Hungry for financial flexibility, a California man named Dylan shelled out a measly $150 a year to eat every meal at Six Flags Magic Mountain in order to save thousands, pay off his student loan debt, get married and purchase a house in Los Angeles. “You can pay around $150 for unlimited, year-round access to Six Flags, which includes parking and two meals a day,” Dylan, 33, explained to Mel Magazine Monday. “If you time it right, you could eat both lunch and dinner there every day.” https://nypost.com/2021/10/27/man-spent-150-yearly-on-six-flags-food-paid-off-student-debt/ .... This is an old story about a man who paid $150 a year for food, eating two meals at six flags theme park, everyday. Since this story went viral, the theme parks all you can eat for $150 plan has recently been canceled. Still a great example of how life hacks and out of the box thinking can get people ahead. Perfect example of great opportunities in life flying beneath the radar. ... Other amusement parks like valley fair: https://www.valleyfair.com/dining/drinks-dining-dealsMay still carry similar all you can eat deals for less than $100/year. (Although they may not include the cost of parking, which is where the deal may not be perfect)  |

|

|

|

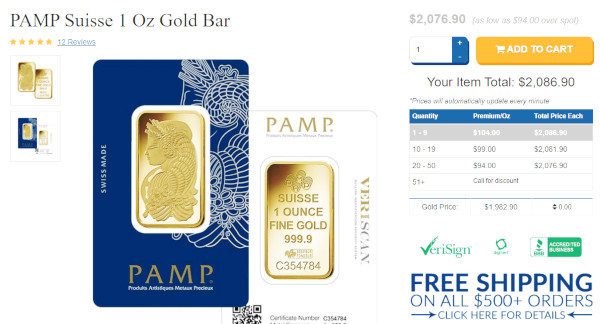

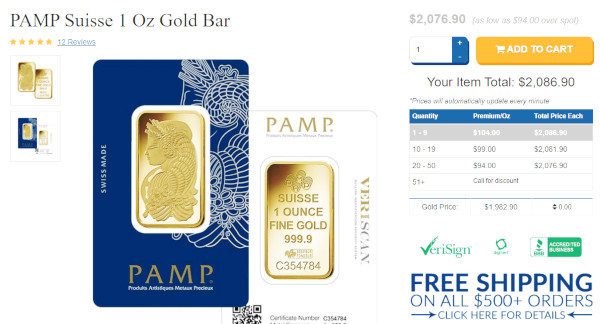

Precious metals minting standards need an upgrade. Current precious metals shopping options.  ...  The current implementation of gold and precious metals do not scale. A cup of coffee cannot reasonably be purchased by shaving gold dust off a bar and weighing it on a scale. What is needed is minting of precious metals in standardized $1, $5, $10, $20, $50, $100 denominations. With coins $0.01, $0.05, $0.10, $0.25. The specific weight and exchange rate at the time of minting can be recorded to make it easier to calculate price drift. This would make it more feasible to revert to a gold or silver standard in the event of war, natural disaster or emergency. If the internet and electronic payment shut down precious metals standardized units of exchange could be used to fill the vacuum and commerce could continue uninterrupted. It would also not interfere with the current state of the economy. Precious metals would be hoarded rather than be a 1st choice of financial exchange. It would function as a fallback in the event of cash or digital finance no longer being viable. This could help in places like ukraine where financial transactions and internet access could be unreliable. |

|

|

|

In the U.S., only accredited investors and those with coins already in the Earn platform will be able to earn rewards.Cryptocurrency lender Celsius is banning new transfers from nonaccredited investors on its U.S. platform from earning rewards on its program effective Friday. - Starting April 15, only “accredited” U.S. investors will be able to add new assets and earn rewards on Celsius' Earn platform, said the company. To be deemed accredited in the U.S., investors must have a minimum annual income of $200,000 or a net worth over $1 million.

- The company said all existing U.S. users – whether accredited or nonaccredited – will continue to earn rewards as long as the coins are in their Earn account prior to April 15.

- Those deemed nonaccredited will have their coins held in custody, where they won’t earn rewards but can continue to swap, borrow and transfer within those custody accounts based on their local jurisdiction.

- “As we previously have acknowledged, Celsius has been working closely with regulators around the world. It is our intention to be as transparent with our community as possible,” the company said in a blog post Tuesday. “More specifically, we have been in ongoing discussions with United States regulators regarding our Earn product. As a result, there will be changes to the way our Earn product will work for users based in the United States.”

- U.S. users wishing to post coins as collateral against a loan opened prior to April 15 will see their assets returned to their accounts when the loan is repaid, the company added.

- The company is currently facing several legal investigations from regulators in various U.S. states on allegations its lending and earn programs might be in violation of securities laws.

