As leaders around the world grapple with cryptocurrencies, what happened when the African country tried to ban them?

Sat 31 Jul 2021 11.00 EDT

When the Nigerian government suddenly banned access to foreign exchange for textile import companies in March 2019, Moses Awa* felt stuck. His business – importing woven shoes from Guangzhou, China, to sell in the northern city of Kano and his home state of Abia, further south – had been suffering along with the country’s economy. The ban threatened to tip it over the edge. “It was a serious crisis: I had to act fast,” Awa says.

He turned to his younger brother, Osy, who had begun trading bitcoins. “He was just accumulating, accumulating crypto, saying that at some point years down the line it could be a great investment. When the forex ban happened, he showed me how much I needed it, too. I could pay my suppliers in bitcoins if they accepted – and they did.”

According to bitcoin trading platform Paxful, Nigeria is now second only to the US for bitcoin trading. The dollar volume of crypto received by users in Nigeria in May was $2.4bn, up from $684m last December, according to blockchain research firm Chainalysis. And the true scale of crypto flows through Africa’s largest economy is likely to be much larger, with many trades untraceable by analysts.

An array of factors, from political repression to currency controls and rampant inflation, have fuelled the stunning rise of cryptocurrencies in Nigeria. In February, the government took fright and banned cryptocurrency transactions through licensed banks. In late July, it announced a pilot scheme for a new government-controlled digital currency – hoping to reduce incentives for those wanting to use unregulated crypto.

But these measures have done little to dampen trading, with exchanges reporting a continued rise in transactions this year.

Nigeria’s experience holds lessons for governments around the world, many of which are now thinking hard about how to regulate digital currencies. Britain’s chancellor, Rishi Sunak, is looking at creating a central-bank-controlled version, already being called Britcoin. EU regulators have set out plans to make digital currencies more traceable, in order to combat money laundering. In rural China, rows of computers used to create bitcoin in a computational process known as “mining” are being switched off after a clampdown by the authorities. The ruling party imposed a ban on transactions in May.

Elsewhere, Egypt, Turkey and Ghana have sought to clamp down on crypto trading, wary of potentially vast movements of digital funds beyond their regulatory controls.

Nigeria has one of the youngest populations in the world and is ripe for digital finance. With many people looking for ways to escape widespread poverty, pyramid schemes are proliferating.

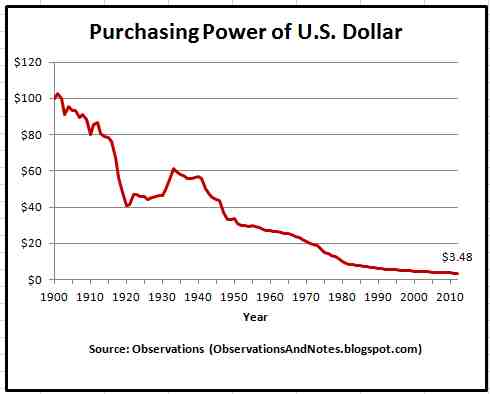

Trading in foreign currencies is an everyday activity for many. Remittances into Nigeria from those working abroad, which were worth more than $17bn in 2020, have played a role, as has the way digital currencies can provide insurance against exchange rate fluctuations. The value of the Nigerian naira has plummeted almost 30% against the dollar in the past five years.

There are political factors too. Some see cryptocurrencies as vital protection from government repression.

Last October, Nigeria was rocked by the largest protests in decades, as many thousands marched against police brutality, and the infamous Sars police unit. The “EndSars” protests saw abuses by security forces, who beat demonstrators, and used water cannon and teargas on them. More than 50 protesters were killed, at least 12 of them shot dead at the Lekki tollgate in Lagos on 20 October

The clampdown was financial too. Civil society organisations, protest groups and individuals in favour of the demonstrations who were raising funds to free protesters or supply demonstrators with first aid and food had their bank accounts suddenly suspended.

Feminist Coalition, a collective of 13 young women founded during the demonstrations, came to national attention as they raised funds for protest groups and supported demonstration efforts. When the women’s accounts were also suspended, the group began taking bitcoin donations, eventually raising $150,000 for its fighting fund through cryptocurrency.

Jack Dorsey, the founder of Twitter and a prominent advocate of cryptocurrencies, reshared the FemCo bitcoin donation page, further drawing the ire of Nigeria’s government, which last month suspended Twitter in Nigeria.

The sight of young people openly critical of government figures easily manoeuvring around restrictions shocked the country’s political class, according to Adewunmi Emoruwa, founder of Gatefield, a public policy organisation which gave grants to journalists covering the protests.

“I think that EndSars is like the key catalyst for some of these decisions the government is making,” he said. “It caused fear. They saw, for example, that people could decide to bypass government structures and institutions to mobilise. It sent shockwaves and those shockwaves have continued.”

During the protests, Gatefield’s bank accounts were suspended, until a court found the suspension unmerited and ordered that they be reopened earlier this year.

The episode reinforced the need many Nigerians felt to insure themselves against sudden moves by the authorities. Many organisations now keep some of their finances in cryptocurrencies.

Speaking anonymously to avoid reprisals from the authorities, a leading figure in one civil society organisation, whose accounts were also briefly suspended last October, said digital currencies were now a key insurance against hostile interventions.

