Bitcoin ETF is a tool to make Bitcoin becomes more attractive in non-crypto guys. However, I don't see the point why they don't like Bitcoin and still want to buy it via Bitcoin ETFs. It is like when you hesitate to create your Bitcoin wallet, buy and move it to your wallet but you create an account on third-party platform, and buy Wrapped BTC that is not real Bitcoin. Bitcoin ETF is another way to make noise but it does not affect Bitcoin network and on-chain transactions so much. In fact, if there are more demands, there would be more transactions and the network will have more waiting transactions in mempool. In future, with Segwit, Taproot, Lightning network adoption and more upgrades, Bitcoin network will have better capacity to handle transactions. Bitcoin ETF Race from Arcane research. |

|

|

|

If you leverage or trade options or even daytrade on the spot market then DCA is pointless as you just risk it all anyway.

DCA is a specific strategy for investment, long term one. With long term investment, basic rule is invest with your own money. If you borrow money to buy something and call it as investment, you are wrong, it is speculation. Because it is for long term strategy, it does not match day trading. Leverage? If you use leverage, you are speculating or gambling, not investing. In addition, a worse part if you DCA with leverage is you will lose you initial capital and the additional capital you use for DCA. In bad case, you will lose double or tripple of your initial capital because you DCA multiple times. Using leverage to DCA more, you will have higher risk and if liquidation comes, you lose more than what you should lose if you don't DCA with leverage. |

|

|

|

Tools for Dollar Cost Averaging (DCA) DCA with your own money and with your investment taste (long term perspective) and afford your lose at beginning. Have your plan and last resort in case your investment fails. It means you should never use all of your capital to invest into anything and you should have a sort of capital part for expenses, just in case your investment falls to 0. |

|

|

|

Nothing is perfect 100%. You can not achieve 100% privacy, anonymity with the Internet, Tor connections, crypto transactions and mixers. What we do believe is perfect nowadays will become outdated and compromised (with its weakness) in future. It is like hackers find security holes, bugs and exploit it. There are always black holes, bugs, weakness in any tool we are using. Tor is the best for now and you can use it on mobile too. |

|

|

|

I don't know about you guys but these days i found myself ignoring unmerited responses in a topic and tend to only read the merited ones because they're "usually" more relevant to the topic and contain more valuable informations,and in big topics with multiple pages it gets difficult to sort them out.

Usually, not always. Not all merited posts are high quality. Sometimes people dump 20, 30, 50 merits on a single post even it does not deserve it. It is common with merit sources when they see that poster has good quality and contribution in general, but the source does not have time to check post history of the poster and an easy solution is pick one of them, and make a huge merit dump. In another case, it falls to merit abuse. So sorting merited posts in a single thread, and displaying it according to orders does not make sense. First, not make sense about quality of post. Second, not makes sense about flow of discussions. It's awkward when you read a discussion and can not follow its flow of idea, discussion from beginning to ending. I don't know if this was suggested before (sorry for repeating if it was) but wouldn't it be better if the replies with the most merites be shown at the top (instead of the most recent ones) and so on kinda like a reddit upvote system,or at least to add a sorting option to switch between these two display modes (by time of posting or merites recieved).

You can suggested it for a new forum software, Epochtalk. |

|

|

|

NeuroticFish already explain very well about the merit system was begin.

For merit system history, how it began, how it adjusted, etc. Please read my topic Merit system was created after a few months of discussions on how to handle spam epidemic on the forum as consequence of bull run 2017 and ICOs. First, we have Serious discussions and Ivory tower boards; then the merit system kicks off a little bit later. |

|

|

|

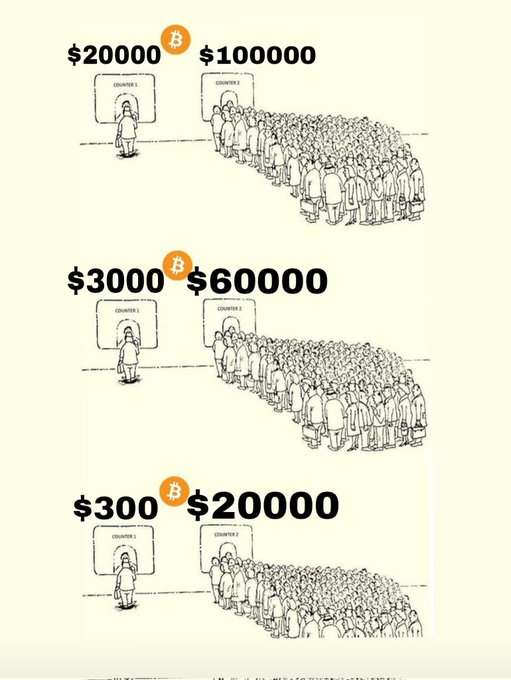

What they said, what they hoped and what they response to when chance comes are differently. So they hope to see lower price again when Bitcoin is in bull run. When bear market comes and gives them discount price, they are fearful that Bitcoin will fall to zero or to much lower price. They reject to take opportunity and when next bull run comes, they hope again. Then if dips come, bear market comes again, they will reject it again.  |

