nattybear

Newbie

Offline Offline

Activity: 33

Merit: 0

|

|

July 11, 2019, 05:03:52 PM |

|

Which could be many months? So in easily accessible language, it's either 1) A 'big' move within the range of a previous month (how is big defined?), or, 2) a month which includes outside price action (above or below) and finishes within the previous range... Edit: 3) It could be a big move outside the range of a previous month. So even more months could qualify on those terms? |

|

|

|

|

|

|

|

Remember that Bitcoin is still beta software. Don't put all of your money into BTC!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

AnonymousCoder

Member

Offline Offline

Activity: 580

Merit: 17

|

|

July 11, 2019, 05:23:42 PM

Last edit: July 20, 2021, 06:34:29 PM by AnonymousCoder |

|

ParalyzedI just get this mailed: Reports after 2019-07-10 close:

Daily Bullish elected: GDXJ Market Vectors Junior Gold Miner

Daily Bullish elected: $DXY THE CASH US$ INDEX

What do you do with that? These signals are in conflict with each other. So it means you cannot trade either market. It is all complete bullshit. Because: GDXJ short is one of the the winners of the day today. Martin Armstrong is a charlatan, and he spent 11 years in jail for that reason but he has not changed. Read this blog starting here to find out more about computerized fraud. See armstrongecmscam.blogspot.com for a more compact view of major findings posted in this blog. Every single defrauded person should report their case, see Where and how to complain

|

|

|

|

|

MTL4

Newbie

Offline Offline

Activity: 62

Merit: 0

|

|

July 11, 2019, 07:21:14 PM |

|

Paralyzed

I just get this mailed:

Reports after 2019-07-10 close:

Daily Bullish elected: GDXJ Market Vectors Junior Gold Miner

Daily Bullish elected: $DXY THE CASH US$ INDEX

What do you do with that? These signals are in conflict with each other. So it means you cannot trade either market.

It is all complete bullshit.

Because: GDXJ short is one of the the winners of the day today.

Read this blog starting at page 273 to find out more about computerized fraud

Not sure either........on the larger trend both are currently bullish but I have no idea how you'd do short trades with that info. |

|

|

|

|

olegrey

Newbie

Offline Offline

Activity: 83

Merit: 0

|

|

July 11, 2019, 09:05:56 PM |

|

Paralyzed

I just get this mailed:

Reports after 2019-07-10 close:

Daily Bullish elected: GDXJ Market Vectors Junior Gold Miner

Daily Bullish elected: $DXY THE CASH US$ INDEX

What do you do with that? These signals are in conflict with each other. So it means you cannot trade either market.

It is all complete bullshit.

Because: GDXJ short is one of the the winners of the day today.

Read this blog starting at page 273 to find out more about computerized fraud

Not sure either........on the larger trend both are currently bullish but I have no idea how you'd do short trades with that info. Was the 1 percent rule elected? If so you have a pretty good chance of moving opposite the elected reversal |

|

|

|

|

olegrey

Newbie

Offline Offline

Activity: 83

Merit: 0

|

|

July 11, 2019, 09:13:45 PM |

|

Re-posting the link to the spreadsheet I started a couple months ago. https://docs.google.com/spreadsheets/d/1ZJ8y06rALN-1eUPX_1ZbAfJ4SPP1oM_LcMHg5fsLW_I/edit#gid=0My main purpose for posting this originally was to try to get some confirmation in my understanding of the reversal system which was not available via Socrates support and this is the only specific trading strategy listed in the documentation (open a position the open of the next trading day and close at the election of the reversal in the opposite direction). But since this information is proprietary I do not want to continue to update with new information. I will close out the open positions when that happens, however, so I will do some updating. And, I will say that the major changes are for the weekly reversals in the DOW (bullish positions were closed out and bearish positions were opened and then closed out all with losses), the USD/EURO weekly and monthly bearish reversals were all closed out at $1.1343, and WMT had several weekly and a monthly bullish reversal elected so more positions would have been opened. In my limited experience so far I do not believe that Socrates is a fraud. The monthly reversals have overall worked very well for the handful of assets shown here. Also, there has always been follow-through when all of the bullish or bearish monthly reversals are elected for an asset. I also believe that Socrates is extremely complicated and getting started is completely overwhelming. There is a lack of support for users trying to understand how to use the system, there are bugs, there is limited historical data, no back-testing capabilities, and some critical information is not included that was available in the version WEC attendees were able to use. It also does not have any capabilities for screening assets. Even if you have the ability on your own to scrape the data it is too expensive to get access to what you would need (i.e. the reversals). It essentially feels like the system is still designed for institutional users who would have access to everything in Socrates. I am currently trying to build a strategy, as alluded to but not well-described in the user manual, for using failed election of reversals which seems to have some promise. Again, the lack of back-testing capabilities and limited access to data makes this an extremely difficult task. @bikefront @MTL4 Could you send me a PM? I have some questions for you on your experience with Socrates. Here is my 3 timeunit analysis on the reversals provided by ediface https://docs.google.com/spreadsheets/d/1W-3pYaPuLEMwS3Vsrjm1YaSrNIftvDhWFpCh3POhZ8g/edit#gid=871043527 |

