|

brg444

|

|

January 07, 2015, 03:35:16 AM |

|

fud

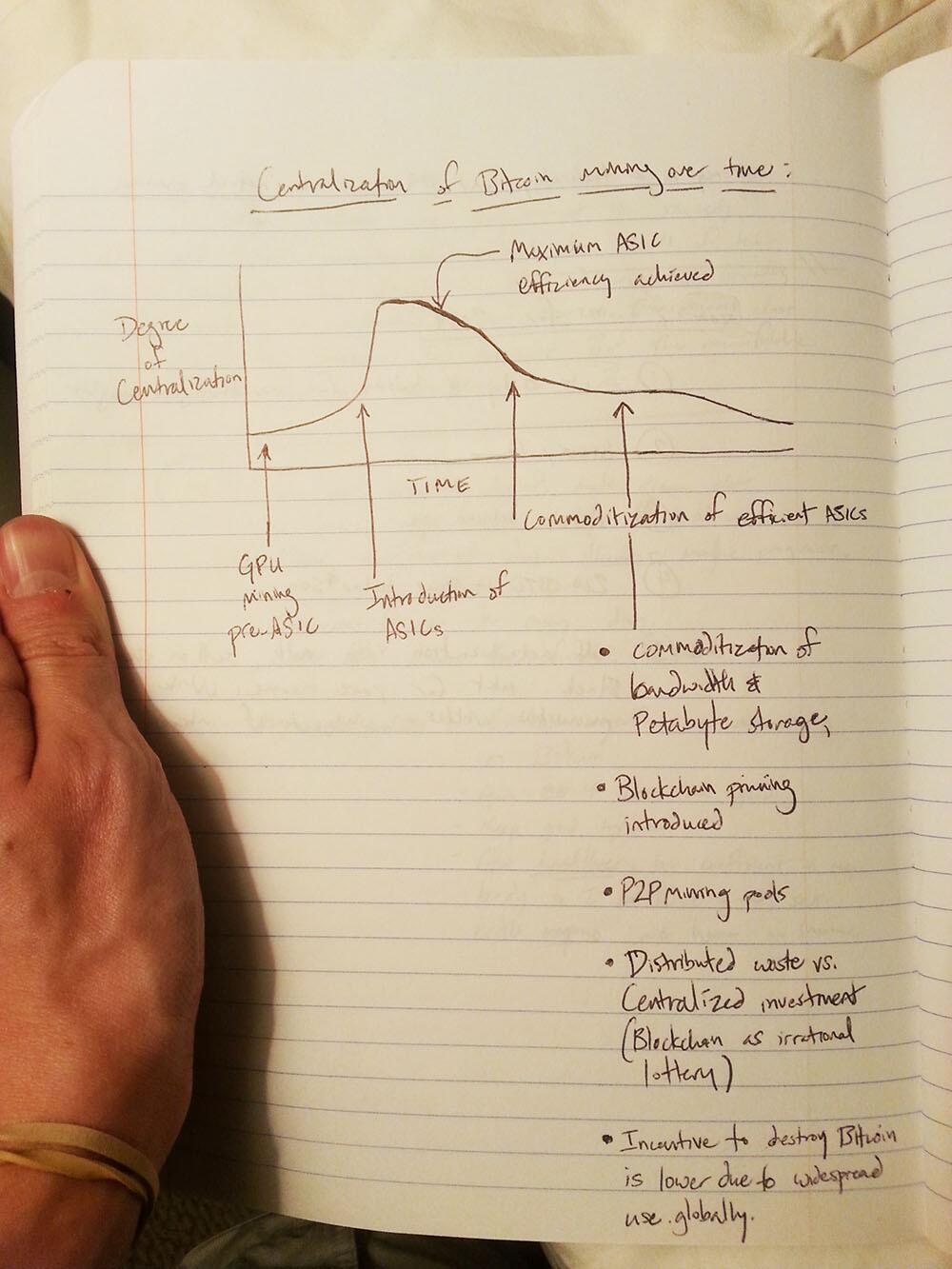

Here, some drawing for you :  |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

|

|

|

The forum strives to allow free discussion of any ideas. All policies are built around this principle. This doesn't mean you can post garbage, though: posts should actually contain ideas, and these ideas should be argued reasonably.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

