* force miners move (even out of USA) instead of complying This could be the case if the move out of New York, including the costs to move itself, is cheaper than a transition to a renewable energy tariff. There are such electricity providers in the New York State (see a list here below), but I don't know how high their rates are, and many large scale miners depend currently on custom agreements with electricity producers to lower their costs. A move outside the US for local miners however should be expensive. * force miners shut down, even for a while (move out), leading to sudden drops (even if small) in the hash rate, hence to congestion on mempool

I seriously doubt there's so much mining in New York that a miner exodus would cause a hashrate drop. According to the source above, it seems to be one of the more expensive states when it comes to electricity costs. There seems to be a mining hotspot in the area near the Canadian border due to cheap hydro electricity, but these miners would be mostly compliant already. |

|

|

|

I know I'm probably in a minority here, but I think this law is actually a good thing, and it's similar to what I'm proposing in this thread. The faster the transition to renewables goes, the better, and once it's near 100%* anti-bitcoiners will lose their main argument** against Bitcoin. Even if you don't agree with it, a PoW ban (or better: a ban for companies to deal with PoW cryptos) like it was discussed in the EU is much, much worse. Remember: Bitcoin is constructed in a way that such kind of regulations for miners don't affect its functioning at all. The likely result if such policies were adopted around the world is that the hashrate/difficulty increase would be simply a bit slower (because of tighter profit margins for mining), or there could even be stagnation/slight diff decrease in bear markets. There's an absolute minimal chance that an 51% attacker could get a minuscule bit more chances (e.g. if some authoritarian regime lik North Korea tried to do it) but current hashrate is so high that this is close to impossible. *sources for current proportion of "renewable" mining at present vary in their estimations, I read between <40% and ~70%; the 58% estimation for Q4 2021 by the Bitcoin Mining Council seems a reasonable value but I wouldn't rule out the 40% due to likely greenwashing by the BMC by buying CO2 certificates. There's some way to go still, imo. **Yeah, there's also the "criminals laundering money" FUD, but this is much less convincing as Bitcoin and cryptos in general (even Monero) are only useful in the early phases of money laundering; it doesn't seem to give any advantage for the goal to insert the money in the legal banking system. |

|

|

|

Wenn ich mir die dicke rote Kerze von heute so anschaue glaub ich nicht das wir inzwischen wieder im Bullenmarkt sondern eher am Weg zur Kapitulation sind.

Die Kerze sehe ich noch nicht kritisch, es blieb oberhalb der untersten Linie. Wir sind vielleicht schon nahe genug an dieser Linie (37.7K bisheriges Tief), dass dieser Dip als Bestätigung der Unterstützungslinie gelten könnte. Dann müsste der Kurs allerdings in den nächsten Tagen reagieren und schnell wieder über die zweitunterste Linie (also ~40-41K) steigen. Im Moment sieht es eher verhalten aus, aber vielleicht kommt ja noch ein Tief näher an den 37K und dann die Reaktion. @Unknown01: für die Kapitulation könnte ich mir zwei Szenarien vorstellen: entweder ein Kampf um die 29-30K und dann nach viel Volumen wieder aufwärts, oder ein Dip in die Region 20-25K. Interessant wäre natürlich, was passiert, wenn Bitcoin noch tiefer fallen sollte: ein Kurs unter einem alten ATH "gab es noch nie". Allerdings bewegt sich der Kurs sowieso seit 2019 viel unregelmäßiger als vorher mit den klaren Bullen- und Bärenphasen, vielleicht macht das dann gar nicht mehr so viel aus. |

|

|

|

Esta parte es así, aunque entiendo que cada vez con más trabas, y siempre además con traza en el Exchange y el banco de salida que, si no hoy, el día de mañana pueden servir de base para la entrega de información acerca de potenciales blanqueos.

Claro, este último paso, el "blanqueo" de verdad, en la operación con criptomonedas seguramente es el más difícil. Creo que por la atención que las autoridades les están prestando a las cripto, calculo que debe ser aún más difícil que operar con efectivo; ya que un negocio para el cual es habitual un pago en efectivo no llama la atención, mientras que uno que cobre principalmente con bitcoin/criptomonedas sí. (Por el otro lado, está la ya mencionada ventaja que es un medio electrónico y los costos para transportarlo y transferirlo son más bajos). Muy interesante post @famososMuertos, el "pago a asociados" en Bitcoin seguramente debe ser una de las operaciones para las que más convienen las criptomonedas, pero ahí también nos queda el último paso: el asociado debe entonces cambiarlo a dinero fiat en un exchange para realmente blanquearlo, y ahí volvemos al problema de antes. Idem con la técnica del cajero automático. Mi conclusión hasta ahora es que las criptomonedas no son de ninguna manera la "solución milagrosa" para el lavado de dinero como las quieren presentar algunos políticos y medios, sino sirven para algunos pocos pasos pero para otros complican aún más el "blanqueo" por ser mucho más rastreable; un error en la operación debe pagarse mucho más caro que usando el efectivo o el "smurfing" tradicional con pequeños montos en distintas cuentas bancarias. Aún usando los exchanges "de las islas Sandwich", transferencias grandes o muchas pequeñas de un solo exchange llamarían la atención a los bancos, y tantos de estos exchanges no quedan para montos muy grandes. Al final terminás necesitando "un banco de confianza". |

