cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 12, 2014, 05:19:33 PM |

|

the sucking sound of deflation and black hole shit:  |

|

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

NewLiberty

Legendary

Offline Offline

Activity: 1204

Merit: 1002

Gresham's Lawyer

|

|

December 12, 2014, 05:24:41 PM |

|

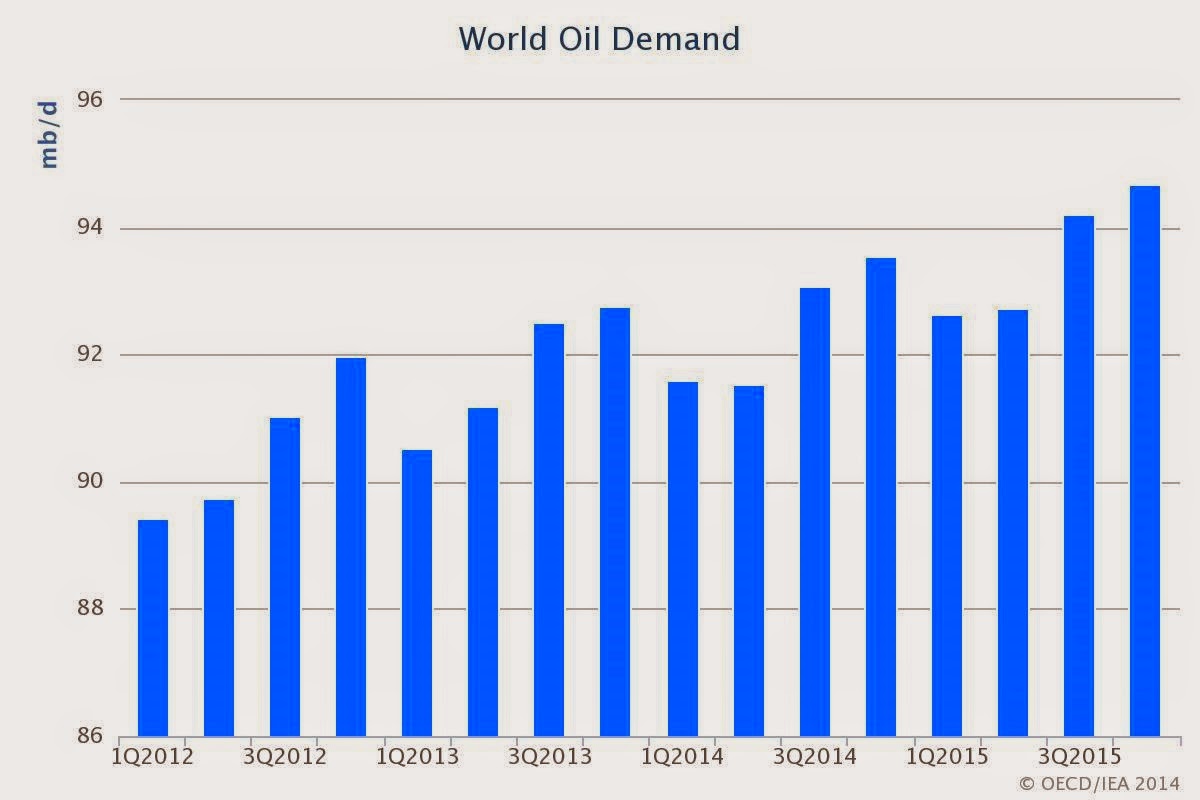

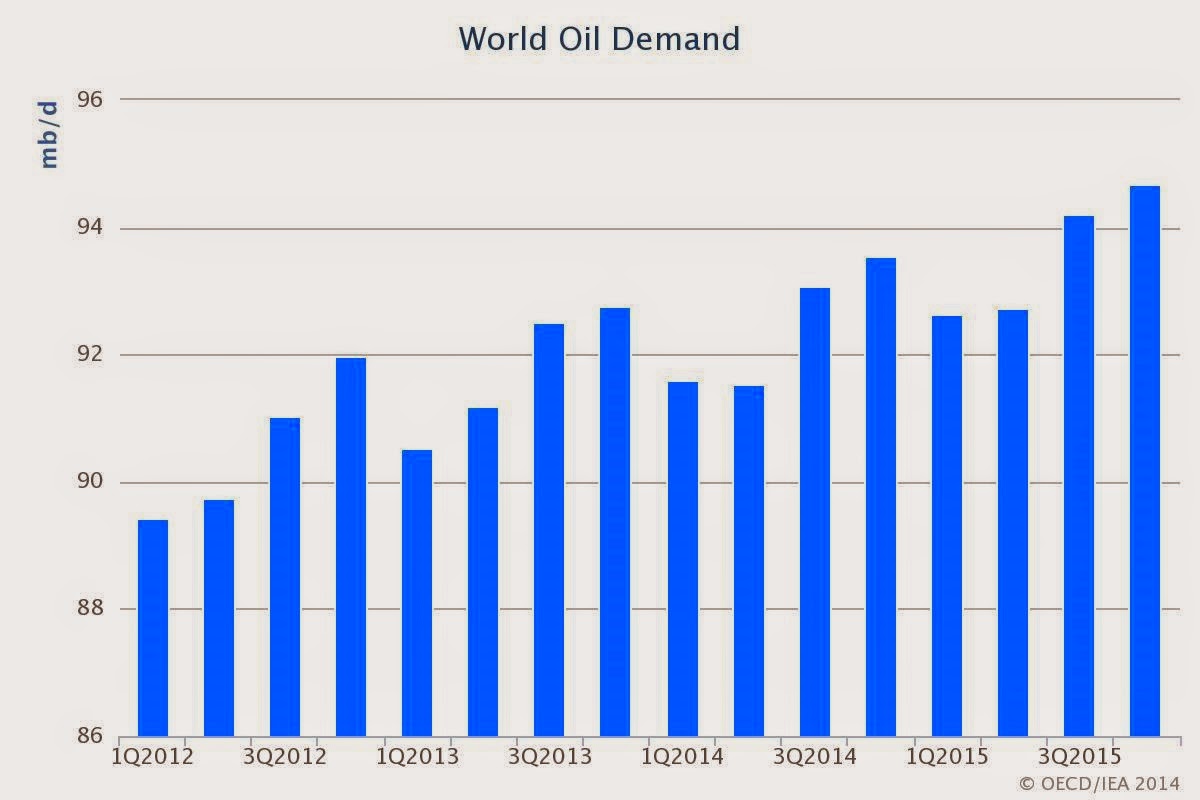

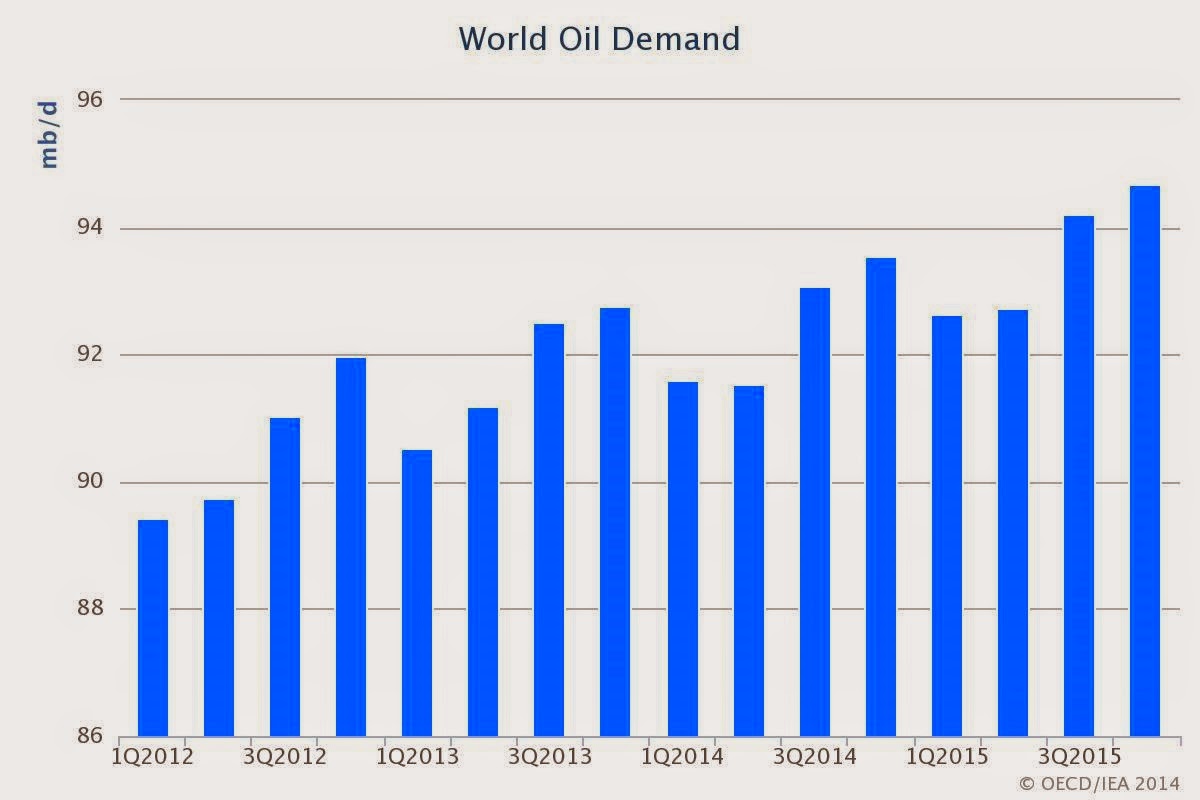

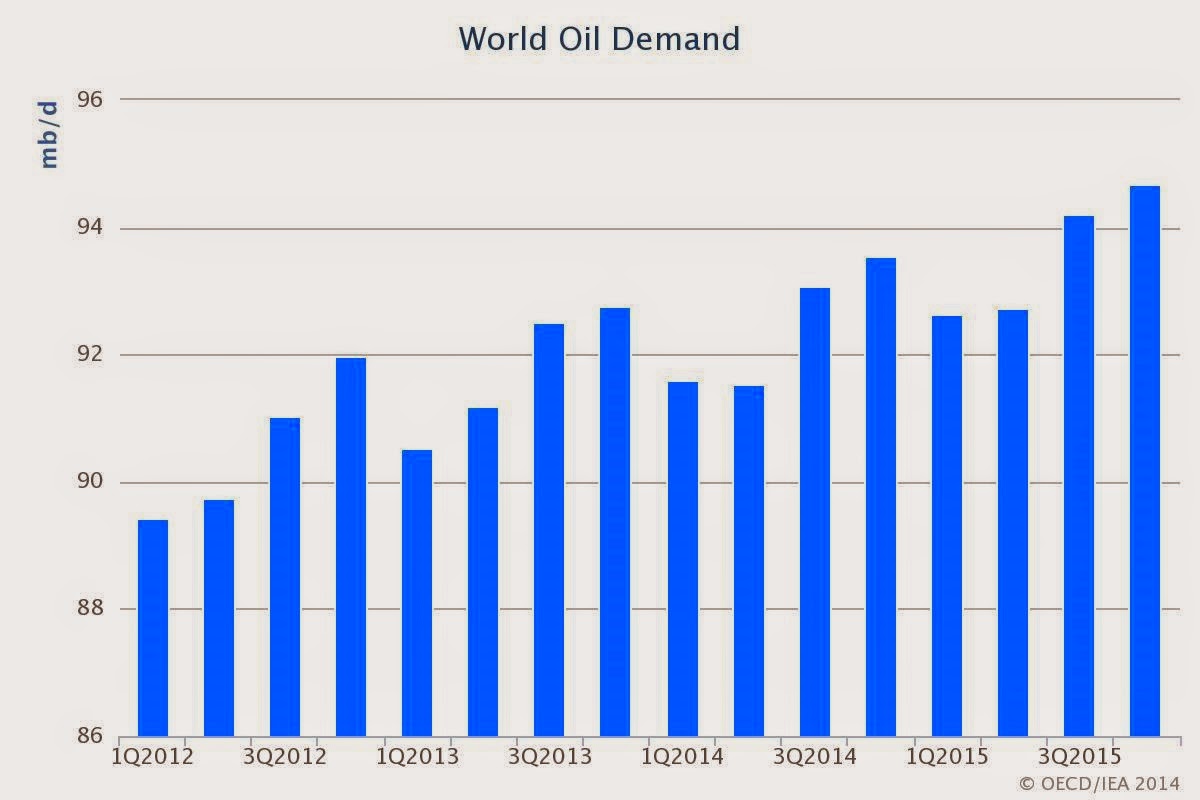

i've been saying all along we're in a deflation. this is a big indicator:  Low energy price in this case may be less an indication of a decreasing economy and more a supply/demand issue, and stronger dollar. The low oil price will be accretive to growth everywhere except oil exporters (as of this year, the USA is also an oil exporter, but not at all significant by percentage of economy). Some costs will be reduced, some additional