Dude, do you work for a news agency? How then can you explain that you created 500 one-page threads? Nothing personal, but I probably would not even have noticed it if the entire page of one of the sections was not flooded with your newly created threads, (You may not even answer, these were rhetorical questions).

When I was more active as a trader, I would read the news almost everyday. Its not that hard to get through 700 or so of the most vital daily news stories in 10 to 20 minutes, using an aggregator or news sharing service which merit rewards users for sharing the best finance related stories they can find. I would guess, even reddit probably has a community which does something similar. Even though I've never seen it. RSS feeds are a good way to do this. Although finding RSS feeds for websites today can involve digging through the source html to locate them. RSS will essentially give you only the text headlines for major websites. It condenses everything, making it much more compact and easy to browse. And can display headlines from many different websites, all inside the same browser window for better one stop shopping. There have long been tickers for stocks and headlines. I have seen that format used as well in a dynamic setting. With the internet and technology, there could be better ways to browse the news today in contrast to more traditional formats. |

|

|

|

|

Tether (USDT) is used to buy bitcoin. Its supply mirrors BTC demand.

In theory they can create tether out of thin air. Don't forget there have also been cases where billions in tether supply was destroyed in an effort to stabilize market forces and keep tether pegged to the US dollar. Billions in tether supply being destroyed, is one of the events which triggered public interest in stablecoins. Many financial institutions can claim to have made billions of dollars. But not many can be profitable enough to afford to destroy billions of their own supply.

Tether's claim to fame is mainly allowing for instant purchase of bitcoin, pegged to the dollar, reducing volatility on the buying side. Its utilized by those who do not want the hassle of coinbase or binance. Or the hassle of trying to buy bitcoin using a debit or credit card. In tether's case, when we say buy bitcoin we're talking about large sums of money being involved. Tether is one of the main bitcoin buying option for whales and large(er) investors.

|

|

|

|

Gold, precious metals and economics used to be a much larger part of global culture. The 3rd James Bond movie Goldfinger featured a plot to make the united states gold supply radioactive in an attempt to neutralize its stabilizing affect on america's economy for a time. Around 1940 nazi germany launched something called operation bernhard. It was an attempt to flood the UK with counterfeit fiat currency that was indistinguishable from legit currency. In an effort to destabilize and crash the UK economy. https://en.wikipedia.org/wiki/Operation_BernhardTopics like these have slowly but surely drifted out of the public consciousness. I'm not 100% certain on the politics behind the gold confiscation of 1933 but thanks for bringing it up, I'll definitely look into it. |

|

|

|

Recently, I was invited to give a talk at the Texas Blockchain Summit on the topic of the growth of bitcoin mining in Texas. Not knowing anything about bitcoin mining in Texas, I interrogated around two dozen mining entrepreneurs, wholesale energy traders, academics and energy experts. What I discovered would completely alter my views on bitcoin mining. Put shortly, bitcoin mining is converging with the energy sector with amazing rapidity, yielding an explosion of innovation that will both decarbonize bitcoin in the medium term, and will dramatically benefit increasingly renewable grids. What’s more, it appears that only bitcoin – rather than other industrial load sources – can actually achieve some of these goals. Bitcoin mining is suitable for renewables – and the proof is in the puddingBitcoin enthusiasts have long maintained that bitcoin mining could drive a clean energy transition. The logic went as follows: Bitcoin miners voraciously buy the cheapest sources of energy available; renewable (wind and solar) sources of energy are getting progressively cheaper and will soon outmatch thermal energy on cost; bitcoin miners will therefore subsidize the buildout of renewable energy, benefiting everyone. I was long suspicious of this argument, due to the acknowledged low capacity factors exhibited by wind and solar sources of energy. Given that miners enter a race against time to get the most out of their new mining machines before hashrate climbs and they become uneconomical to run, putting those miners to work with low-uptime solar or wind energy wouldn’t make sense. Indeed, this was a common critique leveled at bitcoiners promoting this narrative: that renewables weren’t suitable for bitcoin mining. However, a few new developments within the mining market completely changed my mind on this. I now firmly believe that bitcoin mining is suitable for and beneficial to renewable energy, both on a first order and second order (indirect) basis. The key developments that changed my view are the following: - The emergence of the “lifecycle mining” concept

- The development of a new hybrid model for bitcoin mining that is partially grid-based and partially “behind the meter” mining

- The slowing of ASIC development cycles.

