rpietila

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

August 22, 2014, 05:31:53 PM |

|

for all my former subs, what do u see here? answer: a series of L translated cycles:  If it cracks that triple bottom at around 18.5... Yeah. All I see is a tremendous support. Silver is not a stock. It does not go to zero. |

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

|

|

|

"With e-currency based on cryptographic proof, without the need to

trust a third party middleman, money can be secure and transactions

effortless." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

Ivanhoe

|

|

August 22, 2014, 05:33:35 PM |

|

for all my former subs, what do u see here? answer: a series of L translated cycles:  If it cracks that triple bottom at around 18.5... Yeah. All I see is a tremendous support. Silver is not a stock. It does not go to zero. Don't the lower high's worry you then? |

|

|

|

|

|

|

rpietila

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

August 22, 2014, 06:32:28 PM |

|

Don't the lower high's worry you then?

Well I am in general the type of person that honestly does not care how much things are valued in $hitpaper. Proudly. Ever since 2006. |

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

August 22, 2014, 06:39:22 PM |

|

Don't the lower high's worry you then?

Well I am in general the type of person that honestly does not care how much things are valued in $hitpaper. Proudly. Ever since 2006. and for that reason i pray for 16$ silver b4 its all said and done. |

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 22, 2014, 06:54:15 PM |

|

Don't the lower high's worry you then?

Well I am in general the type of person that honestly does not care how much things are valued in $hitpaper. Proudly. Ever since 2006. Paging Melbustus. |

|

|

|

|

|

|

notme

Legendary

Offline Offline

Activity: 1904

Merit: 1002

|

|

August 22, 2014, 07:08:26 PM |

|

They can always paper over the paper with more paper. Besides, silver is mostly worthless other than as a speculation. |

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 22, 2014, 07:16:59 PM |

|

Think of it this way. Speculators leveraged up free fiat from the Fed and bid up the silver market into the May 2011 peak. Now that the market has reversed, leverage is being margin called out of the silver market. Prices are collapsing as a result. |

|

|

|

|

Lowryder

Newbie

Offline Offline

Activity: 30

Merit: 0

|

|

August 22, 2014, 08:51:36 PM |

|

Think of it this way. Speculators leveraged up free fiat from the Fed and bid up the silver market into the May 2011 peak. Now that the market has reversed, leverage is being margin called out of the silver market. Prices are collapsing as a result. And? |

|

|

|

|

notme

Legendary

Offline Offline

Activity: 1904

Merit: 1002

|

|

August 22, 2014, 09:08:26 PM |

|

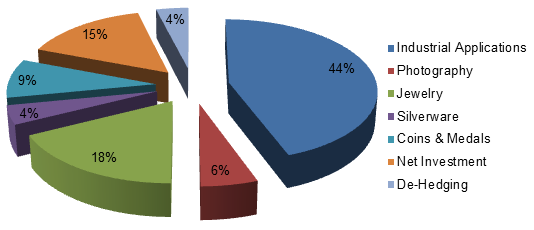

You havent do your homework dude.  Most of the silver used in industry cannot be recycled. So 50% industrial/photography, the rest is investment related (people desire jewelry because it is valuable, same with actual silver silverware). Also, way to go giving me a graphic with no source information and no details about what timeframe the numbers are from. Maybe I should bust out excel and "prove" you wrong with my own graph. |

