LFC_Bitcoin

Legendary

Offline Offline

Activity: 3528

Merit: 9544

#1 VIP Crypto Casino

|

|

April 29, 2019, 02:05:14 PM |

|

^interesting dude thank u.  There's a halving countdown. There certainly is. I followed it before the last one too  |

|

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2156

Merit: 15457

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 29, 2019, 02:13:34 PM

Last edit: May 16, 2023, 09:19:27 AM by fillippone |

|

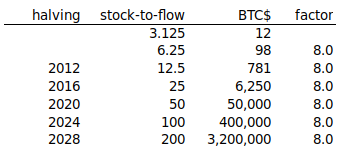

According to this graph made by PlanB, after the halving of 2024 his model is calling a BTC price of USD 400,000.  I dont like this graph. Because it have same factor for every halving but emission inflation keeps decreasing. So supply pressure from freshly mined coins is smaller and smaller. When first halving happened in 2012. 50% of all Bitcoin was mined and daily emission of 3600 BTC gave us 0.03425% daily emission inflation what is if we multiply with 365 days = 12.5% yearly emission inflation When last halving happened in 2016. 75% of all Bitcoin was mined and daily emission of 1800 BTC gave us 0.01142% daily emission inflation what is if we multiply with 365 days = 4.17% yearly emission inflation At next halving next year 87% of all bitcoins will be already mined and daily emission of 900 BTC will give us 0.00489% daily emission inflation what is if we multiply with 365 days = 1.78% yearly emission inflation 12.5/4.17 is more then 4.17/1.78. So impact of halving on price of Bitcoin is decreasing. BTW Gold average yearly mining inflation is 1.6% I am not really getting your point. Firstly this Stock to flow is not a new concept. As far as I know it was proposed in the bitcoin environment in by Saifedean Ammous in his book The Bitcoin Standard: The Decentralized Alternative to Central Banking. Second stock to flow is actually the inverse of inflation rate, so if you are countering this with inflation rate you are actually using the same argument for and against this graph. Thirdly i get you didn't get the point when saying "halving" are less and less relevant: the opposite is actually true as Stock to Flow is increasing dramatically (and this is a choice made by Satoshi when defining the protocol). "halving" are less and less relevant to the price. This table have factor 8. Price increase every halving for 8 times. That have no sense. Impact of halving on price decreases with every halving. If it had factor 8 at last halving then will have less on this halving and had more on previous halving. This is my point. Ofcourse is impossible to see this from price graphs since emission inflation just adds pressure to price increase, but there are also other factors. This model is not black magic. The author used data from 2009-2012 (note: no halving included) and found it pretty accurately as it was able to forecast BTC prices up to 2017. So your "make no sense" collides with an R^" of 95%: pretty high confidence level for a coincidence or spurious correlation, also when you have a strong rationale. Just take numbers yourself. it is not correct. Let me go now with this stock of flow. It is just opposite of how I calculated it. For 2012 9.5, for 2016 should be 24 and for 2020 56. Well I double checked, for what it is worth. IF you think you spotted some errors you can double check all the relevant code here: https://github.com/100trillionUSD/bitcoinand then interact directly with the author via issue requests. I am sure he's more than willing to have his numbers set straight (no sarcasm here). Otherwise you might learn something. |

|

|

|

|

coinlocket$

Legendary

Offline Offline

Activity: 2366

Merit: 1512

#1 VIP Crypto Casino

|

|

April 29, 2019, 02:20:43 PM |

|

Is this prediction updated with a daily base? If yes has a value of 0. Do we have any past result prediction from the website (only, of course, if is not updated daily otherwise make any sense and are only random numbers) |

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2156

Merit: 15457

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 29, 2019, 02:26:06 PM |

|

Is this prediction updated with a daily base? If yes has a value of 0. Do we have any past result prediction from the website (only, of course, if is not updated daily otherwise make any sense and are only random numbers) I would be surprised if any of this "models" has a value >0. As I posted above, the only price model that could be used to predict prices in 2019 using the data only from 2009-2012 is the one of PlanB. That is serious stuff. |

|

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

April 29, 2019, 02:33:41 PM |

|

And “resurfaces” is the wrong term as it implies that the need has previously surfaced, which it has not. The need may never surface.

