I have to agree that these technology advancement has actually caused laziness.

But do you also consider the cost of spending on them and having a large number of children. The father mostly caters for every member of his family in this age. Long where the time where more children means more wealth mostly by farmers who has large portion of farms to farm on. Some of these children turn to there own farming at 18+ and helps the father cater for the family. Not now that at 18 some are just getting into obtaining degree and the father caters for everything.

So I will say the act of reducing birth rate now isn't just laziness but cutting cost down and yeah it's a good strategy. Because these days children prefer to have everything done for them. Sadly there isn't much we can do to change that

if you have 1 spoiled child who always got whatever they dreamed of you will end up with 30 yo parasite that continues to live with you and cannot cope with life on his own. If you have 6 children you have little more work. The older ones take care of the younger ones, help around the house and go to work from the age of 18 to raise their and their family's standard of living because he knows that every penny is worth the effort. You don't help your mum when you see, she is watching netflix 2h daily. You don't go to work for minimal wage when you just get iphone worth 2 months of your work, for free, from parents. If it was possible to have 5 kids in 1800 its possible to have it now. People just forget what they really need, and what they need only because its widely advertised and hyped. |

|

|

|

https://www.gapminder.org/topics/babies-per-woman/ https://www.gapminder.org/topics/babies-per-woman/so you're saying that, mostly without electricity, washing machine, refrigerator, diapers, car, internet, advanced farm tools and other inventions of the last 200 years, women gave birth to 6 children (on average!) and now it's impossible to raise second child? nah. People are just lazy nawadays or are focused too much to get new iphone, clothes with good brands, netflix, tiktok, youtube, etc. The less money a family has, the more children are born. Its a well known fact. You just have to focus on building instead of complaining.  https://en.wikipedia.org/wiki/List_of_sovereign_states_and_dependencies_by_total_fertility_rate https://en.wikipedia.org/wiki/List_of_sovereign_states_and_dependencies_by_total_fertility_rate |

|

|

|

"In the stock exchange market, 90% of traders fail to be profitable yearly. Based on significant brokers' statistics, 80 percent of traders lose, 10 percent of traders are break-even, and 10 percent make money consistently." https://www.forex.in.rs/why-traders-lose-money-in-forex/Shorting is not as easy as borrowing iphone and giving back when new is about to be released. At least this example is way too simplified. To short: 1- you have to have collateral 2- you are exposed to margin call 3- most inexperienced traders will sooner or later gamble with leverage 4- you are exposed to flash crash 5- you have to hold founds on exchanges (you are exposed to exit scams, haks, "liquidity issues") 6- you are exposed to short squeez Shorting is for experienced traders. At least 5 years of trading/investing. Yes ... if you short, you actually make bitcoins on the way down. You protect yourself, you collect blood from the streets. It might be unethical but it might benefit you in the long term.

There is nothing unethical in this. Every trader brings liquidity into market - helps other traders/investors. Thanks to your sell order someone who wanted to buy, bought cheaper (would fill in next order in order book, most likely with higher price). Thanks to you, closing your short position and your buy order someone who wanted to sell have liquidity to sell at higher price. Every trader brings net positive value for others. No mater if short/long trader. |

|

|

|

Destabilizując rynek sami sobie zaszkodzili, chcieli osłabić, może przejąć FTX, a wyszedł z tego Armagedon.

"Some (including me) say this will "set the industry back a few years." But thinking about it, this is natural. There will be failures with progress. Happened in regulated TradFi in 2008, after 70+ years of development. The industry will recover quickly, and become stronger." https://twitter.com/cz_binance/status/1595319261387448321I częściowo się zgadzam. Upadają instytucje i zawsze będą upadały. Zarówno w krypto jak i poza. Powoli mam przeczucie, że ludzie o wszystkim zapomną za kilka tygodni a jak tylko kurs BTC odbije od dna i wróci nad 20k, to już w ogóle. Sprawa FTX stanie się dla inwestorów z 2023 roku archaiczna na zasadzie "dawno i na pewno się nie powtórzy" jak sprawa MTGOX dla inwestorów z 2017 roku. Ludzie mówią, że jak padnie tether to koniec krypto. Jak padnie binance to koniec krypto. Jak musk zacznie sprzedawac to koniec krypto (już sprzedał). Jak xxx to koniec krypto. A może się okazać, i pewnie tak jest, że krypto jeszcze nie jednego trupa pochowa, otrzepie się z błota i pojedzie dalej i jeśli tak będzie, z binance jako monopolistą cexów na czele to pytanie gdzie wtedy będzie kurs BNB. Właśnie padła nam 2 największa giełda ... Jesteśmy, żyjemy, idziemy dalej. _____________ Słyszeliście o pomyśle Vitalka? podobno binance podłapał, będzie realizował a potem udostepnie dla całej branży jako open source - Having a safe CEX: proof of solvency and beyond |