|

|

|

|

nattybear

Newbie

Offline Offline

Activity: 33

Merit: 0

|

|

July 11, 2019, 09:46:27 PM |

|

Looking forward to seeing this. You might need to make the sheet public as it leads to an authorisation request |

|

|

|

|

olegrey

Newbie

Offline Offline

Activity: 83

Merit: 0

|

|

July 11, 2019, 09:56:57 PM |

|

Looking forward to seeing this. You might need to make the sheet public as it leads to an authorisation request Yep, sorry. Changed it to public to anyone with the link, so it should work now. |

|

|

|

|

Kiwibird

Jr. Member

Offline Offline

Activity: 45

Merit: 2

|

|

July 12, 2019, 01:02:49 AM |

|

Anyone here follow David H Hunter? https://twitter.com/DaveHcontrarianAnother cycles and macro strategist. He sees a melt-UP in the markets: S&P 3500, DOW 32000, Nasdaq 11000 by 4th Qtr - then a large fall. Gold to also max out at $1550 and then fall below $1000 thereafter. He sees the next cycle coming soon as highly inflationary with precious metals+miners zooming up (Gold $7000, Silver $200...), inc industrials and commodities. Inflation and interest rates to be double digits by mid 2020s. Bond market to be avoided in that cycle Where he differs from Armstrong is that he sees the stock markets as falling 80% and not recovering for a generation. Armstrong says the high has extended to 2032.. I find it fascinating to follow and compare them both. |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

July 12, 2019, 04:04:29 AM |

|

As for Armstrong's "short dollar vortex" or whatever the hell he calls it, it does not exist. It's just more disinformation to try and prop up the US dollar ponzi. He pretends like defaulting on debts is not a common practice: There is no short dollar vortex, people will simply DEFAULT on those debts. If you default, there is NO DEMAND for the instrument in which you borrowed in. It's all ODIUS, UNPAYABLE debt. There is no synthetic short. Technically it is a synthetic short, but not when nobody plans to honor any of those agreements.

|

|

|

|

|

AnonymousCoder

Member

Offline Offline

Activity: 580

Merit: 17

|

|

July 12, 2019, 04:07:07 AM

Last edit: July 20, 2021, 06:34:21 PM by AnonymousCoder |

|

Super Forecast StrategyAnyone here follow David H Hunter? https://twitter.com/DaveHcontrarianAnother cycles and macro strategist. He sees a melt-UP in the markets: S&P 3500, DOW 32000, Nasdaq 11000 by 4th Qtr - then a large fall. Gold to also max out at $1550 and then fall below $1000 thereafter. He sees the next cycle coming soon as highly inflationary with precious metals+miners zooming up (Gold $7000, Silver $200...), inc industrials and commodities. - Inflation and interest rates to be double digits by mid 2020s. Bond market to be avoided in that cycle Where he differs from Armstrong is that he sees the stock markets as falling 80% and not recovering for a generation. Armstrong says the high has extended to 2032.. I find it fascinating to follow and compare them both. And then we build, true to Martin Armstrong's principles, a Super Forecast Array as follows: For each forecaster (I am sure we will find more forecasters to make this statistically significant) we add to a hit counter per time period column (doesn't matter whether it is a high or low, one high / low extreme hit is one count) and accumulate in the Composite Row the counts of different hit categories. Then we know the future, definitely, because it is detached from human emotion. As Martin Armstrong likes to say: The numbers are the numbersMartin Armstrong is a charlatan, and he spent 11 years in jail for that reason but he has not changed. Read this blog starting here to find out more about computerized fraud. See armstrongecmscam.blogspot.com for a more compact view of major findings posted in this blog. Every single defrauded person should report their case, see Where and how to complain