- CEL, the native token of the Celsius Network, is trading at $2.62 at press time, down from $2.69 24 hours ago, according to Messari.

https://www.coindesk.com/business/2022/04/12/celsius-bans-us-non-accredited-investors-from-earning-crypto-rewards/ .... Well, this sucks considering their highest interest bracket paid out 18% APY: https://celsius.network/earnIt seems celsius network is relegated to the same role as coin ICOs in terms of them being accessible only to accredited investors with a net worth of over $1 million or annual income of $200,000. There is a side announcement present where celsius is being investigated and sued similar to how bitfinex and tether have been investigated since 2017: The company is currently facing several legal investigations from regulators in various U.S. states on allegations its lending and earn programs might be in violation of securities laws. 18% APY is such a good deal and very much needed in eras of high inflation. Its a shame everyone can't get in on it. |

|

|

|

I think nepal is also on the verge of default. Nepal Restricts Imports To Save Cash, Suspends Cenbank GovernorKATHMANDU (Reuters) -Nepal is tightening imports of cars, gold and cosmetics as its foreign exchange reserves have fallen, a central bank official said on Monday, after the government suspended the central bank governor and named his deputy the interim chief. The Himalayan country’s foreign reserves have been hit by a slump in tourism in Asia during the pandemic, a problem that has also hit Sri Lanka which is going through a crippling economic crisis due to a shortage of tourist revenue and other funds. https://www.shorenewsnetwork.com/2022/04/11/nepal-restricts-imports-to/ Statistics for disposable income have a tendency to shrink considerably during eras of economic concern. As disposable income is lost, hospitability and tourism sectors are hit the hardest. Naturally places like sri lanka and nepal which rely heavily on tourism would be affected. COVID travel restrictions may also have played a role in declining visitors. People have criticized me for thinking crypto can solve many problems faced by society. But I can't see a good opportunity for crypto to improve circumstances here. Nepal and sri lanka NFTs? They have beautiful natural wildlife which could be photographed to make NFT art. But if the issue is shrinking disposable income, then art investment would also be on the decline. |

|

|

|

|

War is expensive atm. Expensive enough that expansionism could be a difficult goal to achieve.

We can see russia engaging in heavy cost cutting measures in their war with ukraine. Putin deploys conscript troopers as they are by far the lowest paid option. Putin refrains from deploying jet fighters and bombers to avoid the cost of upkeep and maintenance and also to avoid using expensive smart bombs and missiles. While laser guided munitions are impressive, they also tend to cost near to the same as a lamborghini. Can any nation shoulder the expense of launching a never ending stream of lambo priced missiles at foreign enemies?

From russia's example it seems likely china would bankrupt itself if it attempted a massive campaign of expansionism. The cost of US wars in iraq and afghanistan topped $12 trillion in expenses and achieved little.

We may be living in an era where modern armies could theoretically conquer the earth but the effort would be too expensive for any nation to afford it.

|

|

|

|

|

Banks are still our only option for student loans, car loans, real estate loans and similar financing.

We lack crypto alternatives for those markets. And attempts to break into those areas of finance have not gone well.

There is reported to be a 4 billion people on earth who are unbanked that crypto markets can cater to. The 4 billion in this demographic cannot afford the minimum balance for a bank account, lack identification or other basic requirements to have a bank account. And so they often have no option other than to use bitcoin or another crypto currency for electronic payment, transfer, etc.

Personally I am a big fan of how the rivalry between AMD and intel has given us better GPUs and CPUs over the years. Competition in free markets has done much to advance the industries of personal computing and gaming and all of us have reaped the benefits.

The best outcome for banks and crypto is for them to have an AMD versus intel relationship that gives us access to better technology and better opportunities the way the AMD vs intel rivalry has.

|

|

|

|

|

The mining floor is the basic cost of electricity, cooling and storage space for mining rigs. Versus the current price of bitcoin. If electricity, cooling and storage is greater than mined coins, mining operations are running in the red and might shut down. Basic costs IMO are not the biggest hurdle in crypto mining. The biggest hurdle is the initial start up cost of mining rigs. Miners must recoup the cost of mining rigs (hardware) before they can turn a net profit. These are the basics everyone knows and loves.

I think its safe to say miners would never temporarily shut down in a bear market due to moore's law and the overall climbing trend of hash rate which would converge to make their mining equipment less effective over time. Mining rigs depreciate in value over time, the same way that GPUs and computer hardware does. Miners must remain in constant operation, as long as possible. To make the most of their initial investment.

The ideal arrangement for a crypto miner would be inheriting a hydroelectric dam and warehouse full of ASICs, to mine bitcoin with surplus free electricity. Then there are no floor or even fundamental costs aside from storage, cooling, basic upkeep and maintenance.

