wachtwoord

Legendary

Offline Offline

Activity: 2324

Merit: 1125

|

|

September 08, 2014, 09:10:26 PM |

|

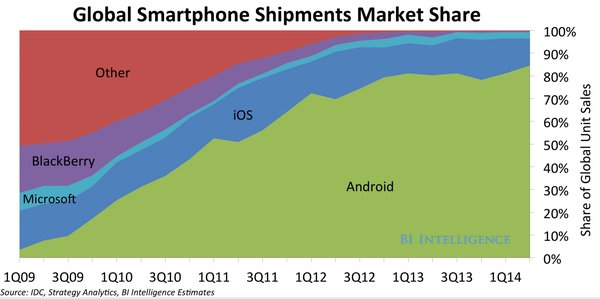

here's another way to look at it:  Let me see: proprietary vs not proprietary. I wonder who wins  |

|

|

|

|

|

|

|

|

|

|

|

|

|

Even if you use Bitcoin through Tor, the way transactions are handled by the network makes anonymity difficult to achieve. Do not expect your transactions to be anonymous unless you really know what you're doing.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

rpietila

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

September 08, 2014, 09:20:28 PM |

|

I still think Elop pulled the biggest corporate back door swindle in history.

It is quite certain he did, after one week at the helm anyone with a brain knew that he was a planted mole, here in Finland where Nokia used to be a big company. But is it really the biggest such trick? Whoaa, Finland makes records  |

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

rocks

Legendary

Offline Offline

Activity: 1153

Merit: 1000

|

|

September 08, 2014, 10:32:12 PM |

|

Thanks for sharing. This is really a great point in the article: Unfortunately for gold, it is relatively stagnant in terms of its use. It does have a few industrial applications, and generally gold has been a hedge against market fear and fiat currency inflation. Mostly, gold acts as a crude storage of historically-induced, market imposed value.

In comparison, bitcoin is remarkably different — its market ecosystem is unique compared with all other contemporary forms of value (e.g., gold, fiat money, and barter systems cannot “teleport” arbitrary-sized value between individuals, nor do they come with third-party ledgers). Bitcoin is anything but a crude storage of value, and the “intrinsic value” of bitcoins is readily apparent. In comparing the varied “protocols” inherent to gold and Bitcoin, the key differences become clear:

In short: The "protocol" nature of Bitcoin enables it's functionality to continue to expand and grow over time, both in terms of the functionality of the protocol (ex: multisig) and in terms of services layered on top (ex: online wallets, open bazaar, etc). This is superior over gold where it's functionality is largely fixed and static. Granted gold's functionality worked very well in the pre-digial era of thousands of years, but in the digital era we can do better. |

|

|

|

|

marcus_of_augustus

Legendary

Offline Offline

Activity: 3920

Merit: 2348

Eadem mutata resurgo

|

|

September 09, 2014, 01:21:53 AM |

|

Thanks for sharing. This is really a great point in the article: Unfortunately for gold, it is relatively stagnant in terms of its use. It does have a few industrial applications, and generally gold has been a hedge against market fear and fiat currency inflation. Mostly, gold acts as a crude storage of historically-induced, market imposed value.

In comparison, bitcoin is remarkably different — its market ecosystem is unique compared with all other contemporary forms of value (e.g., gold, fiat money, and barter systems cannot “teleport” arbitrary-sized value between individuals, nor do they come with third-party ledgers). Bitcoin is anything but a crude storage of value, and the “intrinsic value” of bitcoins is readily apparent. In comparing the varied “protocols” inherent to gold and Bitcoin, the key differences become clear:

In short: The "protocol" nature of Bitcoin enables it's functionality to continue to expand and grow over time, both in terms of the functionality of the protocol (ex: multisig) and in terms of services layered on top (ex: online wallets, open bazaar, etc). This is superior over gold where it's functionality is largely fixed and static. Granted gold's functionality worked very well in the pre-digial era of thousands of years, but in the digital era we can do better. ... you mean, like it is a new form of money? ... like digital gold? |

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

September 09, 2014, 01:23:39 AM |

|

Thanks for sharing. This is really a great point in the article: Unfortunately for gold, it is relatively stagnant in terms of its use. It does have a few industrial applications, and generally gold has been a hedge against market fear and fiat currency inflation. Mostly, gold acts as a crude storage of historically-induced, market imposed value.