Lifecycle mining is a concept I learned of at a talk given by Ro Shirole of miner Compute North at the Bitmain Mining Disrupt summit in Miami. In short, it refers to the concept that the energy inputs and datacenter model that miners employ should be tailored to the age of the hardware. Effectively, the practice of mining is becoming heterogeneous across hardware vintages: the type of energy deployed depends on how old your machines are. Newer units generally go in higher-assurance data centers, and get plugged into reliable energy with high uptime assurances. This is generally grid energy and inherits its carbon intensity – normally a mix of high and low carbon sources. If you have latest-gen units, you want to take advantage of them right away before hashrate climbs. Thus you can afford to pay a bit more for power, because they’re more profitable. For older units, like Bitmain S9s, which are five years old at this point and still represent 30% of the network, according to Coin Metrics, the considerations are quite different. These units head to “ASIC retirement homes,” where they can take more interruption. Operators with these units look instead for dirt cheap power. If the economics make sense, they will run them. Thus while grid energy – or more stable, low-carbon sources like nuclear or hydro – is most suitable for high-end ASICs, more intermittent renewables, even at a capacity factor of 70%, make sense for older units. The opportunity cost is much lower with older units, so they can be placed alongside a more intermittent renewable source of energy and still be economical. Additionally, a new hybrid model for Bitcoin mining is emerging. Bitcoin miners can buy energy from energy providers when energy is abundant (as in West Texas with an excess of wind and solar), drawing from the grid the rest of the time. In so doing, the miners monetize a renewable asset that would otherwise be dumped into the ground, while maintaining generally high uptime. During periods of energy scarcity, the miners can be turned off. The net effect is that renewables become more economical, as they can monetize their asset even when the grid has no demand for it. Critics either don’t understand this concept or deliberately misrepresent reality. For instance, Popular Science claims that “there are no excess renewables,” citing an academic stating “if bitcoin miners or cryptocurrency miners are going to take that renewable, that means it’s not there for somebody else to use.” This is blatantly untrue, as demonstrated by hydro power use in Sichuan. In Texas, the western portion of the grid boasts 32 GW of capacity (much of it wind and solar), 5 GW of load and only 12 GW of transmission to load centers elsewhere in Texas. The rest of the power is habitually curtailed, and it’s no wonder that bitcoin miners are flocking to the region. Alex De Vries, the notorious Bitcoin energy critic (who created Digiconomist and works for the Dutch central bank) claims that miners are “the ideal customer for obsolete fossil fuels rather than renewables since these are both cheap and a source of constant power.” One wonders how he will react to news of low-carbon energy providers engaging with bitcoin miners to serve as a source of additional offtake. Already, we know that hydro (which gets curtailed seasonally) has historically been a huge source of supply for bitcoin miners, and remains one, in Canada, Russia, Washington state and New York. Now, miners are signing up deals with nuclear power plants (which often produce excess power at night, when the grid is less demanding). It’s only a matter of time before solar and wind energy producers begin to take advantage of bitcoin mining as an additional, uncorrelated buyer. Already, we see Norwegian energy giant Aker declaring their intention to use bitcoin as a “load-balancing economic battery” and to become a “valuable partner to new renewable projects.” Blockstream and Square are partnering on a solar-powered mining facility. Lastly, as ASIC releases get more infrequent – and they are undeniably slowing down, due to the physical limits being reached at the transistor level – miners are more incentivized to find cheap energy, rather than racing to get the latest units active. Despite the absolutely comical claims by critics that ASICs last only 1.29 years, ASICs are lasting longer and longer, and new cycles are less and less frequent. This means that miners can take a longer-term focus and work to find cheap, renewable sources of energy. Flared gas mitigation is as close to a free lunch as you can getI first heard about mining as an alternative use for waste methane from Steve Barbour of Upstream Data, who is acknowledged as having pioneered the concept in 2017. For a long time, it was considered a bit of a pipe dream, destined to remain a highly niche sector in the mining space. However, today there are a number of well-funded companies actively deploying assets in the flared gas mitigation space. These include Giga Energy, Crusoe Energy, Great American Mining, Nakamotor Partners, Jai Energy and Upstream. Mining with waste methane at oil wells makes perfect sense because it is a natural byproduct of oil extraction, especially during “initial production” when you get a huge, short term burst of gas. Many oil wells are completely remote from pipeline infrastructure, and due to the prices of natural gas, do not find it economical to transport the methane to refineries. Thus they simply opt to flare the gas (venting it would be far worse, as raw methane is a much worse greenhouse gas than CO2, the output of the combustion). But flaring is inefficient, and on windy days, much of the methane is not consumed in the reaction. What bitcoin miners do instead is capture the natural gas, pipe it into a generator present on the well pad, and use that energy to power bitcoin miners. This is a more complete, controlled burn and therefore reduces emissions associated with the alternative in which the gas is flared. The systems deployed in the field are highly modular and transportable – if a well is producing an abundance of natural gas following initial production, miners can come in for the first six months and take advantage of that initial burst, which wouldn’t otherwise be captured (since no operator would build a pipeline for a short term glut of cheap gas). It’s no surprise that Texas Sen. Ted Cruz extolled the practice in his recent comments at the Texas Blockchain Summit: “Fifty percent of the natural gas in this country that is flared, is being flared in the Permian right now in West Texas. I think that is an enormous opportunity for bitcoin, because that’s right now energy that is just being wasted. It’s being wasted because there is no transmission equipment to get that natural gas where it could be used the way natural gas would ordinarily be employed; it’s just being burned.” The common response to the flared gas mitigation use case is that we shouldn’t be extracting any hydrocarbons, period, and thus waste gas miners are still producing illegitimate emissions. This talking point is aimed to delegitimize the excellent work that bitcoin miners working with otherwise flared gas are doing to manage this waste product in an efficient and low-emission way. But this is a fundamentally Malthusian stance: We are nowhere near a move to a non-fossil fuel energy standard, and to do so would be suicide on a civilizational scale. Cut off natural gas, for instance, and billions of individuals will not be able to heat their homes in winter. Curtail petroleum use, and our transport system will fail. The globalized system of trade would collapse. Farmers, lacking fertilizers, will not be able to feed the earth’s population. Death and famine at a mass scale would directly follow an abrupt end of oil and gas extraction. For now, until we invent nuclear fusion, alternative fuel types or some other energy golden bullet, oil extraction will remain a civilizational necessity. If the critics aren’t willing to live in the counterfactual world where we cease using hydrocarbons, the seriousness of the critique should be questioned. The other objection to flaring is that it should be regulated out of existence, as many states in the U.S. have done. But this wouldn’t stop flaring – all it would do would be to make hydrocarbon extraction more expensive and unwieldy in the U.S., advantaging oil extraction abroad. A ban on flaring, if it raised costs for producers, would simply cause the U.S. to import more oil from overseas. Foreign states like Saudi Arabia and Nigeria have no qualms whatsoever about flaring. As long as the world has a need for oil – and this won’t change anytime soon – there will be waste gas produced at the well pad. Bitcoin miners are undeniably the best positioned to sustainably mitigate this waste product – and also protect a global monetary network while they’re at it. Flexible load allows grids to accommodate more renewablesLastly, and perhaps most importantly, a new feature of bitcoin mining has begun to gain traction, to the benefit of power grid operators. Bitcoin miners represent “interruptible load,” which means that they can deal with power outages without suffering adverse impacts to their business. Of course, they prefer to have power all of the time, but nothing catastrophic happens when they lose power, unlike other industrial consumers such as hospitals, high-end data centers, factories and smelters. This makes them perfect for so-called “demand response” programs, which refers to formal or informal agreements to curtail their demand when the grid is overtaxed and prices are high. This means that when energy is in short supply, bitcoin miners can turn themselves off and get power to the households that need it most. In exchange for agreeing to have their power interrupted some percentage of the time, miners get rebates, so it’s economically worthwhile to opt into these programs. Even if miners aren’t participating in an explicit rebate program, surging market prices during shortages in deregulated grids like ERCOT send miners the signal to turn themselves off. During his remarks in Austin, Texas, Sen. Ted Cruz demonstrated his familiarity with the concept, pointing out the benefit of having bitcoin miners on the grid as a source of interruptible load. Even more compellingly, miners can serve as a source of “controllable load,” which is a concept I learned from Lancium. This means that miners can can dial up and down their consumption to a level the grid operator demands – within seconds. Instead of tweaking the supply side, like turning on gas turbines to make up for a sudden interruption of wind, grid operators can instead ask mining data center operators to dial down their consumption. Having this option means fossil-fuel powered peaker plants don’t need to be triggered as often. The flexibility of these miners is not going unnoticed. The 2020 state of the market report from the ERCOT independent market monitor marvels at 100MW worth of new data centers (all mining Bitcoin) using “fast acting control systems” that enrolled as Controllable Load Resources. Grid operators have rarely encountered such flexible consumers of energy, and it has taken them some time to design appropriate programs to take advantage of these resources. More demand-side control for grid operators means fewer carbon-intense peaker plants. And due to the growing influence of renewables on grids like that of Texas, more flexible load is welcome. Wind and solar, unlike coal plants, hydro or nuclear, don’t produce energy reliably. Their intermittency means they need to be backstopped by batteries (mostly uneconomical at present), or gas-powered turbines. More controllable load however alleviates this intermittency without requiring more fossil fuels. A new paper from Texas energy academics finds that more controllable load would actually assist in decarbonizing the grid. In their words, “Operating the data centers in a flexible manner during times of high grid prices could lead to the deployment of even more wind and solar and – if they are operated with enough flexibility – could result in lower overall carbon emissions.” During the conference, Cruz compared bitcoin mining to fracking, another innovation that has been much maligned by environmental activists, but has contributed to energy independence in the U.S. and actually led the decarbonization of the U.S. grid, as natural gas has around half the carbon intensity of coal. His comments were apt: Bitcoin mining appears to be wholly consistent with the goals of environmentalists in the U.S., as it safeguards grids made unstable by new wind and solar assets; monetizes hydro and nuclear when the grid is not a buyer; and settles into off-grid niches like waste natural gas. That he has achieved this level of sophistication on the topic is truly remarkable, as bitcoin is not a policy priority of his. One can only hope that the rest of his Senate colleagues do the same. https://finance.yahoo.com/news/bitcoin-mining-reshaping-energy-sector-200439550.html.... Above is an amazing piece published on the benefits renewable energy can reap thanks to bitcoin and proof of work cryptocurrencies. Many have claimed for years that the high electricity consumption of bitcoin, is primarily produced by green and renewable sources of energy. Which helps to fund the expansion of energy markets which do not utilize fossil fuels. It appears we may finally have some real world information that further validates this point of view. It appears crypto mining also helps energy grids embrace greener and more environmentally friendly formats, here they label it decarbonization. |

