makrospex

Sr. Member

Offline Offline

Activity: 728

Merit: 317

nothing to see here

|

|

May 15, 2019, 06:36:23 AM |

|

First i thought Austria is an april fool, but i learned it's not  I'm Austrian btw. |

|

|

|

|

|

|

|

|

|

|

|

No Gods or Kings. Only Bitcoin

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

machasm

|

|

May 15, 2019, 06:47:38 AM |

|

Go BTCitcoin Go! The woman iS cupping the scrotum of the Bitcoin bull. Try and see it any other way is futile. I would sm Gyrsur but Im out. +1WO merit |

|

|

|

|

|

Woodie

|

|

May 15, 2019, 06:55:07 AM |

|

That’s all very good and well. But the only alt coins that have shown any value to date so far are stable coins. And even they are quite dubious. Tether and Dai have shown us that current stable coins are not stable. They had one job....

Until we have at least one alt coin which has achieved something, I’m afraid your argument has no practical application, and is of theoretical interest only.

I personally cannot believe that tether still exists. Reason behind it been still alive could be because of the marketing strategies been used by some exchanges to try and keep tether alive and relevant by paying with tether certain tasks on the exchange

Nice strong comeback 600watt but toknormal does bring out some valid points too! (Both posts deserve some m*rit)  |

|

|

|

|

Gyrsur

Legendary

Offline Offline

Activity: 2856

Merit: 1518

Bitcoin Legal Tender Countries: 2 of 206

|

|

May 15, 2019, 06:56:44 AM

Last edit: May 15, 2019, 07:14:27 AM by Gyrsur |

|

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

May 15, 2019, 07:17:54 AM |

|

Just saw my first mention of Bitcoin in the local press in the last six months. The rally is just starting to filter into the public conscious

|

|

|

|

|

toknormal

Legendary

Offline Offline

Activity: 3066

Merit: 1188

|

|

May 15, 2019, 07:25:26 AM |

|

The institutions are finally figuring it out that it really is all about bitcoin and building trading, exchange, settlement and international transmittance layers on top of Bitcoin. Eh...they're not actually. They're figuring out it's about diversification. Not least because of 3 things: 1. no investor in possession of their senses doesn't diversify their portfolios within any asset class 2. they understand that monetary assets are not a natural monopoly 3. they understand that the most expensive asset in the class does not always have the most upside The "God made bitcoin so we don't need anything else" delusional hopium in this thread is quaint, but you already lost that war 5 years ago and diversification is a one-way street. That is one genie that does not go back in the bottle. |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

May 15, 2019, 07:38:29 AM

Last edit: May 15, 2019, 07:51:20 AM by HairyMaclairy |

|

The institutions are finally figuring it out that it really is all about bitcoin and building trading, exchange, settlement and international transmittance layers on top of Bitcoin. Eh...they're not actually. They're figuring out it's about diversification. Not least because of 3 things: 1. no investor in possession of their senses doesn't diversify their portfolios within any asset class 2. they understand that monetary assets are not a natural monopoly 3. they understand that the most expensive asset in the class does not always have the most upside The "God made bitcoin so we don't need anything else" delusional hopium in this thread is quaint, but you already lost that war 5 years ago and diversification is a one-way street. That is one genie that does not go back in the bottle. Tokonormal. How are competitors against Facebook doing? Against Apple? Against Amazon? Against Netflix? Against Google? Do you want to diversify into second tier versions of the FAANGs? No you do not. They each completely dominate their market segment. As does Bitcoin. Diversification is about picking the best of each market segment and buying a little of each. It is not about chasing penny stocks. |

|

|

|

|

RivAngE

Full Member

Offline Offline

Activity: 728

Merit: 169

What doesn't kill you, makes you stronger

|

|

May 15, 2019, 08:09:14 AM |

|

Total market cap has reached September's highs, 25% more up and we'll reach August 2018 highs.

The BTC dominance has spiked a lot though, I don't think it can hold 60%.

I believe the market cap will keep rising but BTC will stabilise at this price for a few days or even weeks, while some people start joining the hype and buy BTC and others take some profit from BTC and are picking good alts which were massacred and are historically cheap.

|

|

|

|

|

Majormax

Legendary

Offline Offline

Activity: 2534

Merit: 1129

|

|

May 15, 2019, 08:09:19 AM |

|

Diversification is about picking the best of each market segment and buying a little of each. It is not about chasing penny stocks.