In comparison, bitcoin is remarkably different — its market ecosystem is unique compared with all other contemporary forms of value (e.g., gold, fiat money, and barter systems cannot “teleport” arbitrary-sized value between individuals, nor do they come with third-party ledgers). Bitcoin is anything but a crude storage of value, and the “intrinsic value” of bitcoins is readily apparent. In comparing the varied “protocols” inherent to gold and Bitcoin, the key differences become clear:

In short: The "protocol" nature of Bitcoin enables it's functionality to continue to expand and grow over time, both in terms of the functionality of the protocol (ex: multisig) and in terms of services layered on top (ex: online wallets, open bazaar, etc). This is superior over gold where it's functionality is largely fixed and static. Granted gold's functionality worked very well in the pre-digial era of thousands of years, but in the digital era we can do better. ... you mean, like it is a new form of money? ... like digital gold? more like digital platinum which can morph into wtv "digital metal" is most desirable at the time. |

|

|

|

STT

Legendary

Offline Offline

Activity: 3892

Merit: 1413

Leading Crypto Sports Betting & Casino Platform

|

|

September 09, 2014, 03:06:39 AM |

|

Unfortunately for gold, it is relatively stagnant in terms of its use. Well evidentially not as gold usage has declined dramatically in the last century despite being used for millennia. Certainly in proportion to the amount of cash used this is true, ie. western countries do not value gold where as eastern cultures may still retain and use gold in more regular set patterns still such as the Indian wedding season, etc If I estimate any great rise its likely a large reversal of this decline This is superior over gold where it's functionality is largely fixed and static. Granted gold's functionality worked very well in the pre-digial era of thousands of years, but in the digital era we can do better. No I think this is a fallacy. Im all for technology but some things are constant like human nature and elemental properties. Every generation thinks they can discard mistakes made previously as obvious and easily avoidable but we havent got past political bias and interference in economies yet. Gold is inverse in its function, so yea its nothing new but look at the world now and effects in progress. Such as the ECB moves recently to increase the magnitude of negative rates and so on. The need and possible usage for gold or any steady medium of exchange is rising in proportion to systemic failure implemented by unproductive elements of the economy like government or general beaurcarcy. At some point they'll be so much crap the demand will break badly in favour of any competitive free medium of value exchange |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|

zeetubes

|

|

September 09, 2014, 04:23:05 AM |

|

Interesting days/weeks ahead. Just to add to all of the political uncertainty and dollar strengthening, we have the 9-11 anniversary and then CME telling us that after 9-15, no more market rigging is allowed. Right. And then 9-18 the Scottish independence ballot. Not to mention a new iphone. How could I forget that? They're rumored to be releasing a 5.5" iphone but even if I liked the iphone, a 5.5" display is just too small for me now. I could almost get excited about the new nokia 1525. I had a windows phone for a while and it honestly wasn't so bad. Metro is quite friendly in a phone environment. But I just bought a black market 6" chinese samsung rip off and even though it was intended to be just a back up, I've stopped using the Note.

|

|

|

|

|

rocks

Legendary

Offline Offline

Activity: 1153

Merit: 1000

|

|

September 09, 2014, 04:31:03 AM |

|

In short: The "protocol" nature of Bitcoin enables it's functionality to continue to expand and grow over time, both in terms of the functionality of the protocol (ex: multisig) and in terms of services layered on top (ex: online wallets, open bazaar, etc). This is superior over gold where it's functionality is largely fixed and static. Granted gold's functionality worked very well in the pre-digial era of thousands of years, but in the digital era we can do better.

... you mean, like it is a new form of money? ... like digital gold? I see what you did there  In all seriousness though, the phrase "digital gold" makes bitcoin sound to be a simple 1-for-1 replacement to gold in terms of functionality. But Bitcoin has the potential to be much more than that, which to me makes the term inaccurate. Of course the whole experiment is still quite likely to fail in the end and we have a long way to go before achieving "gold" status let alone "beyond gold" status. No I think this is a fallacy. Im all for technology but some things are constant like human nature and elemental properties. Every generation thinks they can discard mistakes made previously as obvious and easily avoidable but we havent got past political bias and interference in economies yet.

