molecular

Donator

Legendary

Offline Offline

Activity: 2772

Merit: 1019

|

|

August 13, 2014, 08:11:32 PM |

|

4.5. we’re seeing one after another of former staunch gold bugs convert: Turk, Schiff, Rogers, and possibly Casey and Rickards. the momentum is clear. they will be running to Bitcoin soon.

Schiff and Rickards? According to this video they haven't come around at all. They bash it quite hard to be honest. One might say: they're acquiring and will openly come around when they have their stash... I'm not sure about that. Don't these guys essentially get paid to say what gold bugs want to hear? I would not assume that they believe anything they are spewing. It would be interesting to see how they actually allocate their personal finances. People giving investment advice should be transparent about their personal allocations. But that's wishful thinking. I bet it's hard to resist frontrunning your clientel when you can do it without getting caught. |

PGP key molecular F9B70769 fingerprint 9CDD C0D3 20F8 279F 6BE0 3F39 FC49 2362 F9B7 0769

|

|

|

|

|

|

|

|

|

|

|

|

Bitcoin addresses contain a checksum, so it is very unlikely that mistyping an address will cause you to lose money.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Spaceman_Spiff

Legendary

Offline Offline

Activity: 1638

Merit: 1001

₪``Campaign Manager´´₪

|

|

August 13, 2014, 08:20:15 PM |

|

Don't these guys essentially get paid to say what gold bugs want to hear? I would not assume that they believe anything they are spewing. It would be interesting to see how they actually allocate their personal finances.

Don't underestimate the resistance that people put up against new ideas when they are stuck in a certain mindset. Crypto might sound logical and inevitable to you, doesn't make it so for others. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 13, 2014, 08:21:42 PM |

