fxaprendiz

Newbie

Offline Offline

Activity: 4

Merit: 0

|

|

February 04, 2016, 12:40:16 AM

Last edit: February 04, 2016, 10:51:00 PM by fxaprendiz |

|

Hello guys/gentlemen... however you prefer to be addressed.

Most people seriously interested in the financial markets (even as a hobby) eventually stumble upon Martin Armstrong's work. That was my case about a year ago.

I have been reading his blog frequently since then and a few days ago I made a Google search trying to find a discussion avenue on his work, and here I am...

While I don't follow religiously the man I must concede most of his work is worth a read and he raises many valid points. As most human beings he sometimes falls for exageration of his ideas/opinions/forecasts but imho that doesn't demerit of his work overall.

NOTE: rest of the post deleted.

|

|

|

|

|

|

|

|

|

|

|

|

"Bitcoin: the cutting edge of begging technology." -- Giraffe.BTC

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

fxaprendiz

Newbie

Offline Offline

Activity: 4

Merit: 0

|

|

February 04, 2016, 02:03:11 AM

Last edit: February 04, 2016, 10:54:12 PM by fxaprendiz |

|

After re-reading my first post I realized my point regarding Marting Armstrong got lost on all my exposition.

What I meant to say is that the man is onto something with his concepts on cycles. Where I depart is on the severety of the next 2 corrective waves of 2017 and 2033. Where I have read on his posts that he expects anything from at least a second Great Depression to another Dark Age, I see "only" a severe recession for 2017 and a great recession for 2033. Granted those are still very painful for us but nowhere in the same league as the Middle Ages or even the 1720-1784 corrective wave.

NOTE: rest of the post deleted.

|

|

|

|

|

fxaprendiz

Newbie

Offline Offline

Activity: 4

Merit: 0

|

|

February 04, 2016, 03:03:05 AM

Last edit: February 04, 2016, 10:57:59 PM by fxaprendiz |

|

NOTE: entire post deleted since this thread seems to not be the right place for the topic.

|

|

|

|

|

sloanf

Jr. Member

Offline Offline

Activity: 64

Merit: 1

|

|

February 04, 2016, 06:52:04 AM |

|

After re-reading my first post I realized my point regarding Marting Armstrong got lost on all my exposition.

What I meant to say is that the man is onto something with his concepts on cycles. Where I depart is on the severety of the next 2 corrective waves of 2017 and 2033.

Indeed, this thread is about MA, not about your work. But since you wrote so much, why don't we extract at least some value out of it, if there's any. Can you explain very clearly and possibly short where you get those 2017, 2033 dates? Did you simply take them out of the MA deeply flawed model? And how do we make\save money out of all you posted provided that everything is legit? |

|

|

|

|

|

TPTB_need_war

|

|

February 04, 2016, 01:36:25 PM |

|

[...] It’s a good argument. However, I would note that from the frame of reference of life not all entropy is the same. There is useful entropy information that facilitates further search and there is useless entropy noise which is either irrelevant or possibly inhibits the formation of higher information content.

Agreed as noted above. Please note (and also in reference to thaaanos' post below) that no one can know what is the noise and what is the data, because in unbounded entropy no one can know a total ordering and predict the future precisely enough to know how to organize the mutations. Without friction and a finite speed-of-light, 0 entropy and infinite entropy would be indistinguishable and the game collapses. Martin Armstrong can find higher dimensions of order (repeating cycle patterns) in the chaotic interaction of a plurality of interacting cycles (Butterfly effects) which has been named the Strange Attractor in Lorentz's famous and widely respected Chaos Theory. So he can determine timings on repeating cycles, but he can't tell nature which mutations which adapt to the future because he can't know all the details about the future. He can see one partial ordering which is more informational than than those who don't compile and multi-dimensionally inspect as much data as he claims. [...] |

|

|

|

|

TPTB_need_war

|

|

February 04, 2016, 02:00:49 PM |

|

Excellent and I like how he speaks very quickly so I don't get bored. The chart at 20:20 is amazing. The Middle East and Australia need to tumble economically. [...] Readers make sure you view the aforementioned chart (in the video at 20:20, not the chart below), as it explains why India and China will rise after 2020 and lead the world. Hildago's academic research validates Martin Armstrong's long-standing prediction about this and MA's famous chart: |

