LFC_Bitcoin

Diamond Hands

Legendary

Offline Offline

Activity: 3906

Merit: 11457

#1 VIP Crypto Casino

|

Regarding sell offs & weak hands....

Originally I planned to sell upwards of 50% of my bitcoin next year when we hopefully hit $50,000 plus.

Because of covid & the effect it is having & will continue to have (probably worsening) on traditional savings & investments I’ve changed my mind & plan to sell a much lower % of my stash than 50%.

I don’t want too much shitty fiat, I’d much rather have the majority of my money in bitcoin.

Many are predicting a flat year or two due to covid but with all the brrrr we could be in for a treat in the short to medium term future.

I’ve been reading that traditional fiat savings acc’s will be paying 0.01% annual interest soon. Maybe negative interest rates will even be introduced.

This time next year things will be a lot clearer.

|

|

|

|

|

HI-TEC99

Legendary

Offline Offline

Activity: 2772

Merit: 2847

|

|

September 28, 2020, 03:43:23 PM Merited by LFC_Bitcoin (2) |

|

That's why you don't tell your wife about your crypto adventures. Ever. She'll nag about selling your bag way waaay too early forever  Or about not selling at the top.

My gf of 10 years (we are early 30’s - got together young) is currently in the phase of telling me that I ruined ‘our lives by not selling when it was $19,000’.

|

|

|

|

|

HI-TEC99

Legendary

Offline Offline

Activity: 2772

Merit: 2847

|

|

September 28, 2020, 03:47:04 PM |

|

You forgot the last image with the caption "7 years later... I'm divorcing you and taking half of your crypto!" Let her take the crypto. Just don't tell her about the Bitcoin. Good point (if you class XRP as crypto).  |

|

|

|

|

LFC_Bitcoin

Diamond Hands

Legendary

Offline Offline

Activity: 3906

Merit: 11457

#1 VIP Crypto Casino

|

|

September 28, 2020, 03:56:21 PM |

|

Haha, brilliant. She’s on board now  |

|

|

|

|

HI-TEC99

Legendary

Offline Offline

Activity: 2772

Merit: 2847

|

|

September 28, 2020, 04:03:44 PM |

|

Haha, brilliant. She’s on board now  If I had to choose I'd rather get nagged for not selling at the top than about selling your bag way waaay too early. |

|

|

|

|

Karartma1

Legendary

Offline Offline

Activity: 2310

Merit: 1425

|

|

September 28, 2020, 04:19:59 PM Merited by JayJuanGee (1) |

|

No wonder the exchanges' reserves have come down so much this year. Just a couple of million more and we get our supply shortage event.

No wonder this got covered a long time ago by somebody here on BTT (gbianchi). I remember I read it back then. https://bitcointalk.org/index.php?topic=945881.0This is it boys, when the supply shortage will hit, expect FOMO. I can personally wait. |

|

|

|

|

AlcoHoDL

Legendary

Offline Offline

Activity: 2744

Merit: 5405

Addicted to HoDLing!

|

|

September 28, 2020, 04:26:29 PM Merited by LFC_Bitcoin (2) |

|

Haha, brilliant. She’s on board now  If I had to choose I'd rather get nagged for not selling at the top than about selling your bag way waaay too early. My advice is to NOT tell your GF/wife about how much BTC you have. Not easy, but you've got to try to keep it to yourself. Or, at least, be clear about who is in charge of said coins and who makes the decisions. LFC's 2018 post is infuriating at best. He ruined their lives by not selling when it was $19,000? Really? What is she going to say when it's @ $50,000? Or $250,000? "Oh, you're so smart!" Yeah, thank you. Love and flowers and romantic dinners are all nice and sweet, but when it comes to BTC, the key holder is the boss and total ruler of it, and no one should mess with his/her coins. Sorry LFC, I just couldn't resist! |

|

|

|

|

|

Cryptotourist

|

|

September 28, 2020, 04:40:30 PM |

|

shilling for ponzi

that s it

Normally I would just ignore you on this thread hv_. But to insinuate that I somehow get paid by another party for my efforts, is way out of line. Maybe at the worst case scenario - it's about protecting my bags from people like yourself. My efforts are in direct contrast, with your shilling propaganda - but you knew that - so there is that.

