|

Is it fair to say, the youtube clip posted in OP does the best job putting the future NFT market into perspective, out of anything that anyone has seen so far? If people have seen better content posted on the future of NFTs anywhere, I would like to see it.

If anyone is unhappy with post in OP. What type of content would they prefer to see posted. I can try to shift to topics people are more enthusiastic about.

Give me examples of what you think good crypto content is.

|

|

|

|

What should new investors know about Bitcoin?

#1 Inflation protected asset (The most accessible and easy to store inflation protected asset for poverty to middle class earners, in the world) #2 Deflationary (Bitcoin's historical price chart could trend towards the opposite of inflationary assets a la fiat currency) #3 Trust less design paradigm (Elimination of middle men and physical locations, gives it an intrinsic advantage over banks and traditional financial institutions in moving and storing wealth) #4 Open Public Ledger (Its transparent design is intended to cut down on money laundering, crime, exploitation and abuse) #5 Bitcoin Mining Funds Renewable Energy (Most bitcoin mining is powered by surplus hydroelectric or wind energy, which funds further expansion of energy sectors friendly to the environment) #6 Caters to unbanked demographics (Billions of the unbanked worldwide who could not qualify for a bank account, use bitcoin to conduct transactions and store wealth) There are many other arguments for BTC I tried to cover a few of the most obvious ones. |

|

|

|

The Art Market is a Scam (And Rich People Run It) https://www.youtube.com/watch?v=ZZ3F3zWiEmc.... This is a really good, detail oriented, overview of the modern day art industry for a 20 minute watch. Its information and data heavy with both good and relevant statistics. There are good points made about the art industry remaining unregulated despite some art pieces being valued and sold in the $400 million dollar range. Good points made about the modern art industry being extremely centralized within only 3 nations. Good points made about art lacking intrinsic value. And good points made about organizations like the IRS largely ignoring the art industry. All current trends in modern day art could illustrate what the future holds for NFTs. While NFTs are relatively new, it may be possible to predict exactly what the future NFT market will resemble, simply by comparing it to modern day analogues like art and collectibles which have many years of history behind them.

|

|

|

|

|

Games denying players an open market to buy and sell goods. Seemed like a good practice. Until blockchain P2E (play to earn) gaming showed the potential for gamers to make money and profit from their online gaming experience.

The majority of blockchain P2E is filled with overpriced auto game scams, which makes the steam ban a good choice, for now.

There are a few games in the P2Everse that are legit, which players could conceivably earn enough money to make a frugal living on.

Some of the bigger account holders on splinterlands are earning $40 a day for 1 year through airdrops. If the format is sustainable over the long term, it could be a good model for future gaming.

|

|

|

|

One of the most important risk here is that you stake your reputation and time. If you make a bad call it will definitely affect your reputation and you don't earn anything from time spent in solving the problem. It's risky to spend time trying to solve a problem and you end up losing in the competition, wasting your time and running your reputation. Better to use that time in learning to succeed in what you can do and earn rewards from it