|

|

|

|

|

DanB1

Jr. Member

Offline Offline

Activity: 100

Merit: 1

|

|

July 12, 2019, 06:55:09 AM

Last edit: July 12, 2019, 09:47:34 AM by DanB1 |

|

We failed to elect a key weekly bullish reversal but the main reason for the entry is because Armstrong has stuck his neck out here and said we needed to close this week above 26951.82 to imply a further advance. Also the 1st of July has been a turning point with the next showing up as the 8th and normally one turning point is followed by the opposite event on the next, on the energy model we are seeing the market making new intraday highs while the energy models are declining which indicates this rally is not sustainable. On the weekly energy model we are seeing the energy peak before the price high which indicates we may be forming a temporary high. The energy model is very important to understand and helps you to identify when the market is over-bought or over-sold.

Th exit point is the most immediate daily bearish reversal which lies at 26536.32 but we have crash mode technical support at 26617 which may also offer support.

Hi Gumbi, for my information: - What is the time frame you are looking at for your trade to work? - What is your stop-loss for this trade, is that another reversal or the same weekly that we did not elect last week (26,951.82)? I exited for the close on the 10th since we elected daily reversals on the Nasdaq and Dow. we have another daily bullish at 26966.10. This month is a panic cycle so we either move to the upside to 28k area or retest the lows made the previous month if we elect the weekly bullish at 26951.82 it should be to the upside. August is a turning point and October is the next so a high in August implies a low in October. the week of the high/low looks like the week of the 29th or the 5th. Thanks Gumbi. So can I now come to the conclusion that Socrates does not really work for trading? On your first trade that you have elected yourself and wanted to show us, it shows how difficult it is to trade on the information supplied by Socrates. So you entered the trade because a major weekly bullish was not elected and there was a turning point on the week of the 8th. So has this turning point now become a phase transition? How can one trade this kind of information? I mean, at this point anything can happen: we go down hard or we go up a few percent. (Panic Cycle month). And what about MA's statement that we would not make any substantial new highs in 2019 until the ECM in 2020? |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

July 12, 2019, 07:11:21 AM |

|

Thanks Gumbi. So can I now come to the conclusion that Socrates does not really work for trading?

You must have missed the part where he said in "2015.75" all markets everywhere would crash and they've done nothing but go straight up ever since. The markets are all completely rigged and non-aggregate, controlled by the ESF/PPT and other organizations, so even if he did have some type of miracle model (he doesn't), he would still wind up being wrong anyway. |

|

|

|

|

Gumbi

Copper Member

Newbie

Offline Offline

Activity: 168

Merit: 0

|

|

July 12, 2019, 12:54:19 PM |

|

Thanks Gumbi. So can I now come to the conclusion that Socrates does not really work for trading?

You must have missed the part where he said in "2015.75" all markets everywhere would crash and they've done nothing but go straight up ever since. The markets are all completely rigged and non-aggregate, controlled by the ESF/PPT and other organizations, so even if he did have some type of miracle model (he doesn't), he would still wind up being wrong anyway. the markets were crashing into the 2015.75 target on the ECM indicating that new highs would be carved out in the future. I decline would of been indicated if the market was making highs going into 2015.75. Can you proof that he said that markets would crash after 2015.75? all markets are not completely rigged that is an absurd conspiracy theory. Japan lost over $1 trillion trying to support the Nikkei share market and still could not reverse the bear market, no amount of money can ever manipulate a market and change its trend. @DanB1 I anticipated the direction without waiting for the Dow to elect its key weekly reversal so this trade was my mistake, this is what Armstrong was talking about when he said DO NOT ANTICIPATE" Since we exceeded the high made on the 1st of July yes looks a cycle inversion. August is a turning point it looks like a high at this point. "We do not see highs on any SUSTAINABLE basis until the ECM bottoms come January" The market is not truly breaking out we are due one more retest of support most likely in the fall. |

|

|

|

|

unwashed

Newbie

Offline Offline

Activity: 53

Merit: 0

|

|

July 12, 2019, 04:02:51 PM |

|

Thanks Gumbi. So can I now come to the conclusion that Socrates does not really work for trading?