|

|

|

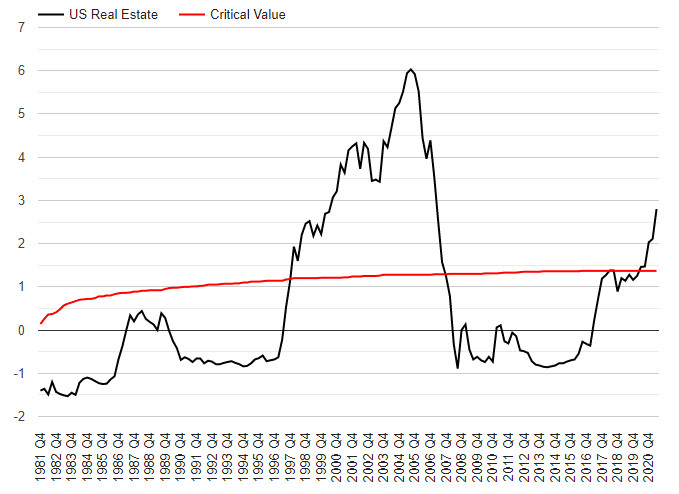

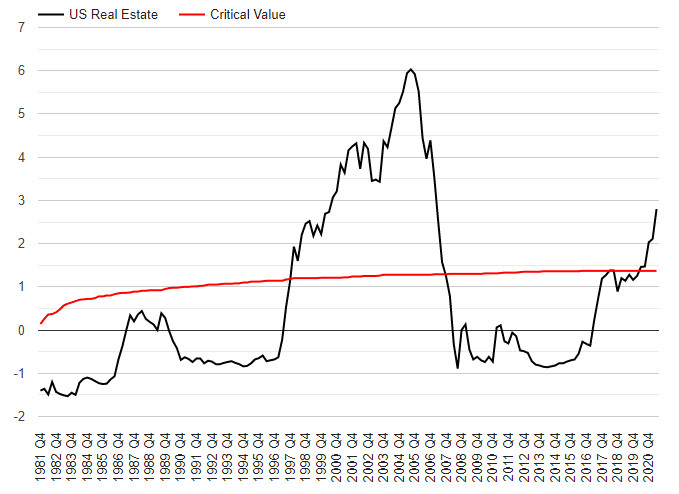

It is interesting to me that we have metrics for identifying housing bubbles in advance. I can't recall this topic having been brought up before.

It is quite interesting, but have there been any records of it being used successfully to determine a bubble in advance before the most recent case where the warning began from Q1 of 1998? I think the last subprime mortgage bubble was due to leveraged collaterized debt obligations (CDOs). Government programs to fund home loans for those who normally would not be able to qualify for them, also played a role. There was an urban legend which said the value of US real estate could never decline. Due to no one remembering a time when it had happened. Many projections used to quantify the market value of CDOs were based upon an assumption that the price of real estate would never decline. When the value of US real estate actually did fall, due to a high number of high risk, government funded, home loans failing. The leveraged positions took a big hit. I guess it is very hard to predict that. Which is why so many were caught by surprise. Even professionals in real estate who had been in the industry for many years were shocked and surprised. There were a handful of people who saw it coming years in advance. But not enough for anyone to listen to them, or take them seriously. |

