masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

March 09, 2014, 09:52:09 AM |

|

How about inverted cup and handle? )  |

|

|

|

|

|

|

Unlike traditional banking where clients have only a few account numbers, with Bitcoin people can create an unlimited number of accounts (addresses). This can be used to easily track payments, and it improves anonymity.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

RyNinDaCleM

Legendary

Offline Offline

Activity: 2408

Merit: 1009

Legen -wait for it- dary

|

|

March 09, 2014, 04:01:43 PM |

|

How about inverted cup and handle? )  Interesting thought, there! |

|

|

|

bitstumped

Newbie

Offline Offline

Activity: 2

Merit: 0

|

|

March 12, 2014, 09:30:32 AM |

|

Hey guys, first time posting but I've been following this thread for about 4 months. Let me say thank you to all of you who contribute analysis.

What do others think of Luc's inverted cup and handle suggestion? And, where do you think we might see a bottom?

|

|

|

|

|

lebing

Legendary

Offline Offline

Activity: 1288

Merit: 1000

Enabling the maximal migration

|

|

March 12, 2014, 10:03:53 AM |

|

What do others think of Luc's inverted cup and handle suggestion?

Its a dream. No fucking way is that going to happen. Worst case scenarios is another dip into the low 500s, but we will not be seeing sub 500 again. |

Bro, do you even blockchain?

-E Voorhees

|

|

|

Tzupy

Legendary

Offline Offline

Activity: 2128

Merit: 1074

|

|

March 12, 2014, 10:13:02 AM |

|

IMO the inverted cup and handle scenario can only happen if Chinese exchanges would be shut down by their government.

In such a case, most coins from China would be cashed out on Western exchanges, and the result would be a death spiral

similar to the one seen on MtGox before shutting down. If Chinese exchanges will keep operating, this bear market is going

to take a long time to fully deflate. Looking at Huobi, the bottom of the first sub-wave after wave B is significantly higher than

the bottom of corrective wave A, so Huobi is for now less bearish than Bitstamp, maybe there's still some demand in China.