Portfolio performance is only gained with a range of stocks from each sector. The lower caps will always be more volatile and some will outperform the dominant stock. We are only talking investment intent and actions here, not fundamental value. Therefore investment is about chasing penny stocks , and medium cap stocks, just as much as big-cap stocks. The sort of investors we are talking about see cryptos as stocks, so plenty of money will flow into alts, and many will outperform BTC (considering price alone) |

|

|

|

|

PaivanTreidi

Jr. Member

Offline Offline

Activity: 34

Merit: 8

|

|

May 15, 2019, 08:15:14 AM |

|

The institutions are finally figuring it out that it really is all about bitcoin and building trading, exchange, settlement and international transmittance layers on top of Bitcoin. Eh...they're not actually. They're figuring out it's about diversification. Not least because of 3 things: 1. no investor in possession of their senses doesn't diversify their portfolios within any asset class 2. they understand that monetary assets are not a natural monopoly 3. they understand that the most expensive asset in the class does not always have the most upside The "God made bitcoin so we don't need anything else" delusional hopium in this thread is quaint, but you already lost that war 5 years ago and diversification is a one-way street. That is one genie that does not go back in the bottle. Tokonormal. How are competitors against Facebook doing? Against Apple? Against Amazon? Against Netflix? Against Google? Do you want to diversify into second tier versions of the FAANGs? No you do not. They each completely dominate their market segment. As does Bitcoin. Diversification is about picking the best of each market segment and buying a little of each. It is not about chasing penny stocks. Are you saying nobody should have bought apple 20 years ago? I think that is what we are talking about here. You are buying sh1tloads of compaq and IBM and blockbuster... At the time they were the giants. I don't pretend to know the future but I do know a good saying about the person who laughs last... |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

May 15, 2019, 08:30:22 AM

Last edit: May 15, 2019, 09:02:23 AM by HairyMaclairy |

|

Diversification is about picking the best of each market segment and buying a little of each. It is not about chasing penny stocks.

Portfolio performance is only gained with a range of stocks from each sector. The lower caps will always be more volatile and some will outperform the dominant stock. We are only talking investment intent and actions here, not fundamental value. Therefore investment is about chasing penny stocks , and medium cap stocks, just as much as big-cap stocks. The sort of investors we are talking about see cryptos as stocks, so plenty of money will flow into alts, and many will outperform BTC (considering price alone) You are confusing two separate concepts. Diversification is a risk reduction technique. https://en.wikipedia.org/wiki/Diversification_(finance) Portfolio optimization is about optimising a portfolio to achieve a specific objective (growth, income etc). https://en.wikipedia.org/wiki/Portfolio_optimization. When you are saying ‘diversification’, you really mean portfolio optimization in a way that increases risk If you want to optimize for high risk, high growth then chasing alts is the way to go. Don’t make the mistake of thinking this is diversification, because it’s not. |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12008

BTC + Crossfit, living life.

|

|

May 15, 2019, 08:56:19 AM |

|

First wanna thank you guys for the "for most massively" support coming from you guys (for the source application) Also wanna thank all the members who are mainly in other sections as speculation or our "WO-thread" Then every member will know the application was my words that I wanted to say, but the PERFECT English wasn't my exact writing, so XhomerX thanks for helping me out putting my words in that awesome text, I owe you a very big THANK YOU and most of respect, helping a member out how you did. Then jojo said one time he wasn't really sending support cause members he talk with and are became sources are a little bit difficult for him, as he doesn't want to make a joke that comes of like merit begging, I been with you guys a very long period of time and I will not change for one F*** while being in here and, I know you guys in here so just be the same to me and don't give a F*** That been said the sun is shining on the terrace where i'm drinking a fresh ginger thea and a sparkling water, the price is 7915$ and BTC looks as beautiful as always 1 BTC still = 1 BTC so nothing changed  |

