Times like these I just don't look at the monetary value of my various wallets. I avoid looking.

What do you mean? The

monetary value, measured in

money (i.e., BTC), remains constant at a rate of 1 BTC = 1 BTC.

There are a lot of contradictions and irony in your above statement, and I am trying to sort in my mind where to start in order to attempt to potentially help anyone who actually believes such dumb thoughts like that.

Don't get me wrong, I am not picking on you in particular, and part of the reason that I tend to respond to quite a few of your posts is that you tend to articulate yourself well and you make a lot of good points, but also you say really dumb shit while trying to act like you are correct in your way of framing matters and that your view is a compelling one that should be shared/adopted (as if it were common sense) blah blah blah.

That’s a fancy way of saying that, for whatever reason, you are afraid that people will see that I’m right. I will take that as a compliment, so no hard feelings.

You yourself have said some stupendously dumb things in reply to me. I wrote a long-ish post to address (a small portion of) that much earlier; but I withheld it for extra review of what is good and necessary, constructive Bitcoin discussion, versus what’s just scoring points in an Internet argument. I don’t generally waste my time with the latter—and I especially don’t want to with you,

you “fucking goofball”.

That said, it does show how weak your argument is when you take up a pattern of little personal jabs that are patently inapplicable to me, and that add nothing to the substance of the discussion. And you

are inviting me to dish some of it back to you—insofar as such

is applicable to you.

I know that I am repeating myself, but the reality of the matter is that we are in a very fucking early transitionary period in which the level of BTC adoption is so damned low (less than 1% of the world population and also less than 1% of the world's monetary value in BTC), so in that regard there is going to both be a lot of volatility and also there is going to be a lot of ongoing upside potential... and neither of those actual on-the-ground reality dynamics justify either putting all your brain power into using BTC as your accounting mechanism or even speculating that you need to hold all of your value (or even high portions of your value) in BTC in order to profit the fuck out of attaining and maintaining a reasonable/prudent stake in bitcoin... which these days I consider 1% to 25% of your overall investment portfolio (as you measure it) to be a good, fair and reasonable starting point (that is purposefully so fucking broad in terms of my recommendation that you (or any other newbie normie) will actually need to personally tailorize it)

I fully recognize that >99% of people are not prepared to become die-hard Bitcoin zealots right now, today, “BTC or bust”.

It is a well-known principle of history and of social change that every major movement needs a leading edge of activists. For Bitcoin, I would be honoured if I could consider myself one of those. Accordingly, I do my best to start by putting my money where my mouth is—to

live it, not only to talk about it.

If 0.1% of people form that leading cadre, then that opens the way for the next 1%. They, in turn, are the nucleus around which forms the next 10%. And it is an observed phenomenon that 10% of society can move the rest of society. Most people are inert—passive—followers only.

I know also the principle of speaking to the audience. When I talk to newbies, I do

not advise them to go all-in on BTC! Instead, since I have no personal experience with the “normal” way of doing this, I typically crib some talking points from posts I have read from JayJuanGee: Allocate a minor portion of your portfolio (say, 10%) to buying BTC, DCA, buy chunks in the dip if you can get a good price, and HODL.

Oh—and “don’t invest what you can’t afford to lose.” Blah, blah, blah. I know that speech perfectly, too. When it comes to BTC, I absolutely do not practice that—but I know how to preach it.

Sadly, I have even sometimes even advised newbies to store coins on an exchange.

Yes. Me, saying that! To the utterly clueless ones, who would have

no hope whatsoever of securing a wallet on their Swiss-cheese, probably malware-infested devices. Those are the same ones who have

no hope whatsoever of buying BTC anonymously, so I tell them just to do the KYC. Given the exclusive choice between “nocoiner” and “has some Bitcoin on a KYC exchange”, I will optimize for finding the least-bad realistic option.

