BldSwtTrs

Legendary

Offline Offline

Activity: 861

Merit: 1010

|

|

December 27, 2014, 01:08:50 PM

Last edit: December 27, 2014, 01:28:27 PM by BldSwtTrs |

|

Daniel says that an asset's value comes from either a future expected payments, or, in the case of cash, from the future random opportunities it allows to enjoy. But that's not a broad enough view: an asset's value comes from a demand which meets a limited supply. He says that Bitcoin is an appcoin. That's true. It offers no expected future payments, and is far from being the equivalent of cash, still, it has value. Why? Daniel says it, because it's the required token to use the Bitcoin network. It follows that an appcoin can have value if it is the only required token to use a network. If there is demand to use a peculiar network, and if the appcoin is the only way to use that network, then there is no reason to think the appcoin will not have value. Concerning his argument that the appcoin will be dumped by the users as soon as they have finish to use the network: then how does he explain that bitcoins have value? Of course bitcoins have value because people use the token of the BTC network as both a store of value and a vehicle to speculate on the fact that the demand for the use of the network will skyrocket. Why do they do that? Because of the limited supply of the BTC tokens, not because bitcoins are the equivalent of cash and people want to have them to enjoy future random opportunities. It follows that it is definitly possible that users will choose to store their wealth in an appcoin and use it to speculate on the adoption of the relevant network (assuming the said appcoin has a limited supply) even is the appcoin has not a cash-equivalent dominance position over the liquidity market. |

|

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 27, 2014, 05:38:40 PM

Last edit: December 27, 2014, 05:50:15 PM by cypherdoc |

|

Daniel says that an asset's value comes from either a future expected payments, or, in the case of cash, from the future random opportunities it allows to enjoy. But that's not a broad enough view: an asset's value comes from a demand which meets a limited supply. He says that Bitcoin is an appcoin. That's true. It offers no expected future payments, and is far from being the equivalent of cash, still, it has value. Why? Daniel says it, because it's the required token to use the Bitcoin network. It follows that an appcoin can have value if it is the only required token to use a network. If there is demand to use a peculiar network, and if the appcoin is the only way to use that network, then there is no reason to think the appcoin will not have value. Concerning his argument that the appcoin will be dumped by the users as soon as they have finish to use the network: then how does he explain that bitcoins have value? Of course bitcoins have value because people use the token of the BTC network as both a store of value and a vehicle to speculate on the fact that the demand for the use of the network will skyrocket. Why do they do that? Because of the limited supply of the BTC tokens, not because bitcoins are the equivalent of cash and people want to have them to enjoy future random opportunities. It follows that it is definitly possible that users will choose to store their wealth in an appcoin and use it to speculate on the adoption of the relevant network (assuming the said appcoin has a limited supply) even is the appcoin has not a cash-equivalent dominance position over the liquidity market. i didn't like that he referred to Bitcoin as an appcoin. when i think of an appcoin, i think of an associated asset or function that requires usage of appcoin, like SCJX for Storj, MSC for Maidsafe, ether, XCP, etc. to me, Bitcoin is digital cash; it functions independently and only gets traded for goods and services unrelated to Bitcoin itself and which exist totally off the blockchain. Bitcoin is its own self contained financial system which transfers BTC from address to address and owner to owner. i foresee a day when goods and services will be priced or denominated in BTC, ie, Bitcoin will become a unit of account and a new form of sound money unto itself. to achieve this would be to achieve Bitcoins greatest potential as a form of digital gold. this is why i am so against any proposal which might detract or distract from this outcome or turn Bitcoin into a multi-asset trading platform. imo, ppl who advocate for this expansion of Bitcoins function either don't understand Bitcoin or are the "entrepreneurs" that Daniel refer to who were late to the party and wish to mold/change Bitcoin into their new "opportunity" at the expense of the rest of us who got in early. the funny thing is, if they just bought BTC now, they would still be early adopters who should experience incredible wealth expansion over time. aaand, it would be a lot easier. b/c it is essentially "perfect" money due to its fixed supply and global payment network, all other altcoins or appcoins pale in comparison and lack the network effect which Bitcoin grabbed early on. this is b/c they usually tweek a parameter that distorts Bitcoin's sound money function or try to add a feature which is useless. eventually, these alternatives will be snuffed out according to Austrian Theory as society will function better and more efficiently with a single global monetary unit. we're slowly seeing it happen. the other reason ppl need or wish to hold digital cash, other than to capitalize on crashed assets, is that there are times when emergencies occur and one needs liquidity to buy or pay off essentials. no one usually goes "all in", even in Bitcoin  . but hodling has an additional benefit. as a result of the fact that it has a fixed supply means that in an ever expanding and chaotic fiat currency world, Bitcoins value has no other choice but to go up as fiat "leaks" into the Bitcoin system. |

