dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

June 13, 2022, 06:52:39 PM Merited by JayJuanGee (1) |

|

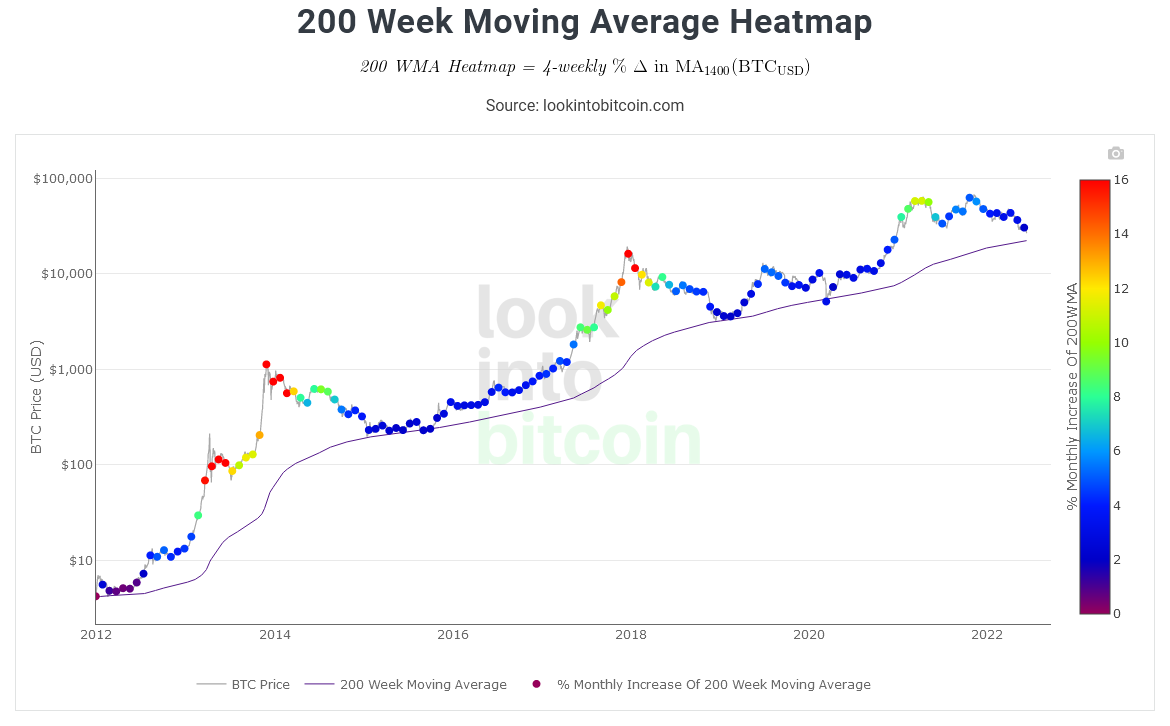

Historically, the 200 WMA has only ever been touched a few times by spot price, but never deeply crossed. In other words, spot price shouldn't go below $22,287 (as of today). If spot price deeply crosses that value (i.e., goes below $20k), it will be a first in Bitcoin's 13-year history.  I think you're confusing price touching the 200 Week MA and closing (a Week) below the 200 Week MA. In reality, out of 4 times price reached this level, price went below it significantly three times (75%). early 2015: under by about 15% late 2015: under by about 12% (also closed just below for multiple weeks) 2018: only went $40 below 2020: under by about 29% (also closed just below for 1 week) I'm not saying it has to do any of the above this time around, just stating the facts here. Ignoring a flash crash event like in 2020, then wicking under by 0%-15% would be completely normal. As a reminder today is Monday, so price also has the rest of the week to wick below the 200 WMA, before being able to close above it or just below... So far based on Daily volume (high) and price volatility (-16%), the capitulation does seem sufficient already. Thanks for that data, which I haven't confirmed, but have no reason to doubt. I haven't zoomed into the price action down to the minute, at the times it touched the 200 WMA, I'm just referring to the data in the chart that I linked to. Note that, in that 200 WMA chart, the spot price is daily, not weekly. So the chart time step is 1 day. OK, it's not instantaneous price down to the minute, so there could be rapid dips within each day, but does this really matter if the price rebounds within a day? Here's a view of BLX with 200 WMA in blue, ignore lack of today's update as price is v close to the 200 WMA. In summary, it shows the wicks below are more common than not.  Without measuring out each individual wick below the MA, you can roughly see price wicking below by a considerable amount. The worst being 2020 with the MA @ $5.5K and price dropping to $3.8K. You're right though the wicks are more or less irrelevant when they are usually only on a Daily time-frame. Technically they are also irrelevant even if on a Weekly time-frame (as the MA is Weekly). It looks like the price has started diverging from 200 WMA, in the right direction (  ), so the 200 WMA boundary may end up holding strong once more. We'll see... There's definitely a reaction happening close to the 200 WMA, but still wouldn't be surprised to see a fake-out below it based on current selling pressure. Ultimately, until price is back in the $28K-$30K zone, it'll be difficult to confirm that it has acted as support (even if it's very likely to do so). By then we are obviously back at pre-capitulation levels, as well as a strong selling zone. Many will still be waiting to get above $32K to play it safe, even $35K I think, as it's never too late to a buy into a trend reversal. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Each block is stacked on top of the previous one. Adding another block to the top makes all lower blocks more difficult to remove: there is more "weight" above each block. A transaction in a block 6 blocks deep (6 confirmations) will be very difficult to remove.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 13, 2022, 07:03:27 PM |