I agree that every generation is naive in the effect they can truly have, and that the vast majority of time are doomed to repeat the same mistakes, but there are fundamental shifts in technology that can and do have large permanent changes on society. For example, the printing press lowered the cost of the written word which brought reading and later education to large segments of the population, steam and then gas combustion engines greatly increased the distances people could travel in a lifetime (previously most people did not travel far from their birth location), the Haber process to create ammonia for fertilizer is widely viewed as one of the most significant enablers of humanity's population boom over the past 100 years (though the guy also invented chemical warfare....). Similarly modern computer technology has for all practical purposes eliminated the costs in storing and disseminating information. That will create permanent changes to society, although we don't really know how. Many of us here are betting on a significant and permanent change to the concept of money. |

|

|

|

|

STT

Legendary

Offline Offline

Activity: 3892

Merit: 1413

Leading Crypto Sports Betting & Casino Platform

|

|

September 09, 2014, 05:02:18 AM |

|

Thats a great run down, yes Im fan of advancement and acceptance of change through technology and obviously we are no longer all in the fields picking potatoes. So some see gold as similar waste of time and effort but my point would be we still (desperately) need it Many of us here are betting on a significant and permanent change to the concept of money. Iam still going to switch back and say the biggest change to money was not this current development but something like what Nixon did in 1972 and has been built on since. That whole focus switch over to debt, away from productive assets and to stop the distribution of capital among people by centralising money production (ie no link to assets) this meant the failure of capitalism itself . I dont think bitcoin fixes that, it may bypass some of the effects however which is helpful, but the biggest changes are to democracy and various 'rights' perhaps. I dont think this is a mainly technology change occurring now, we are just the side menu |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

tabnloz

Legendary

Offline Offline

Activity: 961

Merit: 1000

|

|

September 09, 2014, 09:15:50 AM |

|

|

|

|

|

|

|

zeetubes

|

|

September 09, 2014, 10:04:07 AM |

|

yes, the powers that be want you to be invested in stocks and real estate and they're tired of asking nicely.  |

|

|

|

|

BrunesBTC45

Member

Offline Offline

Activity: 103

Merit: 10

|

|

September 09, 2014, 11:08:42 AM |

|

Who made this? Maybe bitcoin fanatics wrote this one.

|

|

|

|

|

ShintoshiBTC

Full Member

Offline Offline

Activity: 140

Merit: 100

YOU"RE LIKE A TIMEBOMB!