|

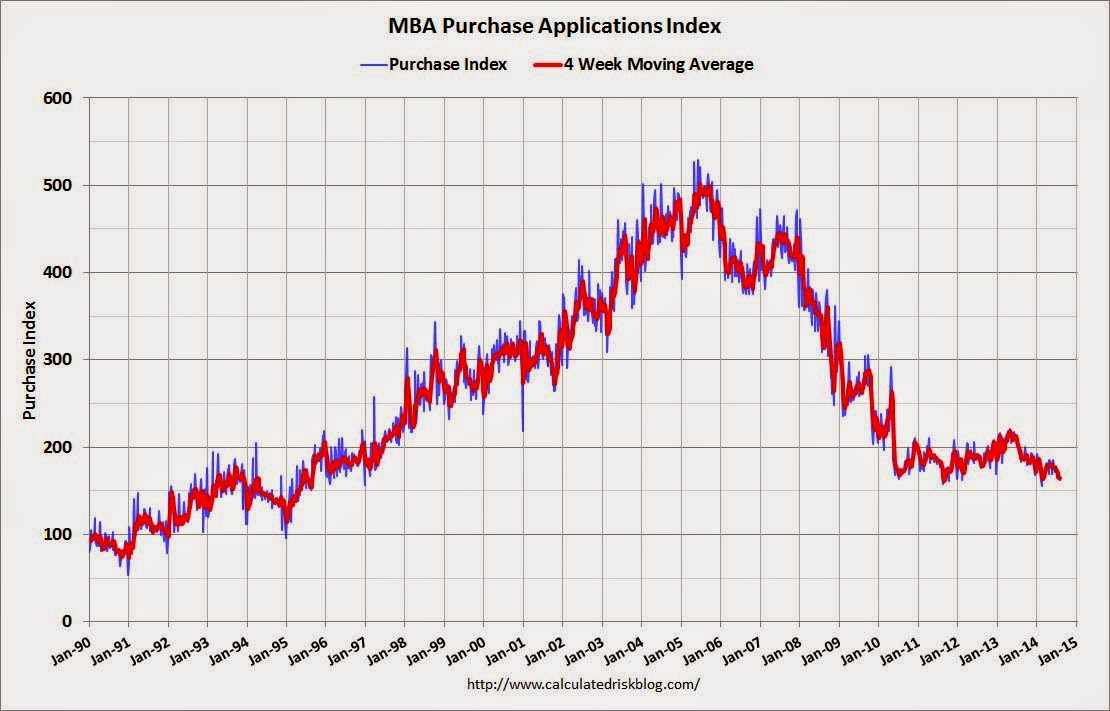

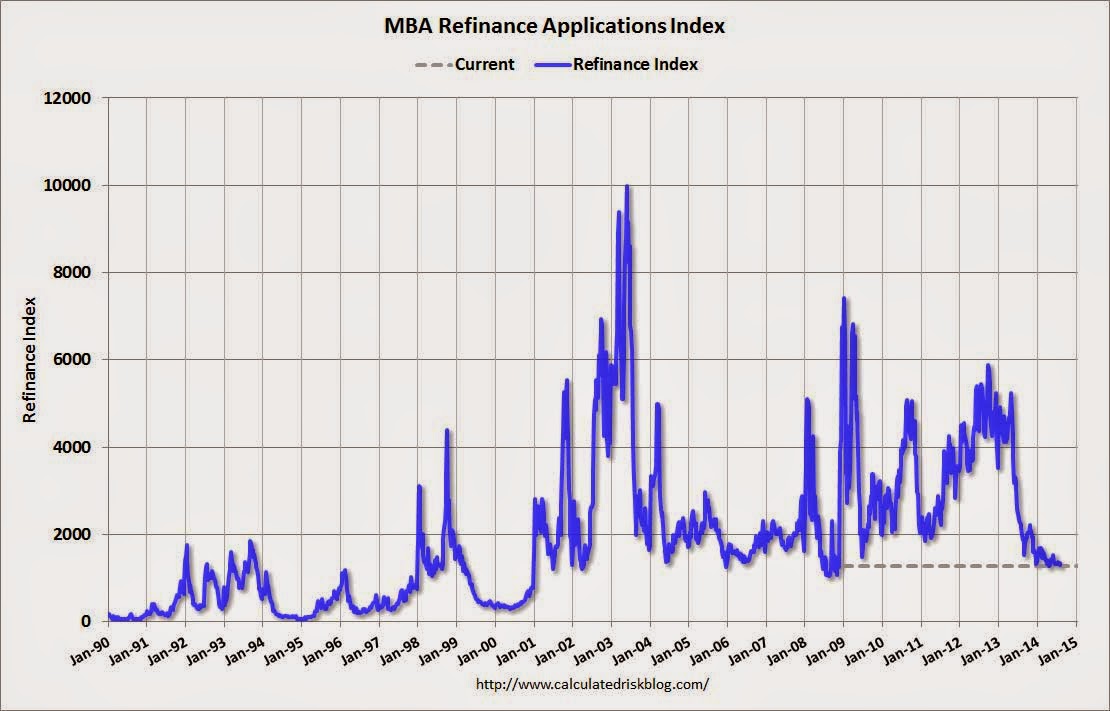

these are actually 2 very important graphs. back in 2007, i recognized that the ability of the banking elite to encumber the average US citizen with the biggest purchase in their lifetimes was coming to an end. ever since that time, the Fed has more than quintupled the monetary base to support all sorts of bad debt instruments doled out to just about everyone except these same average US citizens. it's clear from these graphs the jig is up. the avg person has caught on and are not participating in the necessary Ponzi scheme which is required to keep these Ponzi assets pumped up. since the banksters can't rely on encumbering the avg citizen anymore, they've turned to gov't/Fed bailouts and free money to keep the game going. when we start getting sovereign defaults, a fresh crisis will arise. Argentina may represent that first salvo. get yourselves into a digital bearer instrument asap. and i don't mean USD's. According to the MBA, the unadjusted purchase index is down about 10% from a year ago and have reached levels back to about 1997:  The refinance index is down 75% from the levels in May 2013 and down to about 2009 levels:  |

|

|

|

|

Adrian-x

Legendary

Offline Offline

Activity: 1372

Merit: 1000

|

|

August 13, 2014, 08:30:44 PM |

|

4.5. we’re seeing one after another of former staunch gold bugs convert: Turk, Schiff, Rogers, and possibly Casey and Rickards. the momentum is clear. they will be running to Bitcoin soon.

