|

El salvador's GDP is $24 billion dollars. The failure of a $1 billion dollar venture in crypto amounts to around 4% of GDP and should not represent a significant threat to el salvador's economy unless they have other significant issues that are troubling them.

Tourism ranks in the top 3 of el salvador's industries. Hikes in gas and food prices have a tendency to cut into disposable income which usually hits hospitality and entertainment sectors associated with tourism the hardest.

Its been said el salvador has a tremendous unbanked demographic but that bitcoin adoption there has stalled for various reasons.

There is still a chance for crypto adoption in el salvador to take off IMO. I don't think circumstances there have reached a point of complete closure. What they currently lack is access to free electricity powered by hydroelectric energy to enable crypto mining as occurred in venezuela. Among other things.

|

|

|

|

|

NFTs are collectibles and memorabilia. The loose equivalent of baseball cards, old coins, artifacts. Except in a digital format validated by blockchain.

The main long term focal points of NFTs will be sentimental value, rarity and historical value.

For NFTs to be next level investments requires a successful attempt to embue them with intrinsic value and real world utility. Similar to the intrinsic value gold, silver and precious metals enjoy.

The NFT market currently carries a decent potential to become a bubble.

Jack Dorsey and others "selling" NFTs for values near rivaling the pricetag of the Mona Lisa painting was far too ambitious an overreach IMO. They should have aimed lower to create a more sustainable and realistic NFT market.

|

|

|

|

image link: https://i.ibb.co/pWScQxs/may4th-2022-btc-downtrend.jpgOur recent downtrend began around may 4th, 2022. Was there anything significant in the news for crypto in that timeframe? White House wants nation to prepare for cryptography-breaking quantum computersMay 4, 2022A memorandum issued Wednesday by President Joe Biden orders federal agencies to ramp up preparations for a day when quantum computers are capable of breaking the public-key cryptography currently used to secure digital systems around the world. The document, National Security Memorandum 10 (NSM-10), calls for “a whole-of-government and whole‑of‑society strategy” for quantum information science (QIS), including “the security enhancements provided by quantum-resistant cryptography.” The chief concern is the expected creation of a cryptanalytically relevant quantum computer (CRQC) — the presumed goal of some QIS research by the U.S. as well as adversaries such as China. “Current research shows that at some point in the not-too-distant future, when quantum information science matures and quantum computers are able reach a sufficient size and level of sophistication, they will be capable of breaking much of the cryptography that currently secures our digital communications,” a senior Biden administration official told reporters Tuesday in advance of the memorandum’s release. That cryptography, in many cases, dates to work published in the late 1970s and updated in the decades since. “The good news is that this is not an insurmountable problem,” the official said. “The National Institute of Standards and Technology — NIST — will soon be publishing new cryptographic standards that can protect against these future attacks.” Biden’s memorandum mentions quantum-resistant cryptography more than 20 times as it lays out tasks for agencies such as the Cybersecurity and Infrastructure Security Agency (CISA), the National Security Agency and NIST, which has an authoritative role in setting cybersecurity standards. Those agencies will have about six months to “establish requirements for inventorying all currently deployed cryptographic systems, excluding National Security Systems (NSS).” NIST and CISA also would be required to set up outreach with the private sector, including critical infrastructure operators, on transitioning important systems to quantum-resistant cryptography. Biden also issued an executive order Wednesday that would create a National Quantum Initiative Advisory Committee including White House officials and up to 26 experts from industry, academia and U.S. national laboratories. https://therecord.media/biden-quantum-computing-national-security-memorandu/ There is a past precedent for correlation between quantum computing headlines and declines in bitcoin price. There was a BTC downtrend when google claimed to achieve quantum supremacy. Other news relating to quantum computers are correlated with BTC price declines. Is anyone enthusiastic about this proposal to create and deploy new cryptographic standards announced by the US government. I would be interested to know where public opinion stands on this issue. |

