I think Cathie Wood gets a little too much credit for her ability to see investments. Her performance with her managed funds has been absolutely horrible. The only reason she was popular at all was because people were piling into her funds causing her to invest too much in small companies at bubble valuations absolutely destroying her clients' portfolios when things came back down to reality. Even Jim Cramer was making fun of how she was running ARK investments... I'm glad she's got good things to say about Bitcoin, but if it does go to 1.5 million you can bet she sold right before the rally started.

I looked at the numbers: her fund opened in 2014 and vs QQQ she outperformed 4.5 years and under-performed 4.5 years, but when she under-performs like in 2022 and 2023, it's a woozy. Overall, ARKK is up 129% since 2014 (roughly 8.66%/year) vs QQQ's 319% (15.4%/year over 10 years). That's not great results, but she made "some" money. |

|

|

|

I would argue fuck status is 4-5 million

I would say at least… For me, it’s 0 debt, multimillion dollar home, vacation home, and $30K/month in passive income. That means 2.5 million for a house and car + another 1.5 million for a vacation home. In order to get $30,000 per month in passive income (dividends) you’d need about $12,000,000 in stocks with a diversified portfolio. That’s 16 million after taxes, and around $20,000,000 if you’re talking Bitcoin capital gains and $40,000,000 if you were married without a prenup. You could do away with the vacation home and scale down the house a bit while living off $10K per month, but that would still cost you 6 million and $10K a month with property taxes/upkeep on a 1.75 million dollar house would likely mean living on a budget. Anything less than 6 million and you’re looking at retirement with declining assets (the 4% withdrawal method mentioned above) or potentially a below average quality of life depending on your age as your rising costs exceed $10K per month (car replacement, health issues, kids college, grandkids college funds). Anything less than 3 million and in my opinion you’d (not just potentially like above) have a below average quality of life in retirement OR eventually exhaust all your assets with continued drawdowns due to a budget deficit (what most people do). I should also add if you’re old enough and fine with being a renter, you can live for far less, especially if you have social security. Many retire with nothing at all and just live frugally (not fuck status). I agree in general, but, overall, maybe with a bit of a cushion. House, if not bought outright: $12 mil in capital should give $630K in yearly interest ($52.5K monthly). Mortgage on $4 mil worth of a house at 7% is $26.6K/mo, so you have 630K minus 80K (max RE tax)=550K minus 319.2K (mortgage)=19.23K/mo for after-mortgage and RE tax living, which should be enough for most families. So, if you want to splurge on a big house, then, maybe $12 mil is enough, and $20 mil is extra. I would call the $10-12 mil a "new" (post COVID) "enhanced" fu status (because we are talking about two houses and fu supposed to be just one). I also agree that above 100 mil is probably the filthy rich category now. Many investment houses started to consider $100 mil as a number for UHNWI (it used to be $30 mil). Granted, anyone not on coasts can probably live on 4-5K/mo per person in the household...but that's not "fu", just routine comfortable living. |

|

|

|

"in"? A strange remainder...how it got there?  Usually my dangles come at the end, rather than in the beginning. I will have to make a mental note. No more "in"s in the beginning.,.. even if I am starting out by saying "in the beginning," I should figure out another way to say it. On a more 'serious' note.

The universe inflated in a fraction of a second, then expanded more slowly.

Bitcoin had a hot inflation phase until maybe 2017.

Now, it is in a slowly expanding phase.

You frequently come up with various theories in regards to "how can I stay as whimpy as possible," which is likely one of the reasons that you only have 20 coins and continue to fail/refuse to recognize and appreciate bitcoin's ongoingly immature status. Maybe you keep trying to recognize dee cornz as grown up, while failing/refusing to recognize that we are still in early days? Yeah, sure there are limits in terms of how much bitcoin can grow, so those earliest days were the most explosive because they were starting from zero, so sure maybe we still have tapering of the explosive possibilities, yet there is more money and participants coming into bitcoin at the same time. I heard the same dumbass assertions about bitcoin at various points in the last 10-ish years, which yeah, maybe people are not directly saying it, but they are presuming a kind of maturity and forgetting about exponential s-curve adoption based on network effects and Metcalfe principles... the TA dweebs have the same problems and the ones who are trying to focus too much on supposed macro relationships also have the same problems (you likely fit in the second camp rather than the first).. many times seeming to be distracted by comparing various stocks and macro trends, etc etc etc. Don't get me wrong, we are both likely pretty damned conservative in our ways of investing, but you are even more conservative than me based on your seemingly ongoing and persistent distractions into macro factors and thus discounting the paradigm shifting power of bitcoin and the fact that we are still real earliy in terms of the various adopters.. .think about it, sure there are institutions and governments involved in bitcoin and there are even individuals involved, and some of us earlier bitcoin adopters are hoarding and overly accumulating bitcoin (such as Michael Saylor and MSTR, and Saylor is not even that early of an adopter even though he will make it through a whole cycle this year). I am sorry, but drip-dripping at some small $ value per month will not make you rich if you start now, but it would, hopefully, preserve or even enhance your savings among the sea of inflationary fiat systems. That's the ticket.