Schiff and Rickards? According to this video they haven't come around at all. They bash it quite hard to be honest. One might say: they're acquiring and will openly come around when they have their stash... I'm not sure about that. Don't these guys essentially get paid to say what gold bugs want to hear? I would not assume that they believe anything they are spewing. It would be interesting to see how they actually allocate their personal finances. funny that he totally spilled the beans saying the early adopters have lots of bitcoin and are now pumping it (he just left out the: you know like us gold hoarders.) anyway all the negative argument about Bitcoin apply to gold, to be honest making something of value by melting my gold coins is not within my sphere of influence so its utility is rather impractical, however the utility in a global P2P ledger,... there are already many uses, for one both parties can prove ownership of there private keys before a deal is signed, and that is huge, cuts out the middlemen. i think the take home from this is the SDR will back Fiat in the future, the IMF will be picking the prosperous nations of the world, the only counter balance to this cumming injustice will be the BRICs central bank if it isn't sucked into the void or doesn't cause global conflict. |

Thank me in Bits 12MwnzxtprG2mHm3rKdgi7NmJKCypsMMQw

|

|

|

Chalkbot

Legendary

Offline Offline

Activity: 896

Merit: 1001

|

|

August 13, 2014, 08:50:40 PM |

|

Don't these guys essentially get paid to say what gold bugs want to hear? I would not assume that they believe anything they are spewing. It would be interesting to see how they actually allocate their personal finances.

Don't underestimate the resistance that people put up against new ideas when they are stuck in a certain mindset. Crypto might sound logical and inevitable to you, doesn't make it so for others. Yeah, I understand that for sure, I've never actually met another person in meatspace that believes it's logical or inevitable. I was just pointing out that these are smart guys. They are also guys who get paid to propagate particular ideas. The people paying them right now, want to hear about why it's safe to continue ignoring bitcoin, and they are providing that service. When someone pays you to hear about how everything they are doing is awesome, and the stuff other people are doing is irrelevant, then you provide that service to the best of your ability, or else someone else will steal your cake job. All things considered, there's no way of telling how these guys really feel about bitcoin. All we can gather from their actions is how their audience feels about bitcoin. The fact that they are talking about it means that their audience has shifted from "bitwhat? I don't care..." to "Should I be worried about bitcoin?" |

|

|

|

|

Melbustus

Legendary

Offline Offline

Activity: 1722

Merit: 1003

|

|

August 13, 2014, 08:58:06 PM |

|

...

How absurd is that? The hands down most interesting thing happening in the tech world right now and not one word about it at Defcon.

Dave Perry, Charlie #Shrembot, Bryan Micon, and ytcraker gave a Skytalk on bitcoin at Defcon on Friday. I didn't attend, but Dave said he thought it went well. I was at the Rio for the subsequent impromptu Satoshi-Square; a bunch of people came by with bitcoin questions and it seemed to me like there was more interest than last year. From what I gather, Defcon has, since bitcoin's inception, been a particularly frustrating bucket of bitcoin skepticism in general, when you'd actually expect the exact opposite from that crowd. In any event, given my admittedly limited dataset, I'd say the attitude *is* at least improving year-to-year. |

Bitcoin is the first monetary system to credibly offer perfect information to all economic participants.

|

|

|

Spaceman_Spiff

Legendary

Offline Offline

Activity: 1638

Merit: 1001

₪``Campaign Manager´´₪

|

|

August 13, 2014, 08:59:43 PM |

|

Don't these guys essentially get paid to say what gold bugs want to hear? I would not assume that they believe anything they are spewing. It would be interesting to see how they actually allocate their personal finances.

