|

Yeah, that's for sure. I also believe that it has more of a future as a store of value than as a currency. If you live in the UK you can think of something similar but in pounds, those in the Euro zone in Euros, etc., but the frame of reference has always been the dollar. When global statistics of millionaires in the world are made, they take as a reference $1M, it is not worth counting those who have 1 million Bolivarian pesos, for example.

|

|

|

|

My reaction to the word "bitcoinaires" was that iut referred to people with a million Bitcoin. Well I haven't quite made it to that lofty height, but I am a Satoshiaire.  It would be more like to have so much in Bitcoin to buy a median house in the USA and 10X the USA household median income, to summarize what I said before. I think if Bitcoin is adopted massively, whether it replaces the dollar or not, that term, or some similar one will have to be used, because at the rate the Fed is printing, $1M is going to lose half purchasing power in a few years 1 a BTC is going to gain a lot of purchasing power. So, if 10 years from now, to give an example, we have a group of people whose main wealth is in Bitcoin, I guess it won't make much sense to call them millionaires. |

|

|

|

I am wondering if there are many bitcoinaires in this thred. I suppose you wouldn't disclose it, but I bet there are already some and that there will be more as price rises. |

|

|

|

Why should you care who holds Bitcoin - institutions, whales, or average people?

I was going to say this. In other words do not give everything to the big whales and try to remain in this select club because once you do it you may not be able to take them back. You may think you can but most probably you won't.

I see many people worried about the big whales nowadays but let's not forget that they are playing an important role in the rise in price. If Bitcoin ever gets and surpassed $1M they have will played an important role. Not everything is bad about them. I am more worried about my bitcoin plan than about them. |

|

|

|

Now after having this scam accusation I am feeling not good to be part of this campaign just because of this I remove signature have some serious issues just because of this unable to pay back any thing but still fighting hard for doing this all clear.

Hi mate you have written this like crap but also you are not telling all the truth here. It is not just that you are not feeling good and you allegedly are thinking of removing the signature. The truth is, when campaign manager @CryptopreneurBrainboss finds out he will kick you out of the campaign. He may give you some time to solve the issue but the rule is very clear: no people with red trust are allowed in the campaign. |

|

|

|

|

I've just realized that there is a member of this campaign who has merited many people just for applying. That's unacceptable! Merit is not moderated but you can still be red tagged. I am going to send him a PM and if he doesn't cease his actions I will act.

|

|

|

|

|

You sound like someone who has a lot of opinions about Bitcoin but doesn't own much.

I'll keep my keys and my Bitcoin.

In any case, if I had to leave something to a bank, I would do it the other way around, I would leave them a small part.

|

|

|

|

|

It will happen the same as it did recently when we hit $50k or shortly before when we broke $20k again. A big resistance will form. And in the case of $100k even more so.

When the price hits those round numbers it is hard to beat the ath because so many sell orders are placed at those levels. Then, once the level is beaten, it will cost little to get to $105k for example.

|

|

|

|

It has occurred to me that we could start to use the term bitcoinaire in the same way we use the term millionaire today. A millionaire is someone who has $1M net worth (assets minus liabilities). Let's say he has a $340k paid off house and $660k worth of mutual funds (and no debt). The term millionaire has always been used as a reference, but it is obvious that purchasing power has changed. Someone with $1M of wealth in 1980 had much more purchasing power than a millionaire today. Still, the term millionaire is still a good reference for someone who has accumulated a decent net worth, is financially stable, and is better off than most in economic terms. I will propose a frame of reference to be used as a basis for transferring it to the term bitconaire. A person with $1M net worth can buy a decent house in a developed country and, at least on paper, could live off the return on their investments without touching the principal. So, an American with a $340k paid off house and $660k in mutual funds, has a good house and, in theory, could live if he got a 10% annual return on that $660k. I've taken that house price because the U.S. median home price is $340,000. As for the mutual funds, in 2019 the median household income in the USA was $65k. 10% of the $650k would be $65k. So we can say that, to call someone a bitcoinaire, that person he would have to have enough bitcoin holdings to buy a mid-priced house in the USA and with the remainder he should have 10x the median household income. With this definition, we detach ourselves from the evolution of the price of the dollar or bitcoin. Today we still think in fiat terms but tomorrow Bitcoin may be the unit of account. Even Morgan Stanley recently stated that Bitcoin is Making Progress to Replace Dollar. I that happens, I think we won't be talking about millionaires any more but bitconaires. At current price ($57.5k) I am sure there are some bitconaires in this forum with 17.3 BTC or more. |