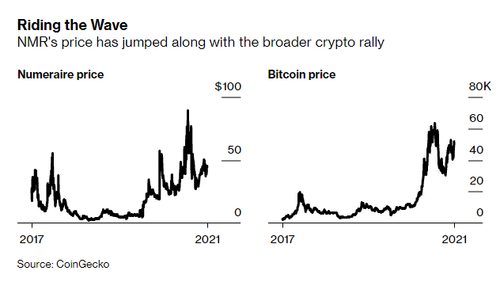

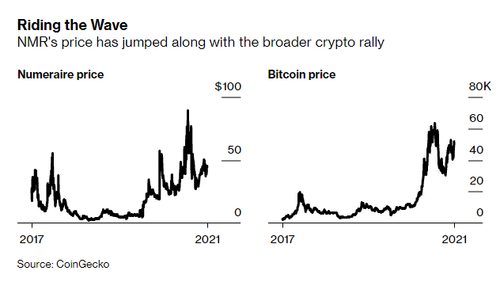

Before the internet era, stock market trading was mainly conducted live on a trading floor.  There were some successful floor traders, who could not successfully make a transition to electronic internet trading as the information age hit. Live trading in an arena against other investors, could be a different experience from solo trading on a computer screen. The arena format could favor some investors who couldn't successfully trade in a solo non competitive format. I've seen crypto investors lash out against crypto commentators on youtube. There are some who give questionable advice and recommend people buy what they're currently holding. Rather than buying something that is likely to earn them profits. The type of meritocratic format numerai supports could be good for cutting down on questionable advice as well as being a good learning experience. I'm going to try it. Will post my experiences later. |

|

|

|

|

Argentina seems like an interesting place. Its where Hitler was rumored to have fled after World War II. I think argentina passed gay marriage with an 80% roman catholic population demographic. Banks in argentina were one of the first to use bitcoin over wire transfers for cross border payments.

I guess the success or failure of their crypto mining venture will all depend on their electricity costs. El salvador could have advantages if they're able to harness geothermal energy which can be cheaper and more affordable than hydroelectric, wind or solar. The texas crypto mining industry could have advantages in terms of Elon Musk building multi megawatt hour lithium batteries to reduce grid electricity costs. Countries like iceland have cool climates which reduce cooling costs.

I would be interested to see what type of energy plan argentina comes up with. Maybe they have something up their sleeve that is really cool. Or maybe crypto mining on an industrial level is so profitable they won't need an ace to see significant gains from this.

|

|

|

|

One NASA engineer is using his smarts not only planning to explore outer space, but also earning cryptocurrency by picking stocks. When 32-year-old Hayden Burgoyne isn't plotting a mission to explore Jupiter's moons as part of project Europa Clipper, the Los Angeles resident spends his spare time as an amateur quant - poring through market data for Paul Tudor Jones-backed crowdsourcing firm Numerai, according to Bloomberg. Without revealing their models, the contributors pick stocks they think will outperform in the coming month and make bets in online trading tournaments using a digital currency issued by Numerai. The San Francisco-based firm, established in 2015, then invests in the corresponding stocks. Those picks from the likes of Burgoyne, a world away from Wall Street, have powered the market-neutral fund to a 9% gain this year through August. In 2020 it was up 8% when many storied quants faltered. “I have no finance background so it puts people like me on an equal footing with somebody with an economics PhD,” he told Bloomberg.  Burgoyne uses an "assortment of data" on 5,000 stocks to make his picks. He uses metrics like price history to valuation ratios, sometimes without even knowing what the underlying metrics are. Those who perform well get "NMR" tokens, which are now worth about $50 a piece. Numerai founder Richard Craib commented: “By setting up the problem and being in charge of data people look at, we can get exactly the type of signal we want. Although they might not work individually, when you combine them altogether the increase in accuracy and performance is huge.”  Craib also commented on paying out in crypto: “Even if we gave away 100% of our profits of the fund to our users we will never be able to pay as much. What I like about cryptocurrencies is the idea that actually through the community, the cryptocurrency is valuable for its own reasons.” Burgoyne has 630 NMR tokens backing his predictions. Another Numerai trader, Sharon Moran, commented: “As a mother of three with a daughter in private college, there’s the money consideration. But the ability to learn and grow and apply some of what I’ve been learning as far as modeling was the initial motivation.” And people are taking notice: one pension fund that has $45 million in assets with Numerai could increase their allocation to $130 million if the firm hits "certain milestones". While quant funds and factor-based investing have consistently shown themselves to be unreliable at best, crowdsourcing ideas as a quant model still hasn't been fully vetted. And something is working for Numerai. https://www.zerohedge.com/markets/nasa-engineer-earns-crypto-helping-crowdsource-stock-picks.... A new challenger has emerged! Numerai (NMR) token! Here is a novel concept. Crowdsourced stock picking. Under a meritocratic format where the most successful stock pickers are awarded crypto tokens. Which determine how influential their picks are within the crowdsphere. This sounds like a great place to learn crypto and asset trading. There's no risk. No need to gamble with your own money. There is no minimum entry to market. Its a competitive atmosphere, an element some require to be successful traders. Making good calls is rewarded with free tokens. Making bad calls carries no loss, except perhaps valuable lessons which can be useful in finance. Surprised this hasn't received more attention, it seems like a sweet deal. |

