Crypto adoption - not really, cash is king. No one is going to suddenly switch to a completely different and unstable currency when the current currency is still working well. I don't know anyone who carries large amounts of cash on them. Banks are often closed during wars and times of crisis, which can make it difficult to withdraw cash. Looting, violence and crime also rise during war and times of crisis. Cash carried in a wallet or pocket can be taken. Or confiscated by soldiers and security forces. Crypto by contrast cannot be taken as easily. It provides an additional feature of making it easier to receive money and donations. Kraken exchange was offered $1,000 in funds to every person in ukraine who had made an account before the crisis began. There are other crypto projects aimed at donating funds to refugees in ukraine via BTC and other tokens. But what really opened the door to crypto adoption in ukraine were services like paypal and electronic banking being shut down intermittently. Crypto was demonstrated to have the better realiability and uptime in contrast to trusted brand name services. Satellite Internet - when Russian occupants enter a village or town, one of the first things they do is destroying or jamming local mobile networks. Similar things can be done to musk's starlink dishes. They also can't survive the shelling that often target residential areas.

Every single time there's a crisis in the world, someone will say "this is good for Bitcoin", and yet practice shows that the use of Bitcoin in such situations is just some lone cases rather than a trend.

Mobile networks can be used to fly drones, which can be used to attack the russian military. In that context, they can be a target. Another thing that happens when countries like russia invade is them conducting electronic warfare against the national internet backbone to jam communications. In which case, satellite internet is the only remaining option. Satellite networks don't need to transmit 24/7. They can be used when needed and shut down when they're not. If they're being used to buy a cup of coffee and for relatively innocent and non military purposes, russia won't care. Its satellite communications used by the ukraine military to organize and to conduct drone attacks, that russia is concerned with. Its not a question of whether its good or bad for crypto, it has more to do with demonstrating real world value that crypto can have to ordinary people in times of crisis. Bitcoin can literally save your life. Surely this must be worth something to someone. |

|

|

|

There are projects to develop paper based crypto, such as Kong cash: https://kong.cash/A paper format isn't necessarily well suited to bitcoin or tether. A person could print a piece of paper with the public key and private key to a specified sum of BTC holdings. An independent 3rd party could verify the details and stamp their approval on the piece of paper to create essentially spendable paper BTC. But I think it would take years for people to accept this process as normal and for people to trust the independent 3rd party as genuine. A single scam, hack or negative publicity could completely sabotage the trust process. But this is not what BTC was built for. BTC is more of an inflation protected HODL asset. It wasn't designed to be spent quickly or in large volumes via a paper system. I think people would better off using something else as a basis for paper crypto. |

|

|

|

|

Putin: "The united states is broke."

Putin: "This is a good time to invade ukraine, when americans are too poor to respond with military force."

It is possible that an american deterrent was the only thing keeping russia in check. Now that the deterrent is removed, Putin can move with relative impunity.

Inversely speaking, if american prosperity prevents russia from invading its neighbors. Then all that is needed to fix problems in ukraine, is for the american economy to be restored to its previous state of prosperity.

Something similar could be said for europe and asia. The best deterrent to invasion and war could be strong economic fundamentals. Predators feast upon the sick and weak. Nations with economies in distress. And so to reverse the trend perhaps it would be wise to pursue the opposite trend.

|

|

|

|

At a certain crude oil tipping point, it will become more cost effective to use vegetable oil in flex fuel diesel vehicles, than actual diesel. More affordable to convert vehicles to biogas or electric, than stay on gasoline. As oil prices rise, consumers will seek alternatives. Some might sell cars and trucks to buy electric scooters and attach a trailer to the rear to haul groceries and cargo. Fossil fuel based transportation isn't a global monopoly, although it is a dominant demographic. These price hikes will incentivize competitors to fossil fuel based transportation to expand. The post industrial age era saw people trade their horses for automobiles. If oil prices soar high enough, we could perhaps live to see people trade automobiles for horses and ostrich pulled carts.  |