|

|

|

|

BldSwtTrs

Legendary

Offline Offline

Activity: 861

Merit: 1010

|

|

December 27, 2014, 06:56:39 PM

Last edit: December 27, 2014, 07:16:27 PM by BldSwtTrs |

|

Daniel says that an asset's value comes from either a future expected payments, or, in the case of cash, from the future random opportunities it allows to enjoy. But that's not a broad enough view: an asset's value comes from a demand which meets a limited supply. He says that Bitcoin is an appcoin. That's true. It offers no expected future payments, and is far from being the equivalent of cash, still, it has value. Why? Daniel says it, because it's the required token to use the Bitcoin network. It follows that an appcoin can have value if it is the only required token to use a network. If there is demand to use a peculiar network, and if the appcoin is the only way to use that network, then there is no reason to think the appcoin will not have value. Concerning his argument that the appcoin will be dumped by the users as soon as they have finish to use the network: then how does he explain that bitcoins have value? Of course bitcoins have value because people use the token of the BTC network as both a store of value and a vehicle to speculate on the fact that the demand for the use of the network will skyrocket. Why do they do that? Because of the limited supply of the BTC tokens, not because bitcoins are the equivalent of cash and people want to have them to enjoy future random opportunities. It follows that it is definitly possible that users will choose to store their wealth in an appcoin and use it to speculate on the adoption of the relevant network (assuming the said appcoin has a limited supply) even is the appcoin has not a cash-equivalent dominance position over the liquidity market. i didn't like that he referred to Bitcoin as an appcoin. when i think of an appcoin, i think of an associated asset or function that requires usage of appcoin, like SCJX for Storj, MSC for Maidsafe, ether, XCP, etc. to me, Bitcoin is digital cash; it functions independently and only gets traded for goods and services unrelated to Bitcoin itself and which exist totally off the blockchain. Bitcoin is its own self contained financial system which transfers BTC from address to address and owner to owner. i foresee a day when goods and services will be priced or denominated in BTC, ie, Bitcoin will become a unit of account and a new form of sound money unto itself. to achieve this would be to achieve Bitcoins greatest potential as a form of digital gold. this is why i am so against any proposal which might detract or distract from this outcome or turn Bitcoin into a multi-asset trading platform. imo, ppl who advocate for this expansion of Bitcoins function either don't understand Bitcoin or are the "entrepreneurs" that Daniel refer to who were late to the party and wish to mold/change Bitcoin into their new "opportunity" at the expense of the rest of us who got in early. the funny thing is, if they just bought BTC now, they would still be early adopters who should experience incredible wealth expansion over time. aaand, it would be a lot easier. b/c it is essentially "perfect" money due to its fixed supply and global payment network, all other altcoins or appcoins pale in comparison and lack the network effect which Bitcoin grabbed early on. this is b/c they usually tweek a parameter that distorts Bitcoin's sound money function or try to add a feature which is useless. eventually, these alternatives will be snuffed out according to Austrian Theory as society will function better and more efficiently with a single global monetary unit. we're slowly seeing it happen. the other reason ppl need or wish to hold digital cash, other than to capitalize on crashed assets, is that there are times when emergencies occur and one needs liquidity to buy or pay off essentials. no one usually goes "all in", even in Bitcoin  . but hodling has an additional benefit. as a result of the fact that it has a fixed supply means that in an ever expanding and chaotic fiat currency world, Bitcoins value has no other choice but to go up as fiat "leaks" into the Bitcoin system. It's digital cash because people aren't afraid of hoarding it. And why are they hoarding it when instead they can just use the payment system and dump the BTC as fast as they can once they have buy the goods and services they needed? Because they don't see the BTC tokens only as a means to use the network/payment system but also as a store of value and a speculation vehicle. The store of value function exists when there is a limited supply. The speculation vehicle function exists when the user-base of the network has a growth potentiel. These two conditions aren't specific to Bitcoin. If Storj tokens exist in limited supply and the Storj network has a big growth potentiel, then people will hoard them like they are hoarding BTC. That doesn't threaten the digital cash position of BTC at all (the superior network effect in payments cannot be overturned), it's just something that will happen outside the scope of BTC. Today they are plenty of assets which allow people to store their value besides gold, and people use a great variety of vehicles to speculate. The Austrian theory is probably right to conclude that the cash function is a natural monopoly, but the SOV and speculation functions aren't natural monopoly. That's why appcoins will have value, not because they will be use as a means of payments or as a unit of account (Bitcoin will stay the king), but because they will allow to store value and speculate. BTC will not capture all the value created by the economy. Some value will exist outside of its scope, and if other networks than the BTC network create value for the consumers, then there is no question that the tokens that allow people to use those networks will have value too. |