|

|

|

|

TPTB_need_war

|

|

February 04, 2016, 02:33:29 PM

Last edit: February 04, 2016, 03:01:30 PM by TPTB_need_war |

|

This is what I have been trying to teach to sloanf, that if you don't use international pricing then analysis is entirely wrong:QUESTION: Dear Mr. Armstrong, I have a question for your Blog . Do we need a falling dollar, like today, to see Gold rise? Thank you SH Germany ANSWER: No. When the majority begin to see government is really in trouble, gold will rise with stocks as they have done going into 1980 as well as 1929 (in basket terms). The press is still touting the world is fine with government in charge. The polls are showing people are losing faith. It is a gradual process which will snap in 2017. The REAL function of gold is the hedge against government – not inflation. Neither do we find any correlation that is consistent to imply that increasing the money supply will make gold rise. When you put the theory aside and just look at the data, you will see that gold rises when CONFIDENCE in government declines. When gold hit $875 in 1980, the national debt of the US reached $1 trillion. We are now approaching $20 trillion. Obviously, all the sales jobs they use to sell gold are just fiction.  Yearly – 1920 to 1950 in Basket of Global Currencies Here is what gold really did during the period 1920 to 1950 through the eyes of a basket of currencies rather than just the gold standard fix of $20.67 and then $35. It was the dollar that rose extremely high going into 1934 which is why Roosevelt devalued the dollar. Gold had actually fallen BELOW the gold standard price of $20.67 to $19.78.

And do understand what is coming starting sometime between March and May and refer to my upthread post of predictions from MA:Now look at gold in January 1970. It fell BELOW the Bretton Woods gold standard price of $35. I was a kid. I was stunned at the time. I thought gold could never go under the “official” pegged price. I was clearly wrong. With time, I came to see that markets always made a FALSE MOVE in the opposite direction before a big move. You need this type of false flag move for it cleans out everyone. This is what we are doing right now. We just have to do this. We will get everyone off-side and then slam them. The bearishness in the Euro is too great so it must rally to clean-out the shorts making them think the Euro has bottomed and QE is working at last, and then when the majority flip positions, wham, it will unfold.  So beware of market false moves. This is just the pendulum swinging to both extremes. It must do so to create the energy for the opposite direction.

QUESTION: Martin, You have said on multiple occasions, that gold will only rise when the Market loses confidence in the Gov’t.This Mid-Benchmark Rally you note here in this article.

is this a temporary blip???, temporary rally???, that will still pop and go bust to the low side???

Or are people losing Confidence in Gov’t now??? is that happening hence this rally???

Thanks

SH

ANSWER: Of course there are many of us who have already lost our confidence in government. Odds are you would not be reading the blog otherwise. Granted, more than 3 million unique viewer read this blog. We are still well below the 10% mark of the US adult population which would be about 23 million, so we are far from that level at this time.

Nevertheless, the rise in the polls of Donald Trump reflect this growing dissatisfaction with government. When Social Security goes bust in 2017, our computer is projecting that between 2017 and 2020 is when we will most likely see the collapse in confidence.

Therefore, it is still premature to expect a breakout just yet. Governments are still moving toward negative interest rates. This will help shift capital from PUBLIC to PRIVATE.

The volatility is still insane. Gold should make a new low yet this year. However, since we DID NOT get the sell signal in gold at year-end, then this is the bounce, but do not expect it to be a breakout just yet.

[...]

We are finally starting to get the breakout to complete the retest in the Euro which has been vital to achieve. This is also helping gold as well. We need these counter-trend moves to end the consolidation the market have been trapped in since the book-squaring at year-end.

We are finishing up the world currency reports. The reports are not ready at this time, but we will make an announcement once they are available.

As we stated at the conferences, nothing appears ready to break before May. Nevertheless, the crazy period ahead appears to be the 2017-2020 time frame. The euro held the Yearly Bearish at the 103 area and elected the 116 number. Normally we would see a rally first to retest that area before turning down.

Every time the dollar moves to record highs, we get major monetary reform. Roosevelt devalued the dollar in 1934, and in 1985 when the dollar was pushed to all-time record highs they formed G5, which is now G20. When it broke in 1971, we ended up with the Floating Exchange Rate System. Extreme moves in the dollar spark political economic reform. Governments see this coming and are preparing to move electronic.

This is the type of move we need to see to create the change in the monetary system once again. It will probably take the form of the U.S. dollar no longer being the reserve currency. We will probably be looking at some electronic currency based on a basket.

So nothing has changed yet. We have a long, hard, road ahead into 2020. The Fed knows there is a problem and raising rates may attract too much capital inflow. They are entertaining negative interest rates to ward-off the inflow of capital. Of course, such a move will create a massive collapse of pension funds nationwide. Most state pension schemes will go belly-up.

The Federal Reserve has been talking to U.S. banks behind the curtain and asking them to consider that the Fed might have to do the same to stop the capital inflows. In its annual stress test, the Fed will assess the ability of big banks to survive a drop to negative rates on the three-month U.S. Treasury bill, which simply becomes prolonged.

The central bank announced the stress test for 2016 last week, commenting, “The severely adverse scenario is characterized by a severe global recession, accompanied by a period of heightened corporate financial stress and negative yields for short-term U.S. Treasury securities.”

Negative Interest Rates will flip investment and drive capital into the [USA] stock market just for yield. If pension funds do not dump government debt, they will go bankrupt. This is totally insane and even Social Security will collapse.

