Phil_S

Legendary

Offline Offline

Activity: 2091

Merit: 1461

We choose to go to the moon

|

|

October 15, 2020, 05:56:38 AM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make sure you back up your wallet regularly! Unlike a bank account, nobody can help you if you lose access to your BTC.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Karartma1

Legendary

Offline Offline

Activity: 2310

Merit: 1422

|

|

October 15, 2020, 07:23:03 AM |

|

How can one not love bitcoin? Look how beautiful that green line is: its unpredictability and readiness to jump over the sky is beautiful. Gold and silver? Look at them, boring. |

|

|

|

|

psycodad

Legendary

Offline Offline

Activity: 1606

Merit: 1582

精神分析的爸

|

In other news, remember the WinNuke or Ping of Death from the last millennium? Microsoft has upgraded it to IPv6...: ...

A remote code execution vulnerability exists when the Windows TCP/IP stack improperly handles ICMPv6 Router Advertisement packets. An attacker who successfully exploited this vulnerability could gain the ability to execute code on the target server or client.

To exploit this vulnerability, an attacker would have to send specially crafted ICMPv6 Router Advertisement packets to a remote Windows computer.

The update addresses the vulnerability by correcting how the Windows TCP/IP stack handles ICMPv6 Router Advertisement packets.

...

* psycodad is still sure Microsoft could easily outperform Dyson with things that suck hard |

|

|

|

|

NeuroticFish

Legendary

Offline Offline

Activity: 3668

Merit: 6387

Looking for campaign manager? Contact icopress!

|

|

October 15, 2020, 07:37:08 AM |

|

Gold and silver? Look at them, boring.

Some do love it to be boring. Not everybody can stand the days when a simple look at the market does more than drinking one RedBull.   Bitcoin-as-investment, however wonderfully goes to the sky sometimes, is clearly not for everybody. |

|

|

|

|

|

|

Paashaas

Legendary

Offline Offline

Activity: 3430

Merit: 4358

|

|

October 15, 2020, 09:03:59 AM |

|

Schnorr and Taproot Upgrade Proposal Merged Into Bitcoin Core.The implementation of the Schnorr/Taproot consensus rules has been merged into Bitcoin Core. However, the upgrade's activation method has yet to be determined.

The pull request was originally created by Bitcoin Core contributor Pieter Wuille on September 13th and has gone through extensive review and testing over the past month. Over 150 developers also participated in a 7-week review club for the proposal which was led by Anthony Towns back in November of 2019.

This upgrade has been highly anticipated due to its potential to increase Bitcoin’s smart contract capabilities while simultaneously benefiting its transactional privacy.

|

|

|

|

|

Karartma1

Legendary

Offline Offline

Activity: 2310

Merit: 1422

|

|

October 15, 2020, 12:49:21 PM |

|

Schnorr and Taproot Upgrade Proposal Merged Into Bitcoin Core.The implementation of the Schnorr/Taproot consensus rules has been merged into Bitcoin Core. However, the upgrade's activation method has yet to be determined.

The pull request was originally created by Bitcoin Core contributor Pieter Wuille on September 13th and has gone through extensive review and testing over the past month. Over 150 developers also participated in a 7-week review club for the proposal which was led by Anthony Towns back in November of 2019.

This upgrade has been highly anticipated due to its potential to increase Bitcoin’s smart contract capabilities while simultaneously benefiting its transactional privacy. God save us from any upgrade's activation method debate!  I am not ready for a segwit, no2x, big block kind of drama now. We have other things to do.  |

|

|

|

|

|

onecall123

|

|

October 15, 2020, 01:24:48 PM |

|

Well.. That was a ride   Weird when you see it jump like a Mofo then it goes back to when you came in to the chart. Then most disappointing feeling to say the least.  I'm in the same boat buddy! It's all clueless....  |

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

October 15, 2020, 01:32:25 PM |

|

re:dumpenings and silly bear domination gifs

No.

Its my belief that bitcoin is still at the beginning of a exponential s-curve adoption phase. I think selling only what is necessary at this point is probably a good idea for most.

Now is the time for accumulation. This is the way.

MSPAINT.exe Agrees with you 100%!  |

|

|

|

|

|

yslyv

|

|

October 15, 2020, 02:18:12 PM |

|

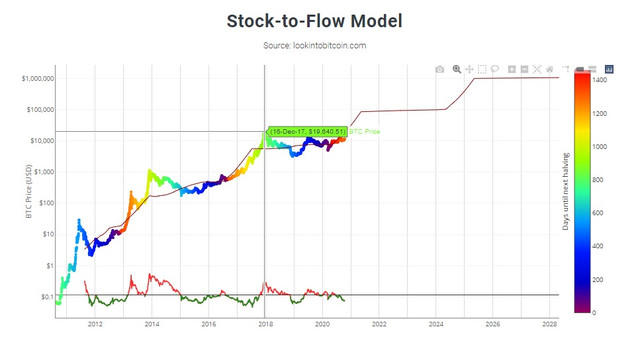

Will PlanB's model keep working or not? Looks like he struggled so much to find out this S2F model that matching with bitcoin price. But acuracy is easy for such model till 2020 that price is max around 10 - 12k. But lets see if it will keep working fine and bitcoin will push till 100k usd next year   |

|

|

|

|

Paashaas

Legendary

Offline Offline

Activity: 3430

Merit: 4358

|

|

October 15, 2020, 02:38:14 PM |

|

Schnorr and Taproot Upgrade Proposal Merged Into Bitcoin Core.The implementation of the Schnorr/Taproot consensus rules has been merged into Bitcoin Core. However, the upgrade's activation method has yet to be determined.