|

|

|

|

|

brg444

|

|

December 27, 2014, 07:17:23 PM |

|

Daniel says that an asset's value comes from either a future expected payments, or, in the case of cash, from the future random opportunities it allows to enjoy. But that's not a broad enough view: an asset's value comes from a demand which meets a limited supply. He says that Bitcoin is an appcoin. That's true. It offers no expected future payments, and is far from being the equivalent of cash, still, it has value. Why? Daniel says it, because it's the required token to use the Bitcoin network. It follows that an appcoin can have value if it is the only required token to use a network. If there is demand to use a peculiar network, and if the appcoin is the only way to use that network, then there is no reason to think the appcoin will not have value. Concerning his argument that the appcoin will be dumped by the users as soon as they have finish to use the network: then how does he explain that bitcoins have value? Of course bitcoins have value because people use the token of the BTC network as both a store of value and a vehicle to speculate on the fact that the demand for the use of the network will skyrocket. Why do they do that? Because of the limited supply of the BTC tokens, not because bitcoins are the equivalent of cash and people want to have them to enjoy future random opportunities. It follows that it is definitly possible that users will choose to store their wealth in an appcoin and use it to speculate on the adoption of the relevant network (assuming the said appcoin has a limited supply) even is the appcoin has not a cash-equivalent dominance position over the liquidity market. i didn't like that he referred to Bitcoin as an appcoin. when i think of an appcoin, i think of an associated asset or function that requires usage of appcoin, like SCJX for Storj, MSC for Maidsafe, ether, XCP, etc. to me, Bitcoin is digital cash; it functions independently and only gets traded for goods and services unrelated to Bitcoin itself and which exist totally off the blockchain. Bitcoin is its own self contained financial system which transfers BTC from address to address and owner to owner. i foresee a day when goods and services will be priced or denominated in BTC, ie, Bitcoin will become a unit of account and a new form of sound money unto itself. to achieve this would be to achieve Bitcoins greatest potential as a form of digital gold. this is why i am so against any proposal which might detract or distract from this outcome or turn Bitcoin into a multi-asset trading platform. imo, ppl who advocate for this expansion of Bitcoins function either don't understand Bitcoin or are the "entrepreneurs" that Daniel refer to who were late to the party and wish to mold/change Bitcoin into their new "opportunity" at the expense of the rest of us who got in early. the funny thing is, if they just bought BTC now, they would still be early adopters who should experience incredible wealth expansion over time. aaand, it would be a lot easier. b/c it is essentially "perfect" money due to its fixed supply and global payment network, all other altcoins or appcoins pale in comparison and lack the network effect which Bitcoin grabbed early on. this is b/c they usually tweek a parameter that distorts Bitcoin's sound money function or try to add a feature which is useless. eventually, these alternatives will be snuffed out according to Austrian Theory as society will function better and more efficiently with a single global monetary unit. we're slowly seeing it happen. the other reason ppl need or wish to hold digital cash, other than to capitalize on crashed assets, is that there are times when