|

|

|

The Russian-Ukraine war took almost everyone by surprise I don't understand why people say its surprising. There was conflict in crimea only 8 years ago and it has always been clear hostilities could resume at any moment. The US and the EU responded with tough economic sanctions targeted at crippling the Russian economy and isolating it from global commerce. By seizing several Russian foreign assets, looking for alternatives to Russian oil, and removing seven banks from the SWIFT network, the West made a bold statement showing that they would not allow any oppression to have a field day. I remember reading news stories about russia seeking alternatives to SWIFT years ago. I've always thought russia had hardened its economy in preparation for this type of economic warfare for some time now. Mcdonald's and other private sector corporations completely shutting down operations in russia may have taken Putin by surprise. Canceling russian athletes, celebrities and businesses as well from outside russia. I believe all of these took Putin by surprise, causing the invasion of ukraine to stall. If however Putin becomes convinced his economic troubles are solved, he will return to invading ukraine once again. An operation which russia appears to be conducting on a shoestring budget without the use of expensive air support, waged primarily by conscription troops on reduced wages. |

|

|

|

The deflationary spiral argument goes as following: Let's imagine an economy that only uses Bitcoin, solely, as currency. When the productivity rises, the price of goods and services decreases. Bolded above assumes profits and gains made from increased productivity trickle down to poor and middle class earners. If trickle down economics MMT (modern monetary theory) pan out, the statement is accurate. Else trends could shift in the opposite direction. Taxation, regulation and other aspects also factor in to the overall effect. One key aspect to economic theory is it does not acknowledge every relevant aspect of markets and finance. Most armchair economic philosophers are not investors or traders of assets. They do not take their economic theories to the real world to test them, with their own money. Market traders who invest with their own money, usually have a better comprehension of markets, economics and finance than armchair philosophers IMO. But, this has a negative effect: People are more discouraged to hoard their currency, than to let it circulate. This stagnates the economy as consumption drops. And when consumption drops, so does the production, because the profit decreases along with the demand. How many people "hoard currency"? I think most would prefer to have their currency in a bank account where it can earn interest. "Hoarding currency" is an urban legend, unless we're referring to international reserve currencies being hoarded in regions with high inflation. I would contend: declines in consumption are more closely correlated with high taxes or wage stagnation than they are currency hoarding. Bitcoins deflate in value when the Bitcoin economy is growing, but doesn't deflation often contribute to lower economic growth? I think deflation can hamper borrowing, lending and credit in loan markets. But bitcoin isn't expanding into loan markets for real estate, student loans or cars. And so that negative aspect to deflationary models doesn't really apply to bitcoin market conditions. |

|

|

|

|

There is no doubt the world has an energy crisis.

How do we address it. Can alternatives be found. Is it worth investing in energy sectors who will be tapped to fill the power vacuum. While there definitely are negatives, there may be positives as well. Good opportunities for energy based start ups. New inventions and ideas in that area.

In woodland and rural areas, I'm wondering if wood gas (biogas) might make a comeback as it did during World War II fuel shortages.

I can't claim to have much experience with steam engines, they could be alternative energy solution with the best longevity due to many having lifespans of 50 to 100 years and needing only a fuel source and water.

Could solar cookers become an emerging trend?

There are so many inventions and ideas out there for possible replacements for crude oil. With markets being driven by necessity and demand, I wonder if we'll see inventors begin to focus on these areas to make breakthroughs in energy sectors.

|

|

|

|

Bucharest and ManilaConsumer Prices in Manila are 2.90% lower than in Bucharest (without rent)

