|

1321

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: December 22, 2023, 03:53:15 AM

|

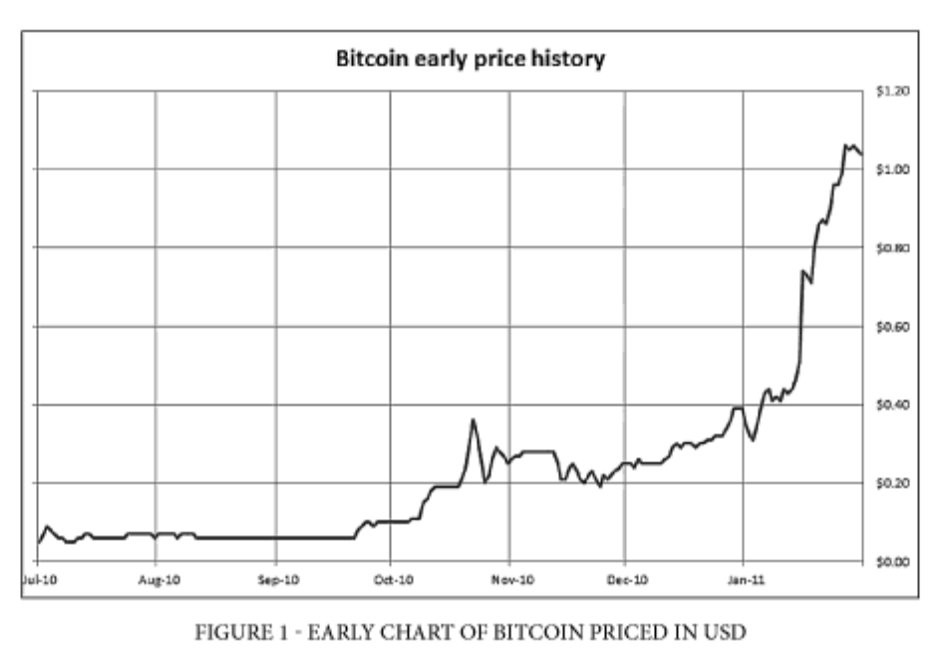

If you invested $1,000, 10 years ago: Google: $5,000 Facebook: $6,000 Amazon: $7,500 Tesla: $25,000 Bitcoin: $44,000 BMshow us dec 2017 to dec 2023 btc is 19 to 43 so 1000 would be around 2300 google facebook amazon tesla do the math bro or better do btc dec 2012 to dec 2023 10 dollars to 43000 or 1,000 to 4,300,000 so btc is godlike 2012 to 2023 and great 2013 to 2023 and good 2017 to 2023 btc 19.5k dec 2017 44.1k dec 2023 edit : google 53 dec 2017 140 dec 2023 that beats BTC Facebook 176 dec 2017 350 dec 2023 just loses to btc amazon 59 dec 2017 145 dec 2023 that beats BTC Tesla 20 dec 2017 241 dec 2023 that beats BTC Tesla is best dec 2017 to dec 2023 |

|

|

|

|

1322

|

Bitcoin / Development & Technical Discussion / Re: Why was the block size not increased?

|

on: December 22, 2023, 03:46:16 AM

|

flexible block size were proposed, where the maximum weight is adjusted by demand or there are incentives to miners to adjust the blocksize carefully if needed.

This would be better than treating transactions differently, in my opinion. However, it has to be implemented similarly to how XMR does it. Raising the block size would result in a reduction in the block subsidy; otherwise, whatever the max cap is will always be activated by greedy miners. This would lead to larger pools absorbing all available well-paying transactions, leaving smaller transactions with almost nothing. If we have three pools—A (45%), B (45%), and C (10%)—block C, with the current protocol, is almost always guaranteed to mine 10% of the transactions. So, if there are 100 transactions paying 0.1 BTC each, and each block can only take 10 of them, it would, on average, make 1 BTC out of that. However, if pools A and B can increase the limit from 10 to 15, pool C (which only finds 1 in 10 blocks) will be left with nothing but dust. The current way relies solely on luck; a small miner may hit a 5 BTC fee block, whereas large miners who find twice as many blocks may not get 5 BTC combined. In other words, as of now, potential rewards from fees are based more on "luck and market conditions" than your hashrate. The other model will shift that, making it more about your hashrate and leaving little room for luck. However, looking at Suzanne5223's comment above this one, if you read what user Kiba wrote right below Satoshi's post, he said: "If we upgrade now, we don't have to convince as much people later if the bitcoin economy continues to grow." Reading this 13 years later, it certainly makes a whole lot of sense; it's pretty difficult to do now. @philipma1957 I agree that leaving a small amount of BTC for emergency cases like this in somebody else's custody may not be a bad idea. My only issue is with the KYC part; I know many people are okay with KYC-ing themselves, but I try to avoid that as much as I possibly can. If you live in the USA they fucking own you yeah real free. free to pay fed income tax ----------- fuck with this possible jail time and likely lose my pension while in jail state income tax --------- " " " " " " trump import tax --------- " " " " " " not sure what penalties for this one. local town property tax. --- take my home if I don't pay county property tax. ------ take my home " state property tax. -------- take my home " I am so KYC'd it is a Joke. |

|

|

|

|

1323

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: December 22, 2023, 03:40:00 AM