|

|

|

New home loans are deepening the role of volatile digital assets in the real estate market.It took Vincent Burniske months to get a seven-figure loan to buy two small apartment buildings in a coveted Miami neighborhood. The sports-media consultant had money — but much of it was tied up in crypto. Digital wealth meant little to banks when it came to a mortgage. And Burniske, 63, wanted to keep his coins rather than trade them for dollars. “If you cash out, you have to pay sizable tax and you’re leaving a lot of upside on the table because you’re getting out early,” he said. Then came an option that wasn’t available when Burniske found the properties late last year: a 30-year fixed-rate mortgage secured by part of his Bitcoin and Ethereum holdings. He nailed down the loan from Milo Credit, a Miami-based startup that’s seeking to tap into the burgeoning pool of crypto loyalists who want to diversify their wealth while hanging on to their tokens. Crypto mortgages are the latest example of the deepening role of digital coins in the U.S. real estate market, with property buyers and lenders alike embracing the volatile currencies to underpin deals for hard assets. Last year, Fannie Mae started allowing borrowers to use crypto for their down payments. New buildings going up in tech hot spots like Miami are accepting digital tokens for deposits on condos. A house in Tampa, Florida, even sold as an NFT earlier this year. The home loans offered by Milo represent a new twist. Instead of simply paying for property with tokens, borrowers pledge their digital holdings as collateral, with no down payments necessary. That enables the holders to keep their coins, avoiding taxes on capital gains and theoretically benefiting from rising values for both the tokens and the real estate. It also heightens risk by using a volatile asset to finance purchases at a time the heated U.S. property market faces a slowdown from the fastest jump in borrowing costs in decades. Milo wants to make such loans a big business by pooling them and selling them to banks, asset managers and insurance companies, maybe even offering them as bonds in a securitization, according to founder Josip Rupena. Wall Street’s financial engine is already looking at the novel mortgages. “We’ve advised on several matters involving the origination of loans backed by crypto and NFTs for eventual securitization and similar concepts, said Steve Blevit, a partner at law firm Sidley Austin, who specializes in financing esoteric assets. “We see a lot of interest in this area and expect it will develop into a new asset class.” Until now, those with large crypto holdings who didn’t want to sell were turning to companies like BlockFi, which offers collateralized loans that can be used to buy property. There’s also Austin, Texas-based Unchained Capital, which offers three-year loans with up to 14% interest rates. Milo, which started originating home loans in 2019 for non-U.S. citizens, is offering a product that looks more like a traditional mortgage. If its wait list of more than 8,000 people ready to buy property in states such as Texas, California and New York is any indication, the company’s crypto offering may dwarf its $100 million of foreign national loans. The company has issued pre-approval letters on $340 million of mortgages in the last 30 days. Milo recently received $17 million in Series A funding led by venture-capital firm M13 to help fuel growth. “Were going to refine this and get it bigger,” said Rupena, 38. “Milo will be looking to provide other long-term solutions to those with crypto wealth — not just mortgages.” It’s the type of lofty ambition rippling through the crypto economy and Milo’s hometown of Miami, where the culture of decentralized finance is fast taking root. In the city’s Wynwood neighborhood, Bored Ape NFTs, which grew in mainstream popularity with the help of Snoop Dogg and Justin Bieber, hang out on building facades and telephone poles. Cranes dot the skyline in between old warehouses about to be inundated by employees of Blockchain.com and MoonPay. Even as the value of digital assets has exploded over the last decade, standing now at about $2 trillion, it’s a big challenge to cross into the decades-old, highly regulated mortgage industry. Skeptics point to cryptocurrencies’ volatility: Bitcoin infamously soared 305% in 2020 but is down more than 40% from an all-time high. Ether and other altcoins have also suffered steep declines. Crypto has also attracted attention from government officials who have expressed concern about the lack of regulatory oversight and surveillance which can come with fraud and other problems. “There are always early adopters out there trying new things,” said David Lykken, president of Transformational Mortgage Solutions, a consulting and advisory firm. “Cryptocurrency doesn’t have enough stability or the confidence of the broader investor community. Certainly not now — maybe never.” Supporters remain steadfast, arguing the tokens will prove their worth in time. Bitcoin has still gained almost 500% since the end of 2019. Milo is lending as much as $10 million on homes, and digitizing the process so closing takes two to three weeks. Borrowers must pledge at least the amount of the property, and the coins get transferred to a custodian for safe keeping. The property seller gets paid in dollars funded by Milo. Borrowers can then make their monthly payments in either crypto or traditional cash. Rates are generally between 3.95% and 5.95%, which is in line with the average borrowing costs for a traditional 30-year mortgage. To account for the volatility, Milo will ask the borrower to put up more crypto or cash if the crypto-to-loan amount drops below 65%. If that figure drops below 30%, the company liquidates the assets and stores them in U.S. dollars. It’s an especially big risk to take for an asset as personal as a home, said John Kerschner, head of U.S. securitized products for Janus Henderson Investors. “A crypto mortgage seems inefficient given the volatility,” he said. “People think Bitcoin will go to the moon but nobody thought the great financial crisis or Covid was coming. These things happen.” Burniske, who used his mortgage to buy investment properties, already has tenants living in his four units, nestled between a 1920s Venetian pool and the Biltmore Hotel in what’s known as Golden Triangle of Coral Gables. For him, the crypto mortgage is just another example of a concept that quickly turns real. “I was convinced I was going down the conventional loan path,” he said. “It’s comfortable. It’s what we know. But at any given moment there are better financing options and you really need to pay attention.” https://www.bloomberg.com/news/articles/2022-04-27/buying-real-estate-with-crypto-new-mortgages-are-backed-by-coins .... Interesting excerpt: Last year, Fannie Mae started allowing borrowers to use crypto for their down payments. New buildings going up in tech hot spots like Miami are accepting digital tokens for deposits on condos. A house in Tampa, Florida, even sold as an NFT earlier this year.

