[edited out]

Otherwise, $100K-150K for no blow-off top, simply reaching the logarithmic growth upper band and reversing.

I don't really have any major problem with this kind of scenario ending up playing out because it is still very profitable for me, personally.

For most hodlers I imagine. Better than losing 50%+ of fiat value at least

Of course, some of the devil of relative price performance remains in the details, especially needing to account for time and sustainability of BTC price. For sure, another aspect remains how much fiat is guaranteed to lose value whether that might be anywhere between 10% and 25% per year, depending on your ongoing consumption basket or to go with the seemingly overly conservative and misleading government projections that even admit supra 6% levels - so long as we are substituting beyond meat for our real meat.. and fuck that shit.

Of course, not even UP is guaranteed in bitcoin, even though many of us would consider it as nearly a no brainer bet that might not work out in the short term, but seems to have almost invincible odds so long as our timeline is decently longer.. such as 4- 10 years or more and even then there just seem to be so many assymetrical aspects that could well even cause shorter term measuring of BTC outperforming fiat and other assets, so even for anyone who might have some reservations about investing into bitcoin, the smarter moves would seem to suggest that those risk averse folks should be merely allocating into bitcoin with smaller proportions rather than completely rejecting any kind of BTC exposure...so the question about how to go about your bitcoin future should be more a matter of how much rather than whether.

So, yeah a blow-off top would seem to justify expectations of greater extremes whether buying into such scenario or not, and for me, it just does not seem too likely that bitcoin would end up with such whimpy top that ends up in the $100k to $150k range, but hey, it's not any kind of tragedy if that's what were to end up playing out.

For sure, there are some folks who seem inclined to compare bitcoin to mature assets (and even seemingly wrongly concluding that BTC has become a mature asset), and therefore consider that the odds are quite great that our already passed exponential price rise of 6.5x to 7x was more than sufficient to constitute a blow off top, and surely many of us longer term bitcoiners just don't buy it.. Sure, some might suggest that we are engaging in wishful thinking based on our own hopes to benefit our portfolios, and I personally deny being biased by such considerations, and in that regard, I consider that the likelihood of our top already being in to be quite low..

and sure I feel that I am not even assigning super high odds to supra $220k prices

(I had not outlined $150k as a cut-off point because I consider it to be in the middle of my $120k to $220k category),

as can be seen from my last revised December 16 estimates in which I had only placed supra $220k prices for this cycle to be at around 29%. I also even considered the top to be in at $69k to be around 45%... so it is not like I am even close to absolutist in my own attempts at assigning probabilities, even though sometimes I will argue about what seems to be a difference of 10% in the assignment of probabilities.. because going from 60% to 70% can sometimes come off as a pretty damned high difference in the level of confidence, depending on the question(s) being asked.

One of my problems with the considering of such scenario to be reasonable remains that it just does not seem to reflect bitcoin's history very well, and it does not even seem to fit very well into a kind of "smoothing of tops" kind of depiction of bitcoin as a maturing asset class... and maybe that ends up being part of the rub (the crux of it) that I have with these kinds of smoothing top depictions of bitcoin in that there seems to be some kind of built presumption that bitcoin is sufficiently maturing as an asset class in order to really meaningfully be considered in that kind of a way.. which I really have some difficulties accepting that as a very likely scenario