You are not completely wrong, but people still can ONLY do what they can do. I frequently suggest for people to be as aggressively as they can in their BTC investment without ending up getting themselves reckt, and some people are not going to get into bitcoin unless they DCA into it, so if that means that they ONLY start with $100 per week, then that's their choice... and other people do not have lump sum amounts available, so they ONLY have the choice of DCA. The more I write this response, the madder you are making me, because I doubt that the ONLY goal is to get rich, but also to stop getting so poor, and if people are already either not saving very much or not used to saving because they know that their cash is losing value, so they are not incentivized to save in cash or to invest into assets that are debased by cash. So why are you poo-pooing on the guy who invests whatever he can even if it is a small amount on a regular basis, and yeah in 2013/2014, we did not realize that $10 per week would result in $5,330 invested and 4.66 BTC, and part of the reason that I am suggesting $100 per week instead of $10 per week because $10 per week is hardly even anything, but if that is all that a person is able to invest, even now, they are going to need to do what they can. In 10 years, there are still going to be people coming into bitcoin for the first time, and some of those folks might have already known about bitcoin since today, but they failed/refused to act, but they are still going to benefit from getting into bitcoin rather than not getting into it, even if they might be investing at somewhere between $250k and $500k per BTC, and yeah maybe a good number of them will have to be thinking in terms of buying satoshis rather than planning on getting whole BTC... but the whole society is likely going to be better too, so even those who are not directly benefitting as much by buying bitcoin, they are still going to benefit from the implementation of more fair money. Of course, some oil sheik can drop a couple of bil in bitcoin any time and make a positive disturbance or, conversely, MtGox or US Gov can sell a large chunk and cause the opposite move.

The rich are going to continue to have advantages over the poor, but if you had not realized that one of the advantages of a sly and round about way of transferring wealth is that the less informed are not going to realize that their wealth is being transferred to them, and therefore some of the current status quo poor are going to end up gaining a lot of advantages over the current status quo rich. Maybe an example is warranted? Status quo poor begins his investment today with $10 per week, and after 6 months moves to $100 per week and maybe is able to figure out how to get up to $200-$300 per week over the next 10 years, so maybe after 10 years, he invests close to $100k into bitcoin and he is able to accumulate nearly 2 BTC. If the status quo rich (or at least well to do) refuses to get involved in bitcoin, and maybe only starts to recognize bitcoin after 10 years, then the status quo poor might have gained some ground on him, and surely the status quo poor who invested in bitcoin is going to pass up a lot of the folks who did not get involved in bitcoin, even if 2 bitcoin is not quite yet getting him to western standards of entry-level fuck you status, and maybe the status quo poor guy might have to spend another 5-10 years to accumulate another 0.5 BTC, but he may well end up making it to entry-level fuck you status, even in western standards, and he surely has a much better chance of getting to entry-level fuck you status or even higher by investing into bitcoin rather than not... even if he only ends up getting up to 1 BTC instead of my description of his getting up to 2.5 BTC.. but I was also trying to show an example of a status quo poor person who is consistent, persistent, aggressive and maybe even just maniacally focused on BTC accumulation but also attempting to manage his situation in such a way that he lessens the odds of losing coins, too. I compared a "wimpy" investor choices with an "aggressive" one because both of them have had OTHER possibilities to invest, even among the mainstream investment vehicles.

But we are talking about bitcoin here.. so fuck off with your macro and/or traditional investment distractions. Sure, I am not against them, but they just are not very relevant to this thread... it is almost like you are getting into shitcoinery.. even though surely there can be some placement of those kind of investments into an investment portfolio, especially maybe once one has spent some time accumulating bitcoin (for the sake of diversification and blah blah blah), but really we are talking about bitcoin here so pumping traditional investments seems off topic, a distraction and probably not even advisable. For example, let's go back to the newbie investor, as you seem to be o.k. with talking about newbies, and suggesting that a newbie is not going to get anywhere by trickling money into bitcoin, and so that is even more true if he fucks around with traditional investments or even dilutes his bitcoin investment by getting distracted into various traditional investments. There is no reason that the newbie cannot build his bitcoin investment for several years before any diversification would even be necessary or justifiable... and I am not sure exactly what level of income that we might suggest that if the guy might have an income of $2k per month, so sure he is relatively poor in western standards, and maybe he has expenses of $1,400, so he has $600 left over.. and if he chooses to invest $100 per week into bitcoin (that is nearly 20% of his income) and then he can build his emergency fund with the other $200 per month, and he can go like this for several years, and if each year he ends up investing a bit more than $5k after 4-5 years he would have had invested close to 1 years salary/ expenses, and maybe at that point he might decide to start to diversify. I don't see any reason to diversify earlier than that, even though surely guys are going to make these decisions at different points, and maybe some guys (including uie-pooie) think it is necessary to diversify after merely having a few months of expenses/income of an investment portfolio. You cannot just say that someone was wimpy because he/she bought bitcoin once and allocated less because you don't know what else they have done.

