MA_talk

Member

Offline Offline

Activity: 226

Merit: 10

|

|

July 14, 2019, 06:05:14 PM |

|

@Gumbi, you said that 2015.75 was just the beginning. Now it's about 2019.5. That is already 3.75 YEARS LATER! Every 8.6 years according to Armstrong's ECM models, there are supposedly some significant economic event. So 44% of the 8.6 years of ECM is gone, and we still have NEGATIVE interest rates in the European market. Beginning?  Are you joking? We are almost at the mid-point of the ECM cycle, and nothing major has happened, dude!!! As I said, Armstrong ALWAYS use play of words to protect "his forecast". Ambiguous Terms like "Beginning of the trend", or "2020/2021", which should be supposed to mean the middle of 2020, BUT instead interpreted as a super-wide window from 2020/1/1 to 2021/12/31, and most likely BEYOND. So the bond crisis of 2015.75 was a "Great" forecasting record by Armstrong, and that was an excellent documentary by trulycoined on how Armstrong FAILED time after time for his LONG-TERM forecast, and Armstrong never bothered to admit his own mistakes. In summary, Armstrong SUCKS at predicting long-term. And he SUCKS at predicting for daily trades, as you have demonstrated. And he SUCKS at predicting at monthly intervals. Oh, you said that your trade was your own mistake? That is EXACTLY the filtering bias that Armstrong keeps playing. When the trades don't go well, it's the users' mistakes, or even Armstrong's personal opinions. When the trades go well, it's excellent work from Socrates. HELLO!!! Didn't I say that you MUST post the trading criteria for BOTH BUY & SELL beforehand? If you make 100 trades, and credit all the winning trades to Socrates, and put all the losing trades to your own mistakes, then Socrates will be perfect. That is exactly the same game that Armstrong has been playing all along. |

|

|

|

|

|

|

|

|

|

"Bitcoin: the cutting edge of begging technology." -- Giraffe.BTC

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

Indyz

Newbie

Offline Offline

Activity: 36

Merit: 0

|

|

July 14, 2019, 06:44:19 PM |

|

Lol.

Can you spell "ponzi"?

So a fund/company that's been around for 30+ years, have verified returns, subject to journalist reveiw and no investigations is a ponzi but MA stating that he can tell the future is legit? Edit, this fund is also doing it by the numbers, correlation and no emotions by Phd's with no trading experience. At the very least, his claim to be the only one with this type of system is incorrect. FYI, I think MA isn't kosher. I'm sure you are correct about the other fund you are pumping. A bit defensive about it, but correct lol. |

|

|

|

|

unwashed

Newbie

Offline Offline

Activity: 53

Merit: 0

|

|

July 14, 2019, 07:10:48 PM |

|

Lol.

Can you spell "ponzi"?

So a fund/company that's been around for 30+ years, have verified returns, subject to journalist reveiw and no investigations is a ponzi but MA stating that he can tell the future is legit? Edit, this fund is also doing it by the numbers, correlation and no emotions by Phd's with no trading experience. At the very least, his claim to be the only one with this type of system is incorrect. FYI, I think MA isn't kosher. I'm sure you are correct about the other fund you are pumping. A bit defensive about it, but correct lol. That's not the way I meant for it to sound. But iirc the way the article describing how and what went into designing their system was very fascinating to me and with the results would want an opportunity to invest in it but sadly, it's only for employees. |