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 22, 2014, 09:22:13 PM

Last edit: August 22, 2014, 09:37:42 PM by cypherdoc |

|

i disagree with some of Naval's concepts. 1. @ 5min he talks about a Dropbox appcoin where instead of POW it uses Proof of Storage. WTF is that? he goes on to say that the appcoin derives its supply and demand from trading btwn those who provide and those who request storage. that's fine. but what happened to the POW security mechanism for the appcoin? 2. he advocates for the appcoin networks-the problem is they all have identifiable creators (Satoshi stayed anonymous for a reason) and they are premining coins. creators can be thrown in prison and the premining would be a problem for me. are Satoshi's coins a problem for me? no, b/c he kick started his own mining after releasing the open source Bitcoin software and everyone was free to have mined back then if they had the foresight and the luck to have heard about Bitcoin. at this point, the general concensus is that he may never sell his coins or if he does, it will be when Bitcoin is @ $10000-100000. good for him. but everyone else who starts an appcoin w/o a POW security mechanism or a decent chance at developing a network effect isn't for me. 3. i view these appcoins as nothing more than the same business structures we have today in fiat. and they're just complicating things with an appcoin that actually might make things worse since they don't necessarily have a rational POW security mechanism for their coins. 4. these appcoins networks are just specialized closed source communities serving a defined function. they will never reach the size of a money system like Bitcoin. 5. money affects everyone round the world. this is why we have global participation in Bitcoin and this is critical to it's security. no one gvt can shut it down b/c gvt's disagree over the long run. their varied interests is what assures the game theory Nash equilibrium that keeps each of them in check as they each worry that the other might just be building secrets mines and support for Bitcoin. this is why we have the network effect we do. 6. as far as allowing these appcoins to merge mine onto the Bitcoin network? i view that as leeching. Namecoin, ok. it was an early merged coin and the DNS function could serve a valuable purpose in the future. but other appcoins/shitcoins? no way. i'm not a dev but from my understanding there does need to be some special code inserted into the mining software to allow merged mining and i doubt there is zero cost to that. also, why should we as Bitcoiner's allow an appcoin distract from what Bitcoin is trying to do? Bitcoin itself is not out of the woods yet so i will seriously resist any appcoin/altcoin/2.0 that tries to leech off our network. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

August 22, 2014, 09:25:28 PM |

|

Think of it this way. Speculators leveraged up free fiat from the Fed and bid up the silver market into the May 2011 peak. Now that the market has reversed, leverage is being margin called out of the silver market. Prices are collapsing as a result. And? and what? Bitcoin? are u kidding me? we're still in a large consolidation phase and the successive lows are still higher over a short 8 mo time period. this is just the pause before the next ramp. |

|

|

|

|

notme

Legendary

Offline Offline

Activity: 1904

Merit: 1002

|

|

August 22, 2014, 09:27:33 PM |

|

i disagree with Naval's concepts. 1. @ 5min he talks about a Dropbox appcoin where instead of POW it uses Proof of Storage. WTF is that? he goes on to say that the appcoin derives its supply and demand from trading btwn those who provide and those who request storage. that's fine. but what happened to the POW security mechanism for the appcoin? Not defending it, but here is some more info. https://storj.iohttps://www.youtube.com/watch?v=LIf5QsYrCb02. he advocates for the appcoin networks-the problem is they all have identifiable creators (Satoshi stayed anonymous for a reason) and they are premining coins. creators can be thrown in prison and the premining would be a problem for me. are Satoshi's coins a problem for me? no, b/c he kick started his own mining after releasing the open source Bitcoin software and everyone was free to have mined back then if they had the foresight and the luck to have heard about Bitcoin. at this point, the general concensus is that he may never sell his coins or if he does, it will be when Bitcoin is @ $10000-100000. good for him. but everyone else who starts an appcoin w/o a POW security mechanism or a decent chance at developing a network effect isn't for me.

3. i view these appcoins as nothing more than the same business structures we have today in fiat. and they're just complicating things with an appcoin that actually might make things worse since they don't necessarily have a rational POW security mechanism for their coins.

4. these appcoins networks are just specialized closed source communities serving a defined function. they will never reach the size of a money system like Bitcoin.

5. money affects everyone round the world. this is why we have global participation in Bitcoin and this is critical to it's security. no one gvt can shut it down b/c gvt's disagree over the long run. their varied interests is what assures the game theory Nash equilibrium that keeps each of them in check as they each worry that the other might just be building secrets mines and support for Bitcoin.

6. as far as allowing these appcoins to merge mine onto the Bitcoin network? i view that as leeching. Namecoin, ok. it was an early merged coin and the DNS function could serve a valuable purpose in the future. but other appcoins/shitcoins? no way. i'm not a dev but from my understanding there does need to be some special code inserted into the mining software to allow merged mining and i doubt there is zero cost to that. also, why should we as Bitcoiner's allow an appcoin distract from what Bitcoin is trying to do? Bitcoin itself is not out of the woods yet so i will seriously resist any appcoin/altcoin/2.0 that tries to leech off our network.