|

|

|

Ich hab mal wieder ein bisschen Kursarchäologie betrieben und mal nachgeschaut, ob in einem der vorigen Bärenmärkte (2014 und 2018) eine derartig "langsam positive Tendenz" wie jetzt der leicht positive Trend seit Anfang 2022 zu finden war. Sind ja inzwischen fast 4 Monate, die der Kurs an dieser Linie entlangkrebst. 2018 wurde ich nicht fündig, die längsten bullischen Wellen waren da rund 1,5 Monate lang (April bis Mitte Mai). In der zweiten Jahreshälfte gab es allerdings einen langen Seitwärtsmarkt, nach der die endgültige Kapitulation folgte (danach gings wieder langsam hoch). 2014 gab es immerhin zweimal 2-monatige Zwischen-Bullentrends: April bis Juni (recht steil) und Oktober bis Dezember (flach). Auch hier mündete die zweite Phase in die endgültige Kapitulation. Was sagt das uns (wenn überhaupt)? Entweder die Kapitulation ist nahe oder wir sind inzwischen wieder in einem Bullenmarkt angelangt (dann waren die ~32900 das Tief), aber eben in der ersten, noch verhaltenen Phase. Oder es kommt ganz anders  |

|

|

|

|

@stompix: The entire point of the thread is that renewables are still (in many regions) not the cheapest option. So again, miners need additional incentives to change to 100% renewables. But if current tendencies continue, then this will be the case in 5 years or less. So the goal would be to get miners to operate now as if costs were from 2027.

6.8 ct/kWh is indeed a likely correct solar production cost for 2019 (the LCOE calculation includes capital costs and fuel costs, the latter are low in renewable plants as fuel is only needed for auxiliary machinery). But this was three years ago; if we continue with the tendency of 13% price fall per year, then we have 5.91 cents for 2020, 5.15 cents for 2021 and 4.48 for 2022. And this would be the global average, not the price in the "best" regions. The Lazard study from 2020 mentioned in the second link even claimed <4 ct, but that may be too optimistic; these costs may be appropiate for places like Mexico but not for Europe.

Ouarzazate has also the advantage that it's mostly a CSP plant and produces some energy also at nighttime due to molten salt storage. So one can say it's a higher quality electricity than that coming from PV panels or wind turbines with a more uneven production which justifies a higher cost. A more modern CSP plant, Cerro Dominador in Chile (inaugurated in 2021), has already a better efficiency: it costed 1 billion USD for a production of 950 MWh/year. With operation costs and assuming 40 years of operation we're getting values slightly over 4 ct/kWh.

|

|

|

|

Buena idea este hilo! A mi también personalmente me parece que el dinero fiat es mucho más apropiado para lavar/blanquear dinero. Pero seguramente para algo les pueden servir las criptomonedas a los (ciber)criminales. Algunos comentarios: 2. El P2P

Esto ni si quiera es blanquear nada. Yo puedo comprarle a mi vecino 20 millones de $ en Bitcoin con dinero negro fiat, pero no estoy blanqueando nada. El dinero no ingresa dentro del marco económico legal. Simplemente lo que he hecho ha sido pasarle el marrón a otro. Si lograste "pasarle el marrón a otro" (alguien no involucrado) entonces has alcanzado tu meta de blanquear el dinero  Sin embargo creo que lo que querías decir era: que un intercambio fiat/btc, si se tratara de un intercambio efectivo/btc, efectivamente "no blanquea nada" porque no está involucrado el circuito "formal", o de intercambios "bancarios". El tema dónde se pone interesante es si creás un negocio o varios (ni siquiera es necesario que sean compañías, puede haber gente cuentapropista que colabore) y te pagás a ti mismo por prestaciones o bienes/servicios que no se pueden trazar con los Bitcoins que compraste con el dinero "negro". Este negocio entonces tiene ingresos "blanqueados" que luego puede convertir a fiat a través de un exchange. Creo que este método sirve para hasta volúmenes de dinero medianos. 3. Los exchanges de las Islas del Sandwitch

Creo que el tema de las criptomonedas es que no sirven tanto para "blanquear" en si, sino para hacer operaciones previas al blanqueo. Hacer desaparecer la conexión entre el hecho delictivo y un paso intermedio previo al blanqueo. Los exchanges de las Islas del Sandwich pueden servir si son exchanges cripto-cripto, haciendo desaparecer la conexión entre la "transacción X" con el dinero que (por ejemplo) te ingresó a través de una estafa con ransomware, y varias "transacciones Y" que son las que vas a usar para finalmente "blanquear" el dinero. El lavado de dinero siempre tiene muchos pasos, y las criptomonedas en mi opinión solo sirven para los primeros pasos, pueden en algunos casos acortar el camino, ya que si el dinero negro ingresó por el sistema bancario (por ejemplo, una cuenta robada) el blanqueo es todavía más complicado. Pero hay pocos casos que me puedo imaginar en los que la criptomoneda sea superior para "blanquear" al dinero en efectivo. Aquí la cripto tiene menores tiempos y costos para las transferencias, pero también es mucho más trazable. Aún los exchanges de las Islas Sandwich pueden cooperar de forma inesperada con la policía, y en casos de estafa en exchanges P2P puede ser que "vuelen" también algunos cuya intención sea lavar dinero. Y para el último paso, el blanqueo total para pasar al sistema formal, las criptos no sirven; definitivamente se trata "de un problema del fiat". |