capacity will be turned on. It will be a savings to some industries which will increase profits and growth. In the sense that all "productivity" increases also create deflation, then yes, it is an indicator of deflation, but only by that weird measurement. We may be in a deflation anyway, but oil prices are not indicating that so much they are indicating a supply glut. Oil may be priced what it was in 2009, but just not for the same reasons. Oil Demand and usage has increased, not contracted. AND... lower prices are going to bend this projection chart upward further toward more demand, because lower prices means more consumption is coming, not less.  "Uncertainty" is going to mess with equity markets for a while, but earnings season is going to be pretty nice for a lot of companies that are petrol dependent. |

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 12, 2014, 05:36:32 PM |

|

i've been saying all along we're in a deflation. this is a big indicator:  Low energy price in this case may be less an indication of a decreasing economy and more a supply/demand issue, and stronger dollar. The low oil price will be accretive to growth everywhere except oil exporters (as of this year, the USA is also an oil exporter, but not at all significant by percentage of economy). Some costs will be reduced, some additional capacity will be turned on. It will be a savings to some industries which will increase profits and growth. In the sense that all "productivity" increases also create deflation, then yes, it is an indicator of deflation, but only by that weird measurement. We may be in a deflation anyway, but oil prices are not indicating that so much they are indicating a supply glut. Oil may be priced what it was in 2009, but just not for the same reasons. Oil Demand and usage has increased, not contracted. AND... lower prices are going to bend this projection chart upward further toward more demand, because lower prices means more consumption is coming, not less.  "Uncertainty" is going to mess with equity markets for a while, but earnings season is going to be pretty nice for a lot of companies that are petrol dependent. yours is certainly the predominant view and logical at a certain level. i only pt out however that 2008 never allowed markets to "clear". the debt buildup since has only multiplied thru unsustainable policies. we could be entering the blow off phase of a multi-decade inflation with QE being the culmination of those policies. i do find myself conflicted on what's happening as, in general, i'm an optimist as to what tech and Bitcoin will bring to society but i am also a believer in cycles. it's time for another down cycle to clear mkts. gold's multi year drop may be leading the next deflationary phase. just be cautious. |

