|

1442

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: December 13, 2023, 12:23:54 AM

|

I cannot remember your exact story in terms of your bitcoin entry date, AlcoHoDL.. but I was thinking that maybe you were only a couple of years after me...[...]

August 2015 was my first transaction. Paid $120, got 0.5 BTC, left it in my phone, forgot about it. 3 months later it had become $200. I remember the market cap then was single-digit billions, maybe $5B (currently $800B -- 160x). I remember I was checking CoinMarketCap. Not even registered to BitcoinTalk. All purchases done via Bitcoin ATMs. No exchanges. Great times... So maybe we could say that even if you made a BTC purchase near the middle of 2015, you really were not engaging very much with the idea of bitcoin, so perhaps just taking a bit of a stake as a "let's see what happens," so then maybe you did not get lured into starting to study BTC until the end of 2015, so in essence yes, you got active in BTC around a couple of years after me, but I was largely trying to study bitcoin right from the start of my investing into it.. so I was active in other bitcoin-related threads before I came to this forum in late February 2014. And, so it still seems that part of my point stands in which we might have some investment without very much conviction, and so our conviction grows over time, and yeah, maybe it is not exactly religious to throw some money at something, but there might be some perceptions of possible value that makes it greater than a 50/50 gamble, but then the more real points to show conviction still might have to do with deciding to become more aggressive about your bitcoin investment. In my own self-assessment, I do consider that i was fairly aggressive right from the start, because I looked into bitcoin for maybe a couple of weeks prior to making my first purchase at the end of November and towards the exact then top, but then I also created a 6 month budget for myself and a plan to buy BTC every week for the next 26 weeks.. and then after those first 26 weeks to continue with a similar plan for the next 26 weeks, so that would then get me to a year of investing into BTC, which I would consider to be pretty aggressive but still within boundaries.. since by the time I got to the end of a year (2014 - a year of being in bitcoin), I figured that bitcoin had constituted about 10% of the total value of my quasi-liquid investment portfolio, and so in that regard, I was more aggressive than some of the guys that I call whimpy in these here parts, so level of faith and conviction can vary, and maye the extent to which there might be motivation to invest into something like bitcoin, but then there can be some stylistic matters that change mindsets between someone who is DCA'ing versus someone who is lump summing or buying on dips. .. and sure there can be overlap, but sometimes mindset can affect practice, but practice can also affect mindset. We may or may not end up in similar places, because some people get distracted into shitcoins and have a lot of difficulties getting out of the shitcoin trap, and then there can be other aspects of a person's investment experience that might contribute towards looking at bitcoin compared to other investment possibilities in a certain kind of way. Who is "we?" Do you have a rock in your pocket? O.k. maybe that response was overly argumentative, but I could not resist.50 + 0.05 = 50.05

25 + 0.05 = 25.05 this looks like a real true ½ ing to me

12.5 + 0.10 = 12.60 " " " " "

6.25 + 0.70 = 6.95 " "

3.125 + 0.70 = 3.825 this looks almost like a ½ ing

1.5625 + 0.70 = 2.2625 this is not what any ½ ing has ever looked like 4 years and 4 months from now

0.78125 + 0.70 = 1.48125 this is certainly far different than anything we have seen in terms of ½ ing

So my point is do we see unexpected changes in 2024 a different cycle pattern

We will certainly see them in 2028 as the ½ ing will not really be one

Well if you are attemtping to figure out what might happen right after 2024 halvening and/or between 2024 and 2028 and also after the 2028 halvening, then surely those are more potentially pressing speculations than some of your earlier speculations regarding what might happen in 2056 or 2140-ish. 2028 is not that far from today do other see this and plan to exit sooner than you predict? Or for that matter does this act to drive price up more than expected.