|

|

|

Add Russia which has tons of oil it can't sell, Nigeria has the same problem, Indonesia which is the biggest coal exporter...

In the case of Russia you're right but this problem should be temporary (at least I hope so). But countries with a weak power grid like Nigeria wouldn't be very happy with a sudden "invasion" of miners. They could require them to work off-grid but if they use fossil fuel (which would not make much sense anyway cost-wise) and emissions are too high, there would for sure be protests and populist governments in these situations tend to ban or restrict it. Indonesia seems to be Bitcoin-friendly for now but that could also change in such a case. Both Nigeria and Indonesia are densely populated so excessive pollution by "Bitcoin factories" for sure wouldn't be very popular. Maybe there will be some "regulatory islands" in the world but it will probably be not significant enough to counter the incentives for renewables-based mining if most bigger countries adopt an "miners must go CO2-neutral" policy. Renewables are profitable only with subsidies. That was the case until a couple of years ago, so it still applies to the Ouarzazate plant which was begun in 2013. But the tendency goes into the opposite direction. From 2013 to now the prices for solar energy fell by more than half according to this source and this wikipedia article shows (with many other sources/graphs) that they're increasingly competitive. If renewables would be cheaper we wouldn't have to subsidize them while taxing fossil.

There were already cases in some countries where an unexpected (and un-subsidiarized) renewable energy boom was responded with taxation, like in Spain in the early 2010s. You may be right that the equation "renewables are cheaper than fossil" is still not true in a large part of the world, but the tendency goes clearly into this direction, see above. But until this point has been reached (I expect it to take ~5 years more), if you want miners to be climate-friendly you have to provide them additional incentives. (Small miners don't matter, the proposal is for large-scale operations) One can of course ignore the problem, or wait for it to resolve. But that would mean to empower the fraction which thinks that a Bitcoin ban is needed (and those that abuse that argument). And we've already discussed the California graph in another thread. I'm still not convinced.  if the price goes down less energy is spent, Bitcoin can perfectly work with 100 exahash, consuming 50% of the energy used now.

Agree somewhat here, but a tighter profit calculation would also prevent miners to go for renewable energy, as long as they're still more expensive than fossil fuels. So a ban followed by a price crash could actually punish those miners who have invested in ecologically-friendly electricity. Less energy would be used for mining, but the proportion of "dirty" energy would be higher. And I agree with 1miau that a price crash won't necessarily happen after a PoW ban. Bitcoin could even still be traded in Europe, in the form of wBTC-like tokens on PoS blockchains. So if miners need to switch to a green energy grid then we will need to invest into lands, power wind fields, ocean mills, solar panel. For large corporation who has thousands of miners running, I am way doubtful that it will full-fill the need in very short area. The electricity generated with the renewable sources is not steady and it highly depends on atmospheres and climate change. They don't need to buy all the infrastructure in the same region. Unless miners aren't the primary electricity consumer of a region there should be no scarcity problem. There would be catastrophic failure to the network if big rigs keep rebooting due to power shortages all around the globe. Are you referring to the bitcoin network? That wouldn't matter at all, difficulty would become a bit lower only if miners mine a bit less (the nodes that matter for the BTC network are mining pools, not miners themselves). If you referred to electricity networks (which would be a problem) then thats what I targeted with the second part of the OP proposal - miners would have to mine in a way power grids aren't affected. It's like with a large factory: they must have an adequate connection.

Secondly, why are we forcing bitcoin mining in the direction of renewable energy tariffs again?

Because renewable tariffs provide incentives for the expansion of renewable power plants. The only ones who aren't convinced yet, are either those who have no idea how the system works (see cleanupbitcoin.com) or those who want to diminish decentralization. Agree in your stance against cleanupbitcoin.com, but not on your conclusion. A transition to a "almost 100%" proportion of renewables would have only advantages (also that you're robbing the anti-decentralization folks one of their arguments) and I don't see where it should be favouring centralization. You can't really begin to compare the highly efficient and expensive fuel used in an airplane like Boeing 747 with the lowest quality dirt cheap gasoil with a lot of impurities used here. Not to mention that the plane would emit CO2 while this is emitting SO2 which is worse.