|

|

|

|

trulycoined

Jr. Member

Offline Offline

Activity: 85

Merit: 8

|

|

July 14, 2019, 09:17:37 PM

Last edit: July 14, 2019, 10:11:31 PM by trulycoined |

|

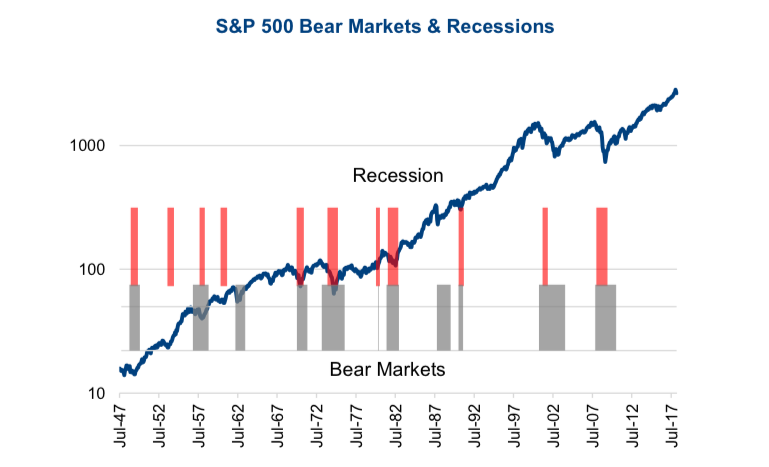

The ECM is a global economic cycle NOT a stock market model what makes you think the market has to bottom precisely in line with the ECM?. The Dow went down from its high over 2000 points into October 1st, the market was crashing going into the ECM date and this is what we can expect going into 2020 if we are going to see new highs into 2024. 2015.75 was the start of an economic decline not the end. "The model is forecasting NOT a “recession” in the old terms, but an economic decline. " https://www.armstrongeconomics.com/armstrongeconomics101/the-gdp-decline-post-2015-75/ post 2015.75 Armstrong never called for a stock market crash in fact he called for new highs. You don't need to be looking at anything other than the ECM target dates which will never change. Are you suggesting that there is no business cycle and that all price movement is in fact random ? @Gumbi I get that the ECM is a global economic cycle, so the US would be affected as would the US stock market. Historically, the stock market DOES go down with recession as this chart proves from 1947-present:  MA predicted US RECESSION 2015.75. That never transpired, nor did any "crash" in the markets. Your claim that there was a "crash" into October is absurd and not truthful. The biggest "crash" that year was August 2015 as the chart I posted in my previous post proves. There isn't even an argument: https://en.wikipedia.org/wiki/List_of_stock_market_crashes_and_bear_markets2015: China stock market crash starts in June and continues into July and August. In January 2016, Chinese stock market experiences a steep sell-off which sets off a global rout.and 2015: The Dow Jones fell 588 points during a two-day period, 1,300 points from August 18–21. On Monday, August 24, world stock markets were down substantially, wiping out all gains made in 2015, with interlinked drops in commodities such as oil, which hit a six-year price low, copper, and most of Asian currencies, but the Japanese yen, losing value against the United States dollar. With this plunge, an estimated ten trillion dollars had been wiped off the books on global markets since June 3.But MA explains his model predicts major (global) economic flashpoints to the day? 2015.75 is not July or August 2015. Markets regained quickly - within months - and continued rising from there on. The ambiguity in your wording is also similar to MA: "the market was crashing going into the ECM date and this is what we can expect going into 2020 if we are going to see new highs into 2024"So if there is no "crash" into 2020, then we WON'T see new highs into 2024. But if we do, then we WILL see new highs? Meanwhile, in your most recent posts, MA blogged the following: Goldman Sachs’ share price is going down hard INTO 2019. The 159 level will be critical on a closing basis for the year. If that is breached, then we could see very major implications for the firm whereby it may no longer survive.You defended this MA claim, explaining: "'not in 2019' but GOING INTO 2019 you can't make such a mistake like that and we never closed below 159 for the year 2018."You have just contradicted yourself, as MA does. The economic decline of the West started with TWO key flashpoints and only those with rudimentary understanding of economics would fail to realise the colossal mess of Western economics courtesy of, and since, these dates: Repeal of Bretton Woods (1971)And Repeal of Glass Steagal (1999)That is long before MA's phantom date of 2015.75, where nothing significant happened. Even from a legal or legislature stand point, there is nothing significant that year, that may cause major economic problems years or decades later, as the repeal of the above caused - and GLOBALLY. MA never called for new highs, he was quite adamant up to 2015.75 that there would be serious economic strife. When his prediction failed to materialise, he then swept it under the carpet and shifted the date forward another 5 years. And if as you claim, MA meant that was the start, remember his most recent hysterical claim that Europe was heading into political, banking and economic CHAOS come May 2019: https://www.armstrongeconomics.com/international-news/europes-current-economy/financial-political-banking-chaos-in-europe-going-into-may/It never happened.I hazard guess come Jan 2020 when nothing happens, the next major date will be 2025... And no, I never mentioned anything about the business cycle, nor denied its existence. I agree with MA: everything in this universe is cyclical and there is bizarre patterns - like a Mandelbrot Set - across totally unconnected things. So MA is onto something with that, but then no more than any physics teacher. It's not a new discovery nor groundbreaking work. He's just repeating known science. Is price movement random? I don't know and nor does MA. If it isn't, we simply do not have the computing power, technology nor the energy required to compute it all to forecast future movements precisely. It's as if there is a "blockchain" baked into nature, and some things are not supposed to be understood or discovered. Like how a dog will never understand why a computer exists or how to use one, the human mind has the same limitations built into it by nature that even evolution won't solve when it comes to more complex systems and concepts. Like predicting the lottery numbers, the stock market or, as MA has proved in recent years, the economic history of mankind - some things are just not possible and if they were, the reverse of that paradigm would then exist, and then that too would be "unsolvable". And that nicely ties in to the duality of this universe, another thing I agree with MA. I do believe we live in a duality, but that too is not a new concept. For those that like to think, it is quite an obvious conclusion to draw about the universe we live in. It is also why a model that predicts future price movements cannot exist, otherwise everyone would make the trade or take the opposite of that trade waiting for the inevitable sell off, and then the REVERSE of that scenario would play out, rendering the model or system defunct and useless. It would be no different than everyone at a poker table knowing everyone's cards. Were that to happen, either no one would play, or different tactics would be found. The game would evolve to take the opposite side of that new reality. That's the "blockchain" of nature at play, and evidence of the duality of our existence. |

