to advance individual freedoms. It’s my belief that technology should help people fight back against the power of the state. How do cryptocurrencies fit into that?Cryptocurrencies become an inseparable part of or progress, because the whole world is moving digital. And if the economy becomes more digital, so does the money. Another philosophical reason is that … governments [have] unlimited opportunities to print money. And printing money is the most exquisite form of borrowing from us and from future generations. And I believe that cryptocurrencies – with bitcoin as a standard – offer a protection against this onslaught of the government, because you’re protected by math. You’re protected by the limited number of any code behind the respective currency. Cryptocurrencies, and all the products related to cryptocurrencies, are absolutely vital for the future development of our world. How, specifically, did you first get involved?My first indirect involvement was through the Human Rights Foundation. Because in the Human Rights Foundation, we had a few experts that have been advocating cryptocurrencies at a very early stage. And as an organization, we offer support to the dissidents around the world. We thought about using crypto as a way to help them to get material help, because in many countries it was impossible – and it’s still impossible – to actually get proper funding. So crypto offered an opportunity to support these activists indirectly. And the more I learned about it, the more interested I got in the whole mechanism. Can you elaborate on why this is important to you?Look, crypto is a controversial thing. Because you hear a lot of people say, “Oh, that’s money laundering. That helps bad guys.” True. I mean, no technology is uniquely good, because it’s technology. Humans still have a monopoly for evil. So, I’ve been doing a lot of talks about it, and I’ll say, “Look, it’s not the magic wand or the terminator. It’s not a harbinger of utopia or dystopia. It’s a tool.” Crypto is a tool. And of course it could benefit some bad guys with maligned intentions. But it’s about the balance, it’s about trade-offs. And I think the balance is so much in favor of progress. You mentioned crypto’s ability to help protect human rights in undemocratic countries. What do you see as the benefits in democratic countries?In the democratic countries in America and Europe, trillions of dollars will be printed. I’m an American taxpayer. And I understand that you need to build new infrastructure. But I’m not happy to see that the government has a free hand to use my taxes, basically to devalue [the dollar]. So I think it’s very important that technology would offer me an opportunity to fight back, to protect my hard-earned fortune. And I think that bitcoin – which I believe is online gold – and other cryptocurrencies are the way to the future. I’m not a financial expert, but I would not be surprised if, I would not be surprised if, in 10 years’ time, the dollar will be replaced by the basket of coins as a standard. I’m guessing it’s safe to say you own bitcoin?I’m a great believer in the future of coins. I suppose if you believe that, then it would almost be foolish not to be buying Bitcoin?Yes. Thoughts on the future of bitcoin?Well, I think bitcoin will remain as a standard. But of course it cannot stay alone. So that’s why you have more coins coming in. It’s a natural process. Now we have thousands and thousands of coins. It’s like the dot-com bubble. Ninety-nine point nine percent will be gone. But those that survive will become the Googles of the world. I’m not here to judge which one, but there will be few that will survive – that’s why I said basket of coins. In the past, your championing of human rights has gotten you in trouble with the Russian authorities. Given that background, are you concerned that your support for cryptocurrency can get you in hot water?Well, this is definitely a no. [In the past,] I was in hot water. To give you an idea, one of the NFTs is a picture of my first arrest in Russia. So it’s all reflected in my NFT. Look, this is much less perilous than to attack Putin directly. I grew up in the Soviet Union, and learned from my mother and my teacher the motto of Soviet dissidents, “Do what you must, and so be it.” And I believe that supporting crypto is an important part of my contribution to the future of humanity. And, again, I [view it] as a much less risky endeavor than speaking publicly about Putin or other dictators. How would you describe your NFT project?I don’t pretend to be a great expert in NFTs, but I’m not aware of anything similar that exists. It’s a collection of 30-plus NFTs that are related to special events in my life and special people in my life. This is a story that connects you to very personal moments. Every NFT has a video message. It’s all connected to the physical assets, like my notebooks from the ‘70s. Thanks to my late mother, who preserved this archive, you can actually look at me scribbling in 1973. The NFTs all reflect the moments of me growing up, learning from my mother, and from my teachers, and then fighting for the title, and then shifting my life and moving into human rights and computers. Interesting. This feels almost like a memoir, in a sense. I’ve worked with CEOs before to collaborate on their memoirs, and one thing I’ve found is that the process can almost be emotional, or even a bit therapeutic. Did you have any sense of that?The whole story starts from a very emotional moment, though it’s a tragic one. My mother died on Christmas day last year, from COVID. And I couldn’t be next to her, and that was a really big blow because we were so close. While she was alive, I didn’t even know that she preserved all these archives. She was not happy to talk about the past. That’s why I [held off] on any major publication that would highlight [the past]. I wrote two books, but not the one that could tell everything. After she died, I thought it would be right for me [to honor] her memory to actually start doing things. I’m doing a documentary now; it’s in Russian. The first segment will be ready early next year. And I hope I can cover my entire chess career, and it’s for her. It’s dedicated for her. And this [NFT] project was inspired by this tragedy. I thought it was very important to show my personal life and her connection, and why she was so important. And so I spoke to 1Kind, and 10% of the sales will go to Kasparov Chess Foundation, and this will be a scholarship under her name for all the great talents raised by single mothers. Amazing. Congrats on the NFT project, and best of luck.https://www.coindesk.com/layer2/2022/01/03/garry-kasparov-crypto-means-freedom/ .... Chess master Garry Kasparov is apparently a big supporter of cryptocurrencies and NFTs. While I do not think he is "one of the smartest people alive" as the opening paragraph describes him. He does have an interesting perspective on things. |

|

|

|

|

Upcoming schedule.