emergencies occur and one needs liquidity to buy or pay off essentials. no one usually goes "all in", even in Bitcoin  . but hodling has an additional benefit. as a result of the fact that it has a fixed supply means that in an ever expanding and chaotic fiat currency world, Bitcoins value has no other choice but to go up as fiat "leaks" into the Bitcoin system. It's digital cash because people aren't afraid of hoarding it. And why are they hoarding it when instead they can just use the payment system and dump the BTC as fast as they can once they have buy the goods and services they needed? Because they don't see the BTC tokens only as a means to use the network/payment system but also as a store of value and a speculation vehicle. The store of value function exists when there is a limited supply. The speculation vehicle function exists when the user-base of the network has a growth potentiel. These two conditions aren't specific to Bitcoin. If Storj tokens exist in limited supply and the Storj network has a big growth potentiel, then people will hoard them like they are hoarding BTC. That doesn't threaten the digital cash position of BTC at all (the superior network effect in payments cannot be overturned), it's just something that will happen outside the scope of BTC. Today they are plenty of assets which allow people to store their value besides gold, and people use a great variety of vehicles to speculate. The Austrian theory is probably right to conclude that the cash function is a natural monopoly, but the SOV and speculation functions aren't natural monopoly. That's why appcoins will have value, not because they will be use as a means of payments or as a unit of account, but because they will allow to store value and speculate. BTC will not capture all the value created by the economy. Some value will exist outside of its scope, and if other networks than the BTC network create value for the consumers, then there is no question that the tokens that allow people to use those networks will have value too. What incentive do I have to hold appcoinx to store value when BTC promises better return & better liquidity. The Austrian theory relates to natural MONEY monopoly, not "cash". SOV is a function of money. There absolutely is a network effect for store of values of the same nature (cryptocoins). Moreover, I don't believe that coins the likes of Storj would have limited supply. |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

BldSwtTrs

Legendary

Offline Offline

Activity: 861

Merit: 1010

|

|

December 27, 2014, 07:20:32 PM

Last edit: December 27, 2014, 07:41:37 PM by BldSwtTrs |

|

What incentive do I have to hold appcoinx to store value when BTC promises better return & better liquidity

Diversification. Why professionnal investors have a portfolio of stocks instead of just having the stock that has the better risk/reward? The Austrian theory relates to natural MONEY monopoly, not "cash". SOV is a function of money. There absolutely is a network effect for store of values of the same nature (cryptocoins). Obligation, stocks, real estate, commodities, etc., are all store of value. There is not reason to think the store of value function begets a network effect nor a natural monopoly (you only need a minimum treshold of liquidity to realize the value, that's it). Nick Szabo has written an outstanding essay about the origins of money: http://szabo.best.vwh.net/shell.htmlYou will see that the network effect isn't a key feature in order to store value. |

|

|

|

|

|

brg444

|

|

December 27, 2014, 07:24:59 PM |

|

What incentive do I have to hold appcoinx to store value when BTC promises better return & better liquidity