Consumer Prices Including Rent in Manila are 11.72% higher than in Bucharest I think those quoted numbers reflect significantly marked up prices in tourist areas. Which are higher than national averages. "Slum" and non tourist regions have significantly lower prices: https://www.youtube.com/watch?v=gHN7S5oTWEsThose areas are supposed to carry a negative connotation. But in some instances when those areas are recorded, there are children playing everywhere. People seem relatively happy and friendly. A stark contrast to many neighborhoods in more developed nations were gangs and organized crime have effectively taken over. |

|

|

|

But are you prepared for upcoming shortages of cash the shortages of money ? As a sideline and hobby. I have 40+ avocado trees growing in 2 liter plastic soda bottles. 30 tomato plants, 20 pineapple plants, numerous lychee, rambutan, dragonfruit and other assorteds. They say money doesn't grow on trees. But fruits sold for cash, do grow on trees. Perhaps its not a bad thing. My plant numbers at the moment are relatively small and unimpressive. If shortages hit and money becomes an issue, I could see myself putting in 14+ hour days to ramp production up. If food prices continue to climb, I could be positioned to provide people with alternatives, which could be lucrative to me over the long run. Feed people. Make money. Win/win scenario IMO. Others have said, it is good to learn skills people need and use, which can be used to barter or trade in the event of crisis. That's another approach which could be worth pursuing, which would help people prepare for money shortages. Having mechanical skills, being able to fix cars, or electrical issues. Knowing how to fix plumbing or drain systems. Having basic essential knowledge and skills. Or being able to do some physical labor. Perhaps these can be valuable in times of crisis and be used to barter in place of money. |

|

|

|

If we're looking at the example of myanmar's recent coup in 2021. Financial and banking services can be shut down. Ground based internet as well. https://en.wikipedia.org/wiki/2021_Myanmar_coup_d%27%C3%A9tatUkraine differed from this precedent in ways. Finance and banking were not as critically impacted as myanmar. Ground based internet appeared to have had rolling blackouts, rather than permanent ones. Traditional finance and banking services being shut down during war, leaves people with no viable alternative aside from cryptocurrencies. Ground based internet, leaves no alternatives aside from satellite based satellite options such as Elon Musk's starlink. These conflicts incentivize mass adoption for crypto and satellite based internet. As they are the main options which remain available in regions of crisis. I think Elon Musk's starlink service has a 1 time startup cost of $500 and costs $99 a month afterward. It is an affordable option, to retain internet connectivity inside a warzone. |

|

|

|

The title says "Crypto users in Africa grew by 2,500% in 2021", but the report talks about an increase in crypto transactions "A recent report by KuCoin reveals that the number of crypto transactions has increased by 2,670% in some African countries"

I guess they meant to say crypto usage increased by 2,500%. Wonder if word prediction got the better of them there? It goes on to say 88.5% were cross border transactions. If each transaction represents 1 person, sending crypto across the border to friends or family. It could correlate with an increase in users on a near 1:1 basis. |

|

|

|

|

Some russian tanks have an active protection system which is designed to shoot down and intercept incoming RPG's and missiles. I wonder if they would be effective against drones?

It seems both russia and ukraine are claiming success with drone based attacks. I wonder how vulnerable radio controlled drones would be to blanket jamming. Is it possible to disrupt the radio signal between the controller and the drone, so that it crashes? There was a case some years ago, where an american drone was electronically hijacked by iran and stolen.

Drones as small as the ones ukraine uses, would be vulnerable to small arms fire.

S-400s would definitely be a prime target.

|

|

|

|

Another perspective on russia. India buys Russian oil despite pressure for sanctionsNEW DELHI (AP) — The state-run Indian Oil Corp. bought 3 million barrels of crude oil from Russia earlier this week to secure its energy needs, resisting Western pressure to avoid such purchases, an Indian government official said Friday. Such prices have surged in recent weeks, posing a huge burden for countries like India, which imports 85% of the oil it consumes. Its demand is projected to jump 8.2% this year to 5.15 million barrels per day as the economy recovers from the devastation caused by the pandemic. Asked by reporters about India buying oil from Russia, the spokesman for the External Affairs Ministry, Arindam Bagchi, said many European countries import Russian oil and gas. “India imports most of its oil requirements. We are exploring all possibilities in the global energy market. I don’t think Russia has been a major oil supplier to India,” Bagchi said. Iraq is India's top supplier with a 27% share. Saudi Arabia is second at around 17%, followed by the United Arab Emirates with 13% and the U.S. at 9%, the Press Trust of India news agency reported. https://news.yahoo.com/india-buys-russian-oil-despite-052218946.html The above article claims india imports 85% of its oil from foreign sources. I think they may not be able to afford boycotts of oil, unless they could find another supplier nearby. It appears russia's army has temporarily halted its invasion, as a cost cutting measure. If russia manages to recover its economic and financial situation, it will once again continue its invasion. |