Yes I can. We are talking about whimpy in regards to his investment to bitcoin, and the topic of this thread is about bitcoin, so it is not necessarily derrogatory to say someone took a more whimpy appproach to bitcoin and other took a more aggressive approach to bitcoin, and the rest of what he did happens to be his own choices, but in regards to bitcoin (which is the topic of this thread) he had been either whimpy, aggressive or some state in between. Why the fuck should we care if he is a whimpy or aggressive investor? That does not matter. We are talking about bitcoin? Aren't you talking about bitcoin? This is not the how to invest your money and get rich thread. This is the what do you think about bitcoin and other topics thread (not shitcoins or trying to pump other products.. including Phil's earlier pumping of Ibonds.. fuck ibonds). For the sake of the argument, they might have outperformed the "aggressive" bitcoin investor as i have shown in at least two common stock occasions during the last 10 years (NVDA and MSFT; AAPL was essentially even).

It does not matter. This is NOT the how do you get your best portfolio performance thread... I mean holy fucking shit Biodom, you have been here pumping things other than bitcoin for nearly 10 years and you still have not figured out some ways to try to stay somewhat focused on bitcoin? You want to do some compare contrast of other things that might have beaten bitcoin? Sure maybe that is somewhat relevant if it is presented in non-pumping and non-distracting way, but doesn't it get us away from our topic, even if you might be all hot and bothered about various other "opportunities" that might exist in the investment world. Well...I did not see "in the beginning", just "in"...maybe it was written in white letters, I dunno  ...but let's back to a more substantial topic. Yes, my opinion was there to contrast with your description of "wimpy" vs 'aggressive', portraying the whole investment universe as consisting of just two items: fiat and bitcoin, but it simply ain't so. Many people here used a variety of techniques to increase their bitcoin exposure, and straight buying it for cash (without somehow boosting that cash) is less efficient, hence a comparison with three great stocks ( in the prior decade). Btw, nobody or almost nobody would probably be buying btc at $500K as investment (when it is at 10 tril). Well, maybe pension funds will, expecting a steady 5% yearly return, haha. Therefore, we have, basically, a 10-12X investment opportunity in the next, say, 6-8 years (at 45% annual growth for 10X in 6 years and about 36% if 12X in 8 years), entirely doable, but it ain't life changing unless you invest $200-300K right now or within a few short months. Even with this level of investment, you would barely achieve fu status in 8 years and only IF inflation cooperates.. |