Diversification. Why investors have a portfolio of stocks instead of just having the stock that has the better risk/reward? This is not diversification. These are all eggs of the same basket (cryptoSOV). Network effect dictates only one egg can survive. There is no comparison with stocks. |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

BldSwtTrs

Legendary

Offline Offline

Activity: 861

Merit: 1010

|

|

December 27, 2014, 07:36:45 PM

Last edit: December 27, 2014, 07:57:50 PM by BldSwtTrs |

|

What incentive do I have to hold appcoinx to store value when BTC promises better return & better liquidity

Diversification. Why investors have a portfolio of stocks instead of just having the stock that has the better risk/reward? This is not diversification. These are all eggs of the same basket (cryptoSOV). Network effect dictates only one egg can survive. I am not taking about buying altcoins but about buying networks (via appcoin). Two networks which are not on the same market aren't competitors. Bitcoin is in competition with Litecoin since they are both payment system networks. But Bitcoin isn't a competitor which MaidSafe or Storj since the two latter are aiming to solve an entirely different problem than Bitcoin. Your argument is like saying that Bitcoin will kill Facebook since there can only be one network in the economy because of the network effect. No, the network effect entails only one network per market. There are a lot of markets in the economy, and Bitcoin will not address all the market of the economy. |

|

|

|

|

|

picolo

|

|

December 27, 2014, 08:00:25 PM |

|

What incentive do I have to hold appcoinx to store value when BTC promises better return & better liquidity

Diversification. Why investors have a portfolio of stocks instead of just having the stock that has the better risk/reward? This is not diversification. These are all eggs of the same basket (cryptoSOV). Network effect dictates only one egg can survive. There is no comparison with stocks. He is diversify in crypto currencies but a good diversification would have more than one asset. |

|

|

|

|

|

NotLambchop

|

|

December 27, 2014, 08:02:31 PM |

|

... ...violence is impossible because its participants cannot be linked to their true names or physical locations. Not quite...   LOL, you know Wei Dai wrote that like a decade before Bitcoin right? Justus is merely pointing out that the anti-theft elements of cryptographic solutions were contemplated long before it occurred to oakpacific this week. The potential to do what governing that needs to be done with less of a central authority is one of the values crypto has the potential to add. Not sure what you're talking about. Non-sequitur? And Charlie pled out to a Money Transmission violation, not theft anyway.

I'm merely pointing out that "Charlie" got owned--according to justusranvier that's impossible. Go go jackbooted thugs  [a bunch of butthurt re moneylaundering laws]

Protip: If you want to break laws, get good. "Charlie" wasn't. He didn't even know how to STFU, and paid   |

|

|

|

|

BldSwtTrs

Legendary

Offline Offline

Activity: 861

Merit: 1010

|

|

December 27, 2014, 08:03:46 PM |

|

Store of value function is a consequence of future economic relevance.

People store their wealth in stocks because they assume companies will have an economic relevance in the future. In gold because they assume that gold will have an economic relevance in the future. In BTC because they assume the network will have a future economic relevance.

Gold isn't the only SOV, it's just happens to be the one with the lower risk over long period, hence its popularity.

BTC will eat a good chunk of the SOV market and will probably remplace gold, but it will not become the only means to transfer value into the future.

|

|

|

|

|

molecular

Donator

Legendary

Offline Offline

Activity: 2772

Merit: 1019

|

|

December 27, 2014, 08:03:53 PM |

|

I wonder if you could use the current CPU temperature to the first or second decimal place as a source of entropy.