|

|

|

The fortunes of China’s richest Internet billionaires are still getting slammed, with four of the country’s best-known tycoons–Colin Huang, Jack Ma, Pony Ma, and Wang Xing—losing more than $73 billion from their combined net worth since April, when Forbes published this year’s World’s Billionaires List. The tycoons face heightening risks from China’s regulators. Ride-sharing giant Didi Global just announced on Friday that it would delist from the New York Stock Exchange–which is widely reported to have come at the behest of government departments such as the Cyberspace Administration of China—and could be a harbinger of similar delistings in the future. If they opt to maintain their U.S. listings, there could be changes to their long-used ownership structure known as variable interest entities (VIE), creating additional risks for shareholders. The added pressure of further scrutiny is clouding outlooks. Already, companies from e-commerce giant Alibaba to food-delivery platform Meituan are battling a protracted growth slowdown in the Chinese economy, and their business outlook is likely to remain downbeat until at least early next year, analysts say. “They [investors] are now back to looking at fundamentals, but the near-term outlook isn’t that exciting,” says Shi Jialong, Hong Kong-based head of China Internet and New Media Research at Nomura Securities. Shi was referring to softer-than-expected earnings released in the third quarter. The Chinese economy, for its part, is expected to ease to 5.5% growth next year amid sporadic Covid-19 outbreaks and a slowing property sector. Meanwhile, China now has more than 1 billion internet users, meaning most of its population is already online and new users are harder to come by. In this challenging environment, Alibaba, cofounded by billionaire Jack Ma, cut its growth forecast for fiscal 2022 from a projected 29.5% in May down to 20% to 23%, causing its New York-listed shares to plunge 11% that day. Led by billionaire Wang, Meituan lowered the outlook for its core food-delivery business and reported widening losses after swallowing a 3.44 billion yuan ($532 million) anti-trust fine in October. Tencent, whose billionaire Chairman Pony Ma Huateng is currently the country’s third-richest person, recently reported its slowest revenue growth since the company went public in Hong Kong in 2004. The company warned about a weak advertising sector into next year, as Beijing’s crackdown on education and real estate companies continues to curb once lavish ad budgets. The biggest wealth wipeout, however, goes to Pinduoduo’s Colin Huang. The 41-year-old tycoon lost almost $35 billion in the eight months since April, as the Nasdaq-listed shares of his discount e-commerce platform more than halved. Previously, investors were willing to give the unprofitable but high-growth company rich valuations, buoyed by rapid increases in its user base that even overtook that of Alibaba. They are now dialing back expectations amid intensifying competition and plateauing growth. Pinduoduo missed revenue expectations in the third quarter, and its user base is believed to have peaked. “Competitors such as Taobao Deals are also very aggressive,” says Shawn Yang, a Shenzhen-based managing director at research firm Blue Lotus Capital Advisors. “Investors can look past a lot of problems when there is high growth, but not so much now.” Pinduoduo didn’t respond to an e-mailed request for comment. The company plans to step up investment in agriculture technology, after pledging to donate all future profits –until the amount reaches 10 billion yuan–to support agriculture and rural revitalization in China. Under President Xi Jinping’s common prosperity campaign, boosting income in those areas is one priority. Other tech billionaires are also answering the state’s call. As the country pushes for technology self-reliance, Alibaba launched in October a chip “built upon advanced 5nm process technology,” which it says can be used in data centers. The e-commerce giant is also expanding aggressively into so-called community group-buying, a sector involving using steep discounts in groceries and daily goods to attract shoppers who live close by. But analysts have sounded a note of caution. “We think it is unlikely that the stock will rerate until Alibaba demonstrates that its investments have generated industry-leading user scale, user stickiness, or a monetization level that will serve as strong entry barriers to deter competitors,” Morningstar analyst Chelsey Tam wrote in a November 19 research note. Blue Lotus’s Yang says investors are also unlikely to pile into the tech companies’ shares due to chip advances, although Tencent and search-engine operator Baidu have also announced progress in this field. “The low-hanging fruits in China’s internet sector have been divided up,” he says. “And it is going to take time for newer businesses to contribute to revenue growth.” https://www.forbes.com/sites/ywang/2021/12/03/chinas-internet-billionaires-suffer-73-billion-wipeout-as-economy-slows-and-government-cracks-down/?sh=56bfad047db9... The didi delisting (see: bolded) appears to be (mostly) flying beneath the radar. It is possible we will see future bitcoin dips coinciding with other delisting of chinese corporations from US exchanges. If true the dips will likely become smaller over time. Which could be one indicator for verifying the origin of negative price trends. It is an unfortunate and harsh truth that economic and financial statistics are prone towards exaggeration. In the way youth on the internet with average sized manhoods might exaggerate a little. If they say projected 2022 growth was downgraded from 29.5% down to 20%. It can sometimes mean the actual projection was downgraded from 20% down to 10%. This is especially true with nations that have little or no independent media which might publish claims to the contrary. If they can get away with exaggerating and painting a rosier picture than reality, it can appear feasible to do so. Of course this can become a double edged sword over time, on the plus side it makes everything look better. On the negative, experts and pros will lack access to reliable data needed to respond appropriately to the status quo. If a disaster strikes, it can completely blindside everyone. Only the truly paranoid would be prepared or expect it coming. |

