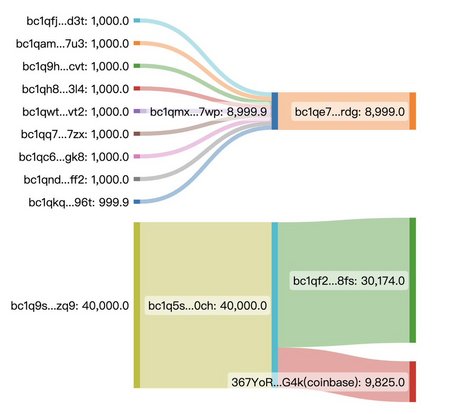

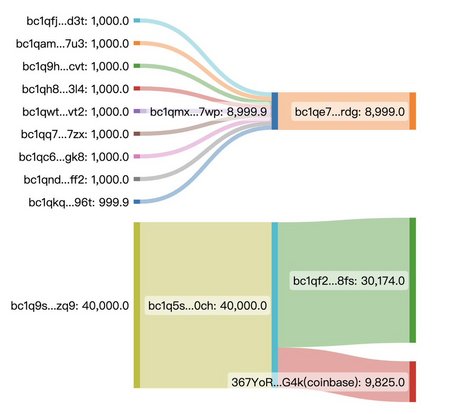

This new information was shared by @PeckShieldAlert that 49k coins of bitcoin from wallets controlled by the American government were transferred to Coinbase. It might not be a speculation anymore if someone predicts that $25k for March is impossible if these coins will be dumped.  #PeckShieldAlert 49k $BTC (worth $1 Billion) from wallets related to US Government law enforcement seizures have been transferred to #Coinbase (~9.8k $BTC, worth $217M), bc1qf2…fsv (30k $BTC) & bc1qe7…rdg (9k $BTC) #SilkRoadSource https://mobile.twitter.com/peckshieldalert/status/1633331891347820544 #PeckShieldAlert 49k $BTC (worth $1 Billion) from wallets related to US Government law enforcement seizures have been transferred to #Coinbase (~9.8k $BTC, worth $217M), bc1qf2…fsv (30k $BTC) & bc1qe7…rdg (9k $BTC) #SilkRoadSource https://mobile.twitter.com/peckshieldalert/status/1633331891347820544 |

|

|

|

I don't think it's completely baseless FUD, we all know they all know we all know they do the same things behind those desks, SBF was just too far out of his league, and lacked the same level of checks and balances.

Does this lead to Binance biting the dust? Nah. Does it mean they won't eventually bite the dust? I won't dismiss the possibility entirely, but it won't be because of this. If I'm wrong and it does? What doesn't kill Bitcoin only makes it stronger =)

I hope you are correct that this will not lead for Binance to be biting the dust because I reckon it will certainly make the cryptospace perceived as a comedy show by scammers and hustlers. This might discourage the institutional investors and encourage regulators to protect consumers by creating stricter regulations that will restrain innovation. Also, regulations are only made under an act that it was created to protect consumers. What it will do is harden the rulers' financial leadership. The cryptospace will not be ours anymore. News update for everyone. Short seller Marc Cohodes said his early scepticism of bankrupt crypto exchange FTX and disgraced CEO Sam Bankman-Fried led him to short the company’s main bank, Silvergate.

As fears surrounding Silvergate’s finances clobber the stock price, the short seller has turned his sights – and bearish bets – to two companies that he claims are analogous: crypto exchange Binance and Signature Bank.

He colourfully explained his thinking about Signature to DL News: “They have major problems, and they have very similar issues to Silvergate. It’s not as exposed to crypto as Silvergate, but their loan book is terrible. And they have huge KYC and AML liability.”

”This is not rocket science,” Cohodes said. “Signature is next, Binance is next.”Source https://www.dlnews.com/articles/people-culture/short-seller-marc-cohodes-shorts-signature-silvergate-binance-ftx/ |

|

|

|

@Betwrong. The final voting for the Oscar awards this year are done on March 2 to March 7 and very much similar to the years before, there are some leaks in information that the oddmakers can collect and change the odds correspondingly.

In any case, the odds did not change. I am quite certain Everything Everywhere will win the Oscar for best picture. I speculate the Hollywood agenda this year is forget everything, enjoy your life heehehe.