smooth

Legendary

Offline Offline

Activity: 2968

Merit: 1198

|

|

January 07, 2015, 03:40:26 AM |

|

fud

Here, some drawing for you : i think the picture is likely somewhat misleading on the left side. Centralization has been declining overall for some time, going back to Satoshi's farm. At each technological shift there is a period of increased centralization as some subset of miners has a technology lead, but that is temporary. |

|

|

|

|

|

brg444

|

|

January 07, 2015, 03:43:05 AM |

|

fud

Here, some drawing for you : i think the picture is likely somewhat misleading on the left side. Centralization has been declining overall for some time, going back to Satoshi's farm. At each technological shift there is a period of increased centralization as some subset of miners has a technology lead, but that is temporary. I would agree. Comments from Oleg Andreev to this previously tweeted picture also relevant to the discussion : @oleganza "centralization" of mining is not important if incentives are correct. There's no objective threshold of centralization. @oleganza e.g. everyone would be fine with Fed and Wall St. if their interests were aligned with everyone else's. |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

January 07, 2015, 03:44:15 AM |

|

Jorge, easy money if you're right, no? I'm still waiting for an answer on my bet.

|

|

|

|

|

JorgeStolfi

|

|

January 07, 2015, 03:54:49 AM |

|

It seems your opinion is that there is no need for bitcoin and that banks and arbitrary enforcements based on claims of thefts conducted by centralized controls of wealth ledgers are the way to go. This is fine for you. Others may want alternatives to this to exist in the world and use each type of wealth unit for its purpose.

No, the question is not whether we need a P2P payment system that is not centralized. The question is whether bitcoin is such a system. To me, it is already clear that it isn't, because it requires us to trust the 4-5 largest miners; in the same way that the banking system requires us to trust the few large banks that dominate it. I bet that you will see that too, eventually. Generally, we disagree on most everything in this post, with especially your assumptions about what future behaviors will occur. These things haven't happened yet. With vigilance and individual action, these things may never happen because it is done in the open, and not in secret banking ledgers, as pointed out previously in my last post to you (which you apparently ignored).

It is you who keeps ignoring what I pointed out several times already: that a cartel of miners can take permanent control of the network in the open, with advance warning, and with the cooperation, approval, or indifference of most of the community. Just as a few large banks took permanent control of the banking system. If such a thing is possible, it will almost certainly happen, because of common human greed. (By the way, have you checked the business career of Brock Pierce? I would not have imagined that "mining" and selling video game points could be a profitable business, much less that a single bilion-dollar company could monopolize that business all over the world. Some similarities to bitcoin are intriguing, e.g. the "game point mining farms" that were set up in China by Pierce's associates. I cannot stop wondering why he decided to buy his way into the Bitcoin Foundation's board...) |

Academic interest in bitcoin only. Not owner, not trader, very skeptical of its longterm success.

|

|

|

|

JorgeStolfi

|

|

January 07, 2015, 04:07:29 AM |

|

I'm still waiting for an answer on my bet.

I don't bet money if I can avoid it. (That is one of the reasons why I do not own bitcoins.) |

Academic interest in bitcoin only. Not owner, not trader, very skeptical of its longterm success.

|

|

|

smooth

Legendary

Offline Offline

Activity: 2968

Merit: 1198

|

|

January 07, 2015, 04:17:18 AM |

|

I'm still waiting for an answer on my bet.

I don't bet money if I can avoid it. (That is one of the reasons why I do not own bitcoins.) Talk is cheap. Keep on trollin. |

|

|

|

|

|

JorgeStolfi

|

|

January 07, 2015, 04:58:09 AM |

|

Provided SideChain are not introduced the cost to mine empty blocks becomes prohibitive, and can approach infinity, the incentive system as is rewards corporation.

I don't understand why, but presumably you are saying that blocks with more transitions should have (or have now) greater weight when choosing between two branches of the orthodox chain. If that were (or is) the case, then wouldn't miners pad their blocks with transactions that move a few bits between their pockets, in order to win the block race by weight rather than by work? If that were (or is) the case, the cratel could fill the blocks of chain (2) with such transactions, instead of leaving them empty. Does this make sense? At the moment you would need to spend around 150MWh to block transactions every 10 minutes.

