Of all those meetings that I read about, I don't like the fact that SEC keeps pressuring them to do share creation/redemption "in cash" instead of 'in kind", with the latter being much superior with no (or minimal) tax implications for the fund. "In cash" would mean that a fund would have to constantly pay cap gains and, of course, unload these costs on investors. In fact, funds with "in cash" option are not even really viable for the non-retirement/taxable accounts. |

|

|

|

Jeff Bezos and others are talking about 1 tril humans living in the Solar system (mostly on O'Neill cylindrical colonies, depicted in the "Intrastellar" movie): https://www.marketwatch.com/story/jeff-bezos-plays-down-ai-dangers-and-says-a-trillion-humans-could-live-in-huge-cylindrical-space-stations-78058437My question is: what would be the longest distance of such colony to Earth (or maybe between different colonies) to still maintain a common bitcoin ledger? I am not exactly sure how nodes "decide" which miner was the first to the block. For example if one miner is on The Moon, which is 1.28 sec away by the light pulse: would that miner always lag and, therefore, not able to claim a block? Or, is there a 'compensation' mechanism that would take the 1.28 sec delay into the account (in case of a Moon miner)? Of course 1.28 sec is much less than 10min between blocks, so theoretically, this still can be sorted IF there is a mechanism to compensate for that 1.28 sec delay due to the speed of light transmission limit. I also found this description ( https://bitcoin.stackexchange.com/questions/84412/how-does-a-node-decide-whether-a-block-is-valid): This is also true in a tie. If two blocks are mined by different miners at the same time, each participant assumes that the first block they received is the valid one, and they continue the Proof-of-Work process from this valid block. The next miner to create a valid block ends the tie by creating the longer chain, and any miner who was working on a block other than the one referred to in the new block's header will discard the work they have done so far on the shorter chain, and continue working on the longer chain. The problem is with the term "at the same" time, imho. Relative to what? In any case, if this cannot be counteracted, then only the O'Neill structures that are closer than Moon to earth could participate, but I doubt that they could be allowed in such a close proximity because of a possibility of those structures colliding with Earth (if they would be built so close).  The Muskcoin Revolution of 2140