|

Sometimes, if it looks too bullish, it's actually bearish

|

|

|

|

thefiniteidea

|

|

March 21, 2014, 05:03:55 PM |

|

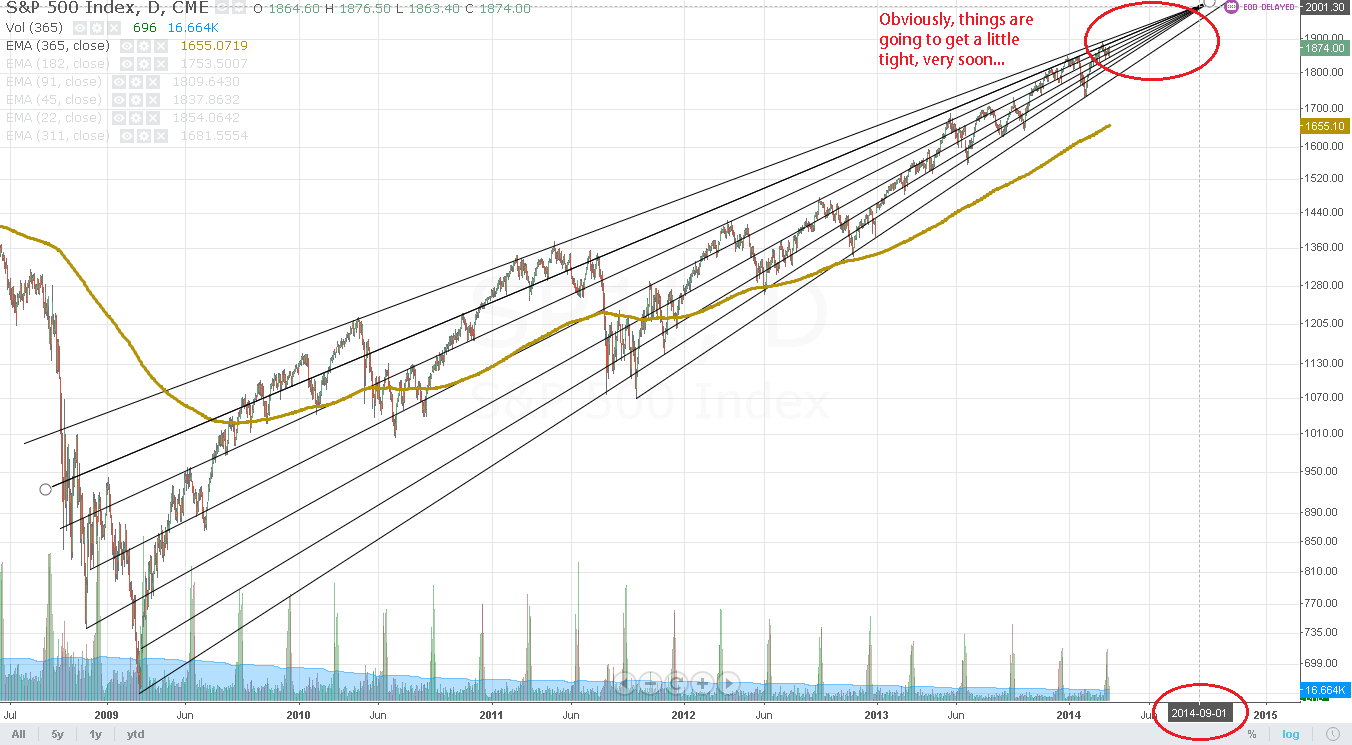

Been a while since we've seen anything in this thread. I'll just leave this here....  |

|

|

|

|

|

JustAnotherSheep

|

|

March 29, 2014, 03:16:07 PM |

|

Looks like your inverted cup n' handle is becoming a likelier possibility, luc  That, combined with an (approximate) descending triangle, seem to be some pretty damn strong bearish signals if validated  |

Is it a bull? Is it a bear? No, it's just another sheep.

|

|

|

lebing

Legendary

Offline Offline

Activity: 1288

Merit: 1000

Enabling the maximal migration

|

|

March 29, 2014, 04:06:07 PM |

|

Looks like your inverted cup n' handle is becoming a likelier possibility, luc  That, combined with an (approximate) descending triangle, seem to be some pretty damn strong bearish signals if validated  this is a bullish pennant. |

Bro, do you even blockchain?

-E Voorhees

|

|

|

|

JustAnotherSheep

|

|

March 29, 2014, 04:23:04 PM |

|

this is a bullish pennant.

Really? I was under the impression that a pennant had to have far less bias on either side, and according to the stockchart definition of a descending triangle; "The lows do not have to be exact, but should be within reasonable proximity of each other." A <5% difference in the lows would seem to be within the margin of what is "reasonable proximity" (someone correct me if I'm wrong). |

Is it a bull? Is it a bear? No, it's just another sheep.

|

|

|

|

Pruden

|

|

March 29, 2014, 04:33:35 PM |

|

If a descending triangle is bearish, stocks' ascending triangle above is bullish?  |

|

|

|

|

RyNinDaCleM

Legendary

Offline Offline

Activity: 2408

Merit: 1009

Legen -wait for it- dary

|

|

March 29, 2014, 04:43:33 PM |

|

Triangles are continuation patterns. They break in the direction they are entered. If the original drop to 380 was an A, then it's bearish. If it's a 4 to the 1200 tops 3, then it will break up.

It can, however, also be counted as a simple ABC correction where we are in the beginnings of a 5th wave down for the C

|

|

|

|

|

JustAnotherSheep

|

|

March 29, 2014, 04:52:32 PM |

|

Triangles are continuation patterns. They break in the direction they are entered. If the original drop to 380 was an A, then it's bearish. If it's a 4 to the 1200 tops 3, then it will break up.

Again, quoting the StockCharts definition of a descending triangle (which has been my main source of info when it comes to learning TA) The descending triangle is a bearish formation that usually forms during a downtrend as a continuation pattern. There are instances when descending triangles form as reversal patterns at the end of an uptrend, but they are typically continuation patterns. Regardless of where they form, descending triangles are bearish patterns that indicate distribution. |

Is it a bull? Is it a bear? No, it's just another sheep.

|

|

|

lebing

Legendary

Offline Offline

Activity: 1288

Merit: 1000

Enabling the maximal migration

|

|

March 29, 2014, 05:11:11 PM |

|

What do others think of Luc's inverted cup and handle suggestion?

Its a dream. No fucking way is that going to happen. Worst case scenarios is another dip into the low 500s, but we will not be seeing sub 500 again. Should have known that China would be China. Nothing is for sure in bitcoin. If it does come true that on the 15th its banned in China then 400 probably wont hold. Otherwise I would very surprised if we broke the bottom of the pennant (at 400). |

Bro, do you even blockchain?

-E Voorhees

|

|

|

RyNinDaCleM

Legendary

Offline Offline

Activity: 2408

Merit: 1009

Legen -wait for it- dary

|

|

March 29, 2014, 07:55:03 PM |

|

If a descending triangle is bearish, stocks' ascending triangle above is bullish?  No! That's called an ending diagonal or a wedge. A triangle has either flat top/ascending bottom, flat bottom/descending top, or a more symmetrical descending top/ascending bottom. If both lines are ascending or descending and not parallel, then it's a wedge. |

|

|

|

masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

March 29, 2014, 08:05:24 PM |

|

Guys. price is in negative weekly BB territory, in negative daily BB territory and additionaly bellow daily sma 200.

It could be a bullish pennant (with horizontal triangle?!) - I don't exclude. But I stay very bearish.