The $5,000 floor number could be the average monthly electricity cost for a decent size mining op. But that would represent an industrial scale which should be mining enough net BTC for even a $5k number to not be a significant liability.

|

|

|

|

Lets be honest chevking charts and try to guess what comes next is gamble.

All i do is i check what the wall street doing and i do exacly what they do That is essentially what inside traders do. They discuss with other big traders to get inside info and guess where the market is headed short term. Charts can reveal future trends. Increases in trading volume can reveal a buy in trend. While decreases in trading volume can indicate a bearish market. At the moment, crisis and its correlation with existing markets dictates price movements. Shipping and transportation costs are high due to elevated oil. Big pharma profits were good while vaccines were mandated. Oil profits are also good atm due to high cost of oil and gas. The biggest concern is people wanting big percentage gains, rather than the single digit profits which are more easily available. Compounding interest is underrated. |

|

|

|

|

The official number for inflation in the united states is 8%.

Basic finance says investors must place assets in accounts earning greater than 8% to turn a profit in the current economic environment.

I have seen US bank accounts offering as high as 5% APY. (Keyword search for accounts paying highest interest)

Celsius network used to offer as high as 8% to 20% on crypto but that option is now only available to accredited investors and closed to poor and middle class earners the way that ICOs are.

Real estate is another good option which can be leveraged by the non wealthy through the use of fractional real estate investment.

The key thing to remember is, 8% gains are needed to break even in an environment where inflation is 8%.

If inflation increases enough, even a million US dollars could someday be worthless.

|

|

|

|

|

There are claims of residents in high inflation regions like turkey, argentina and venezuela using stablecoins like tether (which are pegged to the US dollar).

As a means of protecting their wealth against high(er) inflation than the united states has.

Stablecoins being a tiny sliver of the global economy, it is difficult to imagine a scenario where stablecoin markets represent a significant chunk of a critical asset bubble.

Tether is the largest and most famous stablecoin with a market cap of $82 billion. A crash there won't rival derivative asset bubbles like the subprime mortgage CDO bubble of 2008.

Bitcoin's market cap at $1 trillion at most, is still a small fraction of the $20 trillion dollar US economy.

I see people trying to engineer a scenario where bitcoin and crypto represent a dire threat to the global economy. Earlier this year, nobel prize winning economist, Paul Krugman attempted it.

|

|

|

|

So dogecoin or Elon could make you immortal, right?

Elon is building a new robot called optimus, to someday download human consciousness into, so that people might become immortal. Optimus is also currently targeted for replacing human workers in basic daily tasks. Its built on the same "self driving" AI that tesla cars use, maybe it is doomed to fail the way their autopilot does. |

|

|

|

Despite the availability of life-saving COVID-19 vaccines, so many people died in the second year of the pandemic in the U.S. that the nation's life expectancy dropped for a second year in a row last year, according to a new analysis. The analysis of provisional government statistics found U.S. life expectancy fell by just under a half a year in 2021, adding to a dramatic plummet in life expectancy that occurred in 2020. Public health experts had hoped the vaccines would prevent another drop the following year. "The finding that instead we had a horrible loss of life in 2021 that actually drove the life expectancy even lower than it was in 2020 is very disturbing," says Dr. Steven Woolf, a professor of population health and health equity at Virginia Commonwealth University, who help conduct the analysis. "It speaks to an extensive loss of life during 2021." Many of the deaths occurred in people in the prime of their lives, Woolf says, and drove the overall U.S. life expectancy to fall to 76.6 years — the lowest in at least 25 years. "Shame on the U.S.," says Noreen Goldman, a demographer at Princeton University who wasn't involved in the research. "It just continues to boggle my mind how poorly we've come through this pandemic. And I find that disgraceful." The 2021 drop came after U.S life expectancy plummeted in 2020, tumbling by almost two years — the biggest one-year fall in U.S. life expectancy since at least World War II. "The motivation for this study was to determine whether the horrible drop in life expectancy that we documented in 2020 resolved or rebounded in 2021 or whether there was a continued decline. Unfortunately, we did not find good news," Woolf told NPR in an interview. Surprisingly, while the 2020 drop in life expectancy hit Blacks and Hispanics hardest, that wasn't the case in 2021, the analysis found. Life expectancy among Hispanics didn't significantly change between 2020 and 2021, and life expectancy of Blacks actually inched up slightly — by a little less than half a year. In contrast, the life expectancy of whites fell by about a third of a year, mostly among white men. "So what this tells us is that this continued decline in life expectancy that we see in the second year has been carried mainly by deaths in the white population," Woolf says. It's unclear why this happened, but Woolf and others think it may be due in part to whites being more likely to live in states with fewer restrictions, so they let down their guard more, while often refusing to get vaccinated. "The deaths that occurred in 2021 were a product not only of a lack of vaccination, which was a huge factor, but also being in places that didn't observe policies like masking and social distancing that prevented transmission of the virus," Woolf says. Because the 2020 drop in life expectancy hit Blacks and Latinos so much harder, they still lost more ground overall in the two years since the pandemic began. Hispanics lost almost four years and Blacks almost three, compared to less than two for whites. The 2021 drop also widened the gap in life expectancy between the U.S. and other wealthy countries, the analysis found. That was due primarily to lower vaccination rates in the U.S., researchers say. Life expectancy only dropped by about a half a year in 2020 in countries like England, France and Germany, and then actually increased by about a third of a year in 2021, according to the analysis. So the gap between the U.S. and those countries grew from more than three years in 2019 to more than five years in 2021. The researchers say a big part of that is fewer pandemic restrictions and more vaccine hesitancy in the U.S., which resulted in lower vaccination rates and a much higher death toll. The prevalence of other health problems like diabetes and obesity also played a role, they say. "We spend a fortune on medical care and we're a high-income country. We should be able to do far better," Goldman says. https://www.npr.org/sections/health-shots/2022/04/07/1091398423/u-s-life-expectancy-falls-for-2nd-year-in-a-row.... If it is fair to say life expectancy decreases as a result of negative economic conditions: crisis, high inflation, wealth and wage inequality, recession. Conditions of economic prosperity carry the opposite effect of extending life expectancy. In which case, bitcoin, coins and tokens which contribute towards prosperity could carry a net effect of causing us to live longer. Bitcoin. It could literally save your life. And add more years to our lifespan than we otherwise would enjoy. |