|

|

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9525

#1 VIP Crypto Casino

|

|

June 13, 2022, 07:12:47 PM |

|

Anybody mindrusted yet? My bank blocked me from sending any more money to Coinbase. I waited a good for hours & managed to get some more into Kraken. Might have to wait a few days now or they might shut my accounts  It’s not just bitcoin taking a beating, look at stonks.  Recession incoming, buy as much bitcoin as you can. |

|

|

|

|

Wilhelm

Legendary

Offline Offline

Activity: 1652

Merit: 1265

|

Anybody mindrusted yet? My bank blocked me from sending any more money to Coinbase. I waited a good for hours & managed to get some more into Kraken. Might have to wait a few days now or they might shut my accounts  That's stupid because it's your money. I understand them asking for confirmation because it's unusual. If it's the US it might be a good case to sue them over. Your losses will become substantial  |

|

|

|

|

PoolMinor

Legendary

Offline Offline

Activity: 1843

Merit: 1338

XXXVII Fnord is toast without bread

|

|

June 13, 2022, 07:22:53 PM |

|

Good time to harvest losses, all you US tax payers

|

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

June 13, 2022, 07:26:18 PM |

|

Anybody mindrusted yet? My bank blocked me from sending any more money to Coinbase. I waited a good for hours & managed to get some more into Kraken. Might have to wait a few days now or they might shut my accounts  That's stupid because it's your money. I understand them asking for confirmation because it's unusual. If it's the US it might be a good case to sue them over. Your losses will become substantial  Not really. The "it's your money in the end..." -argument is shit. You lend them your money, they owe it to you at the conditions set by them, which they can change as they wish. Total sellout. Barely legal, protected by thieves (imo). |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3848

|

|

June 13, 2022, 07:27:59 PM |

|

Good time to harvest losses, all you US tax payers

I always do it in late November (for stocks), then rebuy >30 day later. For btc or anything else-anytime is OK as long as they don't change the law for wash sales, but chances are probably zero that they would before the end of the year. That's just me. |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7821

'The right to privacy matters'

|

|

June 13, 2022, 07:34:51 PM |

|

Good time to harvest losses, all you US tax payers

May sell all coins tonight or maybe not. |

|

|

|

|

Wilhelm

Legendary

Offline Offline

Activity: 1652

Merit: 1265

|

|

June 13, 2022, 07:38:11 PM |

|

Anybody mindrusted yet? My bank blocked me from sending any more money to Coinbase. I waited a good for hours & managed to get some more into Kraken. Might have to wait a few days now or they might shut my accounts  That's stupid because it's your money. I understand them asking for confirmation because it's unusual. If it's the US it might be a good case to sue them over. Your losses will become substantial  Not really. The "it's your money in the end..." -argument is shit. You lend them your money, they owe it to you at the conditions set by them, which they can change as they wish. Total sellout. Barely legal, protected by thieves (imo). Just looked it up for fun but there are lawyers specialized in this. https://kneuppercovey.com/can-i-sue-if-my-bank-wont-release-my-money/ |