|

|

|

|

rocks

Legendary

Offline Offline

Activity: 1153

Merit: 1000

|

|

December 12, 2014, 06:15:21 PM |

|

i've been saying all along we're in a deflation. this is a big indicator:  Low energy price in this case may be less an indication of a decreasing economy and more a supply/demand issue, and stronger dollar. The low oil price will be accretive to growth everywhere except oil exporters (as of this year, the USA is also an oil exporter, but not at all significant by percentage of economy). Some costs will be reduced, some additional capacity will be turned on. It will be a savings to some industries which will increase profits and growth. In the sense that all "productivity" increases also create deflation, then yes, it is an indicator of deflation, but only by that weird measurement. We may be in a deflation anyway, but oil prices are not indicating that so much they are indicating a supply glut. Oil may be priced what it was in 2009, but just not for the same reasons. Oil Demand and usage has increased, not contracted. AND... lower prices are going to bend this projection chart upward further toward more demand, because lower prices means more consumption is coming, not less.  "Uncertainty" is going to mess with equity markets for a while, but earnings season is going to be pretty nice for a lot of companies that are petrol dependent. yours is certainly the predominant view and logical at a certain level. i only pt out however that 2008 never allowed markets to "clear". the debt buildup since has only multiplied thru unsustainable policies. we could be entering the blow off phase of a multi-decade inflation with QE being the culmination of those policies. i do find myself conflicted on what's happening as, in general, i'm an optimist as to what tech and Bitcoin will bring to society but i am also a believer in cycles. it's time for another down cycle to clear mkts. gold's multi year drop may be leading the next deflationary phase. just be cautious. This graph by the FED showing "Gross Domestic Product/St. Louis Adjusted Monetary Base" shows well what is happening. http://research.stlouisfed.org/fred2/graph/?g=9wKWhat central banking enabled, was for debts and promises to be made in gross excess of underlying money. This is possible under fiat because the FED can act as a backstop and provide "liquidity on demand" to too big to fail institutions, which allows these institutions to leverage as much as they want. Think of it as a rubber band that gets stretched more and more, under sound money stretching passed 2:1 was not advisable, but under fiat stretching 50:1 is possible. This stretching of debts in excess of money causes inflation, home prices and all prices go up. What we are seeing now is the economy can not support these debts, and if you take away the debts prices will crash down. (for example housing which is a financial asset). so there are 2 options: a) massive debt write-offs, with resulting price crashes or b) massive expansion of money, to "hold" prices where they are today. What is interesting about b) is although people think it will cause hyperinflation, it won't necessarily. What b) does is cement the inflation of the past 100 years, i.e. we already had the hyperinflation, the question is whether to keep it or get rid of it. This is also why central banks get away with their crimes, they stretch their hyperinflation over a long time period, so the public accepts it. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 12, 2014, 06:21:16 PM |

|

i've been saying all along we're in a deflation. this is a big indicator:  Low energy price in this case may be less an indication of a decreasing economy and more a supply/demand issue, and stronger dollar. The low oil price will be accretive to growth everywhere except oil exporters (as of this year, the USA is also an oil exporter, but not at all significant by percentage of economy). Some costs will be reduced, some additional capacity will be turned on. It will be a savings to some industries which will increase profits and growth. In the sense that all "productivity" increases also create deflation, then yes, it is an indicator of deflation, but only by that weird measurement. We may be in a deflation anyway, but oil prices are not indicating that so much they are indicating a supply glut. Oil may be priced what it was in 2009, but just not for the same reasons. Oil Demand and usage has increased, not contracted. AND... lower prices are going to bend this projection chart upward further toward more demand, because lower prices means more consumption is coming, not less.  "Uncertainty" is going to mess with equity markets for a while, but earnings season is going to be pretty nice for a lot of companies that are petrol dependent. yours is certainly the predominant view and logical at a certain level. i only pt out however that 2008 never allowed markets to "clear". the debt buildup since has only multiplied thru unsustainable policies. we could be entering the blow off phase of a multi-decade inflation with QE being the culmination of those policies. i do find myself conflicted on what's happening as, in general, i'm an optimist as to what tech and Bitcoin will bring to society but i am also a believer in cycles. it's time for another down cycle to clear mkts. gold's multi year drop may be leading the next deflationary phase. just be cautious. This graph by the FED showing "Gross Domestic Product/St. Louis Adjusted Monetary Base" shows well what is happening. http://research.stlouisfed.org/fred2/graph/?g=9wKWhat central banking enabled, was for debts and promises to be made in gross excess of underlying money. This is possible under fiat because the FED can act as a backstop and provide "liquidity on demand" to too big to fail institutions, which allows these institutions to leverage as much as they want. Think of it as a rubber band that gets stretched more and more, under sound money stretching passed 2:1 was not advisable, but under fiat stretching 50:1 is possible. This stretching of debts in excess of money causes inflation, home prices and all prices go up. What we are seeing now is the economy can not support these debts, and if you take away the debts prices will crash down. (for example housing which is a financial asset). so there are 2 options: a) massive debt write-offs, with resulting price crashes or b) massive expansion of money, to "hold" prices where they are today. What is interesting about b) is although people think it will cause hyperinflation, it won't necessarily. What b) does is cement the inflation of the past 100 years, i.e. we already had the hyperinflation, the question is whether to keep it or get rid of it. This is also why central banks get away with their crimes, they stretch their hyperinflation over a long time period, so the public accepts it. that's a great graph, rocks. note how it correlates with the black hole shit graph here:  1980 marked the peak of inflation in the US, and ever since, yields have been falling corresponding with the increase of big gvt bond funding needed to sustain the great game. |