|

|

|

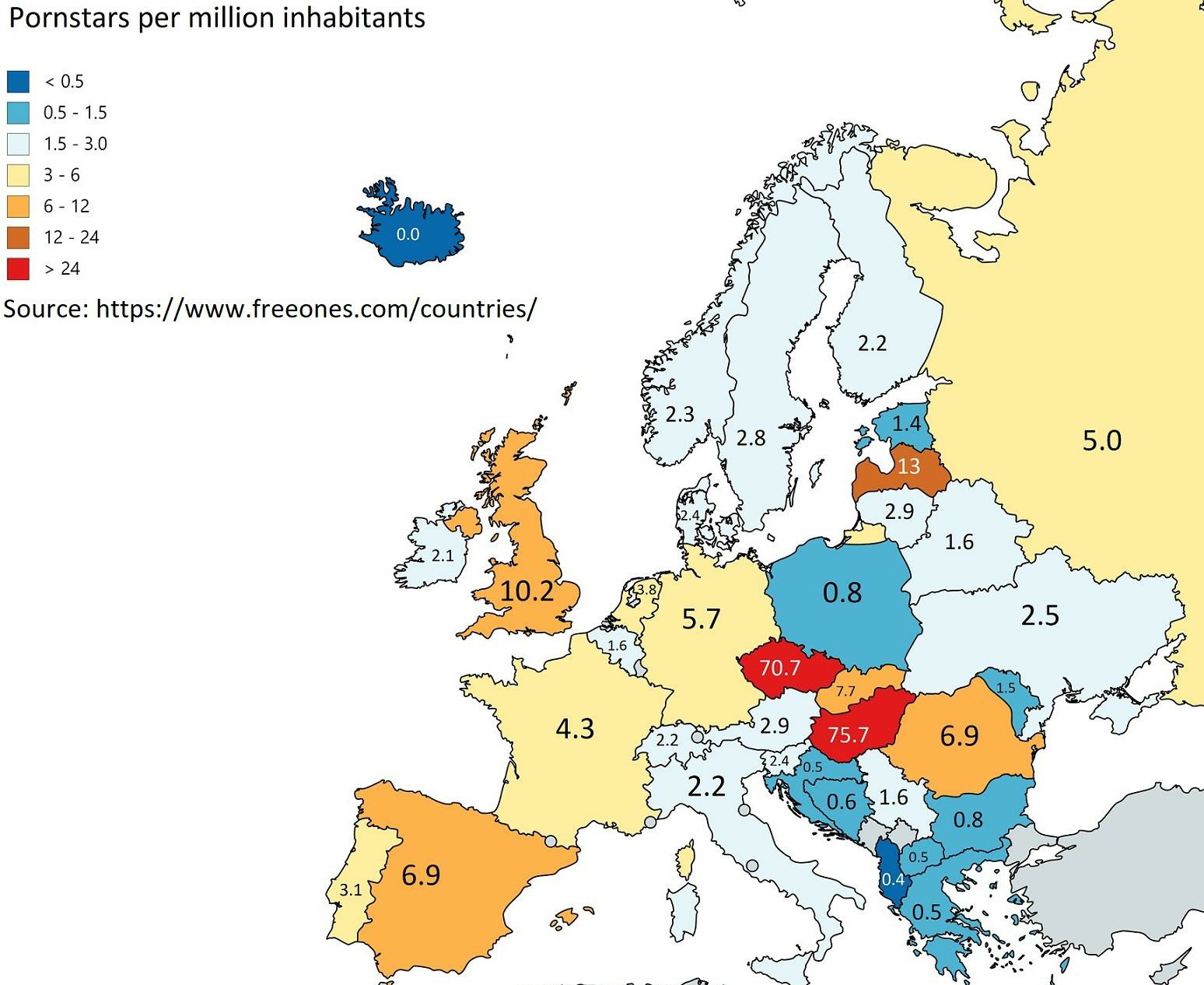

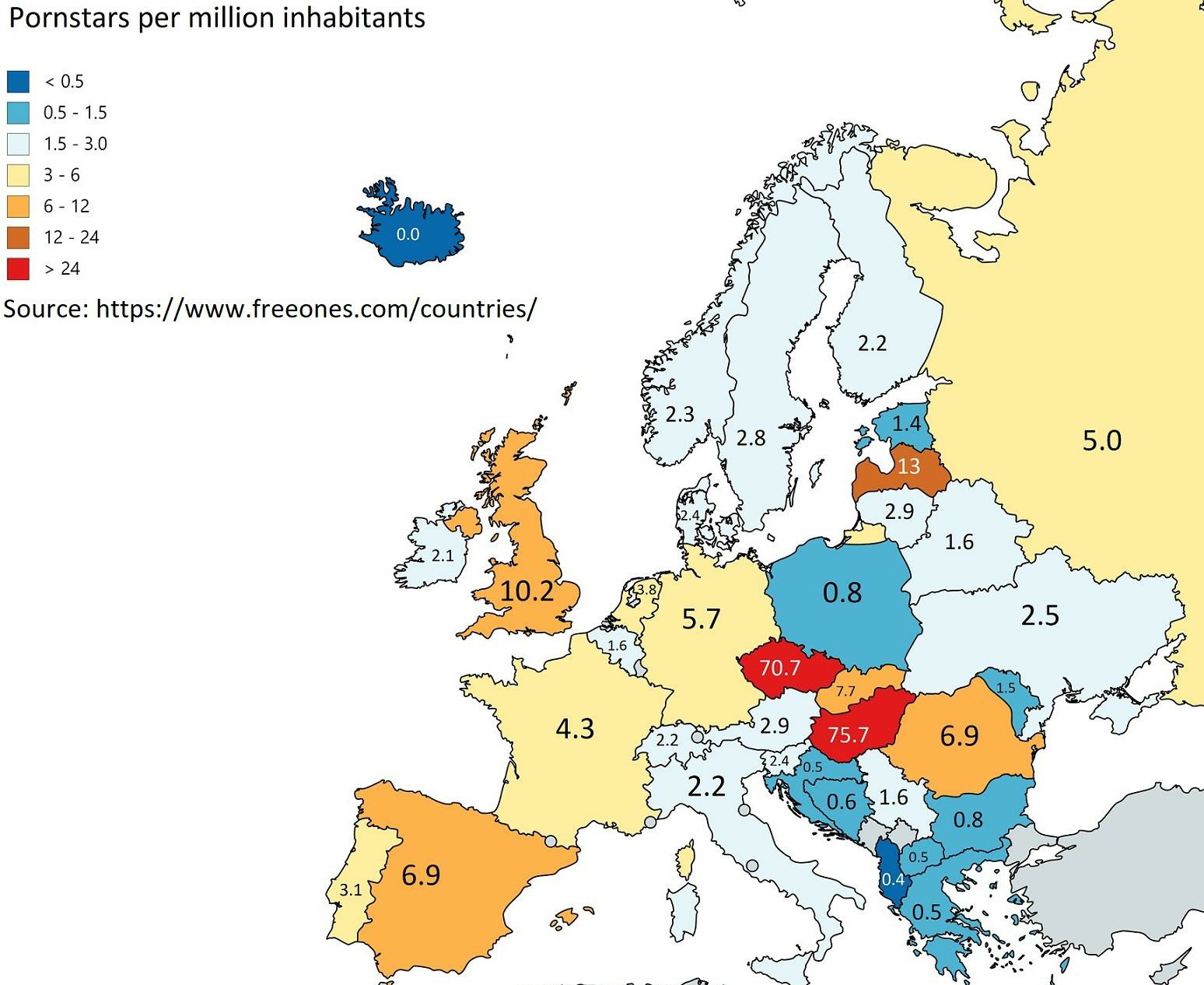

Observing 42,145@Stamp. Posting this image here, in case someone needs a reference.  I understand Czech republic (they also have lots of models), but Hungary? Quite a surprise. |

|

|

|

So maybe you could imagine a more whimpy investor (#1) who might have bought at various scattered times, between 2013 and present and maybe he acquired around 40 BTC for an average cost of $600 per BTC (total invested $24k invested), so he is doing quite well in terms of average cost per BTC. (portfolio valued at $1.7 million)

as compared with a second more aggressive investor (#2) who might have gotten in at the same time, made more mistakes, accumulated 80 BTC, but his average cost per BTC is around $2.4k per BTC... ($192k invested). It should be obvious that most of us would still rather be the second investor rather than the first one, even though his average cost per BTC is 4x higher than the first. (portfolio valued at $3.4 million)