I doubt that we need to really get into analyzing those kinds of dynamics in order to consider that bitcoin is likely going to continue to be more and more valuable in the future, especially since it remains scarce and nothing about the various mining dynamics seem broken or disincentivizing the continued mining of bitcoin, even if there surely could be more and more flattening of the 4-year cycle, but why do we necessarily need to go into expectations of flattening of the 4-year cycle in any kind of profound way, prior to our actual ability to see such dyanamics of flattenening or disappearance of the 4-year cycle playing out. Look at my entry-level fuck you status chart that currently goes to late 2074, and so you might have had been able to see that my previous versions attempted straight-line and diminishing return curves, which are largely projecting out entry-level fuck you status based on expected valuation of the 200-week moving average, but historically it looks like we have seen 2 years up and 2 years down in terms of the intensity in which the 200-week moving average had continued to go up, and even in our worst 18 months ever (between June 2022 and October 2023, in which BTC's spot price continued to stay below the 200-week moving average for extended periods of time), we still barely even got below 10% increases in the 200-week moving average for each of the latest 6-month periods. Surely at some point the 200-week moving average might go negative, but I am not going to assume such going negative until I see such a going negative, and it just seems a better presumption to continue with positive numbers and likely with continuing to expect some kind of a pattern of diminishing differences between the time that the 200-week moving average might be moving up versus when it might be moving down and maybe it just ends up into some kind of a straight line that might end up being between 4% and 8% per year with an average around 6%..? and I even hate to speculate with that level of specificity, since it is likely that we will need to tweak these kinds of projections and expectations to attempt to line up with facts that develop.. and some aspects might be difficult to know what will happen but also what affects the future happenings will end up having on the price (in terms of the 200-week moving average if that might be a kind of bottom measurement that seems currently valid but also could become less valid in the future). In any event, I don't see any reason to tweak any of these kinds of dynamics based on nearly pure speculation and even missing several components that could affect other components, unless you want to propose your own version of something like what i had projected out that is based on decreased mining subsidies and higher percentage of fees.... which again, those are likely driving incentives to mine, but I doubt that those dynamics are driving other aspects of BTC price since BTC price likely has another considerable affect on the incentives for whether and/or how miners might choose to engage in such operations/occupation... And, no problem that surely we are likely going to continue to end up with greater and greater flattening of some of the ingrained bitcoin price dynamics that are based on 4-year cycles. the 2024 to 2028 time slot is truly "different" than any prior as there will not be a supply drop of great significance.