|

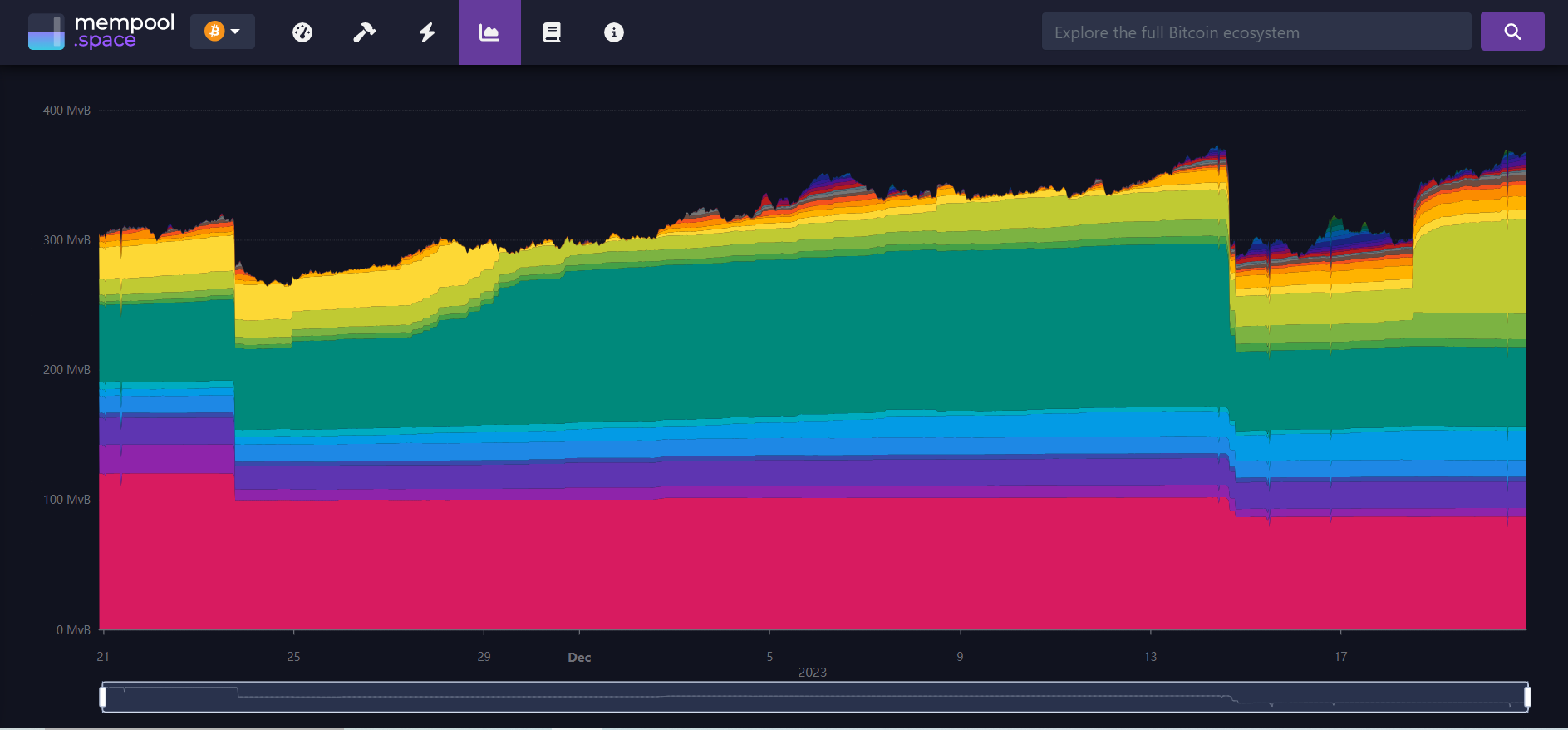

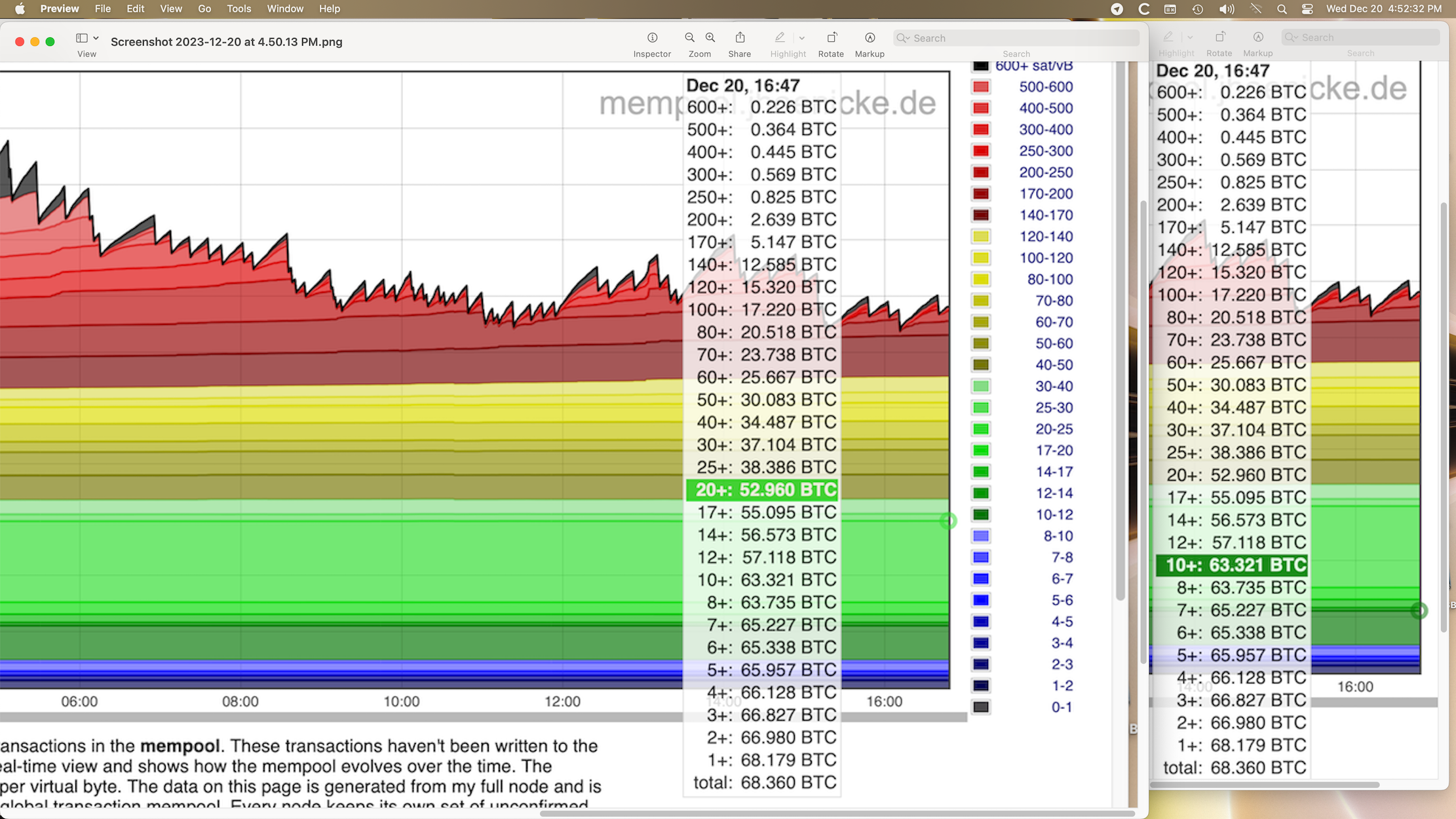

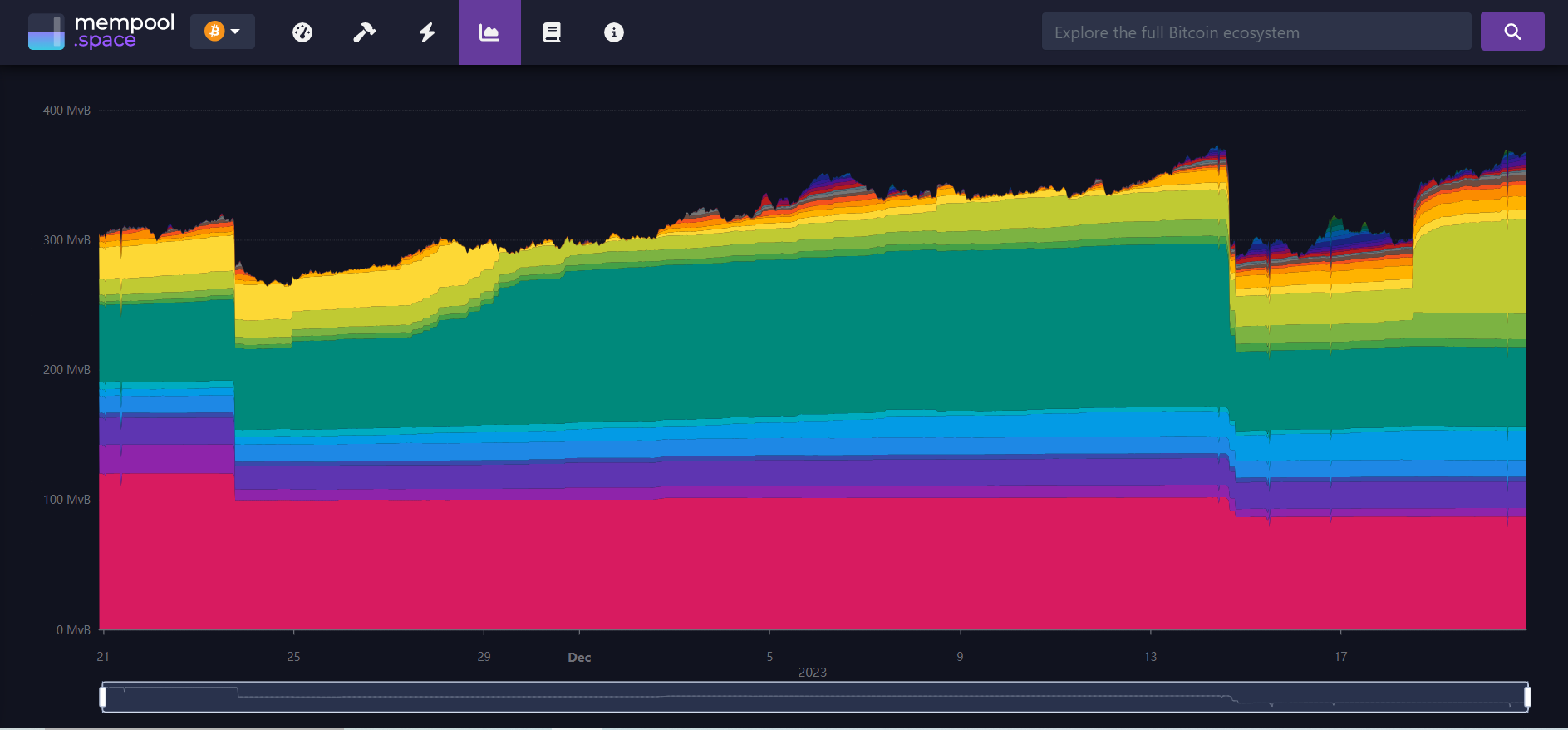

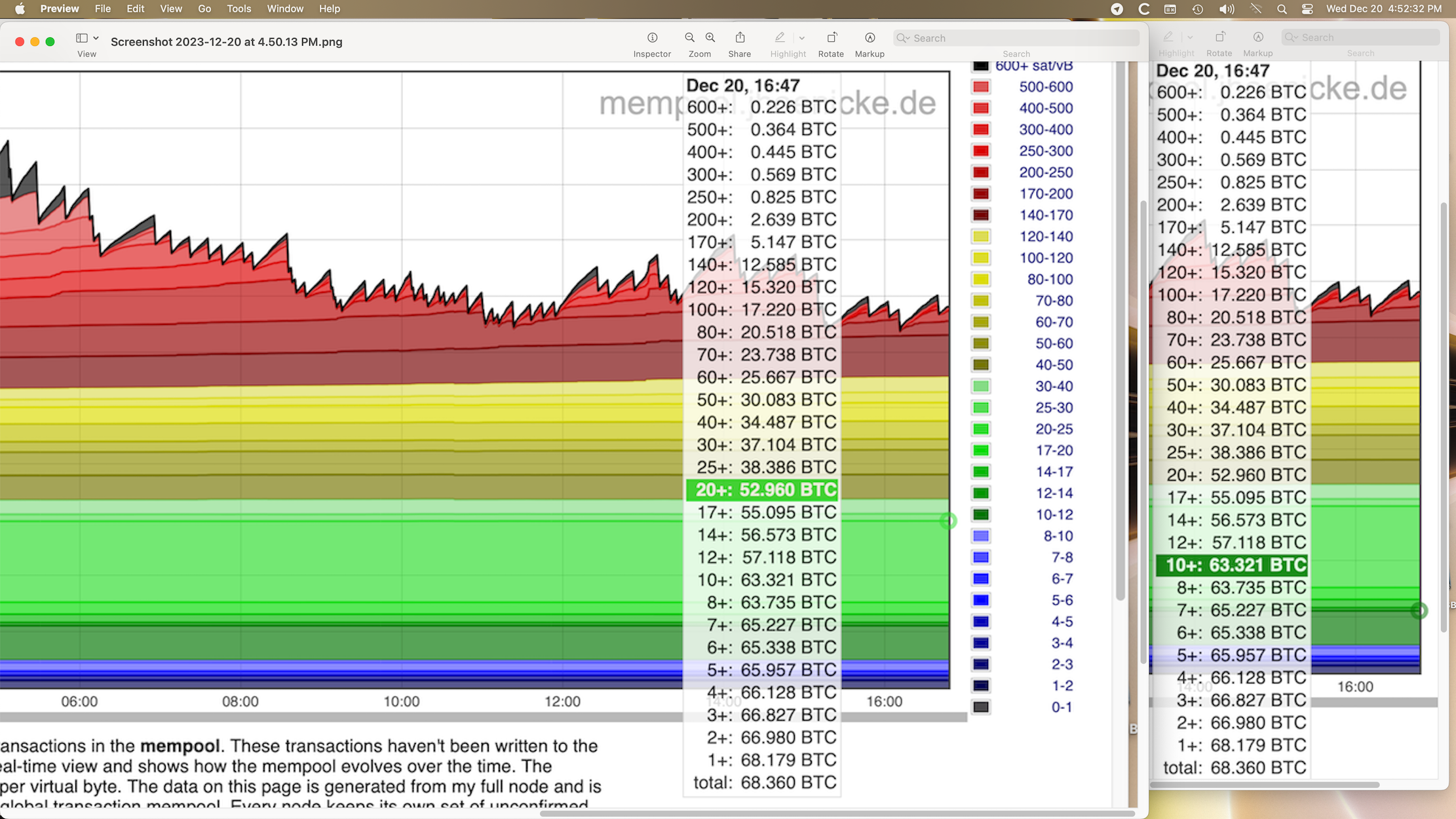

Bitcoin is having a nice run but with its mempool issues currently you can really see the effect on higher throughput blockchains. Solana and ADA seem to be crushing it as a result. I hope Bitcoin can get this figured out. It is way too early in the cycle to be having these issues. Makes you wonder who these people are making transactions currently.

I have used some XMR and LTC recently ( which were quite fast and cheap), it is almost impossible to move btc now. Curiously, those coins are not performing well... that's prorbably because poeple dont HODL these coins, they just use them to send value around fast and cheep. ahh fuck deserves a merit for a pretty good answer. Hate giving out points to newbies on the WO. |

|

|

|

|

1324

|

Bitcoin / Bitcoin Technical Support / Re: This is beyond craziness

|

on: December 22, 2023, 03:37:32 AM

|

It is not an issue at all if you have an LN exchange such as kraken and the electrum wallet.

put cash into kraken buy some btc use their LN wallet to send to your electrum wallet and you spend almost nothing in fees.

