|

Yep, why the market is so bad all of a sudden?

Apart from some TA jerks (cough-Tom Crown-cough) with their ever decreasing price targets, I fail to see why all this 'panic'?

A rhetorical question.

|

|

|

|

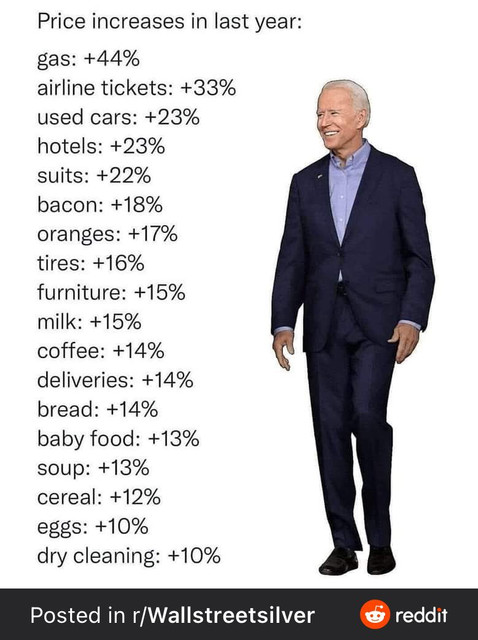

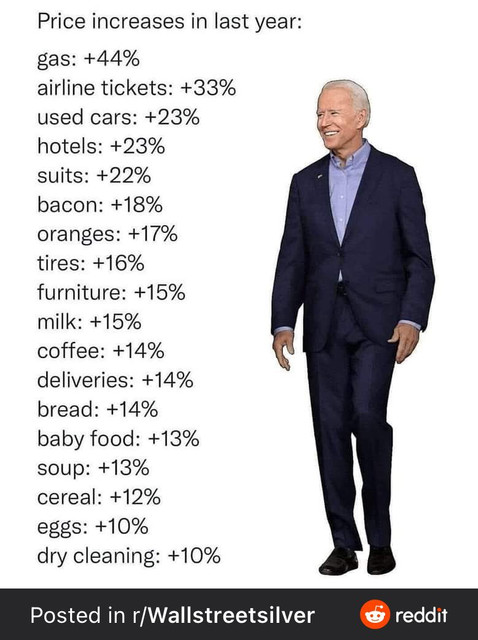

Wall Street Silver@WallStreetSilv In what alternative universe does this add up to an 8.6% inflation rate?  https://twitter.com/wallstreetsilv/status/1535612309762088960?s=21 https://twitter.com/wallstreetsilv/status/1535612309762088960?s=21They’re robbing you blind, man. I will buy bitcoin all the way down, IDGAF. Every satoshi you buy now & in the future is the smartest move you will ever make. Do the opposite of what the herd do, the price is down but so what. The smart money does the exact opposite of what the plebs do. imho, bitcoin priced in these price increases in 2020-2021 and now it is showing what will happen in 6-12 mo: perhaps a severe recession/depression or at least a significant catastrophic deflation. We already see that stocks are dropping fast (a forward looking indicator). RE to follow, imho. |

|

|

|

|

Where you guys think rates (short term) will peak at?

WS thinks around 3%.

As soon as we reach peak rates and they start easing or stay flat, btc should go to an overdrive since "real rates" would still be deeply negative at 3% and 8% (or even 6% if it declines somewhat) inflation.

Could be by the EOY.

|

|

|

|

Rephrase what I said, according to its context: In the hypothetical event of a total ban, >99% of people here could be easily stopped from using Bitcoin.

