|

Populations in the united and states and india have roughly doubled from the 1950s to the present.

I would guess a high percentage of europe was heated by firewood, with renewable forests being grown to satisfy demand prior to 1950. Over time population growth and a decline of renewable tree markets, led to europe becoming more dependent on natural gas. It is more convenient to use natural gas for heating purposes, than it is to chop and haul firewood or grow renewable forests for fuel. Its normal for natural market forces to select the more convenient option as the norm.

One option for europe could be to implement fast growing bamboo as a fuel source for heating purposes. Bamboo has a high growth rate, can be grown affordably and grows well in a variety of climates. Over time a stock of bamboo could be grown and harvested to provide fuel to replace natural gas. Excess bamboo could also be used for a variety of purposes.

The original "pay in rubles" headline may have been a calculated move. Russia undoubtedly wants the ruble to trend higher, which is correlated with higher buying of the ruble. And so if they announce they will only deal in rubles, there are many who will only see the 1st headline, and not the 2nd headline that corrects the 1st. Who will buy rubles for oil exchange. Which will push the ruble higher. its a common tactic in news cycles, where the original headline may deliberately be false and misleading in the hope that not many see the 2nd headline, which corrects it.

|

|

|

|

You can't graft trees younger than 3 years, you have to wait for them to grow that big, besides, grafting is not for that, it's made to improve the plant or for reproduction, trying to get fruits from a young tree will simply put more stress on its growth reducing the overall amount of fruits you will get from it over his lifespan. You might be able to grow a small lemon tree in an apartment but you'll soon realize you paid 10$ for each of the 10 lemons it made a year.

The second problem is that you're basically forfeiting the advantage vegetables would have when growing them in pots, you restrain the combination of nutrients, so you either use supplements (again $) or you end with the same taste as industrial grown low-cost junk. I have avocados which are within the 18-36 inch recommended graft height, that are younger than 3 years. If a small tree is in a bucket, with holes in the bottom, placed on soil. Earthworms will find their way into it to provide castings. There were many earthworms in the pots of things replanted. I supplement my soil with grass cuttings and other organic waste in an effort to provide a variety of nutrients. "Organic" potting soil I bought in walmart hardens into a concrete like substance if it dries out. It is very necessary to mix other things in with potting soil for it to perform at a bare minimum. Other brands of soil I got in stores have a strange water repelling trait. Water sprayed on the surface will bead and refuse to be absorbed by the soil. Which also needs supplements mixed into it. |

|

|

|

|

I would contend offshore tax havens do not publicly disclose the identity of transactions made to them. They're commonly used by corporations, the rich and powerful to hide funds and avoid taxes.

Regulators in the united states recently proposed bank transfers of $600 be monitored. Now european regulators are proposing that crypto transactions over $1,000 be monitored. These restrictive policies appear to target poor to middle class earners.

While transactions made by the wealthy are wholly deregulated and not subject to scrutiny.

If equality is the goal, the rich and powerful should make transactions to offshore tax havens transparent and open to public scrutiny. Before asking the same of the other 99.9% of the population.

|

|

|

|

Similar to ConocoPhillips’ mining scheme in North Dakota’s Bakken region, Exxon is diverting natural gas that would otherwise be burned off into generators, which convert the gas into electricity used to power shipping containers full of thousands of bitcoin miners. Exxon launched the pilot in late January 2021 and expanded its buildout in July[/i]." "Exxon is diverting natural gas that would otherwise be burned off into generators." If exxon is harnessing waste gas as a form of energy, to mine bitcoin. It should be considered a carbon neutral or environmentally friendly operation. Stereotypes regarding exxon business ventures being environmentally destructive may not apply here, which is nice to see. Investment banks like goldman sachs have long bought up crypto exchanges like poloniex (via circle) for their own motives. Now it appears exxon is investing in the mining infrastructure of bitcoin under a similar practice. I think there was a news story about a similar mining operation being constructed near washington DC but for some reason I could find a link to the article about it. |

|

|

|

He has spent decades projecting an illusion that Russia is to be feared, however it has barely made any progress in Ukraine - it would get annihilated by NATO if it ever tried to invade anywhere else in Europe.

I'm not a Putin supporter. My goal is to be as accurate as possible about the situation in ukraine. As accurate information is important to understand the nature of reality. What stands out the most about russia's invasion of ukraine, is its efforts to conduct the operation on a shoestring budget. Russia primarily used conscripts who are paid a reduced wage, in contrast to professional soldiers. Russia avoided using air support to eliminate higher costs associated with jet fighters and smart bomb ordnance. From the beginning, it seems russia prioritized cost savings to wage a war that would put as little strain on its economy as possible. Russia was definitely hit hard by sanctions and other financial measures taken against them. But looking at their approach, they were preparing for this from the start of the war. It may also be fair to say that should russia manage to solve enough of its economic troubles, it will return once again to its invasion. Most sources I have seen credit russia with having the #2 military in the world. I wonder if they are underrated. |

|

|

|

These growlights from Hydrogen's screenshot are complete garbage. There are so many people buying them on aliexpress and then wondering what da hell is wrong with their plants  I have 2 grow lights, which I've used for years. The light has to be positioned as close to the plant as possible to be effective. Many place the light 2 or 3 feet above the plant, which is too great a distance. |

|

|

|

|

Early drafts for CBDCs (central bank issued digital currencies) came with digital funds carrying an expiration date, making it impossible to have long term savings. Competition from 3rd party payment apps, digital currencies and crypto currencies are forcing them to alter their original trajectory, offering more competitive terms to incentivize CBDC mass adoption.