You've already banished it from your revisionist history? There were some high fees in 2017. There was no need for a block size increase as demonstrated by the failure of BCH. If it was “necessary”, BCH would have won. The result was a BTC dominance drop from an overwhelming ~85% to abut half. Are you prepared for a drop to about a quarter next time the stream is blocked? You're whistling past your own graveyard. |

|

|

|

|

|

DoublerHunter

|

|

April 29, 2019, 02:34:54 PM |

|

Is this prediction updated with a daily base? If yes has a value of 0. Do we have any past result prediction from the website (only, of course, if is not updated daily otherwise make any sense and are only random numbers) ^that's why I wanted to know here if they are accurate on giving a forecast in prediction. (they don't have price graph). I found out that they had a bitcoin price date and also today. |

|

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

April 29, 2019, 02:38:53 PM |

|

This is under the assumption that the block size wouldn't grow when needed, blocks aren't full without outside attacks so there's no evidence that when the time comes we won't increase the block size to a common sense size.

Well, other than the evidence that blocks were kept small the last time they became persistently full. Which, in itself, is pretty strong evidence. Once the need resurfaces (and it most certainly will), how long do you think it will take to implement the necessary change? If it was urgent it could probably be done in 48 hours. But it won’t be urgent. It ain't just a river in Egypt. I would mostly agree with the bear here. The last full block crisis resulted in inaction, to force people onto segwit. Yes, but was the attrition worth it? Especially given the fact that it was all so unnecessary. I presume the next full block crisis will result in inaction, to force people onto lightning.

Yes, but will the attrition be worth it? Sanity says no. |

|

|

|

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

April 29, 2019, 02:47:34 PM |

|

oh. yay. derivatives. More tools for the pinstriped bandit class. |

|

|

|

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

April 29, 2019, 02:50:16 PM |

|

This is under the assumption that the block size wouldn't grow when needed, blocks aren't full without outside attacks so there's no evidence that when the time comes we won't increase the block size to a common sense size.

Well, other than the evidence that blocks were kept small the last time they became persistently full. Which, in itself, is pretty strong evidence. Once the need resurfaces (and it most certainly will), how long do you think it will take to implement the necessary change? That was a short spam attack period, you know damn well that was artificial and everyone knew it. Irony of the recent brouhaha over the definition of 'artificial' is duly noted. Natural ... artificial ... what does it matter? Effect is the same. It's a vulnerability. An open attack vector if artificial. A suicide if natural. |

|

|

|

|

_javier_

Member

Offline Offline

Activity: 444

Merit: 31

Still a manic miner

|

|

April 29, 2019, 02:50:53 PM |

|

disgusting interview of a disgusting actor. middle finger to you too, "Doctor" |

|

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

April 29, 2019, 02:52:30 PM |

|

This is under the assumption that the block size wouldn't grow when needed, blocks aren't full without outside attacks so there's no evidence that when the time comes we won't increase the block size to a common sense size.

Well, other than the evidence that blocks were kept small the last time they became persistently full. Which, in itself, is pretty strong evidence. Once the need resurfaces (and it most certainly will), how long do you think it will take to implement the necessary change? That was a short spam attack period, you know damn well that was artificial and everyone knew it. Yes, I remember people posting the addresses of the spammers at the time. That's the good thing about 1mb blocks, spamming gets expensive. Big blocks are a disaster if there isn't sufficient utility. Say you had 32 MB blocks and only < 2 MB of actual traffic. Someone could easily spam 28 MB per block for peanuts. Sustained over 1 day: 4032 MB of garbage for almost free. Good idea indeed. You seem to be postulating some novel mechanism by which one can examine each transaction, and classify it as spam vs. notspam. Care to divulge your criteria? |

|

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

April 29, 2019, 02:55:34 PM |

|

Hoan Kiem Lake is famous because a turtle god lives in it that gave the Vietnamese emperor a sword to fight off Chinese invaders.