Please check again the script that I outlined above. The miners that will form the cartel have 54% (say) of the hashpower, so they consume about half of the total electricity; and that consumption will not change, whether they attempt the protocol change or not. Their expected payoff, if they succeed, is 54% of 3600 BTC/day, instead of 54% of 1800 BTC/day, for the next two years. Even if they had to forfeit their revenue during the transition period, that would still be a huge gain. (And all miners, cartel or not, will enjoy the same benefit.) However, I believe that the cartel would not lose any revenue during the transition period. Through that time, they will collect more than half of 3600 BTC/day from the reformed chain (1), and, if they succced, they will keep those BTC. (They will also collect all the 1800 BTC/day from the empty orthodox chain (2); but those coins will not be usable outside of chains (2)+(3), so they will be discarded at the end of the transition.) Even if they were to fail in the attempt (how, I cannot see), they would lose the coins from chain (1), but would retain those of chain (2); which are twice as much as they would have earned if they mined fairly. (In fact, a cartel with 51% of the hashpower can just starve the other miners and collect 100% of the block rewards, without doing any other evil. But that is a well-known evil. What I am trying to show is that a 51% cartel can force a change in the protocol.) |

Academic interest in bitcoin only. Not owner, not trader, very skeptical of its longterm success.

|

|

|

rocks

Legendary

Offline Offline

Activity: 1153

Merit: 1000

|

|

January 07, 2015, 05:14:52 AM |

|

Obviously, and so we are back to what I already stated, which apparently you didn't bother to read. 1) There are two competing chains where one chain has only the attacker's blocks and the other chain has the honest miner's blocks. The goal of the attacker is to make their chain with their inclusion rules the longest. The network here can optionally choose the honest chain (which is what Gavin's proposal does). It also require 51% to pull off, which I don't think is possible anyway.

Which is the only possible path. This path both requires at least 51% of total hashing power, and it requires that the honest network (users, P2P nodes & miners) to ignore the 2nd chain with all transactions included. Neither of these are likely IMHO, and why the attack fails. You still have not read my reddit posts, did you? Summarizing them: Say the cartel has hashpower 0.54 * Z where Z is the total. The cartel first warns users that starting from block N, there will be a change in the protocol. The only substantive change will be the block reward, that will continue to be 25 BTC, for another 2 years, instead of dropping to 12.5 as originally planed. This change is actually necessary and good for bitcoin because the network is in grave danger bla bla bla. The cartel warns that users and miners who upgrade to the new version of the software, anytime before block N, will see no change at all. Users who do not upgrade will see no change until block N, but after that their transactions will not go through, or will be confirmed an then unconfirmed -- until they upgrade too. Starting from block N, miners who have not upgraded will not earn any rewards, until they upgrade too. ...... This is quite simply an insane position to take. You've created an imaginary world that does not exist in the real world and used that to extrapolate and predict behaviors that are completely opposite to how people and the ecosystem have behaved in the past, which is the predictor on how they will behave in the future. What you describe is not even a +51% attack, it is a demand for a forced hard fork from one miner telling millions of other people what software to upgrade to. That is simply the most absurd thing I've ever heard. And the reason you think this will happen is because if that one miner claims "this change is actually necessary and good for bitcoin because the network is in grave danger", that would be accepted by the general public? What would happen in your example is the millions of bitcoin participants would tell that one miner to take a hike and continue with the existing P2P core protocol. Then when that miner started to produce nonconforming 25BTC blocks, they would simply be rejected out of the P2P network as invalid, and the honest network would carry on. The attacking miner could have 95% of hash power and it wouldn't matter, his blocks would be rejected as nonconforming and the network would simply re-adjust to the 5% remaining. You do not even understand the basics of how a potential 51% attack is limited in it's range of attack vectors in the real world and how those limited attack vectors are harmless/manageable. You then claim miners and users who do not upgrade would have their transactions blocked. Again this is insane. What would happen is those miners and users would confirm transactions on their own honest chain (the original chain) and not care whether their transactions confirm on the attacker's invalid chain. |