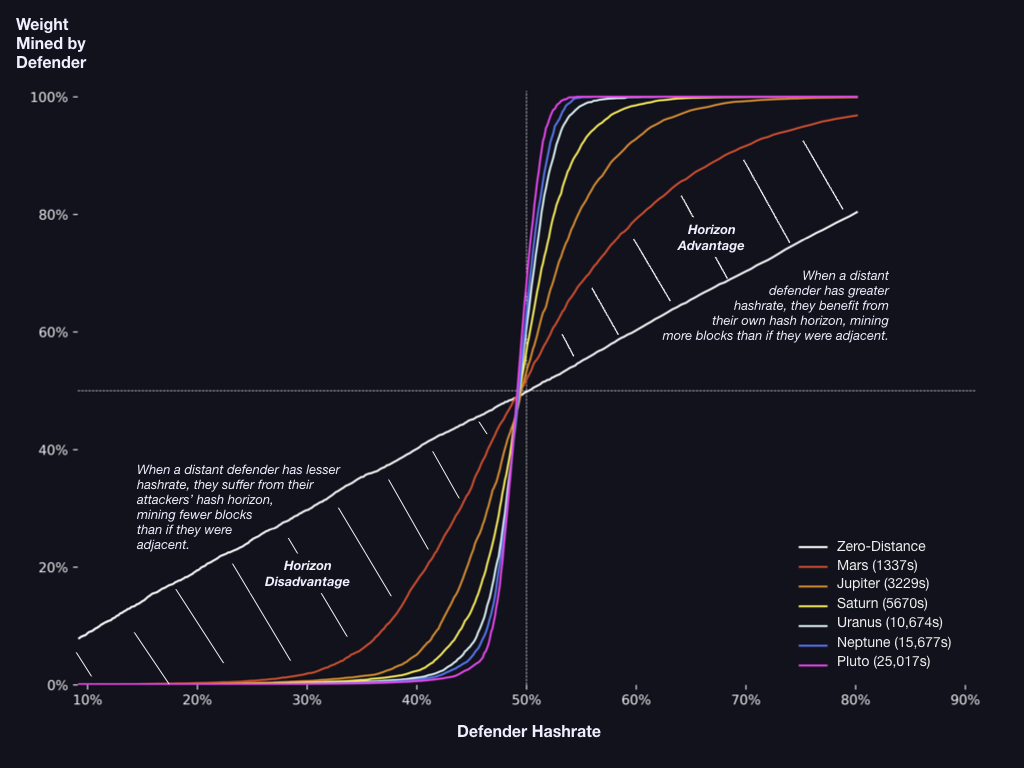

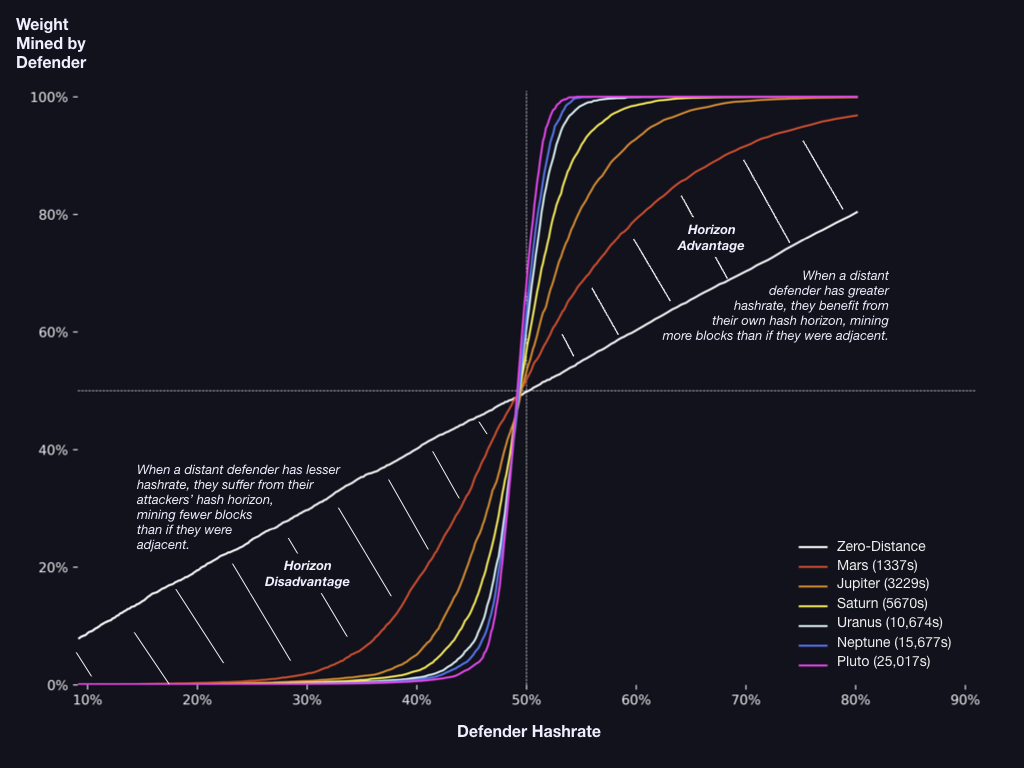

In our view, Clark is partially right. Earth will remain the dominant bitcoin mining planet. But one day Martians will stage a revolution in support of their own token: Muskcoin. If they succeed, then Mars will become the dominant Muskcoin mining planet. The Muskcoin Revolution of 2140 will become a template for other colonies of Earth to follow, just like the American Revolution of 1776 was in its age.

Why Martians will want Muskcoin

Transaction without settlement is tyranny.