The kind of fuel doesn't change much (I'd argue that the burning process in a stationary engine should be more efficient than in an aircraft), the point is that the aircraft provides a service to 300-500 persons a day, while the power plant provides a basic, everyday service for around one million people. It's comparing apples with oranges, such a big plant (as all factories etc.) will always consume some fossil fuels. @thecodebear, @1miau: Agree with your proposals. These would be a bit less harsh than the one outlined in the OP, and that would be probably better. I also am thinking about opt-in models, with reduced taxes or cheaper electricity in exchange for going 100%-renewable (and shutting down in power shortage situations). It's not that I'm wanting to lobby for the OP proposal exclusively. What I want to achieve is a discussion which could lead in to proposals which could be presented to e.g. the EU authorities as an alternative for a PoW ban. I consider PoW an outstanding achievement of Bitcoin and all alternatives until now have severe shortcomings. That's the reason for this thread and I'm quite happy with the development of the discussion, even if many don't agree with me here  |

|

|

|

Also muss man das so lesen: "Mr. Whale is secretly buying your Bitcoins and doesn't want you to know"?  Ich meine das mit den 30 $ bei El Salvador war schon extrem "fishy" und durchschaubar. Das habe ich auch damals in den entsprechenden Threads (leider nicht mehr ohne Internet-Archäologie auffindbar) kritisiert. Allerdings gab es danach tatsächlich noch einige Gelegenheiten, die Coins für einen besseren Kurs zurückzuverkaufen. Interessante bullische Bewegung aber heute nach dem Dip gestern Nacht. Vielleicht angetrieben von Dogecoin und den Twitter-Ankündigungen (i.e. "irgendwas mit Blockchain blablabla") des reichsten Manns der Welt, oder halt wieder von irgendwelchen Zwischenlinien ... die 37K der untersten (kurzfristigen) bullischen Linie wurden ja noch nicht touchiert. |

|

|

|

...an den Linien

Ja, sehe ich ähnlich, da werden wohl einige Bots dann eben wieder verkauft haben, weil das Momentum über die entsprechenden MAs zu kommen noch nicht da war. Vom Sentiment her würde ich tatsächlich wohl drauf tippen, dass die untere Linie (die jetzt bei ca. 37000 liegt) noch mal getestet wird. Wir waren ja schon mal nah dran, aber noch nicht ganz. Hält diese sehe ich eigentlich viel Potenzial nach oben. Das aber diese Vorhersage im Prognose-Gewinnspielthread bis Ende Juni gerissen wird ist wohl eher unwahrscheinlich  (aber völlig ausschließen würde ich es auch nicht) Zum Thema EU PoW ban: Ich glaube nicht, dass das kommt. Wie aber hier geschrieben fehlt es an deutsch- und generell nicht-englischsprachigen guten Infos zum Thema "Nein, Proof of Stake ist nicht die (beste) Lösung!". Daher denke ich an einen entsprechenden Blogpost. Ich bleibe grundsätzlich bei dem Standpunkt: PoW muss überwiegend (>95%, und nicht nur durch Zertifikatekauf!) klimaneutral werden und am besten schon in den nächsten 2-3 Jahren wesentliche Fortschritte machen. Dann würde diese Initiative ins Leere laufen (und könnte auch nicht durch die ausgenutzt werden, denen Bitcoin aus anderen Gründen ein Dorn im Auge ist). |

|

|

|

Anyhow, would this be something that you believe would be required to be proven before being allowed to mine? The only issue I see with something like this, is largely the problem of centralisation, which obviously goes against what Bitcoin stands for. We would need a central authority to verify that the miners are using green energy, but also they would need to do it without bias, and would actually need to be able to verify it. How do you verify that you're using green energy? Would it be photos which could easily be manipulated or would it be a in person visit, which could potentially anonymise anyone wishing to stay anonymous. The proposal would be aimed at large scale miners, not so much to the Bitcoin nerd who mines some alts with GPU or Bitcoin with a handful of miners - i.e. when you need an industrial-scale power connection, then you would be affected by this regulation. In most countries these miners have actually already to be registered with the authorities to be able to do their business legally, so I don't see major issues here. Monitoring would take place via smart meters, so the availability of renewable electricity would be compared in realtime with the consumption of the miner. For privacy concerns, I think the (already common) housing model - where the mining hardware is inside a data center but managed by a third person - is good enough. The data center would then register for the mining permit, but the persons investing the money (and collecting rewards) can stay anonymous. Of course this would lead to a specialization of data centers who allow mining and those that do not (and don't need the permit) which would increase costs, but all this could generate is a slight difficulty increase. Didn't a study in the US demonstrate just that a few months ago? I think that's the study by the Bitcoin Mining Council I cited in the OP, where 58% of mining energy was estimated to be renewable. The problem is that 1) 42% are still a lot of fossil electricity and 2) most of this fossil electricity is likely to be used in timeframes where there's a general renewable energy scarcity, i.e. in winter nights without much wind. What's the purpose of this? To act in accordance with politicians, whose intentions are clearly against the ideals of bitcoin, and to zip the lips of the greenwashed who're misinformed of the way bitcoin works? I don't care.