The least significant bit of a 16 bit audio sample always seemed a good idea to me. The nice thing about randomness: you can mix many sources (using xor or whatever) and you'll not lose anything even if one source is bad. Unfortunately what you may get wrong if you are too careless about this is how much useful randomness you have. If I recall correctly some sources in the Linux kernel rng are added to the pool but counted as zero entropy. this is why understanding the inner workings of predifined rng's or procedure calls to generate entropy is essential. Also making sure that entropy is explicitly used properly is key. Simply make sure entropy is being used for what it is being generated for. Somebody should code up an entropy "meter" to go in the menu bar of Linux distros. This would be interesting to see as well as a current list of entropy sources. At some point you only need so much entropy from real world randomness but it is cool to come up with new ideas on ways to generate even more randomness. I have suggested somewhere on reddit (although I can't find it now) to found the "church of random", where prayer nodes send around random data as prayers and randomness is collected to build "cathedrals" from it. While the main focus was to get religious protection for sending encrypted random data, those prayers could certainly also be used as a source for randomness. |

PGP key molecular F9B70769 fingerprint 9CDD C0D3 20F8 279F 6BE0 3F39 FC49 2362 F9B7 0769

|

|

|

Melbustus

Legendary

Offline Offline

Activity: 1722

Merit: 1003

|

|

December 27, 2014, 08:16:41 PM |

|

Store of value function is a consequence of future economic relevance.

People store their wealth in stocks because they assume companies will have an economic relevance in the future. In gold because they assume that gold will have an economic relevance in the future. In BTC because they assume the network will have a future economic relevance.

Gold isn't the only SOV, it's just happens to be the one with the lower risk over long period, hence its popularity.

BTC will eat a good chunk of the SOV market, but it will not become the only means to transfer value in the future.

It's funny that gold is perceived as low risk. I think that perception inverts at some point. Given that gold no longer has any direct connection whatsoever to our monetary system or day-to-day economy, it sounds incredibly risky to me. There's no functional demand underpinning its value beyond the $300/oz (or whatever) of industrial-use demand, and it's a huge pain to actually manage ownership of it. |

Bitcoin is the first monetary system to credibly offer perfect information to all economic participants.

|

|

|

|

brg444

|

|

December 27, 2014, 08:24:58 PM |

|

I am not taking about buying altcoins but about buying networks (via appcoin). Two networks which are not on the same market aren't competitors. Bitcoin is a competitor with Litecoin since they are both payment system network. But Bitcoin isn't a competitor which MaidSafe or Storj since the two latter are aiming to solve an entirely different problem than Bitcoin.

Your argument is like saying that Bitcoin will kill Facebook because there can only be one network in the economy because of the network effect. No, the network effect entails only one network per market. There are a lot of markets in the economy, and Bitcoin will not address all the market of the economy.

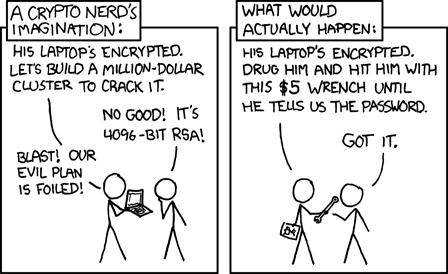

I see where you're coming from but IMO this is where your argument falls short : Concerning his argument that the appcoin will be dumped by the users as soon as they have finish to use the network: then how does he explain that bitcoins have value? Of course bitcoins have value because people use the token of the BTC network as both a store of value and a vehicle to speculate on the fact that the demand for the use of the network will skyrocket. Why do they do that? Because of the limited supply of the BTC tokens, not because bitcoins are the equivalent of cash and people want to have them to enjoy future random opportunities. Bitcoin, as money, aspires to become the most easily exchangeable good so that it can be traded for any goods or services on the market. For that reason Bitcoin is absolutely held, to some extent, because of its ability to be saved and maintain in exchange value so as to satisfy "future random opportunities" (the very definition of a SOV). Now Storjcoin, as an appcoin, only serves one purpose which is to (afaik) use storage capabilities of the Storj network. One will not hold Storjcoin to satisfy future storage needs. Presumably they will hold BTC and exchange for Storjcoin only when they want to use the Storj network. Given the frictionless nature of this exchange it is reasonable to assume that most people will prefer holding the more valuable, liquid asset instead of one that is restricted to use in only one market(network). |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 27, 2014, 08:39:46 PM |

|

No one is saying that the app won't have value as in Storj or Maidsafe. It's the appcoin that will trend towards 0 as BTC is held until only when one needs to utilize appcoin. Eventually, you might as well just use BTC instead of appcoin and the devs will probably come to this realization .