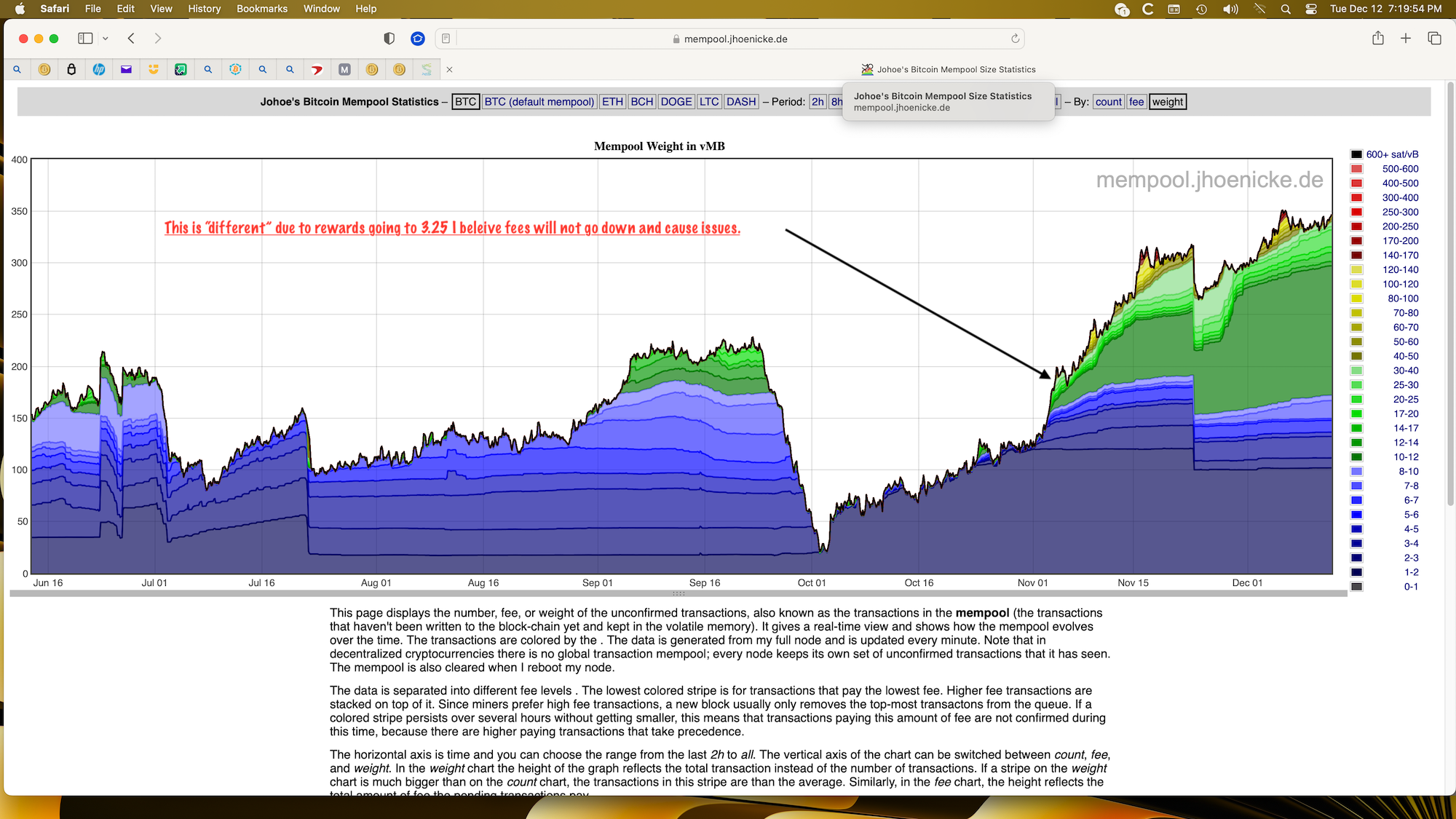

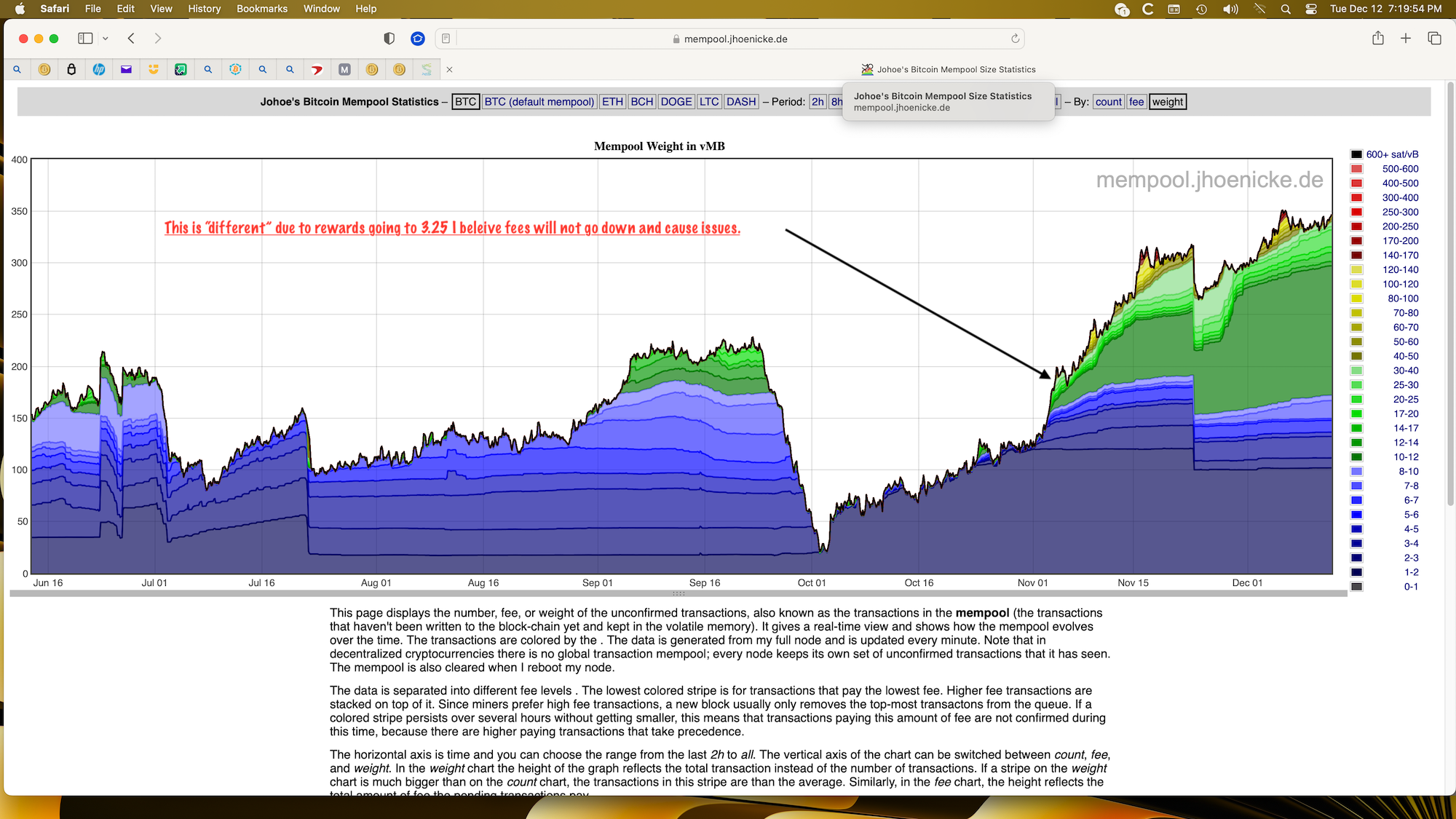

But it is all a BIG so what? if we are trying to talk about BTC price dynamics, and if you are frequently trying to suggest that hash rate is driving BTC prices.. and I am not sure what point you are wanting to make that is even needing to be speculated upon, since we largely agree BTC prices are going up.. but we might have differing ideas about by how much and whether any kind of cycle dynamics might continue which also might be a who cares aspect, unless you are trying to trade such price waves, which you have already admitted that you are way more into those kinds of selling too much on the way up and expecting to buy on the way down than me, and so maybe if you are questioning if the BTC price is going to go down, then maybe you will sell less than what you would have had sold otherwise, but I doubt that any of that affects me very much, since I just follow my system and it becomes a BIG so fucking what if the BTC price does not end up coming down.. I don't care either way, even though I hardly have any reason to believe that hype cycles are not going to continue in something similar to a 4-year pattern, even if they might not be exactly materially driven by new supply constraint dynamics. No you don't see what I see. Look at this chart. It is not typical  |

|

|

|

|

1443

|

Bitcoin / Mining speculation / Re: 2023 Diff thread now opened.

|

on: December 13, 2023, 12:15:24 AM

|

I don't think it's that difficult for this to happen, because gradually large pools start to have more and more weight in the global hash. Which makes it easy for them to reach an agreement.