|

|

|

Red sunday incoming

Do you have any rational argument to back up what you say or is this just a hunch? |

|

|

|

|

Well, I wouldn't have said inevitable but in my opinion it is so likely that, okay, using hyperbole we can say that it is inevitable. What I find rather weak is the argument you make. What people want or don't want rarely ends up materializing in reality. It seems to me that there are strong arguments to think about it without relying on people's will.

It is pretty clear that institutions will gradually adopt Bitcoin, both for their reserves and as a means of payment. This will bring back retail FOMO, which has already started. In turn, this will bring a decrease in supply, because people will not want to sell (as is already happening) and with the deflationary nature of Bitcoin, the production of new Bitcoins will be less and less.

These seem like stronger arguments to me, but well, other than that, I congratulate you on holding since 2013. I sold a few small parts of what I have with the recent rise but have decided not to sell anything else at least until the next cycle (in about 4 years time). We have to look at this as a long term plan and I think you have done it very well in this regard.

|

|

|

|

And when the time comes, when these players can enjoy the benefits of having FUN tokens, they will realize the importance of FUN tokens and then it will rise its value. And at that point, some will say that they should have bought some for them.

Hi mate, I hope you are right because I bought FUN tokens but I think what you say doesn't make sense. In my opinion, the official launch date won't affect the price, unles FB does some buyback or something, because FB userbase already know about the potential benefits. The only difference will be that after the launch date they will start experiencing them. They will also be able to sell them, instead of only being able to buying them like now through the site. I think the pre-launch was designed to draw up the price (only allowing TB user to buy) but it has gone wrong especially in BTC terms because it is not so bad in $ terms. |

|

|

|

|

Bang it on!

No, no and no. If you read that link that you have put you will see that "Wallets with the most bitcoins belong to exchanges". Apart from that, I don't have a problem with few people owning a lot of Bitcoin, like early adopters, or Satoshi, or people who invest a lot of money nowadays.

Lately I'm hearing the same complaint from people who until recently were saying that Bitcoin is a scam and that it's going to go to 0 and that it's going to be banned....

Well, from those same people I hear lately that it is unfair that Bitcoin is badly distributed.

Moral of the story: buy Bitcoin and shut up your mouth.

|

|

|

|

|

What surprises me is all these people who get caught for ban evasion simply because they reuse the same address.... WTF? With how simple it is to create a new address. I suppose there will be many more who don't catch them because they use a new one. Although if they continue with the same habits they will end up with red trust or banned anyway.

|

|

|

|

I think we are going to cross $100k for sure. How far up above that I'm not sure but everything points to a very bullish year. Please, without any bases of Tesla and Elon did this and that so it will be a bull run.

So, how would you like us to make the prediction? Just by a hunch? By crystall-balling? Also, I know it's demand and supply is there any more reason heavy reason why you see that the bitcoin value could go up or down?

The only factor explaining the rise in price is the demand/supply ratio. But there are many factors influencing these two: for the demand, mainly institutional investors, not only Tesla and Elon but if other big companies like Apple join in, this is going to be very big. I'd say if Apple announces they are buying Bitcoin like Tesla we are going to pass the $200k mark. For supply, the massive printing by Central Banks which has accelerated due to Coronavirus crisis. There is the Supercycle theory predicting a top of between $800k and $1M this cycle precisely because of the institutional investors (and other factors). I see it like too exaggerated but I'd be delighted to be wrong. |

|

|

|

Just think about it: if I can use fiat currencies that constantly lose value of Bitcoin that it's the best at keeping it, which one am I going to use?