|

|

|

|

Wilhelm

Legendary

Offline Offline

Activity: 1652

Merit: 1265

|

|

June 13, 2022, 07:39:22 PM Merited by JayJuanGee (1) |

|

Good time to harvest losses, all you US tax payers

May sell all coins tonight or maybe not. SellTheDip is a suboptimal strategy  |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 13, 2022, 07:51:36 PM |

|

Margin account liquidated only hours ago is now around 2.5% health again. If this doesn’t let up soon, it will set some kind of record for repeated executions without time for a last meal or... ok, I am wittier when I am not in this type of a situation. MARGIN SUCKS!!![...] If we really visit the $23k range, I could get liquidated again-again. I ought to avoid repeating the same mistake. Slightly over $23,200, to be precise. You must be here to cheer us up. Each of us can say: "At least I am not as bad off as that shmuck." I prefer the power of positive thinking: Please feel free to feel smug that your bitcoins are IN YOUR WALLET WHERE THEY BELONG. Just like I was smug and self-satisfied during past major crashes: Hahah, the market can’t touch my bitcoins! WHY THE BLOODY HELL DID I DO THIS, I DO NOT KNOW. Why do we need to do positive thinking or to enable gamblers when that is amongst the worst of techniques, and surely I cannot really know, beyond your own representations, regarding how easy it may have been or that it still might be to potentially reasonably extract yourself from any precarious too much mgambling position that you had admittedly put your lil selfie into. You cannot expect people on the interwebs (including yours truly) to be nice to you about those kinds of matters, even if you admit that mistakes were made.. and even seem to admit that mistakes are continued to be made.. but maybe in the end, you are largely ONLY suggesting that they are mistakes based on subsequent BTC price moves rather than the real most likely elephant in the room mistake of getting into those shitty-ass too much gambling-inclined positions in the first place. I am having trouble understanding how you could be reasonably considering that I am being smug or even too smug given the circumstances... There are likely guys who played this whole BTC price move way much MOAR better than me in terms of their allocations towards DOWNity and their levels of confidence regarding DOWNity.. including but not limited to LFC and some of the downity proclaimers who may well have engaged in some pretty high levels of gambling to bet on downity, and their bet paid off for them.. this time. I don't regret the way that I played this whole matter (even though I could have done it better) because I already have a system that I try to follow to the best of my abilities. I have been attempting to follow and I have been tweaking based on changes in my own financial/psychological situation and even changes in my learning about how to make some better assessments in order to attempt to better align what I am doing with my beliefs and finances.. and I started learning these kinds of techniques and putting them into practice since I first got into bitcoin in late 2013.. and they became way more concrete the longer that I was in the "game" and trying to ongoingly put ideas/theory into practice.. including also attempting to ongoinly fight my own inner desires to gamble or to get emotional.. which does not really end with an asset like bitcoin that is both volatile, but seemingly volatile beyond expectations.. So frequently each of us should be attempting to both prepare for expectations but to prepare beyond expectations.. to some degree... and I do not fuck around with betting on down or UP, so in that sense, there is almost no way that I am going to profit as much from any kind of BTC price move like the BTC price move that we are currently in because the BTC price has already gone quite a bit beyond my expectations including but not limited to my expectations that I thought that it was unlikely that we would go into a bear market prior to having a more meaningful blow-off top or something like that. ...and when the BTC price went below the 100-week moving average of $35k-ish on May 7th-ish and stayed below that 100-week moving average for more than a couple of days.. I was forced into a concession that we were no longer in Kansas (meaning a bull market.. fuck that).. So yeah, the reality of the matter was that we had already gone beyond my expectations at that time.. and surely as any of us can now see we continue to go further downity.. so why should I be smug about a situation that is not good for me.. and perhaps my only saving grace remains that I have made a few changes to tweak my system and my holdings and my reserves (including some amounts that I had thought that I had taken off the table) a few times.. including that I just tweaked in the past less than 12 hours in order to attempt to account for the seeming outrageousnes of the past 48 hours of BTC downity price moves. so fuck all of that.. and I am tweaking to attempt to make my lil selfie feel more comfortable both financially and psychologically in order to feel that