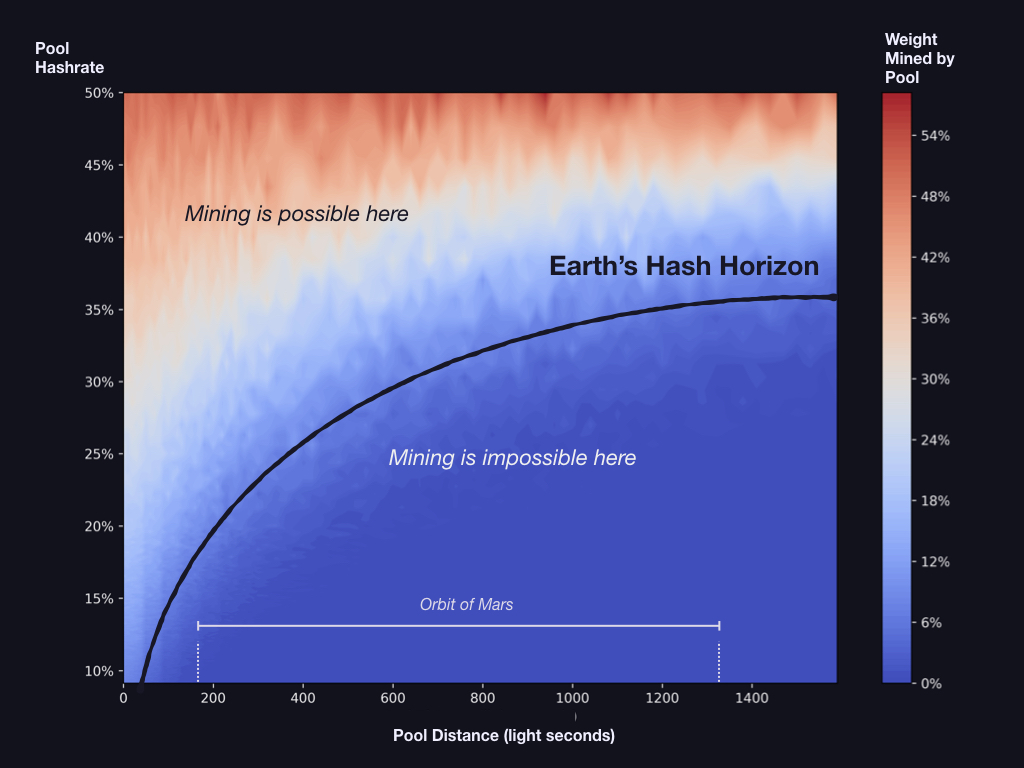

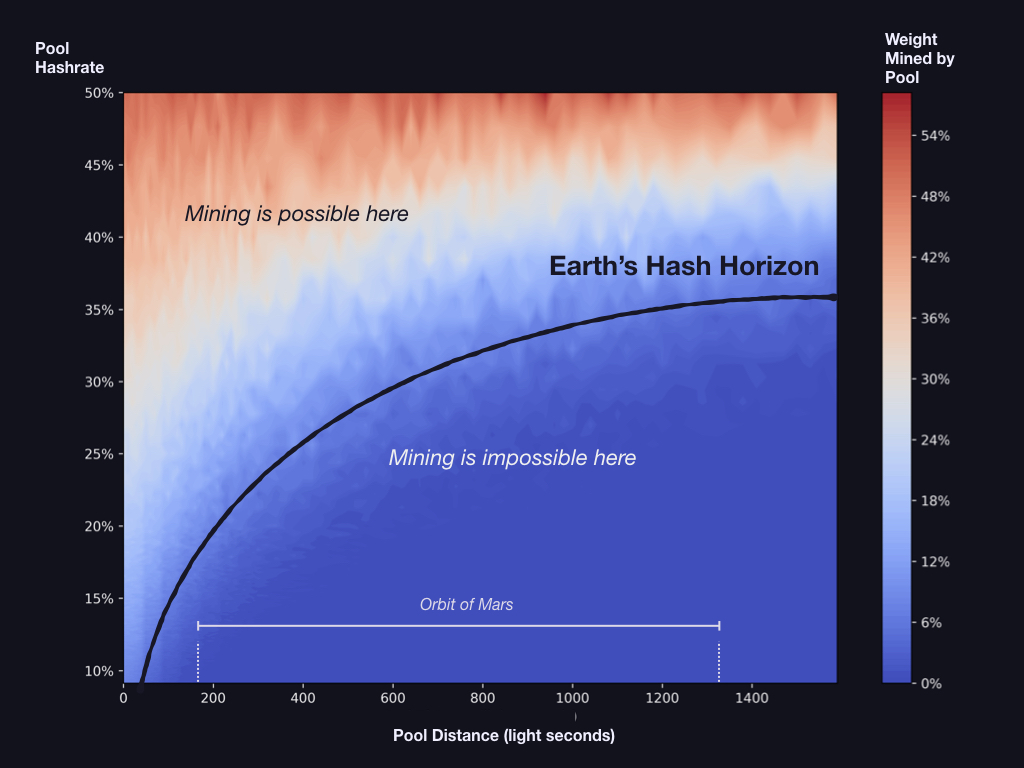

Ė Martian revolutionary slogan, 2138  After the revolution, everyone will understand that successful human colonies near locations with abundant natural resources that are able to attract settlers and build industry will launch their own blockchains once they have sufficient political will and hashrate. Indeed, becoming a peer in the Solchain network will become the definition of what it means to be a successful colony. Awesome.. 1. Looking at the graph it seems that it shows somewhat strange numbers. For example, a pool with a theoretical 15% hash rate produces "only" about 9% of the blocks. Maybe this explains why block production was always lagging in more minor pools that I favored, probably erroneously (but it never was less than 90-91% of "theoretical"). I guess large pools gobbled the "extra". 2. The graph "starts" at 50 light seconds (by eyeballing the graph). I assume that anything less that this would not affect the effective hash rates, so, multiplying this by the speed of light, it gives us a "sphere" with the radius of 50sX299792.458km/s=14989622.9km or 9334119.85 miles, with the sphere's volume of 1.41X10^22 km 3. The volume of earth is 1.086X10^12 km 3, which, if my rough calculations are correct, bitcoin mining could be done in a volume of space around Earth that exceeds Earth's volume by a factor of ~12.9 billion (X12900000000), which roughly corresponds to the distance of up to x39 the distance between the Earth and the Moon. In other words: plenty of space to put O'Neill structures there that would still be able to hash the common bitcoin chain (Mars is out of luck, though..too far). Even if numbers presented here prove to be a rough estimate, in my mind I already "see" it (O'Neill[space cylinders with gravity on the surface due to rotation] colonies in space hashing bitcoin for trading, etc): the "Nakomoto sphere". |

|

|

|

Jeff Bezos and others are talking about 1 tril humans living in the Solar system (mostly on O'Neill cylindrical colonies, depicted in the "Intrastellar" movie): https://www.marketwatch.com/story/jeff-bezos-plays-down-ai-dangers-and-says-a-trillion-humans-could-live-in-huge-cylindrical-space-stations-78058437My question is: what would be the longest distance of such colony to Earth (or maybe between different colonies) to still maintain a common bitcoin ledger? I am not exactly sure how nodes "decide" which miner was the first to the block. For example if one miner is on The Moon, which is 1.28 sec away by the light pulse: would that miner always lag and, therefore, not able to claim a block? Or, is there a 'compensation' mechanism that would take the 1.28 sec delay into the account (in case of a Moon miner)? Of course 1.28 sec is much less than 10min between blocks, so theoretically, this still can be sorted IF there is a mechanism to compensate for that 1.28 sec delay due