|

|

|

|

smooth

Legendary

Offline Offline

Activity: 2968

Merit: 1198

|

|

January 07, 2015, 05:20:11 AM |

|

Even if they were to fail in the attempt (how, I cannot see) It will fail because the community will press what Adam calls the Big Red Button and hard fork. Your cartel will lose the transaction fees they didn't earn when rejecting transactions on the original chain. They will also lose the value of the mining gear (and other brand value associated with their mining businesses). I doubt the community would go so far as to hard fork retroactively (eliminating the mining rewards from the empty attack blocks), but that is also possible, so its a risk the cartel would face. You don't have to believe that individual end users would be behind this (I argue they will simple update their software from whatever its original source, which in no case of which I'm aware includes miners), but that the rest of bitcoin industry -- coinbase, bitpay, venture capital firms, hedge funds, etc. -- certainly would support it. They have nothing to gain and everything to lose from ceding power over the network to miners. It is exactly this Big Red Button that will keep the future you describe from ever happening. Since your model fails to contain a mechanism that would prevent the outcome you predict, and that outcome will not occur, your model must be missing something. If it is not the Big Red Button that is missing from your model, what is it? |

|

|

|

|

tvbcof

Legendary

Offline Offline

Activity: 4592

Merit: 1276

|

|

January 07, 2015, 05:25:25 AM

Last edit: January 07, 2015, 05:39:46 AM by tvbcof |

|

...

What would happen in your example is the millions of bitcoin participants would tell that one miner to take a hike and continue with the existing P2P core protocol. Then when that miner started to produce nonconforming 25BTC blocks, they would simply be rejected out of the P2P network as invalid, and the honest network would carry on. The attacking miner could have 95% of hash power and it wouldn't matter, his blocks would be rejected as nonconforming and the network would simply re-adjust to the 5% remaining.

...

IIRC that actually did happen at the 50BTC->25BTC juncture. What you 'predict' is about exactly what happened I think but I was not paying that close of attention. Whatever happened it was a blip and over within hours or days. Back then though more Joe Sixpacks were running transfer nodes...I was at the time but I've since stopped (in part because I'm behind a satellite connection and the blockchain represents several months of my data allowance.) edit - Nowadays with most people running Multibit, most people may not know (or much care) what chain they might be following in a stolfi-type attack scenario. But then again they may...I don't know the precise details and capabilities of Multibit. |

sig spam anywhere and self-moderated threads on the pol&soc board are for losers.

|

|

|

Adrian-x

Legendary

Offline Offline

Activity: 1372

Merit: 1000

|

|

January 07, 2015, 05:28:56 AM |

|

I understand "success" as "the bitcoin protocol provides a P2P payment system that does not require trust in a third-party authority".

We now know that the bitcon protocol does not provide that. The protocol requires users to trust the miners; which is OK, as long as mining power is sufficiently well distributed over thousands of independent entities, benign or short-term greedy. However, the protocol cannot prevent concentration of mining, and in fact forsters it. Once mining is concentrated in a small number of companies, having to trust them is no longer OK.

OK lets all jump on Jorge,  Jorge you're not expressing a sound understanding of Bitcoin. Miners, in order to have a block accepted must follow the rules of the protocol. The protocol rules are maintained by the p2p network of nodes. Nodes are maintained by those who have an invested interest in the blockchain's integrity. We hardly need to trust miners given the incentives, or the economic cost to participate but not cooperate. From my understand even if there were very few centralized miners the incentives would still provoke cooperation. To your credit that balance is not well understood by the community or some of the core developers, mainly those accredited to authoring the SideChains white paper. When If miners are enabled (entrusted) by the Bitcoin protocol to interoperate with other blockchains (SideChains) to process Bitcoin equipment transactions that do not registered the full transaction ledger in the Bitcoin blockchain, or conform with the Bitcoin protocol, (ie some SC with a feature not supported by the native Bitcoin protocol) then we can assume the quoted passage above to be correct. While it's the nodes and not the miners that maintain the features in the Bitcoin protocol, the p2p payment network and the incentives that motivate miners and keep them cooperative is successful by your definition. |

Thank me in Bits 12MwnzxtprG2mHm3rKdgi7NmJKCypsMMQw

|

|

|

Adrian-x

Legendary

Offline Offline

Activity: 1372

Merit: 1000

|

|

January 07, 2015, 05:31:28 AM |

|

I'm still waiting for an answer on my bet.

I don't bet money if I can avoid it. (That is one of the reasons why I do not own bitcoins.) So Bitcoin is money?  |

Thank me in Bits 12MwnzxtprG2mHm3rKdgi7NmJKCypsMMQw

|

|

|

|

Bagatell

|

|

January 07, 2015, 05:36:50 AM |

|

So Bitcoin is money?  See the level he's dragged you down to? |

|

|

|

|

|

JorgeStolfi

|

|

January 07, 2015, 05:38:39 AM |

|

I'm still waiting for an answer on my bet.