For sloanf, I inserted "[USA]" in the quote above so he doesn't misinterpret MA's intent because:The Federal Reserve is in a real crisis. Interest rates are falling negative around the world which by no means has succeeded in stimulating anything. Governments are dead broke and they keep raising taxes yet hope the central bank can compensate by lowering interest rates to negative. Between rising Taxes and declining interest rates, this toxic-mix is destroying pension funds and wiping out the elderly. There is nobody in government who has any common sense to see this is going to wipe out the economy – not stimulate anything.

Which is consistent with MA's theme of the world's capital wanting to flee to the safe of the USA, but instead of USA bonds it will be forced into USA stocks.

The above is an example of why when sloanf cherry picks data from a few blog posts, he gets lost in the forest as to the holistic meaning and predictions.

Gold will be driven underground. If you have too much gold jewelry on, they will pull you over and weight it at the airport. So, this guy would be in trouble.

In all cases where a currency has been cancelled or the confidence in government collapses to any extent, from Russia to a Zimbabwe event, the people use the currency of a neighboring country. The best thing for Europeans to do right now is to hoard U.S. dollars in cash — not euros, and not even Swiss francs. The Swiss will surrender to the demands of the EU, so I would not count on those 1,000 Swiss franc notes remaining valid for long either. The USA would find it extremely difficult to move to electronic currency. The USD remains the legal tender since 1792. It has never been cancelled and it might even spark a breakup of the USA with the Bible Belt whom is moving to secede.

|

|

|

|

|

TPTB_need_war

|

|

February 04, 2016, 05:38:06 PM |

|

Another excellent piece, trollerc. Thanks for posting it. Europe is on the edge of becoming a neutered country, incapable of maintaining its society along the norms of "The West". 5 - 10 years after, they will become Islamicized. It's already starting to happen, yet the Socialist Retards running EVERYTHING over there are hypnotized... I wonder, trollerc, if the USA and/or Australia will allow their women to be harassed like that. My guess is "no", but who knows. At least in the West or South in the USA the Musloids would get an immediate ticket to their heaven, where their 72 goats await them. What do you mean by 'their women?' I'm not into communism therefore my obvious allegiance is to my wife and females in my family, nobody else. That's the whole point of being anti-collectivism. In Germany and Sweden, the criminal elements travel in packs - and a lot of the females they attack probably vote for left-wing parties, or actively implement these policies in their employment at a government agency or NGO. After generations of social engineering, the men are looking at jail or even death at the hands of the police if they retaliate. They are looking at being stuck on a life support machine for protecting their own political opponents. In other words, it's very easy being a keyboard warrior in the US, especially if you live somewhere like Nowheresville, Idaho. Incidentally, I don't see American males going after the likes of Soros and the people who work for him. What's your personal excuse for that? What's the point having all those weapons if you refuse to defend yourselves from domestic enemies? Or is that just a job for ex-Marines (if so, it looks like they are totally failing also)? Therefore I am going to have call BS on the idea that Americans and Aussies are toughguys here. Badmouth European men all you want, but you're all heading for the same fate eventually. Don't fool yourselves about that.

Whereas, in the rural areas of (and Bible Belt of the USA for example) there is still some significant percentage who hate socialism. trollercoaster claims a similar effect in rural areas of Australia.

The Bundy incidents have shown that the ex-marines and militias will stand up for women and other rights. They even put the women and children at the front with the men on horses with guns behind then and the Feds backed down.

Too many Americans have bought into socialism for the minority of the population to take control politically. Instead they await the fight locally with their guns locked and loaded.Gold will be driven underground. If you have too much gold jewelry on, they will pull you over and weight it at the airport. So, this guy would be in trouble.

In all cases where a currency has been cancelled or the confidence in government collapses to any extent, from Russia to a Zimbabwe event, the people use the currency of a neighboring country. The best thing for Europeans to do right now is to hoard U.S. dollars in cash — not euros, and not even Swiss francs. The Swiss will surrender to the demands of the EU, so I would not count on those 1,000 Swiss franc notes remaining valid for long either. The USA would find it extremely difficult to move to electronic currency. The USD remains the legal tender since 1792. It has never been cancelled and it might even spark a breakup of the USA with the Bible Belt whom is moving to secede.

The future course of the United States will follow the same pattern. Pre-Revolution, you had separate states. That became the UNITED states in 1789. We will see a breakup of the states most likely banding together in regions because of the difference in cultural views such as the Bible Belt. The fight over Obamacare illustrates the stark differences and this is fundamentally wrong for it is forcing one groups interests upon another. There is no such thing as equal rights but money is the exception. We are all treated the same even in law (no exception for politicians and bankers) or we are not a nation of equal rights. You can’t be just a little be pregnant! The US will break up, but it should not go into a MADMAX event as long as we reach resistance from the people. If the people keep just watching their sports and never notice what the governments are doing to their future until it is too late, then it can go too far and that in the MADMAX event the ended the Roman Empire.

As for the break-up of the USA, the computer has been warning for decades now that the 2016 election will see a sharp rise in third-party activity. The Republican Party may split again. We see the internal civil war with the Tea Party people. This is the core of the break-up for what lies behind that is culture and religion. Once the economy turns down, this will accelerate.