I think central banks may eventually offer CBDC funds which payout annual APY % similar to a bank account. That's one area they're established and can offer FDIC and other forms of insurance to cater to consumer brand name trust. It is also an area where crypto currencies have difficulty competing due to lack of FDIC and similar industry guarantees.

It all depends on who they source to architect their vision for CBDC. They certainly have a large pool of candidates to select from.

|

|

|

|

|

The average summer temperature in dubai being what it is, one would imagine they would offer every incentive and option they could to offset the uncomfortable weather. Dubai representing arab oil sheiks attempt to prepare for a post oil future, implies the success of real estate in the region must be long term. This determines the UAE strategy being one to incentivize long term immigration into the region.

I would expect dubai's regulatory policies to mirror that of el salvador. Low taxation, deregulation with support for innovative and growing technologies.

What would be cool is if dubai partnered with Elon Musk's boring company. To attempt subterranean real estate development. Which could greatly save on cooling costs and create an environment which maintained comfortable temperatures year round.

|

|

|

|

Climate activists and crypto billionaire Chris Larsen want to convince Bitcoin companies, miners and developers into changing Bitcoin’s consensus mechanism.Several climate activist groups including Greenpeace and billionaire Ripple co-founder Chris Larsen are launching a campaign to advocate for Bitcoin moving away from Proof-of-Work, a consensus mechanism they argue consumes an unsustainable amount of energy, Bloomberg reported Tuesday. The “Change the Code, Not the Climate” campaign will attempt to lobby institutions in the Bitcoin industry that pledge an environmental, social, and governance (ESG) agenda, buy ads in leading publications and appeal to communities allegedly suffering from bitcoin miners’ noisy activities to try and convince investors that Bitcoin could use a different consensus protocol that is supposedly both better for the environment and enables a similar degree of security. The argument, albeit flawed, is not new. In January, a cohort of U.S. Representatives put the same suggestion forward in a Congressional hearing on bitcoin mining whereby they received two different but complementary responses as to why such a move away from PoW would defeat Bitcoin’s purpose. John Belizaire, CEO of Soluna Computing and a witness at the January hearing, told Bitcoin Magazine at the time that Bitcoin “can’t take the risk to shift” to Proof-of-Stake (PoS), a consensus mechanism that “may actually undermine what has given [Bitcoin] its strength and growth.” Belizaire added that consensus mechanisms other than PoW “reintroduce the centralized concept of trust.” Bitcoin miner Bitfury CEO, the former acting comptroller of the currency and a witness at that hearing, Brian Brooks, explained in his statements then that not only it isn’t fitting for policymakers to decide whether Bitcoin represents a “good” use of energy but also that the peer-to-peer monetary system can help the development of the renewable energy economy of the United States. U.S. Representatives and climate activists still display plenty of misconceptions about Bitcoin and its energy use in their arguments. The House had scheduled the hearing after a cohort of national and international climate-related organizations sent Representatives a letter claiming proof of work (PoW) mining could be hazardous to the world’s climate in the long run. However, the letter based its arguments on controversial and faulty research, as highlighted by the Bitcoin Policy Institute (BPI) in a fact-checking note it published on January 13. BPI later published another fact sheet to curb possible misinformation being leveraged by the committee in its assessment of Bitcoin’s power usage. If the “Change the Code, Not the Climate” campaign bases itself on truthful research and factual arguments, it is unlikely to succeed. Castle Island Ventures Partner Nic Carter wrote last year that the opinions of those who don’t understand Bitcoin should not be taken into consideration in the currency’s energy consumption discussion. Chris Bendiksen, a Bitcoin researcher at CoinShares and according to the Bloomberg report one of the world’s leading experts on bitcoin mining, echoed Belizaire’s comments and said that moving away from PoW would “destroy the security of the protocol.” Moreover, Greenpeace’s move might stand in stark contrast to the group’s own interests. Alex Gladstein, chief strategy officer at the Human Rights Foundation, tweeted Tuesday about the irony of the climate activist’s move. “Environmental activists face a high threat of frozen bank accounts and deplatforming,” the tweet reads. “Greenpeace has literally been targeted this way before and will need censorship-resistant fundraising tech again.” On a different note, to “Change the Code, Not the Climate” requires making a formal code proposal to Bitcoin, not advocating with publication ads, noted the CTO and co-founder of Bitcoin security company Casa, Jameson Lopp, on Twitter. “Dear @bruneski @chrislarsensf @Greenpeace, I am unable to find your Bitcoin Improvement Proposal submission, nor can I find any discussions initiated by you on the development mailing list,” the tweet says. “Please follow the process if you wish to be taken seriously.” U.S. Congressman Warren Davidson equaled the campaign to an attempt to ban Bitcoin. “If you don’t see an attack on Proof-of-Work as an attack on #BTC, you understand neither,” he tweeted. “It’s an attack on the fundamental architecture.” Pro-Bitcoin U.S. Senator Cynthia Lummis also shared her thoughts on the campaign. “This is a disingenuous play for federal regulatory capture,” she tweeted. “Don’t fall for it. Let ‘em compete.” The European Union has recently flirted with similar measures at the government level. The region’s Committee on Economic and Monetary Affairs (ECON) touted banning PoW cryptocurrencies altogether earlier this month over claims that the technology could allegedly hurt EU efforts to promote sustainable innovation. The provision, which was part of the Markets in Crypto Assets (MiCA) legislation and sought to force changes on PoW cryptocurrency’s mining mechanisms, was dropped and substituted by another section that added bitcoin mining to the EU sustainable finance taxonomy. In the U.S., New York Assembly’s Environmental Conservation Committee voted last week to advance legislation that would impose a ban on bitcoin mining, Bloomberg reported. However, it would still need to pass by the entire Assembly and State Senate and be signed by the Governor to become law, per the report. According to the Bloomberg report, the campaign believes that about 50 key miners, bitcoin exchanges and core developers have the power to change Bitcoin’s code. Similar coordination among key industry players – including miners – happened in 2017 to increase Bitcoin’s block size, another foundational characteristic of Bitcoin, as transaction fees turned expensive as mainstream interest in Bitcoin skyrocketed. The failed attempt that took place nearly five years ago proved that miners and corporations albeit how powerful cannot force changes on the Bitcoin protocol without the support of nodes and end-users. “I’d put the chance of Bitcoin ever moving to PoS at exactly 0%,” Bendiksen said, per the report. https://bitcoinmagazine.com/markets/greenpeace-seeks-to-change-bitcoin-code .... Previous research claimed as much as 76% of bitcoin mining uses renewable, environmentally friendly, sources of electricity: Bitcoin mining in china utilized a high percentage of state subsidized coal energy. A negative trend which was reversed by china banning BTC mining. The china ban may have done more to further the expansion of environmentally friendly bitcoin mining than any other event in bitcoin's history. ... Environmental organizations like greenpeace who are calling for bitcoin to switch to proof of stake, are on international terrorist watch lists. Billionaire ripple, co founder, Chris Larsen also does not have a good reputation in the crypto community, as far as I know. ... |