The home loans offered by Milo represent a new twist. Instead of simply paying for property with tokens, borrowers pledge their digital holdings as collateral, with no down payments necessary. That enables the holders to keep their coins, avoiding taxes on capital gains and theoretically benefiting from rising values for both the tokens and the real estate. It also heightens risk by using a volatile asset to finance purchases at a time the heated U.S. property market faces a slowdown from the fastest jump in borrowing costs in decades. This following is also interesting: Milo wants to make such loans a big business by pooling them and selling them to banks, asset managers and insurance companies, maybe even offering them as bonds in a securitization, according to founder Josip Rupena. Historically we have not seen mainstream crypto support for real estate, car and student loans. This could represent an expansion into home and real estate loan markets. Although for some reason, I doubt it'll enjoy mainstream support. Crypto whales are the only income bracket that can participate in these programs. If they buy real estate, it will be in a country that is expected to support more friendly regulation towards bitcoin and crypto, I would guess. The subprime mortgage crisis of 2008 was fueled by a bubble of CDOs that were vaguely similar to using crypto as loan collateral. In that case the assets were leveraged and spread across a much larger consumer demographic which greatly multiplied the damaging effects. There may also be parallels with Elon Musk using his tesla stock as collateral to buy twitter. Much of these programs appear to be concentrated in florida which appears to be emerging as a crypto friendly hotspot. |

|

|

|

https://www.youtube.com/watch?v=qZwaDUBAPcEKhalil Rountree's Bitcoin AwakeningPowerfulJRE UFC fighter Khalil Rountree attended the recent bitcoin convention in miami florida and shares his experiences on Joe Rogan's MMA show #124. Back in january of this year Francis Ngannou took 50% of his purse in bitcoin. ... It appears crypto is gaining traction in the sport of MMA. Although MMA fighters like Rory Macdonald and Chris Camozzi have been associated with crypto for years.

|

|

|

|

|

In a world where advertisers payout millions to advertise their product during the NFL superbowl and consider it a good deal.

It definitely makes sense to leverage the free advertising capacity offered by social media and the internet. There are crypto tokens I have seen who did not have a good product who succeeded in inflating their market value far beyond what it should have been with clever adbot campaigns. The power of the internet and viral marketing campaigns definitely cannot be denied.

Floyd Mayweather was involved with ICOs. Mike Tyson owned bitcoin ATMs. Partnerships with celebrities appears to be a solid strategy for crypto tokens and coins getting their name out there.

|

|

|

|

I would be curious to know how many remember india's withdrawal of 500 and 1,000 rupee bills back in 2016. India scraps 500 and 1,000 rupee bank notes overnight9 November 2016 Indian Prime Minister Narendra Modi has announced that the 500 ($7.60) and 1,000 rupee banknotes will be withdrawn from the financial system overnight. The surprise move, announced on Tuesday evening, is part of a crackdown on corruption and illegal cash holdings. Banks will be closed on Wednesday and ATM machines will not be working. India is overwhelmingly a cash economy. New 500 and 2,000 rupee denomination notes will be issued to replace those removed from circulation. "Black money and corruption are the biggest obstacles in eradicating poverty," Mr Modi said. People will be able to exchange their old notes for new ones at banks over the next 50 days but they will no longer be legal tender. The announcement prompted people across the country to rush to ATMs that offer 100 rupee notes in an attempt not to be left without cash over the next few days. https://www.bbc.com/news/business-37906742 If everyone forgot this happened in 2016, they'll have an easier time pushing a CBDC. But if everyone remembers it, they could have a more difficult time. A big part of it could come down to brand name recognition and trust. Do people trust banks in india after the controversial note withdrawal of 2016. |

|

|

|

235 lbs is 106 kg

200sqft is 18.5 sqm

It gets you 5.7 kg per sqm, nothing out of the ordinary for somebody who does this in order to get results.

While plants do technically grow out of thin air they still need nutrients to grow that big fruits or tubers or else, your average garden without aid won't be able to produce 20 kgs/sqm unless much of that is water, like cucumbers. And you can't live on cucumbers

I wonder what you tried to do with yours that went wrong, potatoes are quite resilient in growing, it takes art to mess them up . My specialty is growing cabbage with leaves opened up like a sunflower and harder than bamboo!

I see where I went wrong. Assumed 1 square foot = 3.3 square meters, when in reality its closer to 1 square foot = 0.1 square meter. I put common dirt in a big plastic container. With wood chips, chopped tree branches, grass clippings, leaves. Sprayed water on it. Turned it to mix everything up. Its been decomposing for many months now. It looks and smells bad. That's what I'm using for my potatos. They're growing ok, it doesn't look beautiful. It looks like a swamp. Need to find a way to introduce more oxygen. Everything is too clumped together and choked off. Sawdust might work but am trying to see what type of results I can get without using electricity or modern conveniences. Back to the main topic, did a bit of math on those assumptions. This source claims an average of 200 square feet is needed to produce adequate food for 1 person. 7 billion means 1.6 trillion sqft, so if the online convertor is right this is about 57392 square miles so we could feed the entire world if we raze Georgia to the ground and make it all agricultural land. The metric system is simpler, 18.5 m2 per person, 148 000 km2, so ~ Sweden or Spain, and we have land for beaches and resorts left. Seriously doubts those claims, it would mean Lesotho would be needed to feed the whole of Africa.  If you can't see that tiny green dot there, I don't think you can see any reason to believe the claims either.  If 200 sq feet can produce 200 pounds of potatos in a 90 day period. And 200 lbs of potato might be "sufficient" food for 90 days on a rationing system. I'm not playing devil's advocate. Perhaps we are planning for future potato world. |

|

|

|

For potatoes, you quote 25 sqft per person, which seems to be 2.32 square meters.