|

|

|

Here is a great chart I saw comparing china's bitcoin bans with contrasting price moves afterward. Newcomers to crypto may view chinese bitcoin bans as a doomsday event where the sky is falling. Historical trends however are not that bad. China's economy may take a big hit as crypto miners exodus from the country. Taking with them considerable capital, electrical consumption, jobs and economic growth which are attributed to cryptocurrency innovation. If china banned the wheel, shortly after it was first invented. Undoubtedly, they would suffer in ways. Perhaps the same can be said of their stance towards crypto. |

|

|

|

|

Week 6 Predictions

Buccaneers > Eagles

Dolphins > Jaguars

Packers > Bears

Bengals > Lions

Texans < Colts

Rams > Giants

Chiefs > Washington

Vikings < Panthers

Chargers > Ravens

Cardinals > Browns

Raiders > Broncos

Cowboys > Patriots

Seahawks < Steelers

Bills > Titans

....

Record through week 5: 12 - 4.

75% win rate.

Many teams appear to be pacing themselves and resting either in the first half or the second half.

Its a strange scenario where a team's defense / offense can only be strong for two quarters. Depending on the intensity with which they're playing.

At some point, I would like to try big data analysis on NFL stats to see if I can find patterns that translate to higher betting accuracy.

|

|

|

|

So to the point: Would you quit if a centralized shitcoin managed to surpass Bitcoin in marketcap? At that point it would be clear that entire space is a joke. Bitcoin would still march on as usual, but it would be just sad to see people putting their money on shitcoins rather than on the only actually decentralized blockchain worth anything. It revolves around a question of whether bitcoin can be improved upon. Do we have talented software engineers and designers who can make a better version of what Satoshi made. Things are looking bad at the moment. It doesn't seem as if there's anyone who is interested in filling the vacuum left behind by Satoshi. Its been said the 2008 economic crisis was one motivation behind Satoshi creating bitcoin. I no longer see people who are upset over the 2008 crisis or economic conditions in general. Its possible motives behind creating bitcoin no longer exist in the public consciousness. People have come to accept economic crisis, downtrends and instability as being normal and ordinary parts of daily life. The void left behind by Satoshi might never be filled, until people are angry about the current state of finance and the economy. If that day ever comes. |

|

|

|

|

Its been said for many years, the majority of electronic attack and theft is committed by current or former disgruntled employees. The majority of attacks in finance sectors are inside jobs.

In the USA the SEC prevents some of these scams by limiting some of the riskier ventures to those earning more than $100,000 a year (accredited investor).

Many ICO scams appear to have been eliminated by the SEC limiting ICO offerings to higher income demographics, who are more savvy when it comes to investments. There is a flip side to this in terms of the poor no longer having access to ICO offerings. Which could payout higher than the normal investments they normally have access to. Its a those risk versus reward scenario that is difficult to quantify.

Defi could be much bigger than ICO was, with more professional and bigger names involved. Still we see many of the same trends and precedents emerging.

|

|

|

|

If printing more money is inflation then why printing more gold is not?