No wonder the exchanges' reserves have come down so much this year. Just a couple of million more and we get our supply shortage event.

This.

That's why you don't tell your wife about your crypto adventures. Ever. She'll nag about selling your bag way waaay too early forever  Actually it's two things you should never let your wife know exactly about. How much money BTC you have, and how much you love her. |

|

|

|

|

VB1001

Legendary

Offline Offline

Activity: 938

Merit: 2540

<<CypherPunkCat>>

|

|

September 28, 2020, 04:41:32 PM |

|

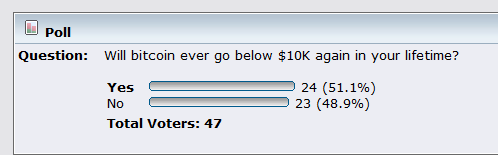

It will be interesting to see the final result. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 4088

Merit: 12223

Self-Custody is a right. Say no to "non-custodial"

|

|

September 28, 2020, 04:44:06 PM |

|

No wonder the exchanges' reserves have come down so much this year. Just a couple of million more and we get our supply shortage event.

You said in one sentence what it took me a JJG sort of novella to try to say above.  Devils in the details, cAPSLOCK.. for those who attempt to develop reading comprehension, which tend to be helpful here on the interwebs.. but frequently, I will deploy images/memes which can be helpful for peeps like you, too.  You can thank me later. Sorry (my condolences to you and your family - they tm) that you did not understand such details from my post(s), so you boiled it down to merely one of the ideas contained therein (an idea that I did not even mention, therein).  Sucks to be you.  |

|

|

|

|

600watt

Legendary

Offline Offline

Activity: 2338

Merit: 2106

|

|

September 28, 2020, 04:45:02 PM Merited by LFC_Bitcoin (1) |

|

And look how my GF Made my travelcase, map with all the papers and where to go “haha, but how very sweet” Just affraid that i would miss something i guess  Every page hours flights marked etc ....... Dude. You need to put a ring on that finger of hers. He is a 'genius' as BTC goes down he will see if it was for himself or the BTC Hoard  My gf of 10 years (we are early 30’s - got together young) is currently in the phase of telling me that I ruined ‘our lives by not selling when it was $19,000’. the thing you need to convince her about is: bitcoin went from zero to $19k. if you would be the kind of person with a more traditional mindset when it comes to investing, you would have sold after hitting 2x or 3x. you didn't because you knew deep down inside that there was a 50x or 100x waiting for you. and still is. you are sitting on the hottest investment ever created. |

|

|

|

|

explorer

Legendary

Offline Offline

Activity: 2016

Merit: 1259

|

|

September 28, 2020, 05:01:34 PM Merited by LFC_Bitcoin (1) |

|

You forgot the last image with the caption "7 years later... I'm divorcing you and taking half of your bitcoin!"

Sorry love, I lost everything you in a boating accident.....ftfy |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 4130

Merit: 5013

|

|

September 28, 2020, 05:04:29 PM

Last edit: September 28, 2020, 07:20:37 PM by Biodom |

|

No wonder the exchanges' reserves have come down so much this year. Just a couple of million more and we get our supply shortage event.