|

|

|

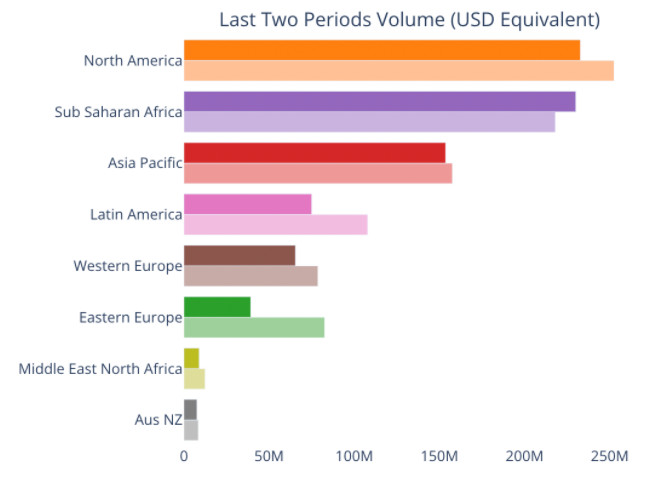

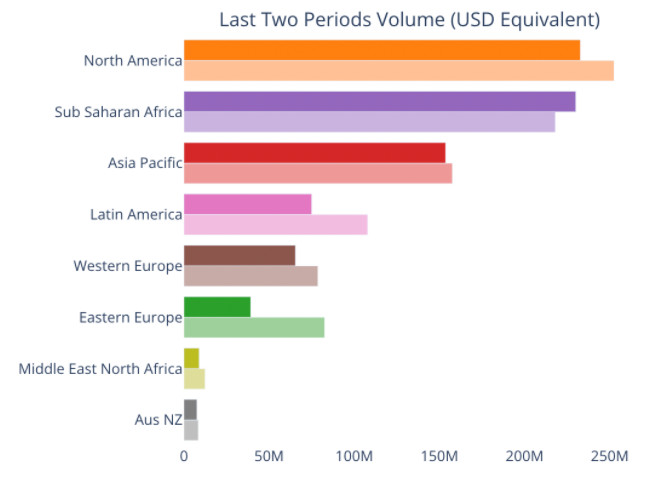

A recent report by KuCoin reveals that the number of crypto transactions has increased by 2,670% in some African countries.Cryptocurrency adoption in Africa is on the march, despite socioeconomic factors and headwinds. A positive report by cryptocurrency exchange KuCoin shows that crypto transactions increased by up to 2,670% in 2022. An astonishing growth trend, the steep influx relates to the low values that have been observed during previous periods. The number of crypto transactions in Africa constitutes roughly 2.8% of global volumes. Johnny Lyu, CEO of KuCoin, told Cointelegraph that “the adoption of digital assets in Africa will continue to grow exponentially,” adding that “African countries have the highest crypto adoption rate in the world, outperforming even the biggest regions such as the United States, Europe and Asia.” Nourou, founder of Bitcoin Senegal, is convinced that the thousand percent growth rates for Bitcoin (BTC) adoption “will continue in coming years.” “Take a look at the way in which cars, mobile phones and consumer electronics took off on the continent. Africa is a continent where lightning-fast progression and adoption is common.”  Worldwide crypto transactions over a 90 day period. Sub-Saharan Africa is second. Source: UsefulTulips Worldwide crypto transactions over a 90 day period. Sub-Saharan Africa is second. Source: UsefulTulipsIn particular, the report cites that “more than 88.5% of cryptocurrency transactions made by Africans are cross-border transfers.” Low fees mean that “users pay less than 0.01% of the overall amount of the transaction transferred in cryptocurrencies.” From high inflation levels and swelling smartphone penetration — effectively allowing anyone to become their own bank — Africa also has a young and digitally native population that is accustomed to digital currencies. Africa is a robust testing ground for the problems which cryptocurrencies attempt to solve. Lyu did add a note of caution to the staggering growth levels: “That rate of growth can depend on both local policy-makers and separate officials’ stances on cryptocurrencies. Still, I believe that a promising future for digital money in Africa is inevitable.” In Central and West Africa, for example, BTC adoption is growing against a backdrop of mistrust and discomfort using the local currency, the CFA. Cointelegraph has previously analyzed the state of crypto adoption in Africa, noting that “economic opportunities presented by the region are immense.” For Lyu, Africa is in an interesting position given that the combination of “growing inflation, high unemployment rates, poor access to bank services and enormous fees for international payments,” creates an environment conducive to crypto adoption. Ultimately: “Financial problems the region is experiencing are forcing people to look for new instruments and technologies that can give them some of the economic freedom they currently lack.” In the long-term, Africa hosts a wealth of advantages “which cannot but contribute to the widespread use of digital assets among locals.” The median age in Africa is very low — at just 19 years old — and over 40% of the population is urban. “Another positive phenomenon is the growing