Actually, it's indeed very difficult when you dive deep into the math of it. Let's take an extreme scenario of pools that own 90% of the hashrate and manage to reach this sort of agreement, and we would keep the figures in USD for easier understanding. Let's say they would invest a total of 1 million just to artificially spam the blockchain to increase fees All these pools combined will find an average 130 blocks a day while the other 10% will find 14 pools. 1 million a day means they inject $6,944 in every block, so the 10% pools will make $97,222 without having to invest or risk anything, that's very close to 3M a month that the 90% folks will have to risk. Obviously, if they manage to actually increase the fee and get other transactions to pay more, they could just drop their transactions at some point, but there is no guarantee that there will always be some transitions paying more than their 'spam' transactions, also some of those 90% folks will look at the 10% and will say (those guys make more than we do % wise, they don't risk anything, and they still get some of the spam fee we put + the real transactions that try to outbid us) which makes joining the 14% group more beneficial. Now if another 10% joins that 10% and become 20% vs 80%, each of those 80% group will need to pay more to get that combined 1M, and then there will be double the amount at risk (6M a month) since now the small group gets 28 blocks a day. I honestly think it's beyond difficult to achieve, they are more likely to agree on simply purging transactions with less than X sat / Vbyte than spamming the blockchain to increase fees, and then even that isn't going to work for long -- there will always be someone else who is willing to mine those purged transactions when there aren't bigger ones. well 2032 is 8 years off blocks will be 0.78xxx plus a fee of ? that should be the clue as to the working ideas of this money system. Scrypt looks much better for sends under $100 than btc does and that is now never mind 2032. |

|

|

|

|

1444

|

Bitcoin / Bitcoin Discussion / Re: Binance reaches deal to pay $4.3B settlement to American regulators