The purpose is to state an alternative for regulators which would avoid further damage to the Bitcoin ecosystem - which is already happening by the action of countries like China, and is likely to worsen if the EU enacts similar laws, as a lot of countries could follow their example. Instead, the idea is to further boost a change which will need to happen if Bitcoin does't want to collide with efforts to improve environmental friendliness. The development is already going into the right direction but 1% improvement in the renewable/non renewable rate per quarter (according to the BMC study) is too slow. The examples you point out of course should also be considered sustainable sources. Let me tell you how this will end.

It will kill all bitcoin mining in Europe and North America and Australia and it will move all of it back to some country that doesn't give a damn about the environment as long as coal-produced electricity is 3 times cheaper. If this happens, I doubt these countries will stay behind and not enact a similar regulation. You cited China which has already banned mining, and India has considered ultra-hard anti-Bitcoin regulation. The choice at the end will be: 1) Bitcoin/PoW ban or 2) transition of mining towards 100% renewables. Of course it would be better if 2) is achieved without any regulation purely by market forces. But the danger of 1) becoming widespread is real. See this thread. Why hasn't this happened to date?

Why haven't miners flocked to the deserts of Nevada and run their own off-grid panels? Because $ that's it! Exactly. That's why perhaps regulation is needed and market forces are still not strong enough. A further 30-50% cost decrease for renewable energy could make regulation unnecessary, but it's perhaps too slow. The only way miners are able to get cheap renewable energy is when this energy can't be moved somewhere else, take Iceland for example. I actually don't see a big difference between both situations. The goal of the proposal is to get the "renewable mining cost < non-renewable mining cost" equation to actually work, which still isn't always the case. In the case of this proposal it would be a relatively "authoritarian" measure towards miners, but still much better than the Chinese or proposed EU normative. Because they know the whole 70-80-90% green energy is just for show, just like Google lies about going 100% renewables.

[...]

So they just pay for green certificates that magically make your coal energy solar because you paid money! I completely agree with you here that a lot of greenwashing occurs, and that's why in my proposal in the OP CO2 certificates would not be allowed; there would be a direct control by smart metering. I think that all businesses should face similar regulations in that regard.

There are already regulations of this kind for industries with a large energy consumption. For example, in France almost every winter there's electricity shortage and some industries are then cut off the grid for some hours of the day. There are also countries where there's an "opt-in" regulation like in Argentina: if you agree to reduce your consumption in times of shortage, then you pay less for your electricity. So the basics of that concept aren't that new. An opt-in regulation like in Argentina but with carbon neutrality requirement would actually also be interesting, but it would be more complex. @pooya87: 19 tons/day is nothing for a 500+ MW plant. It's comparable with the consumption of a single aircraft. A Boeing 747 consumes 10-11 tonnes per hour! @Lucius: See my answer to BlackHatCoiner. @Dunamisx: Thanks for the examples, as I wrote to BlackHatCoiner these techniques are obviously sustainable, although their potential isn't as big as renewable energies (and will likely decrease over time). |

|

|

|

Also wenn du mich fragst würdest du dich doch perfekt dafür anbieten. Du hast die Fähigkeiten und auch das passende know-how. Was sagst du dazu? Ich würde sagen wir stimmen gleich mal ab  Ich plane ja schon was in die Richtung, allerdings würde es nicht für ein "Leitmedium" reichen, da mir die entsprechenden Kontakte fehlen. Eine Idee wäre der Blogbereich im Freitag. Da hätte man auch die Mitte-Links-Klientel als Leser, die ja "aufgeklärt" werden soll. (Sven Giegold dagegen ist schon ein verlorener Fall, denke ich). Wenn aber jemand in der Richtung journalistisch tätig ist oder Ideen hat, wie man so einen Artikel "platzieren" könnte, helfe ich natürlich gerne mit

Edit: Artikel ist online: Nein, Proof of Stake ist nicht besser als Bitcoin |

|

|

|

The point is that it would be naive to think countries that are using the term "ban PoW" are concerned about environment or are banning "PoW". The truth is that they are banning "decentralized" bitcoin that they can not control. I assure you if bitcoin wasn't even using a single megawatt of electricity they still would want to ban it.

Even if this was true (I believe there are two factions: authoritarian/"old-banking"-lobbyist politicians, and actual eco-idealists with poor formation in computing/blockchain - this proposal is aimed at the second group), then it would be strategically intelligent to make proposals which actually achieve the goals they claim to achieve with their "PoW-ban" regulation ideas. A mining regulation requiring them to be carbon-neutral would act directly against the carbon footprint of the industry, while a ban would not (because crypto industry would simply move into other countries, and in Europe you would trade wBTC instead). So it would be the better alternative for everybody ... with the exception of the authoritarians. Renewable energy being abundant in the Sahara Desert?Are you kidding me?

Are there any big solar power plants in the Sahara desert? You're wrong: Ouarzazate power plant1.Nobody wants to work in the Sahara Desert. There are actually people living there already.  (Or: If you go a little bit east, you have places like Dubai with a similar climate. It's not necessary to go into the deepest Central Sahara, southern Morocco/Tunisia is also ok.) 2.The solar panels will have to be cleaned from all the dust on a daily basis. True, but there are solutions for that, there's also a big solar plant in the Atacama desert in Chile. Anyway, I think the Sahara desert isn't the ideal place (the South American Altiplano is better, for example, due to lower temperatures) but a good one close to Europe, which has some advantages (fast internet connections nearby, etc.). All this "environmental-friendly regulation of Bitcoin mining" is a big pile of s*it.