|

|

|

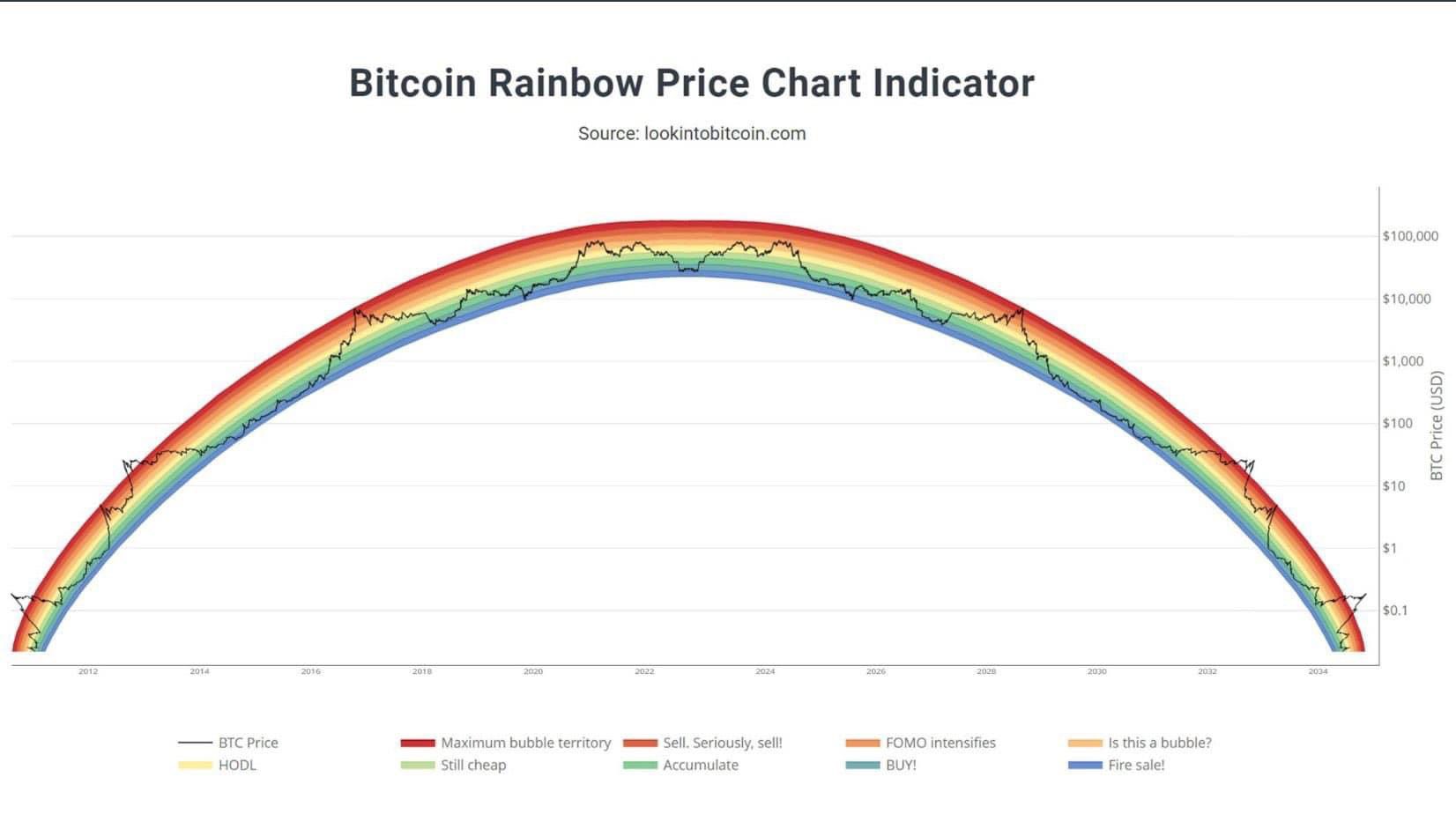

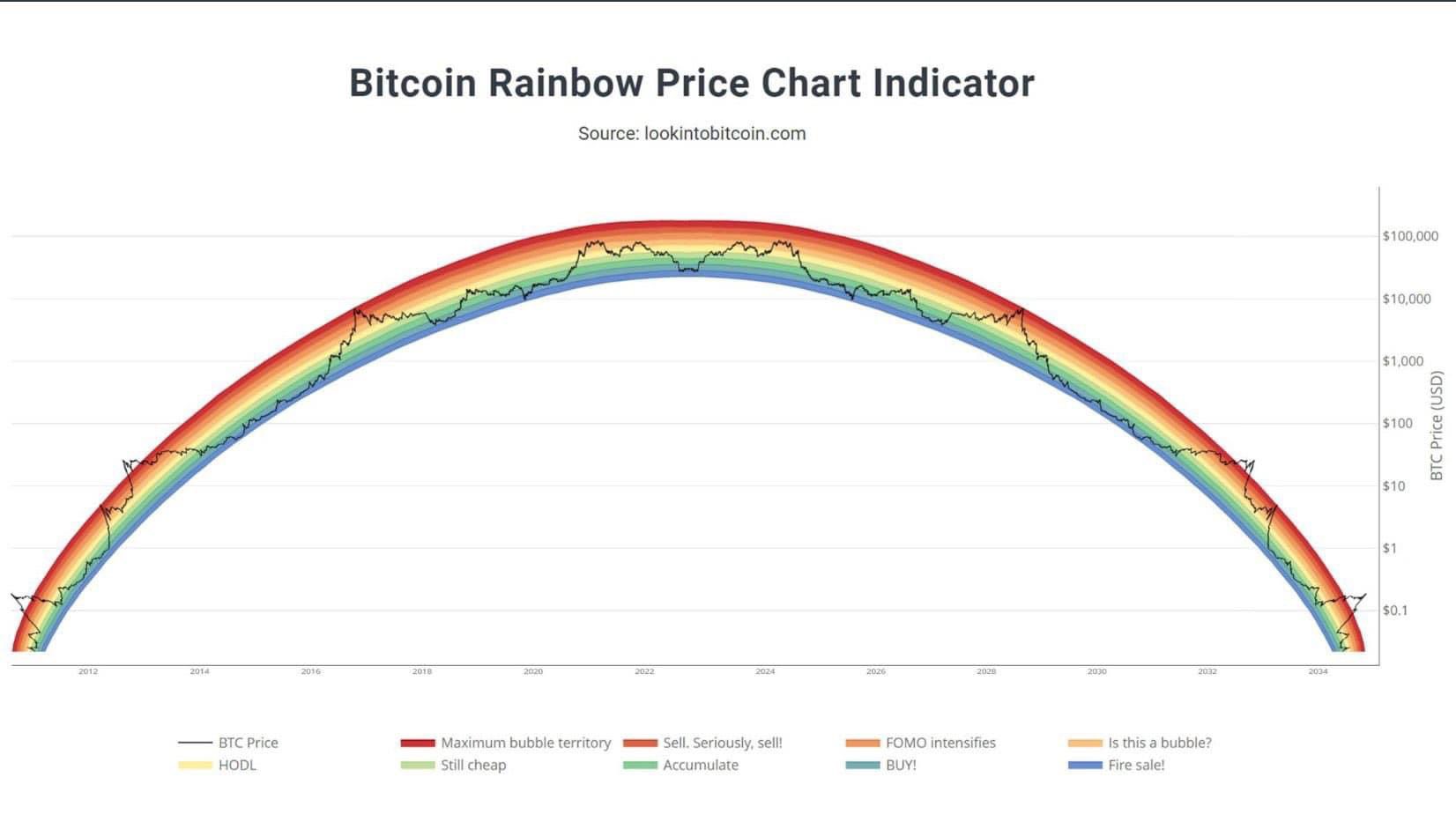

@Flangler1 Apropo Bitcoin rainbow chart to rzucił mi się dziś w oczy cały wykres   https://twitter.com/MMCrypto/status/1595305566250770432/photo/1 https://twitter.com/MMCrypto/status/1595305566250770432/photo/1Cały czas od maja tego roku tydzień w tydzień dokupuję, najwyżej stracę, ale wole kupować jak się leje krew a nie jak jest przebijane nowe ATH.