|

|

|

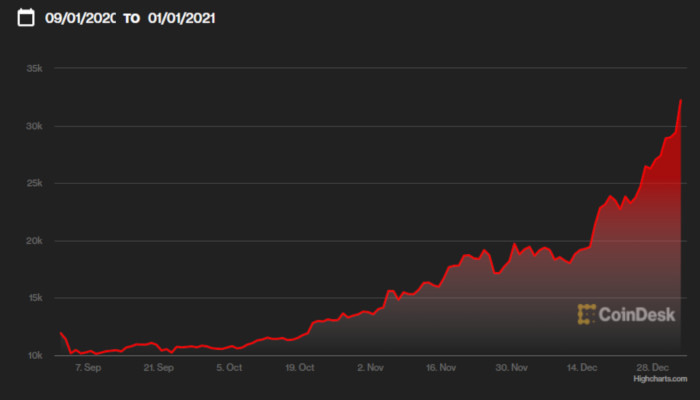

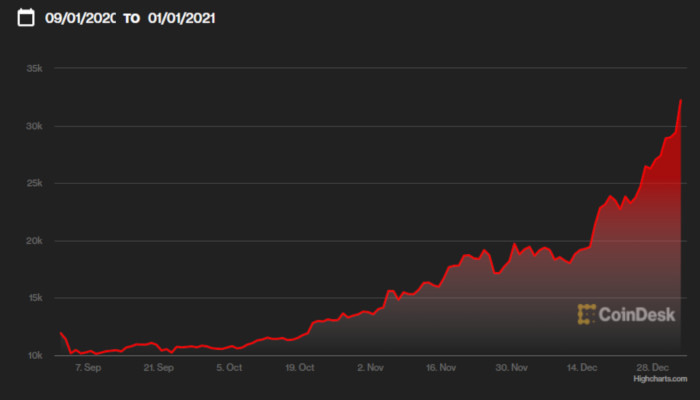

How much will the Bitcoin price spike.... if a decision like this was approved..... and will this boost the global economy?

To answer this question, we can think back to what happened when pornhub implemented bitcoin support. Sometime around september 2020, pornhub added BTC support. We can see bitcoin's chart from september 2020 to january 2021 below.  Chart shows a rise from 10k to 30k over that period. I think its hard to argue with those results. |

|

|

|

|

Moore's law and the doubling of transistors on a given die size, will improve mining efficiency, as long as it remains a relative constant.

Proof of work energy expenditure could be considered collateral or intrinsic backing of crypto assets. No energy is wasted in this process, all of it is directed towards guaranteeing the reliability and security of the infrastructure. If the us dollar is backed by more than 4,000 tons of gold in fort knox. Then bitcoin could be backed by the electrical consumption of its mining sector as proof of its reliability.

There are existing forks of bitcoin, like bitcoin cash. I would like supporters of bitcoin proof of stake mining, forking bitcoin to a PoS variant. It would essentially be a more vulnerable and less reliable fork of BTC. The question is, what would anyone do with a less reliable and more vulnerable bitcoin. What would the motive for it be.

|

|

|

|

Hydrogen, this is the US government we're talking about and a request for funding from Congress. So I don't know, can you make guns and ammunition out of silicon to airdrop to Ukraine, such that the public and Russia is none the wiser? Who knows what goes on in these "classified" meetings. Certainly not me, you, or anyone else not in the inner circles of power.