|

|

|

|

rocks

Legendary

Offline Offline

Activity: 1153

Merit: 1000

|

|

December 12, 2014, 06:45:40 PM |

|

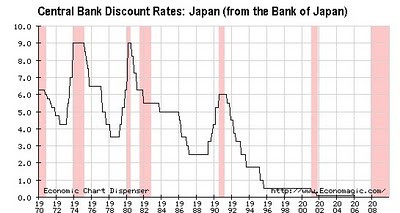

that's a great graph, rocks. note how it correlates with the black hole shit graph here:  1980 marked the peak of inflation in the US, and ever since, yields have been falling corresponding with the increase of big gvt bond funding needed to sustain the great game. Those inflation graphs are scary. The future for the US is what happened to Japan here.  Japan's rates hit near-zero, at which point they were zero bound. At that point Japan's only option was even more massive debts and significant money printing. Their prices haven't gone up though because they are still in the black hole of over indebtedness. This seems to be the path the FED is taking. |

|

|

|

|

NewLiberty

Legendary

Offline Offline

Activity: 1204

Merit: 1002

Gresham's Lawyer

|

|

December 12, 2014, 07:05:07 PM |

|

yours is certainly the predominant view and logical at a certain level.

i only pt out however that 2008 never allowed markets to "clear". the debt buildup since has only multiplied thru unsustainable policies. we could be entering the blow off phase of a multi-decade inflation with QE being the culmination of those policies. i do find myself conflicted on what's happening as, in general, i'm an optimist as to what tech and Bitcoin will bring to society but i am also a believer in cycles. it's time for another down cycle to clear mkts. gold's multi year drop may be leading the next deflationary phase.

just be cautious.

I'm with you there. The macro view is pretty borked in ways that make unborking unlikely without an entirely new paradigm. The deflation is only a piece of that mess, and is being managed to make the massive QE inflation game take longer to play out on the hopes that something weird happens and it doesn't turn calamitous like usual. Optimism? Maybe this time is different. Maybe alien time travelers will visit us and show us the new plan. Maybe we find an efficient, portable, and safe energy storage device. Maybe we will all live forever. Lots of good things can happen, and I don't really want to talk about the bad things because they are just what usually happens historically when the string plays out on this game and we reach the end of the spool. |

|

|

|

Melbustus

Legendary

Offline Offline

Activity: 1722

Merit: 1003

|

|

December 12, 2014, 07:23:42 PM |

|

A couple years behind the discussion here, but still good to see coming out of Princeton: "Why ASICs may be good for Bitcoin" - https://freedom-to-tinker.com/blog/jbonneau/why-asics-may-be-good-for-bitcoin/...

I would like to expand on the argument here though by positing that ASICs may actually make Bitcoin (and similar cryptocurrencies) more stable by ensuring that miners have a large sunk cost and depend on future mining revenues to recoup it. Even if it were technically possible to design a perfectly ASIC-resistant mining puzzle which ensured that mining was efficient on general-purpose computers, this might be a bad idea if it meant you could obtain a lot of computational capacity and use it in a destructive attack on Bitcoin without significantly devaluing your computational resources’ value.

...

|

Bitcoin is the first monetary system to credibly offer perfect information to all economic participants.

|

|

|

rocks

Legendary

Offline Offline

Activity: 1153

Merit: 1000

|

|

December 12, 2014, 07:49:31 PM |

|

yours is certainly the predominant view and logical at a certain level.

i only pt out however that 2008 never allowed markets to "clear". the debt buildup since has only multiplied thru unsustainable policies. we could be entering the blow off phase of a multi-decade inflation with QE being the culmination of those policies. i do find myself conflicted on what's happening as, in general, i'm an optimist as to what tech and Bitcoin will bring to society but i am also a believer in cycles. it's time for another down cycle to clear mkts. gold's multi year drop may be leading the next deflationary phase.

just be cautious.