As a comment: Yes, wimpy investor #1 has less btc, but he/she also spent $166K less. Let's assume for a second that the wimpy investor spent all 166K on NVDA on jan 1, 2014 (10 years ago). That investor would now have (610/3.92)X166K=$25831633 in that investment and can buy 618 additional btc right now (618>>40 extra). IF the same for AAPL, then 39.55 btc, which is essentially the same; 44.5 extra BTC "equivalent" for MSFT during the same time, beating "aggressive" by 5-10% (depending on how to count-the whole stash or only extra over 40). What I am getting at: there were many choices (i just gave the three obvious ones) that would have given you the same btc-equivalent for a wimpy, but smart investor #1. Of course, you needed to have taken a right choice of investment to get there. in <snip> "in"? A strange remainder...how it got there?  On a more 'serious' note. The universe inflated in a fraction of a second, then expanded more slowly. Bitcoin had a hot inflation phase until maybe 2017. Now, it is in a slowly expanding phase. I am sorry, but drip-dripping at some small $ value per month will not make you rich if you start now, but it would, hopefully, preserve or even enhance your savings among the sea of inflationary fiat systems. That's the ticket. Of course, some oil sheik can drop a couple of bil in bitcoin any time and make a positive disturbance or, conversely, MtGox or US Gov can sell a large chunk and cause the opposite move. I compared a "wimpy" investor choices with an "aggressive" one because both of them have had OTHER possibilities to invest, even among the mainstream investment vehicles. You cannot just say that someone was wimpy because he/she bought bitcoin once and allocated less because you don't know what else they have done. For the sake of the argument, they might have outperformed the "aggressive" bitcoin investor as i have shown in at least two common stock occasions during the last 10 years (NVDA and MSFT; AAPL was essentially even). |

|

|

|

Let's see what happens under $ 37K.

$ 34K would liquidate and stoploss many traders so it seems likely we'll go there in the short term.

Or not...it's not like you are guaranteeing 37K, or do you? |

|

|

|

5 kg potato for 250 Pak Rupees. 1 USD = 280 Pak Rupees. 5 kgs of Potato for 0.9$ Cheap? Or is it more cheap in your country?  Photo credit : WatChe Potato measuring tape: $0.18/kg in WatChe country $1.49/lb in Houston, USA (for Russet potatoes)=$3.28/kg 3.28/0.18=18X price difference, wow! I wonder what is the average yearly income in your country, @WatChe? EDIT: found it...USA average income is $61900/year ( https://www.thestreet.com/personal-finance/average-income-in-us-14852178), Pakistan 981600 PKR/year ($3505) However, you can buy almost EXACTLY the same amount of potatoes with it: 18872 kg in US and 19472 kg in the other country. So, on potato purchase parity, pakistanis are slightly ahead! That's why the $$ values are largely meaningless within a country-you have to look at it from a purchase power parity perspective. Of course, if you want to travel, then the difference in cost would be dramatic-either incredibly cheap or very expensive, depending on the direction of travel. |

|

|

|

Define "enough"

you have only been registered on the forum since August 2021, so what happened?

Did you do all lot of BTC accumulation in 2022 and 2023, so your bags are largely already filled?

If you started buying BTC in 2021, then we might be in similar circumstances, although I started buying at the very top of 2013, so it took me a couple of years to start to get comfortable with the stack that I had, even though I largely felt that I had enough within a year of getting in and buying all the way on the way down.. but the down continued... so maybe that is something similar to your entrance into BTC, if we might presume that you started buying BTC at around the time of your forum registration date.