It does seem weird, and you're right to question it. If I actually gave a shit I'd probably lazily browse a little further to figure out what the conspiracy theorists on the interwebz have to say about it. But I don't. If I cared, I'd have a massive anger management problem to deal with, and I'd rather enjoy life instead of being pissed off about things I have zero control over.

That's not advice to anyone else, by the way--I respect and admire people who stand up against assholes in the White House or Parliament or any holy temple of world power by trying to expose the emperor as being buck-ass nekked with pus-filled pimples on his ass the size of the elephant in the room that no one else dares to mention. Me, I'm tired and defeated and jaded and disinterested. But I do thank you for linking to the article.

During supply chain slow downs of 2020, tesla and other global automakers suffered production setbacks while waiting on delivery for semiconductor based components. Elon Musk explored the option of buying his own semiconductor foundry to avoid chip slowdowns. And was immediately criticized by analysts who joked about Elon not being able to afford the cost. It turns out the cost of a semiconductor foundry runs around $20 billion. If $53 billion is allocated towards boosting semiconductor production, they could conceivably finance the construction of 2 new semiconductor foundries. It could be useful to know specifics of the deal to compare. |

|

|

|

I really like Katie Taylor's instagram clips of her working out and hitting the bag. Her technique, speed and conditioning would be good for a man. Much less a woman. Her comprehension of range and setups are lacking however. I think Serrano could beat her. Its hard to tell where the weight and height discrepancy is, without seeing them stand next to each other. Serrano should be the smaller athlete from the lighter weight division. Hopefully this big fight will also lead to Claressa Shields vs Savannah Marshall unification fight this year. As I understand it, Claressa Shields made the transition to MMA in the hope of bigger paydays and recognition. It wasn't until triller began promoting Serrano that women in boxing were paid decent salaries and were able to co-main big boxing events. Katie Taylor may be an exception to this, with the irish behind her, as Conor McGregor was. |