|

|

|

|

marcus_of_augustus

Legendary

Offline Offline

Activity: 3920

Merit: 2348

Eadem mutata resurgo

|

|

August 22, 2014, 09:34:56 PM |

|

... this guy is GETTTING IT. Bitcoin combined with cryptofinancial technologies like an openTXS layer will let value information rip asunder all the BS lawyering and institutionalised graft intermediators incessantly stack on top of anything productive from its inception. The writing is on the wall ... money, banks, corporations, States ... everything will now inevitably be renegotiated in the new language of value technologies, eventually. |

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

August 22, 2014, 09:56:53 PM

Last edit: August 22, 2014, 10:25:33 PM by Peter R |

|

Today's appcoins are disingenuous.

Ripple, Ethereum, Maidsafe, Storj, etc talk about their tokens as "postage stamps" or as "fuel" necessary to run their networks, yet there's this underlying feel of "yeah, but we can't stop people from speculating with them…ahem..ahem." I feel that appcoins are thinly-disguised attempts to profit from investor naïveté.

So what is the equilibrium value of an appcoin? If the appcoin is "fuel" to run the network, and if participating in the network is open and competitive, then the value of fuel needed to use the app will approach the cost of running the app. As technology improves, the value should drop.

Moreover, does it not make more sense to run decentralized apps using bitcoin as fuel (or tokens pegged to bitcoin), and something like m-of-n oracles as the gateway between the networks? Oracles and the app networks would compete for these bitcoins, and the cost of using these services would constantly drop in price due to innovation and competition. Apps payable directly in bitcoin will thus become cheaper and better than closed-network "appcoins" like Storj or Ethereum, stealing the latter's market share. Appcoins that aren't pegged will devalue to zero (unless they somehow develop "money-like" properties but I highly doubt this).

|

|

|

|

marcus_of_augustus

Legendary

Offline Offline

Activity: 3920

Merit: 2348

Eadem mutata resurgo

|

|

August 22, 2014, 10:33:39 PM |

|

Today's appcoins are disingenuous.

Ripple, Ethereum, Maidsafe, Storj, etc talk about their tokens as "postage stamps" or as "fuel" necessary to run their networks, yet there's this underlying feel of "yeah, but we can't stop people from speculating with them…ahem..ahem." I feel that appcoins are thinly-disguised attempts to profit from investor naïveté.

So what is the equilibrium value of an appcoin? If the appcoin is "fuel" to run the network, and if participating in the network is open and competitive, then the value of fuel needed to use the app will approach the marginal cost of running the app. As technology improves, the value should drop.

Moreover, does it not make more sense to run decentralized apps using bitcoin as fuel (or tokens pegged to bitcoin), and something like m-of-n oracles as the gateway between the networks? Oracles and the app networks would compete for these bitcoins, and the cost of using these services would constantly drop in price due to innovation and competition. Apps payable directly in bitcoin will thus become cheaper and better than closed-network "appcoins" like Storj or Ethereum, stealing the latter's market share. Appcoins that aren't pegged will devalue to zero (unless they somehow develop "money-like" properties but I highly doubt this).

I'm inclined to agree somewhat about the disingenuity but are they really much different to some of the super speculative penny stocks that are out there? I mean one of these appcoins could actually become the next Google or Facebook or Dropbox or iTunes type app and it that case they are probably hugely undervalued. What their speculative value represents right now is the 0.1% chance that they could become a multi-billion dollar DAC (in effect). It helps to think of these "coins" as shares in a distributed corporation that is providing the service ... a corporation that does not need seed funding (lawyering/accountants), VC's (more lawyering/accountants) and IPO (even more lawyering/accountants)market makers, etc, etc ... they are a very efficient share/asset/ownership delivery mechanism. Maybe we need to expand out minds past the *coin suffix perception into the digital realm where a "coin" is anything that represents digital value ... shares, property rights, digital keys to houses, cars, services. |

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

August 22, 2014, 10:56:51 PM |

|

Moreover, does it not make more sense to run decentralized apps using bitcoin as fuel (or tokens pegged to bitcoin), and something like m-of-n oracles as the gateway between the networks? Oracles and the app networks would compete for these bitcoins, and the cost of using these services would constantly drop in price due to innovation and competition. Apps payable directly in bitcoin will thus become cheaper and better than closed-network "appcoins" like Storj or Ethereum, stealing the latter's market share. Appcoins that aren't pegged will devalue to zero (unless they somehow develop "money-like" properties but I highly doubt this).