|

|

|

|

trc4949

Jr. Member

Offline Offline

Activity: 61

Merit: 1

|

|

July 15, 2019, 02:56:56 AM |

|

|

|

|

|

|

AnonymousCoder

Member

Offline Offline

Activity: 580

Merit: 17

|

|

July 15, 2019, 05:41:58 AM

Last edit: July 20, 2021, 06:33:36 PM by AnonymousCoder |

|

Nothing new there. Promoting the conferences where as he says usually over three trillion USD are sitting in the room, including central banks. Promoting his new book. 26:45 Just watch their (European) economy completely implode.Boring. He still calls politicians idiots. Which is not very good for a 69 year old man who claims he has the strategy to change the world. It would be sufficient to just point out the facts not attack the people. Greg Hunter seems to disagree with him at times. Martin Armstrong is a charlatan, and he spent 11 years in jail for that reason but he has not changed. Read this blog starting here to find out more about computerized fraud. See armstrongecmscam.blogspot.com for a more compact view of major findings posted in this blog. Every single defrauded person should report their case, see Where and how to complain |

|

|

|

|

s29

Jr. Member

Offline Offline

Activity: 184

Merit: 8

|

|

July 15, 2019, 02:45:26 PM |

|

https://www.armstrongeconomics.com/markets-by-sector/interest-rates/how-long-can-artificially-low-interest-rates-be-maintained/QUESTION:

Dear Martin,

First let me thank you for your paradigm shifting blog and the incredible conferences you and your team put together. They really are on a level all their own. Here he goes again. Is Marty again salivating over his own questions, or is he's only picking out the best fanmail?  ANSWER: This is why we really, really, really, really, need Socrates. Oh really? That dumb machine that misses all the big moves?  Instead of trying to reform, they are digging in their heels and attempting to keep a failed Quantitative Easing theory in play even after more than 10 years of obvious failure. As the Economic Confidence Model turns, everything they are trying to do will backfire. I have no doubt they will blame me, and once again, claim they would have succeeded but too many people listened to me. That is such a BS line, it is no longer funny. They can kill me and it will not change anything. The monetary system as we have known it will blow up in their face. This is IMPOSSIBLE to maintain.

You cannot keep interest rates at artificial lows and expect this game to continue. What will happen is there will be a great awakening. Once the serious money realizes the emperor has no clothes, they will lose all confidence of the people. The next 8.6-year wave will be inflationary because of a collapse in confidence. I am sure I will be the scapegoat and the fake news will keep that image in motion and support the Deep State as they always do. As they say, Bloomberg News has NEVER exposed the manipulations of the banking oligarchy. I even sent a copy about the SEC controlled by Goldman Sachs to David Glovin who will never report on the issue because their income is paid for by the same oligarchy. That is why we are on our own. That would be funny: mainstream media usually ignores Armstrong (maybe because he is a conman); but when the bond market implodes they will suddenly come after him that he is the cause of the implosion. Okay Marty, don't forget your medication tonight

|

|

|

|

|

Alex-11

Newbie

Offline Offline

Activity: 133

Merit: 0

|

|

July 15, 2019, 06:06:27 PM |

|

Marty is the ideal scapegoat. He is a speculator, a enemy of the banks and he was already in prison. When the next crash comes , they surely need scapegoat's. Not one, but several of them. I any case. What I don't get is, why would the banksters still need the Socrates code. Now that Socrates has been released they could simply use it them self. But of course , if only them would have the code, then they would be the only one's who'd have it. I'm interrested in criticism, but please spare comments like, Armstrong is a fraud. I'm not interested. |

