JayJuanGee

Legendary

Offline Offline

Activity: 4088

Merit: 12223

Self-Custody is a right. Say no to "non-custodial"

|

|

July 26, 2018, 11:11:19 PM |

|

Bbut... but Anon, it's like when you want a car engine to 'scale' to higher horsepower and speed, the most straightforward way is to simply add more cylinders! V32 engines for everyone so we can get places faster, amiright? /s

Stupid analogy is stupid. If you want a transportation analogy, a closer analog would be passenger demand for a certain train route exceeding capacity solved by adding more passenger cars to the train. Still a stupid analogy, but an order of magnitude closer to the situation at hand. Dude you are eating my merits! Put those pic'a'nic baskets down! For the record, I maintain that segwit was a mistake. And that bcash is shit. And no, these are not contradictory, Torque. Feel less and think more. O.k. great, so you cannot find another coin? Instead you want to come here and bash on segwit which was accepted through consensus and NOT likely to be diminished anytime soon, except you nutjobs just want some pie in the sky speculative things to complain about? |

|

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 4088

Merit: 12223

Self-Custody is a right. Say no to "non-custodial"

|

|

July 26, 2018, 11:23:35 PM |

|

Maybe you just look down on those who attempt to engage in self-improvement BTC trading practices?

I think that's an astute observation. I don't have the gumption to trade. Full-stop. And this is why I suck at this. This remains exact within expectations of what could happen. Remember 3 weeks ago, we were down at $5,777-ish? O.k.? On the overall scheme of things, we would have been buying BTC all the way down to $5,777 - or whatever closest proximate buy order was filled.. perhaps $6k might have been the closest, depending on how far apart your buy orders are placed. Then when the BTC price went up, largely, from that point until nearly $8,500, then you would have been selling all the way up. Let's say for example, you did not hit the bottom, and you were only able to buy around $6,000, then you might have been selling from $6,500 up or maybe your orders are spread wider (because you don't like to be so active in your trades) and your sell orders would have begun to execute around $7k all the way up to $8,500.. Again, on the way up, let's say that your sell orders are spread kind of wide, and the closest one to hit was around $8k, and therefore, you might not be ready to buy back until $7k or something like that? Anyhow, if your orders are closer together, then more of them will trigger, but a $2,700 price swing (nearly a 50% swing in price) should have caused some orders to trigger - unless you are playing really large swings (and some folks do play the really large swings). Currently, I have larger gaps between my buy and sell orders, but once the orders start to trigger, then subsequent orders are relatively close together. |

|

|

|

|

V1lpu

Member

Offline Offline

Activity: 332

Merit: 12

|

|

July 26, 2018, 11:26:42 PM |

|

Did anyone still following Masterluc? He posted this yesterday: Six months have passed since the beginning of the correction, there is still the same. The drains didn't want to fall. Bitcoin too. The longer we stay at current levels, the lower the likelihood of falling to new bottoms.

I think it will be many months of sideways movement. Time is now against the bears. |

|

|

|

|

Elwar

Legendary

Offline Offline

Activity: 3598

Merit: 2386

Viva Ut Vivas

|

|

July 26, 2018, 11:31:04 PM |

|

After going through the whole process of verifying my account on WEX.nz, sending them signed transactions of wallets I control that received LTC, PPC and BTC from them along with much more proof they sent me this: Hi, Unfortunately we haven't found any way to work with USA citizens yet. We will renew our news portals when this possibility appears Best Regards, WEX Support Knowledge Base https://wex.kayako.comUtter bullshit. I'm not even a US resident. I haven't lived in the US for 5 years. Bitfinex was fine with non-US residents using their exchange. Non-US residents are not bound to the same SEC or exchange laws as US residents. They can just come up with some new reasons (after they have your money) on why they can keep your money. |

|

|

|

|

|

Rosewater Foundation

|

|

July 26, 2018, 11:31:23 PM |

|

Maybe you just look down on those who attempt to engage in self-improvement BTC trading practices?

I think that's an astute observation. I don't have the gumption to trade. Full-stop. And this is why I suck at this. This remains exact within expectations of what could happen. Remember 3 weeks ago, we were down at $5,777-ish? O.k.? On the overall scheme of things, we would have been buying BTC all the way down to $5,777 - or whatever closest proximate buy order was filled.. perhaps $6k might have been the closest, depending on how far apart your buy orders are placed. Then when the BTC price went up, largely, from that point until nearly $8,500, then you would have been selling all the way up. Let's say for example, you did not hit the bottom, and you were only able to buy around $6,000, then you might have been selling from $6,500 up or maybe your orders are spread wider (because you don't like to be so active in your trades) and your sell orders would have begun to execute around $7k all the way up to $8,500.. Again, on the way up, let's say that your sell orders are spread kind of wide, and the closest one to hit was around $8k, and therefore, you might not be ready to buy back until $7k or something like that? Anyhow, if your orders are closer together, then more of them will trigger, but a $2,700 price swing (nearly a 50% swing in price) should have caused some orders to trigger - unless you are playing really large swings (and some folks do play the really large swings). Currently, I have larger gaps between my buy and sell orders, but once the orders start to trigger, then subsequent orders are relatively close together. Ok Jay. I'm going to start improving my Bitcorn position. No guts no glory. Wish me luck. Edit: Let me know if you want your own action figure. |