to the speed of light transmission limit. I also found this description ( https://bitcoin.stackexchange.com/questions/84412/how-does-a-node-decide-whether-a-block-is-valid): This is also true in a tie. If two blocks are mined by different miners at the same time, each participant assumes that the first block they received is the valid one, and they continue the Proof-of-Work process from this valid block. The next miner to create a valid block ends the tie by creating the longer chain, and any miner who was working on a block other than the one referred to in the new block's header will discard the work they have done so far on the shorter chain, and continue working on the longer chain. The problem is with the term "at the same" time, imho. Relative to what? In any case, if this cannot be counteracted, then only the O'Neill structures that are closer than Moon to earth could participate, but I doubt that they could be allowed in such a close proximity because of a possibility of those structures colliding with Earth (if they would be built so close). |

|

|

|

|

Mow says: a million

weeks after ETF release

a party so soon?

#haiku

|

|

|

|

There is now no more money left to write woke propaganda in support of terrible woke movies such as Indiana Jones and The British Arsehole Woman. Hollywood has pretty much died on its ass this year. If it hadn't been for Barbie and Oppenheimer literally almost all Hollywood movies over $100 million can be considered failures this year (Super Mario Bros is a French/Japanese made movie distributed by Universal). <snip> --sorry for the long rant.  In addition to everything that you said, which even most normies these day now realize, they are also changing cinema into "corporate product" built specifically for a future of streaming. Remember when studios were desperate to trim movies down to 1h:30m, and a series episode to 45m runtime? Well imagine a world where directors are now being flat out told to pad their movies and tv shows with useless boring filler shots, lengthening their runtime significantly, because the studios will want to "cram as many commercial breaks as we can into them in the future". That is already happening, without a doubt. I simply refuse to watch anything with commercial brakes in the middle of actual performance (before is OK). That's why I barely watch TV..maybe cable or streaming of channels with no commercials here and there, like HBO/Max, etc. For those outside of US: contrary to football (called soccer in US), where there are NEVER commercials during the game (because the game never stops apart from the halftime break), American football and other sports are filled to the brim with in-game commercials, which, to me, make those events largely unwatchable 3 hr affairs. |

|

|

|

Everybody expects the imminent ETF bull run, but then it would be a first bull run I am aware of that was predicted, discussed and "implemented'.