|

|

|

MILAN, Dec 9 (Reuters) - Italy's antitrust watchdog said on Thursday it had fined Amazon 1.13 billion euros ($1.28 billion) for alleged abuse of market dominance, in one of the biggest penalties imposed on a U.S. tech giant in Europe. Amazon said it "strongly disagreed" with the Italian regulator's decision and would appeal. Global regulatory scrutiny of tech giants has been increasing after a string of scandals over privacy and misinformation, as well as complaints from some businesses that they abuse their market power. As well as Amazon, Alphabet's Google (GOOGL.O), Facebook Inc (FB.O), Apple Inc (AAPL.O) and Microsoft Corp (MSFT.O) have drawn heightened scrutiny in Europe. Italy's watchdog said in a statement that Amazon had leveraged its dominant position in the Italian market for intermediation services on marketplaces to favour the adoption of its own logistics service - Fulfilment by Amazon (FBA) - by sellers active on Amazon.it. The authority said Amazon tied to the use of FBA access to a set of exclusive benefits, including the Prime label, that help increase visibility and boost sales on Amazon.it. "Amazon prevents third-party sellers from associating the Prime label with offers not managed with FBA," it said. The Prime label makes it easier to sell to the more than 7 million most loyal and high-spending consumers members of Amazon’s loyalty program. The antitrust authority also said it would impose corrective steps that will be subject to review by a monitoring trustee. Amazon said FBA "is a completely optional service" and that the majority of third-party sellers on Amazon do not use it. "When sellers choose FBA, they do so because it is efficient, convenient and competitive in terms of price", the U.S. group said in a statement. "The proposed fine and remedies are unjustified and disproportionate", it added. The EU Commission said it had cooperated closely with the Italian competition authority on the case, within the framework of the European Competition Network, to ensure consistency with its two own ongoing investigations into Amazon's business practices. The first was opened in July 2019 to assess whether Amazon's use of sensitive data from independent retailers who sell on its marketplace was in breach of EU competition rules. The second, in late 2020, focussed on the possible preferential treatment of Amazon's own retail offers and those of marketplace sellers that use Amazon's logistics and delivery services. "This investigation complements today’s decision of the Italian competition authority which addresses Amazon’s conduct in the Italian logistics markets," the Commission said on Thursday. https://www.reuters.com/technology/italys-antitrust-fines-amazon-113-bln-euros-alleged-abuse-market-dominance-2021-12-09/.... $1.3 billion seems like a large fine for an EU nation like italy which is not known for enforcing anti trust laws locally, much less on an international scale. Surveillance and censorship by platforms like facebook drew negative sentiment against big tech. But I do not know if that negative sentiment extends to cover amazon. Jeff Bezos seemed like the most hated thing about amazon but Bezos resigned from his position as amazon CEO a long time ago. With Bezos gone, do people retain a legitimate reason to hate amazon? Jack Dorsey has also resigned from his former position as twitter CEO. There are rumors and speculation that Elon Musk may do something similar and resign from his positions in tesla, space x and solar city. There is a lot happening in the world today. I don't know if people care to pay attention. Or would prefer to forget. There are definitely many interesting trends emerging for anyone interested in business, finance and economics. |

|

|

|

Every time there's a problem with the debt-ceiling in the US since 2011 there has been talks about the possibility of minting a one trillion-dollar platinum coin out of thin air. Although the current US Treasury Secretary is opposed to this idea, there are people out there that are pushing to make this happen. On the other hand, most people think that Bitcoin reaching one million dollars is ludicrous. Combining these two ideas, I get the impression that most people still believe more in the USD than Bitcoin. .... If $1 trillion dollars worth of platinum, could be molded into a coin. A cube. Or another geometric shape. It would only be useful so much as it could be divided into individual sums to pay liabilities and cover debt. If the united states owed the EU $200 billion, japan $100 billion and china $700 billion. A trillion dollar chunk of platinum could not easily be divided into $200, $100 and $700 billion dollar chunks. It would be useful as collateral and backing with the understanding that it could be chopped up and divided in an emergency. Beyond that its utility would be restricted, in ways which a $1 million dollar bitcoin would not. With the US economy being roughly $20 trillion in GDP. A $1 trillion chunk of platinum would cover roughly 5% of GDP. Far shy of covering the national debt. Much less swiftly growing costs of social programs, which grow at a significantly greater pace than tax revenues. Roughly 5% of GDP without factoring in the cost of purchasing platinum or extracting it from the earth. Which would have overhead costs of labor, equipment and surveys. $1 million dollar bitcoin is much more exciting and useful than a big slab of platinum IMO. |

|

|

|

US real estate prices are looking frothy, according to central bank researchers. The US Federal Reserve (the Fed) recently updated its exuberance index for Q2 2021. The little-known index exists to identify housing bubbles early, to minimize damage. For the first time since 2007, that indicator is now warning that US real estate prices are in a bubble. Did the Fed even notice? The US Federal Reserve Exuberance IndexExuberance might sound like a good thing, but when economists say it — lookout. If asset buyers are said to be exuberant, they’re excitedly paying emotional premiums. These premiums are above fundamentals, paid because people think prices will always rise. If buyers are exuberant for an extended period, the whole market can become exuberant. Exuberant buyers no longer stand out in contrast to rational buyers. It’s been happening just long enough that people think it’s the new market normal. After the US housing bubble nearly took down the global economy, housing became a focus. Previously, experts thought real estate was local. Now they’ve come to learn that exuberant homebuyers can take down a whole economy if left unchecked. Consequently, researchers set out to design this exuberance indicator, to help identify bubbles. The exuberance index works by identifying explosive growth in home prices. Explosive growth is just another way of saying growth above fundamentals. The longer a market strays from fundamentals, the greater the odds it needs a correction. If the whole market shows persistent exuberance, it will require a correction to make it efficient. The central bank can minimize the economic fallout by identifying these issues early. How To Read The Exuberance IndexThe Dallas Fed did all of the hard work, and analysts just have to learn how to read a straightforward data set. We’ve graphed two values — the exuberance indicator and critical threshold. If the exuberance rises above the critical threshold, buyers are exuberant. If the market prints five consecutive exuberant quarters, the whole market is exuberant. An exuberant real estate market is better known as a real estate bubble. US Real Estate Has Entered Its First Bubble Since 2005American real estate buyers are displaying obvious signs of exuberance. The exuberance index read 2.8 in Q2 2021, more than double the 1.37 threshold needed to seem bubbly. The most recent quarter was the fifth above the threshold, making it officially a bubble. Home prices across the US have been on the rise for a few years now, but they’ve only just begun to show exuberant growth. American housing is in its first national bubble since 2007. US Real Estate Exuberance IndexThe US Federal Reserve Exuberance Index for American real estate, and critical value threshold. A market that is above the threshold for 5 consecutive quarters is considered to be exuberant.  Source: US Federal Reserve; Better Dwelling. The last time this indicator showed bubble-like behavior was back in 2007. That run first produced a warning from Q1 1998 until finally falling below the threshold in Q3 2007. That’s 39 quarters or 9.75 years for you weirdos that don’t count your kid’s birthdays in dividend payments. Nearly a decade of exuberance caused a bubble big enough to take down the economy in a correction. The most recent five quarters of exuberance look tiny in contrast, don’t they? Declaring a bubble after just five quarters might seem early, but that’s the point. The indicators help central banks and policymakers identify them early. By alerting policy makers early, they can act and contain the issue before it gets out of control. The current bubble will be the first time in history that the US has a system in place for an early warning. The question is, will they ignore the warning sign? Central banks have become increasingly political, dismissing even their own research. It wouldn’t be surprising to see them gloss over existing warning systems as they did with inflation. Though the “transitory” narrative was retired shortly after they would have seen this data. https://betterdwelling.com/us-real-estate-enters-a-bubble-for-the-first-time-since-2007-us-federal-reserve/.... It wouldn't be a legit economic or financial discussion, without a daily prediction of future doom and gloom. It is interesting to me that we have metrics for identifying housing bubbles in advance. I can't recall this topic having been brought up before. A common urban myth in finance is the concept of bitcoin being a bubble. Could it be possible to devise a system of metrics which might identify the degree to which cryptocurrencies were actual bubbles? There doesn't appear to have been much of an attempt to quantify such claims made by Jamie Dimon and others. If it were possible to devise metrics for identifying potential bubbles in crypto, what would they look like? |