|

on: December 12, 2023, 11:05:55 PM

|

I'd wait and see the outcome of Binance battle with the SEC which is still a work in progress. SEC recently confirmed that they're still going after binance and that the DOJ settlement will only serve as fuel for its battle with Binance. Till all the legal battles that Binance has settles down, I won't be too involved with using that exchange as much as I used to. Binance is already losing its market share to the likes of Bybit, OKX amd Kucoin but I don't think any of these exchanges have what it takes to completely dethrone Binance — so best play imo, it's to wait and see how it plays out. If Binance survives the legal hurdles, then definitely; BNB will see another all time high. https://www.bloomberg.com/news/articles/2023-12-08/sec-says-its-binance-case-should-advance-despite-doj-settlementThe SEC wants to take down Binance at all costs. It seems like Gary Gensler hates crypto more than anything else. If this keeps going, it's likely the crypto industry will move away from the US into countries with a friendly-regulatory stance. I see both HK and the UAE becoming the next epicenters of the crypto industry. Without money pouring into the US market, the country will lose the opportunity of staying at the forefront of innovation. In other words, the US will be left behind in the dust. CZ was smart enough to pay the fine and face responsibility for his actions (unlike SBF). This is good for the long-term image/reputation of Binance. I'm pretty sure BNB will rise from the ground up after a prolonged fiasco with the SEC. As for Bitcoin, I believe it will only grow bigger and stronger in the future. If the crypto industry works hand-in-hand with the government, it will be able to grow towards unprecedented heights. Just keep buying, holding, and forget about the rest.  Why do you think crypto industry needs to "work hand-in-hand" with the government? For one, I believe it defeats the purpose of Bitcoin because the only way that government will agree to work alongside Crypto industry is if they have control of important affairs of crypto. For instance, see how US government will heavily engage with Binance over the next couple of years simply because of that settlement. From what I've seen so far from Coinbase and the XRP lawsuit, it's clear that the US government makes its crypto regulations to be as vague as possible in order for convict most of crypto-centric firms when they have enough evidence to mount a solid case. In the end, Crypto and government should not me. It wasn't meant to be, at any point. If you are correct the governments of the world would all side against crypto. and crypto would die. The reality is: some governments will be neutral. some will attack it some will help it. this is the way with most things on earth. So here is hoping a good balance settles out in the next 12-16 years. |

|

|

|

|

1445

|

Bitcoin / Mining speculation / Re: Nerd Miner question!!

|

on: December 12, 2023, 10:57:49 PM

|

Hi Folks

Just wondering can a nerd miner earn even a few satoshis per week/month if connected to a mining pool? Any if so, is there any pool that has a low withdrawal threshold such that you can withdraw the few satoshis every quarter / month??? If so, any pool youd recommend?

dude it does 78kh that is terrible. also I am not sure you can join it to any other pool. 1000 kh = 1 mh 1000 mh = 1gh 1000 gh = 1th 1 th earns about 0.00000210 btc a day you are earning 78/1,000,000 x 0.00000210 btc a day if you can point it to a pool. If it has real software. you earn 0.00000000001638 a day on average. which means nothing since you need to do 0.00000001 as a minimum earn. so: in 10 days 0.000000001638 in 100 days 0.000000016380 which is 1 sat to maybe 2 sats every 100 days. in 1000 days 0.000000163800 which is 16 sats maybe 17 sats every 1000 days. in 10000 days 0.000001638000 which is 163 sats maybe 164 sats every 10,000 days. in 100,000 days 0.000016380000 which is 1638 sats every 100,000 days. none of the numbers above reflect future difficulty or future 1/2 ings |

|

|

|

|

1446

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: December 12, 2023, 09:22:02 AM

|

So basically I remember JJG fucking around and saying there is no 4 year cycle (at least 2 years ago)

Doesn't sound like the same JJG that I know. <snip> When I look at the reward to fee next 3 ½ ings if miners keep force fees to stay at 30 stats

10 percent fee per block now

18 percent fee per block 2024

31 percent fee per block. 2028

47 percent fee per block 2032

what does all of the above mean for supply shock?

say

6.95000 now

3.82500 2024

2.26250 2028

1.48125 2032

if fees flatten out at .7 btc per block. the ½ effect ends by 2036 or sooner if fees go to a steady 1 btc a block