|

|

|

|

Gumbi

Copper Member

Newbie

Offline Offline

Activity: 168

Merit: 0

|

|

July 15, 2019, 07:50:14 PM |

|

Gumbi, how would the top of this market be shorted 'to the day'? I assume one would need to use the arrays and pick out the turning point if price comes into contact with the Bullish Reversal at that point in time, which is what I had tried to do previously. If I am not mistaken, that number is ~28,000, or that is just minimum resistance?

Yes that is correct but it is very difficult to short the day of the high and often unnecessary but looks like early August for a high on the weekly array most likely the 5th of August, we have a weekly bullish that may be tested at 28600 level and daily at the 27900 level. The market must come down and retest support one more time going into the bottom of the ECM to imply we move higher with a high in 2024. In my opinion the market cannot truly breakout until the next cycle begins. |

|

|

|

|

AnonymousCoder

Member

Offline Offline

Activity: 580

Merit: 17

|

|

July 15, 2019, 08:35:58 PM

Last edit: July 20, 2021, 06:33:28 PM by AnonymousCoder |

|

Marty is the ideal scapegoat. He is a speculator, a enemy of the banks and he was already in prison. When the next crash comes , they surely need scapegoat's. Not one, but several of them. I any case. What I don't get is, why would the banksters still need the Socrates code. Now that Socrates has been released they could simply use it them self. But of course , if only them would have the code, then they would be the only one's who'd have it. I'm interrested in criticism, but please spare comments like, Armstrong is a fraud. I'm not interested.That is an interesting question, and it appears that you have already answered it yourself. I don't have the Socrates code, but I have a fairly good grasp of its complexity, or the lack of it because I have inspected hundreds of reports. This is in understatement, because I don't want to get into the details of what else I did. I am a computer programmer with decades of professional experience. I am not into speculation especially not into conspiracy theories. I am interested in facts and high probability scenarios. This story of someone actually wanting to get hold of the source code of this system in order to benefit from its forecasting ability is a distraction, a smoke screen. For someone who is not able to question the quality of the system, this story projects the image of magic abilities. Therefore, it was useful for Armstrong for some time. Like UFOs are always useful for a good story. As you discovered, this story is no longer a useful tool for Martin Armstrong because Socrates is now available for everyone as an online service. So why own the source code? It is funny that someone in this forum raised the idea that the publicly available version of Socrates is not the real thing, and that the REAL computer system is only available to Martin Armstrong himself: ... First, I can confirm from other sources that the system that MA made available to everyone as Socrates and the one he uses for himself are completely different. Many people are duped into believing this which is unfortunate. I also was hoping to get access to his famous buy/sell charts like this he posts on the blog occasionally but again never gonna happen (also confirmed). So basically if you think you are going to get access to the actual program he uses by buying a Socrates service, I would urge you to save your money. ... That myth is exactly what some people need, people who believe in silver bullets, in the holy grail and so on. The only difference I can see is that Armstrong, because he owns the source code, can run some of his code in a type of custom research mode to produce custom reports that the system does not produce out of the box. But that is something else. From my perspective, it would be very useful to get all of the source code and expose it publicly. I am convinced that it would be sobering for at least a couple of reasons: 1) We could see how simple it is because it actually does not do much 2) We could see ho many patches it contains to make the system APPEAR to work as advertised. Unfortunately, this is what the reports reveal, even without knowledge of the source code itself: https://bitcointalk.org/index.php?topic=1082909.msg51666429#msg51666429So after considering all this, my conclusion is that this code is not worth owning for forecasting purposes. Martin Armstrong is a charlatan, and he spent 11 years in jail for that reason but he has not changed. Read this blog starting here to find out more about computerized fraud. See armstrongecmscam.blogspot.com for a more compact view of major findings posted in this blog. Every single defrauded person should report their case, see Where and how to complain |

|

|

|

|

Alex-11

Newbie

Offline Offline

Activity: 133

Merit: 0

|

|

July 15, 2019, 09:19:05 PM |

|

I don't have the Socrates code, but I have a fairly good grasp of its complexity, or the lack of it because I have inspected hundreds of reports. This is in understatement, because I don't want to get into the details of what else I did. I am a computer programmer with decades of professional experience.

