goldkingcoiner

Legendary

Offline Offline

Activity: 2030

Merit: 1652

Verified Bitcoin Hodler

|

|

December 19, 2018, 11:48:39 AM |

|

Mornin, thread.  morning lucky coiner never close that 80X macro play  Never will bro, this might be the thing that makes me a millionaire if the bull run is actually a bull run. Mornin, thread.  You're pushing your luck, pal.  When life gives you lemons, you trade it for bitcoin. |

|

|

|

|

|

|

|

|

|

Each block is stacked on top of the previous one. Adding another block to the top makes all lower blocks more difficult to remove: there is more "weight" above each block. A transaction in a block 6 blocks deep (6 confirmations) will be very difficult to remove.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Elwar

Legendary

Offline Offline

Activity: 3598

Merit: 2384

Viva Ut Vivas

|

|

December 19, 2018, 11:49:12 AM |

|

Elwar scared me lol

After the distribution we will be able to finally close the Gox chapter for good after so many years. Will be another important milestone for bitcoin to leave the goxxing behind.

I post scary things more to scare myself so I don't get my hopes up. I will still anticipate 2018 being a wash and look forward to a fresh start in 2019. Big things (tm) coming in 2019. |

|

|

|

|

Deeyoh

Member

Offline Offline

Activity: 258

Merit: 14

|

|

December 19, 2018, 11:50:30 AM |

|

Bears still way to comfortable. Longs going down and shorts going up on this last little pump. Then again, that would be nice fuel with few longs to impede the rise. Only 125 mil short rekts on Bitmex since yesterday. I'm looking for at least 400mil short carnage to really have some hope of a new run up.

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

December 19, 2018, 11:50:36 AM |

|

I have bad FOMO. Someone whisper sweet FUD in my ear.

|

|

|

|

|

Elwar

Legendary

Offline Offline

Activity: 3598

Merit: 2384

Viva Ut Vivas

|

|

December 19, 2018, 11:52:20 AM |

|

I have bad FOMO. Someone whisper sweet FUD in my ear.

Price is still under $10k.  |

|

|

|

|

|

dandannn

|

|

December 19, 2018, 11:52:52 AM |

|

LFC keep increasing your stash man, there will be a day we drink some ALCOHOLS on these decisions over a LIVERPOOL game .....

Jeez, will you two stop flirting |

|

|

|

|

goldkingcoiner

Legendary

Offline Offline

Activity: 2030

Merit: 1652

Verified Bitcoin Hodler

|

|

December 19, 2018, 11:53:47 AM |

|

I have bad FOMO. Someone whisper sweet FUD in my ear.

You're missing out. Big time. |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

December 19, 2018, 11:56:04 AM |

|

Hey. Fuck. You. Not. Helpful.

|

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12006

BTC + Crossfit, living life.

|

|

December 19, 2018, 12:04:00 PM |

|

Let BTC suprise everyone

And keep pumping/make a big time millionaire of goldkingcoiner....

|

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12006

BTC + Crossfit, living life.

|

|

December 19, 2018, 12:04:56 PM |

|

BOB keep those invitations ready 100K here we come haha Bit to much ??  |

|

|

|

|

Phil_S

Legendary

Offline Offline

Activity: 2090

Merit: 1461

We choose to go to the moon

|

|

December 19, 2018, 12:06:34 PM |

|

Mornin, thread.  You're pushing your luck, pal.  When life gives you lemons, you trade it for bitcoin. Let's imagine these are lemons. And let's imagine I photoshopped them into bitcoins, haha.   |

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

December 19, 2018, 12:08:57 PM |

|

Even you couldn't handle the f.u.d. I've got up my sleeve.

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

December 19, 2018, 12:11:40 PM |

|

I’m glad you keep it in your sleeeve frankly

|

|

|

|

|

|

Totscha

|

|

December 19, 2018, 12:14:29 PM |

|

Soooo... 2800-ish over the weekend?

|

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

December 19, 2018, 12:14:39 PM |

|

I’m glad you keep it in your sleeeve frankly

I'm glad you emphasise the size of it. |

|

|

|

|

|

soullyG

|

|

December 19, 2018, 12:14:53 PM |

|

I’m glad you keep it in your sleeeve frankly

Not if you knew what else he has in there.. |

|

|

|

|

Kylapoiss

Sr. Member

Offline Offline

Activity: 616

Merit: 292

I don't know where I'm going, but I'm going.

|

|

December 19, 2018, 12:15:08 PM |

|

Good mornin' goldie. So I heard you've been lucky, will you do a party for us instead of waiting for the 100k? Yes? Thanks.

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

December 19, 2018, 12:16:41 PM |

|

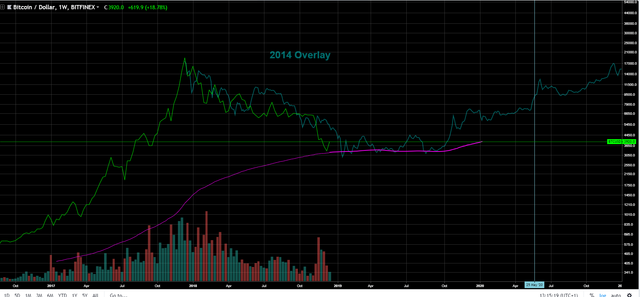

Is that a V shaped bottom or you just happy to see me?  |

|

|

|

|

rafanadal

Member

Offline Offline

Activity: 368

Merit: 31

|

|

December 19, 2018, 12:19:59 PM |

|

What's the next resistance ?

|

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

December 19, 2018, 12:21:38 PM |

|

Is that a V shaped bottom or you just happy to see me?

Keep it in your pants please. Markets don't let people off this lightly. |

|

|

|

|

|

Poll

Poll