You come up with some doosies, sometimes... and yeah there are going to be changes in the ratios in which miners are more dependent upon fees rather than subsidies.. so yeah, each halvening we will see the extent to which the BTC price goes up which would be at least doubled ever four years for the halvening to have the same effect on the reward... so surely, it is difficult to predict that many legs in advance without necessarily knowing price, and if BTC price doubles every 4 years, then perhaps that is enough to have the subsidies to have the same effect, but we know adoption is going up too.. so usage and fees are likely to go up, as you project... so in the end ? what is the punchline? [/quote] <snip> [/quote] JJG we did 50 + 0.05 = 50.05 25 + 0.05 = 25.05 this looks like a real true ½ ing to me 12.5 + 0.10 = 12.60 " " " " " 6.25 + 0.70 = 6.95 " " 3.125 + 0.70 = 3.825 this looks almost like a ½ ing 1.5625 + 0.70 = 2.2625 this is not what any ½ ing has ever looked like 4 years and 4 months from now 0.78125 + 0.70 = 1.48125 this is certainly far different than anything we have seen in terms of ½ ing So my point is do we see unexpected changes in 2024 a different cycle pattern We will certainly see them in 2028 as the ½ ing will not really be one 2028 is not that far from today do other see this and plan to exit sooner than you predict? Or for that matter does this act to drive price up more than expected. the 2024 to 2028 time slot is truly "different" than any prior as there will not be a supply drop of great significance. |

|

|

|

|

1447

|

Other / Meta / Re: Second chances

|

on: December 12, 2023, 09:01:29 AM

|

- A ban on wearing a signature will be added, equal to at least 2 years minus however long you were banned.

<snip> Enjoy the Holidays and Happy 2024 everyone! Ah hah hah hah hahahaha.....Merry Effin' holidays to all of the banned members who want to come back to the forum so badly that they'd be active whilst not renting out their signature space. I suppose if someone has been banned for over 2 years, they'll go for it but I'm not sure about others. This is quite generous, Cyrus. Let us hope said generosity doesn't backfire and spray shit all over this fine forum. Hope this second chance won't cause much damage on the forum. Good idea OP but I feel some don't deserve it at all because out of a 100 persons that are victims we only have 2-5 persons who can boldly say they have changed for good.

Yeah, you got that right. I've seen a lot of ban appeal threads, and frankly I wouldn't give 99% of them a second chance, as those threads consist of: 1. Lies 2. Excuses 3. Begging 4. Rationalizing 5. Blaming others 6. Raging against the mods 7. Assholes who have zillions of accounts that are already banned. I wonder if they will bother to come back now that mixer sigs are to be banned. 19 days left. There are at least 8 active mixer campaigns to be taken away. So that was a good about of coin given away that no longer will be here. |

|

|

|

|

1448

|

Bitcoin / Mining speculation / Re: 2023 Diff thread now opened.

|

on: December 12, 2023, 08:53:35 AM

|

it is pretty certain that 30 sats can be done by big pools for long maybe forever time periods.

So here's the the next ½ ing

The problem for us, simple users, will be when miners think that the average of 30 sats is no longer enough. If they start to think that the ideal is 50 or 100 sats, the most advantageous average, it will be very difficult to carry out transactions. well if btc was 10,000 and not 40,000 the fees would be cheaper by a factor of 4x. So no one that invests wants that. https://newhedge.io/terminal/bitcoin/difficulty-estimatorLatest Block: 820830 (10 minutes ago) Current Pace: 99.7344% (319 / 319.85 expected, 0.85 behind) Previous Difficulty: 67957790298897.88 Current Difficulty: 67305906902031.39 Next Difficulty: between 67414022607132 and 67678344651489 Next Difficulty Change: between +0.1606% and +0.5534% Previous Retarget: last Saturday at 10:31 PM (-0.9592%) Next Retarget (earliest): December 23, 2023 at 10:46 PM (in 11d 18h 57m 9s) Next Retarget (latest): December 23, 2023 at 11:25 PM (in 11d 19h 35m 11s) Projected Epoch Length: between 14d 0h 15m 38s and 14d 0h 53m 41s block fees are pretty stable about 30-50 works at the moment |

|

|

|

|

1449

|

Other / Meta / Re: Lists of non merit sources that got to 5000 merits

|

on: December 12, 2023, 03:43:53 AM

|

I heard something that merits deplete. Do they actually? And how often do they like "decay" or "deplete"? Anyone know a set rate?

they deplete when you give them away. I do not know if anyones have been decayed. I suspect if they do decay the member may be idle for a long time and they take them. |

|

|

|

|

1450

|

Bitcoin / Bitcoin Discussion / Re: What Will Collapse First, Bitcoin or the Dollar?