The maximum yield for full industrialized production is 40 000 kilos per ha, 10 000 sqm, 4 kilos per sqm They could be quoting outlier results, rather than mean averages. Like these claimed results of 105 kilograms of potatos grown in 6 square meters, which works out to 17.5 kilos of potato produced per square meter. I grew 235 lbs Of Potatoes in 200 sq ft Without Wateringhttps://www.youtube.com/watch?v=JrytUqXE9NsMy attempts to grow potatos are an absolute horror show in comparison to his methods.  My yields are ok though due to climate advantages. (300 inches of rain/year/avg) |

|

|

|

Elon has thought about buying social media platforms for 3 years minimum: He joked about buying facebook to delete it in 2018. The share price at which Elon bought twitter is more than it is worth. It might have been better if he lowballed them. The current trend of society could make platforms like twitter completely worthless considering I see only bs posted there recently for the most part. There appear to be fewer and fewer people everyday speaking truth and facts on the internet. |

|

|

|

|

My money management strategy is, every dollar of disposable income spent must have carry the potential to create value and return ROI. This doesn't imply asset investment. A pack of tomato seeds can cost $3 and carry the potential to return more than $3 worth of tomatos. I would consider a pack of seeds to be an investment. A sewing machine, 3d printer, CNC laser cutter, weedwhacker, lawnmower can all be investments which can return greater value than their base cost.

Becoming less reliant on corporations and the government is another primary goal. Any investment that allows me rely less on people like Elon Musk or the state is a sound investment. Planning for disaster I try to focus on, can't say I've done well with this. I have tried to come up with plans for generating and filtering water in the event of a major crisis. Generating electricity. I have some of the components needed to build windmills and harvest water. Although if anyone saw what the final product looked like, they might laugh. Its not the best. Everything done as much as possible on a budget.