I mitigated the whole situation based on a kind of ongoing moving target as best as I can giving the situation of both beyond expectations but way beyond expectations ongoing happenings.. fuck that shit.. . By the way.. my tweak of today changed some of my outstanding buy orders (of course set for on the way down). and even tweaked a few sell orders (on the way up).. and I suppose part of my own internal justification for the tweaks for the orders on the way down was that the BTC price had been moving down faster than expected and there are even some downity momentum issues that seem to be ongoing. .that of course could reverse at any time and without expectation, but then again, they might not.. so my buy orders now go down into the $18ks as contrasted to earlier (before the most recent tweakenings) going down into the $19ks.. and I am thinking that it would be quite crazy if all of those all get filled.. or even get close top being filled.. but we are already way closer to having them filled than I had even though to be within reasonable expectations.. so then if all of my currently outstanding buy orders get filled before I am able to tweak them down further (if I get such an opportunity and consider it to be justified).. then what do I do at that point? start DCA'ing.. with what? $10 - $100 per week as I have been recommending as starting point buying amounts for newbies? Some kind of an implementation of a kind of DCA strategy remains my current tentative plan if we end up getting to the point that I run out of buy on the dip money and all my buy orders are filled prior to my tweaking them again to go down further. This is not my first rodeo of suffering through then what do I do at the extremes, and it almost never feels good while it is happening.. .whether we are forced into having to just HODL.. or maybe as the bear manipulators cause some folks to mindrust.. which is not completely a joking matter because there are variations of mindrusting.. .. that might objectively appear to be better ways of dealing with whatever extreme dippenings that we find our lil selfies to be in.. and some of those ways of dealing with seemingly bad or outrageous situations can be way more moderate than the seeming actions that mindrust ended up taking and ended up sharing (perhaps regrettingly) quite a few of his personal trading and thought process details with us.. which surely helps us to better understand his situation, but still might not stop us from doing something like what he ended up doing.. because he was not totally irrational in what he did end up doing because he was trying to conform with his own personal situation as he understood it to be... So, yeah for me if I run out of buying on the dip money, then probably DCA seems like the next most logical step.. since my buying on dip money would then have run completely out if the BTC price suddenly dipped down to my outstanding $18ks buy order amounts and all of my currently outstanding buy orders end up getting filled.. Smug? I am having my doubts about that kind of a characterization - except if you are engaging in behavior that is way out there, then maybe I am being smug because there are surely guys doing better than me, but there are quite a few folks who are in between you and me in terms of their approach including at what point they might have run out of buying on dip money, and some of those ran out of money around $35k or below and others maybe have merely been doing DCA since $35k because they have no more buying on the dip money because the dippity went way way way further than expected. Another thing is that our current price location was no where near any kind of a sure bet, and it was even seeming to be quite a long-shot bet, whether we are talking about some of those guys (gal perhaps too?) who made their bets on down (to the 200-week moving average-ish) at various earlier points, such as Raja_MBZ in June-ish 2021 or some of the guys who seemed to have been making their bets around late 2021/early 2022 (when the Stock-to-Flow model seemed to have had shown standard deviations of about 2-ish standards of deviation and even more than 2-ish.. which seemed to show that PlanB was wrong-ish.. or at least that the 4-year cycle may well have been over, even if some of us might not even concede that PlanB was wrong.. just a bit off in terms of magnitude and timeline)... |

|

|

|

|

PoolMinor

Legendary

Offline Offline

Activity: 1843

Merit: 1338

XXXVII Fnord is toast without bread

|

|

June 13, 2022, 07:57:02 PM |

|

Good time to harvest losses, all you US tax payers

May sell all coins tonight or maybe not. SellTheDip is a suboptimal strategy  Sell and buy back immediately, harvest losses...if your trading vol is high enough, the fees should be low enough. HIFO with losses harvested make for the best strategy, IMO for US tax payers |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3848

|

Interestingly, btc dominance is declining slightly, but it is a false signal.

it does not mean that alts are doing better, it simply means that everything is depreciating vs stablecoins.