|

|

September 09, 2014, 11:13:24 AM |

|

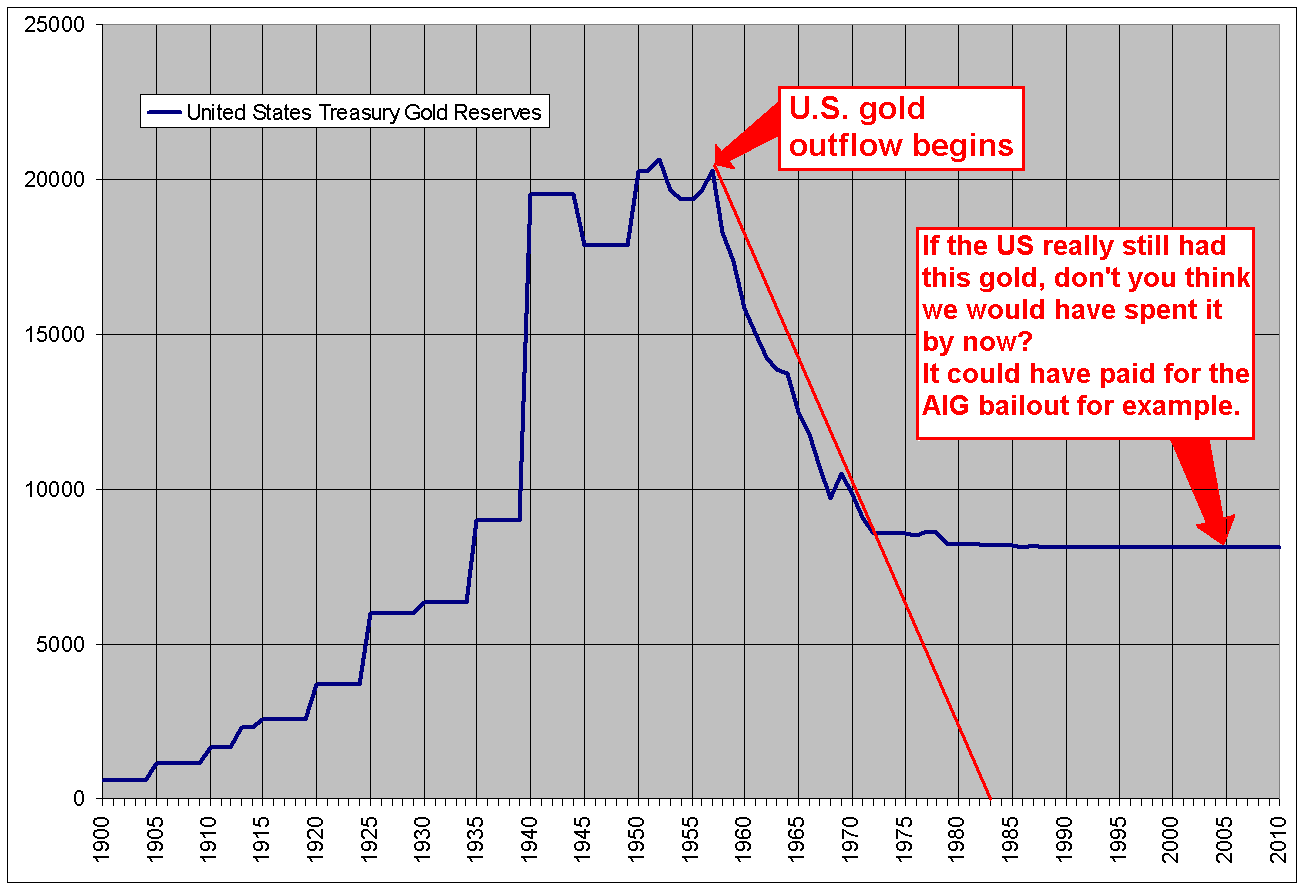

Gold collapsing? I don't follow the metal prices. Link?

For years gold is one of the 3 things that doesnt depreciate. You think Gold Reserves of the US doesnt regulate these things? |

|

|

|

|

Wilhelm

Legendary

Offline Offline

Activity: 1652

Merit: 1265

|

|

September 09, 2014, 11:21:04 AM |

|

Gold collapsing? I don't follow the metal prices. Link?

For years gold is one of the 3 things that doesnt depreciate. You think Gold Reserves of the US doesnt regulate these things? You assume there is still gold left in those reserves? |

Bitcoin is like a box of chocolates. You never know what you're gonna get !!

|

|

|

|

thoughtfan

|

|

September 09, 2014, 11:36:16 AM |

|

How high a proportion of the world's gold would need to be with one entity (e.g. the Chinese gov't), given a viable alternative to the rest of us as a store of value were an option, for gov'ts and people worldwide to go: 'nah, I'm not playing the game of gold having a substantial store of value anymore, we're just going to buy it for pretty things and industrial use' and it's value permanently dive off a cliff to somewhere relative to its demand for those other things?

|

|

|

|

|

rpietila

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

September 09, 2014, 12:13:30 PM |

|

How high a proportion of the world's gold would need to be with one entity (e.g. the Chinese gov't), given a viable alternative to the rest of us as a store of value were an option, for gov'ts and people worldwide to go: 'nah, I'm not playing the game of gold having a substantial store of value anymore, we're just going to buy it for pretty things and industrial use' and it's value permanently dive off a cliff to somewhere relative to its demand for those other things?

Up to 80% of the world's physical gold is commanded by the banking cartel, and they have also been campaigning for the demonetization for 1.5 centuries at least. The plan until crypto was probably that fiat money regime earns them the best fees, but even if they lose control, they have the control of the only alternative also. I don't believe that a sufficient number of wealthy entities ever discards gold totally, and therefore its monetary premium will stay forever. Only 1% need to care, for gold still to have a high value. |

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

rocks

Legendary

Offline Offline

Activity: 1153

Merit: 1000

|

|

September 09, 2014, 04:53:05 PM |

|

Many of us here are betting on a significant and permanent change to the concept of money. Iam still going to switch back and say the biggest change to money was not this current development but something like what Nixon did in 1972 and has been built on since. That whole focus switch over to debt, away from productive assets and to stop the distribution of capital among people by centralising money production (ie no link to assets) this meant the failure of capitalism itself . I dont think bitcoin fixes that, it may bypass some of the effects however which is helpful, but the biggest changes are to democracy and various 'rights' perhaps. I dont think this is a mainly technology change occurring now, we are just the side menu Those are great points and I agree with all of that. One comment though is it really was Wilson and FDR who created the switch in money to a debt based system, Nixon just inherited the mess and was forced to close the gold window to protect the US's remaining holding. By the time Nixon came to office the run on the US's gold holdings was accelerating since the amount of money and debt created previously was vastly larger than the amount of gold held. This started in the 1950s.  From: http://www.marketskeptics.com/2010/06/draft.html |

|

|

|

|

rocks

Legendary

Offline Offline

Activity: 1153

Merit: 1000

|

|

September 09, 2014, 06:23:17 PM |

|

Up to 80% of the world's physical gold is commanded by the banking cartel, and they have also been campaigning for the demonetization for 1.5 centuries at least.