It appears that Hillary will be the Democratic candidate and that will merely solidify the Republic split. By 2032, the other side of this 51.6 year wave looks to be a starkly different world. The USA will split and China will become the Financial Capital of the World.

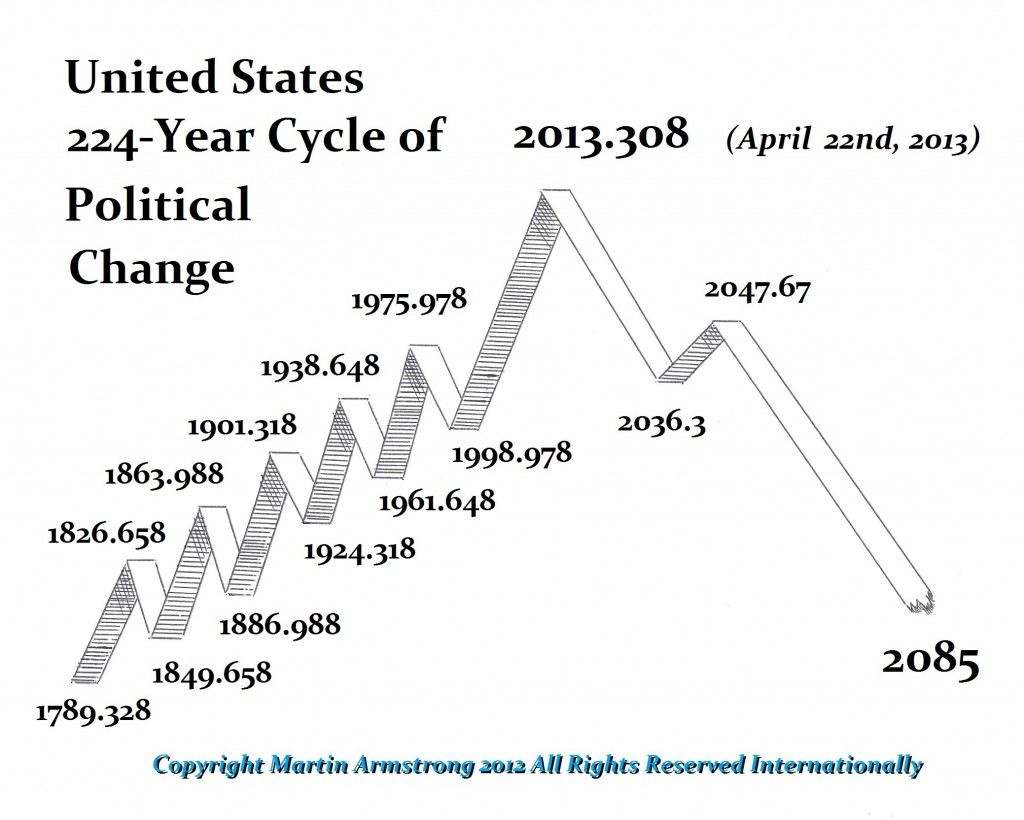

Do you know what happened on 2013.308? That was when Edward Snowden made his final move (no turning back any more) to release documents about the NSA. Yet people claim Martin Armstrong's cycles don't predict anything.   There are two types of waves on the 224 Year Cycle – the Collapsing Wave and the Protracted Wave. It appears that the USA is in the Collapsing Wave formation meaning that the 224 year runs from the birth to the peak with the total duration running minimum 296 years with the optimum being 309.6 years meaning the society splits and does not remain intact. A Protracted Wave is a society view where the wave is measured peak to peak totaling 224 years. The second Protracted Wave formation is where governments come and go, but society survives and reforms remaining intact. In the Collapsing Wave structure where it is 224 year from birth to peak, the overall duration appears to be is 296-309 years. for the conclusion whereby society breaks apart and fragmentation emerges..In the case of Rome, 309 years from the assassination of Julius Caesar in 44BC is 265AD where Rome broke apart and the Gallic Empire emerged under Postumus (259-268AD). This Collapsing Wave structure that the United States appears to be in means it is a one-time-wonder and that the United States will break-up and the there will be no more “united” union. This is becoming self-evidence in the polarization of politics with tremendous differences in culture on a regional basis. The Obamacare is just one aspect revealing the undercurrent whereby one segment of society believes it has a right to force their views upon another group. So unfortunately, the USA does not appear to be destined to remain intact otherwise we would have seen and overall structured wave of 224 years. We seem to be in the Collapsing Wave with the 224 years was from birth to peak with an overall duration of 309.6 years at best. This appears to be like the Collapsing Wave in Imperial Rome itself whereas from the assassination of Julius Caesar in 44BC to the peak in the glory of Rome and population in the city took place under Marcus Aurelius that was 224 years later in 180AD. The decline that followed brought total chaos, sovereign debt crisis, massive government seizure of capital, fragmentation of the Empire, and in the end, Rome was no longer the Capitol and that became Constantinople followed by the split of East and West. We are much more akin to the this type of Collapsing Wave formation whereby society collapses and breaks apart. Now we have the Cycle of War turning in 2014 that appears to be focused within civil unrest at least initially. |

|

|

|

|

TPTB_need_war

|

|

February 04, 2016, 06:33:14 PM |

|

Zika virus is a poor pandemic candidate. Its a potential nightmare for women in some areas who are planning to conceive but in everyone else it appears to mostly cause a self limited infection. It is a blood born pathogen that requires mosquitoes to spread.