IMHO this is a misunderstanding. the creation of the reports is not the core of Socrates. It is more like an extension of the core. The reports are actually not needed. If you have the numbers and you know how the system works and have the trading experience, then there is not need for reports. As you discovered, this story is no longer a useful tool for Martin Armstrong because Socrates is now available for everyone as an online service. So why own the source code?

Because of this (as I mentioned above): But of course , if only them would have the code, then they would be the only one's who'd have it [and this would give an additional advantage in trading].

It is funny that someone in this forum raised the idea that the publicly available version of Socrates is not the real thing, and that the REAL computer system is only available to Martin Armstrong himself: .....his famous buy/sell charts like this he posts ..... I don't believe this is true because Marty has explained several times where these sell and buy signals come from. From reversals. Yes, there are some tweaks (like finese or hedging) he probably didn't (yet?) release, but in general one could use the buy and sell signals today (if known how - see this calculation here). See the video here. There is also one with audio explanation, but I don't have that at hand https://www.armstrongeconomics.com/armstrongeconomics101/training-tools/fractal-nature-of-trading/ |

|

|

|

|

MA_talk

Member

Offline Offline

Activity: 226

Merit: 10

|

|

July 15, 2019, 09:42:09 PM

Last edit: July 15, 2019, 09:57:00 PM by MA_talk |

|

Marty is the ideal scapegoat. He is a speculator, a enemy of the banks and he was already in prison. When the next crash comes , they surely need scapegoat's. Not one, but several of them. I any case. What I don't get is, why would the banksters still need the Socrates code. Now that Socrates has been released they could simply use it them self. But of course , if only them would have the code, then they would be the only one's who'd have it. I'm interrested in criticism, but please spare comments like, Armstrong is a fraud. I'm not interested.In any debate, both sides present their evidences to support their arguments. That is what I have been trying to do, but the opposing side hasn't presented anything that can stand up to any statistical test. Here is a summary on Martin Armstrong. If you need to get the details & links, it's all at armstrong ecm scam . blogspot . com 1. He claimed that his algorithm will take up 90+% of the super-computer annual capacity, which is solely owned by government, and whose usage was intended for research. 2. He claimed that ECM date is accurate down to the day, and yet he said it's 10/1/2015, and also 10/7/2015. If it's accurate down to the day, ECM date cannot be on two dates. 3. He forecasted a bitcoin drop to 775 this year, and yet bitcoin is at about 10400. 4. He claimed that his office building construction is near completion. Made the whole thing sounded like he owned the entire building, when in fact, he probably would just time-share the office with someone else. 5. The readers' comments are most likely made up by him, with the same blatant typos in such short sentences. 6. The Greatest Trade of Century report had 1 page of forecast out of 280+ pages. And that single page forecast said NOTHING about any time frame. 7. His Socrates reports had revisions after-the-fact, documented by AnonymousCoder. 8. He stated gold will break $1000 in WEC conference. Caused lots of losses to attendees, and yet, later he claimed successful predictions, post-event, again. 9. NOBODY out of possibly 1000+ people on this forum after about 300 pages of discussion and after many years has found a successful trading strategy using Socrates. The only pro-Socrates argument is that it's too complex for ordinary human to understand. That is ridiculous as I have argued, since if it's too complex to be understood, then why bother subscribing to the service?  And exactly because it is complicate, it should be all coded up into the computer algorithm to produce buy/sell signals. Duh? Aren't we talking about AI? And isn't that the whole purpose of trading? But obviously, producing such signals will immediately defeat Armstrong's goal to confound the readers, and document Armstrong's own failures. 10. From the scooter man blog post, Armstrong doesn't even have the most basic understanding of science that energy is the system is always conserved. It can neither be destroyed or created. I kept saying that if a trading method works, then it can be repeated by anyone else, and have the trades executed without human intervention nor emotions. But NOBODY can show any functional trading methods based on Socrates. Science is always repeatable. Anybody who measures the density of water at a given temperature/pressure will always get the same answer. That is called Science. If you only select the correct forecasts, and ignore all the wrong forecasts from Armstrong, or if you only attribute the winning trades to Socrates, but claim the responsibilities for all the losing trades for yourself, or if you always pick the few lucky/capable traders who filtered out the wrong signals from Socrates, but ignore all the other average traders who simply follow Socrates blindly, they are all in essence manipulating the statistics, and cherry-pick the results. I'm not denying that Armstrong "may have" had some good calls. But I'm saying that to MAKE a PROFIT, you cannot wait for all 100 calls by Armstrong to become reality, and then cherry-pick only the good calls. Because good calls are only known to be good, POST-EVENT, at which time, the information becomes useless. The strategy taken by Martin Armstrong is obviously to be a "charlatan" and predicts as many outrageous calls as possible, and just hope that one of them turns out to be correct. The recollection process of the human memory will not register all of the insignificant events (all the bad calls, assuming that you didn't trade on it), but only registers the most significant events (the very few good calls that you MISSED). The entire discussion forum is obviously about finding the illusive profits from Armstrong's blog and Socrates reports. And to show that Armstrong's stuffs have values, the trading method MUST be statistically and significantly profitable. No one-time wonders (well, assuming that Armstrong did call them.) |