|

|

|

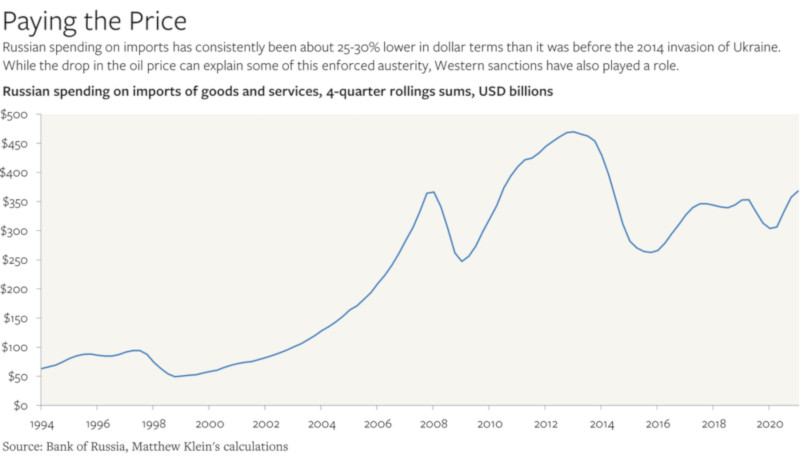

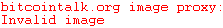

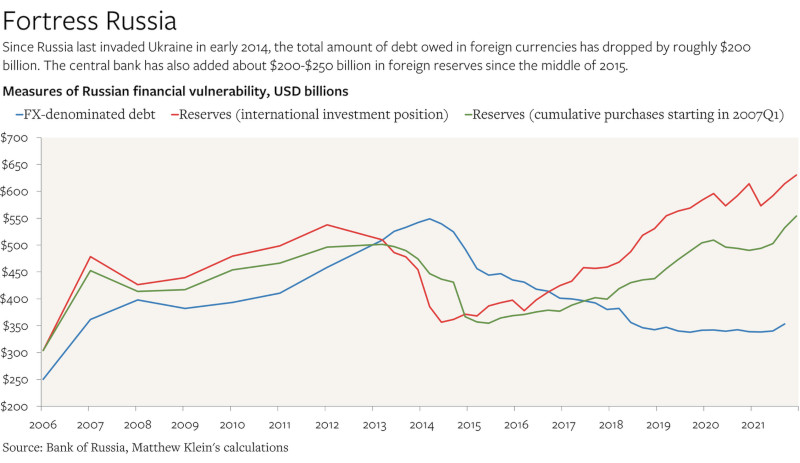

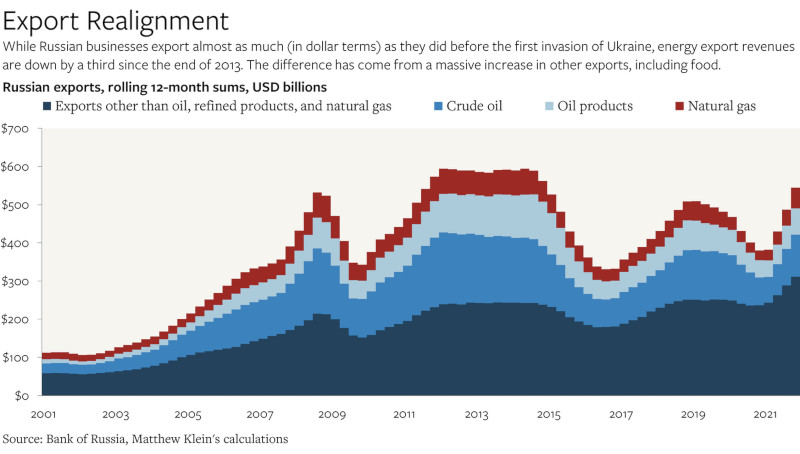

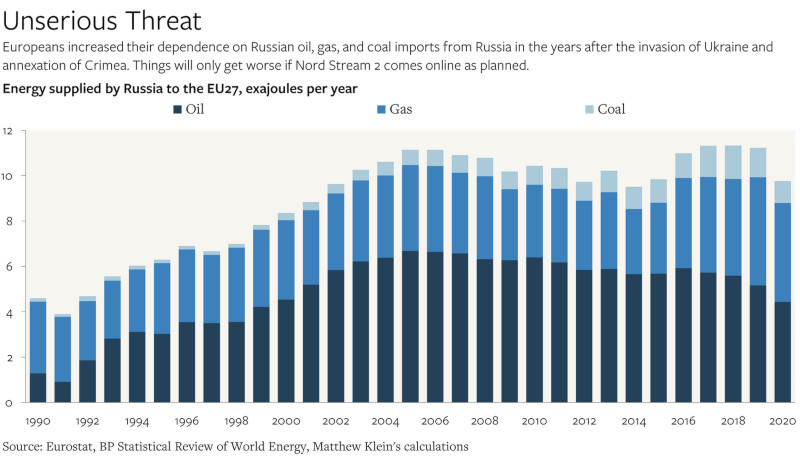

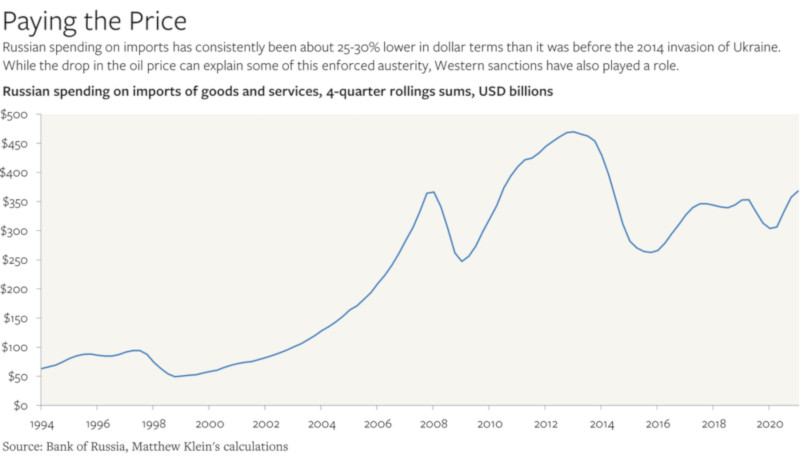

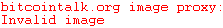

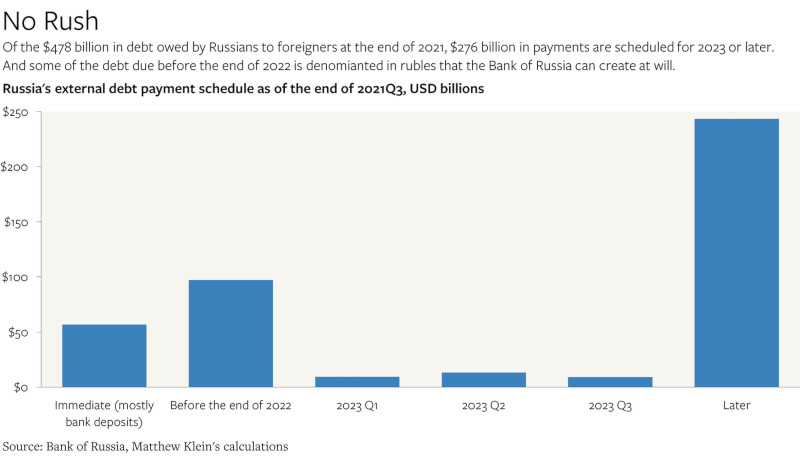

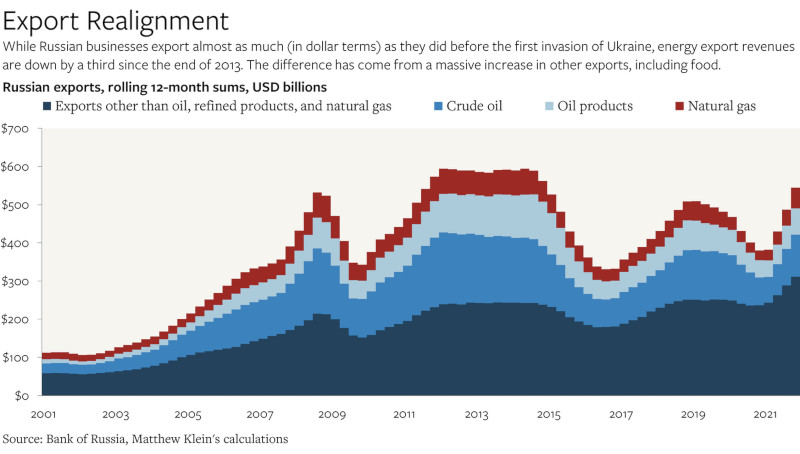

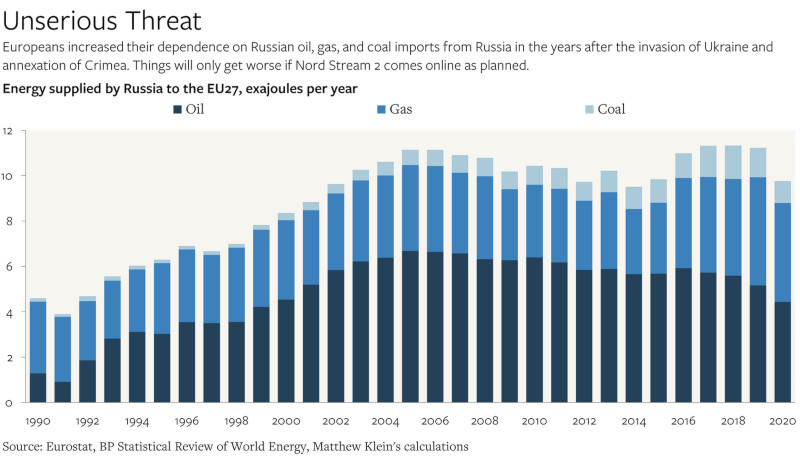

It has been eight years since Russia last invaded Ukraine. What has changed, and what has not?Russian exports of oil and natural gas are an essential source of hard currency that helps cover the cost of importing manufactured goods. Russia’s oil, gas, and coal exports are also an essential source of energy for European consumers and businesses, without which they couldn’t generate electricity, fuel their vehicles, or heat their homes and offices. This entanglement limits the West’s ability to penalize Russian aggression financially. Yes, cutting Russia off from the global financial system would devastate the Russian economy and impose severe hardship on the Russian civilian population, but it would also force Europeans to slash their energy consumption. Milder sanctions could protect Europe’s access to oil, coal, and gas, but their impact on the Russian government’s behavior would be commensurately smaller. The Putin regime has spent years acclimating Russians to material deprivation and it has also built up substantial financial buffers. Not for the first time, conservative macroeconomic and regulatory policies have shielded a revisionist regime from international pressure. There was nothing that Europeans could have done about the Russian government’s decision to impose severe costs on its civilian population for the sake of maintaining its own flexibility. But Europeans can and should be blamed for becoming even more reliant on Russian fossil fuel exports since the 2014 invasion of Ukraine. They wasted nearly a decade when they could have been greening their economies and also increasing the security of their own neighborhood. Ukrainians—and others—will now have to live with the consequences. Russia’s Fortress Balance SheetThe Russian government’s ability to withstand financial pressure was hard-earned. Most obviously, total spending on imported goods and services (in U.S. dollar terms) has consistently been about 25-30% lower than it was before the first invasion of Ukraine. While some of this can be attributed to declines in the world prices of Russia’s oil and gas exports, Western sanctions and Russian domestic policies have also played a role.  The sustained drop in imports has left a mark on Russian consumers’ spending. In inflation-adjusted terms, Russian households spent 12% less in 2016 than they did at the peak in 2014. Even in 2019—before the coronavirus pandemic upended the world economy—Russian consumers were about 2% worse off in material terms than they were before the first invasion of Ukraine.  