You said in one sentence what it took me a JJG sort of novella to try to say above.  Not looking forward to that. IMHO, what is happening (my hypothesis): faced with constant withdrawals, exchanges instituted a scheme where they are getting re-hypothecated bitcoin from the likes of blockfi, celsius, nexo and crypto.com That's why price does not react to bullish events, as long as their "supply" is virtually unlimited. The question is: do you trust that each btc on exchange 'actually' represents a "real" bitcoin or a bitcoin genuinely "borrowed" from the companies mentioned above? I strongly suspect that it is not the case. It is probably much, much worse. There is not going to be any supply shortage as long as the 'scheme' continues unabated. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 4088

Merit: 12223

Self-Custody is a right. Say no to "non-custodial"

|

|

September 28, 2020, 05:04:49 PM

Last edit: September 28, 2020, 05:36:24 PM by JayJuanGee Merited by Karartma1 (1), VB1001 (1) |

|

It will be interesting to see the final result. Yep interesting. When the BTC price is going up, many of us tend to gravitate towards greater levels of optimism in regards to UPpity and even considering that UPpity is more and MOAR inevitable. Of course, waves take place - and also at some point, we are going to enter into a "last time below $10k" point in time. Really knowing the bottom is probably almost as powerful as knowing peaks - but surely, we know that neither peaks nor bottoms can really be known with any kinds of high levels of certainty, except in retrospect. No wonder the exchanges' reserves have come down so much this year. Just a couple of million more and we get our supply shortage event.

You said in one sentence what it took me a JJG sort of novella to try to say above.  Not looking forward to that. IMHO, what is happening (my hypothesis): faced with constant withdrawals, exchanges instituted a scheme where they are getting re-hypothecated bitcoin from the likes of blockfi, celsius, nexo and crypto.com That's why price does not react to bullish events, as long as their "supply" is virtually unlimited. The question is: do you trust that each btc on exchange 'actually' represent a "real" bitcoin or a bitcoin genuinely "borrowed" from the companies mentioned above? I strongly suspect that it is not the case. It is probably much, much worse. There is not going to be any supply shortage as long as the 'scheme' continues unabated. Those engaged in fractional reserves could get caught on the wrong side of those kinds of bets, too.... Fractional reserves is part of the theory of what happened with MTGOX... sure, those kinds of actors may well be able to play their bad fractional reserve bets (which does not adequately prepare them for UP) for a while but sometimes face-melting UPpity could come with extreme explosiveness and thereby cause chickens to come home to roost for those kinds of ill-prepared betters - and really show who the naked swimmers happen to be (employment of mixed metaphores, of course). |

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3822

Merit: 5504

|

|

September 28, 2020, 05:11:14 PM |

|

My gf of 10 years (we are early 30’s - got together young) is currently in the phase of telling me that I ruined ‘our lives by not selling when it was $19,000’.

You can: 1. Remind her that without your initial interest in Bitcoin, you/she would likely have none at all by this point. --or-- 2. Dump her.  |

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1918

Merit: 3891

Man who stares at charts (and stars, too...)

|

|

September 28, 2020, 05:14:12 PM |

|

voted. 22/ 23  |

|

|

|

|

BitcoinGirl.Club

Legendary

Offline Offline

Activity: 3136

Merit: 2815

The voice of the community w/o a gang

|

|

September 28, 2020, 07:12:14 PM

Last edit: May 14, 2023, 04:50:18 PM by BitcoinGirl.Club |

|

A yes from me but I am going to hope my best that it never happen anymore.  Good evening WO! Observing @ $10,870 |

|

|

|

|

bitcoinPsycho

Legendary

Offline Offline

Activity: 2856

Merit: 2665

$130000 next target Confirmed

|

|

September 28, 2020, 07:22:08 PM |

|

A yes from me but I am going to hope my best that it never happen anymore.  Good evening WO! Observing @ $10,870 Id say 50/50 is fairly accurate |

|

|

|

|

El duderino_

Legendary

Online Online

Activity: 2884

Merit: 14221

“They have no clue”

|

|

September 28, 2020, 07:29:06 PM |

|

Will we visit 11k again ?? This night perhaps??

|

|

|

|

|

vapourminer

Legendary

Offline Offline

Activity: 4704

Merit: 4661

what is this "brake pedal" you speak of?

|

|

September 28, 2020, 07:33:37 PM |

|

^^

asking the important questions

|

|

|

|

|

|

Poll

Poll