I don't bet money if I can avoid it. (That is one of the reasons why I do not own bitcoins.) Talk is cheap. Keep on trollin. What difference would the bet make? I am not claiming that my hunch about the future is better than you faith. I am not making predicitons. As I already said, the survival of the network and the price of BTC are not the issue. I claimed that the bitcoin protocol does not provide a decentralized p2p payment scheme. That should be obvious from the fact that 51% of the hash power is controlled by a handful of companies. Mining is now centralized; that is a fact. People have retorted that it is not really centralized because the piechart changes over time; or that GHash was forced to shrink. Do I need to explain again why those facts are irrelevant? People have claimed that a 51% cartel could not do anything except jam the network. That is false, it is well known that they can do many nasty things besides just jamming. People claimed that a 51% cartel cannot do harm because the users decide which blocks are valid, so the miners cannot do anything against the will of the majority of the users. That is false, and I explained why. I observed that an entity that can jam a process can force users to accept changes to that process. In particular, I observed that a 51% cartel can force a change in the protocol. People denied that based on (1) implicit assumptions the cartel would try to do only "attacks" of a certain type, (2) statements of faith about how users and other miners woud react to such attempts and (3) claims that the users and miners who objected to the attack could prevent the change. So I described in detail a plausible "attack" that did not fit those assumptions, pointed out that most miners (even those outside the cartel) would want the change and would cooperate with the cartel, and that users would submit to the change because it would not harm them directly, whereas rebellion could. And showed why the rebellious users and miners would not be able to stop the change. So, where would my bet fit in the above? Or my profession, or my IQ? |

Academic interest in bitcoin only. Not owner, not trader, very skeptical of its longterm success.

|

|

|

Adrian-x

Legendary

Offline Offline

Activity: 1372

Merit: 1000

|

|

January 07, 2015, 06:08:54 AM

Last edit: January 07, 2015, 06:26:12 AM by Adrian-x |

|

Provided SideChain are not introduced the cost to mine empty blocks becomes prohibitive, and can approach infinity, the incentive system as is rewards corporation.

I don't understand why, but presumably you are saying that blocks with more transitions should have (or have now) greater weight when choosing between two branches of the orthodox chain. If that were (or is) the case, then wouldn't miners pad their blocks with transactions that move a few bits between their pockets, in order to win the block race by weight rather than by work? If that were (or is) the case, the cratel could fill the blocks of chain (2) with such transactions, instead of leaving them empty. Does this make sense? At the moment you would need to spend around 150MWh to block transactions every 10 minutes.

Please check again the script that I outlined above. The miners that will form the cartel have 54% (say) of the hashpower, so they consume about half of the total electricity; and that consumption will not change, whether they attempt the protocol change or not. Their expected payoff, if they succeed, is 54% of 3600 BTC/day, instead of 54% of 1800 BTC/day, for the next two years. Even if they had to forfeit their revenue during the transition period, that would still be a huge gain. (And all miners, cartel or not, will enjoy the same benefit.) However, I believe that the cartel would not lose any revenue during the transition period. Through that time, they will collect more than half of 3600 BTC/day from the reformed chain (1), and, if they succced, they will keep those BTC. (They will also collect all the 1800 BTC/day from the empty orthodox chain (2); but those coins will not be usable outside of chains (2)+(3), so they will be discarded at the end of the transition.) Even if they were to fail in the attempt (how, I cannot see), they would lose the coins from chain (1), but would retain those of chain (2); which are twice as much as they would have earned if they mined fairly. (In fact, a cartel with 51% of the hashpower can just starve the other miners and collect 100% of the block rewards, without doing any other evil. But that is a well-known evil. What I am trying to show is that a 51% cartel can force a change in the protocol.) Given the cost, you can't mine empty blocks for long even though the blockchain can support empty blocks and will support the longest chain, but that doesn't invalidate past transactions or future ones or constitute a change to the protocol supported by the p2p nodes. Transactions resume after the attack. That type of attack you describe would be prohibitive in terms of cost, if successful it would render Bitcoin useless, given the cost to participate un-cooperatively, any actor would stand to gain more by cooperating. But that said, miners can change the protocol but all nodes need to accept the blocks in order to be valid, so the change is limiting but as BlockStream have pointed out disruption of the incentive stasis is possible with such a change it's called a SideChain soft fork, in this scenario centralization is both inevitable and bad. If miners were ever allowed control the flow of Bitcoin and earn it through mining at the same time then yes it would constitute a fail of the protocol. The evil doers may even trick the miners into supporting such a change by offering them additional mining revenue, should that happen miners won't be dependent on the p2p Bitcoin nodes to validate there blocks and rewards, they could depend on a cacophony of financial products governed by rules set by a central authority to provide income. So yes we're at a junction, but no, the protocol hasn't failed yet. |