Meanwhile, Russian businesses and other borrowers responded to external financial pressures—and domestic political ones—by slashing their foreign-currency denominated debt by $200 billion since the beginning of 2014. The Russian government also spent $200 billion adding to its stockpile of reserves (gold, bank deposits, and bonds) since mid-2015.  The net effect is that Russia’s central bank now has enough foreign exchange reserves ($630 billion as of last month) to cover 2021 spending on imports ($368 billion) plus 75% of the country’s entire stock of foreign-currency denominated debt ($353 billion as of 2021Q3). Much of that debt isn’t even due for at least two years.  None of this, however, is sufficient to protect Russia from the impact of sustained Western sanctions. As the Taliban has discovered, foreign reserves are useless if your counterparties freeze your accounts. Even Russia’s $132 billion in gold reserves couldn’t be used to settle payments if Western banks were banned from touching anything involving Russia. The Russian government nevertheless feels that it has room to act because it knows that the Europeans need them. Europe’s Self-Inflicted ErrorShortly after Russia invaded Ukraine in early 2014, I wrote that Russia faced a long-term strategic vulnerability: Europeans had the option to squeeze Russia permanently by reducing their reliance on Russian energy exports. At the time, about 60% of Russia’s total export revenues came from sales of crude oil, refined products, and natural gas—and much of that went to Europe. The Europeans could have built out their capacity to import liquefied natural gas (LNG) from the U.S. and other allies. Even better, the Europeans could have reduced their reliance on fossil fuels altogether by building out more alternative energy generation. Either way, Gazprom’s network of pipelines would have been transformed from a source of leverage into an albatross. Russia could have found other customers for its gas—most obviously China—but building the necessary transportation infrastructure to compensate for the loss of the European market would take years. Russian oil could be sold elsewhere more easily, but the prices would have to be lower if European demand disappeared. At first glance, it almost looks as if that’s what happened. Russia’s total export revenues from oil and gas fell from $350 billion/year before the first invasion of Ukraine to $231 billion in 2019. While Russians made up the difference by increasing other exports, including food, the squeeze on energy revenues is real.  