Priority #1 is to get them into BTC for even $100—even $50; for any amount, even if it is below the exchange’s withdrawal minimum!—and drill it into their heads never, ever to panic-sell.

Store it on a reputable exchange, in an account with 2FA, etc. Then,

wait for Bitcoin to work its magic; sooner or later, as long as there is no panic-selling, the proud ownership of some itty bitty bitcoins will incite the desire for more bitcoins! Bitcoin is seductive. It only needs to make and maintain contact—thereafter, resistance is futile.

As Bitcoin rises and/or they buy more (on my advice of a JJG-style DCA strategy), at some point, a hardware wallet will be a worthwhile purchase.

Then, teach them how to do “not your keys”, “Be Your Own Bank”, etc.

Then, help them to experience the thrill of total, direct control of their own money!

Then—when they have enough BTC that they are willing to spend at least $100–200 on a way to secure it.

You probably see me as one of the most fanatical preachers of

never KYC!,

not your keys, not your coins!, and so forth. In my own life, I practice what I preach about that

(except for the “not your coins” part, when I do something foolish and out of character with a margin account—whoops—I guess I proved empirically that they aren’t my coins).

If I can turn around on a

dime and be so pragmatic about

that, then you had better not bet that I am blind to the realities on other issues.

Unless you are wagering against me. Please take that bet! I need to make some BTC.

(Note well: I analyze each issue carefully. Treating Bitcoin as “like a stock” is not acceptable in any circumstance whatsoever! I will spend two hours explaining to a hopelessly clueless n00b that

Bitcoin is nothing like a stock—then turn around and say to do KYC, keep coins on the exchange unless/until enough is accumulated to justify the purchase of a hardware wallet, etc. To do otherwise would be

lying to a new investor in the investment prospectus, in addition to coupling BTC to stocks

and opening the door to securities regulators.

Do not argue with me: Take it up with the SEC, if that’s what you really want.)

But here, in the Wall Observer, my primary audience is die-hard Bitcoin fanatics who treat BTC as a lifestyle. I speak to them accordingly.

If WO mad hatters can’t handle my challenge to be even Bitcoinier, then who can?

The only reason to get upset about the central bank shitcoin trade value is if you were playing around with margin.

I cannot really disagree with your overall point in regards to any suggestion that the employment of margin trading or any other financial instrument are way more advanced techniques than the vast majority of normies should be employing in terms of either their desires to accumulate BTC or to maintain their BTC holdings.. and sure there might be ways to employ such tools once any of us might reach a kind of status of very high BTC accumulation values and/or feeling that we are way overly allocated in BTC.. but still if we are using logic and/or reasonable assessments of our BTC holdings, we are most likely going to come to conclusions that we likely would not need to employ very high levels of employment of such tools in the event we want to use such tools to either continue to accumulate, maintain the value of our BTC holdings or even to try to inject some possibilities of exponentiality onto an asset class that is already seemingly quite exponential in the way that it is already designed (the "designed to pump forever" idea that is built into bitcoin).

By the way, my above paragraph is meant to be largely as an agreement with you, even though I realize that you personally are not emplying the prudence and reasonableness that you seem to recognize as being better practices (perhaps best practices).

I don’t disagree with you about that, either. You do understand that when I just went through five months of hell and destroyed my own assets with foolishness

that I had previously warned others against, I am urgently,

passionately warning those who don’t know better—which I did, which makes it worse for me.

Even after my recent experiences, I may try margin again someday. For example, if I were to devote serious time and effort to studying mathematical finance (I’ve been dabbling with it lately, on a “beginner dipping a toe in” level), become a Real Quant(TM), and create a thoroughly backtested algorithmic HFT bot based on a rigoroous probability model, then—well, then, at that point I would know if and how that bot should use leverage!

Until then, I will stay the hell away from margin.

And I don’t need it. I can write other bots, that do more basic stuff without risks... I’m working on that; it was my plan to save my bitcoins from debt that I otherwise had no way to repay.I will advise others accordingly.