Assuming the day comes sometime in the future that people worldwide can and have chosen be paid with bitcoin for their wages/sales— would you prefer selling the bitcoin for fiat then spend it? Or just straight off spend the bitcoin instead? Well, I think if market cap increases, Bitcoin becomes a unit of account and people worldwide can be paid with it, there won't be that option. Fiat will have disappeared by then, or it won't be long. As long as there is coexistence of a crappy currency and one that is worth a lot, people will spend the crappy currency. And if there comes a time when the shitty currencies lose so much value that they collapse, the only option will be to spend Bitcoin. Although this is very hypothetical about the future and we don't know if by then a decent cryptocurrency may have appeared and/or taken an important role in our economy. One that is not as good as a store of value as bitcoin and is better for everyday payments. |

|

|

|

|

The problem with these posts is that they age very badly. The internet is full of posts and tweets, etc. saying that you shouldn't buy at $10 or $100 because the price was too high, or it was a bubble, and there was going to be a crash.

Just HODL.

|

|

|

|

This seems a hugely exaggerated claim.

I agree. I don't know why, it seems that the human tendency is to be unhappy. We have been waiting years for a price increase like this and lately I keep seeing posts like this: that if the Bitcoin is not distributed equally, that if the companies that are buying it are going to kill it... Now, this is where the crucial problem starts, because Bitcoin need on-chain transactions to generate income for the miners in the form of Miners fees. We know the Halving will ultimately reduce the Block reward to almost nothing and the miners fee will have to replace the Block reward as a method of payment for their processing power. What happens if transactions on-chain are replaced with off-chain transactions in ledgers? It reduces the available supply of coins and it also does not generate income for the miners. We know miners are not going to mine for free, so the on-chain transactions will not be able to confirm and the whole experiment will fail.  If companies take Bitcoin out of the circulation, they reduce the offer even more, thus driving up the price. The miners may get fewer transaction fees but they get more profits from they mined Bitcoins. Remember that there will be Bitcoins to mine until 2140, we can only guess what will happen then. Bitcoin may not even exist. You are too conspiratorial, it seems to me. |

|

|

|

Due to the scarcity of Bitcoin, it can never be used as money or currency. Whoever has even small portion of it, prefer to hold it till it's value appreciate to a level where he has made huge profit.

Bitcoin is seen by many as store of value. New adopters are buying it because they know it's price will shoot up and they find it as good investment.

I think this is the key factor here. Also, I mostly agree with Murad Mahmudov's Lindy Effect chart: ^take note that this was posted in 2018, so the "We are here" part might be outdated. I am not so sure about that. No matter how big the market cap is, or how low the fees are with LN developments, I think if Bitcoin is perceived as more valuable than other currencies (fiat and shitcoins) people will tend to store it instead of keeping it. That's what Gresham's law states. But it doesn't matter what Gresham said or not. Just think about it: if I can use fiat currencies that constantly lose value of Bitcoin that it's the best at keeping it, which one am I going to use? |