|

|

|

|

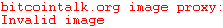

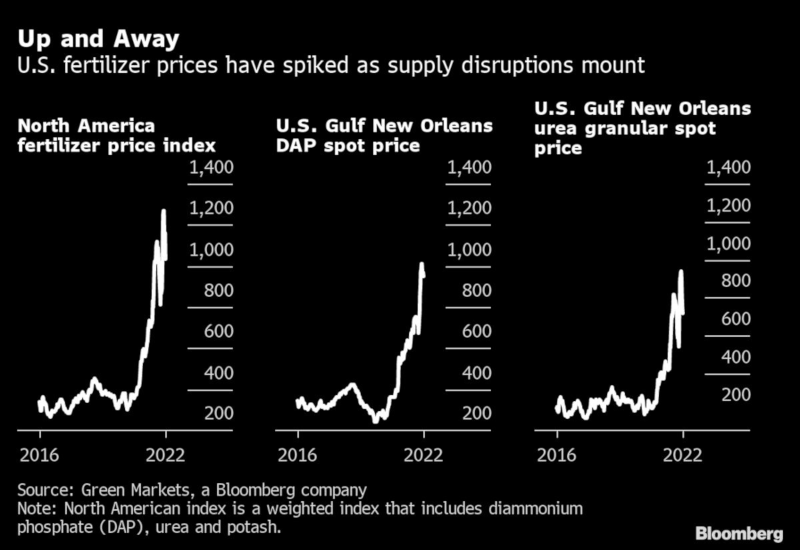

.(Bloomberg) -- For the first time ever, farmers the world over — all at the same time — are testing the limits of how little chemical fertilizer they can apply without devastating their yields come harvest time. Early predictions are bleak. In Brazil, the world’s biggest soybean producer, a 20% cut in potash use could bring a 14% drop in yields, according to industry consultancy MB Agro. In Costa Rica, a coffee cooperative representing 1,200 small producers sees output falling as much as 15% next year if the farmers miss even one-third of normal application. In West Africa, falling fertilizer use will shrink this year’s rice and corn harvest by a third, according to the International Fertilizer Development Center, a food security non-profit group. “Probably farmers will grow enough to feed themselves. But the question is what they will have to feed the cities,” said Patrice Annequin, a senior fertilizer market specialist for IFDC based in Ivory Coast. When you add increased hunger across West Africa on top of existing risks like terrorism, “this is absolutely dangerous for many governments in our region. ”For the billions of people around the world who don’t work in agriculture, the global shortage of affordable fertilizer likely reads like a distant problem. In truth, it will leave no household unscathed. In even the least-disruptive scenario, soaring prices for synthetic nutrients will result in lower crop yields and higher grocery-store prices for everything from milk to beef to packaged foods for months or even years to come across the developed world. And in developing economies already facing high levels of food insecurity? Lower fertilizer use risks engendering malnutrition, political unrest and, ultimately, the otherwise avoidable loss of human life. “I’m reducing the use of fertilizer in this crop cycle. I can’t afford such stratospheric prices,” Marcelo Cudia, 61, a farmer in the Philippines’ rice-producing region of Central Luzon, said outside the patch of land he’s been cultivating for the last 13 years. About 12,000 miles away, Brazilian soybean farmer Napoleão Rutilli is facing the same tough choices. “If fertilizers are expensive, we’ll use less fertilizers. If we’ll use less, we’ll produce less,” said the second-generation farmer, 33. “Food prices will increase and everyone will suffer.” Why Are Fertilizer Prices Going Up?Commercial farmers rely on a combination of three key nutrients — nitrogen, phosphorus and potassium — to fuel their harvests. Those inputs have always been key, but it was only about a century ago that humanity learned to manufacture mass-produced ammonia-based nutrients. The discovery of the Haber-Bosch method in the early 1900s, which is still used to make fertilizer today, has allowed farmers to vastly increase their yields. The agriculture industry has since come to depend on — even hinge on — man-made fertilizer. Although soil’s needs are different region to region, the general trend is pretty undisputed: More fertilizer use brings more food production.But as costs for synthetic nutrients have skyrocketed — in North America, one gauge of prices is nearly triple where it was at the start of the pandemic — farmers have had to start paring back use, sometimes dramatically. That’s put the world in uncharted territory.  Image link: https://i.ibb.co/jWPSwkM/runaway-fertilizer-prices.png“Fertilizer prices are up an average of 70% from last year,” said Timothy Njagi, a researcher at the Tegemeo Institute of Agricultural Policy and Development in Kenya, referring to prices in the country. “The fertilizer is available locally, but it’s out of reach for the majority of farmers. Worse, many farmers know that they cannot recover these costs. ”Prices have been climbing for more than a year for a host of reasons: runaway pricing for natural gas, the main feedstock for much of the world’s nitrogen fertilizer; sanctions on a major Belarusian potash producer; back-to-back late-summer storms on the U.S. Gulf Coast that temporarily shut-in production in the region; plus Covid-19 restrictions that have disrupted every global supply chain, including chemicals. That tightening in the physical fertilizer market has galvanized China, the largest phosphate producer, to restrict outgoing shipments in order to build up a stockpile at home, further exacerbating the global shortage. Add Russia’s invasion of Ukraine, which effectively cut off nearly a fifth of the world’s nutrient exports, and the fertilizer industry and its pricing mechanisms are arguably more broken than ever before. “Fertilizer sales are very, very low, to the point of desperately low, and this should be traditionally the busiest time of the year,” said Jo Gilbertson, head of fertilizer at Agricultural Industries Confederation, a U.K.-based trade association. “The seeds of the problem are being sown now.” How Will Lower Fertilizer Use Hit Output?“My biggest concern is that we end up with a very severe shortage of food in certain areas of the world,” Tony Will, the chief executive of the world’s largest nitrogen fertilizer company CF Industries Holdings Inc., said in a March interview. In the Philippines, urea — a key nitrogenous fertilizer — is now about 3,000 pesos (about $57) per bag, and even more when transported to the fields. That’s more than three times the price at this time last year, said Roger Navarro, president of Philippine Maize Federation Inc. “Farmers will tend to decrease the usual fertilizer dose of their crop and that will lessen the production,” he said, forecasting a 10% drop in yields. “It is rather sad, but this is reality.” The yield outlook is even worse elsewhere. Peru’s agricultural industry is facing a deficit of 180,000 metric tons of urea, and output of staples such as rice, potatoes and corn could tumble as much as 40% unless more fertilizer becomes available. The International Rice Research Institute predicted crop yields could drop 10% in the next season, meaning there’ll be 36 million fewer tons of rice — enough to feed 500 million people. In Sub-Saharan Africa, food production could drop by about 30 million tons in 2022, equivalent to the food requirement of 100 million people, the IFDC said in December — and that forecast was made before the war in Ukraine pushed prices to new records this spring. There’s also a growing concern less fertilizer use will result in lower-quality crops. Just ask Gary Millershaski, who farms nearly 4,000 acres of wheat and roughly 3,000 acres of corn and sorghum in southwest Kansas. Also chairman of the Kansas Wheat Commission, Millershaski said the commission’s “biggest fear” this spring is that farmers may have skipped applying nitrogen as the wheat emerged from winter dormancy several weeks ago. If they did, it could hurt protein content of the grain and result in a “lower class of wheat.” With nearly half of U.S. wheat exported to other countries, that’s a problem that will impact consumers the world over. The harvesting of hard red winter wheat, the most widely grown class in the U.S. and the grain that’s used to make all-purpose flour, will begin in June. How Will Lower Fertilizer Use Hit Inflation?Without a doubt, the food that is produced will be more expensive. Global food prices are already surging at the fastest pace ever as the war in Ukraine hits crop supplies, with a United Nations index of world food costs soaring another 13% in March. “Food security is in peril,” Philippines Agriculture Secretary William Dar said in a text message to Bloomberg News.Rising food prices, without a corresponding increase in incomes, have a long history of triggering social unrest. In 2008 and 2011, soaring inflation triggered food riots in more than 30 nations across Asia, the Middle East and Africa, helping to fuel uprisings in the Arab Spring. “That’s the big concern: Will the high prices of food have a boomerang reaction?” said Gideon Negedu, executive secretary of the Fertilizer Producers and Suppliers Association of Nigeria and a member of the Presidential Fertilizer Initiative. “The food markets may begin to react to these prices because there is no commensurate increase in average household incomes.” What Can Farmers Do? Farmers aren’t sitting idly by. Those who managed to secure fertilizer ahead of the latest run-up are being more strategic about how much they use, including leaning into “precision agriculture.” That means collecting more data on their fields, monitoring crops for increased efficiency and rolling out other data analysis tools. Farmers are increasingly testing soil for lingering nutrients and applying exactly as much fertilizer is needed, rather than an overly generous ballpark — a practice that’s been in use across some places like the U.S. and parts of Brazil for decades but isn’t yet commonplace in some other parts of the word. If a soil tests high for phosphorous or potassium, “often little to no fertilizer is needed at all,” said Carrie Laboski, professor and extension soil scientist at University of Wisconsin-Madison. For some crops like corn, growers might apply a little bit of “starter fertilizer” when they’re planting, which is like insurance if soils are testing high for crop nutrients. When it comes to nitrogen, “they shouldn't eliminate it, but cut back,” she said. Some farms are also exploring controlled-release formulations, like tiny capsules of nutrients that dissolve slowly over time. Although not a solution for many commercial farms given their large scales, others are exploring alternatives to chemical fertilizers, including animal waste. “Compost and sewage sludge and biosolids or organic nutrients become more valuable,” said Mark Topliff, lead analyst for farm economics at the Agriculture and Horticulture Development Board in the U.K. “The supply of those has been stretched” as more growers turn to alternatives. Some farmers are even moving away from high-fertilizer crops altogether, like corn, in favor of lower-demand plantings like beans. Tregg Cronin, a U.S. farmer in central South Dakota who chooses between growing wheat, corn, sunflowers, oats and soybeans, has found himself in an enviable situation: Drought last year left Cronin’s soil with excess nitrogen. So he’s opting to plant 10% more acres of sunflowers — which need the nitrogen more than soybeans do. But if fertilizer prices stay high in the months ahead, next year he’ll pivot to more soybeans. Others are making similar calculations — and hoping they’re betting in the right direction. “If you really want to play 3D chess,” he said, “you need to be thinking about your rotation next year more so than this year.” https://www.bloombergquint.com/politics/farmers-are-struggling-to-keep-up-food-supply-as-fertilizer-prices-surge.... I have to admit economic doom and gloom in 2022 is looking a little different from typical "the sky is falling" content we see published every year. They say alternatives are already being explored in an effort to avert crisis. As someone who follows current events and the news, I've read about food riots abroad for many years. Not much is being said about these topics and what steps might be taken to minimize their impact. In nations like africa, it was normalized for humanitarian groups to work with local rural communities to grow food and crops, in an effort to minimize food scarcity. I'm not certain a similar approach is viable for the western world given population trends towards densely populated cities. Populations in the united states and india have doubled from the 1950s to the present. While the amount of arable land in the world has decreased annually. Population growth coupled with declining global farmland could imply we were destined for a correction of some type eventually. Hopefully we can have a clean and smooth transition, rather than an uncomfortable one. If such becomes necessary. |