Indeed you really started your BTC journey with some hardcore challenge! At least you started with DCAing, which is the way to go! I imagine that when you zoom-out the chart, you probably find it funny now right?  Buying at 1k, would be a crazy privilege from a 2024s newcomer point of view! I think I was lucky from my side, I learned about BTC in late 2017/2018. I made a sort of "all in" with BTC, so a lot of movements and mistakes.. at the beggining I lost some coins trying to trade lol. I sold some of my BTC in 2021 to buy my house (I recently changed my username on the forum thanks to this), most of my stack is from mining. Enough $ per BTC would be around 17-19k for me, so I am fine with the current value. Not selling now because I consider most of my stack as a bonus for the future/old days ; but I could sell some without "psychological difficulty" if needed at 40k (it would be different if BTC fall to 10k tomorrow  ). BTC already helped for the house, my diploma and some good lazying years, so I am not too greedy anymore, more is welcome but not vital Of course, I cannot judge for you, but it still seems that you have not had a lot of time accumulating because you bought some, sold some and bought some, and in part you seem to be somewhat worried about ongoingly buying BTC is going to raise your average cost per BTC, and I am not really sure if that matters so much in the long run, and to me it seems to be the main question regarding if you believe that you have enough BTC or not.. and you may well have had concluded that you do have enough. I am thinking that each year since about 2016, I have had some BTC to declare on my taxes, but I am also thinking that if I had been less active I may well not have as many BTC, even though my average cost per BTC is more. So maybe you could imagine a more whimpy investor (#1) who might have bought at various scattered times, between 2013 and present and maybe he acquired around 40 BTC for an average cost of $600 per BTC (total invested $24k invested), so he is doing quite well in terms of average cost per BTC. (portfolio valued at $1.7 million) as compared with a second more aggressive investor (#2) who might have gotten in at the same time, made more mistakes, accumulated 80 BTC, but his average cost per BTC is around $2.4k per BTC... ($192k invested). It should be obvious that most of us would still rather be the second investor rather than the first one, even though his average cost per BTC is 4x higher than the first. (portfolio valued at $3.4 million) As a comment: Yes, wimpy investor #1 has less btc, but he/she also spent $166K less. Let's assume for a second that the wimpy investor spent all 166K on NVDA on jan 1, 2014 (10 years ago). That investor would now have (610/3.92)X166K=$25831633 in that investment and can buy 618 additional btc right now (618>>40 extra). IF the same for AAPL, then 39.55 btc, which is essentially the same; 44.5 extra BTC "equivalent" for MSFT during the same time, beating "aggressive" by 5-10% (depending on how to count-the whole stash or only extra over 40). What I am getting at: there were many choices (i just gave the three obvious ones) that would have given you the same btc-equivalent for a wimpy, but smart investor #1. Of course, you needed to have taken a right choice of investment to get there. Btw, for a "wimpy investor" who bought a thousand btc at the beginning of 2013 for half of a "wimpy" allocation and never sold any, it would be all academic (sitting pretty on $41.8 mil). I wish i would be smart and "wimpy" like this in Jan 2013, but I wasn't. Everyone deserves the btc price they got...and we all have to live with this maxim. |

|

|

|

So??

Never

Under

40

Again

??

I'd happily take a bet with you, or another reputable member, that price will go below $40K again before the end of the year (2024). 0.1 BTC is the offer. It could easily do so, of course, as 40K has no particular meaning. 42, on the other hand,....the meaning of life  $35k = meaning $55k = meaning $35k ...........................[no meaning zone]........................................$55k #justsaying35 vs 55 would make a solid difference to my 'virtual' number (NOT on the blockchain), but I agree as far as the trend is concerned. |

|

|

|

So??

Never

Under

40

Again

??

I'd happily take a bet with you, or another reputable member, that price will go below $40K again before the end of the year (2024). 0.1 BTC is the offer. It could easily do so, of course, as 40K has no particular meaning. 42, on the other hand,....the meaning of life  |

|

|

|

Waking up to see an alert Bitcoin has crossed $41.5K is as beautiful as "your food is ready".

haha...not when you are on ozempic..I am not, but someone I know is...  |

|

|

|

You want my name don't you?