Personally, I see a more complex trajectory:

Whatever the price is at ETF approval, I see a flat to 10% reduction during the first 4-6 mo "post ETF" with a possibility of a short duration 20-30% run up just before the halving, most likely followed by an equivalent "Bart" down with btc price at $40-50K (maybe it be would smack in the middle of that range at $45K) by May-June 2024 followed by an increasingly strong bull for the next 6-16 mo, with a possibility of at least a first wave (if it would have two humps) peaking in Dec 2024 and the second one in September-November of 2025.

Of course, no need to sell during any of those presumed flat or slight down periods.

So, you're a "sell the news" kind of guy. I understand that people have this attitude because it comes from when whales were playing the street and treating bitcoin like a speculative low liquidity asset that nobody watches, so you had situations like Musk buying, telling the world he bought, selling, telling the world he sold. Or Jamie Dimon saying bitcoin is for scammers and then opening a trading desk to make some money on the side. I also have this contrarian voice stuck inside my head saying that it can't be that easy. Black Rock tells people to buy and you buy and get 100% profit in a year? No, if that was true then everybody would won and statistics say that over 80% of investors lose money... but... Let's cover some buts  How many random people will listen to Black Rock? How many random people will listen to people like Keiser, Long, Mow, Back, Saylor, Vays... Bitcoiners know these names but more than 90% of random people you'd ask wouldn't recognize them. What I'm saying here is that we're biased because we already hold bitcoin and we read all these predictions from both sides and there's been so many of these positive ones that we're overwhelmed. We start getting into conspiracy theories, thinking it can't be that easy, but in the real big world we're the small group that actually listens and cares. Most people will treat it like gossip and not act. They'll talk with their spouses, put it between what Harry and Meghan are doing and the recent bombardments in Syria and ask if they maybe should allocate some money into bitcoin and then they'll never do it. Bottom line is, the demand is going to be much greater this time. There's not much dumb money for the street to take advantage of anymore and you can see it in statistics that show HODL rates. They're at all time highs. When the street finally sees this demand it will be too late for them to go in. Maybe they'll scrape some profit from the top. I believe the demand is going to surprise us this time and this bull market will last longer than the previous one. Definitely not the "sell the news" guy. The small difference in our opinions could be described as follows: Me-"from the ETF approval flat or down for 3-4 mo, followed by the reversible bump around the halving, then flat until about May-June, THEN a strong, possibly two-humped bull. @darkangel11: basically LFG...it will be mostly up from the get go because the crowd would be pumped by the Black Rock. I grant you that your scenario is possible, just because the general public could be enticed to FOMO, but it kind of goes against what I observed in my investment career. That said, I agree that over long term, this might be a very strong bull, so i don't intend to trade it in-and-out. At some point, I believe, large Sovereign funds would get involved, as predicted by multiple players. |

|

|

|

|

Everybody expects the imminent ETF bull run, but then it would be a first bull run I am aware of that was predicted, discussed and "implemented'.

Personally, I see a more complex trajectory:

Whatever the price is at ETF approval, I see a flat to 10% reduction during the first 4-6 mo "post ETF" with a possibility of a short duration 20-30% run up just before the halving, most likely followed by an equivalent "Bart" down with btc price at $40-50K (maybe it be would smack in the middle of that range at $45K) by May-June 2024 followed by an increasingly strong bull for the next 6-16 mo, with a possibility of at least a first wave (if it would have two humps) peaking in Dec 2024 and the second one in September-November of 2025.

Of course, no need to sell during any of those presumed flat or slight down periods.

|

|

|

|

Well, Ledger has shit the bed yet again https://twitter.com/Ledger/status/1735370531224834430Yet another reason not to dabble in shitcoins but man it has been an embarrassing year for the Ledger team. Couple all that with their software being packed with analytics tracking and they're a big NO for me now No-one ever swapped the firmware on my paper wallet. Attack surfaces: 1. Flood (that one we had and more than once) 2. Nosy gf/wife that likes to "tidy" things up...can't happen  3. Fire 4. Something falling on the house, like a tree (impossible, right?), causing rain to wash away or soak the paper. 6. Forgetting where you put it..or if BIP 38, forgetting the password. That said, I might have agreed a bit more if you delineated how you are circumventing the above...yes, it is doable, but require some trust in those who would hold potential copies, maybe. |

|

|

|

|

I don't think ordinals can be stopped, regardless of what y'all think (plus Luke Dashjr).