But the Russian energy export squeeze had nothing to do with European restraint. In 2013, the countries of the European Union imported about 135 billion cubic meters of natural gas from Russia. That was equivalent to about 70% of Russia’s total gas exports and equal to 37% of the EU’s worldwide gas imports. Yet in 2019, EU countries imported 166 billion cubic meters of Russian gas—23% more than before the invasion of Ukraine. That was equivalent to 75% of Russia’s total gas exports and 38% of the EU’s worldwide gas imports in 2019.1 European demand for Russian crude oil and refined petroleum products was slightly lower in 2019 than in 2013, but this was offset by surging European demand for Russian coal, which now accounts for almost half of the EU’s coal imports. Put another way, the countries of the EU went from consuming about 62 exajoules of energy in 2013 to 61 exajoules in 2019, while Russia went from supplying 10 exajoules of that energy in 2013 to 11 exajoules in 2019. Despite a slight decline in fossil fuel demand, Russia’s share of the European energy mix rose from 16.5% to 18.5% after the invasion of Ukraine. Europe’s dependence will only increase if the Nord Stream 2 gas pipeline comes onstream as planned.  The perverse result is that Europe is at greater risk of Russian pressure than the other way around. Natural gas prices in Europe are now about 5-6 times as high as in the U.S. because Gazprom has been withholding supply and because the lack of LNG terminals has prevented ships from moving gas across the Atlantic. And while Europeans have made some modest investments in solar and wind energy over the past decade, it hasn’t been nearly enough to make a dent in the overall energy mix, especially after factoring in the impact of the decisions to decommission existing nuclear power plants. The Europeans seem to have—belatedly—realized the implications of all this. As EU Commission President Ursula von der Leyen put it on Tuesday: This crisis shows that Europe is still too dependent on Russian gas. We have to diversify our supplies…We will have to massively invest in renewable energy…because this is a strategic investment in our energy independence. I hope her words are heeded. https://theovershoot.co/p/russia-was-prepared-to-withstand .... Interesting write up on the russia ukraine situation from last month. It appears europe's reliance on russian oil has grown from the conflict in crimea in 2014 leading to the present. Rather than taking steps to reduce reliance on russian oil, europe has taken the opposite precedent. Making it even harder to decouple from russian oil today. The author of this piece goes on to criticize europe for not greening its economy to become less reliant on russian oil. I myself am not a fan of these bold criticisms, unless they come before hindsight being 20/20. The charts posted detail russia's efforts to harden its economy against economic sanctions from years past, to the present. Some of us may remember reading about russian efforts to prepare for SWIFT bans a long time ago. Russia never considered the possibility of peace in ukraine and definitely spent the past 10+ years preparing for an eventual war. There is a question of why the rest of the world was not preparing. Russia appears to have caught everyone asleep and unprepared. |