for anyone of us in the USA (you know, land of the "free") a government ban would certainly stop almost all of us in their tracks. even if youre not kyc'd anywhere, use tor, decentralized exchanges etc i would wager they would find out anyway. maybe if you live totally off the grid and never go near civilization it could be done but thats not for me. call me a wimp or whatever, i need modern society to live comfortably. especially modern medicine. understand: i HATE kyc and the government snooping in our business to the point they just hoover all info they can to store and analyze for "security/terrorism/etc" purposes even when its not currently useful. as they can always make some law in the future and look back at all that collected data to retroactively get you on some law that doesnt even exist right now. look, i will mess with a lot of things but one entity i wont mess with is the irs. they have NO sense of humor. makes me glad i did not hide my btc gains even before the irs targeted it. call me a wimp but thats what we here in the USA need to do to exist in peace. bleh. In the USA you could mine to an address and never touch it. I kyc everything fully transparent and I now did an LLC with buysolar. I had a schedule c but turning 65 and wanting to still work my accountant advised using an account with the business name on it for bitcointalk. Thus the new account vs philipma1957. Thinking BTC is truly private and stealthy holds back its adoption as that is my opinion. phil (or LLC2022), you seem to mix a few things (anything below is not an advice, consult CPA): 1. btctalk and business are two different "things" that don't have to be related, lol. 2. If it is a one member LLC, then taxes are being channeled to your INDIVIDUAL 1040. If LLC has more than one member, then it is more like a corp, which has both advantages and disadvantages. 3. You can very well mine to an account, but still record it and pay proper taxes on all proceeds (after accounting for expenses). I sell a lot of gear . I wont be selling with this account. I will be using the LLC account to sell from now on. I did a schedule c and used philipma1957 to sell here and on ebay for years and years and years. I will not be doing a schedule c with the two person LLC . I will be closing the schedule c business. So since I have sold 10s of thousands of gear in the past I want zero confusion when I sell off a lot of gear. All I was saying is that it would complicate your return, perhaps. It's much more 'involved' than a single person LLC. You would have to decide if you want to be a C-corp or a S-corp. If S-corp, then "owners need to draw a reasonable salary". You would also need an "operating agreement". Your CPA can probably fetch all that info, but here is something to start: https://www.upcounsel.com/two-member-llcEDIT: if the second person in LLC is your wife, then it is even more complicated (depending on in which state the LLC was formed). In 9 states an LLC with wife is treated as a single member LLC (with simplified tax treatment). New Jersey is NOT a community property state, but Nevada and Texas are. BTW, you don't have to form LLC in your home state; in fact, many are formed in Nevada for some reason. CPA should know all this and, perhaps, already informed you. Good luck! |

|

|

|

Rephrase what I said, according to its context: In the hypothetical event of a total ban, >99% of people here could be easily stopped from using Bitcoin.

for anyone of us in the USA (you know, land of the "free") a government ban would certainly stop almost all of us in their tracks. even if youre not kyc'd anywhere, use tor, decentralized exchanges etc i would wager they would find out anyway. maybe if you live totally off the grid and never go near civilization it could be done but thats not for me. call me a wimp or whatever, i need modern society to live comfortably. especially modern medicine. understand: i HATE kyc and the government snooping in our business to the point they just hoover all info they can to store and analyze for "security/terrorism/etc" purposes even when its not currently useful. as they can always make some law in the future and look back at all that collected data to retroactively get you on some law that doesnt even exist right now. look, i will mess with a lot of things but one entity i wont mess with is the irs. they have NO sense of humor. makes me glad i did not hide my btc gains even before the irs targeted it. call me a wimp but thats what we here in the USA need to do to exist in peace. bleh. In the USA you could mine to an address and never touch it. I kyc everything fully transparent and I now did an LLC with buysolar. I had a schedule c but turning 65 and wanting to still work my accountant advised using an account with the business name on it for bitcointalk. Thus the new account vs philipma1957. Thinking BTC is truly private and stealthy holds back its adoption as that is my opinion. phil (or LLC2022), you seem to mix a few things (anything below is not an advice, consult CPA): 1. btctalk and business are two different "things" that don't have to be related, lol. 2. If it is a one member LLC, then taxes are being channeled to your INDIVIDUAL 1040. If LLC has more than one member, then it is more like a corp, which has both advantages and disadvantages. 3. You can very well mine to an account, but still record it and pay proper taxes on all proceeds (after accounting for expenses). |

|

|

|

pump it up, buddy boy!  On a serious note, I am not sure why the doldrums. That much noise about such a small (currently & relatively) asset class? ...amazing...hopefully pertains to AT LEAST 10X increase in 2-5 years. |

|

|

|

OT: If you blended all 7.88 billion ppl on Earth into a fine goo (density of a human=985 kg/m3, average human body mass=62 kg), you would end up with a sphere of human goo just under 1 km wide. This is a visualization of how that would look like in Central Park.

© reddit/kiwi2703and weight of that human goo ball will be 332bn kg ~ 732bn lbs  https://twitter.com/_astroerika/status/1533178823335940096?s=21 https://twitter.com/_astroerika/status/1533178823335940096?s=21Interesting, but totally GROSS. I guess, it would be an AI perspective on humanity: it's worth the amount of organic matter (carbon, oxygen and hydrogen are otherwise plentiful in the universe) |

|

|

|

Thanks. Is there a non-scribd link where a PDF or similar can be downloaded? The bill text that you linked is incorrect. It has been explicitly disclaimed by Senator Lummis. Please be more cautious. https://nitter.net/SenLummis/status/1530281115247951872I am working diligently with @sengillibrand to finalize bill text of our comprehensive digital asset legislation.