|

|

|

To help dodge sanctions, Russia had demanded that by the start of this month, members of the European Union begin paying for the natural gas it was buying in rubles rather than dollars or euros, threatening to cut off supplies if they didn’t. And the recent revelation of atrocities committed by the Russian military in Ukraine have renewed calls to boycott Russian gas, an action European countries are struggling to figure out how to implement. Even before all this, just a week after Russia’s invasion of Ukraine began, the International Energy Agency (IEA) issued a press release titled, “How Europe can cut natural gas imports from Russia significantly within a year.” The IEA’s 10-point plan includes strategies for replacing Russian gas (which represents nearly 40 percent of all the natural gas the EU consumes) with other energy sources and for reducing demand. The first of the IEA’s prescriptions for reducing demand is to “speed up the replacement of gas boilers with heat pumps.” Heat pumps are, basically, air conditioners that run in reverse. Powered by electricity, they can “pump” heat from the environment at a colder temperature into a building at a warmer temperature. In the United States, the common perception is that heat pumps are only suitable for comparatively warm climates. For example, Trane, a leading manufacturer of heating and cooling equipment, says on its website “that heat pumps are best for moderate climates.” Carrier, another prominent U.S. manufacturer, echoes that message on its website, saying “Heat pumps are more common in milder climates, where the temperature does not typically drop below freezing.” “This has been one of the myths,” says Jan Rosenow, European program director for the Regulatory Assistance Project, “that heat pumps don’t work in cold climates.” He regards it as misinformation “coming from an industry that is under threat.” This misunderstanding is common not just in the United States, says Rosenow, but also in European countries that don’t have a lot of heat pumps. The distribution of heat pumps in Europe supports Rosenow’s contention. The European countries where heat pumps are most used are some of the coldest, including Norway, Sweden, and Finland, where more than 40 percent of homes use heat pumps. But Rosenow explains that “there is a shortage of installers in Europe; there is a shortage of kit.” The shortages, combined with the urgency of the problem that the war in Ukraine has created, prompted the nonprofit organization Rewiring America to issue a policy plan on 9 March calling for U.S. manufacturers to help the EU rapidly expand the deployment of heat pumps. “We’d be fooling ourselves if we did not take a wartime-production view,” says Ari Mutasiak, CEO of Rewiring America. Mutasiak has been working with climate activist Bill McKibben, who just a few days after war broke out proposed in a blog post that the Biden administration invoke the Defense Production Act to lend U.S. manufacturing might to the effort to speed the replacement of gas-fired boilers with electric heat pumps in Europe. And on 8 March, the Washington Post reported that the White House was taking this suggestion under serious consideration. There’s a fundamental shortcoming with this approach, though. The IEA estimates that expanding the use of heat pumps could make only a small dent, saving just 2 billion cubic meters of natural gas annually, a mere 1.3 percent of what Russia provides the EU. If you’re an optimist, maybe double or triple that savings. It still doesn’t move the needle far enough to help much by next winter, which could be the deadline here. What if in the next few weeks or months Russia were to follow through on its threats to cut off the natural gas that it is sending to EU countries? Or what if EU leaders acted on what seems to many to be a moral obligation to impose a boycott? How could EU officials, engineers, or individual homeowners prepare for such an eventuality? I posed this question to energy expert and IEEE Spectrum columnist Vaclav Smil, Distinguished Professor Emeritus in the Faculty of Environment at the University of Manitoba in Canada, who wrote about some of the war’s implications for fossil fuels just a few days after Russia invaded Ukraine. He stressed that there are enormous structural impediments to making the kind of changes necessary to respond to such a natural-gas embargo. Pressed to consider what could be done if the EU soon loses access to Russian gas entirely, Smil offered a few suggestions. European nations (which he stresses have varying degrees of dependence on Russian gas) would want to look to generate as much electricity as they can using alternative fuels—just as the IEA notes in the “Going Faster and Further” addendum to its 10-point plan, which outlines some temporary fuel-switching options. They could gear up to switch fuels in the central boilers used for district heating, which warms a quarter of EU homes. Also: “You could distribute electric heaters,” says Smil, referring not to heat pumps but to simple electric space heaters. Such heaters are, of course, not an efficient way to heat your entire home. But small portable units could well help people who are forced to do in a big way next winter what the IEA sees the most effective conservation strategy of all: turn down the thermostat. The IEA’s 10-point plan calls for reducing temperatures by just 1° C. But if push truly came to shove, the EU as a whole could in theory save enough energy to displace all imported Russian gas by implementing the IEA plan and fuel-switching measures if people also reduced indoor temperatures more drastically—by something like 8° or 9° C, which would be the amount needed according to the IEA’s estimate that each degree lower on everyone’s thermostats would result in an annual savings of 10 billion cubic meters of gas. This prescription glosses over the differences in the use of Russian gas among EU countries, but it gives you an idea of just how drastic the needed temperature reductions would be. Turning down the heat by that much would be very difficult, to say the least. The IEA indicates average indoor temperatures in the EU are now about 22° C, so we’re talking about temperatures over winter months of just 13° or 14° C (55° to 57° F). That’s darn cold, but most people could manage that hardship, particularly if they used electric heaters to warm the air further in a small space surrounding them. Space heaters could thus prove immensely helpful in a heating crisis. And unlike heat pumps, which are relatively complex pieces of machinery costing thousands of dollars and requiring skilled contractors to install, electric space heaters are simple, cheap, and easy to use. Could enough space heaters be produced in the limited time available before next winter? Sure, says Smil: “Germany's Siemens is already EU's largest industrial manufacturing company, and so they could turn to mass-producing electric heaters—they could also tell the Chinese, where the company is well established, ‘We need 10 million heaters,’ and they could make them.” What’s more, space heaters are “rapidly distributable and scalable,” says Smil, should they be needed “in extremis.” So Rewiring America, Bill McKibben, and various EU energy policymakers are right to be thinking about electric sources of heat and how they could help reduce the EU’s reliance on Russian natural gas. But in their enthusiasm for heat pumps, whose value will take years to manifest to a significant extent, they overlooked what could prove a more realistic option for next winter should a new kind of Cold War challenge the nearly 450 million residents of the EU: the lowly electric space heater. https://spectrum.ieee.org/russia-europe-natural-gas.... Good data and statistics. This is a recommendation from the IEA (International Energy Agency) for european nations to look into heat pumps, electric heaters and greater electrical grid power generation via alt fuels to reduce dependence on russian oil. They're also encouraging europeans to turn their thermostats lower. As a living space heating issue, better residential insulation could also drastically reduce required heating and gas consumption. Growing renewable bamboo to produce woodchip fuel for hearths is an old school solution which might sidestep infrastructure and electrical grid concerns. |