The pull request was originally created by Bitcoin Core contributor Pieter Wuille on September 13th and has gone through extensive review and testing over the past month. Over 150 developers also participated in a 7-week review club for the proposal which was led by Anthony Towns back in November of 2019.

This upgrade has been highly anticipated due to its potential to increase Bitcoin’s smart contract capabilities while simultaneously benefiting its transactional privacy. God save us from any upgrade's activation method debate!  I am not ready for a segwit, no2x, big block kind of drama now. We have other things to do.  I don't see any form of resistance so it will be much easier to get consensus for this than segwit, expect activation to take some months ore even spring 2021. https://en.bitcoin.it/wiki/Taproot_activation_proposals |

|

|

|

|

|

Krubster

|

|

October 15, 2020, 04:04:53 PM Merited by JayJuanGee (1) |

|

The MtGox Rehabilitation Trustee delayed the deadline for another 2 months. October 15, 2020 To whom it may concern: Rehabilitation Debtor: MTGOX Co., Ltd.

Rehabilitation Trustee: Nobuaki Kobayashi, Attorney-at-law

Announcement of Order to Change Submission Deadline for Rehabilitation Plan The Rehabilitation Trustee is currently formulating the rehabilitation plan, but as there are matters that require closer examination with regard to the rehabilitation plan, it has become necessary to extend the submission deadline for the rehabilitation plan. In light of the foregoing, the Rehabilitation Trustee filed a motion to seek an extension of the submission deadline of the rehabilitation plan at the Tokyo District Court, and, on October 14, 2020, the Tokyo District Court issued an order to extend the submission deadline for the rehabilitation plan to December 15, 2020. It only got delayed 2 months this time. I'm cautiously optimistic. |

|

|

|

|

Toxic2040

Legendary

Offline Offline

Activity: 1792

Merit: 4141

|

morning snap shots #dyor 6h  12h  3D  #stronghands |

|

|

|

|

VB1001

Legendary

Offline Offline

Activity: 938

Merit: 2540

<<CypherPunkCat>>

|

|

October 15, 2020, 05:46:17 PM |

|

Bitcoin Optech Newsletter #119This week’s newsletter relays a security warning for LND users, summarizes discussion about LN upfront payments, describes a mailing list thread about updating bech32 addresses for taproot, and links to an updated proposal for an alternative way to secure LN payments. Also included are our regular sections with summaries of a Bitcoin Core PR Review Club meeting, releases and release candidates, and notable changes to popular Bitcoin infrastructure software. https://bitcoinops.org/en/newsletters/2020/10/14/

|

|

|

|

|

BlackHatCoiner

Legendary

Online Online

Activity: 1512

Merit: 7364

Farewell, Leo

|

|

October 15, 2020, 06:57:16 PM |

|

|

|

|

|

|

yefi

Legendary

Offline Offline

Activity: 2842

Merit: 1511

|

|

October 15, 2020, 06:58:40 PM |

|

It only got delayed 2 months this time. I'm cautiously optimistic.

You wanna be cautiously pessimistic. Even if it does get submitted it's a moot point until the Coinlab claim is settled. |

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

October 15, 2020, 08:35:32 PM |

|

Ima jus leave this here...  |

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

October 15, 2020, 08:38:39 PM |

|

|

|

|

|

|

|

Krubster

|

|

October 15, 2020, 08:51:17 PM |

|

It only got delayed 2 months this time. I'm cautiously optimistic.

You wanna be cautiously pessimistic. Even if it does get submitted it's a moot point until the Coinlab claim is settled. Well, CoinLab and Peter Vessenes can go f*ck themself. Their claim is ridiculous and their attempt to rob the rest of us creditors is outrageous. Me being slightly optimistic is because of the recent progress. For a very long time, I considered those coins lost. But now I think I might just see some of those coins one day. I realize that even if the plan gets submitted it won't be the end of this, but at least it will be one step closer to the end. |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3752

Merit: 3869

|

|

October 15, 2020, 09:24:44 PM |

|

OT: an Altcoin rant...

Some poop, called Filecoin, is trading (FIL, first day) at $70, which with 2bil max coins means a projected market cap of 140bil.

Color me skeptical. Decentralized storage? Who gives a flying f-k?

Wall street went heavily 'inside" on that ICO (only accredited investors were allowed to participate, which is against the overall psyche of the "crypto" space anyway), various Winkelevi, Consensus, etc etc.

I will wait until it trades on Coinbase, then maybe even short it (if I can find where).

same story as COMP, they jerk it up, then 60-80% decline, me thinks

the market cap that is showing on coinmarketcap is BS as there were 200mil tokens released even at ICO, not to mention 2bil total.

Bitcoin is largely unaffected, but considering that some s-t got 14-140bil valuation for "nothing" make me sad for the market.

A scam for now.

|

|

|

|

|

|

Poll

Poll