The bubonic plague was a bacterial infection spread by fleas and rats. The developing world can't avoid mosquitos, because their bamboo or wooden homes have cracks in the walls. The Zika virus may possibly spread via sex: http://www.theglobeandmail.com/news/world/who-concerned-by-report-of-sexual-spread-of-zika-virus/article28531722/ |

|

|

|

fxaprendiz

Newbie

Offline Offline

Activity: 4

Merit: 0

|

|

February 04, 2016, 11:01:09 PM |

|

After re-reading my first post I realized my point regarding Marting Armstrong got lost on all my exposition.

What I meant to say is that the man is onto something with his concepts on cycles. Where I depart is on the severety of the next 2 corrective waves of 2017 and 2033.

Indeed, this thread is about MA, not about your work. But since you wrote so much, why don't we extract at least some value out of it, if there's any. Can you explain very clearly and possibly short where you get those 2017, 2033 dates? Did you simply take them out of the MA deeply flawed model? And how do we make\save money out of all you posted provided that everything is legit? I could explain but I won't do it. I have a policy of not feeding the trolls. |

|

|

|

|

sloanf

Jr. Member

Offline Offline

Activity: 64

Merit: 1

|

|

February 05, 2016, 06:22:07 AM |

|

This is what I have been trying to teach to sloanf, that if you don't use international pricing then analysis is entirely wrong:

Oh, you are trying to teach me after we have established this:

Since you:

1. have been buying bs from MA, a convicted fraudster and an extremely terrible forecaster, for years

2. even brag by this fact (1) in front of everybody as if it was an achievement

3. did not do even a basic fact-checking because of your inability to do so due to lack of common sense and any form of critical and independent thinking

4. deny all the facts and evidence collected, brought and very carefully explained to you by many others

5. keep spreading MA bs promoting his scam all over the place for free despite (4)

you embrace the very definition of stupidity. And since you have been stupid for so long, it must be your normal and pretty comfortable state and therefore cannot be an insult for you. And the reason I have written the above is not to humiliate you or make you feel bad. As I said, I don’t care about you because it’s not important because it’s not the purpose of this thread. My only intention was to prove my claims about your stupidity and that’s what I have done.

Anyhow, what is the point of your posts? All you do is simply copy-paste from MA posts without any relevance or meaning. If somebody wants to read MA, they can go on his website and read the original posts without your skewed interpretation. If you want to prove some of MA claims, you cannot do so simply by referring to his own posts. In other words, you’re saying “MA is right because check this here, he says he’s right”. Or are you trying to persuade everybody that these forecasts were correct? 1. Gold 5K-12K by 2015\2016. The opposite happened. 2. Collapse of the USD after 2011. The opposite happened. 3. Gold below 1K since 2013. Never happened since then. 4. RE will not recover after the 2008 crash. The opposite happened. 5. Oil rally after mid-2014 into 2017. The opposite happened. 6. Dow 32K-40K by 2015 then by 2017 and now by 2020. Never happened. 7. Big Bang on 2015.75, the US government shutdown, government debt collapse, shift from bonds to equities. The opposite happens. |

|

|

|

|

|

TPTB_need_war

|

|

February 05, 2016, 07:47:34 AM

Last edit: February 05, 2016, 09:29:31 AM by TPTB_need_war |

|

This is what I have been trying to teach to sloanf, that if you don't use international pricing then analysis is entirely wrong:

Oh, you are trying to teach me after we have established this:

Since you:

1. have been buying bs from MA, a convicted fraudster and an extremely terrible forecaster, for years

2. even brag by this fact (1) in front of everybody as if it was an achievement

3. did not do even a basic fact-checking because of your inability to do so due to lack of common sense and any form of critical and independent thinking

4. deny all the facts and evidence collected, brought and very carefully explained to you by many others

5. keep spreading MA bs promoting his scam all over the place for free despite (4)

you embrace the very definition of stupidity. And since you have been stupid for so long, it must be your normal and pretty comfortable state and therefore cannot be an insult for you. And the reason I have written the above is not to humiliate you or make you feel bad. As I said, I don’t care about you because it’s not important because it’s not the purpose of this thread. My only intention was to prove my claims about your stupidity and that’s what I have done.

Speak those (erroneous, liar) words in front of my face and you'll get a lesson about who is stupid. Anyhow, what is the point of your posts?

Given that question admits you are oblivious to reading comprehension, you are refuting your own words above. 1. Gold 5K-12K by 2015\2016. The opposite happened.