There is a limit to those things Unless you have some very loose inbound capacity limits, you will be very limited using LN. And as fees are already high now, you cannot increase your capacity now. For bitcoin ecosystem, onchain transaction are still very important Kraken will let me move up to 1.5 btc and nicehash will also allow up to 1.5 btc. and I would never move more than 0.05 btc via LN so they are decent solutions. I suspect that people will flood both kraken and Nicehash once they realize how cheap they are and then that limit will be tested. For now kraken and nicehash will work . <REMEMBER ALL COINS ARE AT RISK ON BOTH WEBSITES AND THEY WANT KYC>but if I put 1000 cash in kraken buy 1000 in btc and send 500 via LN to nicehash I would have 2 different small change LN accessible wallets. |

|

|

|

|

1325

|

Bitcoin / Bitcoin Discussion / Re: Do you see individual satoshi becoming valuable?

|

on: December 21, 2023, 10:38:29 PM

|

who would use bitcoin if it cost $339 per tx even at just 10sat/byte

It depends on how much $339 is worth  Considering how dedollarisation has been speeding up and how possible it is to see dollar value tanking hard, bitcoin reaching millions against dollar is not as far a you'd think. After all the current transaction fees of 1 sat/vbyte is about 300 in a bunch of currencies like the Colombian Peso  well the dollar is less valuable. one could argue that 19 k in dec 2017 is pretty close to to 43 k in dec 2023 it is about +14.5% gain but the dollar sank at least 6% a year since 2017 |

|

|

|

|

1328

|

Bitcoin / Development & Technical Discussion / Re: Why was the block size not increased?

|

on: December 21, 2023, 08:55:35 PM

|

It really depends on how you look at it, you may call it a 50% discount or you may call it a 100% tax, being on the "normal transaction" side, it would seem as though you are getting a 50% discount compared to the rest, being on the other side, it would seem that you are paying a 100% tax compared to the rest, if we think of block space as goods sold at the market, at the end of the day, a "normal" person can buy twice as much of those goods with the same money compared to those "weird" people. Yes, but compared to the current policy, it's not correct to call it a "tax" or "discrimination", because nothing would have been changed and these transactions are even favoured because blocks would be, on the whole, emptier. And if the blocks are not full, like it was the case many times even in 2022/early 2023 before Ordinals came up, then there is no tax at all. With the other part of your post, you are correct - it's possible that fee income goes down if demand is not high enough. To avoid this, in the block size debate models for a flexible block size were proposed, where the maximum weight is adjusted by demand or there are incentives to miners to adjust the blocksize carefully if needed. Monero (which was already mentioned in this thread) is an example how such a policy could look like. In contrast to Monero, however, Bitcoin needs slightly stricter parameters, because of Monero's tail supply which ensures they get rewards infinitely, so the necessity of a fee market isn't that pronounced on XMR. So you could combine the "payment transaction discount" with a "flexible blocksize" policy. In this case, if the minimum max size is set too low, then the contract/Ordinals transactions could pay a "tax" indeed even compared to today. I think it would make sense, if such a change was decided, to ensure the minimum max block size is never lower than the current 4 vMB. Anyway, such a policy is, again, meant as a possibility if there is general consensus in the commuity of the need for a block size increase, and that would be decided only if demand justifies it. Simply: instead of moving max block size "straight" to 8 MB, one could change the weight formula in a way simple payment transactions pay half the fees. Even if the current fee situation is a bit annoying, in my opinion we have not reached the point, and my hope is we'll never need it due to sidechains/LN improvements.Yeah LN is viable for smaller sends. You do not even need to maintain a node to do it. Let's say you have 1 btc . Keep the whole 1.0 btc in a safe storage place and open an account with an LN exchange. Kraken does LN put 0 btc in just do KYC and put in 200 or 300 cash. Maybe 500 cash. Buy some BTC with the cash. You can then use kraken's LN wallet at no cost other than the 0.00000014 fee to do the send. SO far I tested Nicehash and kraken both are kyc and I have about $500 worth of btc in them. They work pretty good for LN . Yeah I have $500 or $600 worth of btc not in my full control. I can live with this. |

|

|

|

|

1329

|

Bitcoin / Bitcoin Technical Support / Re: This is beyond craziness

|

on: December 21, 2023, 08:23:10 PM

|

|

It is not an issue at all if you have an LN exchange such as kraken and the electrum wallet.

put cash into kraken buy some btc use their LN wallet to send to your electrum wallet and you spend almost nothing in fees.

|

|

|

|

|

1330

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: December 21, 2023, 06:43:21 PM

|

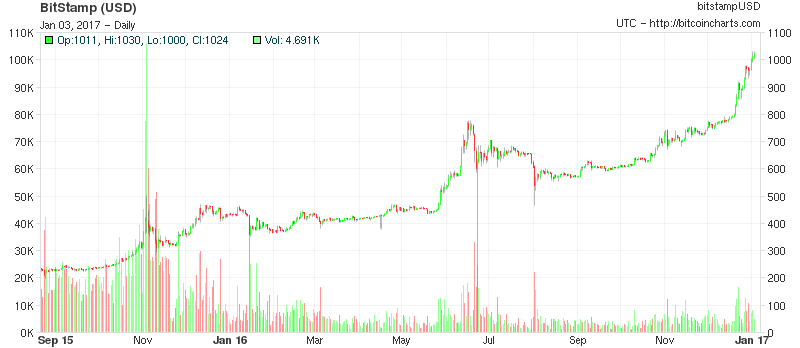

If you invested $1,000, 10 years ago: Google: $5,000 Facebook: $6,000 Amazon: $7,500 Tesla: $25,000 Bitcoin: $44,000 BMshow us dec 2017 to dec 2023 btc is 19 to 43 so 1000 would be around 2300 google facebook amazon tesla do the math bro or better do btc dec 2012 to dec 2023 10 dollars to 43000 or 1,000 to 4,300,000 so btc is godlike 2012 to 2023 and great 2013 to 2023 and good 2017 to 2023 |