technological awareness of the local population, with many young people exploring programming and internet technologies.” https://cointelegraph.com/news/crypto-users-in-africa-grew-by-2-500-in-2021-report .... The groundwork for mobile based finance and banking in africa has been laid for many years. Making the transition to a cryptocurrency based economy easier, than it may be for other nations like el salvador. There is speculation 1,000% annual growth will be maintained in africa, with 88.5% transactions occurring across borders to leverage low transaction fees. Africa is a region which is no stranger to hyperinflation and economic troubles. The zimbabwe dollar was known for hyperinflating, long before venezuela and the bolivar or even argentina had their own inflationary troubles. I suppose the question now, is whether africa is an exception and outlier. Or whether it embracing cryptocurrencies illustrates for us, the future. |

|

|

|

|

They're a natural spin off to fantasy sports. Fans always debate GOAT status. Who would win in a fight between prime Muhammad Ali, prime Mike Tyson and prime Tyson Fury. Whether Michael Jordan could beat Lebron James, or Stephen Curry could hit more 3 pointers than Larry Bird or Earvin Magic Johnson.

Another recent movement in gambling is sports pickers being associated with academic institutions like MIT. There are AI based gambling picks being sold on the internet which claim university affiliation.

Combine the two and we could have a simulated reality game genre on our hands. I think its too early to say how this trend will turn out. It will all depend on the implementation and fan interest. Both of which could shift over time. The focus in sports over time, has become more profit centric. People appear to care less about history and sports statistics. There may not be enough sports nostalgia or sentimentality present for simulated games to garner much interest.

|

|

|

|

This is the reason Conor vs Jake Paul won't happen. Conor McGregor boasts whiskey sale is worth $700 million as his net worth soarsConor McGregor has claimed the sale of whiskey brand Proper 12 will end up being worth over $500million. McGregor became the world's richest athlete when he sold his company, which he launched in 2018, for $150m, but he says that the deal will ultimately net a profit of as much as $700m. Speaking with News.com.au, the Irishman explained that he has been abstaining from drinking Proper 12 since losing to Dustin Poirier in their rematch in January, not even raising a toast to celebrate the sale in April. "I am in a great place in body and mind, I'm taking my health very seriously," McGregor said. "I haven't touched the most delicious Irish whiskey on the planet Proper 12 at all this camp, I haven't actually touched it since we re-upped the deal. "It's upwards of $700m that deal is worth over the coming years and I haven't celebrated with a glass yet because I was in camp so I stayed focused." https://www.mirror.co.uk/sport/other-sports/mma/conor-mcgregor-boasts-whiskey-sale-24490832 Conor is worth nearly $1 billion and doesn't need money. He doesn't need the payday from fighting Jake Paul. It is clear that what motivates Conor now is UFC gold. He wants to fight a belt holder and win a title. Jake Paul has nothing to offer him. |