Any language circulating online is an incredibly outdated version from March 1. Stay tuned for our release of the actual bill on June 7th!

May 27, 2022 · 8:13 PM UTC · Twitter for iPhone I found that tweet when searching for this about a week ago. It was linked in a correction to an article by The Block. The said article also linked to the exact same Scribd page—I didn’t notice earlier that it is the exact same link. Here’s a full draft of Senator Cynthia Lummis' landmark crypto billby Kollen Post[...] In the months since the bill’s initial announcement, the senator’s staff has kept the actual text of the draft under wraps, using software that prohibits sharing and printing of the document. Various members of the crypto industry, lobby and Congressional staffers have expressed frustration about the limited access to the bill, which has changed frequently. [...] [ Highlight of the following: https://archive.ph/TQcog#selection-785.0-815.10] Following the publication of this story, Lummis said in a tweet that "any language circulating online is an incredibly outdated version from March 1," adding: "Stay tuned for our release of the actual bill on June 7th!" According to a source with knowledge of the behind-the-scenes process, staffers have continued to update the bill’s contents. Editor's Note: This story has been updated to reflect that, according to a post-publication comment from the Lummis team, the draft is dated March 1. Also adds a tweet from Lummis.Lummis Bill Draft by Mike McSweeney on Scribd Since The Block failed to fact-check this adequately before publication, I will make a mental note to be more skeptical of their articles (and of the byline “journalist”) in the future.

This is not only of interest to Americans. Just as political pressure on mining in the E.U. affects American Bitcoiners, and just as 1990s-era U.S. export regulations on cryptography affected everyone in the world, I think that major American legislative activity about Bitcoin and cryptocurrency is of more general interest. With all due respect to Senator Lummis, I’ll just say for now—this could be for better, or for worse. If the bill released June 7 is anything like that early draft, I think it is overall much for the worse (despite a few improvements to the situation). However, Senator Lummis obviously did not want to be held to whatever that text said. Perhaps there may have been some major improvements. Ah, back and forth. 1. Some publication posted the link, that is all that it is. Not sure about the concerns about "incorrect" and "be careful". 2. pretty sure 99% of it will be there, especially $600 cut out and mining income only after you sell. 1% possible change might be some minutia. Contrary to what you hope for, I expect no major improvements. |

|

|

|

Thanks. Is there a non-scribd link where a PDF or similar can be downloaded? TL;DR too complex to truly understand, but i noticed a couple of things:

1. $600 exception for payment (no tax on appreciation for tx less than $600).

2. Mining is not taxed until you sell btc for $ (or other coin, I suppose).

I think the capital gains tax exemption for small purchases was expected. That would remove one of the biggest obstacles to using Bitcoin as money. I am worried about any possible attempt, by accident or otherwise, to redefine Bitcoin as something substantively different than a currency, for regulatory purposes. Worst of all, anything that winds up twisting Bitcoin into a security. Bitcoin has zero equity. That’s an important feature. It is also why it is perfectly fair to buy 10k BTC for 2 pizzas, or 1 BTC for $67k. Bitcoin has no memory of what you paid for it.(I may elaborate on this sometime, here or elsewhere. Cryptic here, in a way. I am deeply concerned about any attempt to redefine Bitcoin in this fashion, especially in the U.S. or other influential jurisdictions. It would be easy to slip by the public, because most of the public stupidly thinks of Bitcoin as sort of like a stock. STOP THAT!) If you skimmed the bill, did you see the legal definitions that would apply to Bitcoin? This is a "view from above", so no coins are mentioned by name. There are only "digital assets", "payment stablecoins" and "ancillary assets" (those are maybe tradable derivatives, like WBTC, for example). Of interest, the bill specifically says that payment stablecoins CANNOT be backed by other "digital assets". They also refer to "virtual currencies" and stipulate that those are NOT legal tender (of course, at this stage). they also stipulate that "virtual currencies" have no backing by any financial assets (with the exception of "digital assets"). Specifically modifies language of 401K and 401a, allowing those to buy "digital assets". Wowza! Specifically says that validators (miners), sellers of software and hardware, software developers are NOT brokers. DAOs would be business entities, not disregarded entities. Start of mark-to-market treatment of "digital assets", not forever intangibles anymore (not sure if this is good or bad). NO cancellation of bank accounts for 'reputational risk'. "An appropriate Federal banking agency shall not restrict or discourage a depository institution from entering into or maintaining a banking relationship with a specific customer or group of customers based on reputation risk, including through the examinations and ratings of the depository institution." This is nice as people lost accounts at some banks under the auspices of "reputational risk". |