|

on: December 12, 2023, 03:39:54 AM

|

I came from the future to say BTC is winning

this was cute 🥰. I actually can understand why you dug the thread up 🔝 The dollar has taken a beating since 2011, but it is still here. Maybe worth 35 or 40 cents if you compare it to 2011. I would have never thought that we would have had all these negative federal budgets in a row. We have so btc could still end up the true winner. |

|

|

|

|

1452

|

Other / Meta / Re: Second chances

|

on: December 12, 2023, 01:52:44 AM

|

It looks like a good idea, I don't know if should be asking this, @Cyrus since I'm still a low ranked member,

but my question is this: "If the initial punishment for being banned was to never create a new account and to leave the forum completely, and if creating a new account is considered ban evasion, how do you plan to communicate this message to banned accounts falling into these categories?" I'm aware that some banned users try to appeal by creating new accounts, although not all of these accounts are unbanned.

What I'm wondering is if this means that banned users are still using the forum with new accounts because that seems to be the only way they can receive this message and request to have their old account unbanned.

You can still read the forum without an account. Not an issue. |

|

|

|

|

1453

|

Other / Meta / Re: Mixers to be banned

|

on: December 12, 2023, 01:35:05 AM

|

And cost me 90 minutes to about 2 hours time before I pulled my signature. Which means If the government goes after me.

I will need to get a lawyer to defend myself. Which in turn means I have to go after those that posted the negative trusts. Any of us attacked be the government because we were too slow will need.

All info from the forum about the 'warning' poster and the taggers of it. In order to defend ourselves for being too slow to remove the signatures.

Did you bother to look up people with the signatures still intact and let them know you had no real evidence to tag no you did not.

So you no favors to anyone that had an active signature.

Your first duty would be to them just in case it was real. You put your self in line for legal action by a quite a few people that were slow to remove the signature. Even though I am the only one talking about it now. I know of at least five others that were close to a day to pull the signatures.

Hopefully it is all over nothing and the government is done with us. I got curious. Were you contacted by the authorities because you had a SB signature? Has this happened to other users?  Or are you just putting on the table the possibility of this scenario happening? If you were contacted, even via PM on this forum, this whole matter takes on a completely different perspective, and the reason for this decision becomes clearer. Okay no one has contacted me. But I am USA based and fed laws have long statues of limitation. Likely If they go after anyone on Bitcointalk it would be Royse777 as he ran the campaign. I am not trying to put the fear of the Gov into people. But we are not in a vacuum. As far as I know the LE announcement could be real or fake. No proof was provided one way or the other. But the red tags took a complicated issue and made it more complex. Which is why I mentioned it. As I USA based guy on a USA Federal based pension. I am very vulnerable to my government trying to punish me. So to read the LE is fake. When who knows what is true was a shock. |

|

|

|

|

1454

|

Other / Meta / Re: Second chances

|

on: December 12, 2023, 01:26:33 AM

|

|

nice. my compliments to the person that made this plan come into being.

|

|

|

|

|

1455

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: December 12, 2023, 01:17:28 AM

|

BTC can go up or down

[...]

Most accurate prediction ever!  nope. he forgot sideways  just saying

I wanted to bring this up. It is on my difficulty thread. Latest Block: 820777 (8 minutes ago)

Previous Retarget: last Sunday at 5:31 AM (-0.9592%)