|

|

|

|

Alex-11

Newbie

Offline Offline

Activity: 133

Merit: 0

|

|

July 15, 2019, 10:46:58 PM |

|

... 4352 characters later....

did I not say, no fraud accusations pls?  MA talk, I know your arguments since there were repeated in the forum countless times. Many of them are valid, but IMHO some misses the point. Additionally, some positive points are not investigated or neglected. E.g. this forum post on buy and sell signals. I agree that Socrates and Armstrong are terribly (and sometimes unnecessarily) complex, but that is just not the full truth. Unfortunately I don't have the time to explain this and I sure this will be the point where you will now feel a massive desire to respond to  . Come on, go ahead...  |

|

|

|

|

Kiwibird

Jr. Member

Offline Offline

Activity: 45

Merit: 2

|

|

July 15, 2019, 10:49:28 PM |

|

So, something to share, a number of years ago I read an article about an investment fund that constantly beat the market. It is a private fund only offered to employees to the Company. The interesting part is the people who ran the fund had created a system solely on science, numbers and correlations. They only hired "Quants", for the people who do not know what quants are ,they are Phd's of various fields, specifically Mathematicians, Physics and Science. Wall street started using them in the mid 2000's but this fund have been using them for much longer. The company also required the quants to NOT have any financial background. At the time their investing record was very very impressive, they always beat the market with returns and performance in the double digit area. Since 1994-2014 their average return was 71%, wow how do I get in, lol. You can't, you have to work for them,  . what's more interesting is they since opened two funds to the general public but doesn't even come close to the performance of their flag ship fund, Medallion fund and the Company's name Renaissance Technologies. n 1988, the firm established its most profitable portfolio, the Medallion Fund, which used an improved and expanded form of Leonard Baum's mathematical models, improved by algebraist James Ax, to explore correlations from which they could profit. Simons and Ax started a hedge fund and named it Medallion in honor of the math awards that they had won.

enaissance's flagship Medallion fund, which is run mostly for fund employees,[8] "is famed for one of the best records in investing history, returning more than 35 percent annualized over a 20-year span".[5] From 1994 through mid-2014 it averaged a 71.8% annual return. My point is Why would anyone want to sell a system that almost doubles your returns every year? It seems Renaissance Technologies isn't willing to give up their secret trading system to anyone. Which I don't blame them. https://en.wikipedia.org/wiki/Renaissance_Technologies'Understanding Performance - Socrates v Medallion QUESTION: Marty; I invested in your Deutsche Bank hedge fund and the performance was about 3 times that of even the Renaissance’s Medallion fund. Your employees said for the public fund you closed positions early because you were making too much in 1998. Yet that was still about 3 times what Medallion produced in 1998. Medallion is closed since 2005 and nobody has been able to duplicate their returns no less your’s. You said at the WEC you had no interest in returning to managing funds. Why is it that the only two quantitative funds to be successful, you and Renaissance, do not take on more clients? ANSWER: Performance declines the larger a fund becomes. There is a limit to the amount of money one can manage on the same scenario. Conspiracy theorists do not want to hear that. But this is reality. Someone can return 50% with $10 million and lose money with $100 million. As I will point out, the scope of trading is paramount to fund management. To set the record straight, yes I had to close out positions early in 1998 in the public fund because we made way too much money. That may sound nuts, but in a public open fund you cannot post gains in the hundreds or percent for a two months. It would upset the entire industry cause all sorts of problems even with regulators. The model correctly forecast the Long-Term Capital Management Crash. I sold $1 billion worth of Japanese yen at 147 against the Yearly Bullish Reversal in addition to numerous other markets. They began calling me Mr. Yen for that trade.... |