|

|

|

There is an idyllic vision of the past that believes it would be wonderful to go back to living in the countryside and working the land and raising animals to produce your food. Those who think that have no idea how much it costs to produce the food they eat all year round, let alone with the variety available to us. And I'm not just talking about money or resources. I'm talking about the physical effort it would take to produce a small part of what you eat.

Growing a few plants indoors and some in small pots will give you two bites but if there is a real situation of serious shortage in the long term, it will not solve anything. And even less if you plant fruits, which will cut off your ketosis.

I don't pray, but whoever does should pray that there is not a serious and long term shortage situation because many people are going to have a very bad time; and planting plants indoors and/or in pots, or having an acre of land will solve little. That's a good point. It normally could be expensive, cost cutting measures are important. Rather than use plastic nursery pots from home depot, some use 2 liter soda bottles with holes drilled in the bottom. A solo bag of 80 plastic cups costs around $5.00. Those can be used as small planters. For larger sizes a 5 gallon bucket can be used, there are other options. Rather than buy mulch, grass clippings can be used after mowing the lawn. Some fruits like avocados contain good phosphorous content (and assorted minerals) can used as a natural fertilizer. Many items necessary for growing can be repurposed or taken from natural sources. I think if a single acre of land were covered in tomato plants or something with a rapid production. It is possible to produce a yearly diet. For amateur growers. Professional farmers claim to grow 20 to 30 pounds of tomatos per plant. I am certainly nowhere near approaching those yields. I'm still learning and trying different things with my growing, so perhaps later I'll have a better idea of what the hard limitations are. Even if its not possible to fully satisfy 365 days per year of diet. Being able to fill a few days or weeks per year can make a difference. |

|

|

|

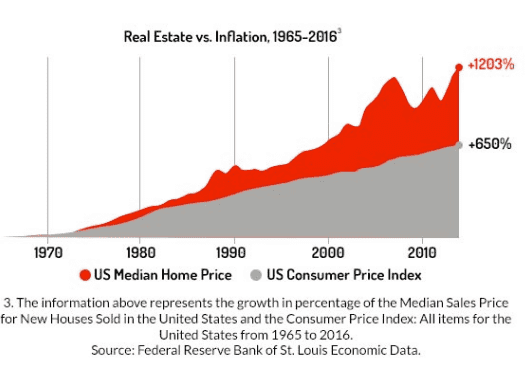

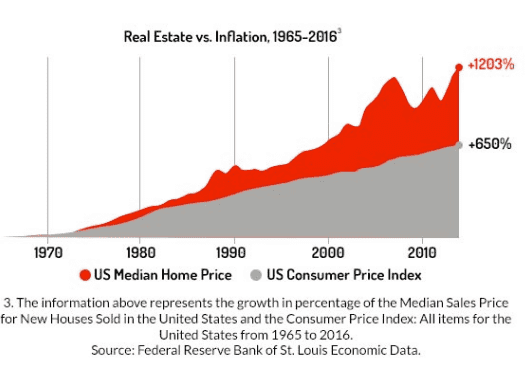

I just feel like real estate it way too risky to hold in the long term.

You are not owning the actual real estate but rather the piece of paper that grants you title to the land. Which can be obviously retracted from you at any given time if the government decides to do so.

Also, it's not accessible - there is no access for people with net worth of at least $100-200k in savings.

Cryptoassets and precious metals remain the strongest options in the inflation hedge category imo.