|

|

|

|

Stablecoins like tether are used to purchase bitcoin. It can be hard to exchange balance in a credit card or debit card for BTC instantaneously. If an order for bitcoin is made, it can take time to execute. Non instant purchasing introduces price drift and volatility into the equation. Stablecoins like tether allow for instant purchase, reducing volatility on the consumer side for BTC buy orders.

There is a very strong correlation tether purchasing volume, and bitcoin purchasing volume. When large quantities of tether are bought up, it translates to them being exchanged directly for BTC at a later date. That appears to be their main role in the crypto economy.

|

|

|

|

Please please please read the entire article before making assumptions. We already have people in the IRC and Reddit already spreading FUD regarding these headlines. As far as I know, there have been spammers on forums, social media and chatrooms for many many years. They usually promote ethereum and ripple. Their promotion and spam may coincide with the pump side, of pump and dump cycles for alts. In past years, they enjoyed some success. Many fell for the false hype and contrived marketing campaigns. In recent years, their effectiveness appears to be on a decline. Fewer are buying things like bitcoin cash. If nothing else, it appears to be giving people a life experience which will give them greater odds of success, than in previous years. The boy who cried wolf only had to be wrong twice to lose his credibility. Saruman the White strained his vocal power of persuasion until it was broken and destroyed. It appears something similar is happening with the people of the world, who no longer blindly believe everything that they read or see on TV. |

|

|

|

I wonder what the economic impact of investors and finance demographics immigrating from the united states to the carribean, puerto rico and regions with more crypto friendly regulation is. What is the opposite of capital flight? I think el salvador might have a clue on this. Smaller nations like tonga may not. It would be very interesting to know what percentage of residents are aware of the western union fees they pay in contrast to fees, the rest of the world. Or even fees bitcoin users might expect to pay. Around 2007, I visited an island which mostly lacked internet support. There was an internet cafe there which charged $60 an hour to use the internet. Tonga's native internet infrastructure could be better or worse than this precedent. Pending the passing of the law that will hopefully make Bitcoin a legal tender of the beautiful yet isolated kingdom of Tonga, why doesn't the government just declare Bitcoin as an acceptable currency? I guess a mere executive order or something like that would be enough to make the ball rolling for this tiny country. To answer that, it may help to remember the era from 2016 to 2020 when Donald Trump was called a dictator due to him issuing executive orders. Apparently, that type of behavior is... what dictators do?  Is that how it works? |

|

|

|

Chris Curtis beating Allen was the first surprise fight then two fights away was Guida beating Santos in the second round after taking a beating in the first. Santos was looking at the referee wondering when he was going to stop the fight since he was just landing fist after fist to the back of Guida's head. That was a strange one since he was exhausted by the time the next round began and got submitted. Something Guida hasn't done in over 10 years in his career. I was shocked Clay Guida subbed Leonardo Santos. Guida circled and passed guard to the wrong side when he was submitted via guillotine by Charles Oliveira in 2018 and Jim Miller in 2019. Since then Clay Guida moved to train from jackson wink to team alpha male and it seems his grappling and striking skills have improved as a result. Leonardo Santos being a former world champion in BJJ it is an impressive feat for Clay Guida to submit him. .... When someone says they're a fighter. What comes to mind is not someone who complains all the time about everything. Julianna Pena has done nothing but complain for the past 2 years. It will be very nice for her to return to being a fighter full time, rather than someone who complains full time, while fighting only part time. |

|

|

|

|

Our culture encourages people to amass huge amounts of debt on their credit card. Take on mountains of debt and loans to afford post compulsory education. Pay higher taxes, to run up bigger piles of national debt. As a result of our large appetite for debt, a huge segment of the population lacks more than $500 in savings.

In the midst of these massive spending and debt trends, we have proposals for a... "financial guard rail". (Are you serious? Is this a joke? Better late than never I guess?)

Personally, I think circumstances have deteriorated too far for programs like this to have much of an impact. There could eventually be a counterculture movement whereby people identify negative aspects of debt. And seek to adjust their behavior and lifestyle patterns to be a little more financially responsible. The concept of a "financial guard rail" appears somewhat alien to common trends set by modern day society. Which on a fundamental level, would make me want to question it.