I thought it's about constant fighting for understanding between generations and between people in general, but, well, maybe it's because I'm living in the midst of the war for the last year I see fighting even in movies. Now I think it's both, and you are right too.  Was that the movie's storyline hehehe? What I saw immediately was the LGBTQ agenda and on a conservative Asian family hehe. The messaging has become stronger and it is being displayed everywhere. I am not against LGBTQ, however, the methods used by the creators of movies and television series are forcing it on us already. This is not good, I reckon. In any case, you have made good bet. It appears that the Oscars voters have again chosen a happy movie this year. |

|

|

|

|

Derek Carr has joined the Saints after he left the Raiders. If I remember correctly, the Raiders wanted to trade him to the Saints in exchange for draft picks. Derek Carr scammed his own team hehehe. This might also open a chance for Lamar to the Raiders.

The draft begins on April 23. Why is this sport's offseason very long, the regular season and post very short?

|

|

|

|

If the bullrun would have continued for another two years, who knows how many billions more they would have embezzled.

Yep. If there is any positive thing about all this mess, its that it happened sooner than later because God knows how many more people would lose their money as FTX kept growing due their aggressive marketing, no withdrawal fees and other tactics to attract as many users as possible.

In other news, FTX confirms for the first time that 8.9 billion dollars of users money is missing so if there's anyone still hoping that they will ever see their money back, think again. A recent report from the Wall Street Journal pointed out that $8.9 billion worth of customer funds have been unaccounted for and therefore missing.

This is the first time the exchange has revealed a number pertaining to the fund deficiency. The exchange has reportedly pinned down around $2.7 billion in customer assets, relative to $11.6 billion of the balance outstanding on customer accounts. The estimated value of FTX’s assets and liabilities is based on asset prices in November 2022, when the firm filed for bankruptcy.

Alameda Research had borrowed around $9.3 billion from customer accounts before bankruptcy. Thus, the current $8.9 billion hole can be attributed to Alameda Research. FTX did not clarify if the funds were borrowed with or without customer consent. According to a financial update filed, FTX’s sister company only had around $475 million in cash in its accounts as of Jan. 31.

Thus, at this stage, it cannot be anticipated how much compensation affected customers would receive, even though the exchange has tracked down $2.7 billion. However, around $1.5 billion of that said amount includes illiquid crypto assets like FTX’s token, FTT There might be other types scams that might have occured. They might also sometimes be done on their own services similar to this hedgefund.It is speculated that the founder of Multicoin capital has been selling his own cryptocoins and tokens to the hedgefund before the bubble pop of the bull market. Multicoin Capital’s hedge fund lost 91.4% in 2022, according to a copy of the firm’s annual investor letter viewed by CoinDesk.Source https://www.coindesk.com/business/2023/03/04/multicoin-capitals-hedge-fund-lost-914-last-year-investor-letter-reveals/That Multicoin Capital’s hedge fund news goes to show one of the scariest aspects of "crypto-space": The interdependence of many non-decentralized coins / tokens and platforms. If one fails, it will create a snowball effect that's hard to stop. I think truely decentralized coins (there's just a handful, if at all), most and foremost Bitcoin, are less vulnurable towards these influences, however still take a hit when a big ship things, such as FTX. Especially stablecoins - if they were to fail in a similar way as FTX - could bring down even Bitcoin by quite a bit for several months, up to a few years, worst case scenario. You are comparing different things. The founder Kyle Salami can also have bitcoin and ethereum which he also dumped on his own hedgefund Multicoin Capital. Also, this might not only be happening in organizations similar to hedgefunds. Development teams of different Defi projects might also be dumping their own stake from the project to hold in the project's treasury. |

|

|

|

|

@Darker45. I disagree that we should always be avoiding all centralized exchanges to trade, buy or sell our coins. What we clearly need is an honest and trustworthy exchange where everyone can feel safe. I reckon regulations might help with this but we do not want the type of regulations that the regulators want to impose on the cryptospace. This is a difficult situation.

In any case, if Binance does not bite the dust, I would not be shocked. They might be good in avoiding the law very much similar to Tether, Bitfinex, Ifinex hehehe.

|

|

|

|

^ Yes, Eddie Hearn wanted a Bivol vs Beterbiev and so is Bob Arum, so let's see how they are going to work it out.

Its just for now it's complicated as Bivol is targeting Canelo as well, either 168 or 175 lbs. And then Callum Smith is also coming into the horizon and also looking for a big payday against Beterbiev. We wait how the Smith vs Stepien result will be though, if he wins maybe Bivol is willing to fight him instead of waiting for Bivol.