|

|

|

|

Most assets do not perform well during bear markets and times of high inflation. Economic contraction is correlated with the opposite of investment gains.

One place to look for potential investments during bear markets and inflation is to keyword search: best recession performing assets.

There are many pieces published over the years, which reference the best performing industries and assets under similar historical circumstances to the present.

If crypto can be correlated with bitcoin 4 year boom and bust cycles, it is possible we're in something resembling a bust cycle now. With the next boom cycle due on the next btc mining rewards halving.

|

|

|

|

|

If this scenario happened in the UFC. Dana White would say who was afraid to step up and fight to publicly acknowledge what the obstacle was. Some might be offended by this. In the end, the fight could happen once pressure was applied. Its a good scenario to contrast boxing's modus operandi versus MMAs. Perhaps boxing promoters have room for growth.

On the flip side both Spence and Crawford are undefeated, likely a big part of their marketing and hype trains, as well as their claim to fame. They both want to contend with Floyd for retirement with an undefeated status. It makes more sense from a business perspective to maintain that aura of never being defeated in the ring. Especially considering the years they spent in the sport, building themselves.

It took many "Floyd Mayweather is a chicken" memes and social media posts for Floyd to fight Manny Pacquiao. But it did end up being the highest grossing pay per view, combat sports event, of all time. Perhaps anticipation for Errol Spence vs Terence Crawford can build over time, the way Pacquiao vs Mayweather did.