I was surprised that no one else celebrated the difficult drop, seems like only Phill is following  . finally, after 6 consecutive epochs (roughly 3 months) or since (2023-09-06 epoch to be exact), we got a small -1% drop which isn't all that great but better than 5%+. Fees are down to 30 sat/Vbyte, price is stabilizing at around 41k, so 1PH earns roughly $95 / 0.00229 BTC which isn't bad considering the difficulty, the climb from mid-30s to 40k really helped a lot of miners, 5 months for the halving -- things are about to heat. yeah large farms will practice the cheapest method to keeps fees at at least 30 sats. from blockchain.com 1.11 0.34 0.37 0.43 0.63 0.56 0.37 0.30 0.44 0.57 last ten blocks were between 0.30-1.11 in fees pretend that averages to 0.7 so 6.25 + 0.7 = 6.95 0.7/6.95 = 10 percent of earnings. but in April 2024 3.125 + 0.7 = 3.825 this is 0.7/3.825 = 18 percent of the earnings. So driving up fees will be a large miner desires more than ever. look at 2028 1.5625 + 0.7 = 2.2625 means 0.7/1.5625 = 31% of the earnings are fees. and in 2032 0.78125 + 0.7 = 1.48125 means 0.7/1.48125 = 47% of the earnings are fees. it is pretty certain that 30 sats can be done by big pools for long maybe forever time periods. So here's the the next ½ ing So basically I remember JJG fucking around and saying there is no 4 year cycle (at least 2 years ago) When I look at the reward to fee next 3 ½ ings if miners keep force fees to stay at 30 stats 10 percent fee per block now 18 percent fee per block 2024 31 percent fee per block. 2028 47 percent fee per block 2032 what does all of the above mean for supply shock? say 6.95000 now 3.82500 2024 2.26250 2028 1.48125 2032 if fees flatten out at .7 btc per block. the ½ effect ends by 2036 or sooner if fees go to a steady 1 btc a block |

|

|

|

|

1456

|

Bitcoin / Mining speculation / Re: 2023 Diff thread now opened.

|

on: December 12, 2023, 01:15:57 AM

|

Latest Block: 820777 (8 minutes ago)

Previous Retarget: last Sunday at 5:31 AM (-0.9592%)

I was surprised that no one else celebrated the difficult drop, seems like only Phill is following  . finally, after 6 consecutive epochs (roughly 3 months) or since (2023-09-06 epoch to be exact), we got a small -1% drop which isn't all that great but better than 5%+. Fees are down to 30 sat/Vbyte, price is stabilizing at around 41k, so 1PH earns roughly $95 / 0.00229 BTC which isn't bad considering the difficulty, the climb from mid-30s to 40k really helped a lot of miners, 5 months for the halving -- things are about to heat. yeah large farms will practice the cheapest method to keeps fees at at least 30 sats. from blockchain.com 1.11 0.34 0.37 0.43 0.63 0.56 0.37 0.30 0.44 0.57 last ten blocks were between 0.30-1.11 in fees pretend that averages to 0.7 so 6.25 + 0.7 = 6.95 0.7/6.95 = 10 percent of earnings. but in April 2024 3.125 + 0.7 = 3.825 this is 0.7/3.825 = 18 percent of the earnings. So driving up fees will be a large miner desires more than ever. look at 2028 1.5625 + 0.7 = 2.2625 means 0.7/1.5625 = 31% of the earnings are fees. and in 2032 0.78125 + 0.7 = 1.48125 means 0.7/1.48125 = 47% of the earnings are fees. it is pretty certain that 30 sats can be done by big pools for long maybe forever time periods. So here's the the next ½ ing |

|

|

|

|

1457

|

Other / Beginners & Help / Re: Is mining limited 😮

|

on: December 12, 2023, 12:27:28 AM

|

I am beginning to love this forum as I am getting to understand more about Bitcoin I will for now limit my post except I have reasonable questions on this forum as well as contributions Pls I am not clear on this https://bitcointalk.org/index.php?topic=5452803.0Like does it mean mining Bitcoin has a threshold ? After which mining will no longer be possible This is a very important effect of bitcoin mining. I am pretty sure. the next three ½ ings 3.125 coins in 2024 1.5625 coins 2028 0.78125 coins 2032 will radically alter mining as rewards will likely be under fees in 2032 this should end the ½ ing effect. |

|

|

|

|

1458

|

Other / Meta / Re: How do I fix this ?

|

on: December 12, 2023, 12:22:45 AM

|

|

Having a lot of ram on a pc helps a bit .

But I have a threadripper cpu with 128gb ram and a 2 tb pcie ssd. eth connection to a 1 g verizon line .

And it still happens to me.

|

|

|

|

|

1459

|

Bitcoin / Bitcoin Technical Support / Re: Sending your BTC what to pay.

|

on: December 12, 2023, 12:11:29 AM

|

|

mikeywith relax.

mine btc and stack it.

and mine scrypt and spend ¾ of it.

I am so fucking tired 🥱 of those (not you) that fail to see the economic solution is right there in fromt of them.

If they mine do the above.

It they don’t

buy btc ltc doge.

say 9000 worth of btc

and 1000 worth of ltc and doge.

|

|

|

|

|