|

|

|

There are correlations between timezone, most actively trading time and best time to have cheapest transaction fee. I think it will be reflected on price too and there is correlation between price fluctuation and timezone. However, there is no such best time of days to buy Bitcoin. If the market has no serious crash, price is not much significantly different within 24 hours of a day. Some charts for transaction fees as well as most actively and least actively trading hours. Best time of days, it depends on each person. If you are looking for time when you buy Bitcoin with least risk of crash after that, you will try to find hours with most boring trading activities, with very little fluctuation of price. If you are looking at crash to buy dip and enjoy bounce, it is a different approach and you will look at different hours (most actively trading hours as crashes will cause panic, huge liquidations, huge trading volume, etc.) |

|

|

|

|

Let's pay your attention on tokenomics of ICO. How is token distributed from seed, private to public sales?

What are vesting terms for different types of investors? How long will it last? When the huge token amount will be released on the market as it can cause a massive dump when investors cash out and take profit.

When you check block explorer, you must pay attention on top wallets to see whether that token has a fair launch, fair distribution. Lastly, make sure you pay attention on top wallets to see whether tokens are locked in smart contracts or not. Being locked means there are vesting terms that are good for retail investors. It will reduce risk of scam exit from core team members of that project.

|

|

|

|

|

20% APY, we already witnessed a lesson from Terra LUNA UST catastrophe. Do we need more?

This bear market is the worst ever if we look at it in an aspect that how it can liquidate venture capitals, lending platforms with millions to billions of dollar in value. That is absolutely the worst ever time we have seen in cryptocurrency market history.

It is good if we see it as a way the market refreshes itself, one way or another, via forced liquidations or else means. It's good as after all we will have a cleaner market to move onwards. The halving in 2024 is waiting for us and it is not too far from June 2022.

|

|

|

|

That is true. But with atomic swaps and hybrid exchanges (decentralized/centralized) this no longer becomes an issue. Traders can still get access to their keys/seeds and enjoy high-performance order execution + low fees like they do with any ordinary centralized exchange. A good example of this is the hybrid exchange called Waves which has the performance of a traditional centralized exchange, but the decentralization of Blockchain tech (giving you access to private keys/seeds). It's the best of both worlds, if you ask me. People just need to be thoroughly educated in order to prevent them from storing all of their crypto assets in a centralized exchange that doesn't give them control of their own keys. As long as most people have access to their keys, the number of hacks/scams/theft will be reduced to a minimum. Just my opinion  They own their private key/ mnemonic seed and it's better for them to store their money on centralized exchanges and custodial wallets. However, an important point to remember is you must approve access to your wallet when you are using DEX. Risk comes from here and some 'naively' people lose money because they give access after receiving airdrop from unverified, scam tokens. https://app.unrekt.net/. You can use this site to revoke access for spending your tokens in your wallet. |

|

|

|

It is never to late to get in. It is just whether you are able to hold your Bitcoin tightly after you getting in. It is very difficult challenge to do. Many adopters get in Bitcoin in 2009, 2010, 2013, 2017 but very few of them are able to hold and sell it at price x5 or x10 their entry price. Now they regret about it, why did they sell their Bitcoin too cheap? According to Controlled supply of Bitcoin, you still have lot of opportunities with a next few halvings to get in. If you sell your Bitcoin, let's assign 10% of it for next 20 or 30 years. You won't lose your capital by the 10% allocation for future. |

|

|

|

If I wrote a computer program that generates private btc addresses and then generated the public address