I posted that response in the wrong thread, it should have gone here: https://bitcointalk.org/index.php?topic=5391672.msg59678694#msg59678694 |

|

|

|

Real estate isn't known for being a good inflation protected asset. In the united states, home markets could be considered a deflationary asset. Development of real estate hasn't matched the pace of population growth, leading living space towards being an increasingly scarce commodity. The negative force acting upon US real estate is stagnant wage growth. Yet there are many foreign buyers investing in US real estate who keep markets from collapsing. The united states allows nationals of china and other nations to buy up large masses of its land, which may further incentivize appreciation of real estate value. Fractional real estate denominated in crypto, where fractional investors (owners) receive a portion of rental income could have potential. To be honest, its not something I've looked into. With the overall down payment and monthly payments being outside the budget of most investors, fractional real estate, which allows them to buy up affordable pieces, could be yet another strategy for acquiring inflation protected assets. I think russian oligarchs at the moment are investing in UAE real estate for perhaps similar reasons. |

|

|

|

Methods of Coping with Food Shortages and High PricesIndoor UV Grow Lights These can be acquired affordably on amazon and other global distributors. I have 2 that I've used for small plants. They work well, lights with lower power need to be a close distance from plants to be effective. A decent option for interior growers who lack the outdoor growing option. Outdoor Grafted Fruit Tree Most believe only big trees produce fruit. This is due to fruit trees requiring 4+ years of time to go from a planted seed to a fruit producing tree. However, this time scale can be decreased by grafting the branch from a mature tree onto the stem of a juvenile. This process can shave years off the maturing process, allowing relatively small trees to produce fruits in a smaller area. This could open the door to those with limited space having their own trees capable of producing fruits. Stockpiles of Wheat or Rice These are common staple foods for doomsdayers preparing for the end of the world. Which tends to give them a negative reputation, but they were and possibly still are a good solution. Stockpiled wheat can be ground up to make flour. Which can be used to make spaghetti noodles, bread, pizza dough, tortillas, etc. Wheat in cans or buckets for long term storage used to be very cheap and affordable. Rice is very similar except its not as versatile or diverse, in terms of it being used to make many different things. Wheat used to be a very affordable option, recently prices over the past few years have inflated considerably. Please share if you have other good information.

|

|

|

|

|

They say that history repeats itself and the future can be predicted from the past.

We have already witnessed nigeria's central bank closing the accounts of nigerians who use bitcoin and crypto. This trend and its after effects could define the future policy of central banks in other countries. With some modifications as central banks attempt to learn lessons from their nigerian case study and improve upon it.

I think that a discussion of crypto taxation cannot be complete without acknowledging puerto rico and other nations requiring a 4% income tax. While nations like the united states demand the entire world implement a global 30% income tax, so that high taxes cannot be escaped. No matter which country a person moves to.

The european union still has not solved greece's debt troubles. That outstanding debt coupled with recent economic crisis, and the loss of the UK could be enough to break up the EU eventually. It is surprising that the EU has lasted as long as it has, IMO. Everything the EU has tried to accomplish from the eurofighter typhoon to open borders appears to not have succeeded, to put it mildly.

|

|

|

|

Funny that no one yet suggested walking as an alternative to high gas prices? Walking - will make you be more healthy, fit, improve endurance. Cons - shoe deprecation, takes more time to travel, weather dependable.

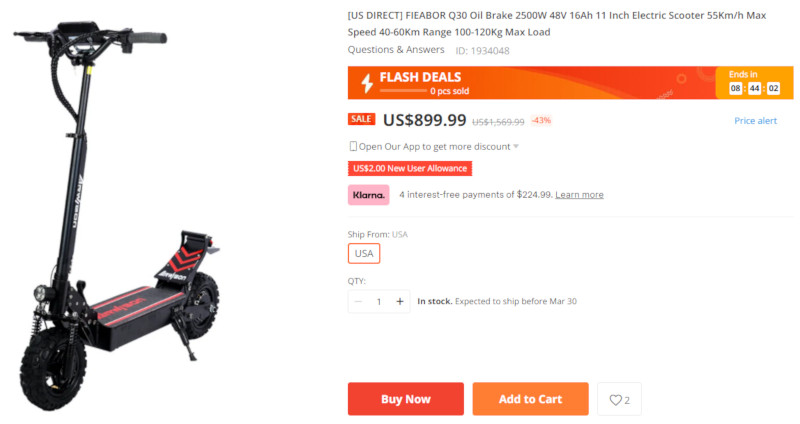

Now serious - compare how much km you cover during March to October in city only, divide it to 100 and calculate the amount fuel you spend, to $300+ for a scooter plus several dollars weekly for scooter charge. It might turn, that car is still more profitable. I have walked around 8 miles to and from work. On a regular basis. It is time consuming and takes 1 to 2 hours to cover the distance. Then I tried covering the same route using a skateboard and bike. It definitely cut down on travel time. Walking is not a good form of exercise, in my opinion. To get good exercise a person's heart rate needs to be elevated, which casual walking isn't known for producing. I planned to recharge my scooter using solar panels and a windmill. That is close to an optimal solution AFAIK. At the moment I have a proof of concept windmill I want to build using a 775 permanent magnet motor. The biggest obstacle to windmills AFAIK is them needing 50:1 to 100:1 gearboxes so the motor can spin at the high RPM it needs to produce peak power. With a 775 motor acting as generator that's worth maybe 100 watts. Starting small seems like the way to go, to scale up to larger capacities later. I have an old razor E300 with a few planned mods for that as well. I have copper tubing I plan to wrap around the motor housing to act as a water cooling jacket. Then I have a PC liquid cooling radiator and a fan to connect to the copper tubing. If it works, it should keep the motor cool. Planned to upgrade to a more powerful motor and eventually lithium batteries for 2x range extension. |