So you prefer a Bitcoin ban?  Apart from the other issues raised above, i also wonder how you'd do this on a technical level without touching the core values of bitcoin. This is not a technical proposal so the Bitcoin software would not be affected at all. It's an idea how governments, if they're really concerned with environment and climate, could regulate the mining sector in their jurisdictions. Instead of outright banning it like China did, this is a possibility to make it 100% carbon neutral, without affecting the operation and decentralization of Bitcoin at all. |

|

|

|

Bitcoin's Proof of Work has been seriously criticized in the past years for its high energy consumption. While the CBECI index from the University of Cambridge is most likely overestimating the electricity consumption, it cannot be negated that the problem would be substantial if this electricity was generated majorly from fossil fuels, primarily from coal (although numbers are disputed*, see below). Some jurisdictions, primarily the EU, have considered severe restrictions for Proof of Work cryptocurrencies like Bitcoin. The EU proposal, which was rejected in early April, aimed at banning trading and other services for PoW currencies for EU companies, which would have forced all EU exchanges to delist Bitcoin (and other PoW currencies like Litecoin and Monero). Often in the justifications for the regulation Proof of Stake is mentioned as a "better" and "more environmental friendly" consensus method. However, PoS has a number of severe disadvantages, and relies on what's called " weak subjectivity", what means that the consensus is never completely objective and could be theoretically "faked" with sophisticated methods. It also favours centralization in much more direct ways than PoW. So a "PoW ban" or even a "PoW restriction" would threaten one of Bitcoin's main innovations. But instead of banning or restricting PoW currencies like Bitcoin, there is actually a much more promising alternative: Large-scale miners should have to demonstrate real carbon neutrality. This could mean miners could have two alternatives: 1) Mine disconnected from the grid with exclusively own renewable electricity. (For example they could use a solar park or wind turbines, and store the energy accordingly). 2) Mine connected to the grid with a "100% renewable energy tariff", but ensuring they don't rely on fossil electricity in cases of scarcity of renewable electricity. This could be achieved a) powering off the mining equipment in these situations, or b) investing directly in new renewable generation. Miners would have to be equipped with smart meters, so the authorities could ensure they obey these rules. The word real is emphasized because it wouldn't be enough to simply buy CO2 certificates (like some experts have proposed); they'd have to directly contribute to carbon-neutrality. This kind of regulation would have at least three effects which would help combat climate change: 1) it solves the problem of miners competing with households for renewable electricity, as this wouldn't be allowed anymore (they can only mine connected to the grid as long as there is no renewables' scarcity, i.e. they can use "surplus" electricity), 2) provide a strong incentive for economies of scale in the renewable generation and storage industry, 3) provide a strong incentive to move to places where renewable energy is abundant (Sahara desert, some regions in South America like Patagonia, Brazil and the Altiplano, North American desert regions, Scandinavia/Iceland) Feedback is much appreciated! The idea is to create an article about this topic in several languages (above all, EU languages as there the discussion about a de facto PoW ban hasn't stopped) to contribute to the discussion in a constructive way and preventing catastrophic decisions by politicians, without negating the problem. *Estimations diverge, a recent one from the Bitcoin Mining Council claims 58% is coming from renewables, but this would be still 42% from fossil fuels and (probably on a much smaller scale) nuclear energy. |

|

|

|

No me hagáis mucho caso, yo no lo entiendo completamente (tampoco sé si se puede con Bitcoin); pero creo que una forma bastante rentable y segura de ganar criptomonedas es proveyendo liquidez a un token.

Básicamente comparte el mismo tipo de riesgo con el de ofrecer préstamos en criptos: Si el precio del token al que le proveés liquidez cae con respecto al Bitcoin, es probable que pierdas dinero. Hay otros riesgos, como un posible aumento del precio del "gas" en el caso de Ethereum: En este artículo hay un pequeño resumen. También está el rug pulling (ver aquí), es decir un abandono y una masiva venta por parte de los "desarrolladores" del token, que sin embargo es más que nada un problema cuando se trata de tokens relativamente nuevos y desconocidos (pero son estos obviamente los que dan más ganancias en el yield farming, otra vez: riesgo == posible ganancia). En síntesis: Es igual que con la mayoría de los métodos en el mundo financiero: "ganar" está íntimamente ligado a "asumir un riesgo". Puede ser, sin embargo, que en ciertos tipos de mercados el riesgo sea menor que en un casino. |