Time is running out on Beterbiev though, I mean he is not getting any younger, if in two years, he didn't get Bivol it might be too late when the are going to face in the future and it might not be the fight that we are expecting for. And so we might not see the unification fight in my opinion. And they will have to go on their separate fight, Bivol vs Buatsi, Beterbiev vs Smith. True, Beterbiev should not waste any more time as his power may slowly decline once he turns 40. I would like to see him have one more fight before a unification bout with Bivol, and after that, he can think about retiring if he fails. Speaking of Bivol, when do you think Canelo will have his rematch with Bivol? According to some news articles Bivol wants to unify the championships in his own division first before a rematch against Canelo. However, it appears Beterbiev does not want to fight Bivol. There are also other articles that Bivol vs. Beterbiev might occur on June. My speculation is if Bivol cannot fight Beterbiev, he might be forced to accept a money deal for a rematch against Canelo on September. |

|

|

|

Mike Tyson made his prediction for this fight hehe. He is on Tank Davis, however, he also told everyone that this will be a good fight. Does this imply that King Ry has a chance more than everyone's predictions? I quite certainly speculate that this fight might show that King Ry is better than what was expected from him. While in Saudi Arabia for the Paul Vs. Fury fight, Tyson had a quick interview with Fight Hub TV, discussing upcoming bouts in the sport. Tyson discussed the lightweight bout and said, “It’s going to be a Good fight.” The ‘Baddest Man on the Planet’ expects a thrilling fight between these two lightweight boxers.

Tyson further went on to choose his side for the fight. When asked who he thinks will win the fight, Tyson responded, “I gotta say Tank, but it’s going to be a good fight“Source https://www.essentiallysports.com/boxing-news-mike-tysons-brutal-prediction-for-ryan-garcia-vs-gervonta-davis/ |

|

|

|

That's right, Inoue is not your ordinary boxer who's is easy to predict and evident to see his limits. Currently, there's no boxer that managed to unlock Inoue's weakness and Donaire was the only boxer who actually gave him a good toe-to-toe fight but even that fight wasn't enough to show his weakness and up until now, it's still a mystery and it will be an expensive move by any boxer just to know what is it.

For weakness of Inoue to unfold, he just needs to fight a better boxer than he is. He may be dominated the bantamweight division, but I do not think that he will do the same in the super bantamweight. Super Bantamweight is a different division and there are several known boxers that can possibly defeat Inoue in this division. The boxer in this division have heavier punches and more resistance to blows or punches, and since Inoue is taking a shortcut, he probably doesn't know the extent of the punching power of this division. I very much agree, however, this is what the sport of boxing is supposed to be. The best boxers should challenge the other best boxers in another weight division or in their present weight division. This will bring the sport forward again and not need to become a comedy show to get more attention similar to Jake Paul. Fulton vs. Inoue, Tank vs. King Ry and Haney vs. Lomanchenko are good fights for the fans and the sport. |

|

|

|

|

@Betwrong. The final voting for the Oscar awards this year are done on March 2 to March 7 and very much similar to the years before, there are some leaks in information that the oddmakers can collect and change the odds correspondingly.

In any case, the odds did not change. I am quite certain Everything Everywhere will win the Oscar for best picture. I speculate the Hollywood agenda this year is forget everything, enjoy your life heehehe.

|

|

|

|

I think there will be real difficulties in March for bitcoin. Past data has largely not supported bitcoin's strong upside move but there were exceptional years like March (2021) and March (2022) when bitcoin had an impressive green wick. so maybe bitcoin will hold this scenario. March 14 (US CPI announcement) and March 23 (Fed announced interest rate adjustment) are events that can be of great interest and are likely to affect the likely scenarios.

Many predict the Fed will raise interest rates by 0.5% instead of 0.25% as previously predicted because the recent indicators have not been as expected and showed that inflation is returning. But I believe interest rates won't affect bitcoin too much anymore, I remember the last Fed rate hike in 2002 also didn't cause bitcoin price movement. But this is not good for the global economy and will make it difficult for bitcoin to do well this year. I don't know if this news will affect bitcoin but I still believe bitcoin will hit $25k this month. I speculate that this Binance fud will be the cause of bitcoin's difficulty of pumping to more than $25k. It presently has the attention of American senators from both the Republican and the Democratic party. This might imply the summoning of Binance employees in America for questioning and there might be a crackdown on binance.us. There is also a rumor that the SEC has sent wells notices to many founders and development teams of altcoin and Defi projects. US Senators representing both Democrats and Republicans are demanding that Binance and Binance.US provide a detailed accounting of their finances and efforts to maintain regulatory compliance, according to a letter signed by Senators Elizabeth Warren, Chris Van Hollen and Roger Marshall.