|

|

|

|

Berkshire Hathaway CEO Warren Buffett lambasted Wall Street for encouraging speculative behavior in the stock market, effectively turning it into a “gambling parlor.” Buffett, 91, spoke at length during his annual shareholder meeting Saturday about one of his favorite targets for criticism: investment banks and brokerages. “Wall Street makes money, one way or another, catching the crumbs that fall off the table of capitalism,” Buffett said. “They don’t make money unless people do things, and they get a piece of them. They make a lot more money when people are gambling than when they are investing.” Buffett bemoaned that large American companies have “became poker chips” for market speculation. He cited soaring use of call options, saying that brokers make more money from these bets than simple investing. Still, the situation can result in market dislocations that give Berkshire Hathaway an opportunity, he said. Buffett said that Berkshire spent an incredible $41 billion on stocks in the first quarter, unleashing his company’s cash hoard after an extended lull. Some $7 billion of that went to snap up shares of Occidental, bringing up his stake to more than 14% of the oil producer’s shares. “That’s why markets do crazy things, and occasionally Berkshire gets a chance to do something,” Buffett said. “It’s almost a mania of speculation,” Charlie Munger, 98, Buffett’s long-time partner and Berkshire Hathaway vice chairman, chimed in. “We have people who know nothing about stocks being advised by stock brokers who know even less,” Munger said. “It’s an incredible, crazy situation. I don’t think any wise country would want this outcome. Why would you want your country’s stock to trade on a casino?” Retail traders flooded into the stock market during the pandemic, boosting share prices to records. Last year, the frenzy was fueled further by meme-inspired trading from Reddit message boards. But the stock market has turned this year, putting many of those new at-home traders in the red. The Nasdaq Composite, which holds many of the favorite names of small traders, is in a bear market, down more than 23% from its high after an April crush. Warren Buffett has a long history of deriding investment bankers and their institutions –saying that they encourage mergers and spinoffs to reap fees, rather than improve companies. He typically shuns investment bankers for his acquisitions, calling them pricey “money shufflers.” Buffett’s $848.02 per share offer for insurer Alleghany reportedly excludes Goldman’s advisory fee. Earlier in the session, he noted that Berkshire would always be cash-rich, and in times of need, would be “better than the banks” at extending credit lines to companies. An audience member made an inaudible comment while he was talking. “Was that a banker screaming?” Buffett joked. https://www.cnbc.com/2022/04/30/warren-buffett-rips-wall-street-for-turning-the-stock-market-into-a-gambling-parlor.html.... While the headline gives the impression of Warren Buffett losing money in stocks. Wishing he had invested his capital in bitcoin instead. It seems that Buffett put a good stake in oil companies in 2021, likely turning a profit. I'm not certain how much of Buffett's views are tongue in cheek sarcasm or legit commentary. While Buffett has words to say about investment banks treating assets as speculative vehicles. I seem to remember Buffett owning a big stake in wells fargo which is not so dissimilar from an investment bank. Buffett is also a big holder of amtrak stock (low speed american rail) and is likely profiting there as well. One thing that appears to be missing from Buffett's investment portfolio is a long term hedge against inflation, in the worst case scenario for future US markets. Inflationary crisis carries a potential to turn Buffett's gains in oil and rail into losses. I wonder what american billionaires are thinking about inflation, in terms of them not appearing concerned. Perhaps inflation is not as big an issue, as we may have believed? Or perhaps high net worth leads some to believe they are too big to fail? |

|

|

|

Could you grow enough food to feed yourself and your family if you wanted to—or needed to?Gardening is often pitched as a relaxing, therapeutic activity—and it is relaxing and therapeutic! But it’s also a sign of how advanced society has become that we can regard growing food as a charming hobby instead of an absolute necessity. On the one hand, that’s a clear sign of mankind’s mastery over the world. On the other, it’s left us remarkably dependent on a system of farming and delivery logistics that has been shown to be distressingly fragile. Anyone who has ever successfully grown a tomato plant in their backyard has wondered if they could go “off-grid,” grow their own food, and be done with their local supermarket. The answer is yes, but that’s the wrong question. The question isn’t whether it’s possible—the question is how. It’s all about the logistics: How much space do you need to grow enough crops to feed you and your family? Math will help you figure this one out. Calculate the necessary square footageIf you’ve only ever gardened for fun, or to supplement your store-bought groceries with some tasty home-grown treats, you might not be aware of just how much space is required to feed someone. You may have noticed that family farms are kind of large, and there’s a very good reason for that (though some of that space was traditionally given over to livestock and draft animals). Estimates vary. Different crops require different amounts of space, for example, and some gardening gurus estimate you’d need at least 4,000 square feet per person, with more space allotted for stuff like lanes between crops. Most of us don’t have 4,000 square feet to dedicate to gardening, but you probably don’t need quite that much as long as you’re efficient. A good rule of thumb is that you need about 200 square feet per person for a self-sustaining garden. So if you’re a family of four, figure you’ll need about 800 square feet, or a space about 20x40 or 10x80. That’s ... still a lot of space, especially if you’re in an urban setting. The key is planning your garden out, because different crops take up different amounts of space, and if you’re going to live off of those crops you have to include a wide variety of plants for nutritional completeness. Your garden will need to include these: - Proteins. If you’re going to survive on a garden, you won’t be eating meat. While nuts are an excellent source of protein, nut trees take up a lot of space, so make sure you plant beans. Growing lima beans on poles will require about six square feet of garden per person. Snap beans will take about 10 square feet and soybeans will eat up about 30 square feet.

- Carbohydrates. You’ll need some starch in your diet. The good news is that you have a lot of options. Beans will pull double duty here, in fact. Potatoes will require about 25 square feet per person, corn will require about 30 square feet per person, squash will need about six square feet, and peas need about eight square feet.

- Vitamins. A complete diet requires a load of nutrients beyond protein and carbs, so plan on including stuff like spinach (eight square feet per person), broccoli (eight square feet), kale (one square foot), or cabbage (10 square feet).