Fundamental supply and demand. The supply of fiat can be expanded and printed in higher volume. This expansion can be achieved easily without obstacles. Increasing supply, while demand remains constant, generally reduces the value of a thing. (Higher volatility than gold.) The supply of gold can only be increased by mining it from the earth. This expansion is much more difficult to achieve. Supply doesn't shift as drastically or severely as printed money. (Lower volatility than fiat.) Supply of cryptocurrencies like bitcoin, could be even harder to expand than gold. Due to it being algorithmically limited. As Steve Jobs once said, better methods to extract gold from the earth will be devised as technology improves. While bitcoin's mining difficulty will never be overcome, no matter how much the technology of ASICS or GPUs advance. |

|

|

|

|

I feel like this is simply another page in the long history of platforms like thepiratebay attempting to avoid regulation by hosting servers in neutral locations. At one point thepiratebay planned torrent servers be hosted in airborne drones flying over international waters to avoid regulation and law enforcement. Then we have TOR and darknet market places like silk road, alphabay, etc.

Its possible in the future, africans will host their own cryptocurrency exchanges using TOR. Or perhaps even with servers hosted in drones flying over international waters. Like they say necessity is the mother of all invention and history repeats itself.

If africans are someday spamming Elon Musk's social media asking him to host a bitcoin exchange in space, the moon or mars for them, I won't be surprised.

|

|

|

|

Taiwan carries considerable strategic and economic value being the world's largest manufacturer and supplier of semiconductors. If I'm remembering right, the cost to construct a semiconductor foundry ranges around $20 billion. Which could put it outside the budget of even billionaires like Elon Musk who looked into acquiring their own semiconductor foundry ever since supply chain issues manifested in 2020. If china invades taiwan using military force, taiwan's semiconductor foundries could be damaged or destroyed. There is a chance taiwan could choose to destroy their semiconductor plants, rather than have china capture them intact. That could be one reason behind china's hesitation. There is also a domino effect. If neighboring nations see china invading taiwan, they could take steps to harden their defenses against being treated in a similar manner. And so its normal to take time to weigh the pros versus cons and try to come up with a way to invade taiwan that guarantees their semiconductor industry can be captured completely intact. If taiwans semiconductor industry is damaged. There is a chance that remaining semiconductor producers could be repurposed to producing higher priority chips. Worst case scenario: ASICs and GPUs are deemed "low priority" or "non essential" while chips for other industries are deemed the opposite. ASIC and GPU production could take a hit. Even if those industries are not directly being targeted. |

|

|

|

The dogma of ‘increasing wants’ as an indispensible basis for further industrial progress. Instead of the duty to work, we now have the duty to consume. To ensure rapid absorbtion of its immense productivity, megatechnics resorts to a score of different devices: consumer credit, installment buying, multiple packaging, non-functional designs, meretricious novelties, shoddy materials, defective workmanship, built-in fragility.

The aim of industry is not primarily to satisfy essential human needs with a minimal productive effort, but to multiply the number of needs, factitious and fictitious, and accommodate them to the maximum mechanical capacity to produce profits. These are the sacred principle of the power complex. Not the least effort of this system is that of replacing selectivity and quantitative restriction by indiscriminate and incontinent consumption.

--THE PENTAGON OF POWER, Lewis Mumford, 1970 I like the way Lewis Mumford defined principles of capitalism and economics above. The line about "multiplying the number of needs, factitious and fictitious, and accommodating them to the maximum mechanical capacity to produce profit" could also apply to taxes, social programs and the public sector. Its strange how a high percentage of content published on topics like finance and economics today are formatted like a wikipedia page. They contain information and content while neglecting some of the deeper observations and conclusions which could be made. This is particularly apparent in terms of history. Where today we never seen an effort to compare current trends to previous statistics to put events into their proper context. Isn't it strange how people today discuss "inflation" as if it were a new thing that was invented only yesterday. With zero context cited on inflation / hyperinflation in past eras of history. Most fail to acknowledge even the most basic causes of inflation. As if the goal for humanity was to forget basic fundamentals and simply parrot whatever trendy news headlines say. |