However this question will be resolved very soon.

PS. My pic with inverted cup and handle was invalidated of course.

|

|

|

|

arepo

Sr. Member

Offline Offline

Activity: 448

Merit: 250

this statement is false

|

|

March 29, 2014, 08:14:32 PM |

|

it's interesting to see trading sites and others say that "pattern X is generally bullish/bearish" as if they were citing a statistical study that showed this result >50% of the time. triangle continuation patterns are only continuation patterns until they break counter-trend  from my own work in Bitcoin, it seems that these patterns are very sensitive to their price environments (that is if they occurred within an uptrend or dowtrend; near, below, or above the previous high/low; and if the previous movement pushed the price into overbought or oversold territory). once the environment has been factored in, i think that there is something to these patterns having a consistent "context-sensitive" bias. but it is ridiculous to make a blanket statement about them, not only because of context-sensitivity but also because i imagine the behavior is different in different markets (stocks vs Bitcoin). --arepo |

this sentence has fifteen words, seventy-four letters, four commas, one hyphen, and a period.

18N9md2G1oA89kdBuiyJFrtJShuL5iDWDz

|

|

|

oda.krell

Legendary

Offline Offline

Activity: 1470

Merit: 1007

|

|

March 29, 2014, 08:59:03 PM |

|

it's interesting to see trading sites and others say that "pattern X is generally bullish/bearish" as if they were citing a statistical study that showed this result >50% of the time. triangle continuation patterns are only continuation patterns until they break counter-trend  from my own work in Bitcoin, it seems that these patterns are very sensitive to their price environments (that is if they occurred within an uptrend or dowtrend; near, below, or above the previous high/low; and if the previous movement pushed the price into overbought or oversold territory). once the environment has been factored in, i think that there is something to these patterns having a consistent "context-sensitive" bias. but it is ridiculous to make a blanket statement about them, not only because of context-sensitivity but also because i imagine the behavior is different in different markets (stocks vs Bitcoin). --arepo Interestingly enough, the Kirkpatrick/Dahlquist TA book has a (smallish) section on empirical studies that were done about patterns. I'll have to look up the details, but the continuation patterns flag and pennant seemed by far the most reliable ones *however* they were (IIRC) all short to midterm patterns, i.e. way shorter duration than what was proposed above (spanning from December to now). |

Not sure which Bitcoin wallet you should use? Get Electrum!Electrum is an open-source lightweight client: fast, user friendly, and 100% secure. Download the source or executables for Windows/OSX/Linux/Android from, and only from, the official Electrum homepage.

|

|

|

|

g4c

|

|

March 29, 2014, 09:05:39 PM |

|

Log scale chart of complete bitstamp USD history.  Why might the latest pennant be such a different beast to the previous ones? |

CORTEX7 Multi exchange Bitcoin trading client for Win, Mac, Nix, Android.

|

|

|

arepo

Sr. Member

Offline Offline

Activity: 448

Merit: 250

this statement is false

|

|

March 29, 2014, 09:09:34 PM |

|

Log scale chart of complete bitstamp USD history.  Why might the latest pennant be such a different beast to the previous ones? well, we're currently resting on the bottom support in your figure. wouldn't this model be falsified if we broke below? |

this sentence has fifteen words, seventy-four letters, four commas, one hyphen, and a period.

18N9md2G1oA89kdBuiyJFrtJShuL5iDWDz

|

|

|

arepo

Sr. Member

Offline Offline

Activity: 448

Merit: 250

this statement is false

|

|

March 29, 2014, 09:11:42 PM |

|

it's interesting to see trading sites and others say that "pattern X is generally bullish/bearish" as if they were citing a statistical study that showed this result >50% of the time. triangle continuation patterns are only continuation patterns until they break counter-trend  from my own work in Bitcoin, it seems that these patterns are very sensitive to their price environments (that is if they occurred within an uptrend or dowtrend; near, below, or above the previous high/low; and if the previous movement pushed the price into overbought or oversold territory). once the environment has been factored in, i think that there is something to these patterns having a consistent "context-sensitive" bias. but it is ridiculous to make a blanket statement about them, not only because of context-sensitivity but also because i imagine the behavior is different in different markets (stocks vs Bitcoin). --arepo Interestingly enough, the Kirkpatrick/Dahlquist TA book has a (smallish) section on empirical studies that were done about patterns. I'll have to look up the details, but the continuation patterns flag and pennant seemed by far the most reliable ones *however* they were (IIRC) all short to midterm patterns, i.e. way shorter duration than what was proposed above (spanning from December to now). thanks for the reference. is this the book you're talking about? |

this sentence has fifteen words, seventy-four letters, four commas, one hyphen, and a period.

18N9md2G1oA89kdBuiyJFrtJShuL5iDWDz

|

|

|

|