|

|

|

|

marcus_of_augustus

Legendary

Offline Offline

Activity: 3920

Merit: 2349

Eadem mutata resurgo

|

|

July 26, 2018, 11:44:11 PM |

|

From https://www.sec.gov/news/public-statement/peirce-dissent-34-83723By precluding approval of cryptocurrency-based ETPs for the foreseeable future, the Commission is engaging in merit regulation. Bitcoin is a new phenomenon, and its long-term viability is uncertain. It may succeed; it may fail. The Commission, however, is not well positioned to assess the likelihood of either outcome, for bitcoin or any other asset. Many investors have expressed an interest in gaining exposure to bitcoin, and a subset of these investors would prefer to gain exposure without owning bitcoin directly. An ETP based on bitcoin would offer investors indirect exposure to bitcoin through a product that trades on a regulated securities market and in a manner that eliminates some of the frictions and worries of buying and holding bitcoin directly. If we were to approve the ETP at issue here, investors could choose whether to buy it or avoid it. The Commission’s action today deprives investors of this choice. I reject the role of gatekeeper of innovation—a role very different from (and, indeed, inconsistent with) our mission of protecting investors, fostering capital formation, and facilitating fair, orderly, and efficient markets. Accordingly, I dissent.

Hester M. Peirce, Commissioner   |

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4393

Be a bank

|

|

July 26, 2018, 11:48:25 PM |

|

There's a slim chance still for the SolidX Cboe effort https://www.sec.gov/rules/sro/cboebzx/2018/34-83520.pdf Policy Considerations pages 42 and following attempts to address market manipulation etc. Some of it is quite funny - 'actually bitcoin is less dishonest than legacy' |

|

|

|

|

Anon136

Legendary

Offline Offline

Activity: 1722

Merit: 1217

|

|

July 26, 2018, 11:53:01 PM |

|

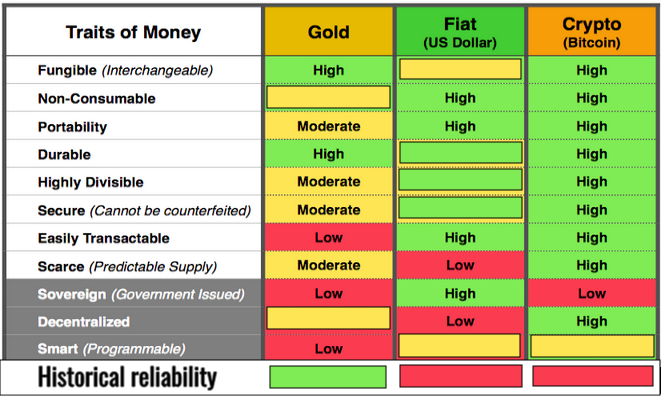

I didn't quite agree with this chart so I made some changes.  I start off with the assumption that fiat will be considered as cash or checkbook money depending upon which of those two puts it in a more favorable light for a given question but knock off a point for fungibility because of the need to switch back and forth between cash and check book money in order to achieve this. - first change to fiat fungibility mentioned above

- the original author put the cart before the horse on non consumability of gold, the main reason why gold is not consumed is BECAUSE of it's monetary status. If it became demonetized than it would become a consumable resource.

- checkbook money is very durable

- checkbook money is very divisable

- both cash and checkbook money are extremely difficult to counterfeit convincingly

- and of course the one thing that gold has that makes it even a contender in this race at all is it's 5000 year history of value. no matter how much you love crypto and hate gold you would be a fool to pretend that this isn't relevant

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1442

Merit: 2284

Degenerate bull hatter & Bitcoin monotheist

|

|

July 26, 2018, 11:58:57 PM |

|

|

|

|

|

|

Ibian

Legendary

Offline Offline

Activity: 2268

Merit: 1278

|

|

July 27, 2018, 12:00:44 AM |

|

Bbut... but Anon, it's like when you want a car engine to 'scale' to higher horsepower and speed, the most straightforward way is to simply add more cylinders! V32 engines for everyone so we can get places faster, amiright? /s