MA never made such a prediction. I have explained this to you upthread yet you continue trolling the thread with lies. 2. Collapse of the USD after 2011. The opposite happened.

That is entirely opposite of what MA predicted. 3. Gold below 1K since 2013. Never happened since then.

MA never made such a prediction. The target date of the gold low was in his paid report which I had access to indirectly and is for 2016. 4. RE will not recover after the 2008 crash. The opposite happened.

His real estate cycle chart (from his Pi model and historic data archive) has been around since the 1980s and has always shown a bounce from 2007 to 2012 then a renewed decline. It is based on international dollar value, not domestic. This was explained to you in a longish post I made within the past couple of pages of this thread which even included a copy of the Real Estate cycle chart. 5. Oil rally after mid-2014 into 2017. The opposite happened.

It was already explained to you that he prediction was for oil to decline from $100+ to $57 for 2014 closing. And for a rise off of eventual lows ($25 - $35) by 2017, but that does not mean rising between 2014 and 2017. It means finding the low first and then rising as the hot wars start in 2017. 6. Dow 32K-40K by 2015 then by 2017 and now by 2020. Never happened.

The TIME was always orthogonal to the price. And he was writing in blog posts I read in 2012 that it could extend out as far as 2020 and we would have to wait for the year end closing in 2014 to know for sure. 7. Big Bang on 2015.75, the US government shutdown, government debt collapse, shift from bonds to equities. The opposite happens.

That was the directional change and yes it is underway with the post I showed yesterday that the Fed may try to keep rates low and this will force money from bonds to stocks. And the ingress to the USD will happen anyway (as MA predicted) because the rest of the world is collapsing. Dude you are wrong on every point. Hahaha.  Do you enjoy making a fool of yourself. Come on sloanf, give it up. You are out of your league against me. You picked a fight with the wrong person. It is also really asinine to pick a fight over an issue where you are wrong. The truth always wins in the end. |

|

|

|

|

TPTB_need_war

|

|

February 05, 2016, 10:53:03 AM |

|

MA was predicting some technical innovation to enable us to grow food in less space and in any mini Ice Age coming... One of the more vital technological advancements has been developed locally in Philadelphia. They can grow all the necessary food without farmland from inside a warehouse that is completely free from genetic tinkering or chemical whatever. The owners of Metropolis Farms actually grow fresh produce all year long. Those interested in survival of the fittest, well here it is. President Jack Griffin developed this technology and has been doing a bang-up job. It would probably be a bad idea to set one up in a basement for the years ahead. As he explained, “The innovation here is density, as well as energy and water conservation.” Griffin continued, “We can grow more food in less space using less energy and water. The result is that I can replace 44,000 square feet with 36 square feet. When you hear those numbers, it kind of makes sense.” This is the way of the future — fresh food coming from your basement. I believe the key technological breakthrough may be long-life, high-efficiency, solid-state LED grow lights: https://www.google.com/search?q=high+efficiency+grow+light |

|

|

|

sloanf

Jr. Member

Offline Offline

Activity: 64

Merit: 1

|

|

February 05, 2016, 02:18:59 PM |

|

MA never made such a prediction. I have explained this to you upthread yet you continue trolling the thread with lies.

It’s really funny how you defend your stupidity by doing the same over and over again hoping to get a different result. By repeating the same bs, facts are not going to change, ok? I explained that to you several times already: bring factual evidence that support your claims, otherwise they are just what they are – empty claims. Again:1. Here on March 2011 http://s3.amazonaws.com/armstrongeconomics-wp/2011/03/armstrongeconomics-how-when-030111.pdf MA clearly says gold to go to 5K-12K by 2015\2016. Of course, his prediction fails and he then simply flip-flopped on gold. Do finally read this report or since you proved that you are not able to, get someone to read it to you and explain it to you. 2. Here in September 2011 http://www.bloomberg.com/news/articles/2011-09-28/felon-forecaster-blogs-on-8-6-year-economic-cycles-after-11-years-in-jail MA predicts the U.S. dollar collapse. Same result: failed prediction --> flip-flop. 3. Take-off in gold in 2013 into 2016, gold at 650-910 coming soon, 907 in two weeks, etc. MA clearly failed on gold as usual. 4. How many times do we have to go through this? As with everything else, as we have seen above, you are not able to get things from the first/second/third time. Ok, let’s do it again. That real estate picture that MA claims to have drawn in 1979 uses the Case-Shiller home price index. Back then there was nothing like “internationally inflation adjusted value“ and nowhere was it mentioned by MA or anybody. He started to exploit this trick relatively recently when it became obvious that he failed yet another of his numerous predictions so he had to cover his ass by making it up. Interestingly, he uses that IIM trick on real estate because, as he argues, real estate attracts global money but at the same time he does not use IIM when he makes predictions on the Dow, Gold, Nikkei and so on (which also attract global capital). Now, if you compare the index and the picture, you’ll easily find out that they do not match (put it mildly). First, the index had been rising without any drop up until 2006 (the MA’s graph predicted drops after every 8.6 years). Second, the absolute high according to MA should have been reached in 2007.15, but in reality the S&P Case-Shiller topped in 2006 https://research.stlouisfed.org/fred2/series/CSUSHPINSA, http://www.spindices.com/index-family/real-estate/sp-case-shiller, and the original Case-Shiller topped in 2005 http://www.econ.yale.edu/~shiller/data.htmThird, the index significantly recovered and keeps rising, contrary to what MA predicted. Here is another dirty trick that MA used. When real estate picked he did not say anything. Only after the crisis hit and real estate plunged he came out and claimed that he’d predicted the top. Not only that, he claimed that he predicted the top to the day referencing to (wait!) the S&P Reit index. Again, there was nothing about “internationally inflation adjusted value“ or any of such bs. But wait, there’s more. The S&P Reit includes not only home RE, but everything else such as residential, office, health-care, hotels, etc. In other words, from very beginning he used the Case-Shiller (only home RE). Then when it didn’t work out, he switched to the S&P Reit which tracks all RE, and now he switches again by bs people with a new trick called “internationally inflation adjusted value“. He clearly failed miserably on RE. 5. and the list goes on...

