bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

February 26, 2020, 09:39:41 AM Merited by vapourminer (1) |

|

Corn is s*ck*ng donkey c*ck

Bought my first bitcoin today, in 2020. |

|

|

|

|

|

|

|

|

|

|

|

|

|

"Bitcoin: mining our own business since 2009" -- Pieter Wuille

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

El duderino_

Legendary

Offline Offline

Activity: 2506

Merit: 12038

BTC + Crossfit, living life.

|

|

February 26, 2020, 09:41:41 AM |

|

Corn is s*ck*ng donkey c*ck

Bought my first bitcoin today, in 2020. I have won my first BTC of 2020, starting on a recovery of the boating incident |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2506

Merit: 12038

BTC + Crossfit, living life.

|

|

February 26, 2020, 09:44:27 AM Merited by vapourminer (1) |

|

Btw a total random (a friend but not a coiner) called me just like 2 minutes ago ... To ask for information and help to set up an exchange for buying Corn .... Then he said but will I buy or wait cause the market always between 9.5 and 8.5k...   Why ending the conversation with the classic n00b ending  Gotta instruct him the DCA strategy but I hope he's not to big of a job to explain to |

|

|

|

|

|

|

Gyrsur

Legendary

Offline Offline

Activity: 2856

Merit: 1518

Bitcoin Legal Tender Countries: 2 of 206

|

|

February 26, 2020, 09:57:15 AM |

|

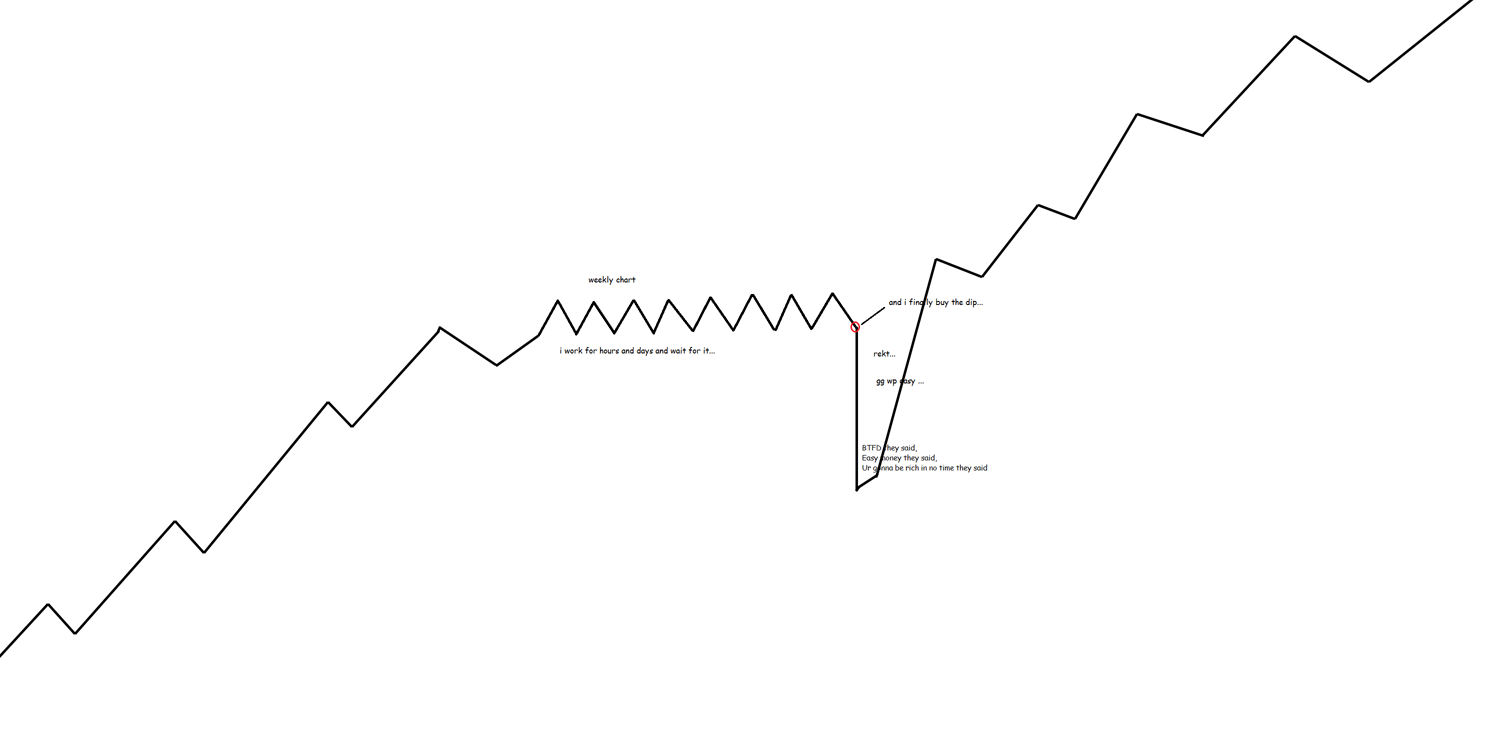

Buy the f*cking dip they said, easy money they said... Activity 2422, you should be a veteran, general, major or whatever.... Don't frighten the n00bs  Don't be affected by a dump/correction Btw last time we past Vegeta we went up pretty fast, remember Vegeta is an iconic character with some real dragon ball Z powers.... One that doesn't let himself to be taken easily... Never saw the episodes? The guy is extremely powerful, probably BTC will be the only one to truly defeat him, time will tell when. but I thought our plan is to frighten the n00bs that we can accumulate MOAR of the corn with cheap prices?  |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2506