You must have missed the part where he said in "2015.75" all markets everywhere would crash and they've done nothing but go straight up ever since. The markets are all completely rigged and non-aggregate, controlled by the ESF/PPT and other organizations, so even if he did have some type of miracle model (he doesn't), he would still wind up being wrong anyway. the markets were crashing into the 2015.75 target on the ECM indicating that new highs would be carved out in the future. I decline would of been indicated if the market was making highs going into 2015.75. Can you proof that he said that markets would crash after 2015.75? all markets are not completely rigged that is an absurd conspiracy theory. Japan lost over $1 trillion trying to support the Nikkei share market and still could not reverse the bear market, no amount of money can ever manipulate a market and change its trend. @DanB1 I anticipated the direction without waiting for the Dow to elect its key weekly reversal so this trade was my mistake, this is what Armstrong was talking about when he said DO NOT ANTICIPATE" Since we exceeded the high made on the 1st of July yes looks a cycle inversion. August is a turning point it looks like a high at this point. "We do not see highs on any SUSTAINABLE basis until the ECM bottoms come January" The market is not truly breaking out we are due one more retest of support most likely in the fall. Sorry I have to put my 2c in on this. Since I've been trading/investing since 1998, first as a day trader, now to sometimes swing trade and buy and hold short/intermediate term, I'm always in conflict with MA. The reason is is my technical analysis training. In my previous post on the Dow breaking out with the 3 taps and out is an example, it took me all of 10 min. to come to that conclusion and yes this is a break out since 27k has been resistance since feb 2018. I'm by no means an expert but of my own experiences. As far as Anticipation goes, first he has said in the past that traders always trade on expectations, ie anticipation, second this also shows on, earning, news, fed and regs, third reversals are no different then a conformation as in candlestick TA, Bar has different rules, sorry I can't reconcile this and always fall back on my own TA and experience. I personally can not handle all the conflicting, contradiction and vagueness of his writings and system. IMHO |

|

|

|

|

trulycoined

Jr. Member

Offline Offline

Activity: 85

Merit: 8

|

|

July 12, 2019, 06:15:40 PM

Last edit: July 12, 2019, 06:35:42 PM by trulycoined |

|

the markets were crashing into the 2015.75 target on the ECM indicating that new highs would be carved out in the future. I decline would of been indicated if the market was making highs going into 2015.75.

Can you proof that he said that markets would crash after 2015.75?

...

@Gumbi Yes this can be proved, using multiple sources: 2013, MA explained that the rising dollar will turn "the US economy into recession from 2015.75": https://www.armstrongeconomics.com/uncategorized/back-to-the-future/The dollar MUST rise... This will be the straw that breaks the back of the economy turning the US economy into recession from 2015.75.Never happened.

Article in De Welt 3 May 2015. https://www.welt.de/finanzen/article140453591/US-Finanzprophet-Armstrong-sagt-Ende-des-Euro-voraus.htmlMA explains: Be sure to keep your fingers off government bonds. They are hopelessly overrated. Here it will come to the big crash. My model predicts October 1st (2015).Never happened.

Days later in that same paper (7 may 2015), MA makes another prediction, but with a different and far less certain date!: https://www.welt.de/finanzen/geldanlage/article140550440/Es-wird-zu-einem-grossen-Crash-kommen.htmlWhen asked "What does your model say (about the future)?", MA explains: The big crash is coming. 2017 or 2018.Never happened.One must ask how, if MA's claims of a supercomputer that predicts the future are true (TO THE DAY), and when referencing his own model, he gives one date that passed with nothing happening (1 October 2015). Then days later in a different interview gives two ambiguous years as the forecast of his model that also both pass with no real economic drama. And lest we forget this bogus claim about his supercomputer that was in fact built for the US government, and he would not be allowed to access: https://www.armstrongeconomics.com/institutional-time-share/See: https://en.wikipedia.org/wiki/Sequoia_(supercomputer)

In another article that same vintage year (2015): https://www.lavanguardia.com/lacontra/20150625/54432509475/la-contra-martin-armstrong.htmlIn October of this year will begin a debt crisis of governments (historically, none has survived) that will reach the high point in 2017Never happened and debt continues increasing (2019: c$244trn).