U mnie podobnie. Stale dobieram w sumie od okolic 30k. Średnia nie najgorsza, bo największe zakupy przy 20k miałem i teraz też dobieram. Jak u ciebie? |

|

|

|

Hello Guys just checking BNB coin, losing the support, and investors and people are predicting it may further fall, as Binance CZ is solely relying on BNB , what will happen if

1) BNB kept losing its value

2) Till How much value (you think) that BNB can sustain

3) What will happen to public funds, will there be liquidity issue if BNB falls to a certain level

4) What will be your way to save yourself if anything goes bad..

Please share your opinions ...

BNB is one of the best performing coins of 2020-2023. Not only it was much stronger than bitcoin during bull run it also was much stronger during bear market which is a phenomenon (altcoin that dumped far less than bitcoin durting devastating and long bear market). BTC/BNB price is at ATH. So you are wrong here saying that bnb is loosing value. It hold value the best from whole crypto industry. Answer to questions: 1- nothing. We will just have better opportunity to accumulate more 2- how much it can dump? The lower the better. How long will binance survive? I don't think that bnb price will affect binance itself. 3- The fact that FTX was overleveraged scam that collapsed due to 1 tweet does not mean that binance is weak too. https://coinmarketcap.com/exchanges/binance/ - 70B founds on hold. 4- store coins on self custody wallets and accumulate more |

|

|

|

I właśnie takich nastrojów oczekiwałbym na dnie  BTC jest w bessie już 370 dni. 580 dni, jeśli pominiemy fałszywe nowe ATH w listopadzie 2021. Fear/greed index pokazuje skrajny strach przez cały ostatni rok, jeśli pominiemy kilka dni strachu i neutralności. 350 dni ekstremalnego strachu. FTX, druga co do wielkości giełda, po prostu zbankrutowała pozostawiając wszystkich inwestorów, miliony ludzi, bez grosza przy duszy. Co może być gorszego niż to? Po tej wiadomości BTC spadł tylko o 20%, ponieważ jest wyjątkowo wyprzedany. Oczywiście spadek niżej jest możliwy i widząc dziś wykres też czuję, że nieunikniony (właśnie walczymy przyklejeni do wsparcia na 15 600). Uważam tylko, że nigdy nie było tak, by rynek zalewały dobre newsy na dnie. Dno zawsze pełne jest trupów. Spadek do 12k wydaje się dziś bardzo prawdopodobne, tylko moim zdaniem lepiej jest traktować każdy pozytywny znak jak jaskółkę wzrostów i szukać pozycji długich tutaj dla potencjalnego 2-10x (nawet przy ryzyku dalszych spadków) niż shortów dla 10-20%. Bo znacznie niżej będzie ciężko bez kolejnego trupa wypadającego z szafy. |

|

|

|

Powoli zaczyna się wyjaśniać jak to było mozliwe że tak szybko i bez problemów otworzyli FTX w stanach, okazuje sie ze SBF miał mocne plecy w partii demokratycznej, był jednym z najwiekszych sponsorów, nie tylko partii ale i kampanii prezydenckiej Bidena.

Kurde pytanie jak silne te plecy są w próbach odegrania sie na binance? pewnie jak zawsze prawda bedzie gdzies pomiędzy, zaczęli jako startup z duzym przytupem, udało sie, zarobili pare ładnych milionów na arbitrażu, zaczęły się pojawiać coraz większe okazje i mozliwości, gdzieś cos poszło nie tak i szybciutko z dobrego pomysłu zrobił się potęzny scam - welcome in crypto - szkoda.

Z tego co wiem, to rezerwa cząstkowa była powodem upadku (i używanie FTT jako "zastaw" (collateral)). To, o czym przestrzegałem od stycznia 2019 roku - https://bitcointalk.org/index.php?topic=5094172.msg49099952#msg49099952Wszystkie banki tak funkcjonują. Jest jedna różnica. Jak bank ma problem to przychodzi rząd i robi bailout z pieniędzy podatnika. Przy nieskończonej płynności nie ma problemów z rezerwą cząstkową. W krytpo w takim wypadku się upada. Moim zdaniem to był zamach na pieniądze, celowa kradzież. To nie był amber gold. To była kreatywna księgowość połączona z optymalizacjami kapitału, która wywaliła się na plecy przez zmienną dynamikę rynku i pstryczek od CZ, który w odpowiednim momencie podstawił nogę kolosowi. money.pl to niskich lotów portal. U mnie na czarnej liście. Więcej tam babolów niż przydatnej wiedzy. Zwłaszcza dla specjalistów branży. _________________________ https://coinmarketcap.com/rankings/exchanges/ - dodana nowa ikona przy giełdach, która zrobiły proof of reserve. Można wejść i zobaczyć ile środków leży na giełdach. Warto zobaczyć. |