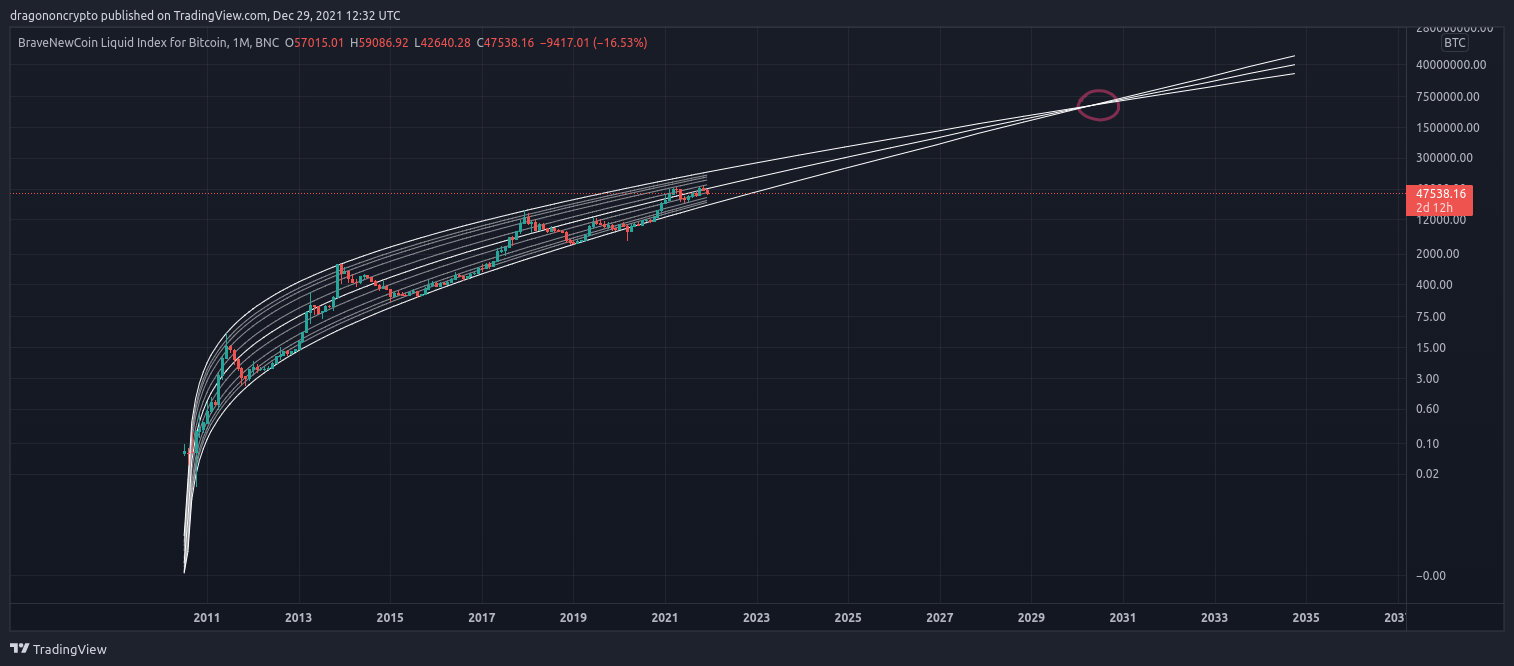

Personally I find it fits perfectly into the smoothing of tops adoption/maturation theory, based on Bitcoin's price history. That of declining highs based on % gain, increased volume, declining volatility, increased adoption, etc. I just stick to the current growth curve, no need to over-complicate things imo with any theoretical supply shock models or otherwise.

Whether you refer to it as over-complication or the failure/refusal to account for where we are likely at might be two different questions.

In other words, yeah there are a lot of people who find data to support their presumptions that bitcoin is maturing or that adoption has increased a lot in a variety of ways, so therefore bitcoin is becoming a lot MOAR BIGGER, and therefore is better to be considered within those kinds of presumed parameters.

Good luck with that. I continue to believe that evidence remains way too lacking to support such presumptions that bitcoin is maturing in any kind of meaningful or significant way to justify that the tops and bottoms are going to smooth out. Yeah, there are a lot of wet dreams in regards to BTC's upcoming stability, and sure, I am not denying that stability comes with a growing asset, but I will still assert that bitcoin remains way too small to have reached such level so people who are ongoingly making those kinds of presumptions are failing/refusing to appreciate the still existing exponential upside potential of our lillie fiend, aka king daddy, aka honey badger, aka corns.

But hey.. do what you want.. I give few shits about whether bitcoin is exponential or not, even though I hardly can see that it's adoption has yet reached any kind of significant/meaningful level to presume its cycles or outrageous moves to be disappearing any time soon. I don't even care if I am wrong.. but I just don't see it.

Therefore for Q1 high would be around $150K, Q2 $175K or Q3 $200K. I'm never a fan of the "this year will be different theory", when for the past 10 years Bitcoin has formed and remained within a pretty clear-cut logarithmic adoption curve, until there's any evidence to suggest breaking a decade long trend. Depending on how you look at it, from peak to peak the growth declined considerably from ~35,000% to around 1,500%, so the % rise declined enoromously by 95%. So for example another decline of even just 50% would only be a rise of around 750%, which would put a top around the $175K mark.

Sounds too Kumbaya and civil to me, and does not seem to coincide with either being in a war or in the midst of the greatest wealth transfer in history.. which seems to be where we actually are, currently.

But, hey believe what you will in terms of your gradual risenings theories.

I am not even saying that we might not end up at $175k-ish/$200k-ish by 2nd or third quarter 2022.. and surely, I would consider the difference between those two numbers to largely be a rounding error, even if we were to throw $150k somewhere into that gradually kumbaya mixening of yours.

Also, it could end up playing out in a kind of gradual way as you outlined, but it seems like quite a minority scenario to actually end up playing out like that and without a decent amount of violence in the mix, too.

For sure we could see a wick above or below this curve, like in March 2020 when price went 50% below the lower band, but it would take a black-swan event for that to happen imo, as opposed to the usual up-trend that occurs. So I do see the argument and possibility for reaching some $250K level or higher, but it wouldn't be typical of Bitcoin's price movements based on it's entire history.

It's a little difficult to see what you are getting at here.. except that you are expecting mostly a gradual, and if there is a kind of upwards wick, it would ONLY end up taking us briefly to $250k, and at the same time that would be a bit of an aberration.

Surely, I will admit that is a nice looking set of squigglies that you got going on there, and with a decent amount of logic contained in the assumptions of both an ongoing narrowing range and a kind of lessening of the upward extreme of the slope. For sure, it looks good. Gotta give you that much.