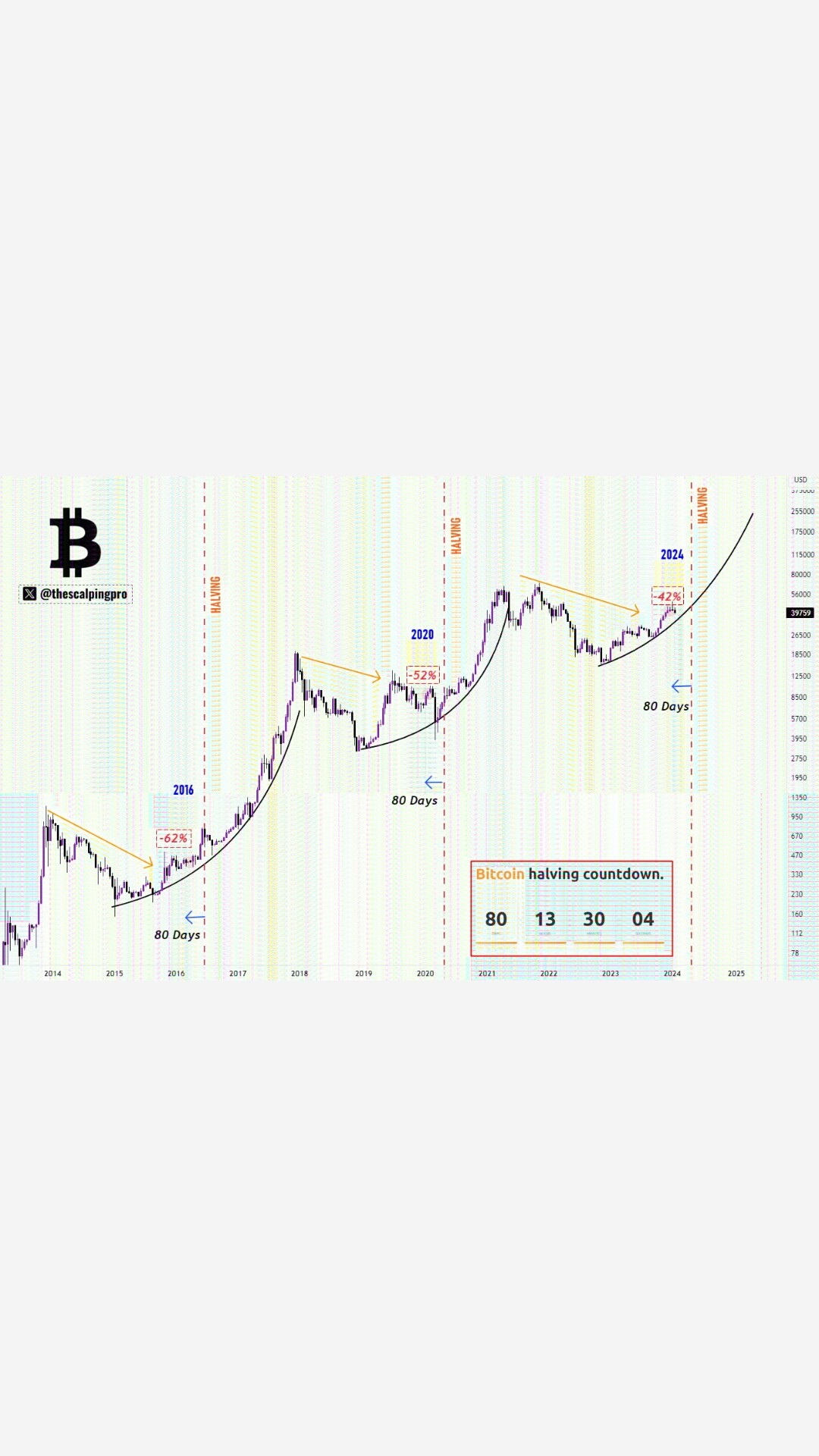

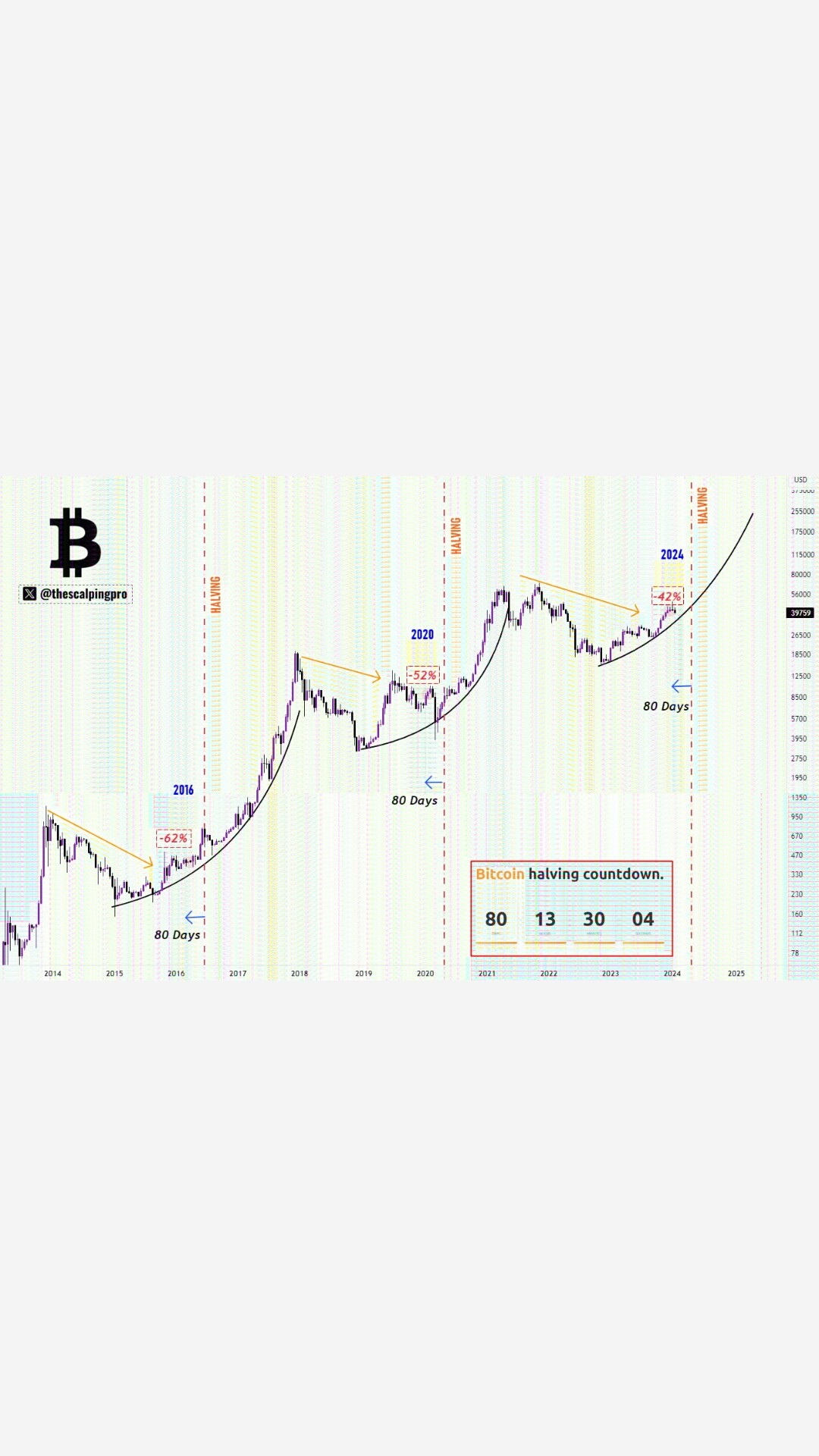

No am not I'm Batman The batman.  Usually a dip before the halving. History like always,repeating itself. I love when people say "But Bitcoin isn't backed by anything" As opposed to either criminal or hypocritical woke enterprises backed by dumb share holders? Enterprises that couldn't run a fucking bath? Look at the uselessness of the likes of Disney and Royal Mail these days. Utterly pathetic. Their shares should be below zero these days to show the companies' true valuations.  Bitcoin is backed up by it's service, community and future. Most of these hypocrites are one way or the other in relation with shares of company with no intrinsic value Like how Bitcoin is called. the US dollar is backed by the belief and credit of the US government( the government debt). Does the US dollar really have any intrinsic value? No But Bitcoin is been called out everytime that it lacks intrinsic value. I'm getting used to muting all this shenanigans. Control the size of your pics and empty spaces, please. |

|

|

|

At any moment, the SEC could end its investigation and charge them with fraud and manipulation and shut down their company and their ETF.

Or, maybe you just make s-t up...I wonder what is more likely? |

|

|

|

Phil can provide the current numbers: is it even possible to turn mining profit with, say, 4c electricity after halving with btc at 39K? My guess is that it is not, but let's see what Phil says. Here is a topic that is of some concern: https://studyfinds.org/no-cash-accepted-signs-bad-news/Imho, it should be illegal NOT to allow to pay for anything with cash. Hopefully, Congress would pass such a bill sooner than later. |

|

|

|

Yea....so what if others pick it up and more. This trade is too simplistic to be true (on balance). I don't give a hoot how much they sell as long as they match the underlying. |

|

|

|

Greyscale will sell much more.

This is just the start of a soul crushing multi-month pre-halving correction.

Consolidation during summer.

It will go up again q4 with a possible ATH.

Real fun starts in 2025, until that happens i will remain extremely bearish.

Sorry..

Greyscale sells, others buy that much AND a bit more...so who cares if they sell or not? Remain whatever you are...maybe don't come back and stay bearish? |

|

|

|

[...]

♦️ Correction before halving (maybe to $30k-$35k)

♦️ A few months of consolidation during the summer

♦️ Bullish Q4 of 2024 and a new ATH of $70,000

♦️ $100k $BTC in Q1 of 2025

♦️ Full-blown altseason where alts will pump 100x-1000x