|

|

|

Week 5 results. Win Rams > Seahawks

Win Jets < Falcons

Win Packers > Bengals

Win Lions < Vikings

Loss Broncos > Steelers

Win Dolphins < Buccaneers

Win Saints > Washington

Loss Eagles < Panthers

Win Titans > Jaguars

Win Patriots > Texans

Loss Bears < Raiders

Win Browns < Chargers

Win Giants < Cowboys

Win 49ers < Cardinals

Loss Bills < Chiefs

Game is later today - Colts < Ravens

11 correct, 4 incorrect. 11/15. 73% win average. With Colts vs Ravens still to be played later today. I'll edit this post & drop my predictions for week 6 here. I only want to take some time to think about some of the match ups and look up stats. NFL isn't a sport I'm knowledgeable in. I can't say I know much about the history of the game or expostionary info a sharp gambler in this area should have. This is mostly for fun. And to perhaps show that even casual gamblers can do ok gambling in an area where they don't specialize in.  |

|

|

|

Here is a chart of the inflationary dollar losing value over time. Bitcoin is a deflationary currency. Which could mean natural forces dictate, it will trend upwards in value, opposite of inflationary assets like usd. Looking at a life history chart of bitcoin, it appears to represent the mirror opposite of the euro, dollar, bolivar, zimbabwe dollar and assorted inflationary currencies. It could all come down to fundamentals. Printing increasingly larger quantities of something over time will devalue it, while printing increasingly smaller quantities of something will increase scarcity and value over time. Of course there are rogue actors involved. China and central banks do not appear too fond of cryptocurrencies atm. |

|

|

|

This, as I explained in another thread, makes it difficult for Bitcoin to be used as a day-to-day currency. In order to keep track of all transactions and pay taxes correctly you should rely on some App or some kind of software that keeps track of transactions and does the calculations for you. This means giving up your privacy and giving your purchase data to a centralized entity. Holding BTC as disposable income for remittance payment, rather than as an HODL investment. $1,000 in bitcoin could be exchanged for $1,000 in stablecoin to avoid price swings. Then exchanged for BTC again for payment. Governments only "capitulate" to the informed, motivated and organized public. If people become uninformed and unorganized enough for governments to get away with oppressing them. That often occurs. For many years legalizing gambling was a common theme for how to boost local economies. Then legalizing and taxing marijuana became the common theme. 2021 we don't hear many proposals for legalizing gambling or weed. Everyone only talks about legalizing cryptocurrencies. This is what real progress looks like, am I right. |

|

|

|

|

Would anyone care to guess what the motive behind removing select nations from the list is. I wonder if people would be upset if they knew. Or would they not care, its normal life as usual.

In some poor nations, the average worker might make $4 a day. If the average wage was raised 200% businesses would go bankrupt being unable to afford it. If the income tax was raised 200% it could destroy the entire economy. A country must retain a relative degree of economic wealth and prosperity to afford 15% income taxes. The reason poorer countries like puerto rico impose only 4% income taxes is their economies could not afford to raise taxes higher without destroying their economies.

And so it could be interesting and painful to see what picture emerges with recent trends.

People have developed the idea things like taxes and politics are completely 100% unrelated to their quality of life. Then they're shocked and surprised when a shift in oil prices significantly affects the cost of goods and services they use on a daily basis. Its a very strange thing.

|

|

|

|

|

If only lawmakers would abandon their war on gambling and pursue causes with a higher potential to improve life and standard of living. If governments showed the same enthusiasm for decreasing oil prices, that they do for their war on gambling, the world would be a much different and better place.

While there are unfortunate and sad stories about gambling addiction. There are also a small segment of the population who are winning gamblers who profit and earn a living from gambling. Its irresponsible for the media to illustrate gambling as being an entirely negative thing. Gambling isn't so different from lotteries, prize giveaways, sweepstakes and other formats that people appear to use responsibly without much negative trend.

There are people who are consistently earning money who are becoming millionaires off fantasy sports. While gambling addiction is sad, I don't think wiping out the entire industry -- with many jobs people rely upon, is the answer.

|

|

|

|

|