Thank me in Bits 12MwnzxtprG2mHm3rKdgi7NmJKCypsMMQw

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

January 07, 2015, 06:18:08 AM |

|

|

|

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

January 07, 2015, 06:18:20 AM |

|

I'm still waiting for an answer on my bet.

I don't bet money if I can avoid it. (That is one of the reasons why I do not own bitcoins.) Talk is cheap. Keep on trollin. What difference would the bet make? ... Assuming the bet was for a non-trivial amount, it would suggest that you actually believed the claims you're making. Like the PoW miners, you'd be putting your resources at risk. I think this debate regarding mining centralization has gone as far as it can with you. You presented your theories (and called them facts). Many people provided counter arguments as to why it won't play out the way you imagined. You disagreed. Smooth then offered you a chance to wager on what, according to your logic, is almost guaranteed to occur (that the block reward halving wouldn't happen). You made excuses and declined. |

|

|

|

|

JorgeStolfi

|

|

January 07, 2015, 06:27:08 AM |

|

What you describe is not even a +51% attack, it is a demand for a forced hard fork from one miner telling millions of other people what software to upgrade to. That is simply the most absurd thing I've ever heard. And the reason you think this will happen is because if that one miner claims "this change is actually necessary and good for bitcoin because the network is in grave danger", that would be accepted by the general public?

It is not "one miner". It is 51% of the haspower having decided to do something that will bring millions additional revenue to all miners. And that is precisely why the 51% attack is a problem: because 51% of the hashpower may be just one miner, and yet that miner WILL prevail against all the others. That is a fundamental feature of the protocol. When it was designed, it was called "one CPU, one vote instead of one man, one vote", and it was believed that the difference between those two concepts would not be significant. Now we have seen that the two are vastly different. What would happen in your example is the millions of bitcoin participants would tell that one miner to take a hike and continue with the existing P2P core protocol. Then when that miner started to produce nonconforming 25BTC blocks, they would simply be rejected out of the P2P network as invalid, and the honest network would carry on. The attacking miner could have 95% of hash power and it wouldn't matter, his blocks would be rejected as nonconforming and the network would simply re-adjust to the 5% remaining. You do not even understand the basics of how a potential 51% attack is limited in it's range of attack vectors in the real world and how those limited attack vectors are harmless/manageable.

As I have pointed out several times, users can reject blocks, but cannot create them; only miners can. The users do not own the mining equipment, the miners (obviously) do. So the millions of users can scream and cuss as much as they want, but they cannot control or harm the miners, not even deny them the block rewards. Even if all the users reject all the blocks that the miners mine, they will not be able to interact with other users, or get any transactions in the blockchain, if the miners will not serve them. And a cartel that has 51% of the hashpower can close the network to all competing miners, and to all millions of users who are using the current protocol, whatever that is. Even if the users try to mine with their CPUs, they will not have enough hashpower to get through the cartel's jamming. Is any of these statements wrong? When the banks get together and decide to raise some fee, their millions of users may scream and cuss as much as they want, but cannot stop the banks from doing that. Some rebel users may take their cash out, and perhaps try to create their own informal banks; but most users would continue using the banks, because they would rather pay the extra fee than do without their services. That is reality. Why do you think that bitcoin users and bitcoin miners would behave differently? You then claim miners and users who do not upgrade would have their transactions blocked. Again this is insane. What would happen is those miners and users would confirm transactions on their own honest chain (the original chain) and not care whether their transactions confirm on the attacker's invalid chain.

But that is not how a 51% cartel can jam the honest chain. Read my outline, PLEASE. |

Academic interest in bitcoin only. Not owner, not trader, very skeptical of its longterm success.

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

January 07, 2015, 06:27:24 AM |

|

Black holes everywhere:  |

|

|

|

|

|

Poll

Poll