|

|

|

As for scooters and bicycles, it may be because they don't use as much energy, but about electric cars I doubt it very much. The cost of electricity has also risen a lot recently and you have to think that as combustion cars are replaced by electric cars, the demand for electricity will grow, therefore, the more demand (assuming an equal or lower supply) the price will grow. In the USA there are almost 300 million cars. Imagine that in a few years these cars will all be electric. Do you know the increase in demand that this would imply? Internal combustion engines in automobiles are around 10% to 15% efficient at converting fuel into usable energy. Power plants which power electrical grids can achieve 30% to 40% efficiency at converting fuel to electricity. (Some carry an advantage of not needing fossil fuels and simply using natural steam vents, wind or sunlight as an energy source.) While a transition to electrical power may shift the burden of energy generation to grids. Overall power consumption may be reduced thanks to the higher efficiency. Electric motors are also more energy efficient in contrast to internal combustion engines and have built in energy scavenging in the form of regenerative braking. Overall demand will diminish. But what is really needed to make a switch to EVs optimal is more people switching to an offgrid format where they generate more of their own power. And better batteries with better storage capacity and longevity. Most expect governments and states to spearhead the movement to improve grid infrastructure. But things would go much better, if people took the matter into their own hands and looked for ways to make themselves more energy independent on their own time. |

|

|

|

The main drawback to electric scooters is safety and in many cases insurance of the vehicle. There are many statistics that will tell you that these are very prone to accidents and users tend to misuse them and ride over walkways and the like. I am not so sure you can escape the cost of crude as the cost of electricity has also increased everywhere.

Advice - if you buy one, let it not be chinesse.

In the united states, I think vehicles with an engine smaller than 50 cubic centimeters in displacement, usually do not pay insurance. That's one advantage to the 50cc moped bracket. Mopeds are fuel efficient and another good option for avoiding high gas costs. Some US states have little or no regulation for electric scooters and bikes. There may be no insurance requirements. I think the determining factor is the watt power of the motor. In some regions a motor with less than 500 to 1,000 watts of power will require no licensing or insurance. While larger and more powerful vehicles, might be require a valid driver's license or insurance of some type. There are accounts on youtube who buy scooters, bikes, motorcycles, mopeds and review them. Its good to check reviews there to see if someone else bought it 1st and get a reaction for what their experience was. I think most accidents stem from people not exercising proper caution, going too fast in areas with many pedestrians. Not following the rules of the road. Even before electric scooters became common, bicyclists have always had a difficult time with safety. Partly due to them being so quiet that people do not notice them. Many drivers listen for the sound of an engine and if they don't hear one, they assume its safe to back out of their driveway. Causing them to hit the scooter/bicycle that was moving past. |

|

|

|

Russia is open to accepting bitcoin for its natural resources exports, the chairman of the country’s Congressional energy committee, Pavel Zavalny, said in a press conference on Thursday. Zavalny explained that Russia is open to accepting different currencies for its exports, beginning with natural gas, depending on the buyer’s preferred method of payment. However, the chairman said terms will depend on the importing country’s foreign relations status with Russia. “When it comes to our ‘friendly’ countries, like China or Turkey, which don’t pressure us, then we have been offering them for a while to switch payments to national currencies, like rubles and yuan,” Zavalny said during the press conference. “With Turkey, it can be lira and rubles. So there can be a variety of currencies, and that’s a standard practice. If they want bitcoin, we will trade in bitcoin.” Zavalny’s statement comes on the heels of President Vladimir Putin’s comments on Wednesday demanding that ‘unfriendly’ countries pay for Russian gas in rubles. Putin’s message was clear, but it is unclear whether Russia can unilaterally change existing contracts agreed upon in euros. The State Duma’s energy committee chair echoed Putin’s decision while adding that the country should also accept gold. “When we exchange with Western countries…they should pay in hard money,” Zavalny said. “And hard money is gold, or they must pay in currencies which are convenient for us, and that is the national currency – ruble. That relates to our ‘unfriendly’ countries.” Russia being open to accepting bitcoin shift the tide as Putin last year had dismissed the possibility in an interview at the Russian Energy Week event in Moscow. “I believe that it has value,” Putin said at the time, referring to Bitcoin. “But I don’t believe it can be used in the oil trade.” The current size of the Bitcoin market and its liquidity do pose questions as to whether the peer-to-peer currency could be used widely by countries in international trade at this moment. However, by being open to the possibility and eventually conducting pilot trades with interested parties, Russia could set the stage for an upcoming trend where nations choose to transact in the stateless, global monetary system. https://bitcoinmagazine.com/markets/russia-open-to-sell-gas-for-bitcoin.... When the US dollar was used to buy and sell oil on a global scale, it was referred to as the petro dollar in this role. In 2018, china announced it would denominate oil transactions in its native currency, the yuan. At which time, people referred to it as the petro yuan. China also initially announced it would offer yuan exchange for gold, to setup something resembling a gold standard. Unfortunately, this aspect of the announcement never materialized. Today it seems russia is prepared to sell natural gas and oil in bitcoin. Could this signal the beginning of a petro bitcoin? Russia also seems to be offering to sell its natural resources in exchange for precious metals like gold. A move which precious metals supporters who have long called for a return to a gold standard might approve of. If russia sold oil in exchange for BTC could this represent yet another major step towards cryptocurrency mass adoption? Will other world leaders view these announcements as a trend for the future. |

|

|

|

|