So, not just 1%-10% wrong but wrong big time. Also, he missed the recent commodity collapse and particularly oil.

He likes to constantly bs people about how everything is connected, all asset prices are interlinked, etc. If that’s the case, then you can’t simply miss such a big move in oil price. Especially if you do have a computer model (as he claims) that tracks everything for you. Yet he missed it completely. He never warned about upcoming collapse. If fact, he predicted the opposite, right at the YTD peak http://www.armstrongeconomics.com/archives/22328 (“It is poised to rally into 2017 and it appears this is lining up with our war models”). Wars are all over the place yet oil went down sharply. Even when the price declined substantially, he kept ignoring it. He only start mentioning oil when it came to 70. Nevertheless, let me once again show everybody how stupid you are. Here http://www.armstrongeconomics.com/archives/22328 already after the YTD-peak he said oil would rise into 2017 (the opposite to what happened). This proves beyond all doubts MA did not predict the collapse. Here in September when oil was at 90 he still did not see the upcoming collapse http://www.armstrongeconomics.com/archives/23450 and even thought it might have been a plot against Russia. Here in November, oil at 80, he still does not get it http://www.armstrongeconomics.com/archives/24733. And only here http://www.armstrongeconomics.com/archives/25545 in December when oil collapsed below 65 he started to acknowledge ”a serious trend change is potentially on the horizon”. Notice, below 65, and not at 100+ as you claim. MA failed his bullish forecast on oil in 2014, flip-flopped as usual but only after it was clear to everybody that oil was heading down. 6. First it was 32-40K by 2015.75 and of course it failed big time. Then MA shifted the date to 2017 hoping this trick would work out. Of course he failed again. Would anybody except his obtuse clients believe in 40K on the Dow by 2017? No, so he shifted the date again to 2020. When he fails again, he will do what? <-- It’s a rhetorical question. 7. Further to that, here http://www.armstrongeconomics.com/models/historical-turning-points-economic-confidence-model-6000bc-2072ad he put thousands of points so naturally something happened on or around some dates. But it clear that in absolute majority of cases nothing happened at all, just like in 2015.75, which MA had been preaching for years as Big Bang. But let me remind you, he predicted http://www.armstrongeconomics.com/archives/35652 the US government shutdown, government debt collapse and so much else. Of course, nothing of that happened. In fact, nothing happened at all. So in the absence of anything significant, he, in order to cover his ass, used the fact that Putin sent a couple of planes to Syria as the major Big Bang event. What a pathetic charlatan! Where are the government shutdown, collapse of the bond market and the shift from bonds to equities? The exactly the opposite is happening: stocks are down and bonds are rising globally. Do continue to buy bs from MA and other charlatans at exorbitant prices for stupidity should be punished. |

|

|

|

|

|

|

|

TPTB_need_war

|

|

February 05, 2016, 03:34:18 PM |

|

MA never made such a prediction. I have explained this to you upthread yet you continue trolling the thread with lies.

1. Here on March 2011 http://s3.amazonaws.com/armstrongeconomics-wp/2011/03/armstrongeconomics-how-when-030111.pdf MA clearly says gold to go to 5K-12K by 2015\2016. Of course, his prediction fails and he then simply flip-flopped on gold. Do finally read this report or since you proved that you are not able to, get someone to read it to you and explain it to you. I suggest you go back to elementary school and learn how to read, because you seem to not be able to comprehend the difference between a conditional statement and a prediction: As we move into the next major target such as 2011.45 (June 13th/14th, 2011)...

THE BEST OF ALL WORLDS FOR A BULL MARKET shall be for gold to make a low on that day... [note there is no prediction here, only a statement such an event would be best for gold will be maximally bullish]

The second type of pattern is the real breakout. Gold could be in a PHASE TRANSITION period...[thus what is written below this is contingent of if Gold exhibits a PHASE TRANSITION and then MA explains what those conditions are]

...or we blast out of the top of this main channel, fall back to find it [the top of the channel] providing support, and then we will be on our way to at least $5000 and maybe $12,000 by 2015/6...