“We keep some securities in crypto – not too much but enough, sort of as an insurance policy,” they said. “When the ban happened we were, thankfully, able to pay salaries. This way, in a situation like that, we’ll have a way to keep paying our staff.”

In February, the Central Bank of Nigeria responded by telling banks to close the accounts of all customers using cryptocurrencies. Financial institutions would have to “identify persons and/or entities” making transactions in crypto or face sanctions.

The ban was at first a blow to an emerging industry of cryptocurrency brokers who relied on commercial banks to facilitate transactions between sellers and buyers. However, many customers found workarounds, said Marius Reitz, Africa general manager at Luno, a cryptocurrency trading platform.

“A lot of trading activity has now been pushed underground, which means many Nigerians are now depending on less secure, less transparent over-the-counter channels, as well as Telegram and WhatsApp groups, where people trade directly with each other,” Reitz said. The ban has made cryptocurrency trading harder to monitor and less safe. “This also means regulators now have a reduced level of visibility and control of the market, and unfortunately this can expose consumers to a higher risk of being defrauded.”

Platforms have also adjusted, by continuing to facilitate transactions as long as the currency being traded is not declared as a cryptocurrency.

While some platforms experienced a hit in trades, for others, the clampdown has increased demand for cryptocurrencies, not dampened it. In the first five months of 2021, according to Helsinki-based platform LocalBitcoins, Nigerians traded 50% more than in the same period last year.

The Nigerian government’s response to cryptocurrencies has in fact been inconsistent. Announcing the February curbs, the governor of the central bank, Godwin Emefiele, told a senate committee that cryptocurrency was “not legitimate money”.

At the same time, Vice-President Yemi Osinbajo publicly rebuked the move. “Rather than adopt a policy that prohibits cryptocurrency operations in the Nigerian banking sector, we must act with knowledge and not fear,” he said, calling for a “robust regulatory regime that is thoughtful and knowledge-based”.

Another Nigerian government agency, the Securities and Exchange Commission, has been more open to creating a more regulated environment for cryptocurrency transactions.

The reality that cryptocurrencies cannot effectively be stopped had gradually dawned on the government, said the operator of one Nigerian crypto trading platform, speaking anonymously after having been targeted by the authorities. “They know they can’t really stop it. It’s out of their control, and what scares them is they are not used to being in this position.”

* Not his real surname

Bitcoin: the pros and cons

Bitcoin was the first cryptocurrency, created in 2009, and remains the most widely known and valuable. It’s a digital or virtual asset, operating outside of the traditional banking system, and its influence has soared, with a growing number of companies now accepting it for payments.

Each bitcoin is essentially a digital token containing a secret key that proves to anyone in the network who it belongs to. Effectively, each bitcoin is a collective agreement of every other computer on the bitcoin network that the token is real, created by a bitcoin “miner”, and then acquired through a series of legitimate transactions.

Each time bitcoins are spent, it becomes known to the entire network that their ownership has been transferred. Every transaction is stored in a lasting public record called a blockchain, which underpins the entire system, making it possible to trace a coin’s history and preventing people from spending coins they do not own.

For bitcoin’s many advocates, there are several advantages to the virtual system – from the way the blockchain can be used to track things other than simple money, to support for “smart contracts”, which execute automatically when certain conditions are met.

But bitcoin’s biggest advantage is that it is decentralised and so extremely resistant to censorship or regulatory control by a single entity. It’s possible to observe a bitcoin payment in process, but no one can stop it. This has made governments wary: in a conventional financial system, banks can freeze accounts, vet payments for money laundering or enforce regulations.

Thanks to the decentralised nature of cryptocurrency networks, people have been able to make international payments from closed or tightly restricted economies, but this has also made them a haven for illegal activities, from cybercrime to money laundering and drug trading.

Another concern about bitcoins is that they damage the environment. Bitcoin mining – the process in which a bitcoin is awarded to a computer that solves a complex series of algorithms – consumes vast amounts of energy. Miners set up large computer rigs to maximise the chances of being awarded bitcoins. The carbon footprint of this “mining” is now similar to Chile’s, according to the Cambridge Bitcoin Electricity Consumption Index, a tool from Cambridge University that measures the currency’s energy usage.

Advocates of bitcoin say the mining is increasingly being done with electricity from renewable sources. And while the amount of energy consumed by bitcoin has dropped significantly this year, concerns remain. Environmentalists argue that miners tend to set up wherever electricity is cheapest, which may be in places with coal-generated power.

https://www.theguardian.com/technology/2021/jul/31/out-of-control-and-rising-why-bitcoin-has-nigerias-government-in-a-panic....

Good read. Attempts at accurate and informative journalism like these are becoming increasingly rare.

It seems many of nigeria's ruling elites were shocked by nigerians being able to circumvent the central banks bans. I hope this encourages them to buy bitcoin and HODL. Rather than store their wealth in their countries native inflationary currency, which appears to be losing value by the day. It is surreal to see nigeria's government continue to insist "bitcoin is not real money" when btc is a more stable and reliable asset than the nigerian government's native fiat currency.

This article however is not perfect. It contains misinformation about crypto's alleged abuses of the environment. Which I hope everyone knows is a false narrative. Crypto mining probably does not rank in the top 20 most destructive industries to the environment. It is a very strange world we live in, where the media insists toxic waste generated by nuclear power plants is perfectly "healthy" to the environment. And crypto mining which is powered mainly by hydroelectric, wind and solar energy is "not".