HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

May 22, 2019, 11:17:10 AM |

|

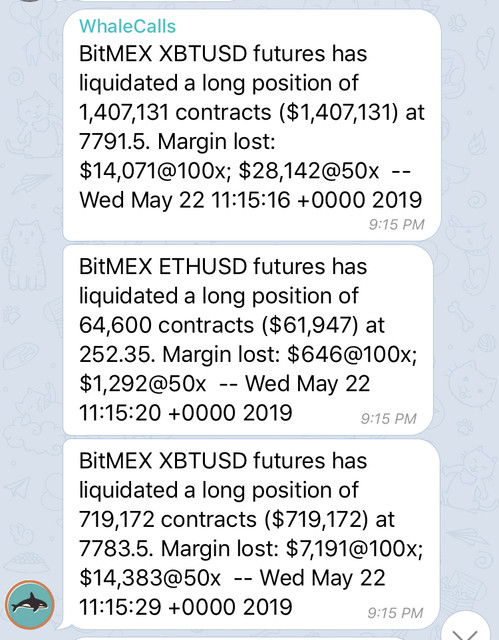

Oops  |

|

|

|

|

|

|

|

|

|

"In a nutshell, the network works like a distributed

timestamp server, stamping the first transaction to spend a coin. It

takes advantage of the nature of information being easy to spread but

hard to stifle." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

gentlemand

Legendary

Offline Offline

Activity: 2590

Merit: 3013

Welt Am Draht

|

Out of interest does anybody (except jbreher) still own any BCH or SV?

Yes. Still got plenty of both. I spend it every now and then. They're prime pump fodder for the foreseeable future no matter how poo they are. If there's to be a monster bubble I'll offload the majority then as they'll reach truly insulting prices no matter what. |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9500

#1 VIP Crypto Casino

|

|

May 22, 2019, 11:18:46 AM |

|

Out of interest does anybody (except jbreher) still own any BCH or SV?

I transferred all of my BCH into Bitcoin & spent it living like a king for just over 12 months.

(I donít sell any of the Bitcoin Iíve bought myself but give me a break for wanting to enjoy the fruits of my labour here).

Obviously I got 0 SV because I had 0 BCH at the time of their shitfiri.

Couldnít stand that shit. Dumped it for BTC immediately. Iíd rather be a no-coiner than have Roger control my coins. Never got any SV as a result but definitely got the better end of the deal. Didnít want to move my bitcoinís out of cold storage to claim BCH for quite a while. It actually worked out better for me in the end as I got $1,200 per BCH. |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9500

#1 VIP Crypto Casino

|

|

May 22, 2019, 11:19:42 AM |

|

Out of interest does anybody (except jbreher) still own any BCH or SV?

Yes. Still got plenty of both. I spend it every now and then. They're prime pump fodder for the foreseeable future no matter how poo they are. If there's to be a monster bubble I'll offload the majority then as they'll reach truly insulting prices no matter what. I think theyíre both going to double digits or worse eventually. |

|

|

|

|

gentlemand

Legendary

Offline Offline

Activity: 2590

Merit: 3013

Welt Am Draht

|

|

May 22, 2019, 11:23:00 AM |

|

I think theyíre both going to double digits or worse eventually.

I think it's easy to underestimate the greed and literal mindedness out there. They're both called 'bitcoin' and they're both 'cheaper'. That's going to give them many years of life yet. I'll be out of it when their respective prices make me shake my head in wonder. I'm really amazed how many alts are still a thing. |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

May 22, 2019, 11:24:42 AM |

|

Individual alts are almost impossible to kill. I am resigned to the fact that we will always be surrounded by a spectrum of alts. They just wonít have any value once the next big thing comes along.  |

|

|

|

|

P_Shep

Legendary

Offline Offline

Activity: 1795

Merit: 1198

This is not OK.

|

|

May 22, 2019, 11:30:28 AM |

|

Out of interest does anybody (except jbreher) still own any BCH or SV?