Saturday, January 15, 2022

Raiders vs Bengals

Patriots vs Bills

Sunday, January 16, 2022

Eagles vs Buccaneers

49ers vs Cowboys

Steelers vs Chiefs

Monday, January 17, 2022

Cardinals vs Rams

Would anyone care to take a guess what the win / loss results will be?

|

|

|

|

|

Muslim Salikov pulled out of the fight with Michel Pereira. Its been said Andre Fialho might step in as a replacement but not officially confirmed.

MMA fighters are usually better athletes than boxers IMO. That's one thing Ngannou could have going for him if he fights Tyson Fury. He might not get tired as quickly as Deontay Wilder did. But could have the same big KO power.

Tyson Fury has trained MMA with Darren Till in the past. I'm certain he can appreciate both boxing and MMA. I wish more boxers would approach the title undisputed champion as having competed with the best MMA has to offer as well as boxing.

|

|

|

|

Things like this are indeed quite good because he himself wants to advance the country and even the continent but can it really be done? is Africa now ready for this? because indeed as you say with the current minimum wage in africa i have doubts about this.

On the other hand, why do you have to make Akoin (AKN) for transactions, for example, you can't just use BTC because I think this is better.

not without reason because indeed akoin also implements the same system, namely decentralized and this is certainly contrary to the country which is still using the CFA franc. regulated and issued by the central bank BCEAO based in Dakar.

In the united states, there are camps of homeless living in tents only 1 block from big and expensive office buildings where high paid executives work. In places like india it seems normal for lamborghini owners to drive through slums with a camera, to later publish the experience on social media. Extremes of wealth and poverty are often found dwelling in close proximity in the modern world. While africa may not be the wealthiest nation, it would make sense for them to have cities which support modern conveniences like high speed broadband infrastructure, chargers for electric vehicles, WIFI hotspots, satellite internet and TV, solar panel and windmill powered homes, and businesses offering specialized skillsets and services to the public. Akoin could have advantages in that it may not be banned by china or having its crypto mining industry under fire. There have been similar regional alts like auroracoin in iceland which have been in circulation for many years. https://en.wikipedia.org/wiki/AuroracoinNot certain if akoin is pre-mined. It could be legit. Personally I don't mind developers of the city who invest time and money into the project, regulating the local currency. The fate of akoin and akon city are tied together and closely bound. If they devalue the currency, they'll only succeed in destroying their own city. So long as the interests of akoin and akon city are aligned. And so long as the concept and motive behind akon city remains genuine. I don't think the margin potential for fraud or abuse is high. |

|

|

|

Akon City is expected to be completed next year located in Senegal. Can this really good project change the African economy today? Source : AKON CITYroadmapHere is the closest thing to an update I could find on Akon City (Wakanda Forever?). What Happened to Akon’s City DevelopmentsOctober 7, 2021 Akon’s Current SituationThe 1st phase of Akon City expects to be complete by December 2023. Full coverage would include Hospitals, malls, residences, schools, police stations and a solar power plant. The 2nd phase is expected to run from 2024 to 2029. Akon City, located two hour’s drive from Dakar and south of Diagne International Airport. While certain government officials praise Akon city, it has received Scepticism from natives. Some doubt its legitimacy given its decade of poverty for its 15.4 million residents. The plan for the futuristic city is yet to kick start in Senegal. However, the Minister for Urban Development in Uganda has agreed to offer government land for ‘Akon City` development. They term it a “satellite city”, a copy of the plan already laid out for Senegal. Akon plans on building a real-life Wakanda version in Senegal. Due to the amount of infrastructure required, the city would not be complete until 2036. Opposition leaders from Uganda claimed it’s a “public secret” that Akon City would never exist. Additionally, they urged the government to stop giving “sweetheart deals” to Celebrities and wealthy investors. Akon City is yet to become what many aspired it to be, and all eyes are on Senegal’s establishment of real-life Wakanda. https://finance.yahoo.com/news/happened-akon-city-developments-143610432.html There have been similar projects in the past. LeBron James of NBA fame in the united states did succeed in starting his own school. Other professional athletes and performing artists like Bob Marley fed those living in poverty from the villages and towns they came from. There are some who became rich and famous who have succeeded in giving back to their local communities in the place they came from. Akon City could be considered an attempt to modernize a city in africa. Construct a techno city for upper income earners. It could represent a good starting point to normalize things like high speed internet, electric vehicles and other innovative technologies. In an effort to begin a trickle down approach. With the average wage in poor parts of africa being around $4 a day. I don't think they could conceivably build high tech living quarters and infrastructure that would be cost effective for those in the lowest income bracket. But they could conceivably cater to the top income bracket and have the beginnings of a movement which would eventually provide modern amenities for all. |

|

|

|

Any sources on these claims?