|

|

|

Tylko jak ci się bitomat zatnie to oczywiście hajs odzyskasz po jakiś 3 dniach. Tylko co w momencie jak go potrzebuje na za 3 godziny? Więc super, że sam jesteś człowiekiem urodzonym po 3145 roku, ale kolega w kwesti człowiek > maszyna ma wiele racji.

Jak hajs, który potrzebujesz na za 3 godziny masz w krypto, to zdecydowanie fakt, że ci go wciął bitomat jest twoim najmniejszym problemem. W krypto trzymamy nadwyżki finansowe, które jesteśmy w stanie stracić. A nie oszczędności życia i płynność dnia codziennego. Bitomat ci nie wbije kosy przy wypłacaniu 5000zł+. To się liczy dla racjonalnego człowieka a nie fakt, że nie mam kasy z krypto na za 3 godziny. Nawet z 0 w portfelu w tym wypadku bierzesz bociana, pierwsza pożyczka gratis i spłacasz po 3 dniach. |

|

|

|

Hi guys in my opinion that btc is in Bear market right now

BTC is in bear market for 370 days. 580 days if we skip fake new ATH in Now 2021. Fear greed index show extreme fear for last whole year if we skip few days of fear and neutral. 1 year of extreme fear man. Every investor emotions are ragged. Its good time to look for the bottom rather than call "in my opinion that btc is in Bear market". You should call it 300 days ago and predict 15k bottom, when price was at 45k. Not predict 13.5k bottom at a price of 16k when ATH was at 69k. No one should care about this 2.5k$ delta when we already dumped 53k$. Btc is currently running in 16000 dollars range and it might crash if some bad news might happen.

FTX, second largest exchange, just go bust. Leaving all investors, milions of people, without penny. What can be worse than that? Not many things. After this news BTC dumped only 20% because its extreamly oversold. 13500 is possible but its much better to look for longs here for potential 2-10x rather than hope for black swan event to profit 10-20% from shorts. |

|

|

|

The recession understands people like you who are facing Investment and financial difficulties. Do you feel that a bear market in risk assets mimicking the global financial crisis, big losses are yet to come?

BTC is down from 69k to 16k. Its minus 75%. From 17k to 13k is only 20%. So "big losses are yet to come?" Nah. Even with your prediction (dump to 13k) big losses are mostly behind us. Speaking of recession. BTC dumped from 69k to 16k in 2021/2022 evaluating harsh economic condition we have now and will have in near future. Thats how market works. It evaluate future, not present. So if you think that economy will start to recover in 2023/2024 (at least temporary relief) its good time to buy now. Even if we have possible another 20% dump ahead. |

|

|

|

Just exploring your opinion here about the discussion I think from mins 17-30 in https://youtu.be/kYtwxtCPIik or speculations as economists about Bitcoin after 2041 in general. I started at 15 min and stopped 1 min after when guy said that deflationary currencies are bad because "they encourage hoarding of money and they discourage consumption" which is a lie that was created to justify existence of hidden tax. There is nothing good in consumig stuff you don't need. Its bad for you, bad for enviroment, bad for economy. Inflation is bad (even 2-5%) because it create misallocation of resources and discourage wise investments and wise spending. Its super funny how elites call consumption bad because of environment impact, global warning etc and in next interview say that inflation is good because it encourage spending/consumption. Interview is not worth the time. If you want to talk about year 2041. Write in few sentences why is it so special. |

|

|

|

Ciekawy opis bałaganu z FTX na bankierze:

