|

buddy interrupt.

A night of some pretty meaningless movies..like Batman...sorry, what a waste of 3 hr.

btw, why btctalk takes like forever to post, but not to edit.

whatevs

|

|

|

|

All those Ethereum fanboys gonna get rekt when they realize the fiat value of their precious token was in the mining and not in the utility. The utility will still be there when it goes to POS but the price won't.

That's a testable hypothesis..and we shall see soon. If true, it also predicts something else, obviously, which is actionable. I am still thinking whether to make any short term moves or not. |

|

|

|

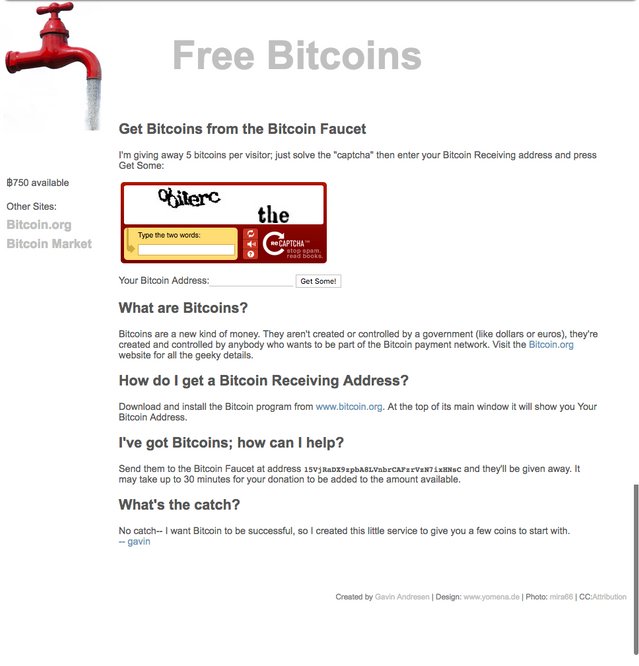

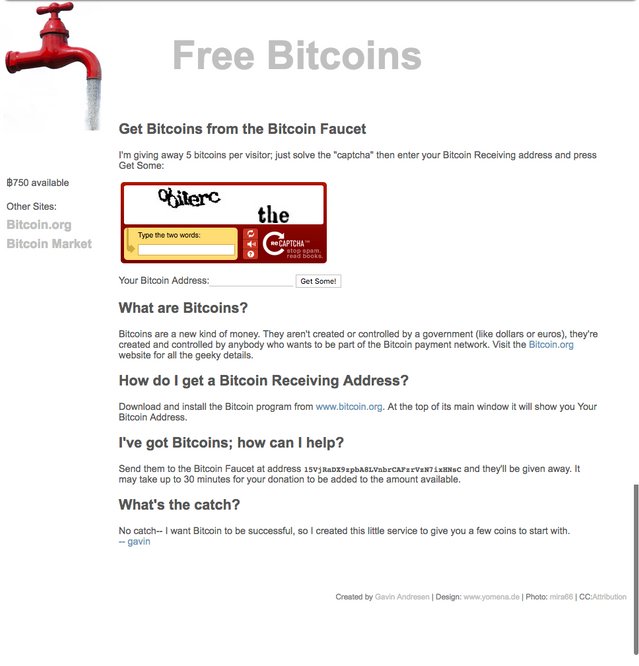

who of you made use of this service back then?  this site has somehow passed me by at that time...   There were many faucets back in the day but you only got very little (for that period) and needed to watch ads or wait a certain period of time. You got 5 bitcoins from that faucet when it first started, and you didn't need to watch ads or wait. However 5 bitcoins was probably worth less than half a cent back then. On June 23, 2010 Gavin added a CAPTCHA. He discusses it in this post. https://bitcointalk.org/index.php?topic=206.msg1711#msg1711back in 2011 when i started my interest in btc and before i started to gpu mine and receive actual btc i wanted to test my core wallet to make sure i knew how to receive btc and could create an address and play with how the wallet worked. so i remember getting some btc once from a faucet, maybe gavins as there were hardly any at that time. wish i could remember which one and how much.. thought it was less that 1 btc though. but heres the thing. im still running and actively using the core wallet i created in june 2011. and i cannot find that transaction. should of been the 1st transaction in the wallet. now before i started mining to i do remember creating a few early test wallets as i want sure if i was doing it right, plus my internet sucked so bad i may of not waited for full sync, figured i did it wrong, and just ignored the early test wallets and created new ones. ergo that 1st transaction from an early faucet (gavins?) to my one of the early test wallet is likely lost. however since i almost never delete anything i still wonder if i still have the early test wallets, as i have many early wallet.dats on my old backups. and im pretty anal about backups. so, one day, all those old early wallets copies will get plugged in and run against the blockchain. who knows maybe i will finally find out what happened to that early faucet transaction lol. Did you feel 'early' or already kind of "late' when you entered in 2011? I definitely felt 'late' in Q3 2013 and blamed myself for not acting upon reading about btc in Wired for the first time in Nov 2011 (at ~$2). It was one of those "bitcoin is dead" articles, but i distinctly remember why I did not invest: it said that you have to use Linux or something to that extent (to run the chain and the wallet) and I had zero interest in Linux at the time (to my ignorant self circa 2011, it seemed kind of irrelevant, lol). EDIT Btw, the guy who apparently threw away the wrong HD years ago now prepared a solid business plan for possible recovery of the 'treasury' with a current worth of $181 mil. The only barrier is his city council's agreement. They would probably agree within 5 years when the payout for each city dweller reaches $1000. https://www.businessinsider.com/james-howells-threw-away-bitcoin-dump-masterplan-get-back-2022-7 |