If many will whine, bitcoin will eventually fork and I currently think that the chain WITH inscriptions would become a dominant one in this case.

Why? Simply because you can do more "stuff" with it, even though large fees are a bit annoying.

|

|

|

|

bouncy  |

|

|

|

|

OT: Well, with Powell mentioning three cuts in 2024, if you want an alternative forex trade, going long japanese yen might be profitable.

USD/JPY peaked at around 150ish recently and yen already appreciated to 141 (it's in reverse).

I think it might go to 120-125, which would add 18-20% to whatever you get in japanese stocks next year.

Not bad..I bought myself a position in japan around 2010-2012 as they were coming out of 21-23 years long depression.

For equities, buying cheap increases the probability of success

Who knows, maybe Argentina would be a buy shortly.

|

|

|

|

...BTW, nice clothes are ALWAYS better than cheap ones...

...I guess to me buying unneeded RE is being what you described, but to each their own.

Habits differ. People here are buying expensive boots...which I never understood, but it is interesting.

I would definitely splurge on a car in the future, just to try several brands over my life..used to drive bland cars, now a "muscular' car, then maybe some vroom vroom car (when btc is at a cool million)...

Nice clothes are somehow better than cheap ones? Nice clothes can be cheap and expensive ones are often garbage. A $15 pair of sturdy Levis or Wrangler jeans will almost always outlast a pair of designer jeans costing hundreds. Buying quality is what matters. A pair of Blundstone boots may be expensive but they are made to last (in more than one way!  ). Nike footwear on the other hand is just overpriced garbage. Unneeded real estate? The house I bought last year is not only an investment but it also provides rental revenues and a much larger living space for us plus a totally private rooftop patio. The lake I bought a couple of years ago may not provide any immediate revenues but it does save on what I used to pay to rent a rural retreat. It also represents a considerable long-term investment. Wasting money on a car is (to me) just silly. Unlike land which is an appreciating asset, cars are a depreciating asset. They also cost a lot to maintain and operate. Here in downtown Toronto just a parking space costs several hundreds of dollars per month. You can rent your parking space out for hundreds if you don't have a car. Parking lots and meters are also expensive, not to mention the inevitable tickets. Then there's insurance, fuel, maintenance, licensing costs, etc. I figure the cost of owning a car in the city is thousands per month. I can take several taxis per day for less than that and save the hassle of driving. Maybe when bitcoins cost millions I'll be able to afford a full-time chauffeur, until then I'll make do with part-time drivers, just like having a part-time cleaning lady. Do some people get as attached to their vacuum cleaners as they do to their cars? Also, driving impairs drinking.  To each their own. As discussed, everybody's investment/living style is different. I hear from people who have rental properties that it is very bothersome because of the need to provide the upkeep (albeit you can hire a company that would "eat" into your income). That said, right now it is not very economical as well because income from rentals is roughly equal to what you get from a money market fund, while doing absolutely nothing and having virtually no risk. Canadian real estate has been appreciating for decades, though, so maybe this is a plus in your particular case. However, my personal opinion is that RE is vastly overpriced around here, so I cannot take this risk. I routinely see $$1.5-2 mil houses which I think should be more like $500-700K in value at most. EDIT: about cars...what can i say..I just like to drive in relative comfort (and I have to do it daily to work and back) and not thinking about the car as an asset  |