|

|

|

|

1331

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: December 21, 2023, 05:02:16 PM

|

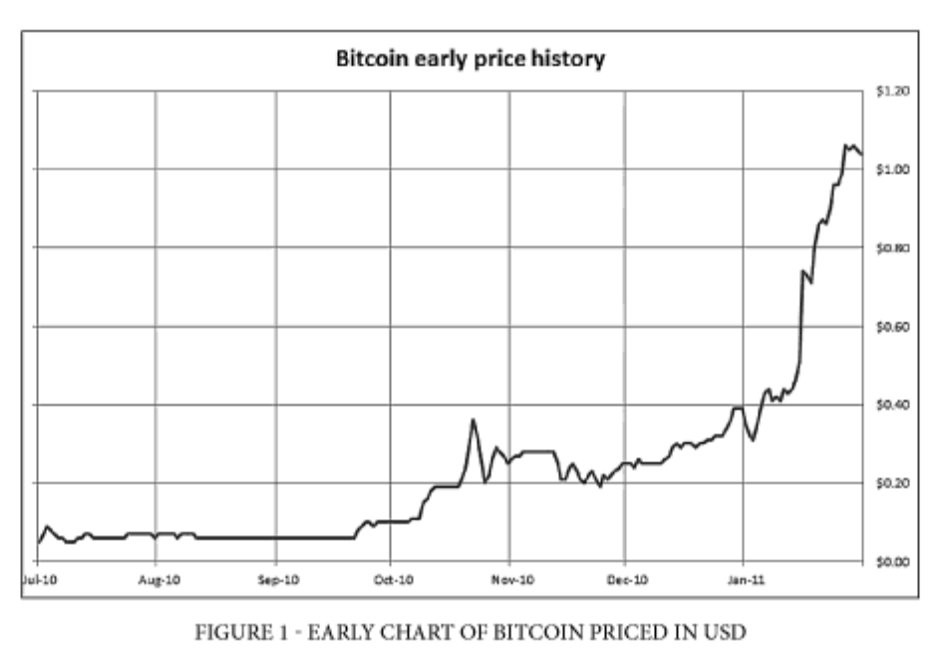

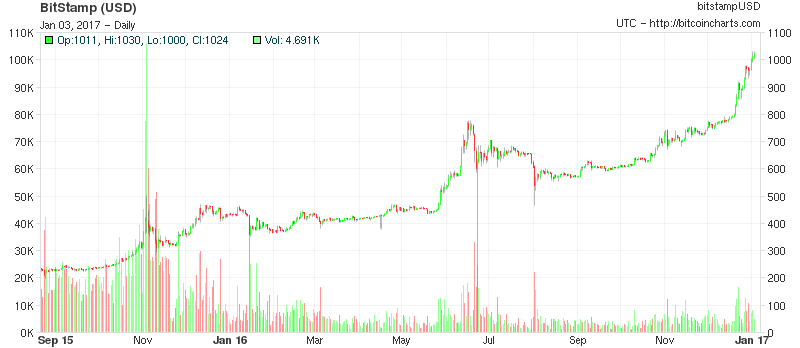

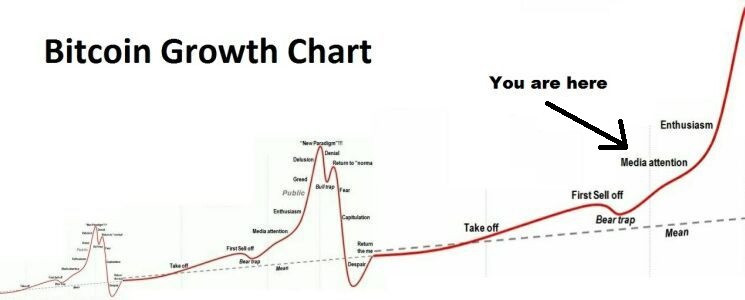

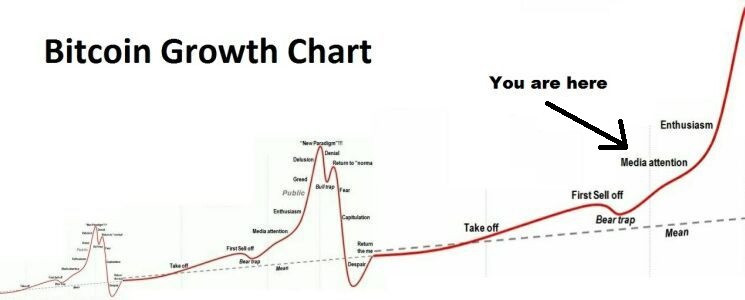

Good morning Bitcoinland. Still hovering around $44k. Still hoping for a nice price boost before I have to sell some before going to Mexico in January. Speaking of price boosts here are some more images from my archives:     Bitcoin smashing through the one dollar barrier followed by $1000 and then $10k. Somewhere I've got one for a hundred bucks. Maybe I'll find it. Also my read on the long-term circa 2016-7. Ahh, the memories. 10 days to get to 48.1 k. lets do it Buddy go btc go. Hey where is that lovely top 100 day thread I would love to see some entries go in it soon. |