You're missing a point: Private address to public address, there is no process like this. It's one-way flow from k > K > A Private key (Elliptic Curve Multiplication: one-way) > Public key (Hash-function: one-way) > Public address It is one-way and irreversible process as you can read more in Chapter 3: Key, addresses in Mastering Bitcoin book |

|

|

|

It's a zero sum game. With time and growth of crypto market, total marketcap of the market, of Bitcoin increase but it is a zero sum game, forever. There are buyers and sellers. If a person feel no more rise or no future, it's a seller will sell Bitcoin and oppositely there is buyer to take it. If you are a buyer who is the one sees opportunity for future, what do you look the bear market? You should consider it as opportunity to buy discount Bitcoin. So if there are sellers who consider it as a worst bear market ever, you are one of buyers consider it as a best chance to buy discount Bitcoin. The best ever chance in history of Bitcoin after a bull market. |

|

|

|

|

Taking profit is part of risk-profit management. In order to reduce risk for your investment, you must take profit and get your capital back. This help you to minimize risk of losing your initial capital.

If you taking profit a part of your investment and get a part of your initial capital back, you minimize risk of losing initial capital. Because in worst case, the part you are holding in that token falls to 0, you will still have a part of initial capital.

If you taking profit when your initial capital doubles, and taking profit 50% of it, you will get all initial capital back. This mean there is 0% risk that you will lose your initial capital no matter the rest 50% part in that token moves to 0.

The best time to take profit (in risk management viewpoint) is when you see x2 of your initial capital, let's take profit 50% of it and let the rest 50% run (upward or downward, it will still be fine).

|

|

|

|

|

Dump or correction? They are different viewpoints and it is related to your approach, your belief in future of Bitcoin.

If you think it is a correction, so is it a matter that at what price you buy it and you believe in future, Bitcoin will reclaim its 2021 all time high and even will make new all time highs that will be higher than $69,000? It is not a matter if you buy it at $20,000 $17,000 or $15,000 or even $10,000.

If you think it is a dump, that means you don't believe in Bitcoin, in its future. You think it will fall lower and lower and lose its value. So it does not a good choice to step in at whatever price, $20,000 or $10,000, it does not worth if you have this viewpoint.

|

|

|

|

There are two types of bitcoin mixers: centralized (custodial) mixers and decentralized (non-custodial) mixers. Centralized mixers are essentially privately-owned platforms like regular centralized exchanges, but instead of trading, they provide mixing services. You deposit your bitcoin in their wallet, and they give you other bitcoin in return from their own reserves. You don't control the keys to the coins being mixed until you have been given a private key to a specific address with mixed coins. Like any other centralized service, they are trust-based platforms because (1) they control the keys, and (2) they have access to mixing logs and other sensitive information like IP addresses. On the other hand, they are more efficient and fast than decentralized solutions and, also, they have more mixing liquidity, thus providing their users a higher anonymity set.

Decentralized (non-custodial) mixers don't require users to give up private keys in order to perform a mixing transaction, but those wanting to mix their coins need to find each other first, establish a communication channel, discuss and set the terms of the transaction, etc.

Thanks for the very helpful clarification I don't know about it in details but from their terms (custodial, non-custodial mixers), I can guess what are their platforms, what they provide, what are sort of wallet they provide to customers. It's clearly that I will never choose custodial mixers to use if I want to mix my coin. I can use centralized exchanges for trading but if it is about coin mixing, it's terrible to use custodial mixer. Because it is not helpful for the purpose we want to use mixer/ tumbler service. It's bad from the beginning. |

|

|

|

|

I am confusing. Non custodial mixers.

I am not an expert in Bitcoin mixers/ tumblers but I believe with the idea of mixing/ tumbling, such service should not require users to send their Bitcoin to custodial wallets of that service in order to use it.

You can send your coin from ycustodial or non custodial wallet to a mixer, and get your coins out is outputs. It is unreasonable to create a custodial Bitcoin mixers, that sounds like scam

Please enlighten me if I am wrong.

|

|

|

|

1miau, you create a huge and helpful thread so feel free to check other collective threads and add anything is missing in yours and if you feel it is good supplementary for your thread. |

|

|

|

Hello I have thought of holding 4 particular currencies which includes BTC, ETH, BNB, UCT. But within me I feels I should trade with them to accumulate more of those currencies maybe before the bear will be finally over I would have ended up having much of them I engaged myself by trading.

In early months, you will succeed to increase total coins but because you don't know when the bear market ends; don't know when a specific coin will has 50%, 100% rise you will halve your total coin some day. In the end, your effort will be nothing. The best practice, in case you do really love a specific coin, after you manage to double amount of coin you have, it's time to hold it tightly, very tightly. My advice is when you don't have plan to sell that coin and are a really long term holder. Hodling is not actually good, especially with altcoins in bear market. |

|

|

|

|