|

|

|

Ich glaube, es ist wirklich an der Zeit, dass jemand mit entsprechend Expertise mal in einem deutschen Leitmedium einen Artikel veröffentlicht, der erklärt, dass PoS nicht eine Alternative, und schon gar keine "bessere" oder "modernere", zu PoW ist. Denn hinter der Position verschiedener Parteien des Mitte-Links-Lagers zu PoW dürfte vor allem Unwissen stehen. Es scheint kaum deutschsprachige Texte zu geben, die beispielsweise das Nothing-at-Stake-Problem wirklich gut erklären (stattdessen liest man dann Sachen wie diesen oberflächlichen Artikel bei Bitpanda, wo N@S halt so als ein Nachteil unter vielen dargestellt wird). Auch habe ich letzt mal wieder im SPIEGEL einen Artikel gelesen, der am Anfang zwar gut die Ursprünge der Kryptowährungen erklärt, aber dann am Ende z.B. Polkadot über die Maßen lobt und suggeriert, Bitcoin sei veraltet (wieder ein Beleg für den Abstieg dieses einst ehrbaren deutschen Leitmediums). Ich bin ja selbst PoS nicht "feindlich" eingestellt, wie ich u.a. in diesem Thread schrieb. Aber die weit bessere Berechenbarkeit und höhere Objektivität von PoW dürfte eigentlich allen Informatikern (die nicht von irgendeinem Shitcoin"projekt" bezahlt werden) klar sein. PoS braucht immer von irgend einer Seite her "weak subjectivity", und das ist eine klare Schwäche des Konzepts. Würde PoW so eingeschränkt, wie es einige in der EU planen (also Handelsverbot auf offiziellen kommerziellen Plattformen innerhalb der EU, Verbot von Dienstleistungen/Verwahrgeschäft), so dürfte damit eine der Hauptinnovationen der gesamten Kryptowährungs-Szene hart zurückgeworfen werden. "Verboten" wäre Bitcoin damit zwar noch nicht, aber doch der Umgang damit deutlich erschwert, gerade für wenig technisch Vorgebildete. PS: Hab mal im englischen Forum eine Idee vorgestellt, wie eine wirklich umweltfreundliche Bitcoin/Mining-Regulierung aussehen könnte, bei der keinerlei Konkurrenz mit anderen Verbrauchern um EE-Strom bestehen würde. |

|

|

|

Mich stört an dem offenen Brief, dass da ausgerechnet ein "zentralisiertes DeFi"-Unternehmen dahintersteckt. Dabei sollte eine solche Initiative von den Nutzern selbst ausgehen. Das macht diesen offenen Brief angreifbar. Das "jede Person" in Punkt 2 ist zudem falsch, da nur Personen betroffen wären, die professionell NFTs selbst erstellen und anbieten, also in dem Fall Unternehmer sind. Bei Unternehmen nur die, die eigene NFTs kreieren. Der allerwichtigste Punkt ist dagegen imo ganz klar Punkt 3, der viel weiter vertieft werden sollte, da durch die neue Regelung irgendwann jeder Bitcoin-User, der auch einen zentralisierten Dienst nutzt, potenziell in Gefahr kommt seine persönlichen Daten zu verlieren, es braucht ja nur einen gehackten Dienst in der Transaktionskette dafür. In diesem exzellenten Beitrag hier im Forum finden sich da einige Punkte. Edit: Außerdem steht die Regulierung sozusagen im Widerspruch zur DSGVO, die EU würde also zwei diametral entgegengesetzte Ziele verfolgen. |

|

|

|

I think that many years ago when mining was a significant way to obtain bitcoins, there may have been something close to a price floor determined by the cost of mining. That was because if mining became unprofitable for some miners, they would buy them instead. The increase in demand from these ex-miners would cause the price to rise toward the cost of mining.

This is basically version 2 of the theory I outlined in the OP. Thinking a bit about it, I think this could have been worked - but mainly in bull markets or sideways markets. In these cases, the miners aren't driven out due to a price drop, but due to a disproportionate hashrate/difficulty increase (superior to the BTC/USD price increase) which makes mining unprofitable for them. If there's still positive sentiment, then they can hope for a short term price increase and thus the "miners become buyers" could make some sense even at a larger scale. This would, however, not constitute a "floor" for a bear market but even generate more FOMO for the bull market. While this is obviously also possible in bear markets from ex-miners who believe that Bitcoin is undervalued, these ex-miners need deep pockets for that to have any positive effect that exceeds the (already present) effect of "Bitcoin believers" who buy BTC in bear markets but have never mined, because of the long periods they would have to hodl to make profit (e.g. between mid-2014 and mid-2016). I think you may be right that there may have been a small "floor" effect let's say in the late 2011 bear market when CPU miners were still the norm, and those who mined in 2010 and early 2011 and sold in the bubble phase in mid-2011 were massively able to buy the $2 bitcoins of late 2011. But since mining is an optimized industry I don't believe this to be possible, at least not at a large scale. I believe at least in 2018 this should already have been the case, so I think my conclusion still is valid. @stompix: Fair enough. I don't think they can permit themselves everything (and even less so in bear markets), but they may have a larger margin to operate than one could believe at a first glance. |

|

|

|

I think is a bit simpler (or should I say complex?) than that. If the price of bitcoin goes below the floor, plenty of miners would stop and in the next halving the difficulty would decrease, along with the cost of mining going back to an equilibrium.