I disagree with your ongoing baloney insertion of likely to be misunderstood characterization of the dollar (and fiats) as shitcoins.. sure they are shittier than bitcoin overall, but they continue to serve quite a few purposes, including liquidity ideas and we still likely need to figure out ways in which we balance our investment portfolio holdings (including BTC) with them and even use those fiats to buy goods and services and of course to spend them first.. or towards the beginning of any spending that we might be doing...

The U.S. Dollar is one of the

worst shitcoins. The Euro isn’t much better, although it lacks the thrilling feature of the petrodollar house-of-cards.

If you’re blind to that, it is only because you can’t see beyond the mirage created by dollarized pricing.

Not shitcoins? WTF do you consider a “shitcoin”? Anything better than SHIB?

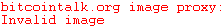

This image is something found searching the Web for historical gold pricing. The other images here are from:https://wtfhappenedin1971.com/

This image is something found searching the Web for historical gold pricing. The other images here are from:https://wtfhappenedin1971.com/

Jay, I will become a SOL maximalist chasing passive income from delegated stake rewards plus 20,000% APY from Leveraged Yield Farming before I consider your absurd argument that central bank debt-fiat altcoins are not shitcoins. It would be less dumb.

Jay, I will become a SOL maximalist chasing passive income from delegated stake rewards plus 20,000% APY from Leveraged Yield Farming before I consider your absurd argument that central bank debt-fiat altcoins are not shitcoins. It would be less dumb.Your problem is that you only see that to which you are accustomed. Study some history.

Become a long-term thinker—with a time horizon beyond “4 to 10 years”; that is “long-term” only to an adolescent. Attain a philosophical detachment from your own circumstances. You have plenty of life experience with investing—but history is the study of the life experience of billions of people, over the course of many lifetimes. Take off the blinkers that restrict your vision to the nice, comfortable world of what most people consider trustworthy. Most people are ignorant, ineducable, and terrifically gullible.

If cryptocurrencies are indeed

currencies, then fiat is just a type of non-cryptographic altcoin. Some fiat monetary systems have worked well, historically—at least, for awhile—at least, as long as the same government remained in power and avoided internal corruption. That is like observing that, in my opinion, about one in a thousand altcoins is a meritorious project and, in a few cases, potentially even a good investment—

maybe. The rest are shitcoins.

Look at the above charts, imagine that they are for altcoins pumped by Twitter and Youtube “crypto influencers”, and then tell me again that those aren’t shitcoins. I will personally petition the CEO of Bitcoin to revoke your Bitcoin membership!

[...]

not feeling too good with the recent low of $22,600 from about 3 hours ago, as I type this post...

..

TBH, if I had not wrecked myself, I would be feeling fine now. Either munching popcorn and watching the carnage, or ignoring it altogether—I didn’t even know about the July 2021 dip to $29k until long after it happened, because my attention was absorbed in other matters.

Protip to newbies: That is the virtue of keeping coins in your wallet where they belong. If you so desire, you can forget the about market—relax; have zero stress; just ignore it, turn off the computer, go outside and play in the sunshine—except when you want to trade, or you need to budget some spending.And if I had spare fiat, I would now be overjoyed.

Cheap discount bitcoins! I am not blustering when I say that I usually

love bear markets.

I am even tempted to wish for this one to last for awhile—to have BTC scrape along bouncing off 200 WMA for the next year, while I rebuild! But my own foolish mistakes do not justify wishing for others to suffer. I congratulate those who were more prudent, who are buying BTC right now. I’ll be lucky if this opportunity continues—if BTC takes some time grinding along more or less close to where I lost it; but I cannot wish for that.

Edits: Fixed typos; there are probably more. Added an observation on the nature of “long-term” thinking. Vaguely clarified image sourcing. Other minor tweaks; ok, I will stop keeping a changelog here unless there are major alterations.

Poll

Poll