Listen -- strange women lying in ponds distributing swords is no basis for a system of government. Supreme executive power derives from a mandate from the masses, not from some farcical aquatic ceremony. ... Well you can't expect to wield supreme executive power just 'cause some watery tart threw a sword at you! - Dennis |

|

|

|

|

siggy_77

Jr. Member

Offline Offline

Activity: 50

Merit: 57

|

|

April 29, 2019, 02:58:11 PM Merited by JayJuanGee (1) |

|

I plan selling 50% of my Bitcoins. Was thinking to do that @$50k per coin. What do you guys think? Hold a bit longer and see where it goes?

I think 50K is pretty conservative Depends.. when did you make the decision to sell at 50K? ... Did you come up with this plan while you were calm, rational, and not under the influence of FOMO, hopium, or any other mind altering condition? IF so, then you should follow your plan. If not, then you should immediately stop reading WO, and any other bitcoin news for at least a week. DO NOT look at the price for a week. Completely disengage all contact from all things crypto for at least a week. Then sit down, and calmly review your plans. Decide a reasonable go forward plan with various sell points. Never go full fiat (always plan on keeping at least a small BTC stash) Once you have a plan, stick to it. In short: DO NOT make decisions based on FOMO. |

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2492

Merit: 2899

|

|

April 29, 2019, 03:07:36 PM Merited by JayJuanGee (1) |

|

You seem to be postulating some novel mechanism by which one can examine each transaction, and classify it as spam vs. notspam. Care to divulge your criteria?

We've been over this already haven't we. Type 1. Legit transaction. The actor needs to move funds because the funds are needed to be elsewhere. Type 2. Spam transaction. The actor wants to move funds for other collateral effects, such as clogging the queue. I admit there is no easy criterion to tell one from the other onchain, after the fact. Keeping blocks small shifts the balance in favor of Type 1, preventively. |

|

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

April 29, 2019, 03:29:49 PM |

|

You seem to be postulating some novel mechanism by which one can examine each transaction, and classify it as spam vs. notspam. Care to divulge your criteria?

We've been over this already haven't we. Type 1. Legit transaction. The actor needs to move funds because the funds are needed to be elsewhere. Type 2. Spam transaction. The actor wants to move funds for other collateral effects, such as clogging the queue. I admit there is no easy criterion to tell one from the other onchain, after the fact. QFT. Keeping blocks small shifts the balance in favor of Type 1, preventively.

By what mechanism? |

|

|

|

|

Febo

Legendary

Offline Offline

Activity: 2730

Merit: 1288

|

|

April 29, 2019, 04:01:14 PM |

|

I see his flaw. "Bitcoin currently have a stock of 17.5m" Then he uses this 17.5m as that was stock in 2012 and 2016 and 2020 and 2024 and 2028. |

|

|

|

|

becoin

Legendary

Offline Offline

Activity: 3431

Merit: 1233

|

|

April 29, 2019, 04:08:38 PM |

|

Craig Wright Dubs Binance a ‘Money-Laundering Bucketshop’

Too bad. Even bucketshops are delisting CSW's coin. |

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2156

Merit: 15457

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 29, 2019, 04:11:37 PM |

|

I see his flaw. "Bitcoin currently have a stock of 17.5m" Then he uses this 17.5m as that was stock in 2012 and 2016 and 2020 and 2024 and 2028. Negative. For past analysis he uses historical BTC supply, for future, projected one. Two evidences for that: 1. In the coloured graph, SF data between halvings change every month, so by construction stock cannot be the same, montly, let alone from 2012 to 2012 and beyond. 2. In the Github there's an excel where you can check he uses historically accurate suplly for all the calculations. |

|

|

|

|

|

Poll

Poll