You can reduce the argument right down when you look at the broader economic context. Namely, why even use a service, however well it provides that service at a mechanistic level, that needs it's own special tokens? Unless the service fails as a concept without a built in currency, then the developers are adding friction to information services instead of continuing in satoshi's spirit of liberation as they claim to. It's all wrong from a plain information theory perspective, either you're a distributed TLD system or you're a currency. If you want to be both, expect inefficiency, confusion or conflict. Put another way, imagine if we all did this in commerce now? Shoecoin at footwear stores, foodcoin when you buy food but don't forget to keep some beercoin just in case you buy that at the same time. No beercoin? Hey, we convert at great rates! Doesn't take alot to see where that would end up... everyone who's not profiteering agreeing on something universal. There will be a natural recognition that schizophrenic designs don't benefit users, and so Namecoin and Maidsafe will survive in their overall purpose as differentiated from bitcoin, but the token component cannot. If the tokens are not made optional or allow for direct access to the bitcoin protocol, then they won't compete well against rival systems that employ bitcoin as money and stick to addressing the actual problem they purport to solve. |

Vires in numeris

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

August 22, 2014, 11:04:16 PM

Last edit: August 22, 2014, 11:17:40 PM by Peter R |

|

Today's appcoins are disingenuous.

Ripple, Ethereum, Maidsafe, Storj, etc talk about their tokens as "postage stamps" or as "fuel" necessary to run their networks, yet there's this underlying feel of "yeah, but we can't stop people from speculating with them…ahem..ahem." I feel that appcoins are thinly-disguised attempts to profit from investor naïveté.

So what is the equilibrium value of an appcoin? If the appcoin is "fuel" to run the network, and if participating in the network is open and competitive, then the value of fuel needed to use the app will approach the marginal cost of running the app. As technology improves, the value should drop.

Moreover, does it not make more sense to run decentralized apps using bitcoin as fuel (or tokens pegged to bitcoin), and something like m-of-n oracles as the gateway between the networks? Oracles and the app networks would compete for these bitcoins, and the cost of using these services would constantly drop in price due to innovation and competition. Apps payable directly in bitcoin will thus become cheaper and better than closed-network "appcoins" like Storj or Ethereum, stealing the latter's market share. Appcoins that aren't pegged will devalue to zero (unless they somehow develop "money-like" properties but I highly doubt this).

I'm inclined to agree somewhat about the disingenuity but are they really much different to some of the super speculative penny stocks that are out there? I mean one of these appcoins could actually become the next Google or Facebook or Dropbox or iTunes type app and it that case they are probably hugely undervalued. What their speculative value represents right now is the 0.1% chance that they could become a multi-billion dollar DAC (in effect). It helps to think of these "coins" as shares in a distributed corporation that is providing the service ... a corporation that does not need seed funding (lawyering/accountants), VC's (more lawyering/accountants) and IPO (even more lawyering/accountants)market makers, etc, etc ... they are a very efficient share/asset/ownership delivery mechanism. Maybe we need to expand out minds past the *coin suffix perception into the digital realm where a "coin" is anything that represents digital value ... shares, property rights, digital keys to houses, cars, services. I'm a big advocate for disintermediation so I'm not questioning the value of decentralized services like Storj. I'm questioning the value proposition of the app's token. I don't think you can view them as shares. Let's consider a decentralized DropBox service. Nodes providing the service (storage) get paid for their work. If the pay is good, more nodes will join the network, thereby reducing the cost of storage for users. It's a competitive market. You can acquire an x% share in the network by providing x% of the storage capacity, and thus earn x% of the network revenue. So, you don't need to buy a share; you just join the network and you immediately have whatever share of the network that you're contributing! It's beautifully simple! Now consider Storjcoin as a share and I think we end up with a contradiction. If I hold x% of the Storjcoins(shares), should I not earn x% of the revenue from the Storj network? If they were shares then I should. But I don't: the revenue flows to the nodes providing the service. The nodes are the shareholders! So Storjcoin is not a share. What is Storjcoin then? |

|

|

|

|

Poll

Poll