|

|

|

For US based peeps...Sen. Lummis is about to introduce her bill (on Tuesday, I believe). https://www.scribd.com/document/576008331/Lummis-Bill-DraftTL;DR too complex to truly understand, but i noticed a couple of things: 1. $600 exception for payment (no tax on appreciation for tx less than $600). 2. Mining is not taxed until you sell btc for $ (or other coin, I suppose). |

|

|

|

OT: good for Wales, but there WAS a penalty (that was not given) to Ukraine. There was a clear knock on (Yarmolenko's?) foot in the penalty area...maybe it was not fully intentional, but it is visible here: https://youtu.be/XxfR-LtiiKM?t=259Congrats to Wales anyway..it would be their first Wcup since 1958. |

|

|

|

Even though we probably should not be kissing the asses of anyone in bitcoin, even if they end up serving as a pretty BIG bitcoin spokesperson in a lot of ways.. And surely Saylor ended up coming to bitcoin in a way that was quite aggressive and assertive in terms of his investment of both money and time, as Gachapin pointed out.

He’s more than that. MicroStrategy is a de facto national intelligence agency for Bitcoin. Hello, what is their core business? Their highly profitable business, the proceeds of which they have used to buy all those bitcoins? Analytics and data mining to guide strategic business decisions. Business Intelligence.(This also relates to some points on the POW vs. POS thread, where I will reply later.) I am dismayed that they apparently got blindsided together with everyone else, as someone out there quietly built up terrifically huge short positions and prepared to execute a multi-pronged trashing of the market, timed to hit right after the big Fed meeting. But it’s not surprising. MicroStrategy are no dummies—but (I infer/upon information and belief) Blackrock, Citadel, et al. are no dummies, either. It is sharks vs. sharks, by analogy to “spy vs. spy”. (Don’t forget that in mid-2020, Saylor himself very quietly built up MSTR’s initial long position. IIRC, before he publicly announced it, he managed to scoop up something like 0.18% of the total then-existing BTC supply without anyone noticing.) Not that timely intelligence on that would mean dumping BTC! Not for someone who is in it for the long term. If I had high capital and an inkling that a much higher-capital party was preparing to wreck the market, I would hold BTC long while shorting perps and dated futures, hedging with options, and taking other steps to batten down the hatches and secure my position with the goal of winding up with more BTC and more dollars at the bottom. FYI, I also take it as highly significant that Saylor and his Business Intelligence company more or less suddenly exchanged their saved-up dollars to bitcoins in mid-2020. (They essentially switched their savings account to BTC—before they started exchanging some of their ongoing income into bitcoins, and using debt to buy even more bitcoins.) That is the action of an extremely well-informed investor, who had access to mountains of data that you and I have no idea about. That’s much more significant than his tweets. Helpful though those are (thx, @saylor). I am in a bit of a loss here. So, you are saying that he was SO well informed that kept buying while SOMEONE was preparing to cut bitcoin price in half? M. Saylor is a good spokesman for bitcoin, but his buys were mostly (in time) at the higher price with an average of 30.8K or something like that. He is not a trader, sure, but it was not a great acumen to buy in mid-late 2020. It's not like Winkelvosses, who bought roughly the same numbers of btc (about 120-130K) at $11 or around. THAT was a prescient buy, made them multi-billionares from a few mil investment. |

|

|

|

OT: for the science buffs out there...here is something that was unexpected (for me): https://www.quantamagazine.org/how-to-make-the-universe-think-for-us-20220531/TL;DR an amazing story on "deep" learning networks, including detailed explanation of "backpropagation" Spoiler: they can convert the image of the number into acoustic waves and then back into a number (their deep learning system would rec that acoustic wave as a number). |

|

|

|

A nice piece of hopium (from reddit): https://www.youtube.com/watch?v=dhL-NhJKeCoTL;DR G. Foss has an intrinsic value of btc of $250K and a target of $2mil (in today's $) with no time frame specified, maybe a few decades. |

|

|

|

|

interrupt

no four in a row...

|

|

|

|

|