|

|

|

|

1332

|

Bitcoin / Wallet software / Re: Mempool fees and Solutions

|

on: December 21, 2023, 04:35:55 PM

|

I agree with you and I think people need to look into LN. The thread I did will show more ways to use LN over the next months. People absolutely need to use it, I'm myself using it for commercial transactions, but it isn't the solution to the problem either. Even currently, it takes a lot of money to open and close just one channel, and a lot of space if we are to dedicate a channel to each person. Let's do some math. Regular opening and closing channel transactions are roughly 150 vB and 180 vB respectively. With block size being limited to 4 MvB, you can fit up to about 12 thousand channels in a block (the entire channel, with the closing transaction included). If 10 million people would want to join lightning, it'd take roughly 10M / 12k = 833 blocks. That's about 6 days of blocks filled to the top exclusively with lightning channels. For a billion people? 600 days. And that's under the hypothesis that: - there will be no other on-chain transactions. - no person will ever open more than a channel. - opening and closing transactions will just have an input and two outputs respectively. (which is the minimum) For me as a primary miner LN-Nicehash LN-Kraken LN-Electrum should fix my issues as long as the three companies above do not fuck with their "free" services. The risk of feeding $1000-$2000 into my Nicehash wallet for mining Kawpow was already being taken. So I have 1000-2000 a month I can use kawpow. the risk of using kraken was already there. I just need to learn LN on electrum. |

|

|

|

|

1335

|

Bitcoin / Wallet software / Re: Mempool fees and Solutions

|

on: December 21, 2023, 01:51:56 PM

|

With attacks like this it would not be that hard for someone with unlimited funds like gov. to make bitcoin almost unusable for most people  You might have meant it as a joke but it's not. The enemies of Bitcoin can't easily attack the decentralized ledger reproduced across tens of thousands of computers. They also can't easily attack and put out of business the thousands of mining companies and small-time home miners. What they can do is exactly what you said: attack the value transfer. Make it difficult and expensive to use Bitcoin and then fud, through their media, what a waste of time and resources Bitcoin is. Maybe it's time for another fork, and more people need to use Lightning Network for small transactions. Doesn't really help much because you still need to open and fund the channel and close it eventually. Both are on-chain transactions and require those currently expensive on-chain fees. Well you can find an exchange that offers LN services. Deposit cash in the exchange and buy some btc. I did a thread that shows how to use Kraken and or nicehash.. The two catches are KYC and you do not have the KEYSbut lets pretend you have 1000usd in btc keep 900 in a wallet and 100 on the exchange problem is solved so to speak. here is a how to thread: https://bitcointalk.org/index.php?topic=5478443.msg63346745#msg63346745

@ BlackHatCoiner you posted as I was typing above. I agree with you and I think people need to look into LN. The thread I did will show more ways to use LN over the next months. Doesn't really help much because you still need to open and fund the channel and close it eventually. Both are on-chain transactions and require those currently expensive on-chain fees.

But, maybe that's the only cure. You cannot fit everyone on-chain. If history of cryptocurrencies has taught us something, it's this. I agree that a regulated block size increase might mitigate the problem, but only temporarily. The real solution has to come from a second layer, and sadly, I don't see lightning being that one. Introducing censorship to lower the fees is definitely not an option. I prefer having terabytes of Ordinals blockchain than that. All things point to high fees on the main chain. So learn a way to use LN |

|

|

|

|

1336

|

Bitcoin / Mining speculation / Re: 2023 Diff thread now opened.

|

on: December 20, 2023, 09:53:29 PM

|

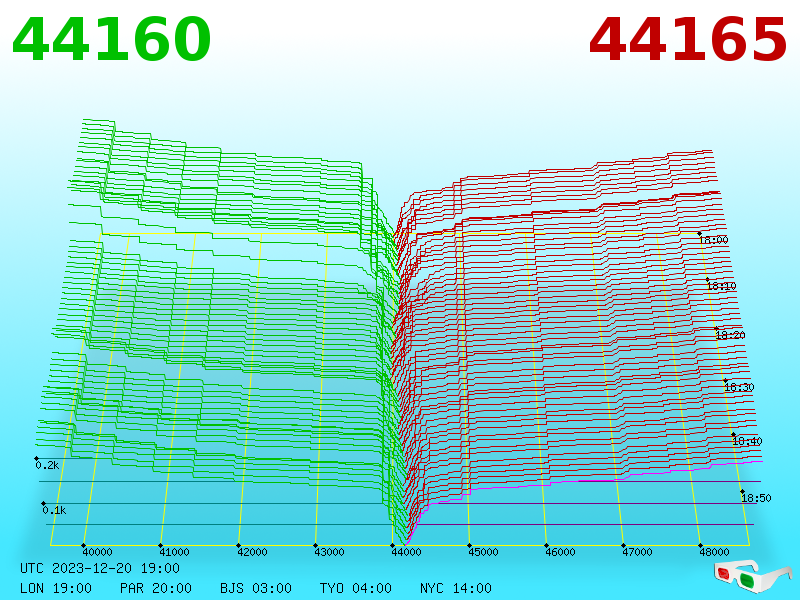

There are less than 20vMB till under 100sat/vb, no major fee wall, This reminds me of the other discussion we had on the other part of the forum about where did that wall of 10 sat go, I said they could be preparing for a new wall, we now have a very similar wall at 2x the fee of that wall.  Just count foundry over last 3 days they should do 48 x 3 they did a ton more.