The plan until crypto was probably that fiat money regime earns them the best fees, but even if they lose control, they have the control of the only alternative also.

I don't believe that a sufficient number of wealthy entities ever discards gold totally, and therefore its monetary premium will stay forever. Only 1% need to care, for gold still to have a high value.

Gold is actually pretty widely distributed, with a majority in private hands via jewelry and to a lesser extent private investment. Central banks have around 18%, not 80%. Of course those are official numbers, they could very well have quite a bit less gold. From: http://minerals.usgs.gov/minerals/pubs/commodity/gold/myb1-2011-gold.pdfAn estimated 171,300 metric tons (t) of gold was mined historically through 2011, with 29,500 t held by central banks as official stocks, 33,000 t held privately as investment, 84,300 t held privately as jewelry, 20,800 t in other fabricated products, and the remaining 3,600 t unaccounted (Klapwijk and others, 2012, p. 59).

|

|

|

|

|

iCEBREAKER

Legendary

Offline Offline

Activity: 2156

Merit: 1072

Crypto is the separation of Power and State.

|

|

September 09, 2014, 06:45:40 PM |

|

Unfortunately for gold, it is relatively stagnant in terms of its use. Well evidentially not as gold usage has declined dramatically in the last century despite being used for millennia. Certainly in proportion to the amount of cash used this is true, ie. western countries do not value gold where as eastern cultures may still retain and use gold in more regular set patterns still such as the Indian wedding season, etc If I estimate any great rise its likely a large reversal of this decline This is superior over gold where it's functionality is largely fixed and static. Granted gold's functionality worked very well in the pre-digial era of thousands of years, but in the digital era we can do better. No I think this is a fallacy. Im all for technology but some things are constant like human nature and elemental properties. Every generation thinks they can discard mistakes made previously as obvious and easily avoidable but we havent got past political bias and interference in economies yet. Gold is inverse in its function, so yea its nothing new but look at the world now and effects in progress. Such as the ECB moves recently to increase the magnitude of negative rates and so on. The need and possible usage for gold or any steady medium of exchange is rising in proportion to systemic failure implemented by unproductive elements of the economy like government or general beaurcarcy. At some point they'll be so much crap the demand will break badly in favour of any competitive free medium of value exchange Gold usage for the last 100 years is in an extended local minimum. This aberration will revert to the historical trend sooner or later. The last century was dominated by world war and central banks (happy birthday US FED). FDR banned gold, as did his authoritarian brethren in China, etc. Now hard money is making a comeback. Gold is in a 12 year bull run, silver tested ATHs, and the people of the BRICs and other emerging markets are once again able to put into practice the wisdom of the average Indian onion farmer who never stopped hloding (his wife would murder him if he did). Most of the world's people are not the bi-coastal cosmopolitan elites who are vastly overrepresented on this thread. Worry about PM vs BTC allocation is a first world problem. Indian onion farmers are not going to diversify into cryptocash, although their computer savvy children are starting to. Speaking of human nature, sweet shiny gold/silver/platinum are absolutely guaranteed get you laid. BTC might also, but only if you are into furries...  |

██████████

██████████████████

██████████████████████

██████████████████████████

████████████████████████████

██████████████████████████████

████████████████████████████████

████████████████████████████████

██████████████████████████████████

██████████████████████████████████

██████████████████████████████████

██████████████████████████████████

██████████████████████████████████

████████████████████████████████

██████████████

██████████████

████████████████████████████

██████████████████████████

██████████████████████

██████████████████

██████████

Monero

|

| "The difference between bad and well-developed digital cash will determine

whether we have a dictatorship or a real democracy." David Chaum 1996

"Fungibility provides privacy as a side effect." Adam Back 2014

|

| | |

|

|

|

Kupsi

Legendary

Offline Offline

Activity: 1193

Merit: 1003

9.9.2012: I predict that single digits... <- FAIL

|

|

September 10, 2014, 12:20:11 AM

Last edit: September 10, 2014, 12:35:04 AM by Kupsi |

|

|

|

|

|

|

|

Poll

Poll