♦️ Some consolidation and correction in Q2 of 2025

♦️ In Q3 of 2025, the pump will resume, and BTC will hit $200k–$250k in Q4 of 2025.

[...]

Meriting this for the hopium, but predictions like this are more or less Crystal Ball TM material IMHO. Regardless, 2024 & 2025 are indeed special, when compared to the previous cycles, due to the ETF approvals, combined with the incoming Halving. Choo-choos will honk many times in the coming 24 months. Pretty good tweet I saw below. Obviously ignore the shitcoin references.

Bitcoin only.

@Ashcryptoreal

BITCOIN WILL HIT $250K IN 2025 From $250k high to capatulation dump below $100k in 2026. Excellent trading opportunity. It is reasonable to expect that wild swings like the one you describe could gradually be "tamed" by the ETF players + regulation, resulting in a slower, but more stable and organic growth, that closely resembles the current 50-, 100-, or even 200-WMA trendlines further into the future. This will be good for HoDLers, not so good for traders. Will see how things play out. Even with ETFs, gold had several corrections during a first bull run (2004-2011): 20% in 2006, and 28% in 2008, then a large bear between 2011 and 2015 (43.6%) and then a new ATH in 2020. The ATH to ATH in gold was 9 years (roughly 2.5X longer than btc) and small corrections are also instructive. Bitcoin used to have up to 50% corrections within the bull. This is probably gone now, but 28-30% (within the bull might happen). However, after we peak, I don't expect more than 50-60% down (vs prior 77% and above). I am not sure if bitcoin will continue the 4 year cycle; it probably will, but with diminishing up- and down-sides. We will probably transition to 25-30% yearly ROI in the next cycle (2024-2028 or 2025-2029 based on ATH peaks). Of note, if we get to 250K in 2025, it would mean roughly just below 40% yearly ROI (from prior ATH to ATH at 250K). |

|

|

|

Agree with the 2025 prediction, still think that we would be at ~47K at the halving. However, it "feels" more like 2016 than 2020 so far. btw, 2015 (prehalving year) also accelerated up at the end, just as 2023 did. We might see some US tax season selling (around late March, early April), but could see a nice rally afterwards into the halving. Re liquidity: apparently, the first FED rate cut is now predicted to be no earlier than May...so that "cavalry" will be arriving a bit late. |

|

|

|

|

Buying at 1k, would be a crazy privilege from a 2024s newcomer point of view!

Buying at 1k, would be a crazy privilege from a 2024s newcomer point of view!