Merit: 12038

BTC + Crossfit, living life.

|

|

February 26, 2020, 09:58:44 AM Merited by LFC_Bitcoin (4) |

|

|

|

|

|

|

AlcoHoDL

Legendary

Online Online

Activity: 2366

Merit: 4161

Addicted to HoDLing!

|

|

February 26, 2020, 10:05:29 AM |

|

Buy the f*cking dip they said, easy money they said... Just zoom out.  |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3528

Merit: 9547

#1 VIP Crypto Casino

|

|

February 26, 2020, 10:06:37 AM |

|

+4 Just woke up & first post I saw, actually enjoyed that. |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2506

Merit: 12038

BTC + Crossfit, living life.

|

|

February 26, 2020, 10:07:08 AM |

|

$9.6 trillion total world GOLD. Not sure bitcoiners realize that 2/3 is jewelry+official. Only $2 trillion is available "investable gold." Bitcoin is already 10% the size of investable gold. Incredible accomplishment for just 10 years of existence. Bitcoin too big to die now.  https://twitter.com/DTAPCAP/status/1232542153513078785?s=20 https://twitter.com/DTAPCAP/status/1232542153513078785?s=20 |

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

February 26, 2020, 10:07:16 AM |

|

|

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 26, 2020, 10:09:32 AM Merited by vapourminer (1) |

|

edit: what does that mean, that the document is watermarked? should I expect the Spanich Inquisition?

No, but you exposed the fact that the user written in that document broke the content licensing with J.P. Morgan and sent the document to people not entitled to receive it. I don’t know and I don’t care if you are that particular user. I just want you to be sure you actually saw that. |

|

|

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

February 26, 2020, 10:14:45 AM Merited by fillippone (2) |

|

edit: what does that mean, that the document is watermarked? should I expect the Spanich Inquisition?

No, but you exposed the fact that the user written in that document broke the content licensing with J.P. Morgan and sent the document to people not entitled to receive it. I don’t know and I don’t care if you are that particular user. I just want you to be sure you actually saw that. well Dibb dobbed @dliedtka in the doodoo so I guess the info is out there now |

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 26, 2020, 10:16:38 AM |

|

edit: what does that mean, that the document is watermarked? should I expect the Spanich Inquisition?

No, but you exposed the fact that the user written in that document broke the content licensing with J.P. Morgan and sent the document to people not entitled to receive it. I don’t know and I don’t care if you are that particular user. I just want you to be sure you actually saw that. well Dibb dobbed @dliedtka in the doodoo so I guess the info is out there now Damn I must have missed that one! Good catch. |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2506

Merit: 12038

BTC + Crossfit, living life.

|

|

February 26, 2020, 10:23:35 AM |

|

+4 Just woke up & first post I saw, actually enjoyed that. Haha me too, enjoyed it as well Glad I could be of service |

|

|

|

|

Ibian

Legendary

Offline Offline

Activity: 2268

Merit: 1278

|

|

February 26, 2020, 10:30:37 AM |

|

The WHO no longer has a procedure to declare something a pandemic, official statement from 2 days ago.

WHO leader makes a public statement that the world must prepare for a global pandemic.

WHO declares that Corona-tama has peaked in china.

This is how entire cultures collapse. Nobody knows what the fuck anyone else is doing, everyone is lying and nobody is held to account.

|

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

February 26, 2020, 10:34:00 AM |

|

|

|

|

|

|

|

|

|

Cryptotourist

|

|

February 26, 2020, 10:50:59 AM |

|

+1 I swear I see Lambie & Bob in there.  #yeeehaa |

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 26, 2020, 10:54:05 AM |

|

Regarding the CoronaVirus outbreak in Italy. Why Italy? I have a guess. According to a Bloomberg survey, Italy has the fourth most efficient Heath service in the world. This Service is basically free, or prepaid via taxes if you want. Cost control has been tightened, but still the vast burden of it is on the central state (trough local governments) who can then spend how much they want. I think in Italy a little bit less than 9,000 people have been tested for corona virus. Other countries haven’t disclosed this information but apparently we are in the ballpark of 7,000 for UK and less than 500 (five hundreds) for France. So this explains why Italy had so many cases. Other countries have the same percentages with CoronaVirus, yet they don’t know, yet. |

|

|

|

|

|

Poll

Poll