Armstrong then explained the other scenario for gold which is that is to make a CYCLE INVERSION so as to align with its true hedge against government; and here is implying that gold's rise and potentially correction before doing so will be contingent on the progression of the sovereign debt crisis and here is where he explained that the $5000 by 2015/6 would be the unlikely outcome and rather the pause and correction are more likely: ...gold is going through a CYCLE INVERSION and this is a good think because it is starting to realign with the major purpose of gold - not a hedge against inflation but the hedge against government...

The key to gold is its CYCLE INVERSION... [that is required to produce a] ...PHASE TRANSITION that is required to produce a big rally...

The market is the only thing that is simply never wrong. For the bull market ahead in gold, a simple pause in NECESSARY. This is how bull markets are sustained.. If we see gold blasting to new highs passing $1500, we are in trouble. This would be a serious development warning that we are now completing a PHASE TRANSITION that could lead to a low 2015.75 and the rally thereafter.

Which is exactly what gold did in 2011 and the resulting decline to $1050 before 2015.75. And in the 2014/5 gold report, MA further clarified that the final low would be in Q1 2016 < $1000 (perhaps < $850). I think you've wasted enough of our time. I am now asking everyone to add you to their Ignore list. If they do not acknowledging do so with a public post, I will not help anyone in this thread any more. You are now added to my Ignore list. Bye. Readers please note I am not going to waste my time explaining to sloanf why he is wrong on each of his enumerated allegations. It is enormously disrespectful to my scarce time. It should be clear enough from the above example and others I have already made in this thread, that he has a severe mental handicap and unable to comprehend what he reads. |

|

|

|

trollercoaster

Legendary

Offline Offline

Activity: 1050

Merit: 1001

|

|

February 05, 2016, 04:20:23 PM

Last edit: February 05, 2016, 05:06:06 PM by trollercoaster |

|

I have sloanf and the latest wave of cointelpro sockpuppet accounts on ignore, as requested I am stating it publicly.  |

|

|

|

|

|

altcoinUK

|

|

February 05, 2016, 05:41:40 PM |

|

Yes, we should all put on ignore that fucking sockpuppet sloanf troll. He doesn't have a minimal character to use his original nick to troll this thread with his fixation about Armstrong.

The troll ignores all rational argument from TPTB_need_war and all others. It is getting really annoying that the information about Armstrong is buried in the crusade trolling of a fucking sockpuppet account.

|

|

|

|

|

sloanf

Jr. Member

Offline Offline

Activity: 64

Merit: 1

|

|

February 05, 2016, 06:05:46 PM |

|

I think you've wasted enough of our time. I am now asking everyone to add you to their Ignore list. If they do not acknowledging do so with a public post, I will not help anyone in this thread any more.

Wasted enough time? You have been wasting your time for years promoting all MA’s bullshit and parroting him all over the place. Don’t kid yourself - who are you able to help in this thread? You can’t even help yourself getting out of your stupidity much less anyone else. Which is exactly what gold did in 2011 and the resulting decline to $1050 before 2015.75. And in the 2014/5 gold report, MA further clarified that the final low would be in Q1 2016 < $1000 (perhaps < $850).

Gold < 850 in Q1? Ok, now gold is at 1160 and keeps rising. We have one month to go down more than $300. Should we wait till March to yet again witness your stupidity or shall we ask you to admit it right now? Meanwhile, again, read all the reports I brought to you Here (August 28th, 2009) http://s3.amazonaws.com/armstrongeconomics-wp/2012/03/will-gold-reach-5000-809.pdf MA says “ It is coming into its own and is still poised to rally to at least test the $3,000 level if not much higher.” And “Government has promised the moon, and can no more keep their promise that Santa really eats the cookies. When there is no one who buys the US debt, that is when the ceiling will fall. We will see this most likely after 2010 and it appears the end may be 2015-2016. A 21 year bull market in stocks points to 2015 and a 17.2 year high in gold points to 2016.” “No demand for the US debt and collapse by 2015-2016”? Completely the opposite is happening: no collapse and the US government bonds are rising. “Gold is poised to rally to at least test the $3,000 level if not much higher into 2016”. Read again or get somebody to help you with it. High in gold in 2016, not low. “A 21 year bull market in stocks points to 2015”. But then it “pointed” to 2017 and now it “points” to 2020. And then maybe to 2030, who knows. I hope somebody will pull you aside and pass on this to you. It is better to say nothing and have people wonder if you are stupid rather than to open your mouth over and over again and prove to all that you are indeed really stupid beyond all doubt.

|

|

|

|

|

|

altcoinUK

|

|

February 05, 2016, 07:05:13 PM |

|

I hope sloanf sockpuppets don't put much effort into his posts - that would be a complete waste of time as all I can see is "This user is currently ignored".

|

|

|

|

|

|