I transferred all of my BCH into Bitcoin & spent it living like a king for just over 12 months.

(I donít sell any of the Bitcoin Iíve bought myself but give me a break for wanting to enjoy the fruits of my labour here).

Obviously I got 0 SV because I had 0 BCH at the time of their shitfiri.

To my shame I do. 0.00000244 of each sitting on my bitfinex account |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

May 22, 2019, 11:34:27 AM

Last edit: May 22, 2019, 11:48:21 AM by realr0ach |

|

This dumb "stock to flow" poster guy Anonymint & Infofront are citing looks like he's lying about silver and gold to try and make Bitcoin look better. There's more like 100,000 tons of silver around, NOT 500,000 as he claims. So silver stock to flow is more like 4 instead of 22. Although I didn't check his "flow" number, so even that might be off too. His gold stock number is also WAY too high. In other words, probably everything in that picture is incorrect.  It's also not even really possible to have valid flow figures in the first place for numerous reasons I won't go into. Do you include the ETFs whose only reason for existing is to suppress price? For all intents and purposes, someone trading a paper receipt of ownership for silver around is the same thing as physical flow. The only purpose of the flow metric is to signify transfer of ownership, and that's what's occuring (doesn't matter if the ETF vaults are empty or gold plated tungsten). He probably leaves all of that out solely to try and make Bitcoin look better. |

|

|

|

|

|

ChinkyEyes

|

|

May 22, 2019, 11:34:49 AM |

|

Now in the rest of the country  Rotterdam, den haag and Amsterdam The Arnhem story is crazy imo, the city was already super Pro BTC years ago, damn that community was fast @the party! It's great that a city has many merchants that accept Bitcoin, the only thing missing in this, is barely anyone is spending their Bitcoins to buy things. Everybody just in hodl mode. If we want true adoption start spending and paying for things in BTC. |

|

|

|

|

bitcoinPsycho

Legendary

Offline Offline

Activity: 2464

Merit: 2066

$120000 in 2024 Confirmed

|

|

May 22, 2019, 11:36:58 AM |

|

Now in the rest of the country  Rotterdam, den haag and Amsterdam The Arnhem story is crazy imo, the city was already super Pro BTC years ago, damn that community was fast @the party! It's great that a city has many merchants that accept Bitcoin, the only thing missing in this, is barely anyone is spending their Bitcoins to buy things. Everybody just in hodl mode. If we want true adoption start spending and paying for things in BTC. After you |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9500

#1 VIP Crypto Casino

|

|

May 22, 2019, 11:48:48 AM |

|

It's great that a city has many merchants that accept Bitcoin, the only thing missing in this, is barely anyone is spending their Bitcoins to buy things. Everybody just in hodl mode. If we want true adoption start spending and paying for things in BTC.

Iím going to be honest here - Iíve been invested in bitcoin (and constantly buying) since 2014. I donít think Iíve ever bought anything with bitcoin. I mean Iíve gambled with bitcoin then sold some & rebought but I donít think Iíve ever bought anything with bitcoin. I know Iíve never done it physically in a shop or something. |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

May 22, 2019, 11:50:39 AM |

|

Iím going to be honest here - Iíve been invested in bitcoin (and constantly buying) since 2014.

I donít think Iíve ever bought anything with bitcoin.

I mean Iíve gambled with bitcoin then sold some & rebought but I donít think Iíve ever bought anything with bitcoin. I know Iíve never done it physically in a shop or something.

In other words, you are the posterboy for why Bitcoin is a bubble? |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

It's great that a city has many merchants that accept Bitcoin, the only thing missing in this, is barely anyone is spending their Bitcoins to buy things. Everybody just in hodl mode. If we want true adoption start spending and paying for things in BTC.