Don't underestimate the resistance that people put up against new ideas when they are stuck in a certain mindset. Crypto might sound logical and inevitable to you, doesn't make it so for others. Yeah, I understand that for sure, I've never actually met another person in meatspace that believes it's logical or inevitable. I was just pointing out that these are smart guys. They are also guys who get paid to propagate particular ideas. The people paying them right now, want to hear about why it's safe to continue ignoring bitcoin, and they are providing that service. When someone pays you to hear about how everything they are doing is awesome, and the stuff other people are doing is irrelevant, then you provide that service to the best of your ability, or else someone else will steal your cake job. All things considered, there's no way of telling how these guys really feel about bitcoin. All we can gather from their actions is how their audience feels about bitcoin. The fact that they are talking about it means that their audience has shifted from "bitwhat? I don't care..." to "Should I be worried about bitcoin?" While they might be buying some bitcoins on the down-low (just to be safe), if they were really convinced bitcoins were the wave of the future, they would change their tune and start building their business around it (also gives them more bragging rights later on if they were early advocates --> "Peter Schiff was right yet again" and so on..). |

|

|

|

|

Melbustus

Legendary

Offline Offline

Activity: 1722

Merit: 1003

|

|

August 13, 2014, 09:07:31 PM |

|

...

Where was Bitcoin when it was at 2.75 years old?

...

No. You said that further upthread too, and I let you get away with it, but this is the 2nd time, so...no! You cannot compare the time-since-inception independently for each since Bitcoin CREATED the entire crypto-currency ecosystem from scratch and had to fight that nasty battle solo. All cryptos are basically coat-tailing on the interest and groundbreaking that bitcoin has done. So if Litecoin has any merit at all, it *should* show A LOT more relative interest/market-cap/whatever 2.75yrs into its lifecycle versus bitcoin 2.75yrs in. Litecoin has the benefit of letting something else pioneer the space; and that was the actual hard work. Using any metric about Litecoin 2.75yrs-in versus Bitcoin 2.75yrs-in in order to supposedly demonstrate some sort of comparative long-run litecoin validity is just broken... |

Bitcoin is the first monetary system to credibly offer perfect information to all economic participants.

|

|

|

Melbustus

Legendary

Offline Offline

Activity: 1722

Merit: 1003

|

|

August 13, 2014, 09:10:16 PM |

|

my biggest fault is underestimating just how stupid ppl can be. as long as the protocol is intact, Bitcoin is good. every day that goes by w/o a hack or major bug strengthens the cause and message.

Heh...I often feel that way too. Hence, being early in almost all of my investments. They tend to go the wrong way for a while before going very much the right way. Bitcoin is no different (was down over 90% at one point on my first 2011 purchases). |

Bitcoin is the first monetary system to credibly offer perfect information to all economic participants.

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 13, 2014, 09:32:14 PM |

|

silver continuing to be destroyed by Bitcoin. gold will follow:  |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 13, 2014, 09:43:20 PM |

|

despite the BTC dump today, LTC continues to do even worse. this is good and serves a purpose, imo, as we need a final flush for the alts:  |

|

|

|

|

|

zeetubes

|

|

August 13, 2014, 09:52:59 PM |

|

silver continuing to be destroyed by Bitcoin. gold will follow:  the new silver price fix algo will be implemented on friday. in the past two weeks there have been massive efforts to hold the price below $20. the annual physical silver market, which used to be cutely known as supply and demand is around $22b if I remember correctly. the annual paper market is $1.6T according to the FT. why any commodity needs to be 'fixed' in a free market is yet another reminder of just how pathetic and irrelevant markets are. but I guess they employ a lot of very brainy people who provide useless and irrelevnt charts and stats and who otherwise couldn't find work. if my flight arrives safely in shanghai then I will watch the silver action on Friday with keen interest. I still think silver has one last gasp left in it. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 13, 2014, 10:14:02 PM |

|

silver continuing to be destroyed by Bitcoin. gold will follow:  the new silver price fix algo will be implemented on friday. in the past two weeks there have been massive efforts to hold the price below $20. the annual physical silver market, which used to be cutely known as supply and demand is around $22b if I remember correctly. the annual paper market is $1.6T according to the FT. why any commodity needs to be 'fixed' in a free market is yet another reminder of just how pathetic and irrelevant markets are. but I guess they employ a lot of very brainy people who provide useless and irrelevnt charts and stats and who otherwise couldn't find work. if my flight arrives safely in shanghai then I will watch the silver action on Friday with keen interest. I still think silver has one last gasp left in it. well, i've been quite vocal about not liking the Bitcoin "fix" being planned by Second Market. maybe routing around NY serves a purpose; avoid that debacle. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 13, 2014, 10:23:38 PM |