#nohomo

#nohomo

Probably my main criticism would be the presumption that the upwards slope is flattening as much as you are depicting it to do or that it is inclined to do..so sure there would be some kind of wait and see aspect to your plotting out such specifics and then to find out if King Daddy ends up largely staying within the range that you had already plotted out, whether we are referring to this cycle or the adding of another 4-8 years onto such a plottening... of course, that plottening ONLY goes out to 2023... so in some sense by just considering how narrow it starts to get at that 2023 edge seems to beg for more criticism of it and likelihood that king daddy is not going to stay within your expected bounds.. hey we will see.. we will see.

Otherwise the target of $1 million sometime after Q3 2026 I find pretty realistic, as well the completion of adoption by 2030 at a $5 million BTC (where the upper and lower bands of the adoption curve cross over, and therefore the model becomes invalidated by default). With a $100 trillion market cap, it'd also be hard to argue that a $5 million Bitcoin price wouldn't make most fiat currencies redundant by then. 9 years from now also seems like a realistic time-frame personally, given how far Bitcoin has come in the past 10 years. This growth is also very similar to S2F, just with a little less pseudo-science

Oh? I see your subsequent chart resolves the post 2023 questions - and really difficult to argue with what that second chart seems to depict.. which seems to be largely UPpity... so making me feel bad

(not so much) about my earlier quibbling about your seeming to be too short-term whimpy.. hahahahaha

It's not that it's my favourite scenario, but simply the most likely now there has been a clear enough trend of lows and highs established over 3 peaks and 3 lows. It's true I wouldn't be a fan of Bitcoin abandoning an adoption curve and forming a speculative marco-bubble (that so far hasn't happened fortunately), which only pops and leads to eventually returning to the adoption curve, taking maybe a decade or so to consolidate, even if entirely possible. As leaving this adoption curve to the upside would certainly open the doors to leaving it to the downside too.... meaning 10 years of adoption down the drain.

I realise the adoption curve might seem "whimpy" to you, because ultimately is typified by

continuing to produce declining % gains, but personally I think a 750% rise from peak to peak is more than satisfactory, as well as a 20x within around 5 years, or even 100x within 10 years. I also think sustainable adoption will win the race faster than a speculative bubble that would likely take many years to recover from, not just the usual mini-boom and mini-bust that are nothing more than Bitcoin's bull markets and bear markets on smaller scales. The Tortoise and the Hare comes to mind here, that of slow and steady wins the race.

There are sometimes that you seem to get so much caught upon certain technicalities that I want to reach through my computer screen and slap you. hahahahhaha

Just a fleeting thought.

Oh yeah.. and your seemingly relative obsessions (or at least emphasis) of the closing of candles.. is another technicality that causes quite a bit of rubbenings for me... but hey, I do understand that some peeps are profitably trading their lillie fiends based on those kinds of technical indicators.

Anyhow, your 3 peaks and 3 lows framing seems to contribute to your presumption that break outs are likely to become more mild and bitcoin has gone through a kind of taming, and hey all of a sudden you are proclaiming that if bitcoin crashes too much, then 10 years of hard adoption work goes down the drain, and it just becomes quite difficult to follow how you go from one extreme to another in terms of suggesting that unless we enter into a more of a smoothening, then bitcoin's crashening is going to lead to its demise, and hey not even I am suggesting that extreme down is going to end up coming to king daddy bitcoin unless we have some kind of exponential UPpity. In other words, we already had two pretty damned significant corrections from our 6.5x to 7x exponential price rise, which largely seems to set us up for a coiling that could well end up in another exponential price rise. How much of an exponential price rise is the $million question that might help to inform us regarding how much of a fall might be within the potential cards based on how fast or far the exponential rise comes (in the event that it does come). So all I am saying is that it seems way too premature to be presuming that another exponential price rise is NOT in the near term (1-9 months) BTC price cards based on the facts that we have in front of us regarding bitcoin's so far price performance.

So, in some sense, I am also accusing you to be getting ahead of yourself if you are going to already presume the top of the next price rise and then to suggest that the ONLY other scenario is that BTC prices correct from here which would be bad for bitcoin.... and I have quite a bit of difficulties even appreciating how there are any kind of high or meaningful strong indications that BTC would have any kind of severe price correction from here when we already had 56% and 39% in recent times.. so that seems like a bit of a fantasy view to me, and it seems that we are ONLY going to get into the realm where supra 70% corrections are even likely in the event that there is some kind of blow off top from here, which maybe 3x would be amongst the most whimpy of blow off tops, and likely 5x or more would be more within a realm to justify 70% or greater corrections.. and sure we could even get something like 20x to 30x from here for this cycle.. even though that really seems like an outlier but still within the realm of possible.

In other words, the next 1-9 months are critical... and I am having a lot of doubts that this particular cycle is probable to drag out beyond 9 months from now, even though I refuse to say never, and even

my December 16 prognostication of timeline had allowed for a 4.5% probability of this cycle's peak after the 3rd quarter of 2022.

Poll

Poll