Iím going to be honest here - Iíve been invested in bitcoin (and constantly buying) since 2014. I donít think Iíve ever bought anything with bitcoin. I mean Iíve gambled with bitcoin then sold some & rebought but I donít think Iíve ever bought anything with bitcoin. I know Iíve never done it physically in a shop or something. They take Bitcoin. And they are bloody good. Hopefully obvious why you would use Bitcoin and not your credit card. |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9500

#1 VIP Crypto Casino

|

|

May 22, 2019, 11:54:26 AM |

|

Saving that in favourites Hairy, thanks. Will have a look when Iím not on an iPhone.

|

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9500

#1 VIP Crypto Casino

|

|

May 22, 2019, 11:57:38 AM |

|

Shit I've spent too much, but it does help the holding during the bear market as the mentality is "fuck it, I've already gotten enough out of this investment even if it goes to zero" so the hodl strength is Strong.

Just looked at your registration date.....2012..... I bet you bought a shit tonne of sickeningly cheap bitcoinís back then ans/or mined)  |

|

|

|

|

|

ChinkyEyes

|

|

May 22, 2019, 12:00:37 PM |

|

After you

I most definitely will, next time I visit Arnhem. The thing is when a merchant who accepts Bitcoin, has not received many transactions with BTC, they tend to forget the action required to make a Bitcoin payment. Which makes the whole process of paying with Bitcoin irl slow. Iím going to be honest here - Iíve been invested in bitcoin (and constantly buying) since 2014.

I donít think Iíve ever bought anything with bitcoin.

I mean Iíve gambled with bitcoin then sold some & rebought but I donít think Iíve ever bought anything with bitcoin. I know Iíve never done it physically in a shop or something.

I think the majority of people in crypto have not done a real life transaction. I hope the app made by Jack Dorsey will help change this in USA at least. |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

May 22, 2019, 12:01:13 PM |

|

https://www.airvpn.org/They take Bitcoin. And they are bloody good. Hopefully obvious why you would use Bitcoin and not your credit card. If you don't recognize the authority of the govt to spy on you, how is that different from my non-recognition of the authority of the US govt on the merit of it's overrun with Jews and blacks, and white people refuse to be 'governed' by either group since: blacks - incompetent. Jews - thieves/murderers/scammers/chronic liars. Like white people will ever accept the authority of Mulatto babboons like AOC? LOL. She can go fuck herself. |

|

|

|

|

|

Woodie

|

https://www.alfatop.meIt's great that a city has many merchants that accept Bitcoin, the only thing missing in this, is barely anyone is spending their Bitcoins to buy things. Everybody just in hodl mode. If we want true adoption start spending and paying for things in BTC.

~SNIP~ I mean Iíve gambled with bitcoin then sold some & rebought but I donít think Iíve ever bought anything with bitcoin. They take Bitcoin. And they are bloody good. Hopefully obvious why you would use Bitcoin and not your credit card. Still interested in spending your btc?? You can always add https://www.alfatop.me to your list if you need some mobile top up.. I just hope you are among the supported countries for this service. GL

Out of interest does anybody (except jbreher) still own any BCH or SV?

Team craig wright

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

May 22, 2019, 12:15:42 PM |

|

Non traceable (harder to trace) SIM cards is another great use case for Bitcoin

|

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9500

#1 VIP Crypto Casino

|

|

May 22, 2019, 12:20:24 PM |

|

https://www.alfatop.meIt's great that a city has many merchants that accept Bitcoin, the only thing missing in this, is barely anyone is spending their Bitcoins to buy things. Everybody just in hodl mode. If we want true adoption start spending and paying for things in BTC.

~SNIP~ I mean Iíve gambled with bitcoin then sold some & rebought but I donít think Iíve ever bought anything with bitcoin. They take Bitcoin. And they are bloody good. Hopefully obvious why you would use Bitcoin and not your credit card. Still interested in spending your btc?? You can always add https://www.alfatop.me to your list if you need some mobile top up.. I just hope you are among the supported countries for this service. GL

Out of interest does anybody (except jbreher) still own any BCH or SV?

Team craig wright  Thanks for the links bro, I might spend my signature campaign money or something but my HODO stash is going nowhere until 2022/22. Much, much higher prices LOADING..... |

|

|

|

|

|

Poll

Poll