|

|

|

|

toknormal

Legendary

Offline Offline

Activity: 3066

Merit: 1188

|

|

May 15, 2019, 08:58:45 AM

Last edit: May 24, 2019, 03:07:53 AM by toknormal |

|

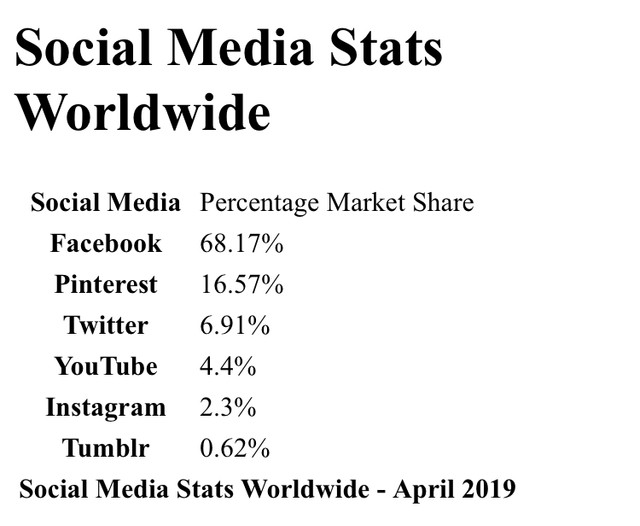

1. no investor in possession of their senses doesn't diversify their portfolios within any asset class

2. they understand that monetary assets are not a natural monopoly

Tokonormal. How are competitors against Facebook doing? Against Apple? Against Amazon? Against Netflix? Against Google? Do you want to diversify into second tier versions of the FAANGs?.....Diversification is about picking the best of each market segment and buying a little of each. It is not about chasing penny stocks. Facebook is dominant but not a monopoly and certainly not necessarily the future. Apple has only around 16% share of the smartphone market, down from 100% at the iPhone's launch. Netflix has less customers than Amazon Prime depending on how you view the statistics and its dominance is nowhere near to inhibiting new entrants. So those companies competitors are doing quite well actually. Bitcoin dominance hit a minimum during the last massive price spike (see below), yet its marketcap/$USD price was at a maximum. That's no accident because as money is made in alts, people profit-take into bitcoin. It's the same structure for any monetary asset market and is in fact the very definition of a "reserve asset". There were of course other factors at play such as hedging the contentious hard forks that were going on, the blocksize war and general ideological differences in priority. But such needs to hedge will always exist - periodic storms in markets are a permanent feature of economics. How does the market respond to such conflicts ? It caters for all through diversification - same as with any commercial sector. 20 years from now, the idea that there was only ever going to be 1 blockchain asset will seem comical, a bit like Thomas Watson's statement of "I think there is a market for maybe five computers". Non-bitcoin digital asset market share moves in sawtooth waves just like bitcoin's own fiat market. It usually declines to just below the last peak marketshare during which time much of that capital flows into bitcoin and consolidates it. Then fuelling starts again and we move through a new cycle. There are very few natural monopolies in the world and monetary assets - digital or otherwise - are definitely not one of them. That is something so-called bitcoin maximalists should be thankful for and not moaning about because without it you'd have stagnation and ultimately death of the entire sector, including bitcoin.  |

|

|

|

|

Wekkel

Legendary

Offline Offline

Activity: 3108

Merit: 1531

yes

|

|

May 15, 2019, 09:00:44 AM |

|

Go BTCitcoin Go! She’s responsible for Bitcoin’s premature ejaculation  The pump will be pumped until nobody’s left to go long. Then, the crush commences. A classic chart for goods without the proper ability to short. |

|

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

May 15, 2019, 09:08:57 AM |

|

Facebook at 5%?  |

|

|

|

|

toknormal

Legendary

Offline Offline

Activity: 3066

Merit: 1188

|

|

May 15, 2019, 09:31:20 AM |

|

I don't think those statistics are for overall social media revenue. Maybe users. Also it shows that Instagram is the most investable, not Facebook, having the smallest market share while being the fastest growing - exactly my point about the crypto market. I'm not saying that this isn't investible...  ...I'm saying people should wake up and smell the coffee. It's investible BECAUSE there's a growing and diversifying sector, not in spite of it. |

|

|

|

|

|

kenzawak

|

|

May 15, 2019, 09:39:52 AM |

|

Hacked Cryptocurrency Exchange Cryptopia Goes Into Liquidation https://www.coindesk.com/hacked-cryptocurrency-exchange-cryptopia-goes-into-liquidation"Cryptopia, the cryptocurrency exchange hit by a major hack in mid-January, has gone into liquidation and suspended trading operations. The news was announced Wednesday by Cryptopia’s assigned liquidator, professional services firm Grant Thornton New Zealand. Cryptopia confirmed the news on Twitter, as well as on its website." |

|

|

|

|

toknormal

Legendary

Offline Offline

Activity: 3066

Merit: 1188

|

|

May 15, 2019, 09:50:49 AM |

|

@HairyMaclairy my stats were wrong about Facebook. You are right that they are dominant - revised my post accordingly.

|

|

|

|

|

|

|

|

Poll

Poll