|

|

|

|

|

|

|

zeetubes

|

|

August 13, 2014, 10:27:17 PM |

|

"well, i've been quite vocal about not liking the Bitcoin "fix" being planned by Second Market. maybe routing around NY serves a purpose; avoid that debacle." Ha, I'm more concerned about my flight routing around the Ukraine at the moment.  I wonder if the bitcoin "fix" will actually provide what passes for legitimacy in this effed up world. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 13, 2014, 10:28:36 PM |

|

and here you've been told Bitcoin was volatile. what'd that take, like 12 min from top to bottom? and during after hours when MOST traders don't have access to markets. btw, this shit happens ALL THE TIME:  |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 13, 2014, 10:36:45 PM |

|

and here you've been told Bitcoin was volatile. what'd that take, like 12 min from top to bottom? and during after hours when MOST traders don't have access to markets. btw, this shit happens ALL THE TIME:  here's a close up. 18.13 to 16.2 in that first red down candle on hardly any volume; within seconds of the announcement. and despite an earnings beat as indicated in yellow. translation: impossible to trade with any rationality, let alone impossible to trade in after hours, period. this is how the pricks on Wall St make money; big players whipsawing small investors according to their whims:  |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 13, 2014, 10:45:27 PM |

|

Overstock starting to look interesting as an investment:  |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 13, 2014, 11:20:56 PM |

|

this is interesting. according to Stockman, the leveraged structured securities markets is alive and well. and starting to trigger margins calls against hedge funds: Hidden Financial Bombs: Margin Calls Hit Hedge Funds Speculating in Freddie/Fannie Bonds With High Repo Leveragehttp://davidstockmanscontracorner.com/hidden-financial-bombs-margin-calls-hit-hedge-funds-speculating-in-freddiefannie-bonds-with-high-repo-leverage/that explains the chart below. technically, i don't see any way that the current bounce can lead to higher highs. there's been too much damage. and if i'm right, there's more significant pain to come for junk bond holders on the downside. any trouble there will be systemic. get into digital bearer assets for safety:  |

|

|

|

|

tabnloz

Legendary

Offline Offline

Activity: 961

Merit: 1000

|

|

August 14, 2014, 03:31:35 AM |

|

they talk about Bitcoin @ 22:00 it's amazing that Rickards can't see the hypocrisy in his own arguments against Bitcoin. he's critical that Bitcoin isn't yet a unit of account. but what about gold? how does everyone refer to their gold values? oh yeah, same way, in USD's! also, he's critical of the capital gains ruling against Bitcoin. well, what about gold again? oh, it's tax tx is even worse as a collectible or as personal income depending on your income bracket. he also criticizes that Bitcoiners may tax dodge, while ignoring that a fundamental property of Bitcoin is that it makes it easier to do so if one wishes compared to gold. that's not a fault of Bitcoin, it's a fault of the owner. Schiff still thinks it's a tulip mania destined to crash. not sure how this squares with what Tucker claims he said. but why should 1200 or so be a ceiling for Bitcoin when gold went to 1923 at it's peak? what's a share of Berkshire Hathaway stock priced at? amazingly shallow analysis. Definitely agree. As much as I like Rickards books, for both he and Schiff to talk of the reckless actions of the Fed, the impending death of the dollar and the fiat system and then give such ordinary arguments against a protocol that disintermediates the very thing they criticise, well, it seems strange. Its like saying that the govt is manipulating, wrong, crooked etc but dont do anything about it cos they will ban you; they are just hoping everything implodes and gold becomes the fallback by default. Even if they are gold guys, being on board with something that benefits their clients should be their main priority not to reinforce their existing biases. Of course they may also steadfastly believe that bitcoin will fail, but their arguments are out of sync with their rhetoric. |

|

|

|

|

|

Poll

Poll