|

|

|

Have finally created my own "bucket list" for a Bitcoin low this bear market: Why these 5 metrics? Because from back-testing it would have given you an average of $3,835 in 2019 (+21.8% from the low) and $245 in 2015 (+49.4% from the low), if you were to put 20% of capital per indicator signalling a low. They otherwise appear to be the most relevant to past Bitcoin bottoms using 2 more fundamental indicators (NUPL and Hash Ribbons), along with 3 technical indicators (Pi Cycle, 200 WMA and RSI). I otherwise think they can give you a bit of "cover" in case price drops down much lower, particularly the hash ribbons indicator in this case, as well as potentially the RSI. There is the other obvious advantage of using 5 indicators/metrics, as opposed to blindly following one or another that could very well fail, even if they have been reliable up until now such as Pi Cycle or previously such as 200 WMA. Niiice. The first large bump might be to 47-49K, imho. Could be in Q3 or shifted to Q1-Q2 of 2023. IMHO, there would not be a slow grind 2014-2015 situation, if the rally would be carried by institutions. |

|

|

|

Here's my own personal bucket list for confirming a Bitcoin low that I'll keep updated. Currently at 40% complete, so still some way to go but getting closer: 1. Pi Cycle bottom signalled: 11/07 @ $20.8K ✅ 2. NUPL leaving capitulation levels: 18/07 @ $22.4K ✅ 3. Weekly RSI leaving oversold conditions: ❔❔❔ 4. Price closing back above 200 WMA: ❔❔❔ 5. Hash Ribbons indicator buy signal: ❔❔❔ Price range: $20.8K - ❔❔❔ Time range: 11/07/21 until ❔❔❔ This is simply my own criteria for attempting to confirm a bear market low, but not an end to the bear market nor new bull market I should add. Currently waiting on Weekly RSI to close a week outside of oversold conditions (this week hopefully), as well as close back above the 200 WMA (next week maybe). Hash Ribbons indicator will likely take longer to confirm buy signal as hash rate continues to decline. What's your criteria for confirming a bear market bottom for Bitcoin, if any? Very nice! merited elsewhere. I wonder if all criteria are independent or crossing a few tremendously increase the probability of others to trigger. Personally, i already thought that this is a real thing, but it is VERY nice to see that the objective criteria confirms. However, I am of the opinion (not supported by facts) that this cycle, similarly to the prior one, would have "fake" rallies a la 2019. As such, I see 47-48K as a limit of such "premature" bitcoin rally (and 3.4K for the competitor). Could be a very fast bump, maybe to September, if macro cooperates. |

|

|

|

Will likely die of skin cancer and/or heart disease. Listen, the dude made it to 80 while still wanting (and probably being capable) to have a girlfriend, plus he is a millionaire (don't know what ultra means...I guess he has slightly less than a billion). He made it by almost all counts. i don't know about his soul, hence the qualification. |

|

|

|

I suppose selling Bitcoin by Tesla is not economical but political decision. If all US based companies sell bitcoin it dumps the market extremely.

naah, it's just Elon being himself. |

|

|

|

|

He never was a hodler...bought with the hype in 2021, sold when distressed in 2022...overall almost broke even (lost 74 mil, which is less than 5% of the initial investment).

Not a player anymore (in bitcoin), so let's just forget about him once and for all.

EDIT bank of England made an "infamous" sell of gold around 2000 for $250-280. Elon's sell would probably just as "timely".

|

|

|

|

This seems worrisome... makes this smell like a bull trap. I do not want to believe that.  Exactly that was weird experience 😂 i was so excited that BTC is above 200 MA after weeks and then suddenly i remembered that a Post of 15.5k BTC Transfer was Posted then I got a Telegram Notification of the same post in Local community Group and then i saw the tweet,,, No words to say now, i wish it will be wrong or, maybe the guy/gal just needed 300mil pronto (and book some losses since he was buying a bit from the peak to now). Essentially, he/she sold down to March-April levels (in btc count). |

|

|

|

|

It is still possible that the whole bear was fake and aimed at ruining CeFi lenders and funds (3AC, Celsius, Voyager) plus idiotic Terra.