|

|

|

WASHINGTON, April 6 (Reuters) - The White House held a classified briefing on Wednesday with some U.S. lawmakers on the dire risks to the American economy from semiconductor supply chain issues as it pushes Congress for $52 billion in funding to subsidize production. White House National Economic Council Director Brian Deese told reporters "the best estimates are the lack of available semiconductors probably took a full percentage point off of GDP in 2021." The briefing included Commerce Secretary Gina Raimondo, Deputy Defense Secretary Kathleen Hicks, National Security Advisor Jake Sullivan to "discuss the urgent need to invest in made-in-America semiconductors as well as research and development that will protect our economic and national security," the White House said. A persistent industry-wide shortage of chips has disrupted production in the automotive and electronics industries, forcing some firms to scale back production. There have been growing calls to decrease reliance on other countries for semiconductors. "A significant interruption to our supply of semiconductors could cause historic damage to the U.S. economy – damage far greater than the impact of chips shortages on the American auto industry right now – and would undercut our technological competitiveness and military advantages over adversaries globally," the White House said. The White House has been pushing Congress to approve U.S. subsidies for semiconductor chips manufacturing after months of discussions. The Senate first passed $52 billion in chips funding in June that also authorized $190 billion to strengthen U.S. technology and research to compete with China, while the House of Representatives passed its version in early February. Deese said he hopes both the Senate and House will appoint negotiators this week to "quickly" begin a formal process to finalize a compromise bill. "The risks are profound," Deese said of what would the U.S. economy face with a severe disruption. Deese cited "economic moves by key competitors - most notably China around the escalating vulnerabilities we have from the semiconductor issue." A Commerce Department analysis that was prepared for the briefing seen by Reuters noted semiconductor fabs take years to construct. "There is no quick fix in the face of emergency," it said, adding private sector investment in U.S. chips production is not enough and "will not be sufficient to mitigate the risks associated with the current U.S. supply chain vulnerabilities." The bills take different approaches to addressing U.S. competitiveness with China on a wide range of issues, as well on trade and some climate provisions. The Biden administration notes the United States produced nearly 40% of all chips in 1990 while today it accounts for only 12% of global production. https://www.reuters.com/world/us/white-house-warns-escalating-vulnerabilities-us-semiconductor-issue-2022-04-06/.... I don't understand how allocating $52 billion dollars to semiconductor subsidies, can boost global production of semiconductors. Semiconductor foundries are already fully incentivized to maintain maximum production to boost profit margins. Throwing greater monetary incentives at them, shouldn't produce gains due to the fundamental nature of their business being production and volume oriented. Details on these proposed spending plans are scarce and difficult to come by. It is possible that funding will be funneled to intel and their new semiconductor foundries to fund expansion and development of recent movements to boost domestic production. But if that is the case, then why not simply come out and acknowledge it. |

|

|

|

New scientific analysis of the composition of Roman denarii has brought fresh understanding to a financial crisis briefly mentioned by the Roman statesman and writer Marcus Tullius Cicero in his essay on moral leadership, De Officiis, and solved a longstanding historical debate. Researchers at the University of Warwick and the University of Liverpool have analyzed coins of the period and revealed a debasement of the currency far greater than historians had thought, with coins that had been pure silver before 90BC cut with up to 10 percent copper five years later. Dr. Ponting at the University of Liverpool said: "The Romans had been used to an extremely fine silver coinage, so they may well have lost confidence in the denarius when it ceased to be pure. The precise level of debasement might have been less important to contemporaries than the mere realization that the coin was adulterated and no longer made of true 'silver.'" Professor Butcher at the University of Warwick said "The discovery of this significant decrease in the value of the denarius has shed new light on Cicero's hints of a currency crisis in 86BC. Historians have long debated what the statesman and scholar meant when he wrote 'the coinage was being tossed around, so that no one was able to know what he had.' (De Officiis, 3:80) and we believe we have now solved this puzzle." The reference is part of an anecdote describing self-serving behavior by Marius Gratidianus, who took credit for a proposal for currency reform worked out jointly by the tribunes and the college of praetors and became hugely popular with the public as a result. But what was the cause of the coinage being "tossed about," and what were the solutions for which Gratidianus took credit? Rome and the Coinages of the Mediterranean 200 BCE—64 CE, a five-year research project funded by the ERC aims to increase our understanding of the economies of classical Rome and other Mediterranean states by analyzing the composition of their coins and cross-referencing the findings with the historical record. The research team includes Professor Kevin Butcher at the University of Warwick, Dr. Matthew Ponting at the University of Liverpool, and Dr. Adrian Hillier at ISIS Neutron and Muon Facility, STFC Rutherford Appleton Laboratory. Dr. Ponting said: "Our minimally invasive sampling technique used to take samples from these important coins has revealed a significant decline in the value of the denarius—from being a pure silver coin, the denarius first dropped to under 95% fine, and then it fell again to 90%, with some coins as low as 86%, suggesting a severe currency crisis." Professor Kevin Butcher explains the context: "In the years after 91 BC the Roman state was in danger of becoming bankrupt. The Romans were at war with their own allies in Italy, and by the conclusion of the war, in 89 BC, there was a debt crisis. "By 86 BC there appears to have been a crisis of confidence in the currency, too. Cicero related how the Roman tribunes approached the college of praetors to resolve the crisis, before Gratidianus claimed sole credit for the collective effort. "One theory is that Gratidianus fixed the exchange rate between the silver denarius and the bronze as (which had only recently been reduced in weight). Another is that he published a method for detecting fake denarii, and so restored faith in the coinage. "Unfortunately, Cicero's choice of words is too obscure for historians to determine exactly what was going on. His purpose in writing about it wasn't to illuminate monetary history; he was just using the incident as an illustration of a Roman magistrate behaving badly by taking credit for the work of others. "It has long been thought that there was a very slight devaluation of the denarius between 89–87; but was it enough to trigger a currency crisis?" The results of the metallurgical analysis suggest that the financial difficulties experienced by Rome in these years led to a relaxation of standards at the mint in 90 BC, with the result that the silver content of the coinage declined in two stages, so that by 87 BC the coinage was deliberately alloyed with 5–10% copper. Professor Butcher added: "This could be the meaning of Cicero's words: that the value of the coinage was 'tossed about' because nobody could be certain whether the denarii they had were pure or not. "It is all the more noteworthy that around the time Gratidianus published his edict, the standard of fineness rose sharply, reversing the debasement and restoring the denarius to a high-quality currency. "Although the precise chronology remains uncertain, the new scientific data suggest that it could have been the main aim of Gratidianus' edict, rather than something to do with exchange rates between silver and bronze or detecting forgeries." In the decades that followed, the Romans avoided debasing the denarius again, until the state once again faced huge expenses during the civil war between Pompey and Julius Caesar. Even then, the Roman mint did not go as far as it had in the time of Gratidianus. These findings are part of a larger EU-funded study that aims to examine the financial and monetary strategies of Mediterranean states from c. 150 BCE to a major coinage reform in c. 64 CE by providing a detailed and reliable set of analyses of the chemical composition of all major silver coinages of that period. https://phys.org/news/2022-04-analysis-roman-coins-uncovers-evidence.html.... Amazing to think of ancient rome having troubles with currency debasement and inflation 2,000 years ago. With something resembling a silver standard, before the era of paper or digital financial transactions. How many thousands of years will it take for humanity to evolve and progress to where it can defeat inflation? Is it accurate to say the average person today has a better comprehension of inflation, than the average roman who lived 2,000 years ago? Many today appear to believe they're better off not being "burdened" by knowledge relating to topics like finance and inflation. They believe they're better off not knowing. Perhaps this is the path to defeat inflation -- not knowing anything about it, and refusing to acknowledge its existence? |