12 of last 40 is 40% not 33% 822097 to 822126 I will look for more

Foundry mined 35 blocks on 13, and the same on 14 dec, and then 50 blocks on 19 dec, you might be onto something here, but it's too early to judge if this is the result of intentionally downclocking gears to jam the network and then overclock to get the big blocks, this could work but needs some serious math. So pretend I have 50% of the network hashrate, fees are 0.5 BTC/ block, I run S19 at 5 cents kWh My daily expense for power is 3.6$ , I net 8$ (assuming fees are low and are only 0.5 btc or 8% of the block) Now let's say I underclock my gear 30% down, I spend 2.52$ on power and net 5.6$, I need 2.4$ more profit for this to breakeven, % wise I need blocks to go from 6.75 btc to 8.775 BTC to break even. Actually, at this point I am beyond break even, because there are other factors that I didn't take into consideration such as 1- I spend less on cooling 2- I actually net more than the above calcs given that my S19 would run more effienct at 70% than 100% (which I didn't do above because it's not simple and not worth the efforts)  3- I increase the service life of my gears since now they run at a lower clock But ya, let's just say I am at break-even, didn't gain anything if I manage to keep block fees at 8.775 BTCWhen fees go even higher, and blocks are now 10 BTC a block, I go nuts and overclock gears, so that I get 60% of the network share, but then, 60% doesn't mean i am up 10% from my previous hashrate due to more cooling needed and less efficiency so let's say it's 5% more so at stock settings my S19 now that blocks are 10 BTC would make 12.16$ (vs the previous 8$), with my overclocking I could end up making 14$ on it, which 75% more profit than without this whole game. Of course, I could point to a few things that would make such plans fail, but we shall get to it later after hearing fellow miner's thoughts. Well it is not just foundry.. with down clock for 5 days and overclock for nine. Junk sends to mempool are cheap if they never get confirmed. all the fees from 1 to 10 sats are 5 btc and change all the fees from 1 to 20 sats are 16 btc and change So spend 16 btc which most is never spent and you have nicely clogged the mempool at very little cost.  |

|

|

|

|

1337

|

Bitcoin / Mining speculation / Re: 2023 Diff thread now opened.

|

on: December 20, 2023, 07:37:29 PM

|

@stompix, you see now why we celebrate any negative adjustments? it's because when they don't show, you are likely to be slapped with an increase like this one.  But that would end with a life full of no celebration in fear of the inevitable  Gonna say it and nothing is going to change my mind, the last negative was a fluke, it never supposed to happen. But this new jump, well, I guess it puts a fork in other theories also, sorry phillip - we're at the end of the epoch and we're seeing 158 blocks per 24h, so there is no back throttling in the last days, there is no throttling down to increase the fees either, we have 14 extra blocks, that's 10% increase in capacity for the last 24h and we're still looking at 512sat/vb last block fee as I type. Again, this is just my opinion but all those schemes pools might try are nothing compared to FOMO. There are less than 20vMB till under 100sat/vb, no major fee wall, weekend in sight , xmas period close, the ones paying up are clearly not looking at the money, those are not manipulated by a few blocks missing (which is not happening) or by walls, it's FOMO. Less of a tech explanation but unfortunately I think closer to reality. they (foundry) throttled back for 5 days we were -1% at day 5. They jammed the mempool. They are overclocking like mad for last 8 days of the pool grabbing 8 coin blocks over and over. Just count foundry over last 3 days they should do 48 x 3 they did a ton more. 12 of last 30 is 40% not 33% 822097 to 822126 I will look for more 822074 to 822 096. 8 blocks of 23 which is more normal 82200 to 822073 30 of 73 way higher than say 24 so 50 of the last 136 they do 48 in a day out of 144 so they are over the pace. which follows they are now over clocked racking up blocks from a crowded mempool. |

|

|

|

|

1339

|

Bitcoin / Development & Technical Discussion / Re: Why was the block size not increased?

|

on: December 20, 2023, 03:28:00 PM

|

Block space needs to be limited to ensure bitcoin's long term survival.

Given that the block subsidy is halving every 4 years, it will not be long before the subsidy alone is negligible and certainly not enough to support even a fraction of the current hashrate. At that point, fees have to be sufficient to take over. For fees to be sufficient, block space has to be limited and there needs to be a full mempool and a competitive fee market. If we increase block size so everything can confirm at 1 sat/vbyte, then even for a (let's say) 16 MvB block you are still only talking about fees of 0.16 BTC.

If you want everything to confirm in the next block at tiny fees, then you need some other mechanism to pay miners once the subsidy is insufficient. That means either lifting the cap of 21 million and having constant inflation, or some other mining incentive like merged mining.

Merged mining already exists> I point 6ph of btc miners at viabtc and earn 3 other coins at the same time. the other coins are essentially worthless. BTC goes against LTC/DOGE 1 block vs 12 blocks vanishing rewards vs a hybrid of vanishing rewards+ stable rewards. if you look at the two setups. btc is far less suited to move small coin values. One reason is it was the first coin and people have pushed using it for value storage. It is a shit fit to move little coin value. Great for large coin value. Tweaking to make it work for small value mya prove to be its undoing. Or LN could get fully adapted along with 10 digits not 8 . Time will tell. |

|

|

|

|

1340

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: December 20, 2023, 02:51:59 PM

|

Maybe this thread comes true for December https://bitcointalk.org/index.php?topic=5472517.0"If we do the 2015 pattern from sept to dec we will rock 2 more months. 35000 x 1.21 = 42350 by dec 1 42350 x 1.1375 = 48173 by jan 1. opinons and guesses?" Made on NOV 1 2023. I actually think we can get to it this year. EFT and fee wars should make Jan 2024 wild. I wonder if we could have a pre ˝ ing ath say 80k by march and crazy numbers to follow. Would be nice. If we compare dec 2017 price of 19.5k to dec 2023 price of 43.5 k we are better than inflation but not by a lot. we have grown about 15% a year since dec 2017 on average. |

|

|

|

|