„w całej swojej karierze nie widział tak kompletnej porażki kontroli korporacyjnej i całkowitego braku wiarygodnych informacji finansowych, jak miało to miejsce w tym przypadku”. „Od naruszania integralności systemów i wadliwego nadzoru regulacyjnego za granicą do koncentracji kontroli w rękach bardzo wąskiej grupy niedoświadczonych, prostych i potencjalnie skompromitowanych osób, sytuacja ta jest bezprecedensowa” - wyliczył Ray. https://www.bankier.pl/wiadomosc/Upadek-kryptogieldy-Nigdy-nie-widzialem-takiej-porazki-mowi-nowy-szef-FTX-Wczesniej-kontrolowal-upadek-Enronu-8441603.htmlCoraz więcej smrodu dookoła stablecoinów a prawda jest taka że panikujący ludzie wywalą peg wszędzie

nie ma mocnych, jak sie wszyscy rzucą do wypłacania, kazdy stablecoin starci peg chociaz na chwile

Zagrożenie może być też w samych bankach w których trzymane jest zabezpieczenie. Credit Suisse ma na przykład spore problemy które nie wiadomo jak się zakończą. Co do chwilowej utraty PEG to zdarzało się to chyba już na każdym stablecoinie. Nawet ostatnio 9 dni temu USDT był krótkotermiono handlowany 3% poniżej 1$. |

|

|

|

|

Check IDENA. Its first proof of person blockchain. Each person is 1 node with equal voting power. Sybil resistance is achived by Turing test that is being done simultaneous for whole network once each epoch.

Very uniqe project with super low marketcap (~~1 M $). So it can even go 1000x. But DYOR. Its much more possible it will go to 0 but risk/reward is worth the try. At least its worth the research.

|

|

|

|

Mini Football Token appears to be a fun meme coin investment, designed to attract the football fans as well as Dogecoin investors. Since it has experienced a boom phase, will the upside potential for MiniFootball Token diminish? Or perhaps there might be harsh corrections for the price to pump? What do you say about this?  There is not even a single word about use case, uniqness, advantage over competitors, marketcap etc. Just "meme coin" "doge copy" shitshow. So is it a lucrative investment? NO! Its a gamble on an asset with 0 value that its price sooner or later will hit 0 and buying this coin worse than "grater fool game" because of insiders that will most likely do rug-pull. Thats how you should research your investment - https://bitcointalk.org/index.php?topic=5208144.msg53299809#msg53299809 After my post coin pumped 40x in 1.5 years. Never invest based on interesting name. |

|

|

|

|

It was after kucoin hack or binance hack in 2020/2021.

The idea was proposed to CZ and I think he respond without thinking too much. It was not seriously considered. Binance give up on this idea saying that it will not be healthy for crypto industry, not that they are able to do it.

|

|

|

|

I'll add that less coins on exchanges is always good. Think of it like this:

More coins available for sale > bigger sell walls > more fiat needed to break into higher prices

Less coins > much easier and more frequent short squeezes > higher possibility of price manipulation but also higher and more frequent pumps, wider price ranges.

Again. You are looking at supply site of equation only. There is also a demand site. People are not only withdrawing bitcoin but fiats too. So there are smaller sell walls but also less money to buy them. Less coins > much easier and more frequent short squeezes > higher possibility of price manipulation but also higher and more frequent pumps, wider price ranges.

IMO more coins outside exchanges is good because it suggest more people self custody and as a result less coins being possibly lost or stolen. It's also better for traders because they're the ones that love volatility. I'm not a trader and I don't care if the price range is wider and btc goes up and down by 100% in a year. I've seen it in 2017, 18 and 19 and was fine with it. I kind of miss it now.

But traders like volatility that is predictable. Not random flash crash that whipe out stoploss orders and leveraged positions. I remember an interview with market operator that I was watching 3-4 years ago. Guy from big found said something like that - "If you want people to buy, create nice looking chart for them that fallows all rules, supports, trend lines. Make it a good place to draw lines and do technical analysis" IMO more coins outside exchanges is good because it suggest more people self custody and as a result less coins being possibly lost or stolen.

Thats indeed a positive thing. Another one, even more imporatant, is less coins being a collateral in fractional reserve - https://bitcointalk.org/index.php?topic=5094088.msg49096584#msg49096584 |

|

|

|

If this trading signals sector of financial sector are so weak then we definately need goverment funding in order to support this signals financial sector.

Something need to be done Also If signal channel gives signal it don't hit the target not hit Even near by target don't give target

Fully regulated stock market also have signal channels (the most popular one is wallstreetbets). The amount of articles of people loosing lifetime savings thanks to listening to signals from there is overwhelming. We don't need regulations here. We need education. People should be able to write whatever they want. You should know not to make financial decision based on random person signal, especially if its pump and dump group made to scam members. |

|

|

|

|