|

|

|

|

unwashed

Newbie

Offline Offline

Activity: 53

Merit: 0

|

|

July 16, 2019, 11:05:06 AM

Last edit: July 16, 2019, 11:27:23 AM by unwashed |

|

So, something to share, a number of years ago I read an article about an investment fund that constantly beat the market. It is a private fund only offered to employees to the Company. The interesting part is the people who ran the fund had created a system solely on science, numbers and correlations. They only hired "Quants", for the people who do not know what quants are ,they are Phd's of various fields, specifically Mathematicians, Physics and Science. Wall street started using them in the mid 2000's but this fund have been using them for much longer. The company also required the quants to NOT have any financial background. At the time their investing record was very very impressive, they always beat the market with returns and performance in the double digit area. Since 1994-2014 their average return was 71%, wow how do I get in, lol. You can't, you have to work for them,  . what's more interesting is they since opened two funds to the general public but doesn't even come close to the performance of their flag ship fund, Medallion fund and the Company's name Renaissance Technologies. n 1988, the firm established its most profitable portfolio, the Medallion Fund, which used an improved and expanded form of Leonard Baum's mathematical models, improved by algebraist James Ax, to explore correlations from which they could profit. Simons and Ax started a hedge fund and named it Medallion in honor of the math awards that they had won.

enaissance's flagship Medallion fund, which is run mostly for fund employees,[8] "is famed for one of the best records in investing history, returning more than 35 percent annualized over a 20-year span".[5] From 1994 through mid-2014 it averaged a 71.8% annual return. My point is Why would anyone want to sell a system that almost doubles your returns every year? It seems Renaissance Technologies isn't willing to give up their secret trading system to anyone. Which I don't blame them. https://en.wikipedia.org/wiki/Renaissance_Technologies'Understanding Performance - Socrates v Medallion QUESTION: Marty; I invested in your Deutsche Bank hedge fund and the performance was about 3 times that of even the Renaissance’s Medallion fund. Your employees said for the public fund you closed positions early because you were making too much in 1998. Yet that was still about 3 times what Medallion produced in 1998. Medallion is closed since 2005 and nobody has been able to duplicate their returns no less your’s. You said at the WEC you had no interest in returning to managing funds. Why is it that the only two quantitative funds to be successful, you and Renaissance, do not take on more clients? ANSWER: Performance declines the larger a fund becomes. There is a limit to the amount of money one can manage on the same scenario. Conspiracy theorists do not want to hear that. But this is reality. Someone can return 50% with $10 million and lose money with $100 million. As I will point out, the scope of trading is paramount to fund management. To set the record straight, yes I had to close out positions early in 1998 in the public fund because we made way too much money. That may sound nuts, but in a public open fund you cannot post gains in the hundreds or percent for a two months. It would upset the entire industry cause all sorts of problems even with regulators. The model correctly forecast the Long-Term Capital Management Crash. I sold $1 billion worth of Japanese yen at 147 against the Yearly Bullish Reversal in addition to numerous other markets. They began calling me Mr. Yen for that trade.... As others have said, Rentech can be verified, has been audited and performance is documented. MA mentions only 1 year but Rentech has been consistently returning on average 71% a year. Geez, a 10K investment makes you a multi-millionaire in 10 years. Can MA show this of his system? I do agree that size is a factor so shouldn't an individual with a system like this return 200% a year? |

|

|

|

|

MA_talk

Member

Offline Offline

Activity: 226

Merit: 10

|

|

July 16, 2019, 03:15:27 PM |

|

.........

Rentech has proof of their performance. I would like to see evidence of Armstrong's performance, not his claims of said performance. Otherwise, I too can claim the same.

@Kiwibird, there is NO verifiable proof AT ALL for Armstrong's claim. And 1-year or even 3 or 5 years of outstanding performance is easily within reach of random luck. There are easily more than 10000 fund managers on Earth. If you ask all of them to gather in a room, and start flipping coins, there will be about 10 of them who happen to get 10 heads in a row, or about 1/1024. THINK ABOUT THAT, 10 people out of 10240 people getting all heads in a row. Are you going to call them smart money managers? NO. They got 10 heads just because of random luck. So if EVER Armstrong had such performance for just 1 year, he just had good luck. That's all. Given Armstrong's verifiable record of flamboyant talking/lying, such as his office building, super-computer, etc, the weight of evidence is that he probably made this up, just like he made up the scooter man story. That scooter guy left his scooter to Armstrong for him to test, for God's sake, and Armstrong couldn't figure out a damn thing about it? |

|

|

|

|

DanB1

Jr. Member

Offline Offline

Activity: 100

Merit: 1

|

|

July 16, 2019, 04:40:05 PM

Last edit: July 16, 2019, 04:53:44 PM by DanB1 |

|

Everytime a new MA fan/associate comes on to this blog and the whole discussion starts all over again...300 pages and counting.

|

|

|

|

|

trulycoined

Jr. Member

Offline Offline

Activity: 85

Merit: 8

|

|

July 16, 2019, 05:38:56 PM |

|

.........