|

|

|

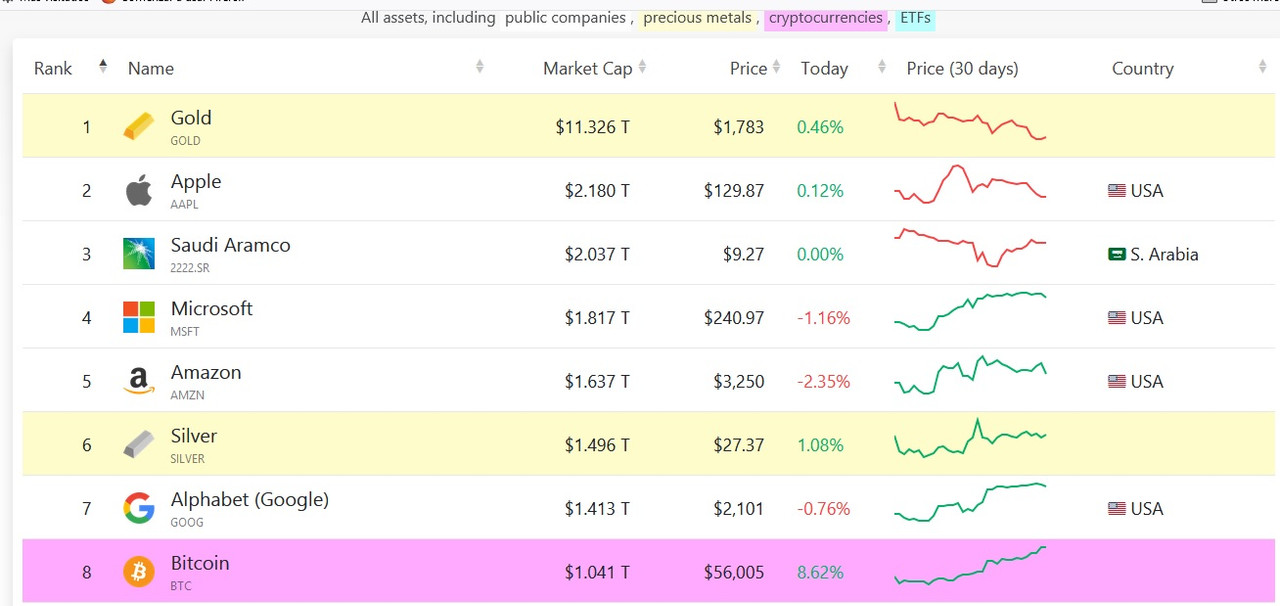

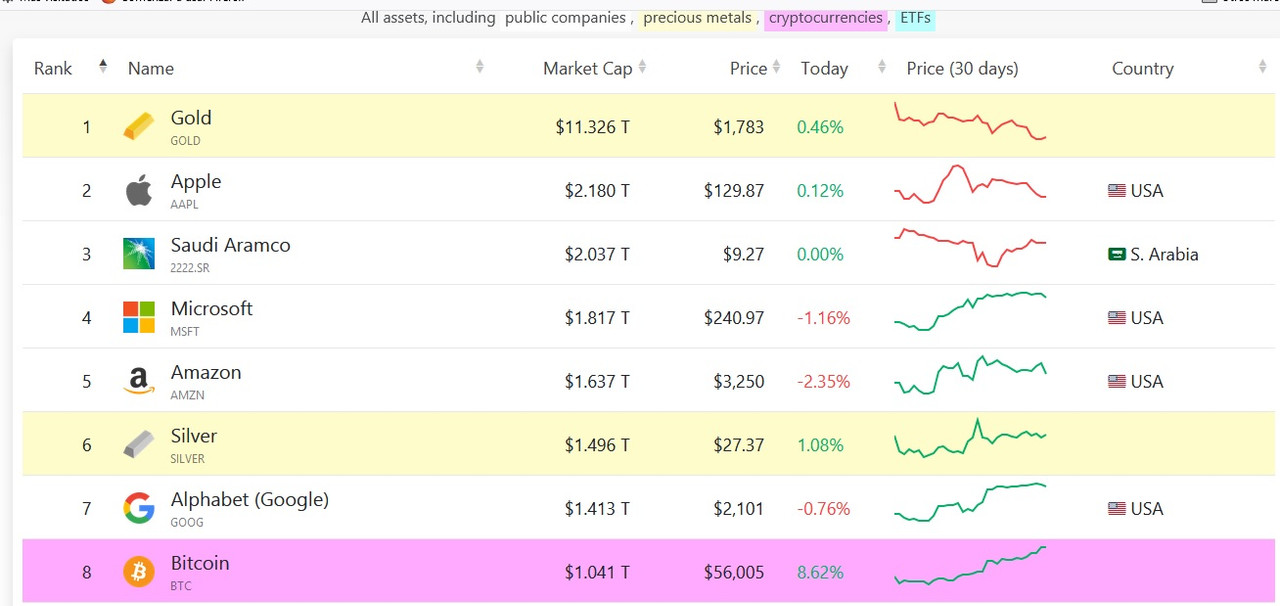

So your sources are probably different from his.

Hey, no. As I was thinking, that article is from back in April. Since then Silver Market Cap has more than doubled. https://companiesmarketcap.com/silver/marketcap/" Silver's Market Cap

Estimated Market Cap: $1.496 T

The Market Capitalization of Silver is currently arround $1.496 T.

This value was obtained by multiplying the current silver price ($27.37 per once) with the amount of silver that is estimated to have been mined so far." A good website to follow Bitcoin market cap vs other assets is: https://companiesmarketcap.com/assets-by-market-cap/ As you can see we aren't there yet but I don't think it will take too long with the current trend. |

|

|

|

|