Instead of issuing appcoins, the devs should issue stock. Then it would be fair.

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 27, 2014, 08:46:53 PM |

|

Sure, appcoins will probably have some value but it will degrade over time, just like frequent flyer miles as they will inevitably be inflated away through promises broken.

|

|

|

|

|

kodtycoon

Legendary

Offline Offline

Activity: 1568

Merit: 1002

|

|

December 27, 2014, 08:53:20 PM |

|

Sure, appcoins will probably have some value but it will degrade over time, just like frequent flyer miles as they will inevitably be inflated away through promises broken.

i am guna laugh my god damn ass off if an "app coin" as you call them ever over takes bitcoin lol im not saying its likely, just that it would be the most hilarious event in crypto history for me to see so many "wise men" proven wrong all in one go  |

|

|

|

|

brg444

|

|

December 27, 2014, 08:57:50 PM |

|

Sure, appcoins will probably have some value but it will degrade over time, just like frequent flyer miles as they will inevitably be inflated away through promises broken.

i am guna laugh my god damn ass off if an "app coin" as you call them ever over takes bitcoin lol im not saying its likely, just that it would be the most hilarious event in crypto history for me to see so many "wise men" proven wrong all in one go  I'd also laugh my ass off if Obama would come on TV and announce the USD is getting converted into BTC. Not saying its likely, just that it would be the most hilarious event in economic history for me to see so many "Nobel prizes" proven wrong all in one go  |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

December 27, 2014, 09:05:33 PM |

|

Sure, appcoins will probably have some value but it will degrade over time, just like frequent flyer miles as they will inevitably be inflated away through promises broken.

i am guna laugh my god damn ass off if an "app coin" as you call them ever over takes bitcoin lol im not saying its likely, just that it would be the most hilarious event in crypto history for me to see so many "wise men" proven wrong all in one go  How could they as most of them have not guaranteed a fixed supply nor will function as a neutral SOV for an undefined purpose. |

|

|

|

|

smooth

Legendary

Offline Offline

Activity: 2968

Merit: 1198

|

|

December 27, 2014, 09:11:19 PM |

|

What incentive do I have to hold appcoinx to store value when BTC promises better return & better liquidity

Diversification. Why investors have a portfolio of stocks instead of just having the stock that has the better risk/reward? This is not diversification. These are all eggs of the same basket (cryptoSOV). Network effect dictates only one egg can survive. There is no comparison with stocks. That is exactly diversification. |

|

|

|

|

lebing

Legendary

Offline Offline

Activity: 1288

Merit: 1000

Enabling the maximal migration

|

|

December 27, 2014, 09:13:59 PM |

|

out of curiosity to the security experts here.

which do you consider more secure, Armory or Trezor?

I'm not a security expert, but I would say trezor (with passphrase). It's also easier to use securely. Trezor seems safe. A simple paper wallet generated offline on a new computer running linux is safe too  the problem with a paper wallet is to spend the coins safely. An average bitcoin user these days isn't able to create a linux live CD, import a private key, export the transaction by USB and broadcast it on another online computer running a full node. Exactly. Like I said above: trezor (with additional passphrase against theft of seed backup) is quite secure, but most importantly: it's both easy to use securely (hard to fuck up) and very convenient. I use it as a day-to-day wallet (plus mycelium on the phone) Has anybody noticed that Bitcoin actually has the potential to eliminate theft, like, for real? more or less.  |

Bro, do you even blockchain?

-E Voorhees

|

|

|

|

Poll

Poll