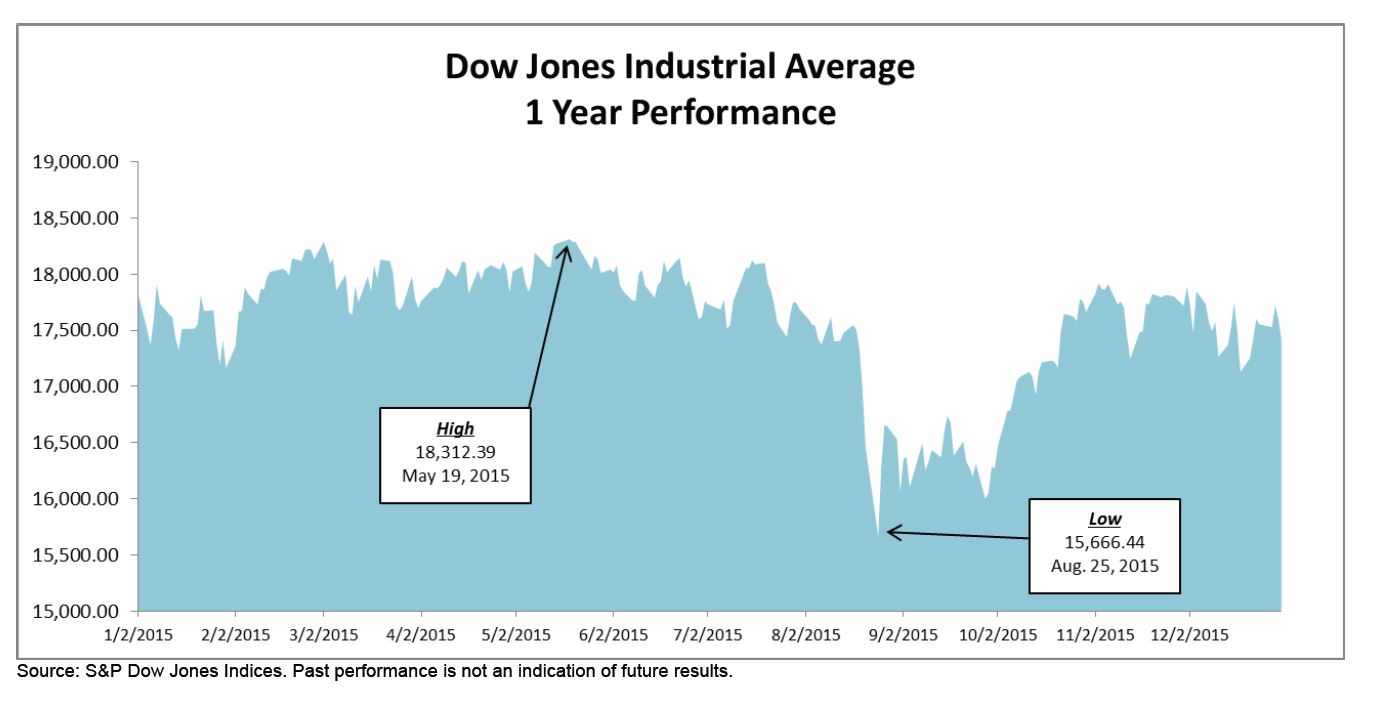

In this article from 29 Sep 2015, so literally on the day of his grand "big bang" forecast: https://www.tradingfloor.com/posts/is-martin-armstrongs-debt-crisis-upon-us-6299991MA is quoted as saying: The fact that we have the stock markets crashing into the 2015.75 turning point rather than making a major high is indicative of the future we should expect to unfoldNever happened.And here is the high and the low for 2015, neither of which MA forecast:

We have proof across multiple sources and in the years up to 2015.75 where MA said - based on his model, not his opinion - that markets would crash. So as a more fervent defender of MA on this thread, now what are your thoughts? |

|

|

|

|

|

|

AnonymousCoder

Member

Offline Offline

Activity: 580

Merit: 17

|

|

July 12, 2019, 08:40:29 PM

Last edit: July 20, 2021, 06:34:14 PM by AnonymousCoder |

|

AE Global Insider identified...

2015.75(October 1st) was just the beginning you are simply mistaken, this is a common misconception by many outsiders.

...