OK, now that we are in OFFICIAL bear market in stonks, what's your opinion on ultimate stonks bottom?

I think it would be somewhere between 3337 and 2250 SP500 (completely negating the COVID bump)

At 3337 it would be a 30% decline.

At 2250 it would be a 53% decline (might take a year or two).

When SP was 3337, btc was about 10K

When SP panic dropped to 2250, btc was at 3.8K

Add to it more scarcity in btc now and we should have better outcomes than prior numbers, but it is quite sobering.

It is also entirely possible that large money people would start to "escape" from SP500 and into bitcoin.

We shall see.

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 13, 2022, 08:04:53 PM |

|

|

|

|

|

|

Wilhelm

Legendary

Offline Offline

Activity: 1652

Merit: 1265

|

|

June 13, 2022, 08:06:43 PM |

|

Good time to harvest losses, all you US tax payers

May sell all coins tonight or maybe not. SellTheDip is a suboptimal strategy  Sell and buy back immediately, harvest losses...if your trading vol is high enough, the fees should be low enough. HIFO with losses harvested make for the best strategy, IMO for US tax payers I'm not American but I get the strategy  |

|

|

|

|

|

savetherainforest

|

|

June 13, 2022, 08:07:16 PM |

|

No Bitcoiners do. We are all "psychopaths" apparently remember ? So we are all woamen??!    |

|

|

|

|

Wilhelm

Legendary

Offline Offline

Activity: 1652

Merit: 1265

|

|

June 13, 2022, 08:09:13 PM |

|

No Bitcoiners do. We are all "psychopaths" apparently remember ? So we are all woamen??!    We're the crowd watching it burn. |

|

|

|

|

|

savetherainforest

|

|

June 13, 2022, 08:11:54 PM |

|

No Bitcoiners do. We are all "psychopaths" apparently remember ? So we are all woamen??!    We're the crowd watching it burn. To be honest, I bought a bit before todays/tomorrows last dip. And even now before that one, it feels like I'm robbing "the bank".      |

|

|

|

|

Wilhelm

Legendary

Offline Offline

Activity: 1652

Merit: 1265

|

|

June 13, 2022, 08:13:31 PM |

|

Good job robbing the weak hands. I'm out of funds for investing. I blew my load a bit too early  |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 13, 2022, 08:16:58 PM |

|

You are so amazing and under-appreciated, too.

We might need to raise money for a statue... #justsaying.

Even though this is sarcastic, I still like it. Thanks! Good play. Right now it looks like you're going to get it too.

Pretty much, thanks! Looking forward to the next 4 years with yall beautiful people. It feels good to have more than a BTC. For sure, getting more than 1 BTC is not easy.. even if you came into bitcoin when BTC was still priced less than $10k for a decent amount of your beginning months of exposure to BTC. It's likely going to take a lot of normies a long time to both get above 1 BTC and/or to maintain any kind of status of having more than 1 BTC (which we already speculate having 1 BTC or more is quite a decently large threshold - relatively speaking and especially if you can maintain your stash at least above that amount.. maybe easier said than done?). to the extent that is going to be practical to maintain 1 BTC or more into the future... So yeah.. then next 4 years.. hopefully we are still here and posting in this here thread the next 4 years.. what will the world look like? Who knows, but it seems that BTC is at least a hedge of some sorts to possibly provide some additional options to those who see bitcoin as a possible future and to act upon acquiring a sufficient and meaningful stake in it as compared with those who are still no coiners and who may or may not even enter into establishing any kind of sufficient and meaningful stake into bitcoin in the next 4 years or so. By the way, you might have already gathered that the more BTC that you accumulate, the more likely that you are NOT going to get very excited about wanting the price to go down... yet it still can take a decent amount of time to get to a position in which there would be complete neutrality and detachment regarding the BTC price moves.. which surely maybe could be the case for guys who have established for their lil selfies decently-sized BTC stashes that they acquired on average for less than $100 per coin... you might be able to identify that yours truly does not fit into that groupening... and maybe those are rare beasts, anyhow? Proudhon.. speaking to you, donkey breath. |

|

|

|

|

|

Poll

Poll