Some Mr/Ms smartie pants (of Goldman, etc ilk...SBF comes to mind) could have figured out that those funds/lenders were way out of balance and pulled the rug.

Wallet data (0.1-1BTC and >1BTC) showed NO typical bear decrease.

Maybe that's why we never had a blowoff top and did not decline 84% (only -74% at max down).

BTW, some stonks are surging too..i have some biotechs that bottomed in May-June and are now almost 100% up. A super-bounce into more tightening? A bit strange.

IMHO, 75bp and they are probably done until the EOY.

|

|

|

|

The largest bank in the Eurozone to launch Bitcoin, Crypto custody platform.French bank BNP Paribas, the leading private bank in the Eurozone, will become a custodial service provider for bitcoin and other digital assets, according to a report from CoinDesk

------

Still, Metaco has previously announced partnerships with the likes of Citigroup, BBVA, Zodia Custody, DBS and Union Bank Philippines. More recently, French bank Societe Generale also partnered with Metaco. Previously, CEO of Metaco Adrien Treccani discussed the rise of banks entering the custody ecosystem of bitcoin and other cryptocurrencies in an interview.

“The series of banks that were already working on certain topics suddenly transformed from innovation pilots to concrete go-to market strategies,” Treccani said in an interview. “You will start seeing a series of announcements involving very big custodians. It’s almost FOMO [a fear of missing out] as these large banking players know that their future somehow depends on this capability.”. I am curious as to what their terms would be...if they are similar to Celsius in that it is not your bitcoin but their liability, then such arrangement would be mostly useless. If it is like a digital safety box, then it could be OK IF there is a reasonable fixed fee, not a percentage of custodial bitcoin fee. |

|

|

|

|

bitcoin is up much..while stonks were down...I like this.

non-US govs started to complain about the $ being too strong. IBM lost $3.5bil in revenue due to the strong dollar, apparently.

On cue, DXY went down a bit.

One "interesting" idea is that the FED is about to break 'something' and would be forced to reverse tightening by no later than EOY, which is quite possible.

If so, some 'smart money" might have started allocating to btc already.

We shall see.

|

|

|

|

|

USDT=USDC

tether is back...fully

no opinion on intrinsic value

|

|

|

|

I have a sell order at 100K$. For something like 5% of my stash. The difficulty will be to keep it when we'll be approaching that level, so I'm already preparing myself. When the price goes down under 100K I don't want to have regrets.

Make it 98-99K, lol...but, if we are in a normal circumstances, perhaps at least 10X from the actual bottom would be in play. However, I decided to probably sell a chunk in 2025 regardless of the price; well, I would not do it if the price would be something silly (on the lower side). EDIT Since we seem to replay the seventies (with major similarity being boomers vs millennials and the effect of those large cohorts on inflation), it stands to reason that stonks and bond markets might bottom by 2024 (with or without a flat all the way to 2030). Going long equities either on a spike down around 2024 and/or by the end of the decade should be one of those generational decisions: buy and forget about it for 20 years. |

|

|

|

@JJG FYI...from https://brians.wsu.edu/2016/05/19/whimp/If you use the much less common “whimp” instead people may regard you as a little wimpy. That said, now I am a wimp for not selling at $60 or 50K? Hilarious. Here is a bet (nonfunded): within 2-3 years anyone who sold at 50-60K would be considered a wimp, unless, of course, they sold at 60K, then bought back at 17.5-20K, but it is REALLY difficult to do if you already did something with that profit plus paid taxes on it; not impossible, but difficult. Every time I sell, I consider that bitcoin gone..but I haven't sell for a while. |

|

|

|

That's me in 2013, 2017 and 2021.

I had a goal set, sell at 100k. That worked out well, not.

I told myself - I'm not greedy so I'll sell at 80k. That worked out just at well. we (since I include myself) just got out-wimped  |

|

|

|

Chamath tries to explain things. Sounds a bit douche-baggy, but maybe it's just my view. https://www.youtube.com/watch?v=9u5q7nDPbJYReminder: he is the dude who pushed the SPAC s-t onfolks. Yet, some of his points are, perhaps, valid, as far as the mechanics is concerned. Still, I don't get why he puts it on bitcoin when most (or at least a large part) of those dealings were in eth. People did not read the contracts they were signing (while going ga-ga for "yield"). IMHO, insolvencies here are just the start. Wait until all those highly leveraged financial companies start to "pop" when IR approach 5%. |

|

|

|

|