- Fruits. You can live on vegetables alone, but having some fruits is a great idea. Melons are great (six square feet per person), as are pumpkins (10 square feet), strawberries (10 square feet), and watermelons (six square feet).

- Medicinals & Spices. Some plants don’t offer much nutritional value, but make life a lot better by providing seasoning or health benefits. Some examples include cilantro (one square foot per person), garlic (four square feet), onions (eight square feet), and mustard (two square feet).

If you grow every plant we just discussed for a family of four, you’d need a garden space of approximately 754 square feet of garden—so the 200 square-foot rule tracks pretty well. Here are the caveats to surviving on your own foodThere are a few caveats here, or aspects of a survival garden you really need to think about before you decide that just because your backyard is precisely 200 square feet you’ll be able to pull this off. First of all, the list above isn’t comprehensive and only included a few examples. You might want things like carrots, okra, or cauliflower. This garden size calculator will give you some idea of how much square footage each crop requires. When planning your garden, the main rule is this: Grow stuff you want to eat. Growing food you despise is no way to live. Other things to consider: - Variety. Keep in mind that growing just enough food to survive on will wear on you over time. Sure, you could go full Mark Watney and try to live on potatoes alone (and you just might be able to with some supplements thrown in), but if you think entering year two of nothing but potatoes won’t be depressing, you’re kidding yourself. Keep in mind that variety is the spice of life, and diet variety will require more square footage.

- Seeds. Make sure you always select open pollinated seeds so you can recover seeds from your crops and re-plant.

- Spoilage. Growing food is a battle against nature. The moment your crops start to grow, hungry things will show up to eat them in the middle of the night, bugs will nest in them, and diseases will somehow find them. You’re going to need a margin of error if you’re going to live off your garden—and you will likely need a year or two to figure out what not to do and make adjustments to your plan.

- Design. There are many ways to lay out and manage a survival garden. Square foot gardens use raised beds and a grid system to maximize space, keyhole gardens are drought-resistant, and homestead gardens utilize a farm-like layout (and require more space). When planning a survival garden, look at the space you have and consider what kind of garden design will maximize your yield.

A survival garden can bring a lot of relief to your pocketbook and a lot of independence to your life—if you have the necessary space. Hey, no one said going off-grid was easy. https://lifehacker.com/how-much-garden-you-would-need-to-100-survive-on-1848829190 .... This source claims an average of 200 square feet needed to produce adequate food for 1 person. Which conflicts with many claiming its impossible to grow sufficient food on 1 acre of land, which is 43,560 square feet. I think it assumes the usage of chemical fertilizers, which are increasing in price due to them being manufactured from natural gas. While it may be possible to grow food in a reasonably small space, the dollar cost of soil, dirt, containers, compost, seeds, plants, mulch. And the man hours of care necessary could make the bar to entry prohibitive for many. Money, experience and time appear to be the largest obstacles to solve for the world to fully embrace independent & organic food production. |

|

|

|

|

A case could be made for bitcoin's volatility decreasing.

While there were massive fluctuations in btc price in past years when forks were announced. When other news headlines hit. These price fluctuations appear to be shrinking over time.

Bitcoin's long term chart could more closely resemble gold, silver and precious metals. Than bitcoin's early era when it was a less known asset, and people weren't certain how it would respond to different market conditions.

|

|

|

|

|

These measures are meant to hurt russians and inflict injury on russia's economy. The motive is to put pressure on russians in an effort to persuade them to blame Putin for all of these harsh measures brought against them. This is a common tactic that is used in many cases in the modern era.

There is a chance that rather than divide or hurt russia. These measures could unite and solidify russian support behind Putin instead. I would be interested to know who russians hold accountable for these harsh measures. Do they blame Putin or foreign interests.

Russia has been hit with sanctions and similar measures for many years. Russians might have noticed how sanctions impact their standard of living and access to modern markets and goods, even before the invasion of ukraine. Before the conflict in crimea. Is this new for them?

|

|

|

|

|

I think this topic is similar to the loot boxes in video games controversy. Some argued that video games should not contain loot boxes which function similar to slot machines due to them being accessible to children. They claim it can encourage negative behavior involving impulse control and addiction. I can't claim to have experience with this. But would guess that owners of these machines are earning good passive income.

There's a chance these bans won't eliminate the gambling practice, but will simply drive it underground. Similar to craigslist bans of personal ads driving prostitution to other websites, rather than eliminating it.

The value of gambling machines in australia will also likely decline. Which could set up a decent buyer's market.

|

|

|

|

Privacy, control and trust.

Is decentralization the key?

The key is the public recognizing its in their best interest to be educated, organized and informed. To make it difficult for them to be scammed, cheated or thrown under a bus by representatives. There is no substitute for this, whether it be systemic or design oriented in nature. People have been persuaded into believing they can built everything within a so easy a caveman can do it sandbox. So that we no longer need to know basic fundamentals or make good decisions. The software and design will make good decisions for us. Its an offshoot of warning labels needing to be on everything. People apparently do not like thinking about things, and apparently do not like learning. We try to build systems which omit thinking and learning but there isn't much indication that this can yield positive results over the long term imo. |

|

|

|

|