|

|

|

Well, using a bit of leverage would have worked during 2014-2015, in early 2017, in late 2018 and 2022, but in my experience, significant leverage always kills your account in the end...maybe that's why i was a bit worried about M. Saylor in late 2022, but, apparently, he did not have any covenants that would have caused him to buy back the loan at that time, despite the fact that MSTR book value was probably deeply negative back then. If he would have been obligated to buy back the loans, MSTR would have to sell into a 'hole", then go bankrupt, and btc would dip even more. There are multiple stories about successes, like people using credit card debt and buying gobs of btc in 2015, but the stories of some who did the same in an inopportune time are not being told and, obviously, you could have put yourself in a pickle by doing this in late 2017 and 2021. So, my general thought about the leverage is...just don't do it! EDIT: someone wants to create the negative weekly handle in US or close the CME gap? $41894 read...  If this was in reference to my post above yours, I am not referencing leverage. I talking about accounts like a 401k. If you withdraw before you are 60 years old there is the typical income tax (let's say 24%) plus an additional 10% fee since you are not 60 years old. So, if in 2017 someone emptied say $100,000usd from thier 401k they would end up with $66,000usd. They then used that to buy bitcoin with. No leverage involved. Only the bet that you make up the $34,000 you had to pay as well as any compounded interest you would of made if it remained in the 401k. i did not quote your post..therefore it was not in response, but simply influenced by. Your scenario could be called a "sacrificial lamb" trade. I wouldn't lose 34% upfront voluntarily on anything, though, as there is no guarantee of making it back. In that sense, small leverage (like 10-25%) looks like a better course of action, at least to me. BTW, in 2017 (and since the fall of 2015) someone could have bought GBTC in the retirement account (IRA, not sure about 401K). More drastically, someone could have quit or change jobs, then transfer money from 401K to IRA, then buy GBTC there...no need to lose 34% upfront. |

|

|

|

Well, using a bit of leverage would have worked during 2014-2015, in early 2017, in late 2018 and 2022, but in my experience, significant leverage always kills your account in the end...maybe that's why i was a bit worried about M. Saylor in late 2022, but, apparently, he did not have any covenants that would have caused him to buy back the loan at that time, despite the fact that MSTR book value was probably deeply negative back then. If he would have been obligated to buy back the loans, MSTR would have to sell into a 'hole", then go bankrupt, and btc would dip even more. There are multiple stories about successes, like people using credit card debt and buying gobs of btc in 2015, but the stories of some who did the same in an inopportune time are not being told and, obviously, you could have put yourself in a pickle by doing this in late 2017 and 2021. So, my general thought about the leverage is...just don't do it! EDIT: someone wants to create the negative weekly handle in US or close the CME gap? $41894 read...  |

|

|

|

On the lifestyle/retirement subject.

I was not in as early as many of you. I do not have retirement or fuck you levels of BTC stashed away. Fortunately, I am what I consider to be "very young" with a very well paying career. My sole objective has always been a responsibile early retirement. Retirement in the sense of not needing to work if I dont want to, no daily agenda of things I need to do other than necessities, and a comfortable lifestyle. I'll add that I will also be an unofficial expat once retired.

I am fortunate enough to have existing retirement assets such as pensions, annuity, 401k, (ect). All of those are not reasonably accessible to me until later in my life when social security is also available. Simply put, 60-death I should have more than enough even if I make a few poor decisions or have an emergency or two. My focus has been on filling the gap between retirement and "retirement age" with personal assets. By current conservative estimates I am on target to reach my goal in 8-10 years which puts me at an age many would consider an unsually young retirement age.

My personal assets are composed of approximately 80% Bitcoin. I have treated it as an asset that I want as much as possible of because I believe it's value will be much higher in the future than now. I project it's increase in value as the average stock market increase of 7-9% per year to keep myself conservative. Meanwhile, it's proved to smoke those estimates to date.

I have not worked out or planned what I will do with my bitcoin once I have achieved retirement level funds. I do plan to run through everything else before touching it though. Honestly, I have hoped once I am at that point I won't need to sell it for cash to use. I am hoping I can actually make direct purchases with it instead. With planning to do a bit of traveling it adds the utility of a being a worldwide currency as well.

I thought I would share this as a truthful post on how bitcoin fits into my life. I know I and others tend to post extreme "hold till I'm dead" type of comments but, that's just the fun side of WO for me. Thought this might be a helpful point of view for others who did not start buying BTC at $10 a coin.

Nice plan...here is a very 'old' remark on love, happiness and money: https://www.youtube.com/watch?v=srwxJUXPHvEEDIT: BTw, the investanswers "character" (James) on youtube claims that there could be only 300 thou people having at least one bitcoin (maybe he meant the situation of buying roght now). Here are more solid stats, perhaps: 859 thou addr with 1-10 btc 139 thou with 10-100 14 thou with 100-1000 Source: https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html |

|

|

|

|

One interesting extra point about bitcoin and lifestyle.