|

|

|

|

I'm not expecting a US CBDC to offer advantages over crypto. They won't offer lower transaction fees, or a private key based system allowing sole ownership and control over funds to end users. They will not adopt a hard deflationary model, which could qualify their CBDC as an inflation protected asset. They won't implement a gold standard whereby their CBDC can be exchanged for precious metals. There won't be high interest earned by staking CBDCs as there is with crypto.

The approach regulators and the state makes to CBDC rules out every avenue which could allow them to be competitive in global markets. In an era where social credit and state surveillance are concerns, CBDC could be viewed as extensions of these programs, which I think most would prefer to avoid.

CBDC will have a difficult time to overcome the many obstacles and skepticism most will have towards it.

If it is pegged to the dollar, CBDC might be used as a stablecoin in countries like venezuela, turkey and argentina which could help residents to avoid inflation. That might be one area it could have real world application. Although given the preference for regional lockouts where video games made in japan can't be played in the USA, as an industry standard, it is possible that may not be an option outside of forex which already exists.

|

|

|

|

Can someone explain us better this so called: "de-dollarisation"

De dollarization is the process of china, japan and other nations reducing exposure to american debt by selling the number of US bonds they hold. This has been an ongoing process for years, in response to growing US national debt. Nations like china (and I think russia) have also sought to denominate oil transactions in their native chinese yuan, rather than the US dollar. Some world leaders (who I won't name) have been very vocal about the potential demise of the US dollar and cheered on the trend. They apparently believe their "kill the united states" goals align with global de dollarization. Some conspiracy theorists go so far as to claim that Saddam Hussein was removed from power in the 2nd iraq invasion due to him opting to use the euro in oil transactions, rather than the dollar. And so our global trend of de dollarization could stem as far back as the 2nd iraq war. Someone well schooled in history and economics could probably discuss the rise and fall of former reserve currencies which precede the dollar. I can't remember details but the rise and fall of reserve currencies could easily be as common as rising and falling of ocean tides. Our current de dollarization could be but one of many trends throughout history, correlated with the demise of a reserve currency. |

|

|

|

|

At a certain tipping point, it could become cheaper to heat ones residence with bitcoin mining rigs, than it is to heat via fossil fuels. Wouldn't that be an ironic turn of events? (Sorry to say water is wet, but I hope everyone knows they can greatly save on heating and cooling costs by improving residence insulation)

My food costs have near to doubled in some cases. Gas prices are up. Everything is up. I've expected these trends for many years and not done a good job preparing. Have some solar capacity to offset rising electrical costs. Limited food production to offset rising market costs. What I currently have can be expanded on. If circumstances continue to deteriorate, hopefully I won't be too badly off.

The region I reside in is said to have sufficient capacity for 7 days of food and power, if container shipping and supply lines were completely cut. I would say that would be the true nightmare scenario.

|

|

|

|

|

The average monthly wage for some regions in africa is $40 a month. There are regions in the world with far lower average cost of living, in contrast to developed nations like the united states.

Earning revenue via internet has encouraged many to migrate to nations with lower average expenses. Essentially they're become known as digital nomads.

There are places in the world which offer free land to anyone willing to move there who can cover their basic costs. Parcels of land which might normally be worth thousands in a good location can be had for nothing. Of course there is a catch to it. It is usually in a ghost town or area which would not be appealing to most. Although I would guess there could be a few who could take this type of opportunity coupled with income from a sig campaign and turn it into a goldmine.

But I guess the only way to truly live like a king would be to slowly exchange sig campaign earnings for assets which will greatly appreciate in value. Or for equipment which might be used to start a business that generates revenue.

|

|

|

|

|