The senators’ letter cited “investigations into criminal sanctions evasion, money laundering conspiracy, unlicensed money transmission, questions about its financial health, and increased scrutiny over its intentionally ‘opaque corporate structure.'"Source https://www.bloomberg.com/news/articles/2023-03-02/binance-accused-of-illegal-activity-by-us-senators-warren-van-hollen-marshall |

|

|

|

If the bullrun would have continued for another two years, who knows how many billions more they would have embezzled.

Yep. If there is any positive thing about all this mess, its that it happened sooner than later because God knows how many more people would lose their money as FTX kept growing due their aggressive marketing, no withdrawal fees and other tactics to attract as many users as possible.

In other news, FTX confirms for the first time that 8.9 billion dollars of users money is missing so if there's anyone still hoping that they will ever see their money back, think again. A recent report from the Wall Street Journal pointed out that $8.9 billion worth of customer funds have been unaccounted for and therefore missing.

This is the first time the exchange has revealed a number pertaining to the fund deficiency. The exchange has reportedly pinned down around $2.7 billion in customer assets, relative to $11.6 billion of the balance outstanding on customer accounts. The estimated value of FTX’s assets and liabilities is based on asset prices in November 2022, when the firm filed for bankruptcy.

Alameda Research had borrowed around $9.3 billion from customer accounts before bankruptcy. Thus, the current $8.9 billion hole can be attributed to Alameda Research. FTX did not clarify if the funds were borrowed with or without customer consent. According to a financial update filed, FTX’s sister company only had around $475 million in cash in its accounts as of Jan. 31.

Thus, at this stage, it cannot be anticipated how much compensation affected customers would receive, even though the exchange has tracked down $2.7 billion. However, around $1.5 billion of that said amount includes illiquid crypto assets like FTX’s token, FTT There might be other types scams that might have occured. They might also sometimes be done on their own services similar to this hedgefund.It is speculated that the founder of Multicoin capital has been selling his own cryptocoins and tokens to the hedgefund before the bubble pop of the bull market. Multicoin Capital’s hedge fund lost 91.4% in 2022, according to a copy of the firm’s annual investor letter viewed by CoinDesk.Source https://www.coindesk.com/business/2023/03/04/multicoin-capitals-hedge-fund-lost-914-last-year-investor-letter-reveals/ |

|

|

|

News update. There is nothing shocking about this news, however, it can add to the argument that it might be the next of th biggest exchanges to bite the dust. Binance might also be an entertaining example of what centralized exchanges presently need to do to continue their service under strict regulations and under threat of a crackdown hhehehe. Binance, one of the world's largest cryptocurrency exchanges, developed a plan to avoid the threat of prosecution by U.S. authorities as it started an American entity in 2019, the Wall Street Journal reported on Sunday.

Any lawsuit from U.S. regulators, who had signaled a coming crackdown on unregulated offshore crypto players, would be like "nuclear fall out" for Binance's business and its officers, the WSJ said, citing a Binance executive's warning to colleagues in a 2019 private chat.

The report is based on messages and documents from 2018 to 2020 reviewed by The Wall Street Journal as well as interviews with former employees.Source https://www.reuters.com/technology/binance-execs-texts-documents-show-plan-avoid-us-scrutiny-wsj-2023-03-05/ |

|

|

|

~snip~

I also remember the interview. If I remember it correctly, he also implied that Binance smartchain will very much be a big part of Binance's progression to become a more decentralized exchange where their jurisdiction might be will not be very important. I honestly found it interesting at first that a company operating all over the world doesn't have headquarters. They're like a digital nomad. When I first read about Binance's unique structure many years ago, around the time it started growing big, I was kind of amazed that even employees are like CIA operatives, working in the shadows, even anonymously. But then I realized later on that there are implications that make it actually risky for clients. I don't even care about tax responsibilities. I'm thinking of the company's accountability to its customers. I reckon we also have to consider that the interview was made before 2018. I am not certain on the correct year, however, the cryptospace community was very different before when everyone encouraged decentralization. Presently the community wants regulation and regulators to enter the cryptospace because we were tricked to think that it will be safer to invest. It might also be because we were tricked to think that our coins will pump. I shake my head on this because the regulators do not care for our safety or if our coins will pump. They only want to control everything. |

|

|

|

and that is usually the case with licensed online casinos. so that when you win big and want to withdraw all the winning funds, the platform has the right to request KYC from these customers as a condition that must be carried out to be able to withdraw these funds.

it's all because the casino platform is licensed and subject to regulations that have been in accordance with the agreement from the beginning with the licensing company.

so for me, if it's true that you get a big win and want to withdraw it but are asked to do KYC, I'll do that. because it is just one way to comply with the rules and to be able to withdraw large funds from our account.