|

|

|

Talk of a looming recession is rampant around the globe, and now a major U.S. bank has issued its own dire forecast for the global economy. It’s been over a month since Russia invaded Ukraine, leading to an unforeseen and prolonged fallout for the global economy. Combined with an inflation problem that was already spiking the prices of virtually every commodity, global institutions have begun ringing the alarm bells that we are on the brink of a long-anticipated recession. In an investment strategy report sent to clients on Thursday, Bank of America analysts warned that “inflation always precedes recessions” and that tighter monetary policies being put in place to control surging prices make a “recession shock” very likely. Inflation has been the bane of the U.S. economy for months, and rates have hit new highs since the war began. The annual inflation rate jumped to 7.9% in February, the highest it’s been in four decades, and the latest forecasts suggest March’s rate could reach 8.5%, according to investment bank UBS. Such a rate would be the highest since 1981. The Federal Reserve has been laser-focused on the problem for months, and the central bank began hiking interest rates weeks ago in an effort to temper demand and counter runaway inflation. Higher interest rates have led to an inversion of the so-called yield curve, which means that short-term yields have suddenly become much more attractive than the traditionally higher long-term ones. A surge in short-term yields is an indicator that investors believe the immediate future of the market is better than the long-term view. BofA analysts say this inversion is a sign that a recession is nigh. “Yield curves always steepen as recessions begin,” the report read. BofA has joined a chorus of financial institutions warning about the likelihood of an immediate recession. Market-watchers have cautioned that an economic slowdown is the reasonable outcome to assume, given current low unemployment numbers in the U.S. and rising inflation rates. And a growing list of billionaires, global investors, and Wall Street personalities have expressed more and more certainty that the trends we are seeing point to one clear conclusion: A recession is close. https://fortune.com/2022/04/08/recession-shock-bank-of-america-delivers-grim-warning-future-inversion-yield-curve-economy-inflation/.... In the past, some may have called recession a bullish trend for crypto. That was in a pre institutionalized crypto era. Investment banks comprising the largest percentage of global trading volume, cause stock markets and bitcoin to trade in similar upward and downward trends. As investment banks are the largest volume traders in wallstreet and bitcoin, it would seem a type of correlation becomes apparent between the two being traded in similar ranges. The big question now is whether the appearance of correlation between wall street and bitcoin will remain constant. Or whether it will fracture, if doom and gloom predictions pan out. Negative predictions which could only undermine faith and trust in the united states economy and its fiat currency along with it. |

|

|

|

|