|

|

|

|

CIA Director William Burns said the agency has "a number of different projects focused on cryptocurrency" on the go. There's a long-running conspiracy theory among a small number of cryptocurrency enthusiasts that Bitcoin's anonymous inventor, Satoshi Nakamoto, was actually the CIA or another three-lettered agency. That fringe theory is having a fresh day in the sun after CIA Director William Burns said on Monday that the intelligence agency has "a number of different projects focused on cryptocurrency" on the go. Burns made his comments at the tail end of a talk at the Wall Street Journal's CEO Summit. After discussing everything from the possible Russian invasion of Ukraine to the challenges of space, someone in the audience asked if the agency is on top of cryptocurrencies, which are currently at the center of the ransomware epidemic that U.S. officials are attempting to get a handle on and stamp out. Here's what Burns said: "This is something I inherited. My predecessor had started this, but had set in motion a number of different projects focused on cryptocurrency and trying to look at second- and third-order consequences as well and helping with our colleagues in other parts of the U.S. government to provide solid intelligence on what we're seeing as well." This is hardly surprising given the focus ransomware is getting from every corner of government. This year, a ransomware attack targeting a pipeline company led to a shutdown, panic buying, and a gas shortage in several states. Cryptocurrencies "could have enormous impact on everything from ransomware attacks, as you mentioned, because one of the ways of getting at ransomware attacks and deterring them is to be able to get at the financial networks that so many of those criminal networks use and that gets right at the issue of digital currencies as well," Burns said. Crypto-Twitter had a field day with Burns' comments, with varying degrees of seriousness, which proliferated via—what else?—a tweet from the frequently apocalyptic, "Tyler Durden"-authored blog ZeroHedge. "damm the CIA made Bitcoin smh. Pack it up it’s over," said one tweet. Another tweet by crypto influencer Crypto Cobain jokingly ranked crypto projects by their likelihood to be CIA plants. (Most likely memecoin? SafeMoon.) Some posters even took the opportunity to say that even if Bitcoin was a CIA plant, it wouldn't matter. "If it came out (and was proven) that Bitcoin was created by the CIA, it wouldn’t significantly diminish my bullishness. The only thing it would change is my view of Satoshi. But, crucially, Satoshi is not Bitcoin. That connection was severed years ago," tweeted Spencer Schiff, who is a Bitcoin promoter and the son of stock broker and anti-crypto advocate Peter Schiff. Of course, (almost) everyone is just having a bit of fun with the joke that the CIA created Bitcoin. But the CIA itself seems pretty serious about its current activities in the crypto space, which no doubt reflects how troublesome ransomware attacks and the like have become. https://www.vice.com/en/article/dyp7vw/the-cia-is-deep-into-cryptocurrency-director-reveals .... Finally a serious remark from a credible source on the topic of whether intelligence agencies like the CIA are involved in cryptocurrencies. I doubt they were involved with the initial development or deployment of bitcoin. It took many years for regulators and establishment personnel to take cryptocurrencies seriously. It seems they have finally decided to get serious. As is witnessed with crypto regulation being passed in recent US infrastructure bills. Would anyone care to take a guess as to which recent cryptocurrency projects the CIA might be involved with. |

|

|

|

Only banks, wire transfer companies would issue currency-backed coins like TetherTOKYO -- Japan is acting to limit the number of issuers of cryptocurrencies like Tether, which are backed by such reserve assets as the dollar or the yen, joining the U.S. in moving toward tougher restrictions on a growing segment of finance, Nikkei has learned. So-called stablecoins are often pegged to a fiat currency to prevent the kind of volatility associated with Bitcoin and other leading cryptocurrencies. The Financial Services Agency seeks to propose legislation in 2022 to restrict issuance of stablecoins to banks and wire transfer companies. The debt crisis engulfing property developer China Evergrande has brought renewed attention to the claims of stability by these cryptocurrencies. Tether, the biggest stablecoin in circulation, is backed partly by commercial paper -- a type of short-term corporate debt. Under scrutiny, the company said in September that it did not hold any commercial paper or other debt issued by Evergrande. "To address risks to stablecoin users and guard against stablecoin runs, legislation should require stablecoin issuers to be insured depository institutions, which are subject to appropriate supervision and regulation, at the depository institution and the holding company level," U.S. financial authorities including the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency wrote in a November report. Japan's FSA sees limiting stablecoin issuance to banks and wire transfer companies, which are legally required to protect customer assets, as a way to lower the risk for coin users. The market capitalization of stablecoins issued by the largest stablecoin issuers came to more than $127 billion as of October 2021, according to a figure cited in the U.S. report. The FSA will also toughen regulations meant to prevent money laundering. Intermediaries like wallet providers involved in stablecoin transactions and management will be brought under the agency's oversight. They will also be required to meet obligations under Japan's law on preventing transfers of criminal proceeds, including verifying user identities and reporting suspicious transactions. Stablecoins hold potential benefits for both businesses and consumers, allowing them to transfer money and pay for purchases at ultralow transaction costs. A new digital currency backed by bank deposits is on track for launch in Japan as early as 2022, an effort that will involve the nation's top banks and about 70 other companies and organizations. https://asia.nikkei.com/Spotlight/Cryptocurrencies/Stablecoins-to-face-new-restrictions-in-Japan .... Stablecoins have been under scrutiny since bitfinex tether 2017. Much has been alleged and published about the specific role stablecoins play in the cryptoeconomy. Without much being confirmed. I hope people remember the various things that have been said about stablecoins over the past 4 years. Past history is a great indication of what the future will resemble, as far as stablecoins go. If current trends and campaign promises pan out, I would guess the President of el salvador will be offering excellent terms to stablecoins next. I personally like stablecoins as a means of limiting purchasing volatility on the consumer side. Instant execution and dollar parity are great options for traders wanting to purchase bitcoin in higher sums. Japan's motive for this move, would be an interesting thing to know. If indeed they are able to publicize reasons for it. |