Rentech has proof of their performance. I would like to see evidence of Armstrong's performance, not his claims of said performance. Otherwise, I too can claim the same.

@Kiwibird, there is NO verifiable proof AT ALL for Armstrong's claim. And 1-year or even 3 or 5 years of outstanding performance is easily within reach of random luck. There are easily more than 10000 fund managers on Earth. If you ask all of them to gather in a room, and start flipping coins, there will be about 10 of them who happen to get 10 heads in a row, or about 1/1024. THINK ABOUT THAT, 10 people out of 10240 people getting all heads in a row. Are you going to call them smart money managers? NO. They got 10 heads just because of random luck. So if EVER Armstrong had such performance for just 1 year, he just had good luck. That's all. Given Armstrong's verifiable record of flamboyant talking/lying, such as his office building, super-computer, etc, the weight of evidence is that he probably made this up, just like he made up the scooter man story. That scooter guy left his scooter to Armstrong for him to test, for God's sake, and Armstrong couldn't figure out a damn thing about it? Neil Woodford in the UK comes to mind. Had decades of success and was highly revered. His £1bn+ funds were constantly ranked as some of the best in the market for returns, where even gov pension funds had invested. Then it started unravelling owing to high investment in illiquid assets as he tried chasing high returns from subdued safer assets. When those risky investments started unravelling, he was trapped and had to block anyone from exiting, save the entire fund collapsing. This is was someone who had a gleaming investment record. So even the "best" can trip up eventually or may even just get lucky flipping heads year after year until their luck runs out... MA may have just got lucky with a few forecasts, but if you look at RenTech or Two Sigma, they appear to have the very technology and processes that MA claims. Yet never has MA ever presented either his tech or his team - where even his WEC events girl isn't based in FL, so she must be a contractor - in any such way. He appears to have run a longstanding publishing firm, and when he was trading, he messed it all up much like Woodford. |

|

|

|

|

AnonymousCoder

Member

Offline Offline

Activity: 580

Merit: 17

|

|

July 16, 2019, 06:27:49 PM

Last edit: July 20, 2021, 06:33:20 PM by AnonymousCoder |

|

Everytime a new MA fan/associate comes on to this blog and the whole discussion starts all over again...300 pages and counting.

I agree. But there is a trend: The fans get desperate. And they are not new ones. The last one Alex-11 started here in 2016. So desperate that in https://bitcointalk.org/index.php?topic=1082909.msg51838096#msg51838096 he pulls out this old trick of showing these fake manufactured success claims that nobody ever had a chance of verifying. I think it is all good. For those who are not complete idiots, it is clear: It boils down to what Martin Armstrong claims is an expert about: Confidence. In financial matters, how can you have confidence in products / services of a person who has been caught lying so many times as seen in this blog? From that perspective, Martin Armstrong is finished. Whenever one of his associates pops up again, point back to what has been revealed here for all to see. 606,300 views of this blog and counting. No problem. Even if it takes 1,000 pages. I mean he is really finished. To the point that he now posts trivial messages in his private blog in an attempt to get the Socrates subscription numbers up again. Martin Armstrong is a charlatan, and he spent 11 years in jail for that reason but he has not changed. Read this blog starting here to find out more about computerized fraud. See armstrongecmscam.blogspot.com for a more compact view of major findings posted in this blog. Every single defrauded person should report their case, see Where and how to complain |

|

|

|

|

s29

Jr. Member

Offline Offline

Activity: 184

Merit: 8

|

|

July 16, 2019, 08:43:08 PM |

|

in the news today: Foreigners Dump US Treasurys, Liquidate A Record $216 Billion In US Stocks In 13 Consecutive Months

Tue, 07/16/2019 - 16:28

And Marty keeps jabbing about capital flows into the US  |

|

|

|

|

|