Stupid analogy is stupid. If you want a transportation analogy, a closer analog would be passenger demand for a certain train route exceeding capacity solved by adding more passenger cars to the train. Still a stupid analogy, but an order of magnitude closer to the situation at hand. Dude you are eating my merits! Put those pic'a'nic baskets down! For the record, I maintain that segwit was a mistake. And that bcash is shit. And no, these are not contradictory, Torque. Feel less and think more. O.k. great, so you cannot find another coin? Instead you want to come here and bash on segwit which was accepted through consensus and NOT likely to be diminished anytime soon, except you nutjobs just want some pie in the sky speculative things to complain about? Get the fuck out of here with your wordy words wordy man. |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1442

Merit: 2284

Degenerate bull hatter & Bitcoin monotheist

|

|

July 27, 2018, 12:10:48 AM |

|

Nice. California Republican congressman on the House Foreign Relations committee, Dana Rohrabacher had a cosy dinner with Maria Butina.  |

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3822

Merit: 5504

|

|

July 27, 2018, 12:11:03 AM

Last edit: July 27, 2018, 12:23:12 AM by Torque |

|

From https://www.sec.gov/news/public-statement/peirce-dissent-34-83723By precluding approval of cryptocurrency-based ETPs for the foreseeable future, the Commission is engaging in merit regulation. Bitcoin is a new phenomenon, and its long-term viability is uncertain. It may succeed; it may fail. The Commission, however, is not well positioned to assess the likelihood of either outcome, for bitcoin or any other asset. Many investors have expressed an interest in gaining exposure to bitcoin, and a subset of these investors would prefer to gain exposure without owning bitcoin directly. An ETP based on bitcoin would offer investors indirect exposure to bitcoin through a product that trades on a regulated securities market and in a manner that eliminates some of the frictions and worries of buying and holding bitcoin directly. If we were to approve the ETP at issue here, investors could choose whether to buy it or avoid it. The Commission’s action today deprives investors of this choice. I reject the role of gatekeeper of innovation—a role very different from (and, indeed, inconsistent with) our mission of protecting investors, fostering capital formation, and facilitating fair, orderly, and efficient markets. Accordingly, I dissent.

Hester M. Peirce, Commissioner Well that... that is the fucking issue right there, isn't it. Just buy the fucking coins directly, investors! Sheesh, what is the problem? Coinbase and Gemini are offering custodial services for this very reason. Just buy the goddamn coins and be done with it. Oh... but you say you can't run derivatives against it and leverage up to the moon? You can't loan your shares out as collateral for other investments? Well too fkn bad. Buy the coins! |

|

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 4018

Merit: 6006

|

|

July 27, 2018, 12:12:34 AM |

|

From towards the end of Peirce's dissent. Evidently she understands the corn fairly well for your average bureaucrat. Emphasis mine. By withholding approval of a bitcoin-based ETP because the underlying market insufficiently resembles the markets for other commodities, we set ourselves up as the gatekeepers of innovation. Securities regulators are ill-equipped to fill this particular role.[22] It is telling that the disapproval order’s analysis shows little consideration of the relatively advanced features of this still nascent market. For example, trading in bitcoin is electronic, which facilitates competition and price transparency.[23] Bitcoin are interchangeable, so that a purchaser is sure to get exactly the same thing no matter where she purchases it.[24] In addition, bitcoin mining is not geographically limited (except to the extent it migrates to places with cheap electricity), so it is not subject to geopolitical threats that plague other commodity markets.[25] Rather than considering the unique opportunity that these innovative characteristics of the bitcoin market present to investors, the order analyzes the ETPs through a legal and regulatory framework derived from prior approval orders for commodities with very different characteristics. More like her please. |

|

|

|

|

|

|

Ibian

Legendary

Offline Offline

Activity: 2268

Merit: 1278

|

|

July 27, 2018, 12:24:29 AM |

|

Nice. California Republican congressman on the House Foreign Relations committee, Dana Rohrabacher had a cosy dinner with Maria Butina.  Literally who gives a shit. Point me to one person in the world who gives a public shit about some random spy that got caught doing spy shit. |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1442

Merit: 2284

Degenerate bull hatter & Bitcoin monotheist

|

|

July 27, 2018, 12:28:42 AM |

|

I just think it’s kinda cute how most of the Republican administration seems to be in bed with Russia. Quite literally.

It’s also fun to point out how many right wingers are traitors, prepared to sell democracy down the river for a few bucks.

|

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3822

Merit: 5504

|

|

July 27, 2018, 12:29:15 AM |

|

Literally who gives a shit. Point me to one person in the world who gives a public shit about some random spy that got caught doing spy shit.

------------------------------------------>>>> HairyMaclairy |

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3822

Merit: 5504

|

|

July 27, 2018, 12:36:18 AM |

|

I just think it’s kinda cute how most of the Republican administration seems to be in bed with Russia. Quite literally.

It’s also fun to point out how many right wingers are traitors, prepared to sell democracy down the river for a few bucks.

I know right? It's like you can just feel the anger and tension in these photos, it's so palpable :    |

|

|

|

|

|

Poll

Poll