Just for the record. When Gumbi refers to other posters as outsiders this implies that he is an insider. Martin Armstrong is a charlatan, and he spent 11 years in jail for that reason but he has not changed. Read this blog starting here to find out more about computerized fraud. See armstrongecmscam.blogspot.com for a more compact view of major findings posted in this blog. Every single defrauded person should report their case, see Where and how to complain

|

|

|

|

|

Gumbi

Copper Member

Newbie

Offline Offline

Activity: 168

Merit: 0

|

|

July 12, 2019, 09:20:10 PM |

|

AE Global Insider identified...

2015.75(October 1st) was just the beginning you are simply mistaken, this is a common misconception by many outsiders.

...

Just for the record. When Gumbi refers to other posters as outsiders this implies that he is an insider. Read this blog starting at page 273 to find out more about computerized fraud Insider meaning someone who has been closely following his work don't make assumptions which is all you ever do. if the Dow is making new highs going into Jan 18 2020 this will be a indication we move lower if we are retesting support this will indicate new highs going into 2024 the same as it what happened in 2015.75. The most likely reason you are not having any success is because you are not trading for the long term which is much easier to Forecast. |

|

|

|

|

DanB1

Jr. Member

Offline Offline

Activity: 100

Merit: 1

|

|

July 12, 2019, 09:46:51 PM |

|

AE Global Insider identified...

2015.75(October 1st) was just the beginning you are simply mistaken, this is a common misconception by many outsiders.

...

Just for the record. When Gumbi refers to other posters as outsiders this implies that he is an insider. Read this blog starting at page 273 to find out more about computerized fraud Insider meaning someone who has been closely following his work don't make assumptions which is all you ever do. if the Dow is making new highs going into Jan 18 2020 this will be a indication we move lower if we are retesting support this will indicate new highs going into 2024 the same as it what happened in 2015.75. The most likely reason you are not having any success is because you are not trading for the long term which is much easier to Forecast. Sorry Gumbi, but I had to reply as you are back on your chair again insulting people, but what have you showed us? You had your change to prove us wrong on your trade as "Armstrong has stuck his neck out here and said we needed to close this week above 26951.82 to imply a further advance" (your words). I feel sad for you. You really believe that the Socrates system works. There are almost 300 pages here with so many people who posted their experiences and all came to the same conclusion. Yet you wanted to show that you could trade based on this, and on your very first trade you had the same problem everybody has when using the Socrates system. Why I feel sad? Because you try to protect Socrates/Armstrong and say it's your own fault. But the truth is, following Socrates will only give you mediocre results. Sure, there will be some wins. But very often you will be on the sideline, waiting for something to happen so you can step in (long/short). And then after some time you realise you missed the trade. |

|

|

|

|

Gumbi

Copper Member

Newbie

Offline Offline

Activity: 168

Merit: 0

|

|

July 12, 2019, 10:01:36 PM |

|

AE Global Insider identified...

2015.75(October 1st) was just the beginning you are simply mistaken, this is a common misconception by many outsiders.

...

Just for the record. When Gumbi refers to other posters as outsiders this implies that he is an insider. Read this blog starting at page 273 to find out more about computerized fraud Insider meaning someone who has been closely following his work don't make assumptions which is all you ever do. if the Dow is making new highs going into Jan 18 2020 this will be a indication we move lower if we are retesting support this will indicate new highs going into 2024 the same as it what happened in 2015.75. The most likely reason you are not having any success is because you are not trading for the long term which is much easier to Forecast. Sorry Gumbi, but I had to reply as you are back on your chair again insulting people, but what have you showed us? You had your change to prove us wrong on your trade as "Armstrong stuck his neck out" (your words). I feel sad for you. You really believe that the Socrates system works. There are almost 300 pages here with so many people who posted their experiences and all came to the same conclusion. Yet you wanted to show that you could trade based on this, and on your very first trade you had the same problem everybody has when using the Socrates system. Why I feel sad? Because you try to protect Socrates and say it's your own fault. But the truth is, following Socrates will only give you mediocre results. Sure, there will be some wins. But very often you will be on the sideline, waiting for something to happen so you can step in (long/short). And then after some time you realise you missed the trade. No I don't believe I know for a fact that it works. Belief is only for medicore minds I am not perfect but that trade didn't make me a loss. Just trade on a elected basis the dow elected another daily bullish on the 11th And a weekly bullish today so it Looks like the dow is going to 28k will give you a few more long term trades this time. I really don't want you to miss the greatest trade of the century. |

|

|

|

|

|