I'm with you there. The macro view is pretty borked in ways that make unborking unlikely without an entirely new paradigm. The deflation is only a piece of that mess, and is being managed to make the massive QE inflation game take longer to play out on the hopes that something weird happens and it doesn't turn calamitous like usual. Optimism? Maybe this time is different. Maybe alien time travelers will visit us and show us the new plan. Maybe we find an efficient, portable, and safe energy storage device. Maybe we will all live forever. Lots of good things can happen, and I don't really want to talk about the bad things because they are just what usually happens historically when the string plays out on this game and we reach the end of the spool. Maybe this time someone motivated who sees what is going on will create an exit from the current financial regime that anyone in the world can join. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 12, 2014, 07:52:52 PM |

|

yours is certainly the predominant view and logical at a certain level.

i only pt out however that 2008 never allowed markets to "clear". the debt buildup since has only multiplied thru unsustainable policies. we could be entering the blow off phase of a multi-decade inflation with QE being the culmination of those policies. i do find myself conflicted on what's happening as, in general, i'm an optimist as to what tech and Bitcoin will bring to society but i am also a believer in cycles. it's time for another down cycle to clear mkts. gold's multi year drop may be leading the next deflationary phase.

just be cautious.

I'm with you there. The macro view is pretty borked in ways that make unborking unlikely without an entirely new paradigm. The deflation is only a piece of that mess, and is being managed to make the massive QE inflation game take longer to play out on the hopes that something weird happens and it doesn't turn calamitous like usual. Optimism? Maybe this time is different. Maybe alien time travelers will visit us and show us the new plan. Maybe we find an efficient, portable, and safe energy storage device. Maybe we will all live forever. Lots of good things can happen, and I don't really want to talk about the bad things because they are just what usually happens historically when the string plays out on this game and we reach the end of the spool. Maybe this time someone motivated who sees what is going on will create an exit from the current financial regime that anyone in the world can join. This is why I think Bitcoin will actually thrive in the next downturn unlike what guys like Jim Rickards is predicting. The timing is suspiciously right as well after a year of bitcoin stagnation in the price. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 12, 2014, 08:40:38 PM |

|

Dow diving now. feels like deflation.

problem being debt implosions with Greek and now energy junk bonds. that would be the next subprime.

|

|

|

|

|

|

|

Wekkel

Legendary

Offline Offline

Activity: 3108

Merit: 1531

yes

|

|

December 12, 2014, 09:14:40 PM |

|

Dow diving now. feels like deflation.

There will also be "up" days again. As if the thing cannot stay down any more. |

|

|

|

|

Fabrizio89

|

|

December 12, 2014, 09:59:02 PM |

|

It's not like 2% is the end of the world, even if in that stock may be an interesting number. As I already said in my opinion we reached the top of this bull cycle and we are about to see a downfall of the major us stocks. Gold seems to have confirmed its historical support from a point of view, but I'm not convinced at all that it will reverse the trend anytime soon.

|

|

|

|

|

Adrian-x

Legendary

Offline Offline

Activity: 1372

Merit: 1000

|

|

December 12, 2014, 10:10:10 PM

Last edit: December 13, 2014, 03:09:13 AM by Adrian-x |

|

Dow diving now. feels like deflation.

There will also be "up" days again. As if the thing cannot stay down any more. To rocks point earlier I'm in total agreement, QE is just locking in past inflation. Deflation should refer to the money supply but is largely measured in consumer prices. When I here deflation I have a hard time relating it to falling stock prices and other investment assets, although consumer prices and investment assets may be correlated. Where I see the deflation happening I see it in consumer value judgments. Here is a distressing story my wife told me. The dentist visits schools in Canada part of oral hygiene education, while my wife was talking the dentist expressed concern, that many children aren't getting the calcium they need in there diet. Many kids don't eat cheese anymore, why, the feedback to the dentist is my mom says it's too expensive. That's feedback I'd expect from people living in poverty not middle class kids. The thing debt purchase like a car a house (even a cellphone believe it or not) are being serviced (creating monetary inflation) while at the same time many of the same people are foregoing basis like nutrition causing consumer deflation. |

Thank me in Bits 12MwnzxtprG2mHm3rKdgi7NmJKCypsMMQw

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 13, 2014, 12:06:23 AM |

|

if Adam says BUY due to GOLD, who are you to deny?

|

|

|

|

|

smoothie

Legendary

Offline Offline

Activity: 2492

Merit: 1473

LEALANA Bitcoin Grim Reaper

|

|

December 13, 2014, 12:09:32 AM |

|

Who here thinks the Bitcoin to Dow ratio will flip someday?