Since owning bitcoin gives you no direct cash flow, in order to spend, you would need to sell bitcoin, which many bitcoiners find at least in part objectionable, 'cause "number is going up".

Personally, I am not sure how to deal with this: so far, I was selling very infrequently, then mostly re-investing in various assets.

There is also a difference between people who are still working (steady paycheck) and those on a fixed income (pension, social security, etc).

Right now, $1 mil in money market fund gives you 53K in interest yearly, so $2 mil would finance a middle class lifestyle (a bit more than $100K/year in interest) in most of US (not in SanFran or NY) without even a need for pension or social security (or they would come as a nice bonus). It is unclear how long will this situation continue, though.

There are some interesting places on the web to read about various ways to be retired with money: i sometimes lurk on the reddit.com/r/FIRE....a bit of snobbish attitude, but also quite interesting.

One point I read there: if you are working at a job you don't particularly like and your investment exceeds you work salary for many decades, like 30-100 years, then quit and retire to what you really like.

Chances are, you would make even more money with your stash and will be free at the same time.

Personally, this is not for me since I still enjoy working, but for many people, that's the "ticket".

|

|

|

|

Anyone here who made it with Bitcoin but still keeps living like a average person? Thank god I made it, thanks to Bitcoin. But I keep staying in cheap hotels, try to eat good food but without spending unnecessary money etc. For example, I eat a good steak but I donít choose a steak house but prefer a supermarket where you buy the meat from the butcher and then they cook it for you in the built in restaurant.. That costs me 20 bucks vs 60-80 bucks in the steak house for the same meat. Iím not sure if this is a good or a bad habit. I hate to spent money on things that do not give me more benefits than the cheaper version. A luxury hotel is nice but at the end you just need it for the night sleep. Iím outside all day exploring. Some people spent 500 bucks a night for a hotel. I try to safe 5Ä per night by finding the same hotel over google. Usually I pay 40-50Ä per night for a hotel

Another example, I live in the center of Bangkok and stay in a luxury apartment in Asok. The room is only 30 sqm and it costs me 700 euros a month. I could have a 60 sqm apartment in the same building but would cost me 1400 Euros. I just canít justify spending that much money every month because itís money I wonít ever see again. So, I live on a budget, but still in a luxury place. Trying to find the middle way when it comes to spending money.

Would be interesting to hear different opinions on this topic. Some people spent it on yachts and lambos. I try to live as cheap (but good) as possible.

For me, both "yes" and "no". I still live like a middle class, but with 'upgrades': take an extra trip to an interesting place at least once, maybe twice, in 12 mo, upgraded (renovated) the house, etc. Still fly economy class, but at some point would upgrade too 'cause sitting on those tiny seats in Transatlantic flight, being surrounded by heavy people, is rough. At some point (if and when btc goes to millions), peeps, including myself, would probably need to upgrade the lifestyle...or it will come 'naturally": your wife will leave you (and take her 50%) is you would force her to live frugally when she knows that you have the resources, it is as simple as this. You can still have a relative balance: not buying multiple residences, but just buying nice clothes and jewelry for her/him. BTW, nice clothes are ALWAYS better than cheap ones. I bought an expensive leather jacket a few decades ago, and it is as good many years later.

I subscribe to semi-austerity. No Lambos, yachts or fancy restaurant meals.

Most of the bitcoins I've sold have gone into real estate and I consider that to be just a diversification of investments.

No need to splurge and act like a high-roller when that really means just being another consumerist sucker.

I guess to me buying unneeded RE is being what you described, but to each their own. Habits differ. People here are buying expensive boots...which I never understood, but it is interesting. I would definitely splurge on a car in the future, just to try several brands over my life..used to drive bland cars, now a "muscular' car, then maybe some vroom vroom car (when btc is at a cool million)  . The main idea is not to change who you are very much, but enjoy the journey. |

|

|

|

|

a "premature" Sunday haiku regarding developments that i am not a part of...so..there is NO endorsement here, just a statement of recent events:

ExtraORDInary:

SATS are TRACing RATS somewhere

deep in outer SPACE

haha...that said...That $622 node/small miner is cool.

1tb disk seems enough for now (maybe for 4-5 years longer), but a question to those who run a node: is pruning to reduce the size OK to do once you downloaded the whole chain?

Thinking of starting running a node, at least from time to time.

|

|

|

|

|

), but, here we are.

), but, here we are.