Yes, this is the base I also part from in the OP, which leads to my disagreement with both variants of the "floor" theory. (I think you didn't mean "halving" but "difficulty adjustment"). Of course, there are situations where smaller miners are driven permanently out of the game, mainly in longer bear markets, because if they have to stop operations and then start again after a diff adjustment, their rentability is much lower than that of those who can stay inside the business, so they'll be slowly driven out. This happened with CPU and GPU miners a long time ago (in the period 2011-2014). Once the difficulty has then adjusted, this leads probably to a higher market share for the more "optimized", bigger mining farms. There may be new entrants of the "smaller miner" class, but it's more difficult to enter a market than to stay inside, so I don't think it outweights those smaller miners leaving the business. (This means that I'm now thinking a bit different than what I wrote in my second post in 2018. But this doesn't modify my thinking about the "floor" theory.) However, such an event would even be more bearish for the price, because to cover costs from the shutdown of operations, and to rescue at least a part of the capital, the bankrupt miners will sell all their coins they could perhaps have hodled (speculating on a price increase which didn't come) as fast as possible. This should counter the effect of the "floor" theories mentioned in the OP adding more BTC to the supply. @kryptqnick: The category you're mentioning would be also invalidate the floor, one could call them "hoping unsuccessful miners". However, some of these would have to shut down operations due to pressures (growing debt, diminishing investment funds, etc.). Conclusion: As everybody and their mother basically agrees with me here that the "price floor" doesn't exist, I think we can bury this "mining cost price floor" theory as a strange piece of 2018 economic esotericism. Perhaps the theory was born out of frustration with the bear market of this year, to create at least a bit of hope. But ... as history told us from 2019 onwards, the theory wasn't needed.  |

|

|

|

Definitiv, ja. Ich fürchte aber, das ist für jemanden vollkommen "Unbedarften" nicht machbar und/oder nachvollziehbar.

Hier im Thread gings ja um die Eltern von 1337leet die im Falle seines Ablebens die Coins erben sollten. Das würde ja voraussetzen, dass bspw. sein Vater bereits ein Wallet o.ä. hat, dieser sich also wieder um die sichere Verwahrung des PKs usw. kümmern müsste, im schlimmsten Fall wär das dann "doppelt gemoppelt" (1337leet -> Eltern, Eltern -> 1337leet).

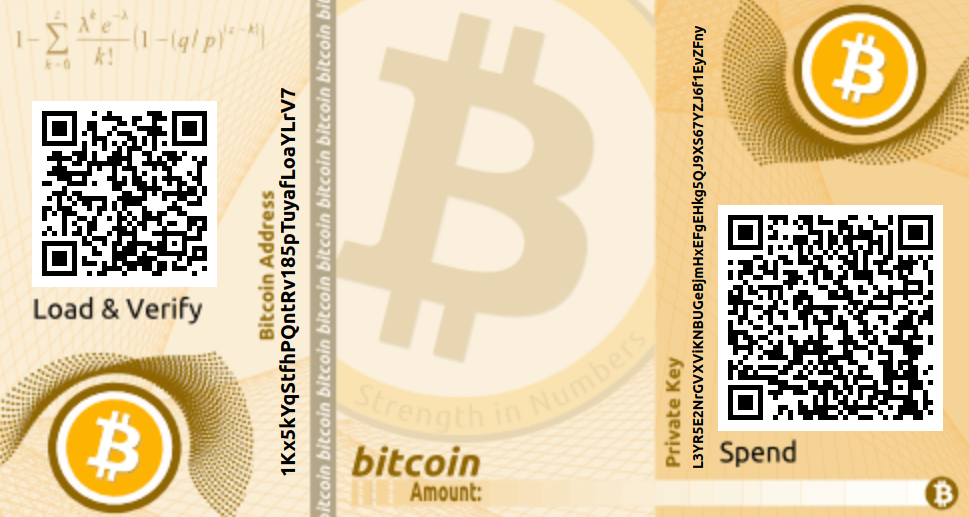

1337leet (oder "Alice" im Beispiel) kann ja den Eltern / Angehörigen eine Paperwallet erstellen und auch die Transaktion auf Papier ausdrucken. LoyceV hat bei seiner (etwas anderen) Methode auch beispielsweise eine "Recovery Sheet" erstellt, siehe hier: Am besten kann man das Ganze ja mit den Metallplatten-Gravierungsmethode von @willi9974 kombinieren.  Die große Gefahr ist ja nicht, dass die Angehörigen die Coins klauen, sondern dass sie entweder Opfer eines Malware-Angriffs werden, oder aber auch dass die physische Wallet (Paperwallet, Metallplatte etc.) gestohlen wird. Die Methode, die ich oben beschrieben habe, verhindert dieses Problem, solange Alice, also die "vererbende" Person lebt und reagieren kann (das gilt auch für LoyceV's Methode mit nLocktime). Sie transferiert die Coins einfach innerhalb des Zeitfensters zurück, erstellt einfach eine neue Wallet für den Erben und eine neue Transaktion. |

|

|

|

|