|

███████████████████████████████████████

,╓p@@███████@╗╖,

,p████████████████████N,

d█████████████████████████b

d██████████████████████████████æ

,████²█████████████████████████████,

,█████ ╙████████████████████╨ █████y

██████ `████████████████` ██████

║██████ Ñ███████████` ███████

███████ ╩██████Ñ ███████

███████ ▐▄ ²██╩ a▌ ███████

╢██████ ▐▓█▄ ▄█▓▌ ███████

██████ ▐▓▓▓▓▌, ▄█▓▓▓▌ ██████─

▐▓▓▓▓▓▓█,,▄▓▓▓▓▓▓▌

▐▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▌

▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓─

²▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓╩

▀▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▀

²▀▀▓▓▓▓▓▓▓▓▓▓▓▓▀▀`

²²²

███████████████████████████████████████

| . ★☆ WWW.LEALANA.COM My PGP fingerprint is A764D833. History of Monero development Visualization ★☆ .

LEALANA BITCOIN GRIM REAPER SILVER COINS.

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 13, 2014, 12:23:48 AM |

|

Who here thinks the Bitcoin to Dow ratio will flip someday?

me. we are at opposite ends of the cycles btwn the two, imo. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 13, 2014, 12:25:27 AM |

|

just as a reminder:

[–]Capt_Roger_Murdock 5 points 4 days ago

Here's how I usually explain what Bitcoin is and why it matters:

The reason it's so hard for most people to understand Bitcoin is that most people don't really understand money. Money isn't wealth. It's an accounting system used to facilitate the exchange of wealth. (The paradox of money is that while everyone wants it, no one actually wants it - they want the stuff they can buy with it!) Many people are put off by the fact that bitcoins are "just zeroes and ones." But that's what ALL money is, information! More precisely, money is a means for credibly conveying information about value given but not yet received (or at least not yet received in a form in which it can directly satisfy a person's wants or needs).

To put it yet another way, money is a ledger. With fiat currencies like the dollar, that ledger is centralized. And that gives the central authority responsible for maintaining that ledger tremendous power, power that history has proven will inevitably be abused. With Bitcoin, the ledger is decentralized. And that means that no one individual or entity has the power to arbitrarily create new units (thereby causing inflation), freeze (or seize) your account, or block a particular payment from being processed. We've had decentralized money before. After all, no one can simply print new gold into existence. And the "ledger" of gold is distributed because the physical gold itself (the "accounting entries" in the metaphor) is distributed. But with gold, that decentralization comes at a heavy price (literally). The physical nature of gold makes it hugely inefficient from a transactional perspective.

Enter Bitcoin.

It is the first currency in the world that is BOTH decentralized AND digital. It is more reliably scarce than gold, more transactionally efficient than "modern" digital banking, and enables greater financial privacy than cash. It could certainly still fail for one reason or another, but if it doesn't, it has the potential to be very, VERY disruptive.

|

|

|

|

|

xcrabber

Newbie

Offline Offline

Activity: 32

Merit: 0

|

|

December 13, 2014, 12:57:40 AM |

|

I was on the fence about buying a new Xbox.

This settles it. Merry Christmas!

I didn't have a console, ever. I quit playing computer games at some point. I think I might get a TV or projector and a steam box. When is steam going to accept Bitcoin? Now that would imply a rocket. (I know one can buy steam games with bitcoin through 3rd parties, that's not what I mean). I quit years ago as well. But I still have one teenager left at home. But who knows? Maybe I'll start again just because of Microsoft. Just to support the cause. A part of me wonders just how much the tech has come along. Your teenagers will use you as a punching bag. I used to think I was good at a few games until I had a son. It will be humbling, but you will have new things to talk about with them. Cypher one suggestion if you get the XBONE get Forza 5 racing sim. with force-feedback wheel and pedals. My teenage son and daughter both use me as a punching bag with all games but this one. I can get cocky and say "who's your daddy" with wheels and pedals but not those thumb sticks. A low latency tv is a must. Now I need to go spend some virtual cash for some virtual car upgrades. Merry Christmas |

|

|

|

|

|

Poll

Poll