|

|

|

After years of dabbling in the crypto and the NFT space, game industry giant Ubisoft is taking things to the next level. Ubisoft was the first major video game publisher to take an interest in the blockchain space, experimenting with crypto game prototypes and supporting startups over the last few years. But now the gaming giant will actually implement NFTs within one of its major franchises in a new initiative that runs on Tezos. Today, the publisher behind Assassin’s Creed and Just Dance revealed Ubisoft Quartz, a platform that lets players earn and purchase in-game items that are tokenized as NFTs on the Tezos blockchain. Quartz will launch first in the PC version of Tom Clancy’s Ghost Recon Breakpoint, the latest online game in the long-running tactical shooter series. Quartz will launch in beta on December 9 in the United States, Canada, France, Germany, Spain, Italy, Belgium, Brazil, and Australia. Ghost Recon Breakpoint players who have reached XP level 5 in the game can access the NFT drops. Ubisoft’s release says that players must be at least 18 years old to create a Tezos wallet for use with the game. Ubisoft is referring to its NFT drops as “Digits” and plans to release free NFTs for early adopters on December 9, 12, and 15, with further drops planned for 2022. An infographic shows items such as weapon skins and unique armor and apparel, along with a message that teases future initiatives: “This is just the beginning…”An NFT effectively serves as a receipt for a provably scarce digital item, and while digital illustrations and profile pictures have been popular, they can also represent video game items. Ethereum-powered monster-battling game Axie Infinity is currently the biggest player in the space, racking up more than $3.6 billion in trading volume to date, per CryptoSlam. “Ubisoft Quartz is the first building block in our ambitious vision for developing a true metaverse,” said Nicolas Pouard, VP of Ubisoft’s Strategic Innovation Lab, in a release. “And it can’t come to life without overcoming blockchain’s early-form limitations for gaming, including scalability and energy consumption.” Much of Ubisoft’s announcement today highlights the difference in environmental impact between the proof-of-stake Tezos blockchain and the energy-intensive Bitcoin. Tezos claims that a single transaction on its network uses “more than 2 million times less energy” than Bitcoin, the leading cryptocurrency. It also suggests that a single Tezos transaction uses about as much energy as a 30-second streaming video, whereas a Bitcoin transaction is estimated to measure up to the environmental impact of a full, uninterrupted year of streaming video footage. The perceived environmental impact of blockchain technology has created backlash within the traditional video game market in the past, including recently when horror game Dead by Daylight unveiled plans to launch a new character in the form of an NFT. Ubisoft first began exploring the crypto and NFT space years back, developing a Minecraft-like game prototype called HashCraft that Decrypt first covered in early 2019. Since then, Ubisoft has worked with numerous crypto startups through its Entrepreneurs Lab accelerator program, and supported projects like Axie Infinity, Nine Chronicles, and NBA Top Shot. It also became a corporate validator on the Tezos network in April of this year. While HashCraft was never released, Ubisoft did debut a couple of small experiments in the space: charity-focused NFT project Rabbids Token, as well as this year’s One Shot League, a spinoff of popular NFT fantasy soccer game, Sorare. In October, Ubisoft made its first true investment in a crypto startup, participating in Animoca Brands’ $65 million funding round and affirming plans to work with the firm on NFT-driven games. Other major game publishers are eyeing the space, as well: Square Enix announced plans in November to develop NFT games, while Electronic Arts CEO Andrew Wilson recently described NFTs as “an important part of the future of our industry on a go-forward basis.” https://decrypt.co/87752/ubisoft-first-major-gaming-company-launch-in-game-nfts.... Ubisoft appears to be embracing the blockchain based P2E (play to earn) movement. This could be a good stride towards legitimizing P2E and reducing the high number of scam games which have emerged. Rather than purely art based NFTs, they will offer NFTs in the form of characters, weapon, armor and clothing. Good decision IMO. NFTs with in game functionality trend towards offering greater intrinsic value than mere art. If I remember correctly, there were rare counterstrike skins which reached values greater than $10,000. There could be a precedent for in game NFTs achieving and retaining decent dollar value over time. Their blockchain is proof of stake based, rather than PoW. There is no info available yet on whether they will offer micro earnings for winning games in the form of their own crypto token. As other P2E games have done. |

|

|

|

It sometimes seems crypto is minting new millionaires by the day, particularly those with the stomach to dabble in the risky world of altcoins. The most famous of these — like doge and shiba inu — have produced some eye-watering returns in 2021. It's no surprise then that investors are flocking to the space with dreams of quick riches, and Gen Z investors, in particular, think crypto will make them millionaires, a recent study by research and data analytics firm Engine Insights showed. Nearly two-thirds — 59% — of Gen Z respondents to the survey believe they could become wealthy by investing in cryptocurrencies. "This generation has a greater acceptance and comfort with all things digital, so not surprising that would be more comfortable with crypto," Kathy Sheehan, SVP at Cassandra, a division of Engine, told Insider. "This generation has a lot of concerns about debt and finances." A confluence of factors, from the rising costs of real estate to college education could be to blame, Sheehan told Insider. Inflation reaching 30-year highs has only reinforced the appeal of crypto as the weakening of fiat money dominates headlines. "They feel that everything financial is harder for them than it was for previous generations," Sheehan said. "Couple that attitude with more of an appetite for risk, it is not surprising that they are hoping for a quick fix or return." Gen Z, a group of about 72 million people in the US born between 1997 and 2012, is the most diverse generation in American history in terms of race, ethnicity, and sexual orientation. Broadly, this generation is progressive, pro-government, and activist-minded. They have also grown up in a period of watershed cultural moments including #MeToo and the post-George Floyd era, weathering a disruptive global pandemic on top of it all. The survey, whose findings are based on responses from 1,027 people in November, also found that if offered $2,000 to invest, Gen Z respondents are three times more likely to buy digital assets compared to baby boomers, and twice as likely to consider virtual currency a "legit currency." The crypto market has fluctuated wildly this year but has generally been trending higher. The crypto market capitalization hit $3 trillion recently. Bitcoin has gained 100% since the start of the year, while ether is up 480%. Meme coins have had it better, with dogecoin rising 4,835% year-to-date and shiba inu skyrocketing 63,490,000%. Many retail investors poured multiple rounds of government stimulus checks into stocks and crypto, helping fuel the surge in both markets seen during the pandemic. https://markets.businessinsider.com/news/currencies/gen-z-crypto-survey-bitcoin-ether-dogecoin-cryptocurrency-investing-2021-11.... Bolded and highlighted some of the most relevant parts. The question is often asked: has bitcoin achieved mass adoption. Numerous statistics and numbers have been cited over the years, in an effort to claim bitcoin and cryptocurrencies have made it big. Our latest offering here claims 57% of generation Z believe crypto is a good method of building wealth, with that segment of the population numbering around 72 million in the USA, roughly 22% of the total US population. What's interesting about generation Z is the right wing claims they are the most conservative generation in many years, while others claim they are the most progressive and left wing generation. There is some dispute as to exactly what generation Z think and believe, which will undoubtedly be resolved eventually. That said its always great to see people acknowledging the positive role cryptocurrencies can play in society. |

|

|

|

Summer 2022 is far away. There's no guarantee the united states won't default, rather than raise the debt ceiling higher by its deadline on december 15th 2021. The fed says something one day, and does the opposite the next. Who knows how much their policy will change by summer 2022. All market and policy fundamentals appear to project price hikes, rather than the opposite. I think most will prepare for a worse case scenario, rather than a best case scenario. Maybe that's wishful thinking on my part? |

|

|

|

|

It all comes down to sources of funding for documentaries. Movie making is an expensive business, which can be prone to certain conflicts of interest.

It would be nice if everyone who made a documentary did so purely based on a motivation to publish the truth. The harsh reality of it is, there is often much more money thrown at people for publishing lies, than there is for those interested in putting the truth or facts out there. So the market can be flawed in ways. Although there definitely are some independent film makers out there who are more motivated by moral concerns than monetary ones.

|

|

|

|

|