If you win a large sum in an unlicensed casino, then no one will pay you anything. Sometimes it is easier for a casino to create a new website than to pay large winnings to players. I agree that it might be cheaper to create a new casino than to pay millions of dollars of winnings to a single bettor who has gotten lucky. However, licensed or unlicensed, it is not easier to convince people to deposit their money and play in your new casino. You need to prove that it is trustworthy, safe and honest. This is very hard and it might be easier to buy a licensed casino that is known already. |

|

|

|

|

I am voting for no for this month because there is a rumor that the SEC has sent wells notices on many projects' founders telling them that they will be charged for selling and distributing illegal securities. I am not certain what projects, however, according to Bankless podcasts much of the Defi projects founded under American jurisdiction might have received wells notices.

This rumor if it becomes news, this might cause a dump on the whole cryptospace including bitcoin. I am quite aware that bitcoin cannot be charged of anything but the actions of the SEC will create fear on markets of the cryptospace.

|

|

|

|

@AverageGlabella. I disagree on your assessment that Bones Jones did not train for this fight, however, I certainly agree that Cyril Gane is is very much underestimated for this fight. Jon Jones did not fight 3 years and he is returning on a new weight class vs. the best heavyweight UFC fighter? This might be uncle Dana's biggest error. Also, there 3 sexy fighting kittens. Where are their pictures hehehehee.    |

|

|

|

According to some people in social media, Barry Sibert's Digital Currency Group has $262 million in cash but they have a loan of $575 million that should be paid on May and a $1.1 billion loss through Genesis Global. The question everyone should want to ask but they might only be afraid is DGC presently insolvent? What will happen to Grayscale? The venture capital firm focused on cryptocurrencies – Digital Currency Group (DCG) – reportedly marked a loss of $1.1 billion last year.

Some of the primary reasons for the downfall were the collapse of the crypto market and the bankruptcy of its subsidiary – Genesis.Source https://cryptopotato.com/crypto-giant-dcg-revealed-a-loss-of-over-1-billion-in-2022-report/ |

|

|

|

|

@BlackBoss_? Agreed that it might not last long, however, these buying of accounts for scamming, for multiaccounting or moneylaundering appears to be very common. I speculate that much of these complaints from people who had their withdrawals blocked and was asked for KYC again but could not submit the proper identification are from people who are using someone else's identity.

|

|

|

|

Does the Falcons have the money to give Lamar a contract for 5 years that is fully guaranteed very much similar to Massage Watson's contract with the Browns?

Also, the article mentioned that it will also open a window for the superbowl for the Falcons if they can trade for Lamar? Is this real? I am shaking my head. The Dolphins might have a bigger window for the superbowl with Lamar, I reckon.

I am not so sure Lamar will be available as the Ravens can always put the exclusive franchise tag on him and if the negotiations fail he will still have to play for the Ravens, however if Lamar wants out he could follow the formula that Kirk Cousins used to get out from the Commanders and receive the tag on consecutive years and by the third year the tag becomes so expensive the Ravens will have to let him go and only receive compensatory picks instead of actually trading for him. This is the only way I see Lamar opening a SB window for any team other than the Ravens, because if a trade has to take place for him to play at any other team then not only they will have to pay the huge salary of Lamar, severely limiting the option of bringing free agents, but a trade for him at minimum will entail 3 first round picks and this will limit the amount of talent which can be brought on the draft too. I could see that happening too. The problem is that franchise tag is so front heavy. Who knows what happens but that's probably the best scenario for everyone. Let's not ignore Lamar does get hurt and laying pit a $300 contract for a guy who can easily miss a quarter or half the games would wreck your squad. That cap is tough and expensive quarterbacks tend to constrain teams to not being able to get people around them. I'd steer clear if I was atlanta to be honest. My next question is which team would be the most to give the risk to trade Lamar for the type of contract that he wants. A contract very much similar to Massage Watson. Also, which team has the money to give Lamar his contract? The teams where I want to see Lamar go and that might also have the money are Miami Dolphins and the Las Vegas Raiders. They also need a good quarterback. |

|

|

|

|