There are great hedge funds that outperform in the long run, like Rennaisance Technologies managed by Jim Simons.

But the vast majority just return market returns over the long run before-fees and therefore below market returns after-fees. The hedge fund format is definitely outdated and needs to include more asset classes than just the traditional long-short equity-bond portfolio, but I don't think that day traders can do better than them on an after-fee basis in the long term either.

Renaissance Technologies is an HFT algorithmic fund. AFAIK those trade in darkpools rather than standard markets accessible to the general public. Which puts it outside the category of how a normal hedge fund could be expected to perform. I think most big HFT and algorithmic trading gains came early on with arbitrage trades, before HFT markets became as heavily saturated as they are today. Where there is much more competition to execute the same algorithmic strategy. Profitable day traders would be those affiliated with the gamestop bull run or the big dogecoin pump. Those types definitely outperform the traditional hedge fund. I think most would agree with that? There are some I've seen do well day trading penny stocks. Hedge funds have traditionally been very lucky if they succeed in breaking 5% year over year gains. The average successful day trader can beat 5% annual gains, easily. Another obvious thing I forgot to acknowledge is, its much easier to buy and sell assets. Get in and get out. Trading small sums of money. Than it is with large sums. That's another big advantage that daytraders have over hedge funds which manage much larger sums. Smaller traders definitely carry some advantages. |

|

|

|

|

The hedge fund format could be a bad indicator for gauging average investor performance. I think hedge fund managers are very limited and restricted with their trading. They must buy and sell assets at inopportune times to accommodate clients depositing and withdrawing funds. This is one reason their historical returns are typically less than 5% annually. Which is a very low return on investment (ROI). Hedge funds also tend to play it safe as they trade with large sums of other peoples money.

Day traders do better than hedge fund traders. Crypto traders do better. Everyone does better than hedge funds on average.

The hedge fund statistic is where to look to find asset traders with the lowest average return on investment.

|

|

|

|

A week ago, Kazakhstan owned approximately 15% of the world's mining capacity. Now the situation is destabilized, a military invasion, which will definitely lead to massive confrontations and destruction, can lead to a halt in mining in the country (the Internet is almost massively disabled). what do you think - what are the consequences of this conflict, in the regional economy, in the world of the crypt? I made a thread on how bitcoin, crypto and blockchains might avoid internet disabling last year: Hardened Orbital Blockchainhttps://bitcointalk.org/index.php?topic=5326006.0The use of satellite based internet coupled with satellite based smartphones can bypass the regional internet if it is disabled. This could provide crucial communications alternatives in state of emergency, natural disaster, war or cyberattack. Crypto based mining is very mobile, the only real requirements are electricity and an internet connection. They can travel anywhere in the world without much in the way of limitation. I would be interested to know what happened with the Arab Spring. It seemed like a major movement which was silenced and forgotten without much explanation. It seems that there is an excess of will for positive change around the world. What is lacking is the knowledge and basic information necessary to make it happen. Ironic that information would be the missing ingredient needed to effect real and lasting social change, in an information age. |

|

|

|

Just a reminder... Watch this vid. Everybody who wasn’t convinced, including me, was convinced. UFC Free Fight: Ngannou vs Miocic 2https://www.youtube.com/watch?v=C2HlMuj9LgUAnyway... 10 days to got til we go the UFC back on! The only question mark on the Ngannou vs Miocic 2 fight is whether Ngannou was indeed getting tired as Stipe claimed he was. If Jon Jones has advantages over current era heavyweights it could be his reach, cardio and endurance. Jon Jones has never looked more tired than any of his opponents in a fight. The problem for Jones is his cardio and endurance could translate to him being less explosive and lacking the big knockout power many heavyweights have. If Jones fought Ngannou his gameplan might have to be one where he tries to get Ngannou tired or fustrated. He might not be able to brawl or go head to head with some of the bigger and more explosive HWs. |

|

|

|

|

I think not only do suicide and overdose rates rise dramatically during times of economic crisis.

Mortality rates due to homicides and criminal activity also rise spectacularly as well.

It can be seen in an uptick in videos circulating on social media containing road rage, robbery and random violence.

|

|

|

|

|

Black friday and the christmas holiday season can be a high point for retail bitcoin transactions. Followed by a lull in transaction volume in january.

I think historically january is the best time of the year to make short plays on bitcoin, off decreasing demand from the holiday season.

It can also serve as an entry point for setting up a good buy in position for the next bitcoin halving. Pushing the value down now can translate to larger profits when the next reward halving hits.

It can be hard to get a read on whether an asset is bullish or bearish. There are undoubtedly many conflicting ideas traders have about what the next stop should be.

I've always been a proponent of bitcoin being defined by 4 year boom and bust cycles. There was a big bust cycle following the last rewards halving. And the one prior. A bearish period could be normal at this stage.

|

|

|

|

|

”

”